A debt fund is a Mutual Fund scheme that invests in fixed income instruments, such as Corporate and Government Bonds, corporate debt securities, and money market instruments etc. that offer capital appreciation. Debt funds are also referred to as Fixed Income Funds or Bond Funds.

A few major advantages of investing in debt funds are low cost structure, relatively stable returns, relatively high liquidity and reasonable safety. Debt funds are less volatile and, hence, are less risky than equity funds.

Types of debt funds

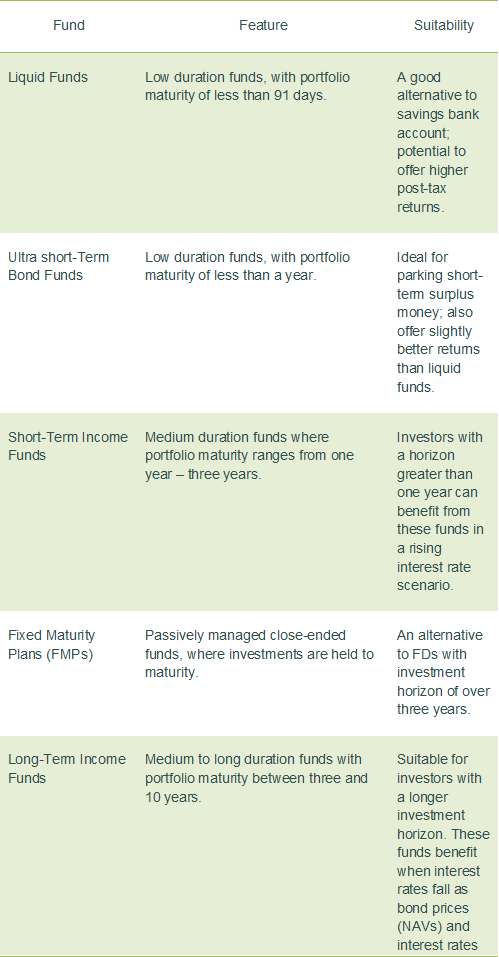

Dynamic bond funds- In dynamic bond funds, the fund manager changes the maturity of the portfolio depending upon their forecast on interest rates. If the forecast is for rising interest rates, the maturity is shorter. If the forecast is for falling interest rates, the maturity is longer. These funds come with a fluctuating maturity period. They invest in instruments that have shorter (1-3 years) as well as longer (3-5 years) maturities. These funds are slightly more risky than short-term debt funds.

Fixed Maturity Plans- Fixed Maturity Plans or FMPs come with a lock-in period. This period can vary based on the scheme you choose. You can invest in FMPs only during the initial offer period. After that, you cannot make further investments in this scheme. Many investors consider FMPs similar to FDs because both come with a lock-in period. However, unlike FDs, FMPs don’t promise fixed returns. However, FMPs are more tax efficient than FDs.

Liquid funds- As the name suggests, liquid funds are a type of debt mutual funds that are highly liquid. These funds invest in debt instruments with a maturity period of not more than 91 days. Investors can withdraw up to Rs.50, 000 as an instant redemption facility from some liquid funds. These funds are considered to be among the least risky within mutual funds.

Short / medium / Long Term funds- Short-term debt funds come with a maturity period of 1-3 years. These funds are suitable for investors with a low-risk appetite because their prices are not much impacted by the change in interest-rate movements also called as interest rate risk.

Medium term funds come with a portfolio maturity of 3-5 years and long term funds come with a maturity beyond 5 years. Medium and long term funds are relatively more risky than short term funds mainly because longer the tenure, larger is the impact of interest rates on the portfolio. This is also known as duration risk or interest rate risk.

How do debt funds work?

Debt funds pool investor capital and the fund managers invest it in carefully picked out debt securities such as corporate and government bonds, corporate debt securities, and money market instruments that offer capital appreciation.

Credit ratings become an important measure of the risk involved in debt instruments, and that is one of the main roles of debt fund managers – to assess the credit risk and make the right pick of underlying assets for the funds. As the underlying fixed income asset generates interest, the value of the fund goes up. The returns are predictable but not fixed; returns are prone to milder fluctuations caused by interest rate changes.

Advantage of investing in debt funds

Stable income- Debt Funds have potential to offer capital appreciation over a period of time While debt funds come with a lower degree of risk than equity funds, the returns are not guaranteed and subject to market risks.

Stability- Investing in debt funds can also increase the balance of your portfolio. Equity funds (while offering higher return potential) can be volatile. This is because the returns on equity funds are linked directly to the performance of the stock market. By investing in debt funds, you can adequately diversify your portfolio and bring down overall risk (cushion the downside)

Professional management- Investing in fixed-income securities requires knowledge of the industry, and many people usually do not want to spend a lot of time researching and analyzing individual bonds. Through a bond fund, they can have their money actively managed by a portfolio manager who possesses the technical knowledge of the industry.

Flexibility- Debt mutual funds also offer you the option of moving around your money to different funds. This is possible through a Systematic Transfer Plan (STP). Here, you have the option to invest a lump sum amount in debt funds and systematically transfer a small portion of the fund into equity at regular intervals. This way you can spread out the risk of equities over a specified period of a few months rather than investing the entire amount at one point. Other traditional investment options do not offer this degree of flexibility to investors.

How to choose debt funds

Investment objective- Before you select a debt fund, ask yourself the question: ‘What is my investment objective?’ do you want to create an emergency fund? As we have seen above, different types of debt funds cater to different investment goals. So, once you identify your investment objective, the process of selecting the right fund becomes easier.

Risk- Debt funds also come with specific risks like credit and interest-rate risk. Credit risk occurs when the fund manager invests your money in securities that have a low credit rating. This can result in a higher probability of default. In case of interest-rate risk, bond prices could fall, when interest rates raise leading to poor returns on your investment. This is why it is essential to carefully check the fund’s history as well as the fund manager’s past performance before investing in any debt fund.

Time horizon- Every investment goal has a specific time limit. If you have a short-term investment goal of around 3 months to 1 year, liquid funds are preferable. If the tenure is between 1-3 years, you can go for short-term debt funds. But if you have an intermediate time horizon of 3-5 years, dynamic / medium term bond funds are more suitable.

Type and their suitability of debt funds:-