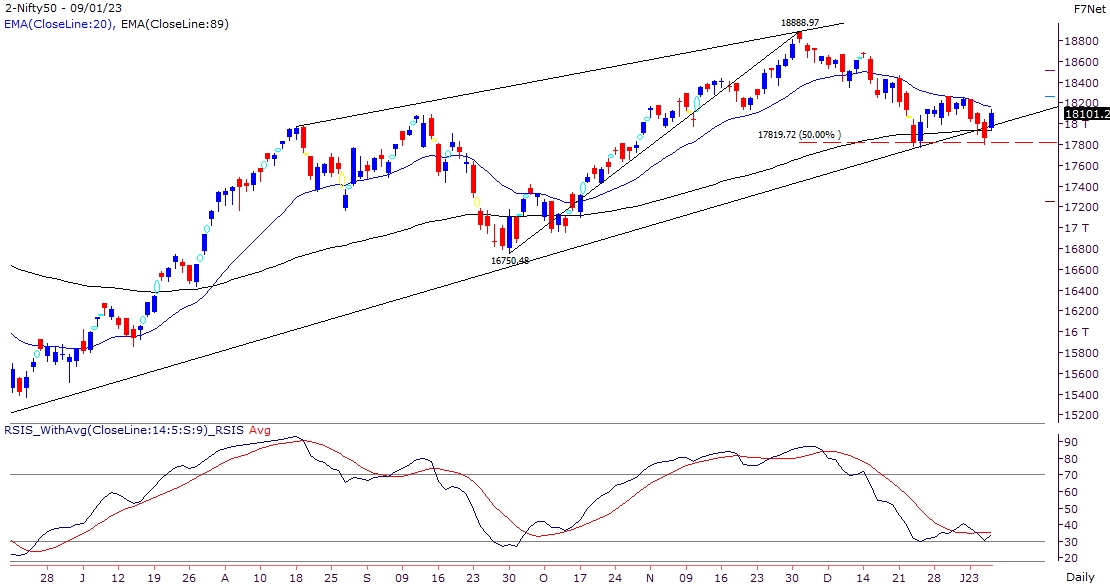

Nifty Outlook 10 Jan 2023

The upmove in the global markets led to a positive sentiment for our markets at open and in line with the same, Nifty started the new week with a gap up opening around 17950. The index witnessed buying interest and it rallied higher to end the day around 18100 with gains of 240 points over last week’s close.

Nifty Today:

Post last three day’s correction in the indices, the momentum readings on the lower time frame had reached the oversold zone and hence a pullback rally was much on the cards. The upmove in the global markets led to a positive sentiment which provided impetus to the momentum. If we look at derivatives data, FII’s had about 60 percent of their positions in the index futures on the short side, but they have not formed any fresh shorts in last two days of the previous week. The positivity in the global markets may lead to covering of their existing short positions. The call option writers too had to run to cover their positions post the gap up today which turned favorable for an upmove. The momentum readings gave a positive crossover and technically, Nifty has now formed a good support base in the range of 17900-17800. Till this support is intact, the structure looks positive and the index heavyweights may lead to a short term upmove in the market. The option writers have now formed decent positions at 18000 put due to which buying interest was seen in intraday dips towards the support. On the higher side, the ’20 DEMA’ hurdle is around 18170 followed by the recent consolidation high at 18265. We expect these resistances to be cleared soon which would then lead the index towards 18330 and 18460 in the short term.

Global markets leads to positive trend in index

In Monday’s session, all the sectoral indices ended positively indicating a broad based buying interest. The reaction to the TCS results could set a tone for the IT sector which has already corrected and is trading near support.

Nifty & Bank Nifty Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

|

Support 1 |

17977 |

42275 |

|

Support 2 |

17910 |

41965 |

|

Resistance 1 |

18170 |

42800 |

|

Resistance 2 |

18265 |

43025 |

Start Investing in 5 mins*

Rs. 20 Flat Per Order | 0% Brokerage