- All About FnO 360

- What are Futures and Options

- All About Futures

- Types of Futures contract

- All About Options

- Types of Options Contract

- Smart Option Strategies

- Smart Scalping Strategies

- Examples of Smart Strategies

- Examples of Smart Scalping Strategies

- How to Access Smart Strategies in FnO 360

- How to Access Scalping Strategies in FnO 360

- Study

- Slides

- Videos

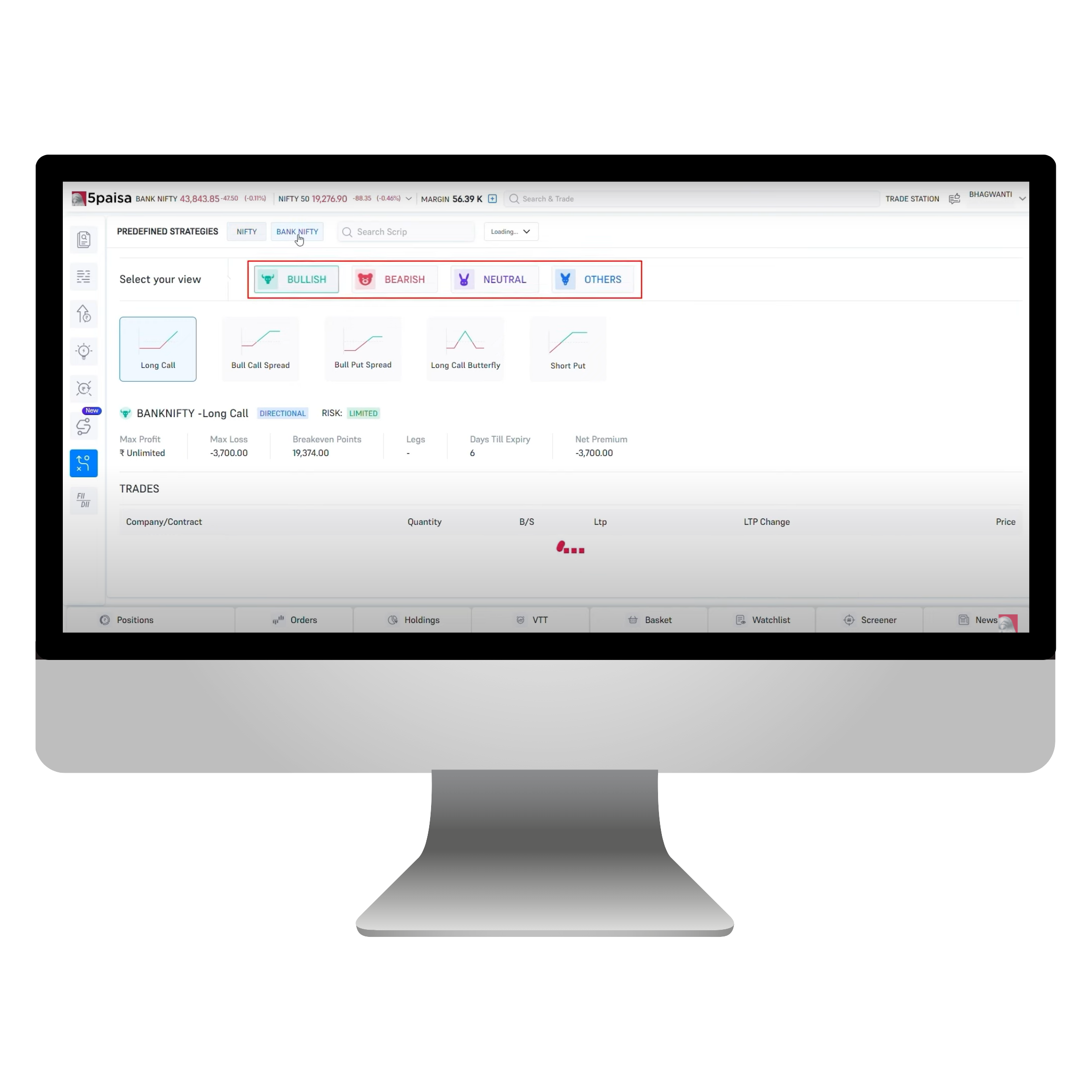

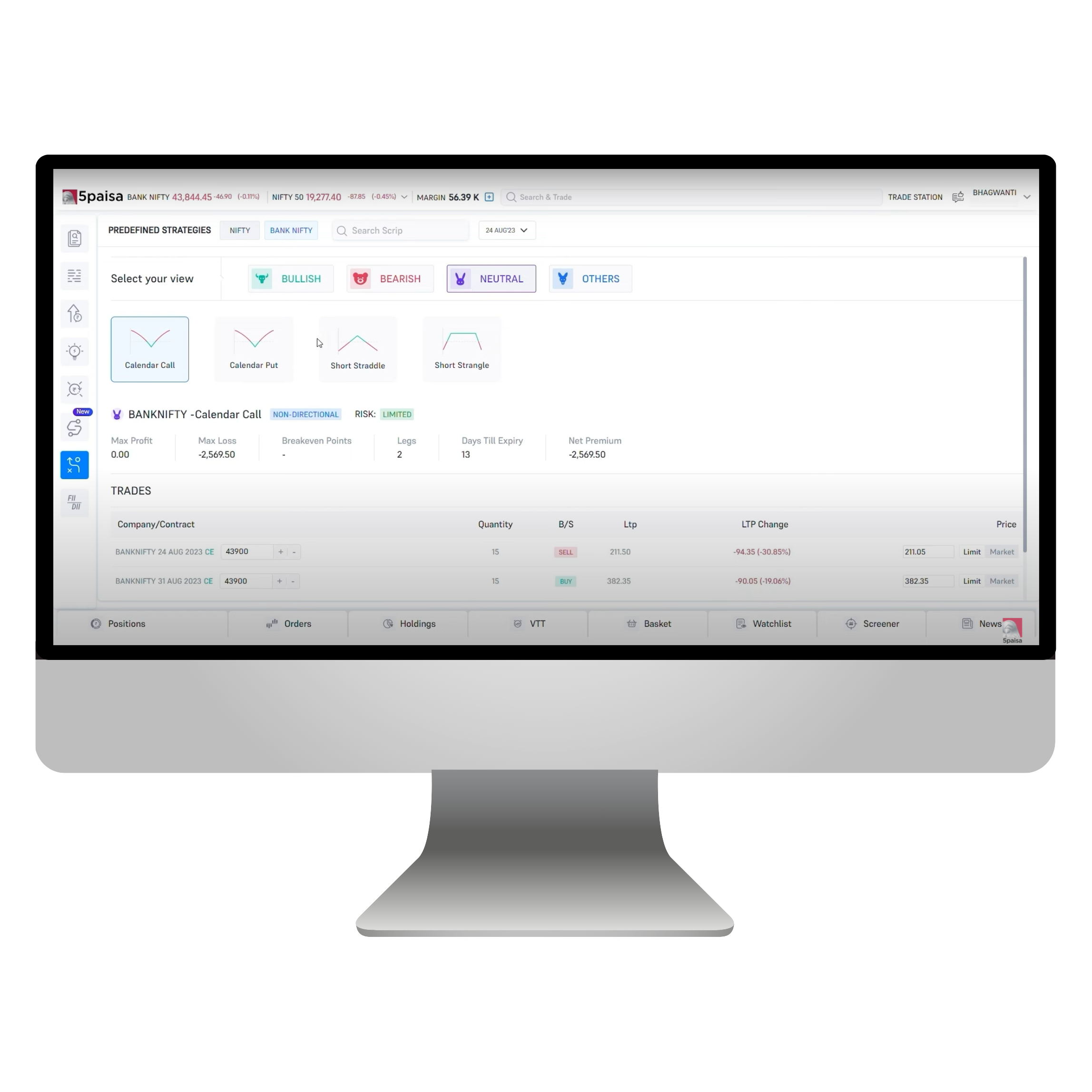

11.1 How to Use Predefined Strategies in FnO 360

Predefined strategies helps you to do complex trading in simple way.

For that login to Fno 360 platform in 5 paisa.

Left side there is an option to choose Predefined strategies

Inside this, according to market sentiments Bullish Bearish and Neutral categories are created.

According to your view for the market you have to select the strategies. By default NIFTY is selected but you can change it according to your choice.

Also script related strategies are available on this screen FOR Example- Max Profit, MAX Loss and the Breakeven points.

Below that you can view the trades executed using the strategies.

Here you can view the quantity of orders placed and verify all the details mentioned and click on place order section

In this way you can place orders and execute your strategies in just one click .

11.2. Special Features of Fn0 360

-

Open interest (OI):

Open Interest (OI) is a key metric for traders involved in stock futures and options. It represents the total number of outstanding or active contracts (both buy and sell) that have not been settled yet. This metric provides valuable insights into market sentiment and activity.

This section helps to understand the importance of OI in analyzing market movements. By integrating OI into graphs, traders can visually assess patterns and trends, helping them understand the level of interest and participation among investors. This graphical representation makes it easier to predict potential market directions based on how actively investors are engaging with specific derivatives.

-

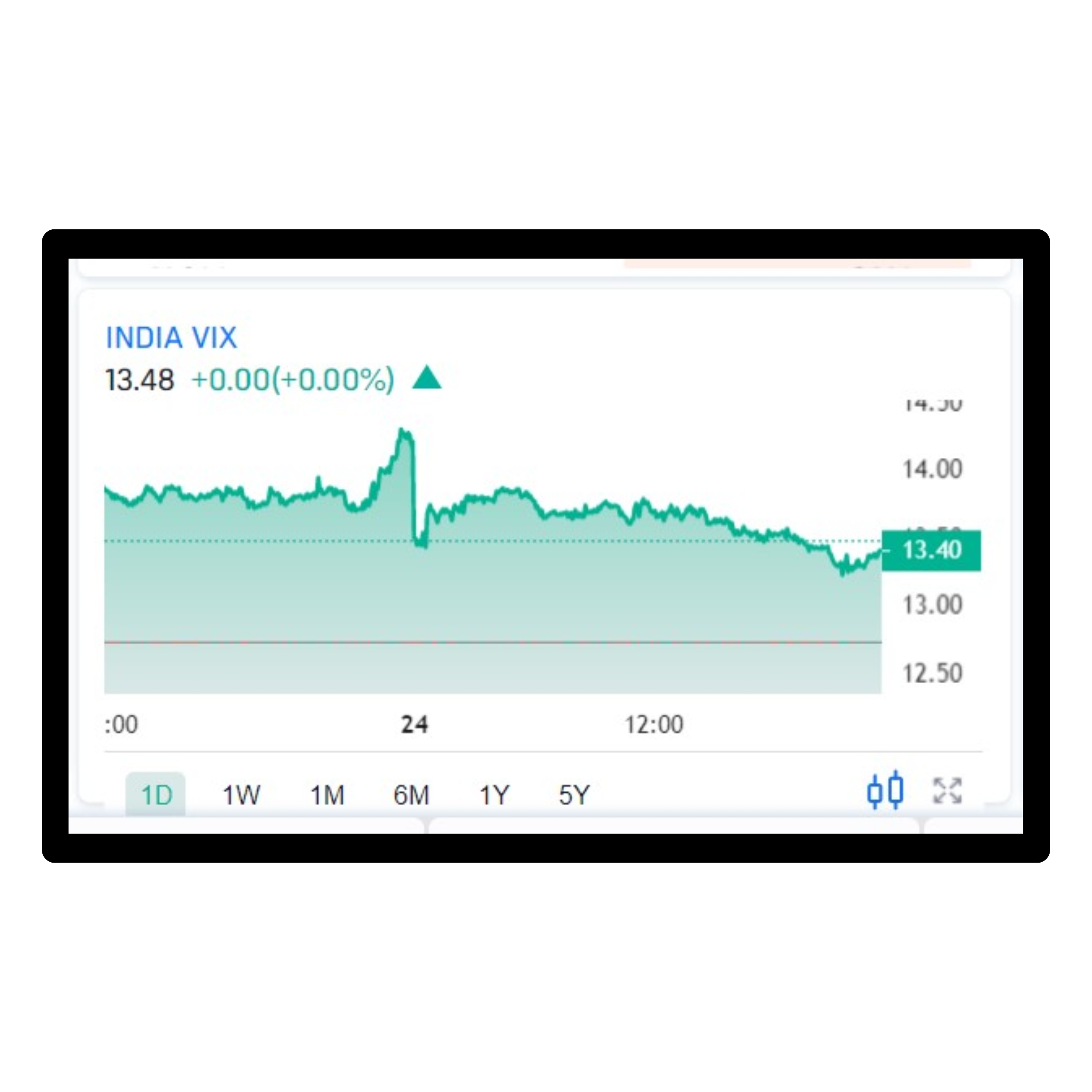

India VIX :

Traders often rely on the Volatility Index (VIX) to guide their trading decisions, as it provides a clear measure of market uncertainty and risk. To make it convenient for traders, the relevant data is readily available in one place, eliminating the need to navigate through multiple tabs or sources.

India VIX, in particular, is widely regarded as the most accurate and dependable indicator for assessing market volatility. By tracking the fluctuations in India VIX, traders can better gauge the level of fear or confidence in the market, allowing them to plan their strategies more effectively.

-

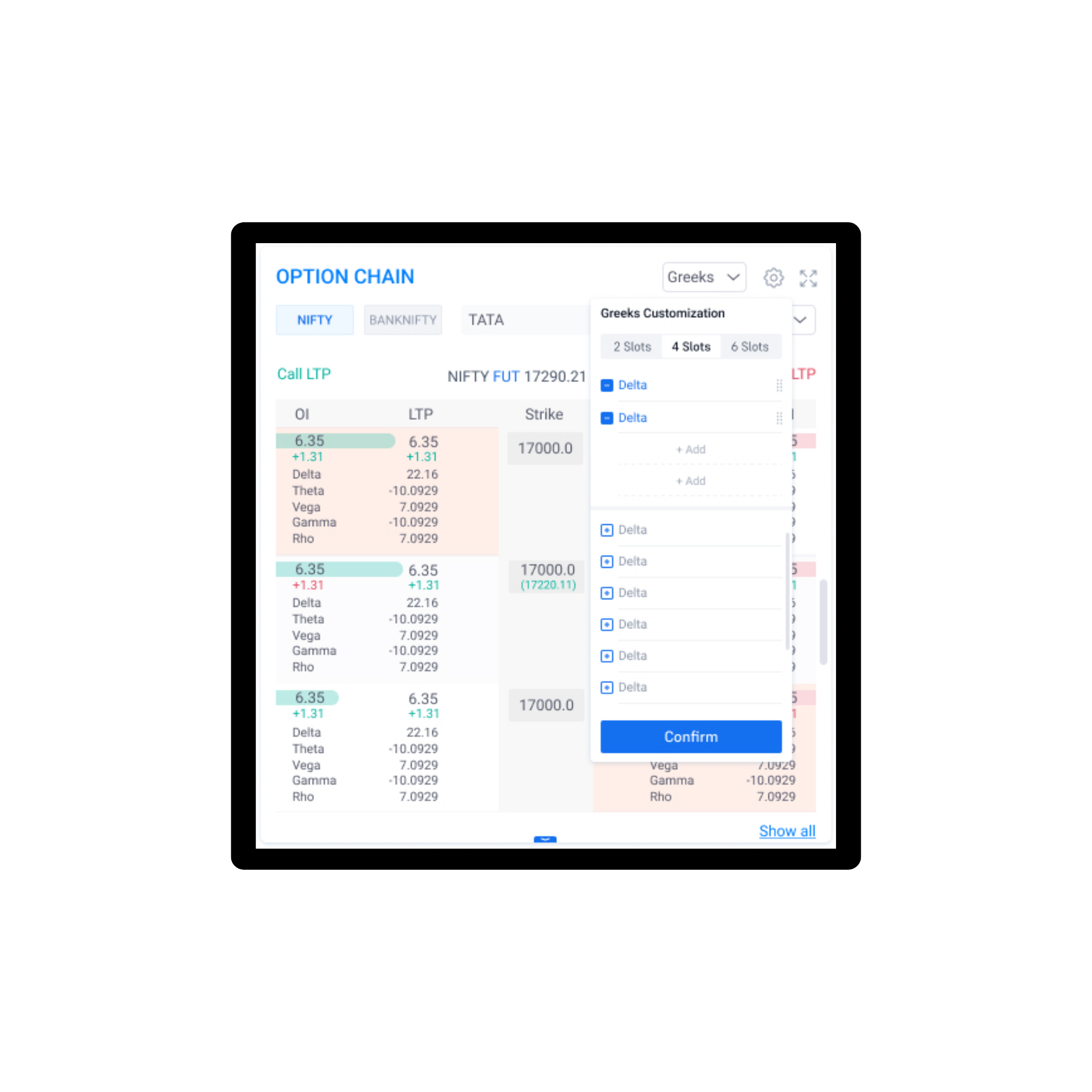

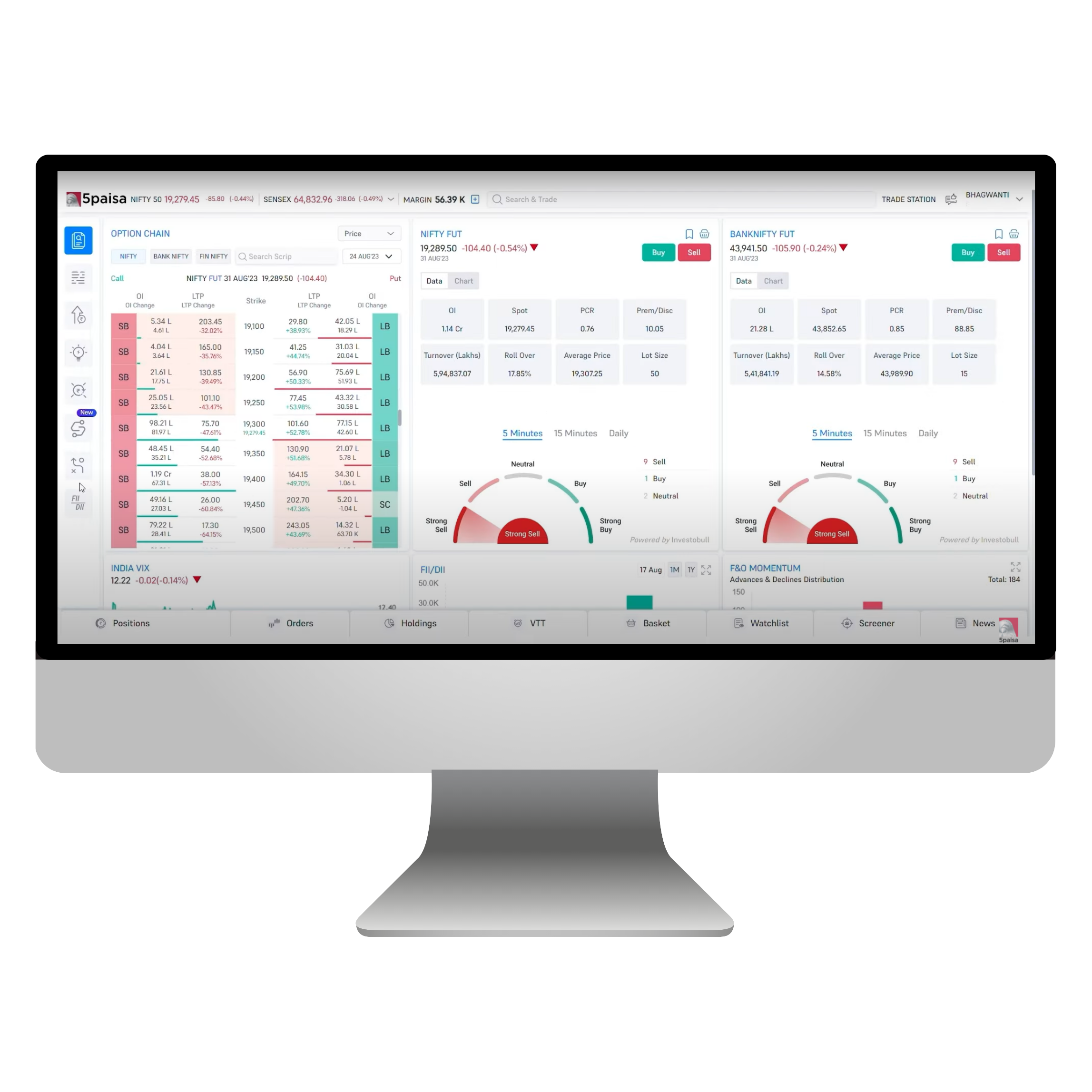

Option Chain :

An options chain, or options matrix, is a comprehensive table showing all the available options contracts for a specific security along with their key details. It provides traders with a complete overview of the market, helping them analyze data in real time with exceptionally fast refresh rates.

The options chain includes vital metrics like Open Interest (OI), Last Traded Price (LTP), changes in OI, straddle data, and Greeks (metrics used to assess risk). These are visually represented with detailed bar graphs for an in-depth, easy-to-interpret analysis.

Specifically, the Open Interest metric in the options chain shows the total number of outstanding contracts held by traders at any given time. By viewing this data in the options chain section, traders can get a clear snapshot of market activity and participant behaviour, enabling more informed decisions.

-

Straddle

A straddle is one of the simplest and most popular trading strategies, widely favoured by traders for its versatility. This strategy involves simultaneously buying or selling a call and put option with the same strike price and expiry date, allowing traders to benefit from significant price movements in either direction.

On the F&O 360 web platform, the options chain includes a dedicated feature for straddles. It provides a streamlined way to view and analyze the entire strategy directly within the platform. Traders can execute a straddle order seamlessly with just a single click, making it convenient and efficient to implement this strategy in their trading.

-

Greeks

Greeks are essential tools for options traders who focus on understanding how the price of an option responds to various factors related to its underlying asset, such as stocks, bonds, commodities, interest rates, market indexes, or currencies.

If your trading strategy revolves around analyzing the sensitivity of an option’s price to changes in these underlying parameters, the Greeks are invaluable. They help you measure critical factors like price movements (Delta), time decay (Theta), volatility (Vega), and changes in interest rates (Rho). By incorporating Greeks into your strategy, you can make more informed decisions and manage risk more effectively while trading options.

Note: User can view the option chain in 2 modes i.e. Mini option chain on the overview page and full screen mode option that you will find below the overview page

-

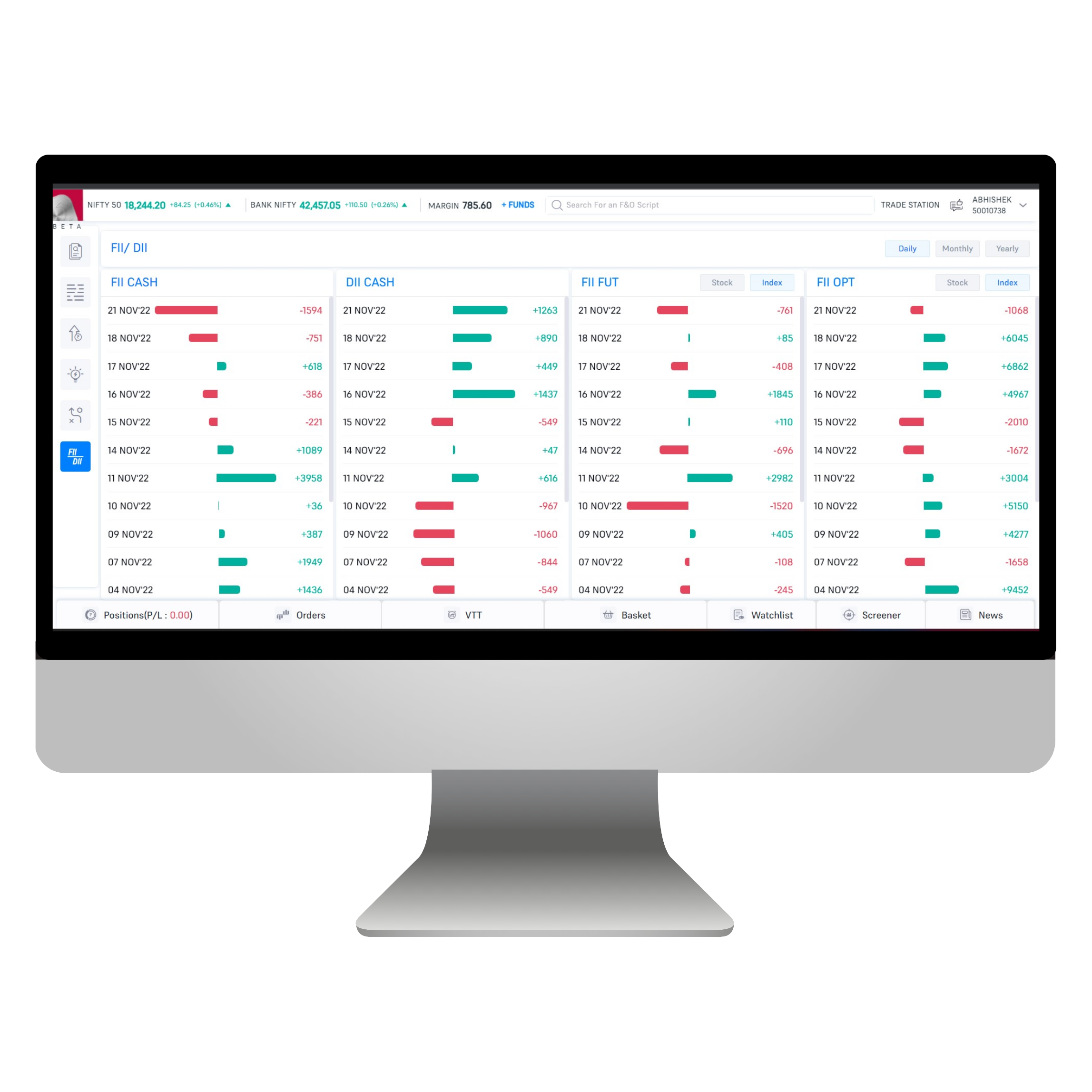

FII/DII:

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) play a significant role in shaping market trends due to the substantial capital they bring into the market. Their trading activity often sets the direction for market movements, making it crucial for traders to track their investments.

The FII/DII feature in the F&O 360 platform provides insights into the trading behaviour of these major players. By analyzing this data, you can gain a competitive edge over retail investors by aligning your strategies with the market-driving actions of FIIs and DIIs. This feature empowers you to make informed decisions and stay ahead in the trading game.

-

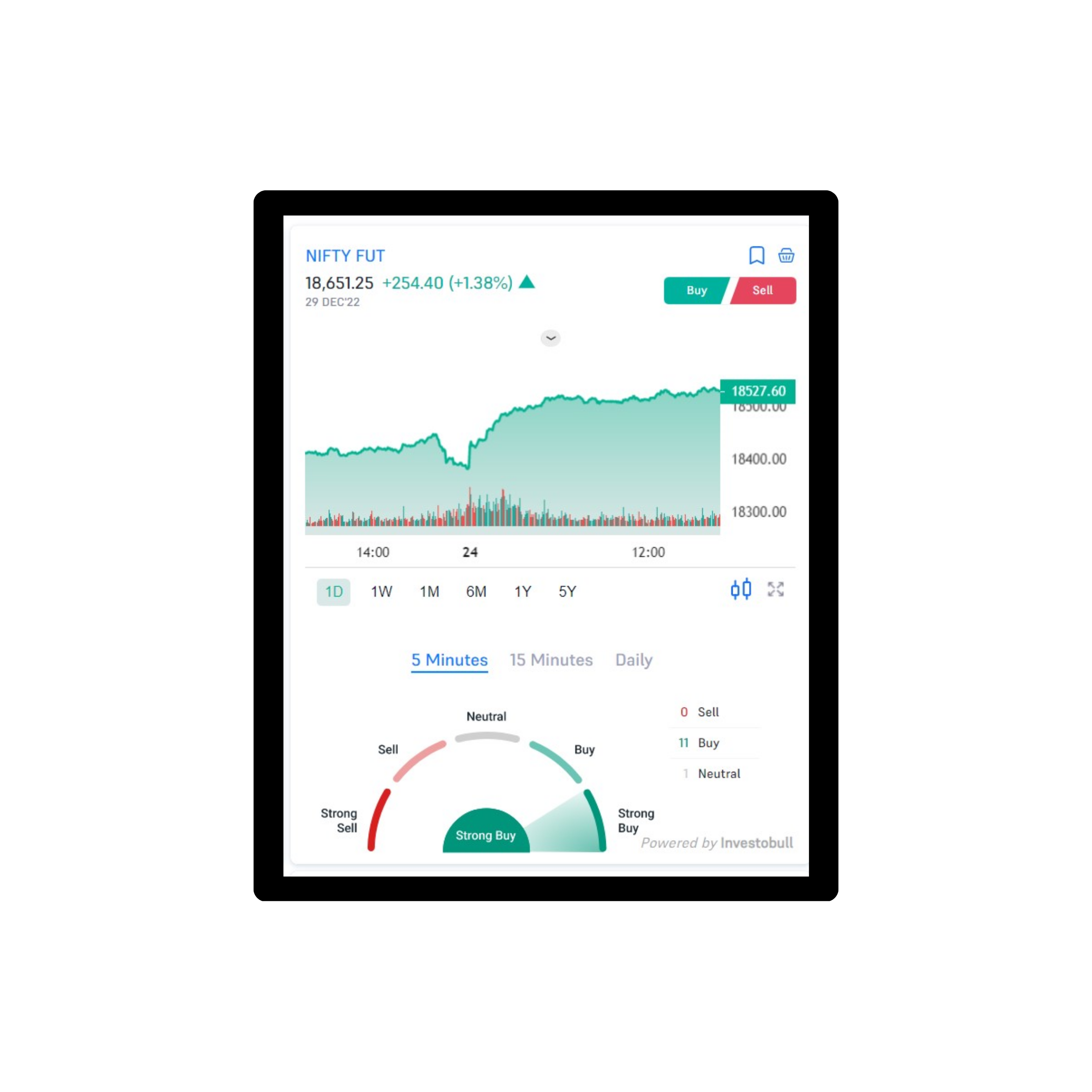

Lightweight charts:

Lightweight charts are compact, interactive visual tools often used in financial trading platforms. Their primary purpose is to present a condensed view of a market’s price movements and trends without overwhelming the user with too much data. These charts allow traders and investors to quickly grasp the current market sentiment and the direction of the price action, making them highly useful for quick decision-making.

A typical lightweight chart might include the following features:

- Price Action: Displays the asset’s price over time, typically in the form of a line or bar chart.

- Buy/Sell Sentiment Indicator: This element shows the overall market sentiment, indicating whether most participants are leaning towards buying (bullish) or selling (bearish) the asset. It can be represented with color codes (e.g., green for buy, red for sell), arrows, or other visual markers.

- Simplified Data: Unlike detailed charts that may include multiple indicators or complex metrics, lightweight charts focus on a simplified view, helping traders quickly interpret the market without excessive information overload.

- Real-time Updates: These charts often offer live, real-time data, ensuring that the trader is always up to date with the latest market shifts.

8. Derivatives Ideas

This section provides specific trading ideas based on different time horizons and strategies within the derivatives market. It helps traders access a variety of ideas tailored to their needs:

-

- Short Term: Ideas for positions you can hold for a few days or weeks based on expected market movements.

- Intraday: Focuses on trades to be opened and closed within the same trading day, aiming to capitalize on quick price movements.

- Expiry Special: Ideas specifically related to trades that are timed around the expiration of futures or options contracts.

- Quick Option Trade: Short-term ideas involving options strategies that aim to exploit market opportunities for quick profits.

-

Currency Segment Ideas

Short Term & Intraday: Trading ideas within the currency markets designed for short-term gains, whether over a few days (short term) or within a single day (intraday). These ideas leverage price movements in foreign currencies.

-

Commodity Segment Ideas

Short Term Ideas: Similar to the currency segment, the commodity section offers ideas focusing on short-term trading in various commodities, like gold, oil, etc.

11.3. Types of Orders you can place on FnO 360 window

The platform provides a variety of order types that enhance trading efficiency and flexibility:

Basket Orders

Allows you to place up to 10 orders at once. This is useful for executing complex strategies or placing multiple trades simultaneously. You also get margin benefits from hedging multiple positions in one go.

Rollover:

This feature lets you easily carry forward your futures contracts to the next expiry cycle with minimal loss. You can roll over a position into the next month’s contract with just one click.

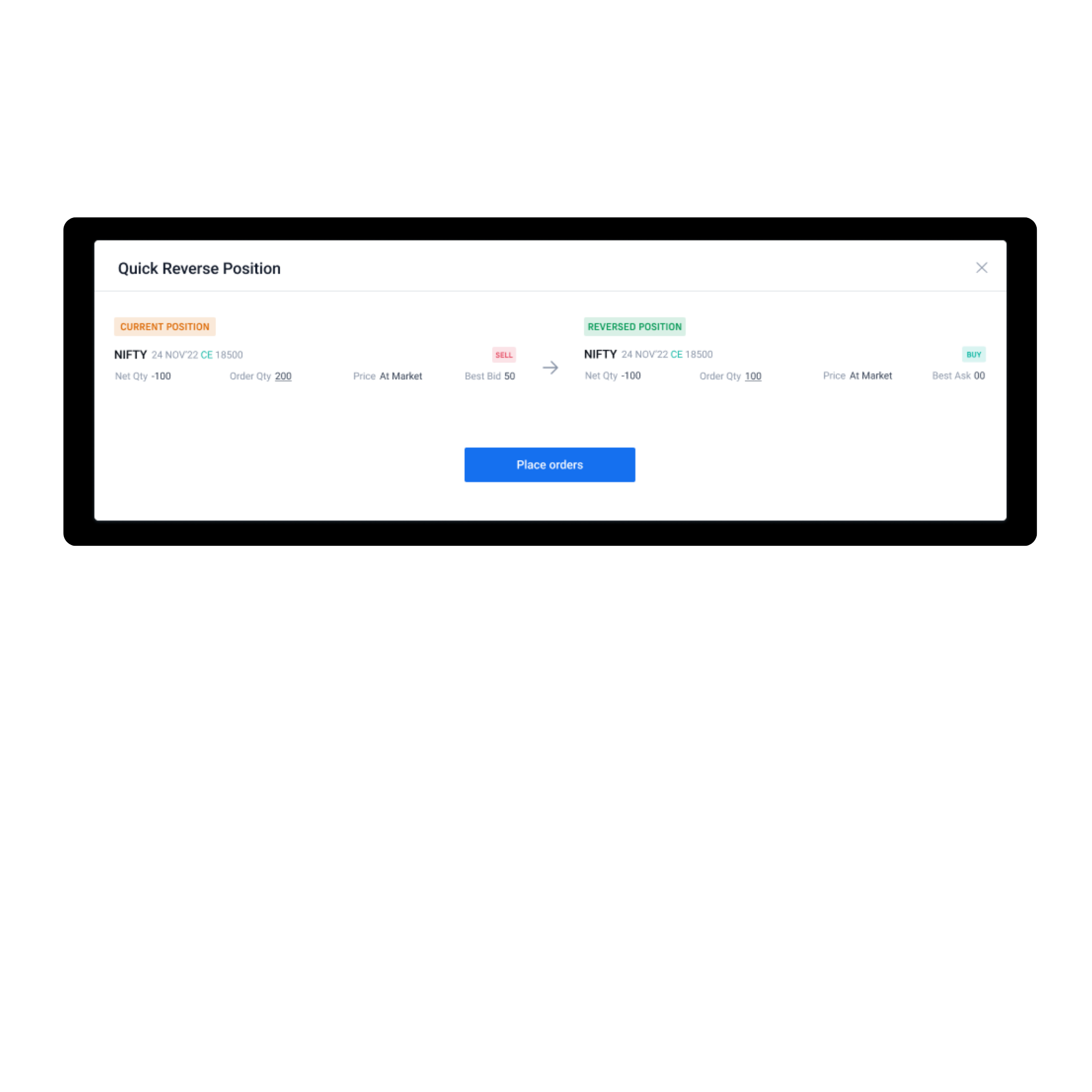

Quick reverse:

If the market outlook changes quickly, you can instantly reverse your position—changing from long (buy) to short (sell) or vice versa—at the click of a button.

VTT orders:

Allows you to set a trigger price for buying or selling a stock. This order gets activated only when the market reaches your predefined price level, providing an automated response to price changes. The order can remain active for up to a year.

11.4. Additional special feature to the FnO 360 window

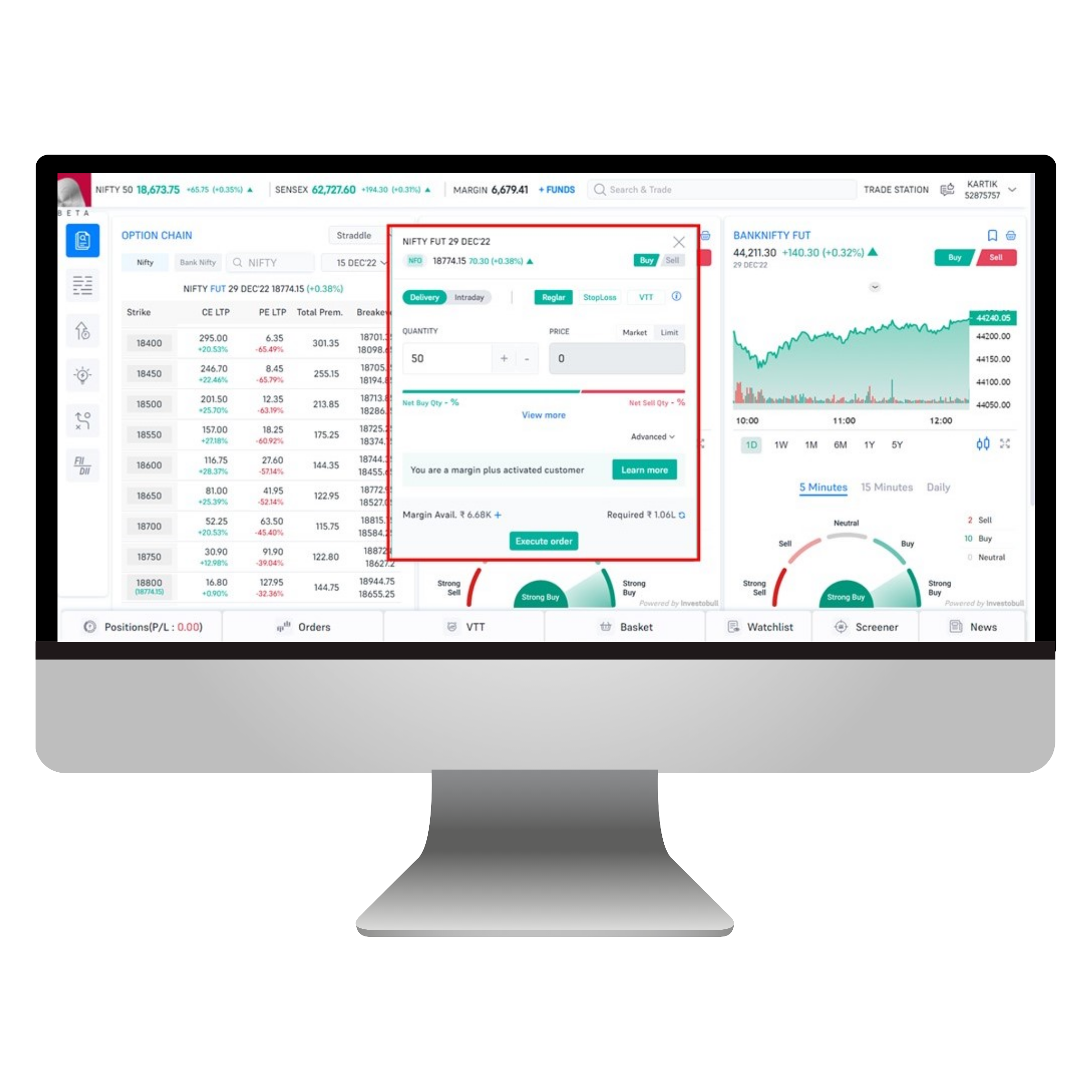

Sleek Orderform:

The Sleek Orderform is designed to make entering orders more efficient and user-friendly. It simplifies the process of placing orders by offering a clear, intuitive interface, making it easier to execute trades accurately and quickly.

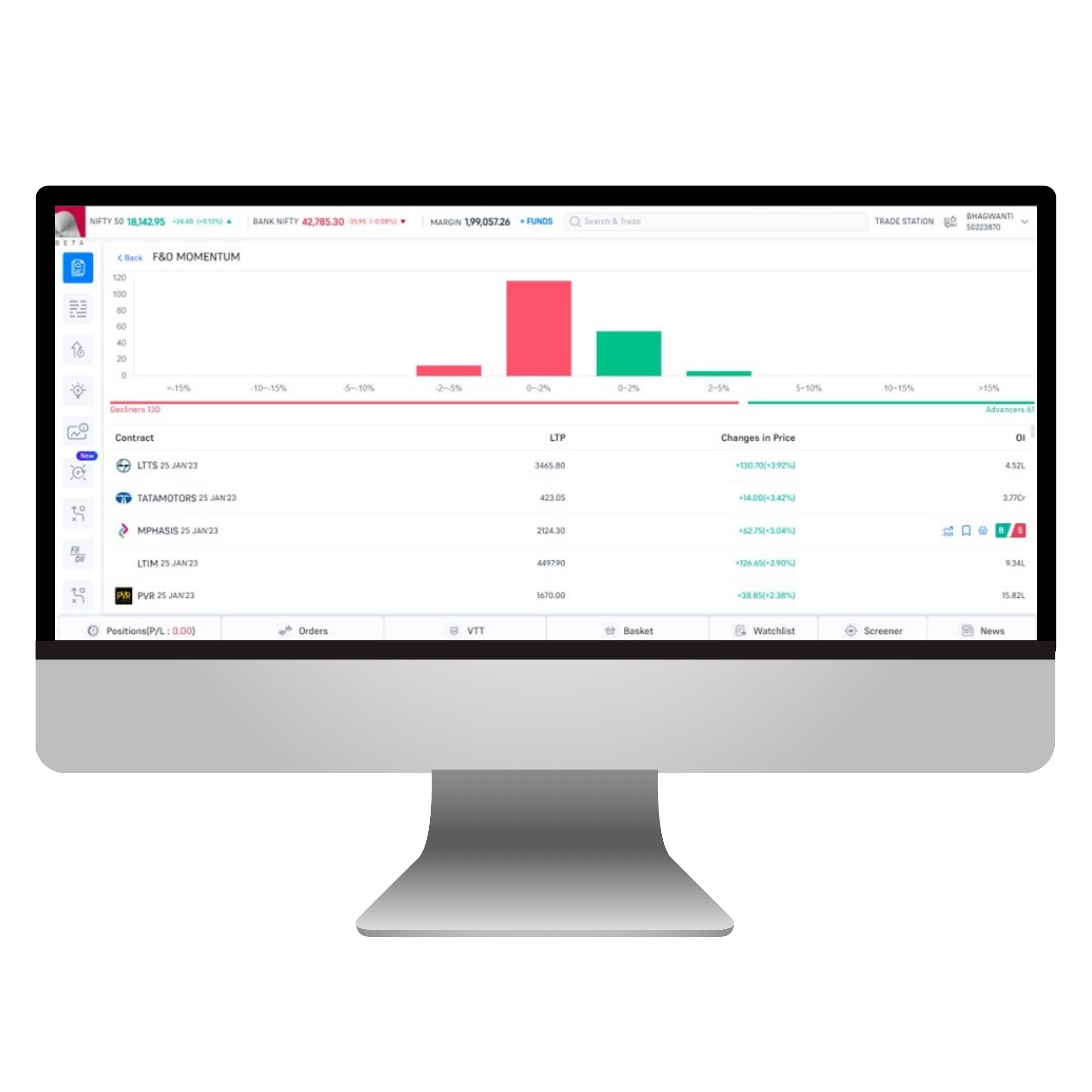

F&O Momentum:

This tool gives a visual representation of the market’s current momentum within the Futures and Options (F&O) segment. It shows the number of stocks that are trending in a positive or negative direction and the strength of their movement. This helps traders gauge market sentiment and make better-informed decisions.

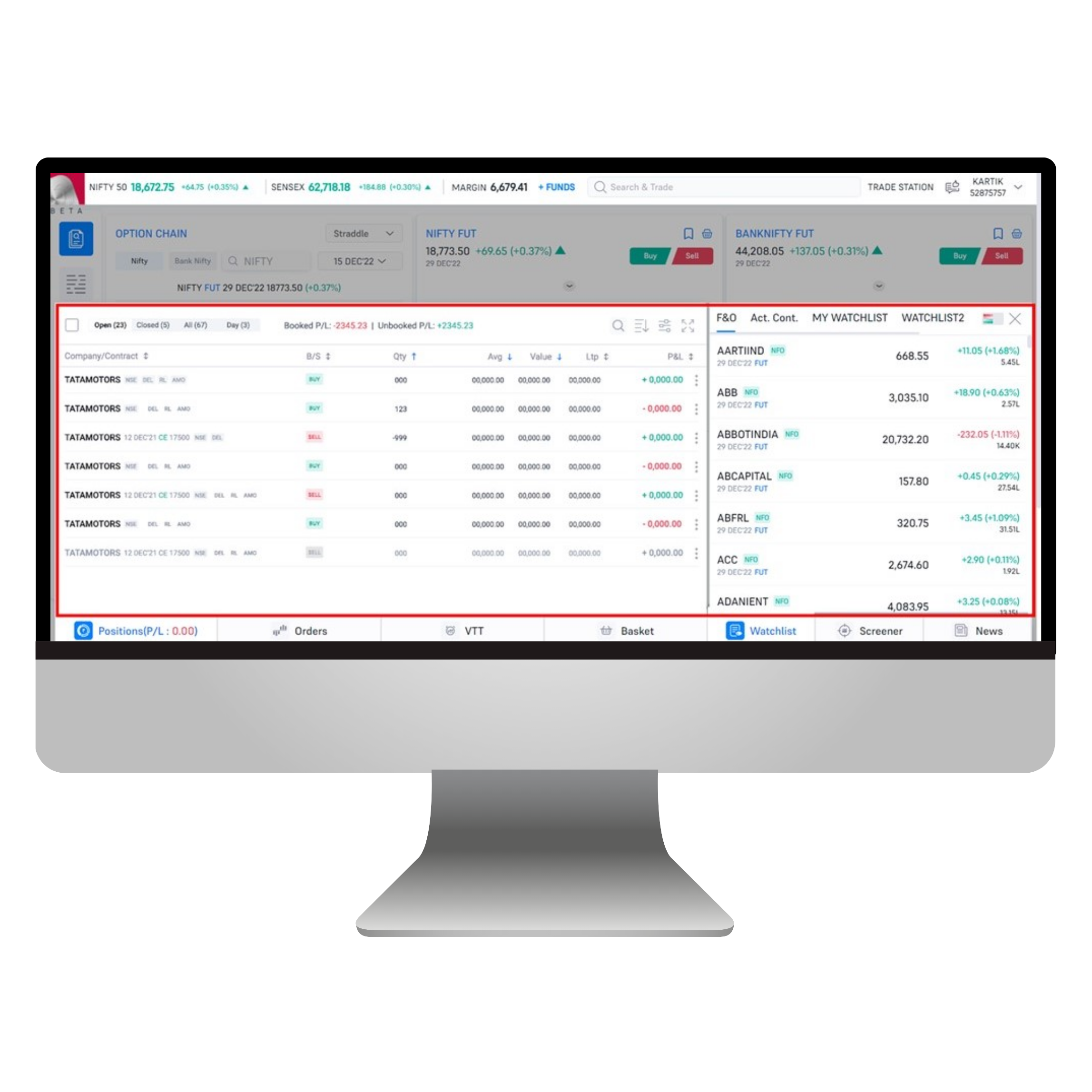

Position book and Watchlist:

- Position Book: The redesigned position book provides an at-a-glance overview of all your current trades. It shows your open positions and helps you track their status, including profit or loss, margin usage, etc.

- Watchlist: The revamped watchlist is more intuitive and now includes all F&O stocks by default, allowing traders to easily monitor stocks of interest and keep track of market changes.

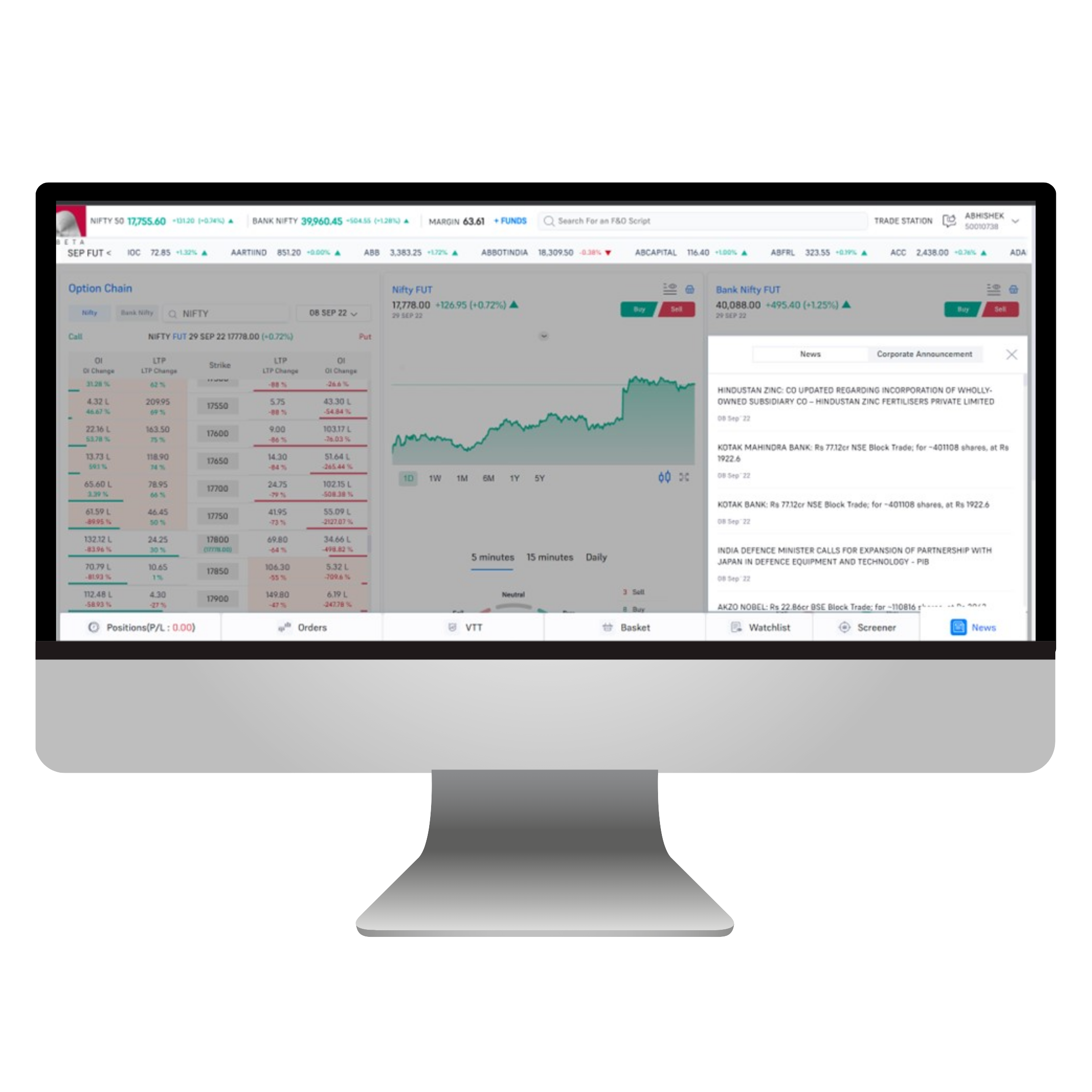

News/corporate announcements:

Staying updated on news is crucial in trading as market movements are often influenced by company announcements, economic reports, and other significant events. This feature lets you view the latest corporate announcements, which can provide valuable information on the direction the market might move based on company earnings, mergers, new product launches, or other news.

Conclusion

In essence, these features combine to create a comprehensive and efficient trading platform, providing users with powerful tools to manage their trades, stay informed, and act quickly in response to market changes. Thus, FnO 360 by 5paisa is an important platform because it combines a range of advanced features like market analysis tools, various order types, and easy execution options—all designed to help traders capitalize on opportunities in the F&O segment. Whether you’re an experienced trader or just starting out, it provides everything needed to manage and optimize your trading strategy effectively.

11.1 How to Use Predefined Strategies in FnO 360

Predefined strategies helps you to do complex trading in simple way.

For that login to Fno 360 platform in 5 paisa.

Left side there is an option to choose Predefined strategies

Inside this, according to market sentiments Bullish Bearish and Neutral categories are created.

According to your view for the market you have to select the strategies. By default NIFTY is selected but you can change it according to your choice.

Also script related strategies are available on this screen FOR Example- Max Profit, MAX Loss and the Breakeven points.

Below that you can view the trades executed using the strategies.

Here you can view the quantity of orders placed and verify all the details mentioned and click on place order section

In this way you can place orders and execute your strategies in just one click .

11.2. Special Features of Fn0 360

-

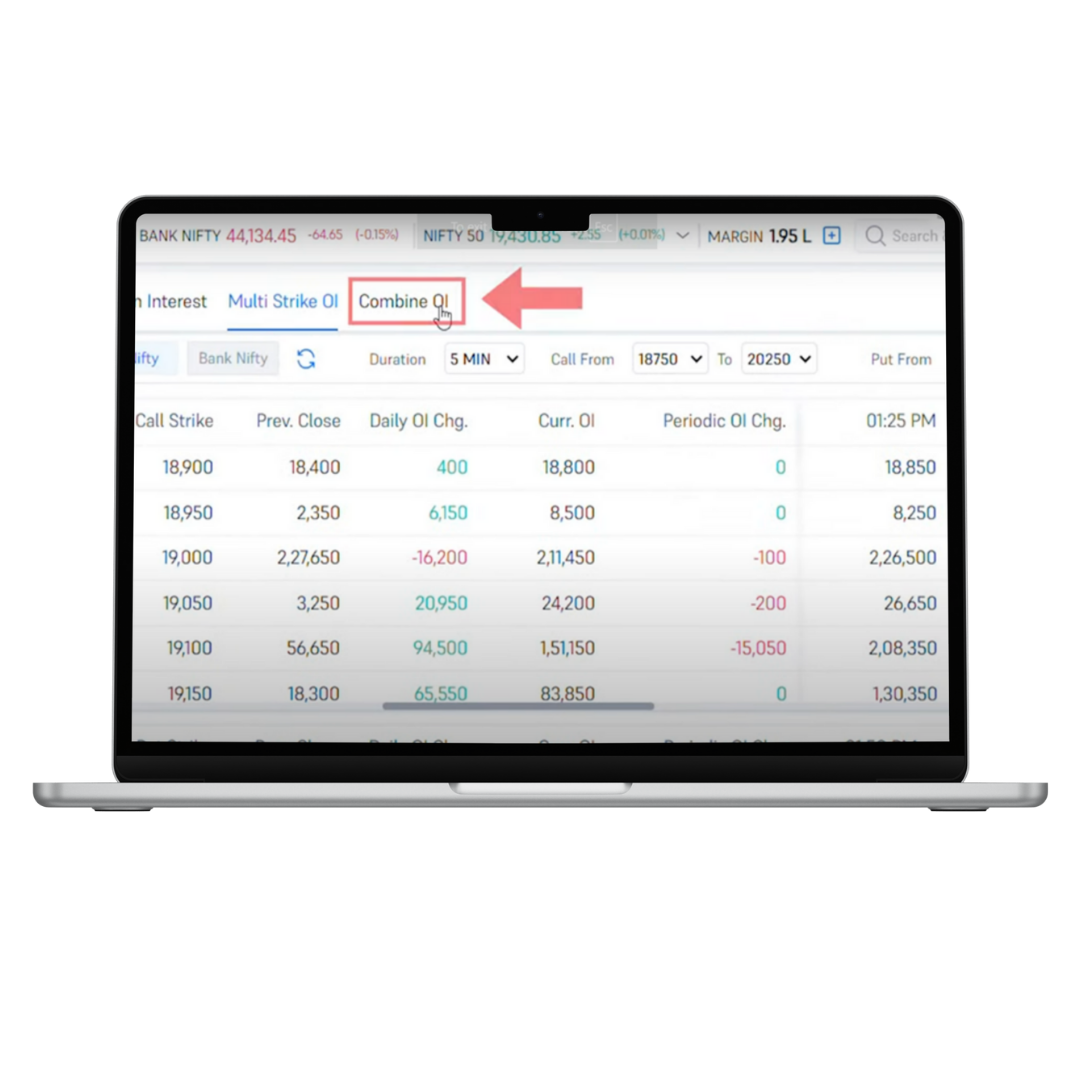

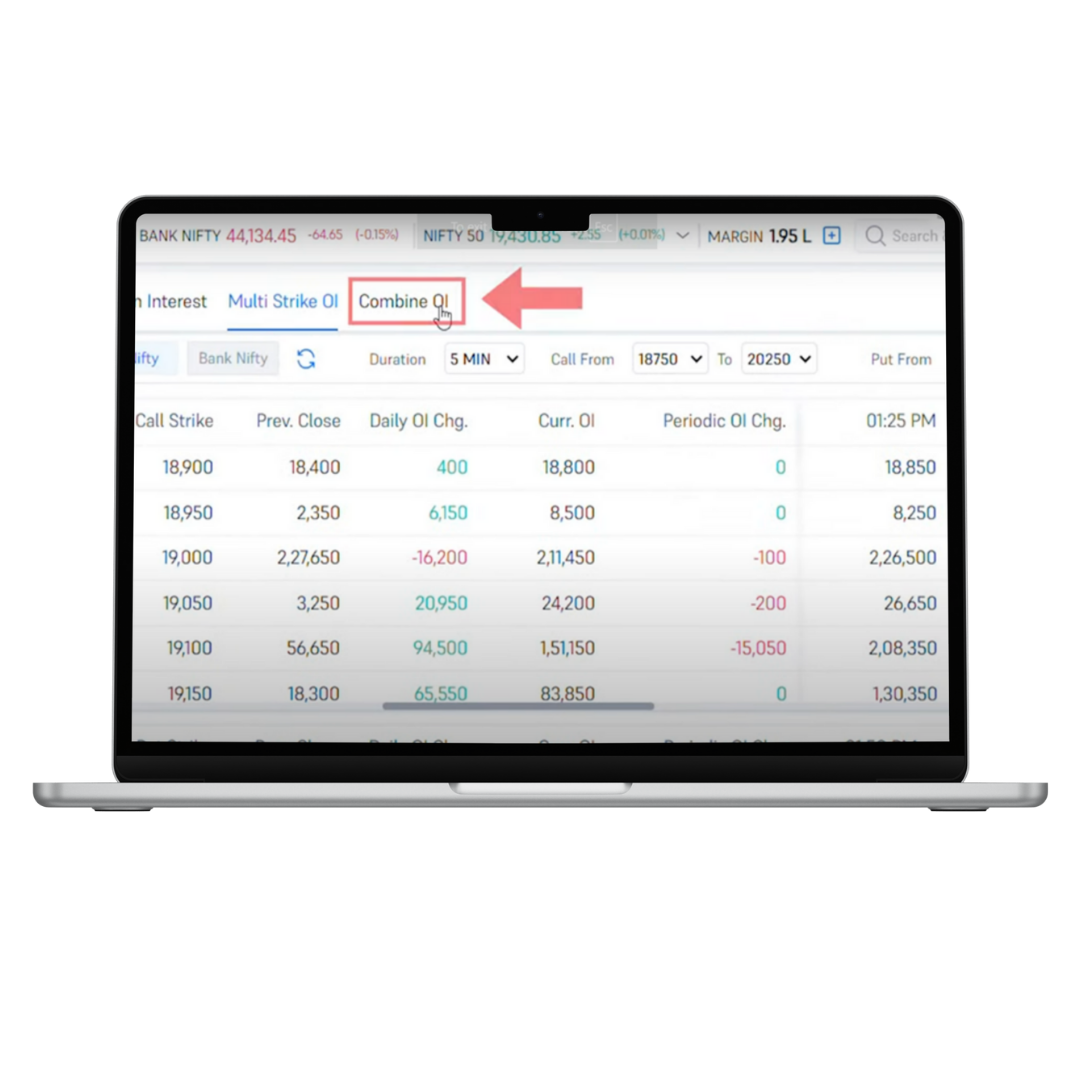

Open interest (OI):

Open Interest (OI) is a key metric for traders involved in stock futures and options. It represents the total number of outstanding or active contracts (both buy and sell) that have not been settled yet. This metric provides valuable insights into market sentiment and activity.

This section helps to understand the importance of OI in analyzing market movements. By integrating OI into graphs, traders can visually assess patterns and trends, helping them understand the level of interest and participation among investors. This graphical representation makes it easier to predict potential market directions based on how actively investors are engaging with specific derivatives.

-

India VIX :

Traders often rely on the Volatility Index (VIX) to guide their trading decisions, as it provides a clear measure of market uncertainty and risk. To make it convenient for traders, the relevant data is readily available in one place, eliminating the need to navigate through multiple tabs or sources.

India VIX, in particular, is widely regarded as the most accurate and dependable indicator for assessing market volatility. By tracking the fluctuations in India VIX, traders can better gauge the level of fear or confidence in the market, allowing them to plan their strategies more effectively.

-

Option Chain :

An options chain, or options matrix, is a comprehensive table showing all the available options contracts for a specific security along with their key details. It provides traders with a complete overview of the market, helping them analyze data in real time with exceptionally fast refresh rates.

The options chain includes vital metrics like Open Interest (OI), Last Traded Price (LTP), changes in OI, straddle data, and Greeks (metrics used to assess risk). These are visually represented with detailed bar graphs for an in-depth, easy-to-interpret analysis.

Specifically, the Open Interest metric in the options chain shows the total number of outstanding contracts held by traders at any given time. By viewing this data in the options chain section, traders can get a clear snapshot of market activity and participant behaviour, enabling more informed decisions.

-

Straddle

A straddle is one of the simplest and most popular trading strategies, widely favoured by traders for its versatility. This strategy involves simultaneously buying or selling a call and put option with the same strike price and expiry date, allowing traders to benefit from significant price movements in either direction.

On the F&O 360 web platform, the options chain includes a dedicated feature for straddles. It provides a streamlined way to view and analyze the entire strategy directly within the platform. Traders can execute a straddle order seamlessly with just a single click, making it convenient and efficient to implement this strategy in their trading.

-

Greeks

Greeks are essential tools for options traders who focus on understanding how the price of an option responds to various factors related to its underlying asset, such as stocks, bonds, commodities, interest rates, market indexes, or currencies.

If your trading strategy revolves around analyzing the sensitivity of an option’s price to changes in these underlying parameters, the Greeks are invaluable. They help you measure critical factors like price movements (Delta), time decay (Theta), volatility (Vega), and changes in interest rates (Rho). By incorporating Greeks into your strategy, you can make more informed decisions and manage risk more effectively while trading options.

Note: User can view the option chain in 2 modes i.e. Mini option chain on the overview page and full screen mode option that you will find below the overview page

-

FII/DII:

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) play a significant role in shaping market trends due to the substantial capital they bring into the market. Their trading activity often sets the direction for market movements, making it crucial for traders to track their investments.

The FII/DII feature in the F&O 360 platform provides insights into the trading behaviour of these major players. By analyzing this data, you can gain a competitive edge over retail investors by aligning your strategies with the market-driving actions of FIIs and DIIs. This feature empowers you to make informed decisions and stay ahead in the trading game.

-

Lightweight charts:

Lightweight charts are compact, interactive visual tools often used in financial trading platforms. Their primary purpose is to present a condensed view of a market’s price movements and trends without overwhelming the user with too much data. These charts allow traders and investors to quickly grasp the current market sentiment and the direction of the price action, making them highly useful for quick decision-making.

A typical lightweight chart might include the following features:

- Price Action: Displays the asset’s price over time, typically in the form of a line or bar chart.

- Buy/Sell Sentiment Indicator: This element shows the overall market sentiment, indicating whether most participants are leaning towards buying (bullish) or selling (bearish) the asset. It can be represented with color codes (e.g., green for buy, red for sell), arrows, or other visual markers.

- Simplified Data: Unlike detailed charts that may include multiple indicators or complex metrics, lightweight charts focus on a simplified view, helping traders quickly interpret the market without excessive information overload.

- Real-time Updates: These charts often offer live, real-time data, ensuring that the trader is always up to date with the latest market shifts.

8. Derivatives Ideas

This section provides specific trading ideas based on different time horizons and strategies within the derivatives market. It helps traders access a variety of ideas tailored to their needs:

-

- Short Term: Ideas for positions you can hold for a few days or weeks based on expected market movements.

- Intraday: Focuses on trades to be opened and closed within the same trading day, aiming to capitalize on quick price movements.

- Expiry Special: Ideas specifically related to trades that are timed around the expiration of futures or options contracts.

- Quick Option Trade: Short-term ideas involving options strategies that aim to exploit market opportunities for quick profits.

-

Currency Segment Ideas

Short Term & Intraday: Trading ideas within the currency markets designed for short-term gains, whether over a few days (short term) or within a single day (intraday). These ideas leverage price movements in foreign currencies.

-

Commodity Segment Ideas

Short Term Ideas: Similar to the currency segment, the commodity section offers ideas focusing on short-term trading in various commodities, like gold, oil, etc.

11.3. Types of Orders you can place on FnO 360 window

The platform provides a variety of order types that enhance trading efficiency and flexibility:

Basket Orders

Allows you to place up to 10 orders at once. This is useful for executing complex strategies or placing multiple trades simultaneously. You also get margin benefits from hedging multiple positions in one go.

Rollover:

This feature lets you easily carry forward your futures contracts to the next expiry cycle with minimal loss. You can roll over a position into the next month’s contract with just one click.

Quick reverse:

If the market outlook changes quickly, you can instantly reverse your position—changing from long (buy) to short (sell) or vice versa—at the click of a button.

VTT orders:

Allows you to set a trigger price for buying or selling a stock. This order gets activated only when the market reaches your predefined price level, providing an automated response to price changes. The order can remain active for up to a year.

11.4. Additional special feature to the FnO 360 window

Sleek Orderform:

The Sleek Orderform is designed to make entering orders more efficient and user-friendly. It simplifies the process of placing orders by offering a clear, intuitive interface, making it easier to execute trades accurately and quickly.

F&O Momentum:

This tool gives a visual representation of the market’s current momentum within the Futures and Options (F&O) segment. It shows the number of stocks that are trending in a positive or negative direction and the strength of their movement. This helps traders gauge market sentiment and make better-informed decisions.

Position book and Watchlist:

- Position Book: The redesigned position book provides an at-a-glance overview of all your current trades. It shows your open positions and helps you track their status, including profit or loss, margin usage, etc.

- Watchlist: The revamped watchlist is more intuitive and now includes all F&O stocks by default, allowing traders to easily monitor stocks of interest and keep track of market changes.

News/corporate announcements:

Staying updated on news is crucial in trading as market movements are often influenced by company announcements, economic reports, and other significant events. This feature lets you view the latest corporate announcements, which can provide valuable information on the direction the market might move based on company earnings, mergers, new product launches, or other news.

Conclusion

In essence, these features combine to create a comprehensive and efficient trading platform, providing users with powerful tools to manage their trades, stay informed, and act quickly in response to market changes. Thus, FnO 360 by 5paisa is an important platform because it combines a range of advanced features like market analysis tools, various order types, and easy execution options—all designed to help traders capitalize on opportunities in the F&O segment. Whether you’re an experienced trader or just starting out, it provides everything needed to manage and optimize your trading strategy effectively.