ONGC recorded its highest ever net profit, Should you invest in the Oil Giant?

Hii, So Once I was just scrolling through Instagram, and I came across a reel by a creator and it was like,

“ Kya ap bhi pareshan hai petrol ke badhte prices se? Apka petrol free ho skta hai!

G haa, Ap ONGC mai invest kijie, ye company India ki sabse badi Oil manufacturing company hai or ye kafi acha dividend deti hai, toh aap ka petrol expenses dividend se cover hoga or wealth appreciation toh milega hi!

Cringe right ? Who says that ? Who gave this person the right to be an influencer ? I was like

Well, all these things are debatable, one thing that is not is that ONGC would benefit from the rising crude oil prices.

This morning the news came that ONGC has recorded its highest net profit, due to increase in its global crude oil prices. Clearly it is a beneficiary of the rise in crude oil prices, but is it an opportunity to invest in the Oil giant?

Further, with the government’s push on EV’s and Renewable energy, will it lose its charm?

Let’s find out!

ONGC

ONGC is the largest crude oil and natural gas producer in India, it contributes nearly 71% to the domestic production.

It is also one of the major producers of products such as liquefied petroleum gas (LPG), superior kerosene oil (SKO), naphtha and C2/C3 (diatomic carbon/tricarbon).

The company has significant onshore and offshore production facilities, subsea and land pipelines, gas processing, drilling and work-over rigs, storage facilities and other infrastructure located throughout the principal oil and gas-producing regions of India.

ONGC drilled 100 exploratory wells in FY21 vs. 500 in FY20. ONGC has declared a total 3 discoveries (2 in onland and 1 in offshore) during FY22 in its operated acreages.

Oil is the new Oil

I know, most of you are wondering, that in a time when everyone is talking about EVs and renewable energy, why are discussing an oil producing company ?

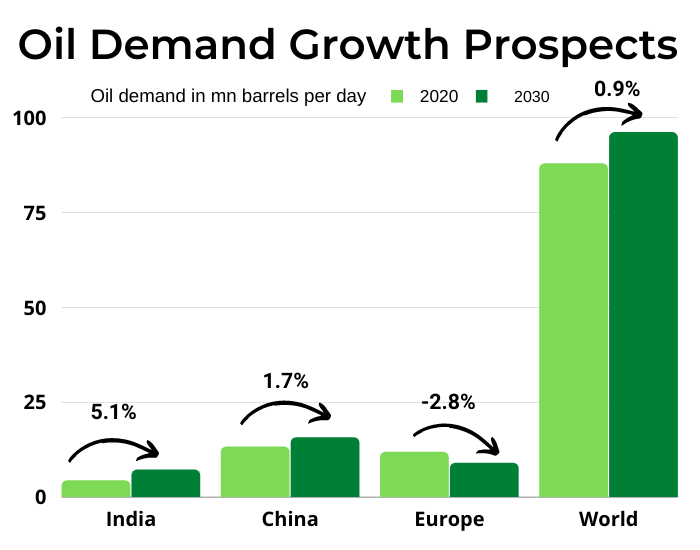

Well, According to a report by IEA, India’s oil demand will rise 50% by 2030 as against a global expansion of 7%,

This decade, demand for oil in India is expected to grow 5.1% on average every year!

“Anybody who is producing oil in India is going to be in business for a long time,” says Anish De, national head for energy, natural resources, and chemicals at consulting firm KPMG.

With the rise in the middle income population, oil consumption would increase dramatically in the coming years. Of course, we are witnessing a push in EVs but they still make up only 1% of the total automobile sales so clearly we are going to rely on Oil for a long long time.

Oil consumption is set to rise, but the problem is most of the oil we consume is imported from different countries, around 85% of the oil we consume is imported.

Now, the problem here is we don’t have a lot of oil reserves in India, we have just 0.3% of total oil reserves in the world and due to that in the future as well, we may have to rely on imports.

But as our government always vouches for an atma nirbhar bharat, it wants ONGC to increase its production and wants to reduce its reliance on imports.

So, will they make us an atma nirbhar bharat, in case of crude oil?, probably not!

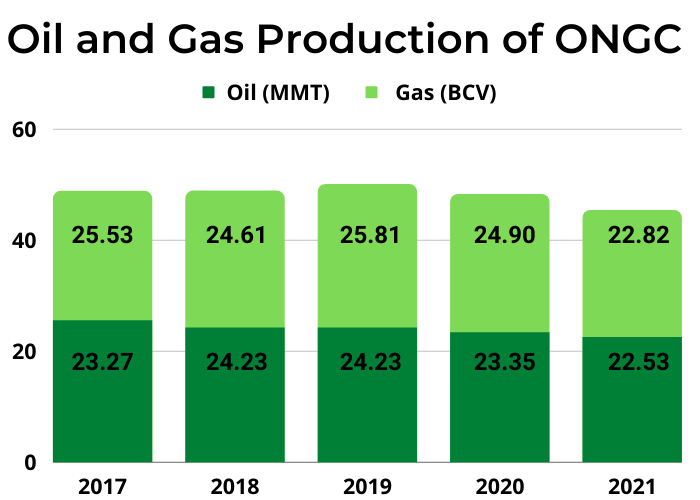

Although the company claims, every year that it would increase its production and invests significantly in increasing its capacities, its overall production has decreased in the last few years!

That’s not really good news for the investors though! Another problem with the Oil giant is its cost of production is amongst the highest in the world, it spends around $45 to produce one barrel of oil, while most players in OPEC spend around 25% of that. So, ONGC has to charge the global prevailing prices of oil from its customers and Oil prices in the global markets are highly volatile, for example during the pandemic when the demand for crude oil was less, its price reached at its all time low. Now, since the cost of production is really high, the company has to incur losses when the global prices take a hit.

Also, at the end of the day, it is a state owned company, and like many of them, most people working on it are dividend hungry. The company spends a ton of money, distributing dividends rather than improving its capacities.

Furthermore, the company operates internationally with its subsidiaries and most of its reserves are in countries like Russia, Brazil. Most of these countries have a politically insatiable environment which could affect its production.

Recently, the company announced a net profit of Rs. 40,306 crores and became the second most profitable firm in the nation. While it is a feast to be celebrated, don’t forget that its profits are as volatile as the crude oil prices in the global market.

The company recorded its highest net profit because the crude oil prices in the global market reached its 14 year high to $139 per barrel, and since the company charges the prevailing global rates for the crude oil, its net realization shot up to $76 per barrel.

While profit shot up due to the global prices, its production and profit from its subsidiaries fell, as ONGC Videsh, the explorer's overseas arm, witnessed a 16% fall in its profits.

The company though is in a lucrative segment, comes with the backdrop of operating as a state owned company by dividend hungry people. To be self-reliant, the government would have to do more than just formulating schemes, and ONGC to be profitable has to work significantly towards improving its production.

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial.

Tanushree Jaiswal

Tanushree Jaiswal