Auto registrations see smart bounce in June 2022

The monthly vehicle auto sales reported by SIAM (Society of Indian Automobile Manufacturers) is a typical wholesale number that is calculated based on dispatches made by manufacturers to wholesalers. However, the number reported by SIAM is more of a production number and does not reflect the sales appetite for vehicles. Quite often, the numbers or growth reported by SIAM are at loggerheads with the actual sales and registrations numbers reported by FADA. That is why FADA numbers assume importance.

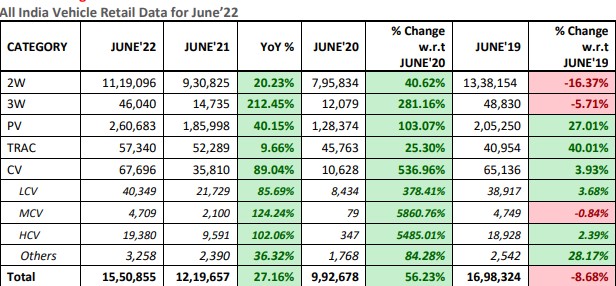

Let us now look at the monthly number of sales / registrations put out by FADA for the month of June 2022. The retail sales numbers for all categories of vehicles (including 2-wheelers, 4-wheelers and CVs) for June 2022, as per the Federation of Automobile Dealers Associations (FADA), shows actual sales of 1,550,855 units in June 2022. This compares favourably with 1,219,657 units sold in June 2021. It also reflects a one year growth in vehicle sales and registrations of 27.16%, with across PVs, CVs, 2-wheelers and 3-wheelers.

Data Source: FADA

Along with the monthly data, FADA has also put out the quarterly data for the June 2022 quarter. For the quarter, the auto industry recorded 64% uptick in retail sales. Total retail sales across vehicle categories stood at 4,832,955 units between in the quarter to June 2022, compared to 2,944,237 units in Q1 of FY22. However, there’s an 8% percent fall in vehicle sales when compared to the pre-Covid levels of 5,260,403 units clocked in Q1 FY20. Effectively, auto sales are still short of the pre-COVID levels reached.

For the month of June 2022, the sales of cars was a lot more robust than 2-wheelers. Passenger vehicles (PVs) registered 40% growth in June 2022 with cumulative sales of 260,683 units for the June 2022 quarter. For the quarter ended June 2022, overall auto sales were up 64%. What worked for the PV segment was the auto companies getting a hang of how to handle the microchip shortage. However, the rural segment demand was still tepid, which led to weak demand growth for tractors and also for entry level 2-wheelers.

Growth more measured in 2-wheelers

For the month of June 2022, 2-wheeler segment also showed positive sales growth but it was relatively subdued. June 2022 sales of two wheelers registered 20.23% growth in June 2022 at 1,119,096 units as compared to 930,825 units in June 2021. There was a lot better traction in quarterly sales of two wheelers for the June 2022 quarter, wherein the growth was 60% on a yoy basis. However, FADA has warned that despite this growth, the 2-wheeler sales have continued to be on the slow lane, in contrast to the pick-up in 4-wheeler PVs.

In fact, FADA has identified several issues for this laboured growth of the two-wheeler segment. These factors include high acquisition cost, high fuel prices, as well as inflationary pressures impacting the household budgets of people. This is a highly price and affordability sensitive market and any negative factors tend to affect the demand in a rather intense way. However, with the monsoons hitting major parts of India, June happens to be an inherently slower month for two-wheeler sales. However, a good Kharif output should help.

In what could be the first signal of economic boom period, the commercial vehicles (CVs) registered a significant 89% growth in the month of June 2022, selling 67,696 units as compared to just 35,810 in the month of June 2021. For the quarter ended June 2022, CVs saw sales doubling to 212,886 units. According to the FADA analysis, within the CV segment, the demand for buses and LCVs has been gaining a lot of traction. What is more critical is that this segment grew by 4% over the June 2019 levels, what other segments struggled.

FADA has identified three factors to watch out for in the coming months. Firstly, rising inflation pressures will continue to be a major red flag for the growth of the entry level models across various categories. Secondly, the ongoing Russia-Ukraine crisis has kept oil prices under pressure and that is going to impact affordability of vehicles. Lastly, a lot would still predicate on the pick-up in the Kharif output and a consequent pick-up in rural demand for vehicles. For now the story looks to be the most robust in the last 3 years.

Share Market Today

| Indices Name | Price | Price Change (% change) |

|---|---|---|

| S&P ASX 200 | 7683.00 | -7.7 (-0.1%) |

| CAC 40 | 8041.65 | -50.21 (-0.62%) |

| DAX | 17982.25 | -106.45 (-0.59%) |

| Dow Jones | 38460.92 | -42.77 (-0.11%) |

| FTSE 100 | 8094.35 | 53.97 (0.67%) |

| Hang Seng | 17284.55 | 83.27 (0.48%) |

| US Tech Composite | 15717.75 | 16.11 (0.1%) |

| Nikkei 225 | 37628.41 | -831.6 (-2.16%) |

| S&P 500 | 5071.63 | 1.08 (0.02%) |

| Gift Nifty | 22569.00 | 199 (0.89%) |

| Shanghai Composite | 3052.90 | 8.08 (0.27%) |

| Taiwan Weighted | 19857.42 | -274.32 (-1.36%) |

| US 30 | 38333.30 | -48.5 (-0.13%) |

Start Investing in 5 mins*

Rs. 20 Flat Per Order | 0% Brokerage