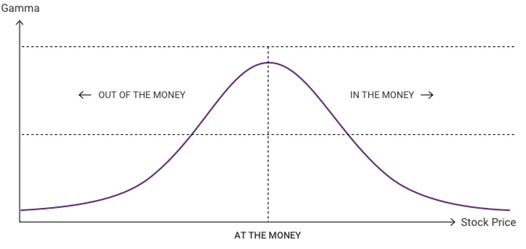

Gamma represents the rate of change between an option’s Delta and the underlying asset’s price. Higher Gamma values indicate that the Delta could change dramatically with even very small price changes in the underlying stock or fund.

At-the-money Hover to view helps pop-up options have the highest Gamma because their Deltas are the most sensitive to underlying price changes. For example, with XYZ at a market price of $100.00, a XYZ $100.00 call is at-the-money as XYZ is trading at the strike price of $100.00. Any movement in either direction will send the contract in-the-money Hover to view help pop-up or out-of-the-money Hover to view help pop-up. This means the contract is extremely sensitive to stock movement, which will be reflected in the option’s Gamma hence, Gamma is higher for at-the-money options.

For options that are near-the-money Hover to view help pop-up, Gamma increases as expiry approaches as time value Hover to view help pop-up is depleting and the option loses its extrinsic value Hover to view help pop-up and retains its intrinsic value Hover to view help pop-up. Gamma measures Delta and Delta measures intrinsic value. At expiration, options mainly price in their intrinsic value Therefore, close to expiration the Delta can have large, sudden moves between close to 0 (out-of-the-money) and close to 1 or -1 (in-the-money), which gets reflected in a very high Gamma. Essentially, higher Gamma means a higher change in Delta, which indicates a higher movement in the option’s value when the stock moves $1.00 all else equal.

Gamma is a positive value for long positions and a negative value for short positions — regardless if the contract is a call or a put.

Factors to consider

Gamma goes to 0 when Delta has reached 0 (out-of-the-money) or +1 / -1 (in-the-money) at expiration. In other words, a Delta of 0 at expiration means the option is worthless as the market price is more favourable than the strike price. A Delta of +1 or -1 at expiration means the option is worth executing as the strike price is more favourable than the market.

Deep in-the-money options have a Delta that is already extremely close to +1 or -1 and Gamma is less prominent, this is why Gamma is typically higher for at-the-money options.

As Gamma increases, the cost of owning an option over time (Theta) decreases. Theta measures the expected rate of decline of an option’s value over time. This is prevalent as options lose their time value as they approach expiration.

Gamma in the Black-Scholes Model

The use of the Greeks was popularized in the Black Scholes Model, which is a financial model that provides information about the dynamics of a financial market, specifically when derivative investing instruments are being used. Gamma and the other Greek metrics help show how sensitive the value of derivatives is to changes in the value of the underlying asset. Gamma, as noted above, is itself a derivative of one of the other Greeks – delta. Call options typically have a plus, or positive, gamma, while put options usually have a negative gamma.

How to use gamma?

The Stability of Delta- Gamma can be used to measure the stability or the instability of Delta. A higher Gamma is an indication of a greater potential change in Delta which equates to instability of Delta. Essentially, when utilizing Delta for the probability of being in-the-money at expiration, Gamma can help determine the stability of the probability Delta provides.

Long Options and Gamma- as Gamma is a measure of the movement of Delta and Delta is the measure of the option’s sensitivity to the underlying, Gamma can help indicate a potential acceleration in changes in the option’s value. A higher Gamma indicates accelerated option value changes when the stock moves up or down by $1.00. This will in return, accelerate profits for a long position and also accelerate losses.

Short Options and Gamma- Higher Gamma can increase risk for option sellers as the option experiences accelerated movement. This is because options can experience drastic profit and loss swings and a higher Gamma indicates accelerated movement of the underlying. A short un-covered option has increased risk a higher Gamma increases this risk as the stock can accelerate movement in either direction creating a loss very quickly.