- Study

- Slides

- Videos

8.1 Stock Market Indices

In the vast architecture of financial markets, stock indices act as critical scaffolding. They not only provide a condensed narrative of market Behavior but also shape how traders interpret, respond, and position themselves. Understanding how indices work, and how to work with them is indispensable to serious market participants. This chapter deconstructs the nature, relevance, evolution, and tactical use of stock market indices in a trader’s toolkit.

Nirav: Vedant, I keep seeing Nifty and Sensex flashing across news screens. Are they just headline numbers or do they actually mean something deeper?

Vedant: They’re much more than headlines. Stock market indices are like economic thermometers—they track selected stocks to show how a segment of the market is performing. Let’s unpack why they matter.

Think of a stock market index like a school report card. Just as a report card shows how a student is performing across subjects, an index like Nifty 50 or Sensex shows how a group of top companies is performing in the market. If the index goes up, it’s like the student scoring better—indicating overall improvement. If it drops, it signals weaker performance. Investors use this “report card” to quickly gauge the health of the market.

A stock market index is a weighted average of a selected group of stocks, representing a particular segment of the market. This “segment” could be based on market capitalization, sector, investment theme, geography, or strategic filters. The index offers a single number that reflects the combined performance of its constituents. But it’s more than just a metric—it’s a reflection of sentiment, capital flow, and macroeconomic undercurrents.

For instance, when the Nifty 50 rises, it implies not just price appreciation of a few stocks but optimism across India’s top corporates. Similarly, when the S&P 500 moves sharply post-Fed announcement, it encapsulates the collective psychological reaction of traders, hedgers, and investors to economic signals.

Nirav: Okay, so if an index tracks performance—how do they decide which stocks go in?

Vedant: Good question. Index design isn’t random. It involves careful selection, weighting rules, and alignment with the index’s purpose. Let’s break down the mechanics.

8.2 Designing an Index

Defining the Objective and Universe

India’s two major stock market indices are the S&P BSE Sensex and the CNX Nifty. These indices act like thermometers for the stock market, they measure how healthy or optimistic the market feels at any given moment.

The S&P in Sensex comes from Standard & Poor’s, a global expert in building financial indices. They’ve partnered with BSE to lend their technical know-how. Similarly, CNX Nifty is managed by a joint venture between NSE and CRISIL, and the name “CNX” reflects that partnership.

Now, why do these indices matter? Imagine them as crowd mood indicators. If the index rises, it means investors are feeling confident about the future—like expecting good economic growth or strong company earnings. If it falls, it signals worry or pessimism—maybe due to global uncertainty, poor results, or policy changes. These ups and downs reflect how lakhs of investors are adjusting their expectations in real time. So, watching the index is like reading the market’s collective mind.

Before an index is built, its purpose must be crystal clear: is it meant to mirror broad market Behavior, focus on a sector, or track a theme

Once the objective is locked, the stock universe is selected—this might include all companies listed on a specific exchange or a filtered subset based on size, liquidity, or geography.

For instance, the Nifty 50’s universe is derived from the top companies listed on the NSE, emphasizing market capitalization and liquidity.

Nirav: There must be filters, right? Not every listed company makes it into Nifty or Sensex. Vedant: Absolutely. Factors like liquidity, market cap, sector representation and trading frequency play key roles. Let’s dive into the screening criteria.

8.3 Eligibility and Screening Criteria

This stage filters the universe by applying rules such as:

- Free-Float Market Capitalization :Only includes publicly tradable shares, excluding promoter holdings. This ensures price movement reflects real market participation.

- Liquidity Thresholds : Stocks must meet minimum turnover or trading frequency to ensure they’re investable and trackable.

- Listing History : New IPOs may be excluded until they’ve traded for a certain duration—common in stability-focused indices.

- Sectoral Balance : Some indices cap weight to prevent over

Nirav: I’ve noticed some stocks influence index movements more than others. Is that due to their size?

Vedant: That’s due to weighting. Different indices use market cap-weighting, equal-weighting or other methods. Time to explore how weights shape index behavior.

8.4 Weighting Methodology

Once constituents are selected, assigning weights determines their influence:

- Market Cap Weighted : Larger companies exert more pull on the index. This mirrors real-world market impact but can skew toward a few giants.

- Price Weighted :Higher-priced stocks have a greater say. Used in legacy indices like the Dow Jones.

- Equal Weighted : Every stock gets the same importance. Offers pure-play diversification, but is more volatile and less reflective of market cap reality.

- Factor-Based/Smart Beta: Custom weighting based on valuation metrics (P/E, P/B), earnings quality, or volatility. Popular in thematic indices.

> Traders monitor weighting to gauge how a single stock’s movement could drive the entire index—vital in event-driven trading and hedging.

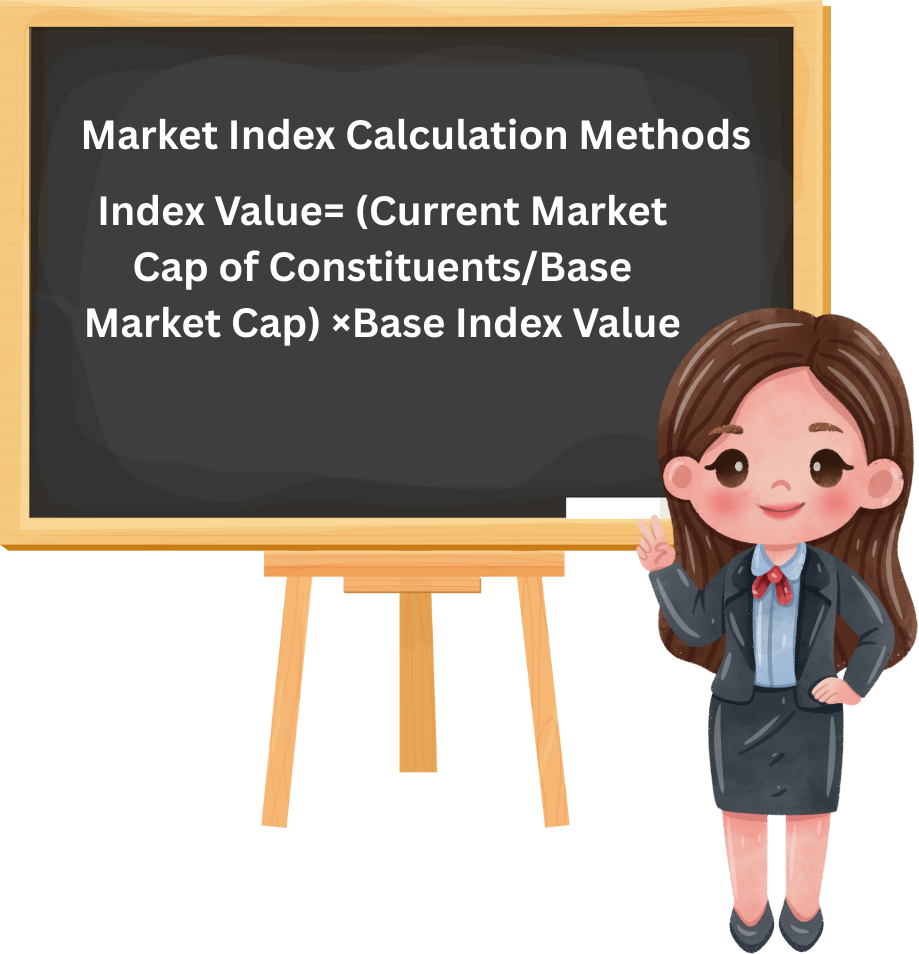

8.5 Market Index Calculation Methods

Market Capitalization Weighted Index (most common)

Used by indices like Nifty 50 and Sensex.

Formula:

Index Value= (Current Market Cap of Constituents/Base Market Cap) ×Base Index Value

- Market Cap= Total Outstanding Shares × Current Share Price

- Free-Float Market Cap: Only includes shares available for public trading (excludes promoter holdings, government stakes, etc.)

- Why Free-Float? It better reflects actual market movements and reduces manipulation risk.

Example (Free-Float Method)

Let’s say we have 3 companies:

|

Company |

Shares Outstanding |

Free-Float % |

Price |

Free-Float Market Cap |

|

A Ltd |

10,000 |

80% |

₹200 |

₹16,00,000 |

|

B Ltd |

20,000 |

60% |

₹300 |

₹36,00,000 |

|

C Ltd |

30,000 |

50% |

₹400 |

₹60,00,000 |

Total Free-Float Market Cap = ₹1,12,00,000

If base market cap = ₹1,00,00,000 and base index value = 1000:

Index Value=(1,12,00,000/1,00,00,000) ×1000=1120

Why It Matters

- Helps investors track market sentiment

- Used for benchmarking portfolio performance

- Drives passive investing via ETFs and Index Funds

Nirav: Markets change, companies rise or fall. How do indices keep up?

Vedant: Through rebalancing and reconstitution—processes that keep the index current and representative. Let’s look at how it’s done and why it matters.

8.6 Rebalancing and Reconstitution

Markets evolve, and so must indices. Hence:

- Rebalancing adjusts stock weights periodically to reflect changes in market cap or float.

- Reconstitution replaces stocks that no longer meet eligibility with new entrants.

Rebalancing frequency may be monthly, quarterly, or semi-annually, depending on volatility and strategy. For example, Nifty indices typically rebalance semi-annually with reviews every six months.

Index events, especially inclusions or exclusions, can cause price shocks as institutional money flows to match the updated basket. Traders often use this knowledge for pre-emptive positioning.

Nirav: Sounds like a lot of decisions behind the scenes. Who ensures indices aren’t manipulated?

Vedant: That’s where governance and transparency come in—rules, oversight committees, and disclosures maintain credibility. Let’s walk through the safeguards.

8.7 Governance and Transparency

Credible index design requires:

- Clearly documented methodology (publicly available rulebooks)

- Independent index committees that govern inclusion decisions

- Back-testing to validate index performance historically

- Handling of corporate actions like stock splits, dividends, mergers, etc., in a consistent and transparent way

The governance structure ensures that indices maintain integrity and can be trusted as benchmarks for funds, ETFs, and derivatives.

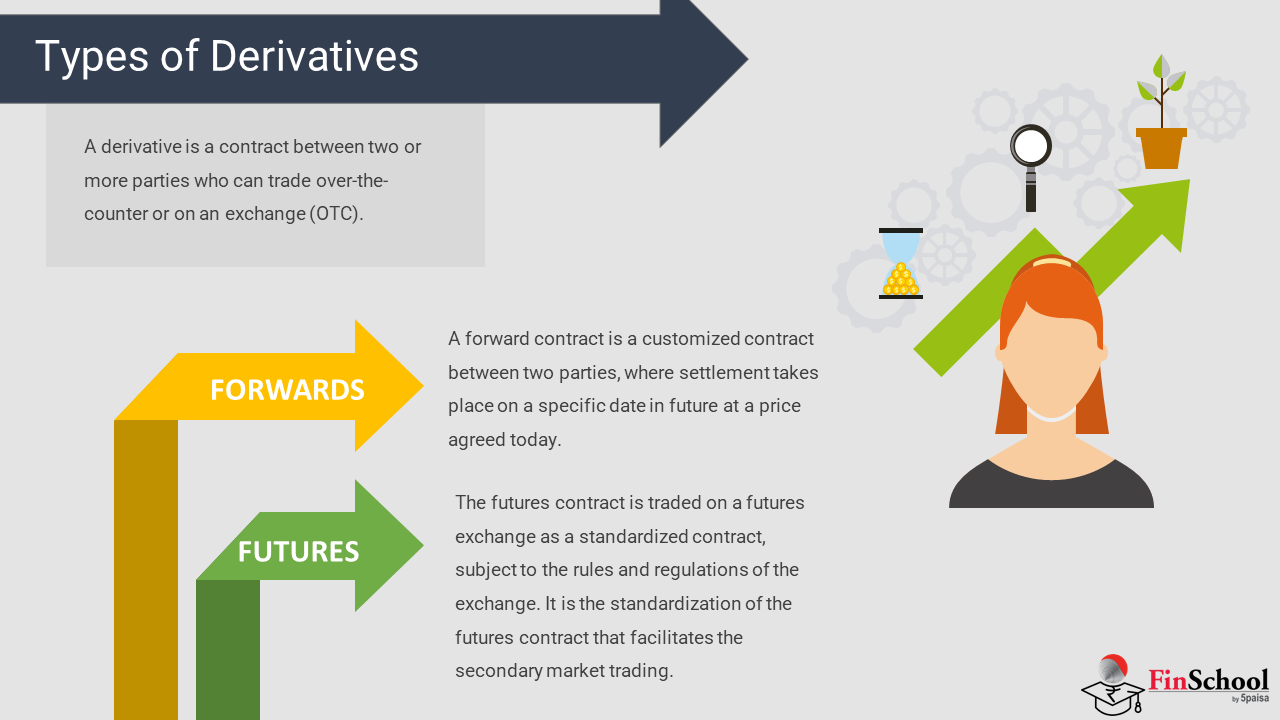

Nirav: I saw traders using Nifty Futures for short-term plays. Are indices tradeable?

Vedant: Through derivatives like futures and options. They’re tactical tools for hedging and speculation. Let’s explore this playground.

8.8 Behavioral Finance and Stock Market Indices: A Study of Crowd Psychology

Indices Reflect Collective Emotion, Not Just Fundamentals

Following a trending diet because everyone’s doing it mirrors how traders chase index rallies—driven by herd behavior and emotion, not logic. When the trend reverses, both your energy and the market dip. Ads boasting “1 million successful dieters” reflect anchoring bias—just like round-number milestones in indices.

Stock indices may be built on math, but they’re shaped by investor psychology. Behavioral biases like fear, greed, and recency distort judgment, leading to overreactions—like “relief rallies” after bad news simply because things didn’t get worse.

> Example: After the 2020 COVID crash, Nifty surged well before earnings recovery—this was sentiment leading price, not logic trailing valuation.

Herding and Momentum in Index Constituents

Index-heavy stocks like Reliance, HDFC Bank, or TCS often attract disproportionate investor flows during bull markets due to herding Behavior. When these stocks move, the index follows—not necessarily because of fundamentals, but because everyone believes they’re “safe bets.” This creates self-fulfilling momentum.

> A trader chasing Nifty because Reliance broke out isn’t necessarily buying the market; they’re buying consensus belief.

The problem? When the herd exits, the fall is just as sharp—fuelled by the same psychology in reverse.

Anchoring Around Round Numbers

Indices exhibit strong anchoring bias near psychological levels—think Nifty 20,000 or Sensex 70,000. These are not mathematically significant, but they act like magnets for price action:

- Traders place stop-losses or targets near round numbers.

- News outlets amplify importance: “Nifty hits new milestone!”

- Options OI spikes around these levels, influencing expiry dynamics.

This anchors market sentiment and even options premiums—often creating synthetic resistance/support zones based more on psychology than market structure.

Overreaction and Underreaction Phenomena

Behavioral biases often cause:

- Overreaction: A surprise inflation prints causes panic selling across all indices—even defensive ones—despite limited long-term impact.

- Underreaction: A large policy reform is dismissed because markets are “waiting for confirmation,” only to price it in months later with momentum-driven moves.

Indices aggregate these behaviors, especially during earnings seasons, policy events, or budget speeches where emotional swings amplify mispricing’s.

Sentiment Indicators and Contrarian Signals

Many traders use Put/Call Ratios, India VIX, and index OI build-up to read emotional sentiment. These are proxies for:

- Greed(overbought zones, excessive call buying)

- Fear(deep OTM puts, panic volume spikes)

- Complacency(low VIX despite macro risk)

Contrarian traders often enter positions when these indicators flash extremes. For example, if Nifty options show heavy short covering near ATHs with low VIX, it may signal euphoria—a warning that a pullback could be near.

Recency Bias and Trend Chasing

Humans tend to overweigh recent outcomes when forecasting the future. So, if Nifty has delivered 3 straight green candles, traders assume the trend will continue, even in absence of fresh triggers.

This explains:

- Late entry into rallies

- Fear of missing out (FOMO)

- Blow-off tops driven purely by momentum followers

This Behavior is profitable only if you’re early. For laggards, trend chasing at index peaks becomes a pain trade.

Loss Aversion and Risk Positioning

According to Behavioral finance, losses hurt more than gains feel good—often twice as much. In index terms:

- Traders hold on to losing positions hoping for a turnaround.

- Index short sellers cover too early at minor upticks due to fear.

- Investors sell profitable positions too soon, undercutting compounding.

This emotional volatility often leads to under-performance despite correct views—a psychological trap especially dangerous in leveraged Nifty/Bank Nifty trades.

Nifty 50 Index with weightage

|

Sr No |

Company |

Weightage* |

|

1 |

RELIANCE INDUSTRIES LTD |

9.54 % |

|

2 |

HDFC BANK LTD |

7.85 % |

|

3 |

BHARTI AIRTEL LTD |

5.86 % |

|

4 |

TATA CONSULTANCY SERVICES LTD |

5.61 % |

|

5 |

ICICI BANK LTD |

5.23 % |

|

6 |

STATE BANK OF INDIA |

3.92 % |

|

7 |

INFOSYS LTD |

3.09 % |

|

8 |

HINDUSTAN UNILEVER LTD |

2.99 % |

|

9 |

BAJAJ FINANCE LTD |

2.75 % |

|

10 |

ITC LTD |

2.65 % |

|

11 |

LARSEN & TOUBRO LTD |

2.60 % |

|

12 |

MARUTI SUZUKI INDIA LTD |

2.09 % |

|

13 |

MAHINDRA & MAHINDRA LTD |

2.08 % |

|

14 |

HCL TECHNOLOGIES LTD |

2.07 % |

|

15 |

SUN PHARMACEUTICAL INDUSTRIES LTD |

2.02 % |

|

16 |

KOTAK MAHINDRA BANK LTD |

2.02 % |

|

17 |

ULTRATECH CEMENT LTD |

1.86 % |

|

18 |

AXIS BANK LTD |

1.70 % |

|

19 |

NTPC LTD |

1.69 % |

|

20 |

TITAN COMPANY LTD |

1.59 % |

|

21 |

BAJAJ FINSERV LTD |

1.58 % |

|

22 |

ZOMATO LTD |

1.58 % |

|

23 |

OIL & NATURAL GAS CORPORATION LTD |

1.53 % |

|

24 |

BHARAT ELECTRONICS LTD |

1.44 % |

|

25 |

ADANI PORTS AND SPECIAL ECONOMIC ZONE LTD |

1.44 % |

|

26 |

POWER GRID CORPORATION OF INDIA LTD |

1.38 % |

|

27 |

ADANI ENTERPRISES LTD |

1.35 % |

|

28 |

WIPRO LTD |

1.33 % |

|

29 |

JSW STEEL LTD |

1.31 % |

|

30 |

TATA MOTORS LTD |

1.26 % |

|

31 |

ASIAN PAINTS LTD |

1.25 % |

|

32 |

COAL INDIA LTD |

1.22 % |

|

33 |

BAJAJ AUTO LTD |

1.18 % |

|

34 |

NESTLE INDIA LTD |

1.08 % |

|

35 |

JIO FINANCIAL SERVICES LTD |

1.07 % |

|

36 |

TATA STEEL LTD |

1.00 % |

|

37 |

TRENT LTD |

0.98 % |

|

38 |

GRASIM INDUSTRIES LTD |

0.97 % |

|

39 |

SBI LIFE INSURANCE COMPANY LTD |

0.95 % |

|

40 |

HDFC LIFE INSURANCE CO LTD |

0.87 % |

|

41 |

EICHER MOTORS LTD |

0.81 % |

|

42 |

HINDALCO INDUSTRIES LTD |

0.80 % |

|

43 |

TECH MAHINDRA LTD |

0.75 % |

|

44 |

CIPLA LTD |

0.65 % |

|

45 |

SHRIRAM FINANCE LTD |

0.60 % |

|

46 |

APOLLO HOSPITALS ENTERPRISE LTD |

0.58 % |

|

47 |

DR REDDYS LABORATORIES LTD |

0.54 % |

|

48 |

TATA CONSUMER PRODUCTS LTD |

0.53 % |

|

49 |

HERO MOTOCORP LTD |

0.48 % |

|

50 |

INDUSIND BANK LTD |

0.31 % |

Nirav: Vedant, I never realized how much psychology and strategy are packed into index trading. It’s not just numbers—it’s human behavior playing out on a screen.

Vedant: That’s the essence of it. Indices may look like sterile metrics, but they mirror emotion, perception, and decision-making. They’re where fundamentals meet behavioral biases.

Nirav: So when I see Nifty rallying or crashing, I shouldn’t just look at charts—I need to ask why it’s happening and who’s behind it.

Vedant: Exactly. Index moves tell stories—about institutions reallocating, traders reacting, or sentiment shifting. And understanding those narratives gives you an edge.

Nirav: Makes me think… maybe trading indices is like reading a crowd: don’t follow the noise blindly, but learn how to listen to it.

Vedant: Well put. Whether you’re a short-term trader or a long-term investor, indices offer more than just market exposure—they’re windows into market psychology. Master them, and you gain more than returns—you gain perspective.

Nirav: Appreciate the deep dive, Vedant. Time to revisit my own strategies with a new lens.

Vedant: And that’s how you evolve—from trading numbers to trading narratives.