- All About FnO 360

- What are Futures and Options

- All About Futures

- Types of Futures contract

- All About Options

- Types of Options Contract

- Smart Option Strategies

- Smart Scalping Strategies

- Examples of Smart Strategies

- Examples of Smart Scalping Strategies

- How to Access Smart Strategies in FnO 360

- How to Access Scalping Strategies in FnO 360

- Study

- Slides

- Videos

7.1 What are Smart Options Strategies?

Smart Options Strategies are Trading Techniques involving options contract-Calls and Puts to achieve specific objectives like

- Hedging

- Speculating

- Earning Income

Here instead of buying or selling a stock you use a combinations of options to create a tailored trade setup with defined risk/reward

Basic concepts involved in Option contract

|

Concept |

Buyer’s Role |

Seller’s Role |

|

Call Option |

Right to Buy |

Obligation to Sell |

|

Put Option |

Right to Sell |

Obligation to Buy |

|

Premium |

Pays |

Receives |

|

Strike Price |

Exercise price |

Exercise price |

|

Expiry |

Last day to exercise |

Last day of obligation |

Why should one use Options Strategies ?

Because

- It has lower capital requirement

- Defined risk and reward

- Make money in bullish, bearish and even sideways market

- Can profit even when the stock doesn’t move

Types of Smart Options Strategies

Bullish Strategies

- Long call

- Bull Call Spread

- Bull Put Spread

- Long call Butterfly

- Short Put

Bearish Strategies

- Bear Put Spread

- Bear call Spread

- Bear Butterfly spread

- Bear Iron Condor Spread

Neutral Strategies

- Calendar Call Spread

- Calendar Put Spread

- Short Straddle

- Short Strangle

Touse SMART STRATEGIES in FnO 360 Platform by 5 paisa -Please click this link

7.2 Bullish Strategies

A. Long Call

A Long Call strategy is a straightforward and popular options trading strategy used when a trader expects the price of an underlying asset to rise. This strategy involves buying a call option, which gives the trader the right, but not the obligation, to purchase the underlying asset at a specified strike price before the option expires.

Mechanics of a Long Call

When implementing a Long Call strategy, the trader pays a premium to purchase the call option. This premium is the maximum amount the trader can lose, as it is the cost of acquiring the option. The strike price is the price at which the trader can buy the underlying asset. If the asset’s price rises above the strike price, the trader can exercise the option and buy the asset at the lower strike price, potentially selling it at the higher market price for a profit.

Profit and Loss Potential

The potential profit of a Long Call strategy is theoretically unlimited, as the asset’s price can rise indefinitely. The breakeven point for this strategy is the strike price plus the premium paid. Any price above this level will result in a profit. For example, if the strike price is ₹50 and the premium paid is ₹5, the breakeven point is ₹55. If the asset’s price rises to ₹60, the trader can buy it at ₹50 and sell it at ₹60, resulting in a profit of ₹5 per share. The maximum loss for a Long Call strategy is limited to the premium paid. If the asset’s price does not rise above the strike price before expiration, the option will expire worthless, and the trader will lose the premium paid.

Advantages and Disadvantages

Advantages of a Long Call strategy include:

-

- Limited Risk: The maximum loss is limited to the premium paid, making it a low-risk strategy.

- Unlimited Profit Potential: The potential profit is unlimited as the asset’s price can rise indefinitely.

- Leverage: A small investment (the premium) can control a large position in the underlying asset, providing significant leverage.

Disadvantages include:

-

- Time Decay: Options lose value as they approach expiration. If the asset’s price does not rise quickly, the option’s value may decrease, even if the trader’s prediction is eventually correct.

- No Dividends: Call option holders do not receive dividends on the underlying asset, which can be a disadvantage compared to owning the asset directly.

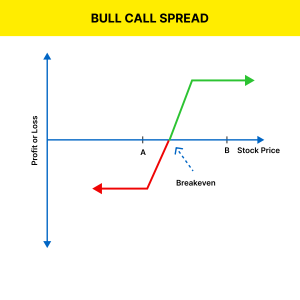

B. Bull Call Spread

A Bull Call Spread is a more conservative bullish options strategy that involves buying a call option at a lower strike price and selling another call option at a higher strike price, both with the same expiration date. This strategy is used when the trader expects a moderate rise in the asset’s price.

Mechanics of a Bull Call Spread

To implement a Bull Call Spread, the trader buys a call option at a lower strike price and sells another call option at a higher strike price. The premium received from selling the higher strike call option offsets part of the premium paid for the lower strike call option, reducing the overall cost of the strategy.

Profit and Loss Potential

The maximum profit for a Bull Call Spread is the difference between the strike prices minus the net premium paid. For example, if the trader buys a call option with a strike price of ₹50 for a premium of ₹5 and sells a call option with a strike price of ₹60 for a premium of ₹2, the net premium paid is ₹3. The maximum profit is ₹10 (the difference between the strike prices) minus ₹3 (the net premium), resulting in a maximum profit of ₹7 per share.

The maximum loss is limited to the net premium paid. If the asset’s price does not rise above the lower strike price, both options will expire worthless, and the trader will lose the net premium paid.

Advantages and Disadvantages

Advantages of a Bull Call Spread include:

- Reduced Cost: The premium received from selling the higher strike call option reduces the overall cost of the strategy.

- Limited Risk: The maximum loss is limited to the net premium paid, making it a relatively low-risk strategy.

Disadvantages include:

- Capped Profit: The maximum profit is limited to the difference between the strike prices minus the net premium paid.

- Complexity: This strategy is more complex than a simple Long Call, requiring the trader to manage two options positions.

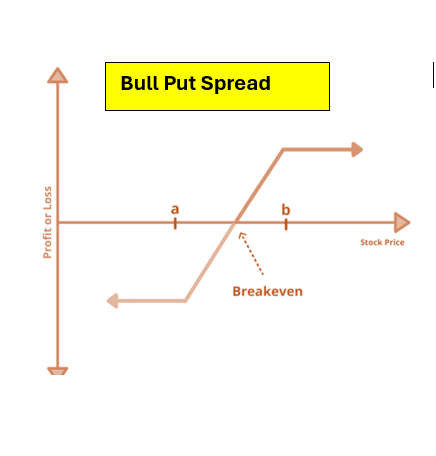

C. Bull Put Spread

A Bull Put Spread is another conservative bullish options strategy that involves selling a put option at a higher strike price and buying another put option at a lower strike price, both with the same expiration date. This strategy is used when the trader expects the asset’s price to rise or remain stable.

Mechanics of a Bull Put Spread

To implement a Bull Put Spread, the trader sells a put option at a higher strike price and buys another put option at a lower strike price. The premium received from selling the higher strike put option offsets part of the premium paid for the lower strike put option, reducing the overall cost of the strategy.

Profit and Loss Potential

The maximum profit for a Bull Put Spread is the net premium received. For example, if the trader sells a put option with a strike price of ₹60 for a premium of ₹5 and buys a put option with a strike price of ₹50 for a premium of ₹2, the net premium received is ₹3.

The maximum loss is limited to the difference between the strike prices minus the net premium received. If the asset’s price falls below the lower strike price, both options will be exercised, and the trader will lose the difference between the strike prices minus the net premium received.

Advantages and Disadvantages

Advantages of a Bull Put Spread include:

- Reduced Cost: The premium received from selling the higher strike put option reduces the overall cost of the strategy.

- Limited Risk: The maximum loss is limited to the difference between the strike prices minus the net premium received.

Disadvantages include:

- Capped Profit: The maximum profit is limited to the net premium received.

- Complexity: This strategy is more complex than a simple Long Call, requiring the trader to manage two options positions.

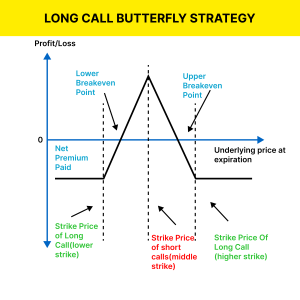

Long Call Butterfly Strategy

The Long Call Butterfly Spread is an options trading strategy used when a trader expects the stock price to stay near a specific level (strike price) by the time of expiration. It is a limited-risk, limited-reward strategy and is designed to profit from low volatility.

Structure of a Long Call Butterfly:

It involves three strike prices, all with the same expiration date, using four call options:

- Buy 1 Call at Lower Strike (A)

- Sell 2 Calls at Middle Strike (B)

- Buy 1 Call at Higher Strike (C)

Where:

-

Strike A < Strike B < Strike C

-

All calls are on the same underlying and have the same expiry date.

Example:

Let’s say a stock is trading at ₹100.

-

Buy 1 Call at ₹90 for ₹12

-

Sell 2 Calls at ₹100 for ₹6 each (receive ₹12)

-

Buy 1 Call at ₹110 for ₹2

🔹 Net Premium Paid = ₹12 (buy) – ₹12 (sell) + ₹2 (buy) = ₹2 (net debit)

Payoff at Expiry:

-

Maximum Profit: When the stock closes at the middle strike (B) (i.e., ₹100 in this example).

-

Maximum Loss: The net premium paid (₹2 in the example), if the stock expires below ₹90 or above ₹110.

-

Breakeven Points:

-

Lower BEP = Strike A + Net Premium (₹90 + ₹2 = ₹92)

-

Upper BEP = Strike C – Net Premium (₹110 – ₹2 = ₹108)

-

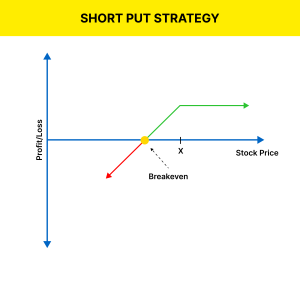

Short Put Strategy

The Short Put strategy (also called naked put) is a bullish options strategy where a trader sells a put option to profit from a rising or stable stock price.

- The short put strategy, also known as a naked put, is an options trading approach where an investor sells a put option with the intention of profiting from a stable or rising stock price. By selling the put, the trader receives a premium upfront, which represents the maximum possible profit in this strategy.

- The seller is obligated to buy the underlying stock at the strike price if the option is exercised, typically when the stock price falls below the strike. This strategy is best suited for bullish market conditions, where the trader expects the stock to stay above the strike price until expiration.

- If the stock remains above the strike, the option expires worthless, and the seller keeps the entire premium as profit. However, if the stock declines below the strike price, the seller may incur a loss equal to the difference between the strike price and the stock’s market price, minus the premium received.

- The break-even point is calculated by subtracting the premium from the strike price.

- While this strategy allows traders to earn income and potentially buy a stock at a lower effective price, it carries significant risk if the stock price falls sharply, making it essential to have proper risk management in place or consider a cash-secured put as a more conservative variation.

How It Works:

- You sell (write) 1 Put Option at a specific strike price.

- In return, you receive the premium.

- You’re obligated to buy the stock at the strike price if the buyer exercises the option.

Payoff Mechanics:

- Maximum Profit = Premium received

- Maximum Loss = If the stock falls to zero, your loss = Strike Price – Premium

- Breakeven Point = Strike Price – Premium Received

Example:

Suppose stock is trading at ₹100.

-

You sell 1 Put option with Strike Price = ₹95

-

Premium received = ₹4

Outcomes at Expiry:

-

Stock closes above ₹95 (say at ₹100):

Option expires worthless → You keep ₹4 profit. -

Stock closes at ₹92:

You have to buy the stock at ₹95, but it’s worth ₹92 →

Loss = ₹3 – ₹4 premium = Net loss ₹1 -

Stock goes to ₹0:

You still have to buy at ₹95 → Loss = ₹95 – ₹4 = ₹91

7.3. Bearish Strategies

a. Bear Call Spread

A Bear Call Spread is an options strategy used when an investor expects a moderate decline in the price of an underlying asset. It involves two key actions: selling a call option and buying another call option with a higher strike price but the same expiration date. Here’s a detailed explanation:

How It Works

-

- Sell a Call Option: Sell a call option at a certain strike price, usually slightly above the asset’s current market price.

- Buy a Call Option: Simultaneously, buy another call option at a higher strike price but with the same expiration date.

When to Use

- Moderately Bearish Outlook: When you expect a slight decline in the asset’s price.

- Risk Management: To limit potential losses compared to outright short selling.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is capped.

- Premium Income: You earn a net credit when initiating the trade.

Cons:

- Limited Profit: Your profit potential is capped by the net premium received.

- Time Decay: Options lose value as they approach expiration.

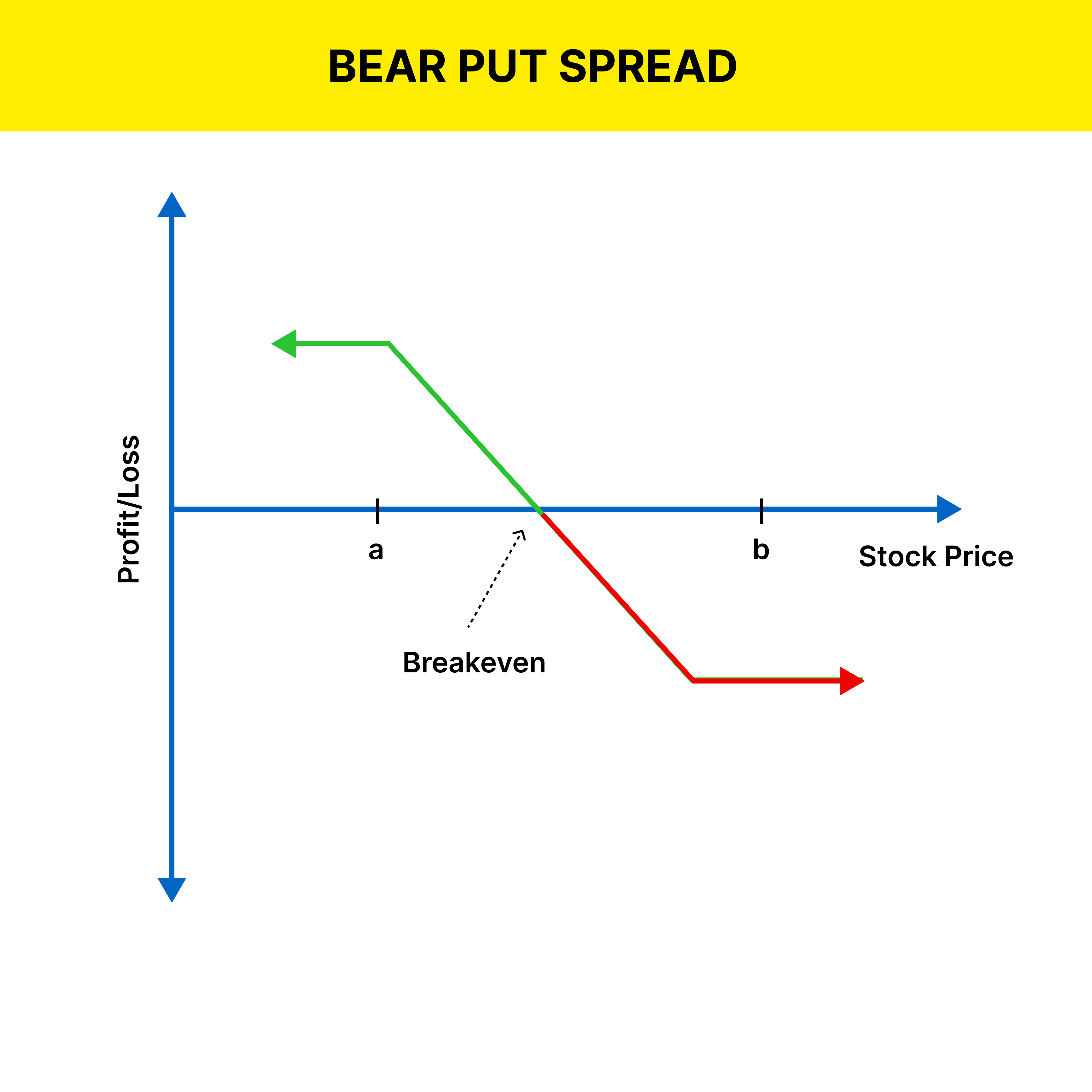

b. Bear Put Spread

A Bear Put Spread is a strategic options trading method where an investor aims to profit from a moderate decline in the price of an underlying asset. This strategy involves buying a put option and selling another put option with a lower strike price but the same expiration date. Here’s a detailed breakdown:

How It Works

-

- Buy a Put Option: Purchase a put option at a higher strike price, anticipating a decline in the asset’s price.

- Sell a Put Option: Simultaneously, sell another put option at a lower strike price with the same expiration date.

When to Use

- Moderately Bearish Outlook: When you expect a slight to moderate decline in the asset’s price.

- Risk Management: To limit potential losses compared to an outright long put position.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is limited to the net premium paid.

- Cost Reduction: The premium received from selling the lower strike put reduces the cost of buying the higher strike put.

Cons:

-

- Limited Profit: Your profit potential is capped by the difference between the strike prices minus the net premium paid.

- Time Decay: Options lose value as they approach expiration, known as time decay.

The Bear Put Spread is a cost-effective strategy that allows investors to capitalize on moderate price declines while keeping the potential losses under control.

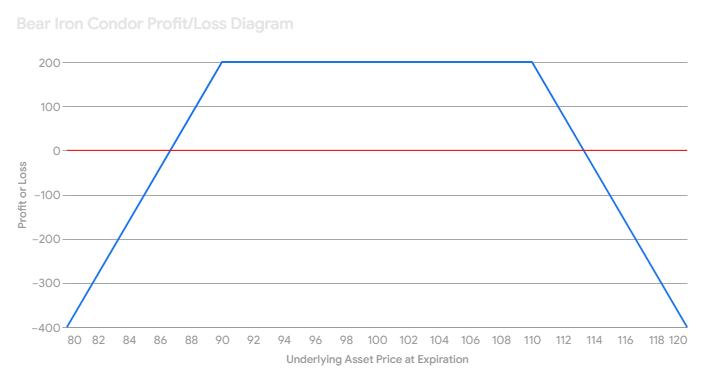

c. Bear Iron Condor

A Bear Iron Condor is an options trading strategy designed to benefit from a moderate decline in the price of an underlying asset, coupled with low volatility. This strategy involves four options contracts with different strike prices but the same expiration date. Here’s a detailed breakdown:

How It Works

-

- Sell a Call Spread:

-

- Sell a Call Option: Sell a call option at a lower strike price.

- Buy a Call Option: Buy a call option at a higher strike price.

-

- Sell a Put Spread:

-

- Sell a Put Option: Sell a put option at a higher strike price.

- Buy a Put Option: Buy a put option at a lower strike price.

When to Use

-

- Market-Neutral Outlook: When you expect low volatility and the asset’s price to remain within a certain range.

- Profit from Time Decay: To benefit from the passage of time as long as the stock price remains between the breakeven points.

Pros and Cons

Pros:

-

- Limited Risk: Your maximum loss is capped.

- Premium Income: You earn a net credit when initiating the trade.

Cons:

-

- Limited Profit: Your profit potential is capped by the net premium received.

- Complexity: Involves managing four different options positions.

The Bear Iron Condor is a versatile strategy that allows traders to profit from a range-bound or moderately declining market with controlled risk.

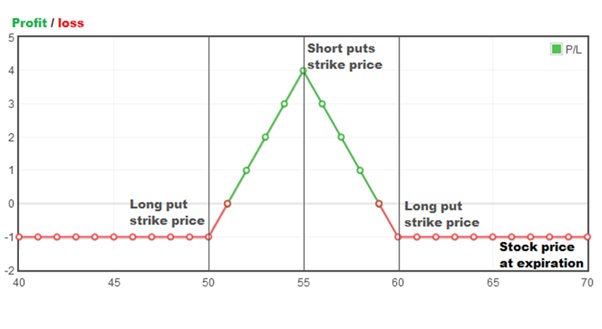

d. Bear Butterfly Spread

A Bear Butterfly Spread is an options trading strategy designed for traders who expect a moderate decline in the price of an underlying asset. It involves four options contracts with three different strike prices2. Here’s a detailed explanation:

How It Works

-

- Sell Two Put Options: Sell two put options at a higher strike price.

- Buy One Put Option: Buy one put option at a middle strike price.

- Buy Two Put Options: Buy two put options at a lower strike price.

When to Use

-

- Moderately Bearish Outlook: When you expect a slight to moderate decline in the asset’s price.

- Risk Management: To limit potential losses compared to a straightforward put option.

Pros and Cons

Pros:

-

- Limited Risk: Your maximum loss is capped.

- Cost Reduction: The premium received from selling the higher strike puts reduces the cost of buying the lower strike puts.

Cons:

-

- Limited Profit: Your profit potential is capped by the difference between the strike prices minus the net premium paid.

- Time Decay: Options lose value as they approach expiration, known as time decay.

7.3. Neutral Strategies

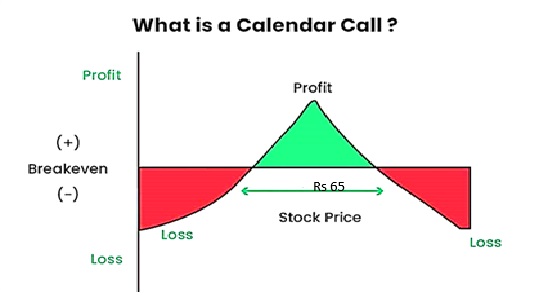

A. Calendar Call

A Calendar Call (also known as a Call Calendar Spread) is an options trading strategy that involves holding two call options with the same strike price but different expiration dates. This strategy is used when an investor expects minimal price movement in the underlying asset in the near term but anticipates a potential increase in price over a longer period. Here’s a detailed explanation:

How It Works

- Sell a Near-Term Call Option: Sell a call option with a shorter expiration date.

- Buy a Longer-Term Call Option: Buy a call option with the same strike price but a later expiration date.

When to Use

- Neutral to Slightly Bullish Outlook: When you expect minimal price movement in the near term but anticipate a potential increase in price over a longer period.

- Benefit from Time Decay: To take advantage of the accelerated time decay of the near-term call option.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is capped at the net premium paid.

- Premium Income: You earn a net credit when initiating the trade.

Cons:

- Limited Profit: Your profit potential is capped by the net premium received.

- Complexity: Managing two different expiration dates can be more complex

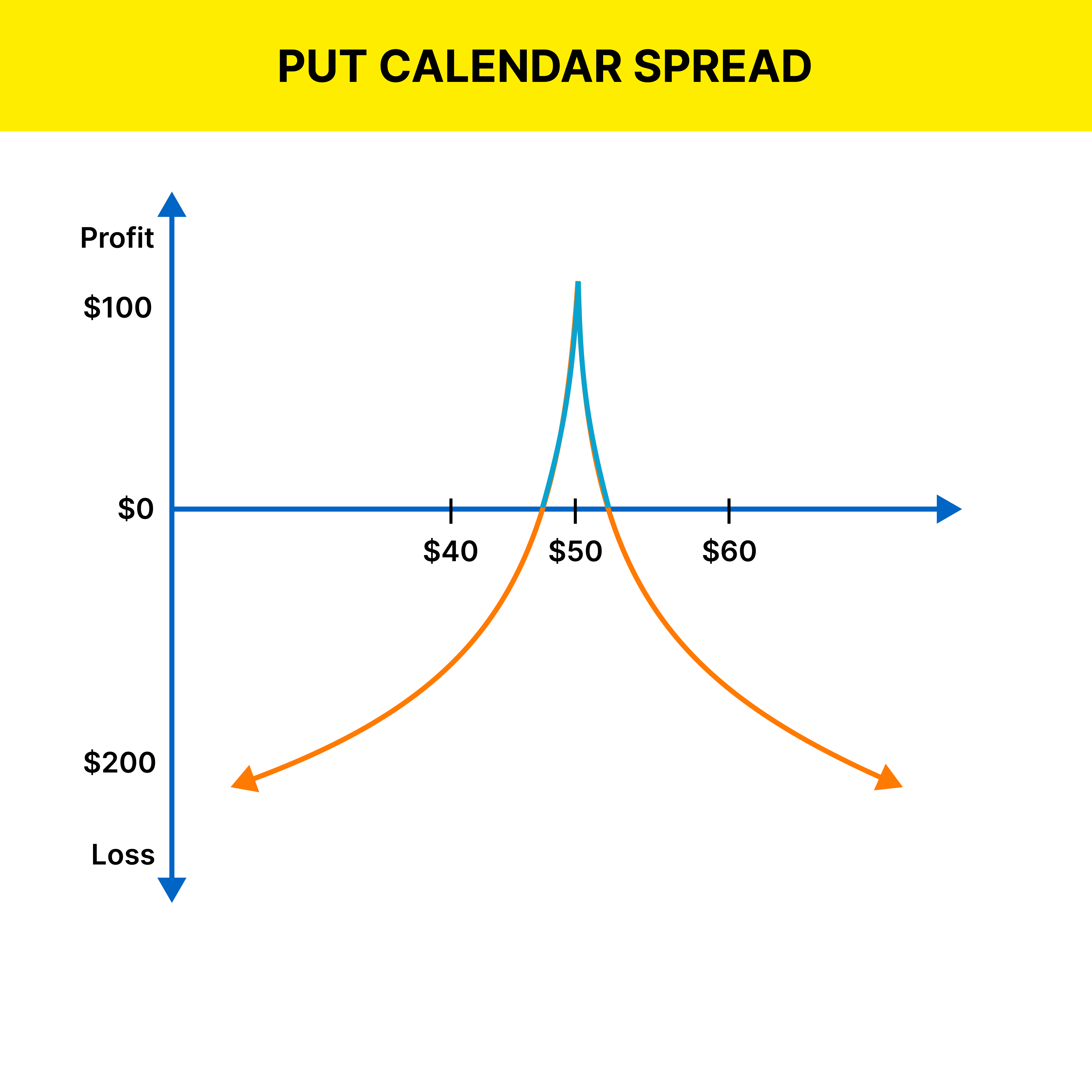

B. Calendar Put

A Calendar Put (also known as a Put Calendar Spread) is an options trading strategy that involves holding two put options with the same strike price but different expiration dates. This strategy is used when an investor expects minimal price movement in the underlying asset in the near term but anticipates a potential decrease in price over a longer period. Let’s dive into the details:

How It Works

-

- Sell a Near-Term Put Option: Sell a put option with a shorter expiration date.

- Buy a Longer-Term Put Option: Buy a put option with the same strike price but a later expiration date.

When to Use

- Neutral to Slightly Bearish Outlook: When you expect minimal price movement in the near term but anticipate a potential decline in price over a longer period.

- Benefit from Time Decay: To take advantage of the accelerated time decay of the near-term put option.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is capped at the net premium paid.

- Cost Reduction: The premium received from selling the near-term put reduces the cost of buying the longer-term put.

Cons:

- Limited Profit: Your profit potential is capped by the net premium received.

- Complexity: Managing two different expiration dates can be more complex.

The Calendar Put strategy is useful for investors who have a slightly bearish outlook in the long term and want to reduce the cost of their position by selling a near-term put option.

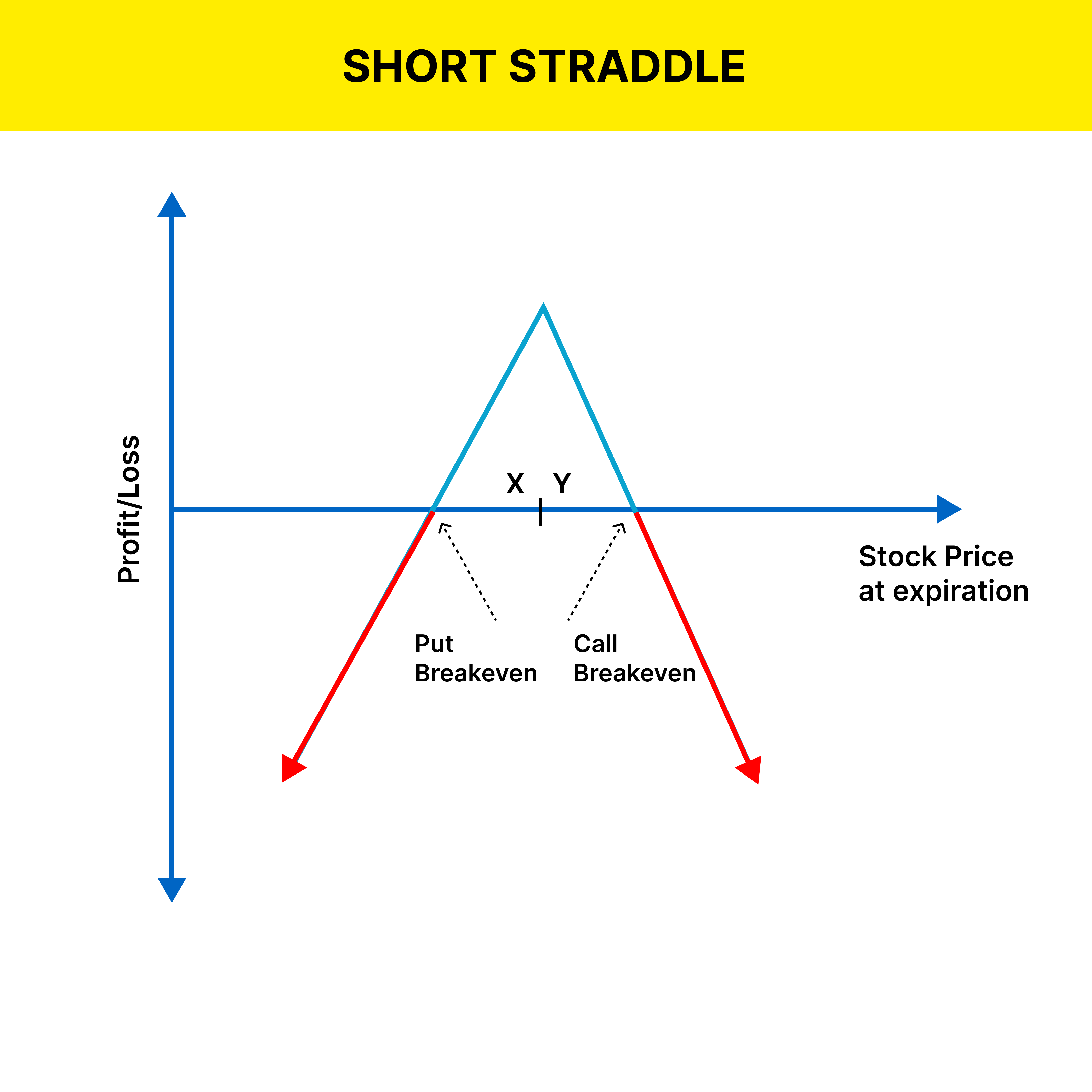

C. Short Straddle

A Short Straddle strategy involves selling both a call and a put option on the same underlying asset with the same strike price and expiration date. This strategy is typically used when an investor expects low volatility in the price of the underlying asset and profits from the lack of significant movement. Here’s a detailed explanation:

How It Works

-

- Sell a Call Option: Sell a call option at a strike price close to the current market price of the underlying asset.

- Sell a Put Option: Sell a put option at the same strike price and expiration date as the call option.

When to Use

- Market-Neutral Outlook: When you expect low volatility and believe the asset’s price will remain within a narrow range.

- Profit from Time Decay: To benefit from the accelerated time decay of the options’ premium as expiration approaches.

Pros and Cons

Pros:

- Premium Income: You receive a significant premium when initiating the trade.

- Profit from Stability: Profitable if the underlying asset’s price remains stable.

Cons:

- Unlimited Risk: Potential for significant losses if the stock price moves sharply in either direction.

- Margin Requirements: Requires substantial margin due to the unlimited risk.

The Short Straddle strategy can be effective in a low-volatility environment but carries significant risk if the underlying asset’s price moves sharply. Always consider the potential risks and rewards before implementing this strategy.

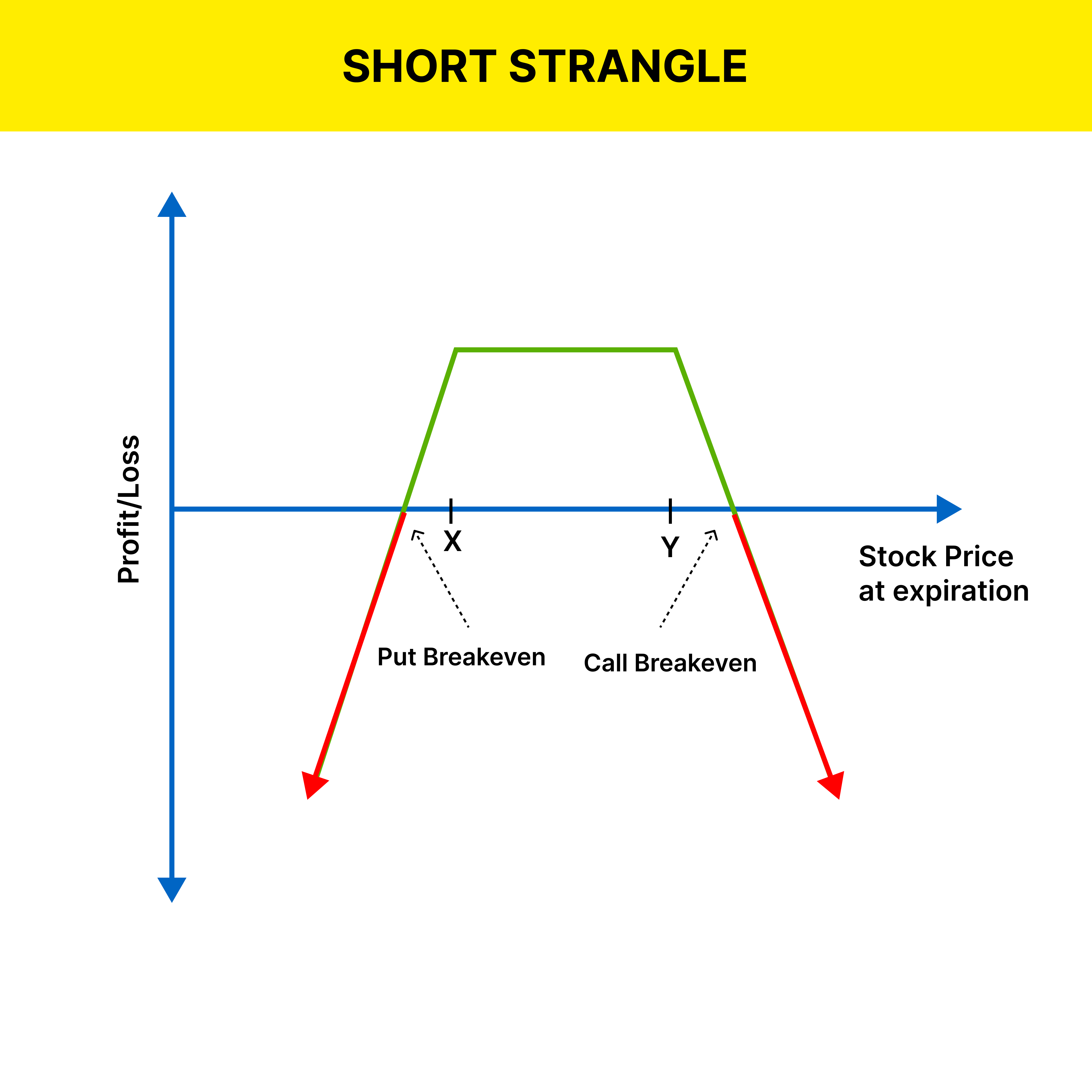

D. Short Strangle

A Short Strangle is an options trading strategy where an investor sells both an out-of-the-money call option and an out-of-the-money put option on the same underlying asset with the same expiration date. This strategy is typically used when the investor expects low volatility in the underlying asset and aims to profit from the lack of significant movement. Here’s a detailed breakdown:

How It Works

-

- Sell an Out-of-the-Money Call Option: Sell a call option with a strike price above the current market price of the underlying asset.

- Sell an Out-of-the-Money Put Option: Sell a put option with a strike price below the current market price of the underlying asset.

When to Use

- Market-Neutral Outlook: When you expect low volatility and believe the asset’s price will remain within a wide range.

- Profit from Time Decay: To benefit from the accelerated time decay of the options’ premium as expiration approaches.

Pros and Cons

Pros:

- Premium Income: You receive a significant premium when initiating the trade.

- Profit from Stability: Profitable if the underlying asset’s price remains stable within the strike prices.

Cons:

- Unlimited Risk: Potential for significant losses if the stock price moves sharply in either direction.

- Margin Requirements: Requires substantial margin due to the unlimited risk.

The Short Strangle strategy can be effective in a low-volatility environment but carries significant risk if the underlying asset’s price moves sharply. Always consider the potential risks and rewards before implementing this strategy.

7.1 What are Smart Options Strategies?

Smart Options Strategies are Trading Techniques involving options contract-Calls and Puts to achieve specific objectives like

- Hedging

- Speculating

- Earning Income

Here instead of buying or selling a stock you use a combinations of options to create a tailored trade setup with defined risk/reward

Basic concepts involved in Option contract

|

Concept |

Buyer’s Role |

Seller’s Role |

|

Call Option |

Right to Buy |

Obligation to Sell |

|

Put Option |

Right to Sell |

Obligation to Buy |

|

Premium |

Pays |

Receives |

|

Strike Price |

Exercise price |

Exercise price |

|

Expiry |

Last day to exercise |

Last day of obligation |

Why should one use Options Strategies ?

Because

- It has lower capital requirement

- Defined risk and reward

- Make money in bullish, bearish and even sideways market

- Can profit even when the stock doesn’t move

Types of Smart Options Strategies

Bullish Strategies

- Long call

- Bull Call Spread

- Bull Put Spread

- Long call Butterfly

- Short Put

Bearish Strategies

- Bear Put Spread

- Bear call Spread

- Bear Butterfly spread

- Bear Iron Condor Spread

Neutral Strategies

- Calendar Call Spread

- Calendar Put Spread

- Short Straddle

- Short Strangle

Touse SMART STRATEGIES in FnO 360 Platform by 5 paisa -Please click this link

7.2 Bullish Strategies

A. Long Call

A Long Call strategy is a straightforward and popular options trading strategy used when a trader expects the price of an underlying asset to rise. This strategy involves buying a call option, which gives the trader the right, but not the obligation, to purchase the underlying asset at a specified strike price before the option expires.

Mechanics of a Long Call

When implementing a Long Call strategy, the trader pays a premium to purchase the call option. This premium is the maximum amount the trader can lose, as it is the cost of acquiring the option. The strike price is the price at which the trader can buy the underlying asset. If the asset’s price rises above the strike price, the trader can exercise the option and buy the asset at the lower strike price, potentially selling it at the higher market price for a profit.

Profit and Loss Potential

The potential profit of a Long Call strategy is theoretically unlimited, as the asset’s price can rise indefinitely. The breakeven point for this strategy is the strike price plus the premium paid. Any price above this level will result in a profit. For example, if the strike price is ₹50 and the premium paid is ₹5, the breakeven point is ₹55. If the asset’s price rises to ₹60, the trader can buy it at ₹50 and sell it at ₹60, resulting in a profit of ₹5 per share. The maximum loss for a Long Call strategy is limited to the premium paid. If the asset’s price does not rise above the strike price before expiration, the option will expire worthless, and the trader will lose the premium paid.

Advantages and Disadvantages

Advantages of a Long Call strategy include:

-

- Limited Risk: The maximum loss is limited to the premium paid, making it a low-risk strategy.

- Unlimited Profit Potential: The potential profit is unlimited as the asset’s price can rise indefinitely.

- Leverage: A small investment (the premium) can control a large position in the underlying asset, providing significant leverage.

Disadvantages include:

-

- Time Decay: Options lose value as they approach expiration. If the asset’s price does not rise quickly, the option’s value may decrease, even if the trader’s prediction is eventually correct.

- No Dividends: Call option holders do not receive dividends on the underlying asset, which can be a disadvantage compared to owning the asset directly.

B. Bull Call Spread

A Bull Call Spread is a more conservative bullish options strategy that involves buying a call option at a lower strike price and selling another call option at a higher strike price, both with the same expiration date. This strategy is used when the trader expects a moderate rise in the asset’s price.

Mechanics of a Bull Call Spread

To implement a Bull Call Spread, the trader buys a call option at a lower strike price and sells another call option at a higher strike price. The premium received from selling the higher strike call option offsets part of the premium paid for the lower strike call option, reducing the overall cost of the strategy.

Profit and Loss Potential

The maximum profit for a Bull Call Spread is the difference between the strike prices minus the net premium paid. For example, if the trader buys a call option with a strike price of ₹50 for a premium of ₹5 and sells a call option with a strike price of ₹60 for a premium of ₹2, the net premium paid is ₹3. The maximum profit is ₹10 (the difference between the strike prices) minus ₹3 (the net premium), resulting in a maximum profit of ₹7 per share.

The maximum loss is limited to the net premium paid. If the asset’s price does not rise above the lower strike price, both options will expire worthless, and the trader will lose the net premium paid.

Advantages and Disadvantages

Advantages of a Bull Call Spread include:

- Reduced Cost: The premium received from selling the higher strike call option reduces the overall cost of the strategy.

- Limited Risk: The maximum loss is limited to the net premium paid, making it a relatively low-risk strategy.

Disadvantages include:

- Capped Profit: The maximum profit is limited to the difference between the strike prices minus the net premium paid.

- Complexity: This strategy is more complex than a simple Long Call, requiring the trader to manage two options positions.

C. Bull Put Spread

A Bull Put Spread is another conservative bullish options strategy that involves selling a put option at a higher strike price and buying another put option at a lower strike price, both with the same expiration date. This strategy is used when the trader expects the asset’s price to rise or remain stable.

Mechanics of a Bull Put Spread

To implement a Bull Put Spread, the trader sells a put option at a higher strike price and buys another put option at a lower strike price. The premium received from selling the higher strike put option offsets part of the premium paid for the lower strike put option, reducing the overall cost of the strategy.

Profit and Loss Potential

The maximum profit for a Bull Put Spread is the net premium received. For example, if the trader sells a put option with a strike price of ₹60 for a premium of ₹5 and buys a put option with a strike price of ₹50 for a premium of ₹2, the net premium received is ₹3.

The maximum loss is limited to the difference between the strike prices minus the net premium received. If the asset’s price falls below the lower strike price, both options will be exercised, and the trader will lose the difference between the strike prices minus the net premium received.

Advantages and Disadvantages

Advantages of a Bull Put Spread include:

- Reduced Cost: The premium received from selling the higher strike put option reduces the overall cost of the strategy.

- Limited Risk: The maximum loss is limited to the difference between the strike prices minus the net premium received.

Disadvantages include:

- Capped Profit: The maximum profit is limited to the net premium received.

- Complexity: This strategy is more complex than a simple Long Call, requiring the trader to manage two options positions.

Long Call Butterfly Strategy

The Long Call Butterfly Spread is an options trading strategy used when a trader expects the stock price to stay near a specific level (strike price) by the time of expiration. It is a limited-risk, limited-reward strategy and is designed to profit from low volatility.

Structure of a Long Call Butterfly:

It involves three strike prices, all with the same expiration date, using four call options:

- Buy 1 Call at Lower Strike (A)

- Sell 2 Calls at Middle Strike (B)

- Buy 1 Call at Higher Strike (C)

Where:

-

Strike A < Strike B < Strike C

-

All calls are on the same underlying and have the same expiry date.

Example:

Let’s say a stock is trading at ₹100.

-

Buy 1 Call at ₹90 for ₹12

-

Sell 2 Calls at ₹100 for ₹6 each (receive ₹12)

-

Buy 1 Call at ₹110 for ₹2

🔹 Net Premium Paid = ₹12 (buy) – ₹12 (sell) + ₹2 (buy) = ₹2 (net debit)

Payoff at Expiry:

-

Maximum Profit: When the stock closes at the middle strike (B) (i.e., ₹100 in this example).

-

Maximum Loss: The net premium paid (₹2 in the example), if the stock expires below ₹90 or above ₹110.

-

Breakeven Points:

-

Lower BEP = Strike A + Net Premium (₹90 + ₹2 = ₹92)

-

Upper BEP = Strike C – Net Premium (₹110 – ₹2 = ₹108)

-

Short Put Strategy

The Short Put strategy (also called naked put) is a bullish options strategy where a trader sells a put option to profit from a rising or stable stock price.

- The short put strategy, also known as a naked put, is an options trading approach where an investor sells a put option with the intention of profiting from a stable or rising stock price. By selling the put, the trader receives a premium upfront, which represents the maximum possible profit in this strategy.

- The seller is obligated to buy the underlying stock at the strike price if the option is exercised, typically when the stock price falls below the strike. This strategy is best suited for bullish market conditions, where the trader expects the stock to stay above the strike price until expiration.

- If the stock remains above the strike, the option expires worthless, and the seller keeps the entire premium as profit. However, if the stock declines below the strike price, the seller may incur a loss equal to the difference between the strike price and the stock’s market price, minus the premium received.

- The break-even point is calculated by subtracting the premium from the strike price.

- While this strategy allows traders to earn income and potentially buy a stock at a lower effective price, it carries significant risk if the stock price falls sharply, making it essential to have proper risk management in place or consider a cash-secured put as a more conservative variation.

How It Works:

- You sell (write) 1 Put Option at a specific strike price.

- In return, you receive the premium.

- You’re obligated to buy the stock at the strike price if the buyer exercises the option.

Payoff Mechanics:

- Maximum Profit = Premium received

- Maximum Loss = If the stock falls to zero, your loss = Strike Price – Premium

- Breakeven Point = Strike Price – Premium Received

Example:

Suppose stock is trading at ₹100.

-

You sell 1 Put option with Strike Price = ₹95

-

Premium received = ₹4

Outcomes at Expiry:

-

Stock closes above ₹95 (say at ₹100):

Option expires worthless → You keep ₹4 profit. -

Stock closes at ₹92:

You have to buy the stock at ₹95, but it’s worth ₹92 →

Loss = ₹3 – ₹4 premium = Net loss ₹1 -

Stock goes to ₹0:

You still have to buy at ₹95 → Loss = ₹95 – ₹4 = ₹91

7.3. Bearish Strategies

a. Bear Call Spread

A Bear Call Spread is an options strategy used when an investor expects a moderate decline in the price of an underlying asset. It involves two key actions: selling a call option and buying another call option with a higher strike price but the same expiration date. Here’s a detailed explanation:

How It Works

-

- Sell a Call Option: Sell a call option at a certain strike price, usually slightly above the asset’s current market price.

- Buy a Call Option: Simultaneously, buy another call option at a higher strike price but with the same expiration date.

When to Use

- Moderately Bearish Outlook: When you expect a slight decline in the asset’s price.

- Risk Management: To limit potential losses compared to outright short selling.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is capped.

- Premium Income: You earn a net credit when initiating the trade.

Cons:

- Limited Profit: Your profit potential is capped by the net premium received.

- Time Decay: Options lose value as they approach expiration.

b. Bear Put Spread

A Bear Put Spread is a strategic options trading method where an investor aims to profit from a moderate decline in the price of an underlying asset. This strategy involves buying a put option and selling another put option with a lower strike price but the same expiration date. Here’s a detailed breakdown:

How It Works

-

- Buy a Put Option: Purchase a put option at a higher strike price, anticipating a decline in the asset’s price.

- Sell a Put Option: Simultaneously, sell another put option at a lower strike price with the same expiration date.

When to Use

- Moderately Bearish Outlook: When you expect a slight to moderate decline in the asset’s price.

- Risk Management: To limit potential losses compared to an outright long put position.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is limited to the net premium paid.

- Cost Reduction: The premium received from selling the lower strike put reduces the cost of buying the higher strike put.

Cons:

-

- Limited Profit: Your profit potential is capped by the difference between the strike prices minus the net premium paid.

- Time Decay: Options lose value as they approach expiration, known as time decay.

The Bear Put Spread is a cost-effective strategy that allows investors to capitalize on moderate price declines while keeping the potential losses under control.

c. Bear Iron Condor

A Bear Iron Condor is an options trading strategy designed to benefit from a moderate decline in the price of an underlying asset, coupled with low volatility. This strategy involves four options contracts with different strike prices but the same expiration date. Here’s a detailed breakdown:

How It Works

-

- Sell a Call Spread:

-

- Sell a Call Option: Sell a call option at a lower strike price.

- Buy a Call Option: Buy a call option at a higher strike price.

-

- Sell a Put Spread:

-

- Sell a Put Option: Sell a put option at a higher strike price.

- Buy a Put Option: Buy a put option at a lower strike price.

When to Use

-

- Market-Neutral Outlook: When you expect low volatility and the asset’s price to remain within a certain range.

- Profit from Time Decay: To benefit from the passage of time as long as the stock price remains between the breakeven points.

Pros and Cons

Pros:

-

- Limited Risk: Your maximum loss is capped.

- Premium Income: You earn a net credit when initiating the trade.

Cons:

-

- Limited Profit: Your profit potential is capped by the net premium received.

- Complexity: Involves managing four different options positions.

The Bear Iron Condor is a versatile strategy that allows traders to profit from a range-bound or moderately declining market with controlled risk.

d. Bear Butterfly Spread

A Bear Butterfly Spread is an options trading strategy designed for traders who expect a moderate decline in the price of an underlying asset. It involves four options contracts with three different strike prices2. Here’s a detailed explanation:

How It Works

-

- Sell Two Put Options: Sell two put options at a higher strike price.

- Buy One Put Option: Buy one put option at a middle strike price.

- Buy Two Put Options: Buy two put options at a lower strike price.

When to Use

-

- Moderately Bearish Outlook: When you expect a slight to moderate decline in the asset’s price.

- Risk Management: To limit potential losses compared to a straightforward put option.

Pros and Cons

Pros:

-

- Limited Risk: Your maximum loss is capped.

- Cost Reduction: The premium received from selling the higher strike puts reduces the cost of buying the lower strike puts.

Cons:

-

- Limited Profit: Your profit potential is capped by the difference between the strike prices minus the net premium paid.

- Time Decay: Options lose value as they approach expiration, known as time decay.

7.3. Neutral Strategies

A. Calendar Call

A Calendar Call (also known as a Call Calendar Spread) is an options trading strategy that involves holding two call options with the same strike price but different expiration dates. This strategy is used when an investor expects minimal price movement in the underlying asset in the near term but anticipates a potential increase in price over a longer period. Here’s a detailed explanation:

How It Works

- Sell a Near-Term Call Option: Sell a call option with a shorter expiration date.

- Buy a Longer-Term Call Option: Buy a call option with the same strike price but a later expiration date.

When to Use

- Neutral to Slightly Bullish Outlook: When you expect minimal price movement in the near term but anticipate a potential increase in price over a longer period.

- Benefit from Time Decay: To take advantage of the accelerated time decay of the near-term call option.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is capped at the net premium paid.

- Premium Income: You earn a net credit when initiating the trade.

Cons:

- Limited Profit: Your profit potential is capped by the net premium received.

- Complexity: Managing two different expiration dates can be more complex

B. Calendar Put

A Calendar Put (also known as a Put Calendar Spread) is an options trading strategy that involves holding two put options with the same strike price but different expiration dates. This strategy is used when an investor expects minimal price movement in the underlying asset in the near term but anticipates a potential decrease in price over a longer period. Let’s dive into the details:

How It Works

-

- Sell a Near-Term Put Option: Sell a put option with a shorter expiration date.

- Buy a Longer-Term Put Option: Buy a put option with the same strike price but a later expiration date.

When to Use

- Neutral to Slightly Bearish Outlook: When you expect minimal price movement in the near term but anticipate a potential decline in price over a longer period.

- Benefit from Time Decay: To take advantage of the accelerated time decay of the near-term put option.

Pros and Cons

Pros:

- Limited Risk: Your maximum loss is capped at the net premium paid.

- Cost Reduction: The premium received from selling the near-term put reduces the cost of buying the longer-term put.

Cons:

- Limited Profit: Your profit potential is capped by the net premium received.

- Complexity: Managing two different expiration dates can be more complex.

The Calendar Put strategy is useful for investors who have a slightly bearish outlook in the long term and want to reduce the cost of their position by selling a near-term put option.

C. Short Straddle

A Short Straddle strategy involves selling both a call and a put option on the same underlying asset with the same strike price and expiration date. This strategy is typically used when an investor expects low volatility in the price of the underlying asset and profits from the lack of significant movement. Here’s a detailed explanation:

How It Works

-

- Sell a Call Option: Sell a call option at a strike price close to the current market price of the underlying asset.

- Sell a Put Option: Sell a put option at the same strike price and expiration date as the call option.

When to Use

- Market-Neutral Outlook: When you expect low volatility and believe the asset’s price will remain within a narrow range.

- Profit from Time Decay: To benefit from the accelerated time decay of the options’ premium as expiration approaches.

Pros and Cons

Pros:

- Premium Income: You receive a significant premium when initiating the trade.

- Profit from Stability: Profitable if the underlying asset’s price remains stable.

Cons:

- Unlimited Risk: Potential for significant losses if the stock price moves sharply in either direction.

- Margin Requirements: Requires substantial margin due to the unlimited risk.

The Short Straddle strategy can be effective in a low-volatility environment but carries significant risk if the underlying asset’s price moves sharply. Always consider the potential risks and rewards before implementing this strategy.

D. Short Strangle

A Short Strangle is an options trading strategy where an investor sells both an out-of-the-money call option and an out-of-the-money put option on the same underlying asset with the same expiration date. This strategy is typically used when the investor expects low volatility in the underlying asset and aims to profit from the lack of significant movement. Here’s a detailed breakdown:

How It Works

-

- Sell an Out-of-the-Money Call Option: Sell a call option with a strike price above the current market price of the underlying asset.

- Sell an Out-of-the-Money Put Option: Sell a put option with a strike price below the current market price of the underlying asset.

When to Use

- Market-Neutral Outlook: When you expect low volatility and believe the asset’s price will remain within a wide range.

- Profit from Time Decay: To benefit from the accelerated time decay of the options’ premium as expiration approaches.

Pros and Cons

Pros:

- Premium Income: You receive a significant premium when initiating the trade.

- Profit from Stability: Profitable if the underlying asset’s price remains stable within the strike prices.

Cons:

- Unlimited Risk: Potential for significant losses if the stock price moves sharply in either direction.

- Margin Requirements: Requires substantial margin due to the unlimited risk.

The Short Strangle strategy can be effective in a low-volatility environment but carries significant risk if the underlying asset’s price moves sharply. Always consider the potential risks and rewards before implementing this strategy.