What is Strangle?

A strangle is an options strategy in which the investor holds a position in both a call and put option but with different strike prices. In this case the expiration date is same as well as the underlying asset. A strangle is a good strategy if the underlying security will experience a large price movement in near future. A strangle pattern is similar to straddle but uses options at different strike prices whereas straddle uses call and put at the same strike price.

How Does Strangle Work

Investors uses the strangle option technique when he has the stake in both the call and put option on the very same asset with the very same expiration date. These options however have distinct strike prices. As an investor this lets you profit from the price swings in the underlying asset. In long strangle the investor simultaneously buys an out of money call and an out of money put option. The call options strike price is higher than the underlying assets current market price, while the put has a strike price that is lower than the assets market price. An investor in the short strangle sells an out of the money put and an out of money call. This approach is a neutral strategy with limited profit potential. A short strangle profits when the price of the underlying stock trades in a narrow range between the breakeven points.

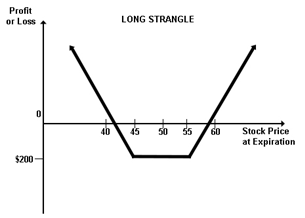

Long Strangle

Long Strangle – Limited Risk and Unlimited profit potential.

Buy 1 OTM call

Buy 1 OTM put

Suppose a stock is trading at $50. An options trader buys a put at a strike price of $45 for $100 and simultaneously buys a call at a strike price of $55 for $100, assuming a lot size of 100. The net debit taken to enter a trade is $200.

Case 1-

On expiration, if the stock is trading between $45 and $55, both options expire worthless and the options trader suffers a maximum loss which is equal to the initial debit of $200 taken to enter the trade.

Case 2-

If the stock goes up and is trading at $60 on expiration, then put will expire worthless but the call expires in the money and has an intrinsic value of $500. The final profit is equal to $300 ($500-$200).

Case 3-

If the stock price drops below $40 on expiration, a call will expire worthless but put is in the money and has the intrinsic value of $500. The final profit is equal to the $300 ($500-$200).

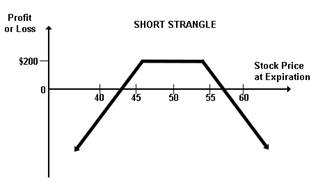

Short Strangle

When the price of the stock does not change , short strangles allow investors to benefit. Short-strangle investors sell call options with strike price higher than the current share price and put options with strike price lower than the current share price. A short strangle strategy is a neutral strategy and allows investor to benefit from the status quo in a financial market. A short strangle position is held when an investor simultaneously sells a slightly out of the money call option as well as an out of the money put option of the same underlying asset with the same expiration date. However the strike prices are different for both.

Short Strangle – Limited Profit and Unlimited Risk Strategy.

Sell 1 OTM call

Sell 1 OTM put

Suppose a stock is trading at $50. An options trader sells a put at a strike price of $45 for a price of $100 and simultaneously sells a call at $55 for $100, assuming a lot size of 100. The net credit to enter the trade is $200.

Case 1-

On expiration, if XYZ is trading between $45 and $55, both options expire worthless and the options trader gets to keep the entire initial credit $200 which is also his maximum profit.

Case 2-

If XYZ stock rallies and is trading at $60 at expiration, the put will expire worthless but the call is in the money and has an intrinsic value of $500. Subtracting the initial credit of $200, the trader’s net loss stands at $300. If the price moves significantly above $55 the loss can be unlimited.

Pros and Cons of a Strangle

Pros

Offers profit potential on upward or downward price movements

Less expensive compared to other trading strategies such as straddle

Offers unlimited profit potential in both directions

Cons

Only profitable following a massive change in the underlying asset’s strike price

Comes with more risks compared to other strategies, as out of the money options are used.

Effects of time decay reduce profits

Strangle V/s Straddle

STRADDLES | STRANGLES |

Strike prices and expiration dates of the options are the same. | Options have the same expiration date but different strike prices. |

Net value of the options changes with any change in the underlying stock’s price. | Larger change in the underlying stock’s price is required before the net value of the options changes. |

More expensive to implement | Cheaper to implement |

No directional bias | Some scope of directional bias |

How do you calculate the Breakeven of a Strangle?

A long strangle generates profits from the underlying either by moving up or down. There are two breakeven points. These are calculated as the cost of the strangle plus the call strike and the cost of the strangle minus the put strike.

How can you lose Money on a Long Strangle?

If you are at a long position in strangle and the underlying does not move past the strikes involved, both options will expire worthless and you will lose what you paid for the strategy.

Terminologies associated with the Strangle Strategy

Put option | Put option is a derivative contract between two parties. The buyer of the put option earns a right (it is not an obligation) to exercise his option to sell a particular asset to the put option seller for a stipulated period of time. |

Call Option | Call option is a derivative contract between two parties. The buyer of the call option earns a right (it is not an obligation) to exercise his option to buy a particular asset from the call option seller for a stipulated period of time. |

Spot Price | Spot price refers to the current price of a security at which it can be bought/ sold at a particular place and time. |

Strike Price | Strike price is the pre-determined price at which the buyer and seller of an option agree on a contract or exercise a valid and unexpired option. While exercising a call option, the option holder buys the asset from the seller, while in the case of a put option, the option holder sells the asset to the seller. |

In the Money Option | “In the money” refers to an option that will produce a profit if it is exercised. It differs for call and put options. When a call option is in the money, the strike price for the underlying asset is less than the market price |

Premium | It is the fee you pay to the seller of an option to participate in online trading. |

Out of the Money Option | An options contract is “out of the money” (OTM) when it lacks intrinsic value. When this is the case, there is no point in exercising the contract. |

At the Money Option | At-the-money (ATM) options have a strike price that is equal to its underlying stock’s market price. At-the-money options have no intrinsic value, but because they have time value, they could potentially earn profits before they expire. |

Conclusion

Thus strangle is an options trading strategy where the traders exercise a call option and put option on the same asset. The expiry date is the same, but the strike price varies. Meticulous planning is necessary to make it work as the investors must account for both high and low volatile markets.