Will Tax Deduction Really Help?

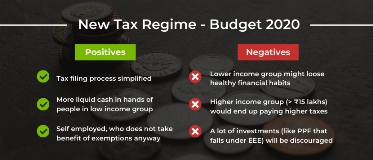

With an idea to simplify the entire process of tax filing, budget 2020 has proposed the introduction of new tax slabs with reduced rates. With the new regime, a common tax-payer may not require any expert advise for tax filing. Though on the face of it is good to be simplified. But not everything that is simplified is good for a general tax-payer. Let me explain you how.

With the new regime, you forfeit tax exemptions under Section 80C, Section 80D and even benefits under LTC, HRA, Tuition Fees and standard deduction. In a nutshell, 70 out of the 100 exemptions will go away. Only a handful of exemptions like the CPF, gratuity, VRS compensation, retrenchment allowance etc will remain. But you give up on the standard deduction of Rs.50,000 and you don’t get any benefit from life insurance premiums, tuition fees or ELSS investments if you opt for the new tax regime.

In the old regime, people falling in the lower income group (below Rs15 lakhs), were investing in instruments like term insurance, health insurance, ELSS related mutual funds, in the pretext of saving tax. Though the objective then was to save tax but unintentionally they were making a wise move that benefited them in the long run. But now with the new scheme, we might see a curb in these healthy investment habits.

While the people falling under lower income group will benefit with more cash in hand, which might be directed to investments in capital market, the higher income group (more than Rs15 lakh per annum) will not gain much benefits. It is this group that makes more investments in sections like 80C, 80D, HRA, and LTA with the surplus available but the removal of the exemptions, which leads to the increased taxable amount would clearly be a loss making proposition for a tax-payer.

Start Investing in 5 mins*

Rs. 20 Flat Per Order | 0% Brokerage