5 Major Market Stories to keep an eye on - May 2021

We have witnessed lot of volatility in Indian stock markets in April 2021. Surge in Covid-19 cases, declaration of state lockdown, concern over vaccine availability and quarterly results were some of the major reasons that have affected market performance and investor sentiments.

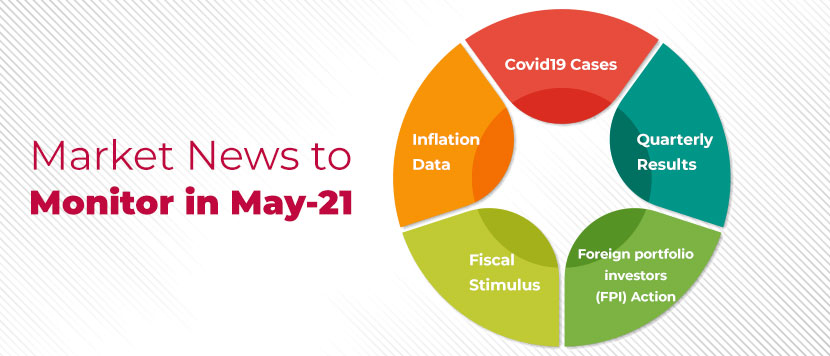

After the uncertainty of Apr-2021, here are 5 major stock market stories to keep an eye on in May 2021

- COVID19 Cases

Increasing COVID cases are a concern with over 400,000 cases per day. If lockdowns get extended, markets will be disappointed and likely to witness a downward trend. The major challenge is to expand vaccinations, control the spread of COVID and minimize the economic impact.

- Quarterly Results:

SEBI has given time till end of Jun-2021 to declare quarterly and annual results. Only ~20% of the BSE-500 companies have declared Mar-2021 results and numbers have been better yoy however, below the Dec-2020 quarter as per the market reports. May will see the results trajectory being established.

- Foreign portfolio investors (FPI) Action:

Foreign portfolio investors withdrew Rs 12,039 crore from Indian equities in April after infusing nearly $37 billion in FY21. May will decide whether this FPI outflow was a temporary action or an act due to something serious with the economy.

- Fiscal Stimulus:

Will there be another fiscal stimulus by the government? There are expectations that government may announce a smaller stimulus in May-2021 to reduce the pain, apart from throwing some helicopter money. Rate cuts are likely to be ruled out for now. Experts have demanded a fresh stimulus package aimed at boosting the economy and putting cash in people’s hands, especially the marginalised, as the second wave of the novel coronavirus disease (COVID-19) pandemic continues to rip through India.

- Inflation Data:

Lastly, the big story in May will be inflation. The lockdown would have deteriorated supply chains and it is likely that inflation spiking once again in May. It would be a concern if it crosses the RBI comfort zone of 6%. In India, consumer price index (CPI) inflation stood at 5.52% in March compared to 5.03% in February and 4.06% in January. The rise in CPI inflation was driven by a surge in fuel and transportation costs along with an increase in some components of the food basket. Moreover, the record Covid-19 surge across the country now, especially at a time when advanced economies have already started recovering, could put serious upward pressure on inflation.

Start Investing in 5 mins*

Rs. 20 Flat Per Order | 0% Brokerage