Weighted average cost of capital (WACC)

The weighted average cost of capital (WACC) is a financial ratio that calculates a company’s cost of financing and acquiring assets by comparing the debt and equity structure of the business. In other words, it measures the weight of debt and the true cost of borrowing money or raising funds through equity to finance new capital purchases and expansions based on the company’s current level of debt and equity structure.

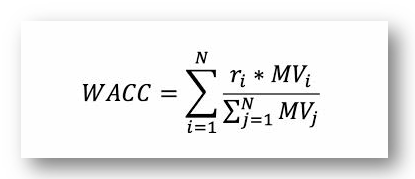

The WACC formula-

WACC = (E/V x Re) + ((D/V x Rd) x (1-T))

Where:

E = Market value of the business’s equity

V = Total value of capital (equity + debt)

Re = Cost of equity

D = Market value of the business’s debt

Rd = Cost of debt

T = Tax rate

Calculating cost of equity

Cost of equity is the return that an investor requires for investing in a company, or the required rate of return that a company must receive on an investment or project. There are two ways to calculate cost of equity: using the dividend capitalization model or the capital asset pricing model (CAPM). Neither method is completely accurate because the return on investment is a calculation based on predictions about the stock market, but they can both help you make educated investments.

Formula

Capital asset pricing model (CAPM): E(Ri) = Rf + βi (E(Rm) – Rf)

E(Ri)= Expected return on investment

Rf= Risk free rate of return= The interest rate of an investment with zero risk- like govt bonds

βi= Beta risk= the volatility of investment compared to general market

(E(Rm) – Rf)= Market Risk= the overall risk of investing in stock market, or the expected return on investment in stock market minus risk free rate

Dividend capitalization model: Re = (D1 / P0) + g

Re= Cost of equity

D1= Yearly dividend per share= the current price of one share in a company’s stock

G= dividend growth rate= the rate at which company dividends have historically grown

What is WACC Used For?

To put it simply, the weighted average cost of capital formula helps management evaluate whether the company should finance the purchase of new assets with debt or equity by comparing the cost of both options. Financing new purchases with debt or equity can make a big impact on the profitability of a company and the overall stock price. Investors and creditors, on the other hand, use WACC to evaluate whether the company is worth investing in or loaning money to.

Since the WACC represents the average cost of borrowing money across all financing structures, higher weighted average percentages mean the company’s overall cost of financing is greater and the company will have less free cash to distribute to its shareholders or pay off additional debt. As the weighted average cost of capital increases, the company is less likely to create value and investors and creditors tend to look for other opportunities.

What Can You Learn From WACC?

WACC can be an effective way for investors and analysts to determine whether or not to invest in a company. Because WACC provides insight into the average cost of borrowing, a higher weighted average percentage may indicate that a company’s cost of financing is greater. This means that the business will have less cash to pay off additional debt or distribute to shareholders, i.e it’s less likely to produce value, and may not be a good investment.