Risk-free rate?

The theoretical rate of return for a risk-free investment is known as the risk-free rate of return. However, as all investments involve some level of risk, there is no such thing as a risk-free rate of return in reality. The risk-free rate is the interest that a potential investor could make on a completely risk-free investment over a specific period of time. By deducting the current inflation rate from the yield on the Treasury bond that corresponds to the investment tenure, we may determine the so-called “actual” risk-free rate. The hypothetical rate of return for an investment with no risk is known as the risk-free rate of return.

Equity risk premium?

Now let us understand what equity risk premium is. The difference between the returns on equities or individual stocks and the risk-free rate of return is known as the equity risk premium. With no chance of the government defaulting, longer-term government bonds can be used as a benchmark for the risk-free rate of return. It is the additional return that a stock gives to the owner in exchange for the risk the owner is incurring, over and above the risk-free rate. It serves as the investor’s reward for choosing equity investments over risk-free products and assuming a higher level of risk.

The equity risk premium is a long-term forecast of the stock market’s performance relative to risk-free debt securities.

Remember the three stages involved in determining the risk premium:

- Calculate the projected stock return

- Calculate the bond’s projected return on risk-free investments.

- Calculate the equity risk premium by deducting the difference.

What is risk premium?

- How much a stock will beat risk-free investments over the long run is predicted by the equity-risk premium.

- By subtracting the projected expected return on risk-free bonds from the estimated expected return on stocks, one may get the risk premium.

- Although predicting future stock returns is challenging, it is possible to do so using earnings- or dividend-based methodology.

- Some assumptions that range from safe to doubtful must be made in order to calculate the risk premium.

- A direct correlation exists between equity risk premium and risk magnitude. The premium increases as risk increases since there is a wider spread between stock returns and the risk-free rate. Additionally, empirical evidence supports the idea of equity risk premium. It demonstrates that every investor will benefit in the long run by accepting a bigger risk.

- For a logical investor, an increase in an investment’s risk must be matched by an increase in its potential profit for the investment to remain feasible. For instance, if government bonds are returning 6% to an investor, a sane investor would only choose a company’s shares if it returned more than 6%, say 14%. In this case, 14% – 6% = 8% is the equity risk premium.

What is a risk-free rate?

Subtract the inflation rate from the yield of the Treasury bond that corresponds to the length of your investment to determine the real risk-free rate.

- Since they won’t take on further risk unless the potential rate of return is higher, an investor should theoretically anticipate that the risk-free rate will be the minimum return on any investment. When finding a proxy for the risk-free rate of return in a specific case, the investor’s home market must be taken into account, and negative interest rates may make matters more challenging.

- But since even the safest investments have a little amount of risk, there is no such thing as a really risk-free rate. As a result, the interest rate on a three-month U.S. Treasury bill (T-bill) is usually used as the risk-free rate for investors located in the United States.

- As Rf increases, there will be pressure on the market risk premium to increase. This is due to investors’ higher expectations for required returns, which have increased as a result of their ability to receive a higher risk-free return, meaning that riskier assets will need to perform better than they did in the past. In other words, investors will perceive alternative assets as having a significantly higher risk than the risk-free rate. As a result, they will ask for a larger rate of return to make up for the increased risk.

- The second component in the CAPM equation will stay the same if the market risk premium increases by an amount equal to that of the risk-free rate. However, the CAPM will rise as the first term rises. If risk-free rates decreased, the chain reaction would go in the opposite way.

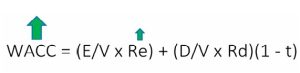

The weighted average cost of capital for a corporation is impacted by the cost of equity, which is determined using the CAPM and takes into account the risk-free rate. The graph below shows how variations in the risk-free rate might impact the cost of stock for a company: