- Study

- Slides

- Videos

7.1 Introduction

Charts always have a story to tell. However, from time to time those charts may be speaking a language you do not understand and you may need some help from an interpreter. Technical indicators are the interpreters of the market. They look at price information and translate it into simple, easy-to-read signals that can help you determine when to buy and when to sell a stock.

Technical indicators are based on mathematical equations that produce a value that is then plotted on your chart. For example, a moving average calculates the average price of a stock in the past and plots a point on your chart. As your stock chart moves forward, the moving average plots new points based on the updated price information it has. Ultimately, the moving average gives you a smooth indication of which direction the stock is moving.

Each technical indicator provides unique information. One will find that one naturally gravitates toward specific technical indicators based on your trading personality, but it is important to become familiar with all of the technical indicators at your disposal. One should also be aware of the one weakness associated with technical indicators: Because technical indicators look at historical price data, they are not guaranteed to know anything definite about the future.

Technical indicators are divided into the following categories:

- Trending Indicators

- Oscillating Indicators

Trending Indicators

Trending indicators, as their name suggests, identify and follow the trend of a currency pair. Forex traders make most of their money when currency pairs are trending. It is, therefore, crucial for you to be able to determine when a currency pair is trending and when it is consolidating. If you can enter your trades shortly after a trend begins and exit shortly after the trend ends, you will be quite successful.

Let’s take a look at the following trending indicators:

- Moving average

- Bollinger bands

7.2 Moving Averages

As explained, these are the most basic trending indicator. They show you what direction a stock is going and where potential levels of support and resistance may be – moving averages themselves can serve as both support and resistance.

MOVING AVERAGE TRADING SIGNAL – Moving averages provide useful trading signals for currency pairs that are trending.

- Entry signal-when an up-trending currency pair bounces back up after hitting an up-trending moving average, or when a down-trending currency pair bounces back down after hitting a down-trending moving average.

- Exit signal-when you enter a trade on an up-trending stock, set a stop loss below the moving average. As the moving average rises, move your stop loss up along with the moving average.

If the stock ever breaks far enough below the moving average, your stop loss will take you out of your trade. When you enter a trade on a down-trending Stock, set a stop loss above the moving average. As the moving average falls, move your stop loss down along with the moving average. If the stock ever breaks far enough above the moving average, your stop loss will take you out of your trade.

7.3 Bollinger Bands

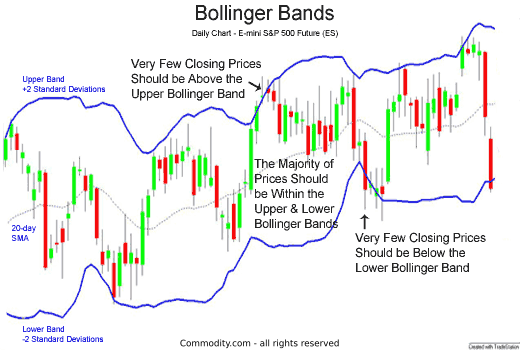

Bollinger bands, created by John Bollinger, are a trending indicator that can show you not only what direction a currency pair is going but also how volatile the price movement of the stock is. Bollinger bands consist of two bands- an upper band and a lower band- and a moving average and are generally plotted on top of the price movement of a chart.

How Bollinger Bands are Constructed

Bollinger bands are typically based on a 20-period moving average. This moving average runs through the middle of the two bands. The upper band is plotted two standard deviations above the 20-period moving average. The lower band is plotted two standard deviations below the 20- period moving average.

A standard deviation is a statistical term that measures how far various closing prices diverge from the average closing price. Therefore 20-period Bollinger bands tell you how wide, or volatile, the range of closing prices has been during the past 20 periods. The more volatile the stock, the wider the bands will be. The less volatile the stock, the narrower the bands will be.

7.4 Why is it so Important to Measure Market Volatility

Well, for one, volatile markets offer more trading opportunities than those without much activity. More importantly, volatility can often predict the market’s direction and is a measure of its performance.

Back in 2011, Crestmont Research conducted a study of the historical relationship between volatility and market performance. For its analysis, Cresmont measured the volatility of the S&P 500 using the average range for each day. At the end of the study, they concluded that higher volatility signals a higher probability of a downward trending market. In comparison, lower volatility signals a higher probability of a rising market.

Now let’s take an example to understand the calculation of a Bollinger band:

For example, the shares of Britannia, if the 20 day SMA is 3600, and the SD is 75 (or 0.96%), then the +2 SD would be 3600 + (75*2) = 3750. Likewise, a -2 SD indicates we multiply the SD by 2 and subtract it from the average. 3600 – (2*75) = 3450.

We now have the components of the BB:

20 day SMA = 3600

Upper band = 3450

Lower band = 3750

Statistically speaking, the current market price should hover around the average price of 3600. However, if the current market price is around 3650, it is considered expensive concerning the average. Hence one should look at shorting opportunities with an expectation that the price will scale back to its average price.

Therefore the trade would be to sell at 3650, with a target of 3600.

Likewise, if the current market price is around 3450, it is considered cheap concerning the average prices. Hence, one should consider buying opportunities to expect that the prices will scale back to its average price.

Therefore the trade would be to buy at 3450, with a target of 3600. The upper and lower bands act as a trigger to initiate a trade.

BOLLINGER BAND TRADING SIGNAL

Bollinger bands provide useful breakout signals for stocks that have been consolidating.

- Entry signal – when the bands widen and begin moving in opposite directions after a period of consolidation, you can enter the trade in the direction the price was moving when the bands began to widen.

- Exit signal – when the band narrows the price of the stock moved away from the breakout turns and starts moving back toward the current price of the stock, set a trailing stop loss to take you out of the trade if the trend reverses.