- Introduction to Trading Psychology

- Risk Management In Trading Psychology

- Challenges in Trading Psychology

- How to Stop Overtrading

- Common Trading Mistakes

- Disciplined Trader Success Formula

- Market Dynamics Basics

- How Trading Psychology Awareness can Improve Performance

- Strategy Plus Psychology=Success

- Resilience and Stress Response Management

- Advanced Techniques for Enhancing Trading Psychology

- Study

- Slides

- Videos

7.1. How Market Works??

Understanding how the market works is fundamental for anyone involved in trading or investing. Here’s an overview of key concepts and mechanisms that explain how financial markets operate:

- Market Structure

-

- Financial Markets: These include stock markets, bond markets, commodity markets, forex markets, and cryptocurrency markets. Each market has its own characteristics, instruments, and participants.

- Exchanges and Platforms: Markets are often organized through exchanges (e.g., NYSE, NASDAQ) or electronic trading platforms where buyers and sellers transact.

- Supply and Demand

-

- Price Determination: Market prices are determined by the forces of supply and demand. Prices start to rise when supply cannot keep up with demand. When supply exceeds demand the prices begin to fall.

- Market Orders: Buyers and sellers place orders (e.g., market orders, limit orders) that affect supply and demand dynamics. Orders are matched on exchanges or platforms based on price and time priority.

- Participants

-

- Individual Investors: Retail traders and investors who buy and sell securities for personal accounts.

- Institutional Investors: Mutual funds, Hedge funds, Pension funds, and insurance companies are some of the institutional investors who trade large volumes of securities.

- Market Makers: Firms or individuals who provide liquidity by quoting buy and sell prices for securities and profiting from the bid-ask spread.

- Brokers: Intermediaries who facilitate trades between buyers and sellers, often earning a commission or fee.

- Order Types

-

- Market Orders: Orders to buy or sell a security immediately at the best available price. These orders prioritize speed of execution.

- Limit Orders: Limit orders are orders to buy or sell a security at a specified price or even better. These orders prioritize price but may not be executed immediately.

- Stop Orders: Orders that become market orders once a specified price level (stop price) is reached, often used for risk management.

- Market Mechanisms

-

- Bid-Ask Spread: The difference between the greatest price a buyer is ready to pay (the bid) and the lowest price a seller is willing to take (the ask) is known as the bid-ask spread.

- Liquidity: Liquidity indicates to how easily a security can be bought or sold without affecting its price. High liquidity means lower spreads and easier execution.

- Volatility: Measures the degree of variation in a security’s price over time. High volatility indicates greater price swings, while low volatility indicates more stable prices.

- Price Discovery

-

- Market Prices: Market Prices are determined through the interaction of supply and demand. Market participants’ buying and selling decisions influence price movements.

- Information Impact: News, economic data, earnings reports, and other information can impact supply and demand, leading to price adjustments.

- Market Trends

-

- Trend Analysis: Identifying the direction in which the market or a security is moving (upward, downward, or sideways) is essential for trading strategies.

- Technical Analysis: Involves analyzing chart patterns to predict future price movements based on historical data.

- Regulation and Oversight

-

- Regulatory Bodies: Entities like the Securities and Exchange Commission (SEC) in the U.S., the Financial Conduct Authority (FCA) in the U.K., and others oversee market activities to ensure fairness and transparency.

- Market Rules: Regulations and rules are in place to prevent manipulation, fraud, and ensure proper functioning of markets.

- Economic Factors

-

- Macroeconomic Indicators: Interest rates, inflation, employment data, and GDP growth are some of the macroeconomic indicators that affect market conditions and investor sentiment.

- Monetary and Fiscal Policy: Central banks and governments influence markets through monetary policy (e.g., interest rates) and fiscal policy (e.g., government spending).

- Market Sentiment

-

- Investor Sentiment: Refers to the overall attitude of investors towards the market or specific securities. Sentiment can drive market trends and influence price movements.

- Behavioral Biases: Psychological factors and biases, such as overconfidence or herd behavior, can affect investor decisions and market dynamics.

7.2. Market v/s Our Own Life -Who wins??

Comparing the market with our own lives involves understanding how each operates and influences us. Here’s a breakdown of how the market and personal life intersect and impact each other, and who might “win” in different contexts:

Market vs. Personal Life

- Control and Predictability

- Market: The market is often unpredictable and influenced by numerous factors, including economic indicators, geopolitical events, and investor sentiment. While traders and investors can employ strategies and analysis to manage risk, they cannot fully control or predict market movements.

- Personal Life: Individuals generally have more control over their personal lives compared to the market.

Who Wins? Personal life often has more direct control, but the market’s unpredictability can significantly influence personal outcomes, especially for those invested in financial markets.

- Stress and Emotional Impact

- Market: Trading and investing can be highly stressful due to market volatility, financial risk, and the pressure of making decisions. Emotional stress from market fluctuations can impact mental health and well-being.

- Personal Life: Stress in personal life can come from various sources, including relationships, health, and work. The impact of stress can vary, and managing personal stress is crucial for overall well-being.

Who Wins? The market and personal life both have stressors. The impact depends on individual resilience and coping strategies. Effective stress management is key in both contexts.

- Time and Effort

- Market: Success in trading or investing often requires significant time and effort for research, analysis, and strategy development. Market participation can be time-consuming and requires ongoing attention.

- Personal Life: Managing personal responsibilities and achieving goals also requires time and effort. Balancing personal life with work, relationships, and self-care is essential.

Who Wins? The balance between market involvement and personal life depends on individual priorities. Both areas require effort, but finding a balance is crucial for long-term satisfaction.

- Financial Impact

- Market: Financial markets can have a profound impact on personal finances, including investments, retirement savings, and financial security.

- Personal Life: Personal financial management, including budgeting, saving, and spending, influences financial stability and quality of life. Personal decisions about finances impact financial outcomes.

Who Wins? Financial markets can significantly impact personal finances, but effective personal financial management can mitigate negative effects and enhance financial security.

- Personal Growth and Fulfillment

- Market: Achieving success in the market can lead to financial rewards and a sense of accomplishment. However, it might not necessarily fulfill broader personal goals or provide holistic satisfaction.

- Personal Life: Personal growth, relationships, and life experiences contribute to overall fulfillment and happiness. Personal achievements and connections often provide deeper satisfaction than financial success alone.

Who Wins? Personal life often offers more holistic and fulfilling experiences. Market success can contribute to personal growth but should be balanced with other life goals and values.

- Adaptability and Change

- Market: Markets are dynamic and constantly evolving. Traders and investors must adapt to changing conditions, new information, and market trends.

- Personal Life: Personal life also involves adaptation to changes, such as career shifts, relationship dynamics, and life transitions.

Who Wins? Adaptability is crucial in both contexts. Success often depends on the ability to navigate and manage changes effectively.

7.3. Stages of Traders in market-Know your status??

Understanding the stages of a trader’s development can help you assess your current status and identify areas for growth. Traders typically go through several stages as they gain experience and refine their skills. Here’s a breakdown of the common stages of a trader’s journey:

1. Novice Trader

Characteristics:

- Limited Experience: New to trading with little to no experience.

- Basic Knowledge: Basic understanding of trading concepts, market terminology, and financial instruments.

- High Enthusiasm: Eager to start trading but may lack a comprehensive plan or strategy.

Common Challenges:

- Overwhelmed by Market Complexity: Difficulty understanding market movements and making informed decisions.

- Emotional Trading: Prone to making impulsive decisions based on emotions rather than a well-defined strategy.

Focus Areas:

- Education: Fundamental concepts, market structures, and basic strategies must be part of education.

- Simulation: Practice with demo accounts or paper trading to build experience without financial risk.

2. Beginner Trader

Characteristics:

- Gained Some Experience: Has started trading live but may still be in the early stages of building confidence and consistency.

- Developing Strategy: Working on developing and refining a trading strategy.

- Initial Results: May experience mixed results with some success and some losses.

Common Challenges:

- Inconsistent Performance: Struggles with maintaining consistent profitability and managing risk effectively.

- Lack of Discipline: May find it challenging to stick to a trading plan and manage emotions.

Focus Areas:

- Refine Strategy: Work on developing a more robust and personalized trading strategy.

- Risk Management: Implement and adhere to risk management rules to protect capital.

3. Intermediate Trader

Characteristics:

- Improved Performance: Shows a better understanding of markets and trading strategies with more consistent results.

- Advanced Knowledge: Has a deeper understanding of technical analysis, market trends, and trading psychology.

- Developed Routine: Establishes a regular trading routine and disciplined approach.

Common Challenges:

- Adapting to Market Conditions: May struggle with adapting strategies to changing market conditions or unexpected events.

- Emotional Management: Still faces challenges in managing emotions and avoiding overtrading.

Focus Areas:

- Strategy Optimization: Continuously refine and adapt trading strategies based on performance and market conditions.

- Advanced Techniques: Explore advanced trading techniques and tools, such as algorithmic trading or options strategies

4. Advanced Trader

Characteristics:

- Consistent Profitability: Achieves consistent profitability and demonstrates a high level of skill and understanding.

- Sophisticated Strategies: Utilizes advanced trading strategies, including quantitative models or high-frequency trading.

- Strong Discipline: Maintains strict discipline, effective risk management, and emotional control.

Common Challenges:

- Managing Large Positions: Challenges related to managing larger positions and dealing with liquidity constraints.

- Market Changes: Adapts to evolving market conditions and technological advancements.

Focus Areas:

- Continual Learning: Stay updated with market trends, new strategies, and technological advancements.

- Diversification: Explore and implement diverse strategies and asset classes to optimize performance.

5. Professional Trader

Characteristics:

- High-Level Expertise: Possesses extensive knowledge and experience in trading, often working full-time or managing large portfolios.

- Institutional or Proprietary: Here financial institutions, hedge funds, or an independent professional trader could be involved.

- Strategic Vision: Demonstrates a strategic vision and ability to handle complex trading scenarios and large-scale operations.

Common Challenges:

- Regulatory Compliance: Navigates complex regulatory requirements and compliance issues.

- High Pressure: Deals with high-pressure situations and large financial stakes.

Focus Areas:

- Innovation and Strategy Development: Lead in developing innovative trading strategies and technologies.

- Mentoring and Leadership: May mentor or lead other traders, contributing to the trading community or firm’s success.

1.1. Trading Psychology-Introduction

Psychology is pivotal in trading because the financial markets are not only analysed with profitable fundamentals but also by the feelings and behaviours of dealers. Dealers are prone to cognitive impulses similar as overconfidence, loss aversion, and evidence bias. Being apprehensive of and managing these impulses through a strong cerebral frame can lead to more accurate and unprejudiced decision.

Cerebral strength helps dealers view miscalculations and losses as learning openings rather than failures. This mind set fosters nonstop enhancement and development of better trading chops. In this course you’ll learn how to know unwanted passions getting in your way of trading, damaging your judgement. Also this course covers important strategies and threat operation ways to avoid crimes that dealers constantly make.

What’s Trading Psychology??

Trading psychology refers to the feelings and internal state that dealers witness while engaging in the financial trading. It encompasses the behaviours, and emotional responses that dealer’s exhibit, which can significantly impact their trading opinions and overall performance.

1.2. Significance of Trading Psychology

There are some crucial reasons why psychology is important in trading

-

Decision Making

Decision making feelings like fear and rapacity can significantly impact decision making processes. Effective trading requires making rational, objective opinions grounded on analysis rather than emotional responses.

Illustration

The decision of a dealer can have a profound impact on their trading issues. Here is an illustration that illustrates how a dealer’s mental state and decision making process can affect their trading

- Ajay is a dealer who has a well-defined trading strategy grounded on specialized analysis. His strategy involves setting stop loss orders to limit losses and taking gains at predefined situations. One day, there’s unanticipated news that causes significant request volatility.

- The price of the stock that Ajay is trading drops fleetly, approaching the stop loss position. Ajay feels a swell of fear as the price drops snappily rather than letting the stop loss order execute as planned, Ajay manually closes the trade to avoid further implicit losses.

- The stock price soon stabilizes and rebounds sprucely, recovering all its losses and moving towards the original profit target. By letting fear mandate the decision, Ajay exits the trade precociously, missing out on the implicit recovery and gains.

- Later, the same stock starts to rise steadily, and Ajay feels confident that it’ll continue to climb. Ajay decides to ignore the profit taking strategy and keeps holding the position, hoping for indeed greater earnings.

- The stock price hits a peak and also reverses, falling sprucely due to profit taking by other dealers. By succumbing to rapacity, Ajay holds the position too long and fails to secure the gains that were originally available, ultimately performing in a lower gain or indeed a loss.

- In this illustration, Ajay’s wrong decision lead to two critical miscalculations ending a trade precociously to avoid perceived further losses, missing the eventual recovery and ignoring the predefined profit target in expedients of advanced earnings, performing in missed profit taking openings.

-

Threat operation (Risk Management)

Proper mind helps dealers cleave to their threat operation strategies. Emotional trading frequently leads to overleveraging or taking on further threat than planned, which can affect in significant losses. Threat operation is a critical element of trading psychology, as it helps dealers cover their capital and maintain long term success.

Illustration

Imagine you are a trader who has just experienced a significant loss on a trade. The market moved against your position rapidly, leading to a loss larger than you anticipated. This loss triggers a strong emotional reaction—anger, frustration, and fear of further losses. You feel an intense urge to “win back” what you lost by immediately placing another trade.

Psychological Risk: This situation is ripe for psychological risks like:

-

- Revenge Trading: The desire to quickly recoup losses can lead to impulsive decisions, often without proper analysis, increasing the risk of further losses.

- Overtrading: Emotional stress might push you to take on more trades than usual, often with poor setups, leading to higher exposure and more potential losses.

- Loss Aversion: The fear of losing more may cause you to exit trades prematurely, locking in small losses or preventing potential gains.

Risk Management Strategies:

Pause and Reflect:

-

- Step Back: Immediately after a significant loss, step away from your trading station. Take a break to allow your emotions to settle. This pause helps prevent impulsive decisions driven by emotion rather than logic.

- Breathing Exercises: Engage in deep breathing or mindfulness exercises to reduce stress and regain a calm state of mind. This helps in clearing your mind and preparing you to think more rationally.

Review the Trade:

-

- Objective Analysis: When you return, review the trade that led to the loss. Analyze what went wrong: Was it a failure in your strategy, an unexpected market event, or an emotional decision? Understanding the cause helps in learning and preventing similar mistakes in the future.

- Record Keeping: Document the trade in a journal, noting the reasons for the loss, your emotional state, and what you learned. This practice not only aids in reflection but also serves as a reference for future trades.

Set Clear Rules:

-

- Loss Limits: Establish a maximum daily loss limit. If this limit is reached, stop trading for the day. This rule prevents the emotional spiral of trying to recover losses immediately, which often leads to more significant losses.

- Cool-Off Period: After a loss, enforce a mandatory cool-off period before placing any new trades. This time allows you to reset emotionally and ensures that any new trades are based on your strategy, not emotional reactions.

Focus on the Process, Not the Outcome:

-

- Detachment from Results: Cultivate a mind-set that focuses on executing your strategy correctly, regardless of the outcome of any single trade. Understand that losses are a natural part of trading and that sticking to a disciplined process is what leads to long-term success.

- Positive Reinforcement: Reward yourself not just for winning trades, but for making disciplined decisions, even if the trade ends in a loss. This reinforces good habits and reduces the emotional impact of losses.

Seek Support:

-

- Mentorship or Community: Engage with a mentor or trading community where you can discuss your emotions and experiences. Sharing your challenges can provide perspective and support, helping you manage stress and stay grounded.

- Professional Help: If emotional reactions are consistently overwhelming and impacting your performance, consider consulting with a psychologist or counsellor specializing in trading psychology or stress management.

-

Consistency:

Successful trading requires consistency in executing strategies. Emotional control and psychological discipline ensure that traders follow their plans and do not deviate due to short-term market fluctuations. Consistency in trading psychology refers to the disciplined execution of a trading plan or strategy without being swayed by emotional impulses or short-term market fluctuations.

Example

A trader named Amit has developed a technical trading strategy based on moving averages and RSI (Relative Strength Index) indicators. His strategy includes the following rules:

- Entry Rule: Buy when the price crosses above the 50day moving average and the RSI is above 30.

- Exit Rule: Sell when the price crosses below the 50day moving average or the RSI exceeds 70.

- Position Sizing: Risk 2% of his trading capital on each trade.

- Stop Loss Orders: Set stop loss orders to limit potential losses to 2% of the trade’s value.

Amit has ₹20,000 in his trading account. He identifies a stock currently priced at ₹50 that meets his entry criteria.

Trade Execution:

-

- Entry Point: Amit buys 200 shares of the stock at ₹50 (2% risk on a ₹20,000 account means he can risk ₹400 on this trade).

- Stop Loss Order: He sets a stop loss order at ₹48 to limit his potential loss to ₹400 (200 shares x ₹2 loss per share).

Adhering to the Plan:

After purchasing the stock, the price drops slightly to ₹49, making Amit anxious. Despite his anxiety, Amit does not deviate from his strategy and keeps the trade open, adhering to his stop loss level. The stock price eventually rises to ₹55. Amit monitors the trade, and the RSI starts approaching 70. When the RSI hits 70 and the price is still above the 50day moving average, Amit decides to exit the trade, consistent with his strategy.

Outcome:

-

- Amit sells his 200 shares at ₹55

- Profit Calculation: He makes a profit of ₹1,000 (200 shares x ₹5 gain per share).

Amit follows the same consistent approach on his next trade. He identifies another stock meeting his entry criteria. Buys the stock, sets the stop loss, and exits based on his predetermined rules.

-

Stress Handling:

Trading can be stressful, especially during periods of high volatility or unexpected losses. Effective stress management through psychological resilience can help traders maintain focus and make sound decisions under pressure. Handling stress effectively is a crucial aspect of trading psychology, as it helps traders make sound decisions even under pressure.

Example

A trader named Shruti follows a swing trading strategy, focusing on holding positions for several days to weeks. Shruti has a trading account with ₹100,000 and typically risks 1% per trade. The market experiences sudden and extreme volatility due to unexpected geopolitical events. Shruti has several open positions, and the market’s rapid movements put her under significant stress.

Stress Management Techniques:

- Preparation and Planning: Before the volatility hit, Shruti had already established clear entry and exit points for each trade, including stop loss and take profit levels. This preparation helps Shruti avoid making impulsive decisions during high stress periods.

- Taking a Step Back: As the market swings wildly, Shruti feels her stress levels rising. She notices her heart rate increasing and a sense of panic setting in. Shruti steps away from her trading desk for a few minutes to take deep breaths and clear her mind. This brief break helps her regain composure and reduces immediate stress.

- Following the Plan: One of Shruti’s trades reaches its stop loss level. Instead of panicking and adjusting the stop loss to avoid the loss, Shruti allows the stop loss order to execute as planned. By following her predetermined plan, Shruti limits her loss to 1% of her account, which is within her risk tolerance.

- Using Stress Relief Techniques: Shruti practices deep breathing exercises to calm her nerves. She inhales deeply for a count of four, holds for a count of four, and exhales slowly for a count of four. After a particularly stressful trading session, Shruti goes for a walk outside. Physical activity helps reduce her stress and clear her mind.

- Reviewing and Learning: Once the market stabilizes, Shruti reviews her trades and the decisions she made under stress. She notes what worked well and where she can improve. Shruti uses this analysis to refine her trading strategy and improve her stress management techniques for future volatile periods.

-

Overcoming Biases:

Traders are prone to cognitive biases such as overconfidence, loss aversion, and confirmation bias. Being aware of and managing these biases through a strong psychological framework can lead to more accurate and unbiased decision-making. Overcoming biases is a crucial aspect of trading psychology, as cognitive biases can significantly impair decision-making and lead to suboptimal trading outcomes.

a. Confirmation Bias

Traders tend to seek out information that confirms their existing beliefs and ignore information that contradicts them. For example a trader named Amit believes that a particular stock will rise because of favourable news. He focuses on positive news articles and ignores negative analysis. Amit might overlook important risks and hold onto the stock despite signs that the price is likely to drop.

Overcoming Strategy:

Amit decides to deliberately seek out and consider opposing viewpoints. He reads bearish analyses and factors them into his decision-making process. By considering all available information, Amit can make a more balanced and informed decision, reducing the impact of confirmation bias.

b. Loss Aversion

Traders tend to prefer avoiding losses rather than acquiring equivalent gains, often leading to holding losing positions too long. For example a trader named Sarah is holding a stock that has dropped in value. She is reluctant to sell it because selling would mean realizing a loss. Sarah might hold the losing position, hoping it will recover, potentially resulting in greater losses.

Overcoming Strategy:

Sarah sets strict stop loss orders before entering trades and adheres to them regardless of her emotions. She also reviews past trades to reinforce the importance of cutting losses early. By accepting losses as part of trading and sticking to predefined exit points, Sarah can limit her losses and improve her overall performance.

c. Overconfidence Bias

Traders overestimate their knowledge, skills, and the accuracy of their predictions, leading to excessive risk-taking. For example, John has had a series of successful trades and starts believing that he has exceptional trading skills. He begins to take larger positions without proper analysis. Overconfidence leads John to take on excessive risk, which can result in significant losses when the market moves against him.

Overcoming Strategy:

John keeps a trading journal where he records his trades, reasons for entering and exiting, and outcomes. He regularly reviews his journal to remain humble and aware of his limitations. By maintaining a realistic view of his abilities and consistently analyzing his performance, John can avoid overconfidence and manage risk more effectively.

d. Recency Bias

Traders give undue weight to recent events or performance, assuming that these are indicative of future outcomes. For Example Shruti experiences a strong bullish trend in the market and assumes it will continue indefinitely. She makes trades based on this assumption. Shruti might ignore broader market indicators or signs of an impending reversal, leading to losses when the trend changes.

Overcoming Strategy:

Shruti develops a comprehensive trading plan that includes analysis of long-term trends, historical data, and market fundamentals. She uses this plan to guide her decisions rather than relying solely on recent performance. By basing her trades on thorough analysis rather than recent events alone, Shruti can make more balanced decisions and avoid the pitfalls of recency bias.

6. Patience and Discipline:

Markets do not always present clear opportunities. A strong psychological foundation helps traders stay patient and disciplined, avoiding impulsive trades that do not fit their strategy. Patience and discipline are crucial traits in trading psychology, essential for long-term success.

Example

Shruti, a seasoned trader, identifies a stock with strong fundamentals but is currently facing short-term market turbulence. She believes in the stock’s long-term potential but recognizes that the market may not reflect its value immediately. Shruti does not rush into buying the stock immediately. Instead, she waits for a confirmation signal from her technical analysis indicators, such as a moving average crossover or a breakout from a key resistance level. Despite seeing the stock price fluctuating and sometimes dropping, Shruti avoids making impulsive decisions based on fear. She reminds herself of her research and the stock’s long-term potential. Shruti maintains her focus on long-term gains rather than getting distracted by short-term market noise. She plans to hold the stock for several months or even years until it reaches her target price.

7. Adapting to Market Conditions:

Markets are dynamic and constantly changing. Psychological flexibility allows traders to adapt their strategies as needed rather than rigidly sticking to a plan that may no longer be effective. Adapting to market conditions is a vital aspect of trading psychology, as markets are dynamic and can change rapidly due to various factors.

Example

- Ajay, who is an experienced trader, has been successfully trading a particular stock using a trend following strategy. However, he notices that the market environment has shifted from a trending phase to a range bound or sideways phase. Ajay observes that the stock is no longer showing strong directional movement.

- Instead, it is oscillating within a defined range, bouncing between support and resistance levels. He recognizes that his trend following strategy might not be effective in this new market condition. Understanding the need for a different approach, Ajay decides to switch to a range trading strategy.

- This involves buying near the support level and selling near the resistance level, capitalizing on the predictable price movements within the range. Ajay revises his trading plan to incorporate the new strategy. He defines new entry and exit points based on support and resistance levels and adjusts his risk management rules accordingly.

- Ajay keeps himself updated with market news and events that could impact the stock’s price movements. He is aware that the market could break out of the range at any time, and he is prepared to adapt again if necessary. Despite the strategy change, he remains disciplined in executing his new plan.

- He does not get tempted to revert to his trend following strategy until there is clear evidence that the market has resumed trending. By adapting to the new market conditions, he avoids losses that might have occurred if he had continued with his trend following strategy.

- His new range trading approach proves effective, allowing him to generate profits in the sideways market. When the market eventually breaks out of the range and resumes trending, Ajay is ready to switch back to his original strategy.

8. Learning from Mistakes:

Psychological strength helps traders view mistakes and losses as learning opportunities rather than failures. This mind-set fosters continuous improvement and development of better trading skills.

Example

- Shyam a novice trader, has experienced several losing trades due to impulsive decisions and a lack of a structured trading plan. He takes a step back to reflect on his recent trading performance.

- He reviews his trading journal, noting the reasons for each loss, such as entering trades without proper analysis, not setting stop loss orders, and exiting trades prematurely due to fear.

- By analyzing his trading history, he identifies a pattern of emotional trading. He realizes that he often makes impulsive decisions driven by market news or short-term price movements, leading to poor trade outcomes.

- Understanding the need for improvement, he decides to educate himself further. He reads books on trading psychology, attends webinars, and follows experienced traders to learn about effective trading strategies and risk management techniques.

- With new knowledge, Shyam creates a detailed trading plan that includes specific criteria for entering and exiting trades, risk management rules, and guidelines for maintaining emotional control. He commits to following this plan, strictly monitors his trades closely, adhering to his trading plan and avoiding impulsive decisions.

- He keeps a trading journal to document each trade, including the rationale behind it, the outcome, and any emotional responses experienced. By learning from his mistakes and making necessary adjustments, Shyam begins to see improvements in his trading performance.

- Over time, his ability to learn from past mistakes helps him develop into a more successful and confident trader. Trading is not about short-term gains but rather long-term success. A strong psychological approach helps traders maintain a long-term perspective, focusing on sustainable growth rather than quick wins.

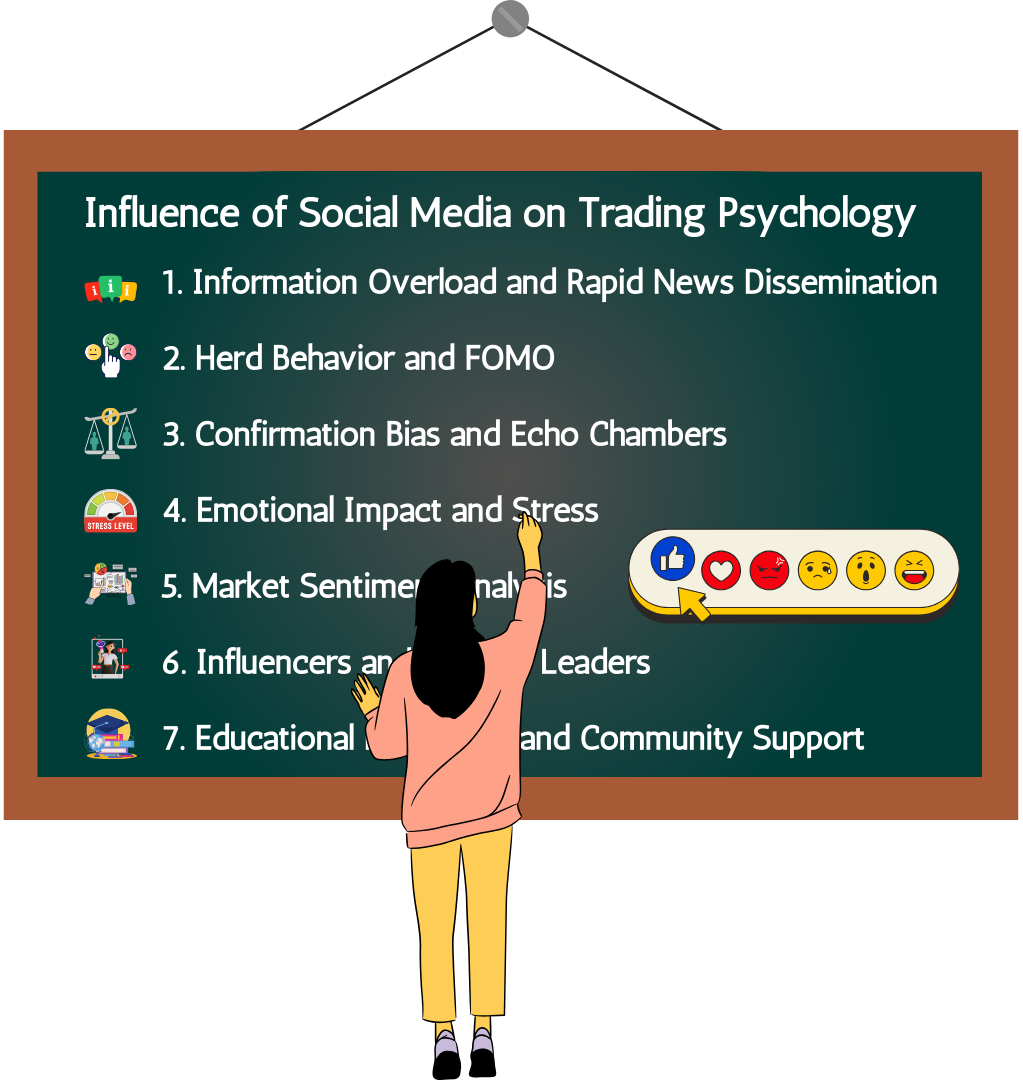

1.3. Influence of Social Media on Trading Psychology

Social media plays a significant role in shaping trading psychology in various ways:

1. Information Overload and Rapid News Dissemination

Social media platforms provide real-time news updates, which can lead to immediate market reactions. False or speculative information can spread quickly, causing traders to make impulsive decisions based on inaccurate data.

2. Herd Behavior and FOMO (Fear of Missing Out)

Seeing many people talking about or trading a particular stock or asset can lead traders to follow the crowd without conducting their own research. The fear of missing out on potential profits can drive traders to make hasty decisions, often leading to buying high and selling low.

3. Confirmation Bias and Echo Chambers

Traders might follow accounts and join groups that align with their existing beliefs, reinforcing their biases. These environments can create a false sense of consensus, making traders overconfident in their decisions.

4. Emotional Impact and Stress

Seeing others’ successes or failures can heighten emotions, leading to stress and emotional trading. Comparing one’s performance to others can create undue pressure, impacting trading decisions negatively.

5. Market Sentiment Analysis

Some traders use social media sentiment as a tool to gauge market trends and sentiment, though this can be a double-edged sword as sentiment can be volatile and manipulated.

6. Influencers and Opinion Leaders

Well-known traders and financial influencers can significantly impact market movements through their opinions and predictions. Unscrupulous individuals can use their influence to artificially inflate the price of an asset before selling it off, leaving others with losses.

7. Educational Resources and Community Support

Social media provides access to a wealth of educational content and community support, helping traders improve their skills and knowledge. Engaging with other traders can provide valuable insights and different perspectives on trading strategies and market analysis.

Example of Social Media Influence on Trading Psychology

- A notable example of social media’s influence on trading psychology in India is the case of the GameStop (GME) short squeeze in early 2021, which had global repercussions, including in India.

- This event was fueled significantly by discussions and campaigns on social media platforms like Reddit, particularly in the subreddit r/WallStreetBets. The GameStop short squeeze drew massive global attention, including from Indian traders.

- The news spread rapidly across social media platforms, leading to heightened interest and participation from traders around the world.

- Indian retail investors, influenced by the social media buzz, started looking for similar opportunities in their local market.

- There was an increase in activity on Indian stock market forums and social media groups discussing potential “short squeeze” targets in India. Stocks like Reliance Communications, Suzlon Energy, and other highly shorted stocks in India saw a significant increase in trading volumes as traders tried to replicate the GameStop phenomenon locally.

- Social media platforms such as Twitter, Facebook, and local forums like Moneycontrol’s message board saw a spike in discussions and posts about these stocks, driving more retail participation.

- Many traders jumped on the bandwagon without thorough research, driven by the fear of missing out (FOMO) on potential high returns that were being talked about on social media.

- The Securities and Exchange Board of India (SEBI) closely monitored the situation to ensure market stability and protect retail investors from potential market manipulation.

- Following the incident, there were increased efforts to educate investors about the risks of following social media trends blindly and the importance of making informed trading decisions.

1.4 Winning V/s Loosing Stripes

Winning and losing stripes are common sensations in trading, and they can significantly impact a dealer’s psychology and decision making process. Understanding how to manage these stripes is vital for long term success.

Winning stripes

A winning band in the stock request is a period during which a stock or index closes at an advanced price for consecutive trading sessions. However, it’s on a five day winning band, if a stock’s price increases for five consecutive days.

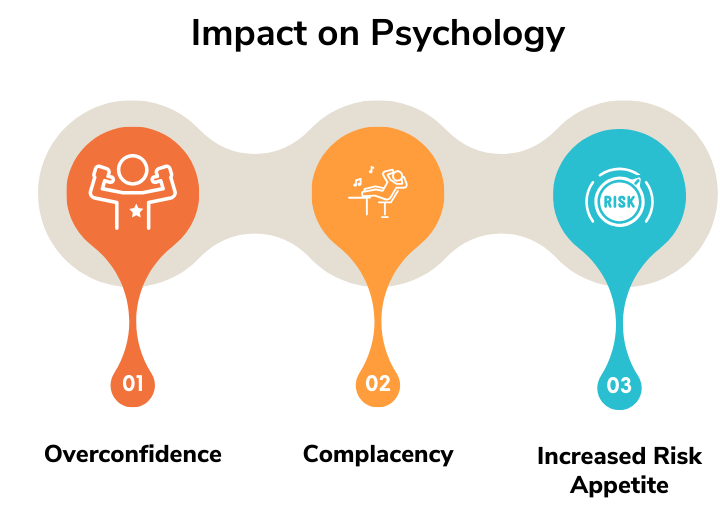

Impact on Psychology

- Overconfidence a series of successful trades can lead to overconfidence, making dealers believe they are invincible. This can affect in taking devilish risks and swinging from their trading plan.

- Complacency Dealers might come insouciant, neglecting thorough analysis and due assiduity, assuming their winning band will continue indefinitely.

- Increased trouble Appetite Buoyed by recent success, dealers may increase their position sizes, influence, or trade more constantly, exposing themselves to lower implicit losses.

Operation Strategies

- Stick to the Plan Maintain discipline by adhering to the original trading plan, including trouble operation rules.

- Review and Reflect Regularly review formerly trades to understand the reasons behind successes and ensure they were due to sound strategy rather than luck.

- Stay Humble Acknowledge that requests are changeable and that no dealer is vulnerable to losses. Staying rested helps maintain a balanced approach.

Losing stripes

- A losing band in the stock request is a period during which a stock or index closes at a lower price for consecutive trading sessions.

- However, it’s on a six day losing band, if a stock’s price diminishments for six consecutive days.

Impact on Psychology

- Loss Aversion passing losses can lead to a violent emotional response where dealers come excessively concentrated on avoiding further losses, constantly leading to poor decision.

- Fear and Hesitation after a series of losses, dealers may come fearful and reticent to take new positions, indeed if the setup is favourable.

- Revenge Trading to recoup losses snappily, dealers might engage in revenge trading, taking fallacious risks and swinging from their plan.

Operation Strategies

- Take a Break Stepping down from the request temporarily can help clear the mind and reduce emotional stress, allowing for a more objective reassessment.

- Anatomize misapprehensions Review losing trades to identify any common misapprehensions or areas for improvement. This helps in knowledge and avoiding similar pitfalls in the future.

- Focus on the Process Shift the focus from short term issues to following the trading process and strategy. Density in execution will eventually lead to better results.

1.5 Developing the Right Trader’s Mind set

Developing the right mind set is vital for successful trading. It involves cultivating internal habits and stations that can help you handle the emotional and cerebral challenges of trading.

- Self-Discipline and forbearance produce a comprehensive trading plan with clear rules and guidelines. Cleave to this plan constantly, indeed during changeable periods. Repel the appetite to make impulsive opinions rested on heartstrings or request noise. Stick to your strategy and avoid chasing the request.

- Emotional Control Learn to recognize and manage your heartstrings, analogous as fear, cupidity, and frustration. Emotional control is essential for making rational opinions. Understand that losses are part of trading. Develop inflexibility to handle setbacks without letting them affect your unborn opinions.

- Realistic prospects set realistic, attainable trading pretensions rather than aiming for unrealistic earnings. Understand that harmonious, small earnings are more sustainable than large, erratic earnings. Recognize that trading is a continuous knowledge trip. Anticipate to make misapprehensions and view them as learning openings rather than failures.

- Risk Management Use stop loss orders and position sizing to manage trouble effectively. Guarding your capital is vital for long term success. Diversify your investments to spread trouble.

- Continuous improvement Document your trades, including the explanation behind each decision and the outgrowth. Engage with other dealers, join trading communities, and seek feedback to gain new perspectives and perceptivity.

- Strictness be set to adapt your strategy rested on changing request conditions. Harshness is vital to navigating different request surroundings. Keep up with request news, trends, and developments. Continuous knowledge will help you stay ahead and make informed opinions.

- Confidence and Humility Confidence in your strategy and decision making process is important. Still, ensure that confidence doesn’t turn into overconfidence. Recognize that no strategy is wisecrack confirmation and that you can always meliorate. Stay humble and open to learning from others.

- Focus on the Process, Not the Outcome Focus on following your trading plan and strategy rather than obsessing over individual trade issues. Constantly applying your process will lead to better long term results. Don’t let a single trade’s outgrowth dictate your overall strategy or tone assessment. Base your evaluation on adherence to your plan and trouble operation.

1.6 The secret of successful Trader Psychology

The secret to successful dealer psychology lies in learning a combination of internal disciplines, emotional operation, and strategic thinking, also are vital rudiments that contribute to a successful trading mind set.

1. Tone awareness and Emotional Intelligence

Be alive of how heartstrings like fear, cupidity, and overconfidence impact your decision. Understanding your emotional triggers can help you manage them better. Develop ways to manage stress and maintain countenance. This might include mindfulness, contemplation, or simply taking breaks from trading to regain perspective.

2. Discipline and density

Develop a well-defined trading plan with clear rules and stick to it. Density in following your plan helps in managing trouble and avoiding impulsive opinions. Establish a trading routine that includes regular analysis, review of formerly trades, and drug for the trading day. Harmonious routines can help make discipline and reduce stress.

3. Risk Management

Implement strict threat operation rules, similar as using stop loss orders and limiting position sizes. Guarding your capital ensures you can continue trading over the long term. Understand your threat forbearance and acclimate your strategies consequently. Effective threat operation is pivotal for surviving and thriving in unpredictable requests.

4. Growth Mind set

Treat losses and miscalculations as learning openings rather than failures. Assaying what went wrong and making adaptations can ameliorate your trading chops. Stay curious and married to literacy. Regularly modernize your knowledge, upgrade your strategies, and seek feedback from others in the trading community.

5. Focus and neutrality

Don’t let the excitement of trading lead to overtrading. Stick to your strategy and avoid making trades grounded on feelings or request noise. Base your opinions on data and analysis rather than particular impulses or external pressures. Ideal decision helps in maintaining thickness and discipline.

6. Adaptability and tolerance

Develop adaptability to handle ages of loss without letting them affect your confidence or decision making process. Tolerance is crucial to staying for the right openings and not forcing trades. Focus on long term pretensions rather than short term earnings. Trading success frequently requires time and continuity.

7. Rigidity

Be willing to acclimatize your strategies grounded on changing request conditions. Inflexibility allows you to respond to new information and evolving request dynamics. Keep up with request trends, news, and developments to make informed opinions and acclimate your approach as demanded.

8. Awareness and Balance

Maintain a healthy work life balance to avoid collapse. Engaging in conditioning outside of trading helps in keeping a clear mind and reducing stress. Incorporate awareness ways to stay focused and calm during trading. Awareness helps in managing feelings and perfecting decision.

1.7 Becoming a Disciplined Trader

A disciplined trader is someone who constantly follows a well-defined trading plan, maintains emotional control, and adheres to established threat operation practices. Crucial

Characteristics of a Disciplined Trader

Adherence to a Trading Plan

A chastened Trader follows a detailed trading plan with specific strategies, entry and exit points, and threat operation rules. Sticks to the plan anyhow of request conditions or feelings.

Emotional Control Remains calm and composed indeed during unpredictable request conditions. Makes opinions grounded on analysis and strategy rather than feelings like fear or rapacity.

Risk Management tools stop loss orders to minimize implicit losses. Precisely sizes positions to align with threat forbearance and overall portfolio strategy. Avoids concentrating too important capital in a single asset or trade.

Nonstop literacy and enhancement Stays informed about request trends, new trading strategies, and fiscal news. Regularly reviews past trades to learn from miscalculations and successes. Adjusts strategies as demanded grounded on request conditions and particular experience.

Attestation and analysis

Maintains a detailed journal of all trades, including the explanation behind each trade, issues, and reflections. Regularly evaluates trading performance to identify areas for enhancement.

Tolerance and Discipline

Doesn’t force trades but delays for setups that meet predefined criteria. Executes trades according to plan without divagation.

Illustration

One well known illustration of a chastened dealer in India is Rakesh Jhunjhunwala, frequently appertained to as the” Warren Buffett of India.” Though he was more extensively known as an investor, his disciplined approach to trading and investing provides precious assignments for dealers. Jhunjhunwala was known for his long term investment strategies, sticking to his persuasions indeed during request volatility. He conducts thorough abecedarian analysis before making investment opinions. Rakesh Jhunjhunwala chastened approach to trading and investing has made him one of the most successful and reputed personality. His styles and gospel offer precious perceptivity for dealers and investors aiming to develop discipline and achieve long term success.

1.8 Analysing and learning from losing streaks

Analysing and learning from losing Streaks is pivotal for getting a successful and disciplined dealer.

1. Define your threat forbearance

Before you enter any trade, you should have a clear idea of how much you’re willing to risk and lose. This is your threat forbearance, and it depends on your trading style, pretensions, and personality. Your threat forbearance should be harmonious and realistic, not grounded on feelings. A common rule of thumb is to risk no further than 1 2 of your account balance per trade, but you can acclimate this according to your preferences.

2. Use stop loss orders

Stop loss orders are essential tools for guarding your capital and limiting your losses. They’re orders that automatically close your position at a destined price position, if the request moves against you. You should always use stop loss orders, and place them grounded on specialized analysis, not on arbitrary figures or wishful thinking. For illustration, you can use support and resistance situations, trend lines, moving pars, or pointers to set your stop loss orders.

3. Reduce your position size

One of the simplest and most effective ways to manage threat and position size during losing stripes is to reduce your exposure to the request. By trading lower quantities, you can reduce the impact of each loss on your account and your feelings. You can use a fixed chance or a fixed bone quantum to determine your position size, or you can use a threat price rate or a Kelly criterion to optimize it. The key is to be harmonious and disciplined, and not to overtrade or chase losses.

4. Review your performance

Losing stripes can also be openings to learn from your miscalculations and ameliorate your trading chops. You should review your performance regularly, and dissect your trades objectively. You should look for patterns, trends, strengths, and weakness in your and identify what works and what doesn’t. You should also keep a trading journal, where you record your entries, exits, reasons, feelings, and issues of each trade. This will help you track your progress, spot your crimes, and acclimate your strategy consequently.

5. Maintain your confidence

Losing streaks can also affect your confidence and motivation as a trader. You may start to doubt yourself, your system, or the market. You may become fearful, frustrated, or angry. You may lose sight of your long-term goals and vision. To avoid these negative effects, you should maintain your confidence and optimism during losing streaks. You should remind yourself of your past successes, your trading edge, and your potential. You should also practice self-care, such as taking breaks, exercising, meditating, or seeking support from others.

6. Follow your plan

Eventually, the most important tip on how to manage threat and position size during losing stripes is to follow your trading plan. Your trading plan is your roadmap to success, and it should include your pretensions, rules, criteria, styles, and pointers for trading. You should follow your trading plan rigorously, and not diverge from it grounded on feelings, impulses, or external influences. You should also review and modernize your trading plan periodically, and test it on different request conditions and scripts