A balanced fund combines equity stock component, a bond component and sometimes a money market component in a single portfolio. Generally, these hybrid funds stick to a relatively fixed mix of stocks and bonds that reflects either a moderate, or higher equity, component, or conservative, or higher fixed-income, component orientation These funds invest in a mix of equities and debt, giving the investor the best of both worlds. Balanced funds gain from a healthy dose of equities but the debt portion fortifies them against any downturn.

Balanced funds are suitable for a medium-term horizon and are ideal for investors who are looking for a mixture of safety, income and modest capital appreciation. The amounts this type of mutual fund invests into each asset class usually must remain within a set minimum and maximum. Although they are in the “asset allocation” family, balanced fund portfolios do not materially change their asset mix. This is unlike life-cycle, target-date and actively managed asset-allocation funds, which make changes in response to an investor’s changing risk-return appetite and age or overall investment market conditions.

Equities And Inflation

Investors who have dual investment objectives favour Balanced Funds. Typically, retirees or investors with low risk tolerance prefer these funds for growth that outpaces inflation and income that supplements current needs. While retirees generally scale back risk as age advances, many individuals recognize the need for equity exposure as life expectancies increase. Equities prevent erosion of purchasing power and help ensure long-term preservation of retirement corpus

Diversification

Balanced funds provide investors with diversification. By diversifying the investment across different asset classes, the investor mitigates the risk that they will otherwise face if they’ve invested in a 100% equity fund or 100% bond fund.

In a scenario where volatility occurs in one industry, a balanced fund portfolio will experience less fluctuation compared to a pure equity portfolio investing in the same industry. While a balanced fund does offer diversification, the securities selected and the weightings of each asset class may not be aligned with the holder’s investment goals.

How Balanced Funds Work?

Balance funds, as the name suggests, balance your exposure to the debt and equity market by optimizing fund’s exposure between debt and equity market.

For example, if a fund manager is optimistic about the future course of the market, and wants to benefit from the positive market outlook, he can increase his exposure in equity market, by allocating major part of his investment in equities.

Advantages of Balanced Funds:

Stable and Consistent Returns- While equity returns are higher compared to other funds, the biggest drawback of these funds is that the returns are highly volatile. In other words, while the returns on equity funds may vary, balanced funds mostly have stable and consistent returns for a long period of time.

Reduced risk- One of the biggest advantages of balanced funds is that they reduce your investment risk by balancing your exposure towards debt and equity. When investing in a balanced fund, you can optimize your exposure to equity and debt, so that when equity market becomes risky, you can chose to reduce your exposure by booking some profits and investing in debt instruments.

Disadvantages of Balanced Funds

They are not risk-less- Contrary to popular belief, balanced funds are not completely risk-less. Every balance fund has 50%-65% exposure to equity market. Such huge exposure itself is strong evidence that despite not being pure equity fund, balanced funds still have a risk factor.

High Fee- Finally, the fee charged by a balanced fund is high compared to potential return received, since the team of fund managers and research analysts involved have to do the tough job of analysing both equity and debt market in order to optimize returns, the fund fee charged by balance funds is comparatively higher.

Returns are lower than Equity Funds- While balance finds can be safer option to invest in stock market, the safety comes at a price. Most of the balanced funds usually under-perform equity mutual funds especially during bull market as a part of their fund still remains allocated to debt funds. This restricts balanced funds from taking full advantage of equity Bull Run and investors have no other option but to live with mediocre returns.

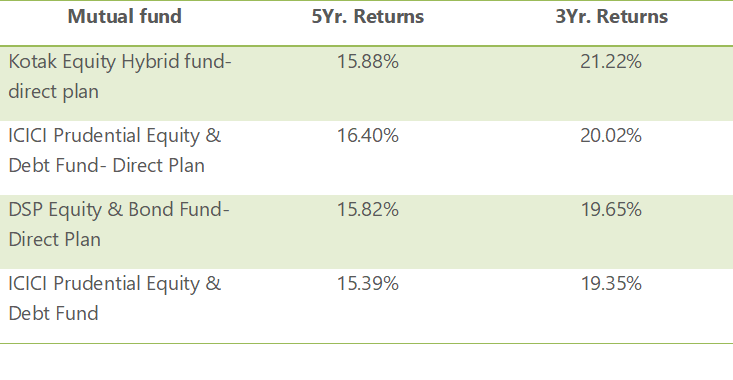

Top Balanced Funds of 2021

As per cleartax.in, it has created a list of top balanced mutual funds for 2021, based on their performance in the past 5 years and 3 years of performance.

Although I do not suggest you to look at past performance as the only factor for choosing a fund, still, it gives you a starting point to explore more about how these funds are managed and what stocks or bonds they hold?

Who Should Invest in Balanced Funds?

So, who should invest in balanced funds? Is it suitable for everyone? Well, since balanced funds are more focused towards safety of your capital, in my opinion, these funds are suitable for those investors that are new to the stock market and have little or no knowledge about investing.

Secondly, those investors that are risk averse, and are close to retirement (let’s say 5-7 years), can invest in this fund.

Conclusion

Balanced funds can be a great way to create wealth passively by investing in equity markets, while preventing overexposure, thus mitigating your risk in a highly volatile market. However, it’s also true that this safety comes at a cost of mediocre returns. Thus investors looking to invest in balanced funds should also analyse the behavior of the fund manager by looking at the how markets fared in the past and how the fund manager allocated capital to maximize return and minimize risk.