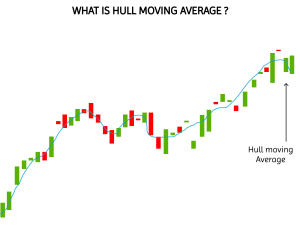

Hull Moving Average, an advanced technical indicator, has gained significant popularity among investors due to its unique approach to smoothing out price data. This article will delve into the details of the Hull Moving Average (HMA) and understand its purpose, mechanics, and practical application in trading strategies.

What is Hull’s Moving Average?

The Hull Moving Average (HMA) is a refined moving average indicator designed to address the limitations of traditional moving averages, such as simple moving averages (SMA) and exponential moving averages (EMA). Alan Hull created this indicator to provide a smoother and more responsive representation of price trends, reducing lag and enhancing accuracy.

Some of the advantages of using the Hull Moving Average:

- It is less susceptible to lag than traditional moving averages.

- It is more responsive to changes in price.

- It is less affected by noise in the data.

- It is easy to interpret.

Here are some of the disadvantages of using the Hull Moving Average:

- It can be more complex to calculate than traditional moving averages.

- It can be more sensitive to whipsaws.

Working of Hull Moving Average

The HMA operates by utilizing weighted calculations and a root mean square approach. This combination helps to eliminate the lag often associated with other moving averages. It places greater emphasis on recent price movements while still incorporating historical data. Doing so offers a clearer picture of the current market trend.

Hull Moving Average Calculation

The HMA is calculated using the following steps:

- Calculate a simple moving average (SMA) with the specified periods.

- Calculate a weighted moving average (WMA) with the same number of periods but with a weighting factor that increases exponentially as the price data gets closer to the present.

- Calculate the difference between the SMA and the WMA.

- Smooth the difference between the SMA and the WMA using a third WMA with a weighting factor inversely proportional to the square root of periods.

The formula for calculating the HMA is as follows:

HMA = WMA(SMA(price, n), k)

Where:

- HMA is the Hull Moving Average

- WMA is the Weighted Moving Average

- SMA is the Simple Moving Average

- n is the number of periods

- k is the weighting factor

The weighting factor is calculated using the following formula:

k = 2 / (sqrt(n) + 1)

For example, if the number of periods is 20, the weighting factor would be 2 / (sqrt(20) + 1) = 0.866.

The HMA can be calculated using any spreadsheet software or trading platform. Many online calculators can be used.

How do these Calculations Reduce Lag?

The HMA is calculated using a weighted moving average formula that places a greater weight on more recent price values. This helps to make the HMA more responsive to changes in price and less susceptible to lag.

The HMA is also calculated using a smoothing factor that helps to reduce the noise in the data. This makes the HMA more smooth and easier to interpret.

The HMA calculations reduce lag in the following ways:

- The weighting factor used to calculate the HMA increases exponentially as the price data gets closer to the present. This means that more recent price values are given more weight, which makes the HMA more responsive to changes in price.

- The smoothing factor used to calculate the HMA is inversely proportional to the square root of the number of periods. This means the HMA is smoothed more heavily for shorter periods and less heavily for more extended periods. This helps to reduce the noise in the data and makes the HMA easier to interpret.

As a result of these calculations, the HMA can track price movements more closely than traditional moving averages while retaining the smoothness of the moving average line. This makes the HMA helpful in identifying trends, support and resistance levels, and overbought and oversold conditions.

Using Hull Moving Average Strategy

The Hull Moving Average is commonly used to identify trends and generate trading signals. Here’s a brief guide on using the HMA strategy:

- Trend following strategy: This strategy involves buying an asset when the HMA crosses above a support level and selling an asset when the HMA crosses below a resistance level.

- The divergence strategy involves looking for divergences between the HMA and the price action. A bullish variation occurs when the price makes lower lows, but the HMA makes higher lows. This signals that the trend is about to reverse to the upside. A bearish variation occurs when the price is higher, but the HMA is lower. This signals that the trend is about to reverse to the downside.

- Filter strategy: This strategy involves using the HMA to filter out noise in market and identify the most vital trends. For example, you might only trade when the HMA is above a certain level.

The best Hull Moving Average strategy for you will depend on trading style and risk tolerance. It is essential to backtest different strategies before using them in real money.

Here are some additional tips for using the Hull Moving Average:

- Use multiple time frames: The HMA can be used at different times, such as daily, weekly, and monthly. Using multiple time frames can help to identify trends and patterns that are not visible in a single time frame.

- Adjust the number of periods: The number used to calculate the HMA can be adjusted to suit your trading style and risk tolerance. A shorter number of periods will make the HMA more responsive to changes in price, but it will also be more susceptible to noise. A more extended number of periods will make the HMA less responsive to changes in price, but it will also be smoother and less prone to whipsaws.

- Use other indicators: The HMA can be used with other technical indicators, such as the Relative Strength Index and the Moving Average Convergence Divergence. This can help you confirm trading signals and reduce the risk of false alerts.

Interpretation of Hull Moving Average Strategy

To interpret the Hull Moving Average strategy, you need to understand the following:

- The HMA is a weighted moving average that weighs more on recent price values. This makes the HMA more responsive to changes in price and less susceptible to lag.

- The HMA is calculated using a smoothing factor that helps to reduce the noise in the data. This makes the HMA more smooth and easier to interpret.

- The HMA can be used on different time frames, such as daily, weekly, and monthly.

- The number of periods used to calculate the HMA can be adjusted to suit your trading style and risk tolerance.

- The HMA can be used with other technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

Here are some common ways to interpret the Hull Moving Average strategy:

- Trend following The HMA can be used to identify trends by looking for the direction of the HMA. A rising HMA indicates an uptrend, while a falling HMA indicates a downtrend.

- Support and resistance: The HMA can identify support and resistance levels by looking for areas where the HMA has previously bounced off.

- Overbought and oversold: The HMA can identify overbought and oversold conditions by looking for areas where the HMA has exceeded or fallen below certain levels.

- Divergence: The HMA can identify divergences between the HMA and the price action. A bullish variation occurs when the price makes lower lows, but the HMA makes higher lows. This signals that the trend is about to reverse to the upside. A bearish variation occurs when the price is higher, but the HMA is lower. This signals that the trend is about to reverse to the downside.

The best way to interpret the Hull Moving Average strategy will depend on your trading style and risk tolerance. It is essential to backtest different strategies before using them in real money.

Drawbacks of Hull Moving Average

Some of the limitations of the HMA include:

- It is still a lagging indicator: The HMA could be a better indicator and will still lag behind the price action. This means it may need help identifying trends as early as other indicators.

- It can be sensitive to whipsaws: The HMA can be sensitive to whipsaws, false signals that occur when the price reverses direction quickly. This can lead to losses if you trade on these signals.

- It can be challenging to interpret: The HMA can be difficult, especially for beginners. Understanding how the HMA works and how to use it before trading with it is essential.

- It is unsuitable for all markets: The HMA is not ideal for all needs. It is best suited for trending markets but can be less effective in consolidating markets.

Despite its limitations, the HMA can be a useful tool for technical analysis. It is essential to be aware of the HMA’s limitations and use it with other indicators to improve the accuracy of your trading decisions.

Conclusion

In conclusion, the Hull Moving Average is a powerful tool for traders seeking a more responsive and accurate indicator of market trends. By incorporating advanced calculations and reducing lag, the HMA helps traders make informed decisions based on a smoother representation of price data. However, it’s crucial to remember that no single indicator guarantees success in trading. The HMA should be used with other technical and fundamental analysis tools to maximize its effectiveness and potential for profit.