- Study

- Slides

- Videos

6.1 What Is Meant By Secondary Market?

The secondary market is where shares, bonds, and derivatives are traded after their initial issuance in the primary market, such as through an IPO. While the primary market raises capital for the company, the secondary market enables investors to trade these instruments among themselves no new funds go to the company. It plays a vital role in price discovery, liquidity, and transparency. Think of it like buying a used car: the manufacturer sells it first (primary market), but all future sales happen between owners (secondary market), with value driven by demand, sentiment, and market dynamics.

Vedant: Ever been to a farmers’ market, Nirav?

Nirav: Yes, why?

Vedant: Picture two stalls one cooperative with fixed prices (like NSE/BSE), and one informal with bargaining (like OTC markets). That’s how secondary markets work.

Nirav: So exchanges are structured and transparent, while OTC is flexible but riskier?

Vedant: Exactly. Both enable trading, but with different levels of regulation and customization.

Nirav: Liquidity and price discovery are key features?

Vedant: Yes. They allow easy entry/exit and reflect market sentiment. Secondary markets also influence capital allocation and signal economic health.

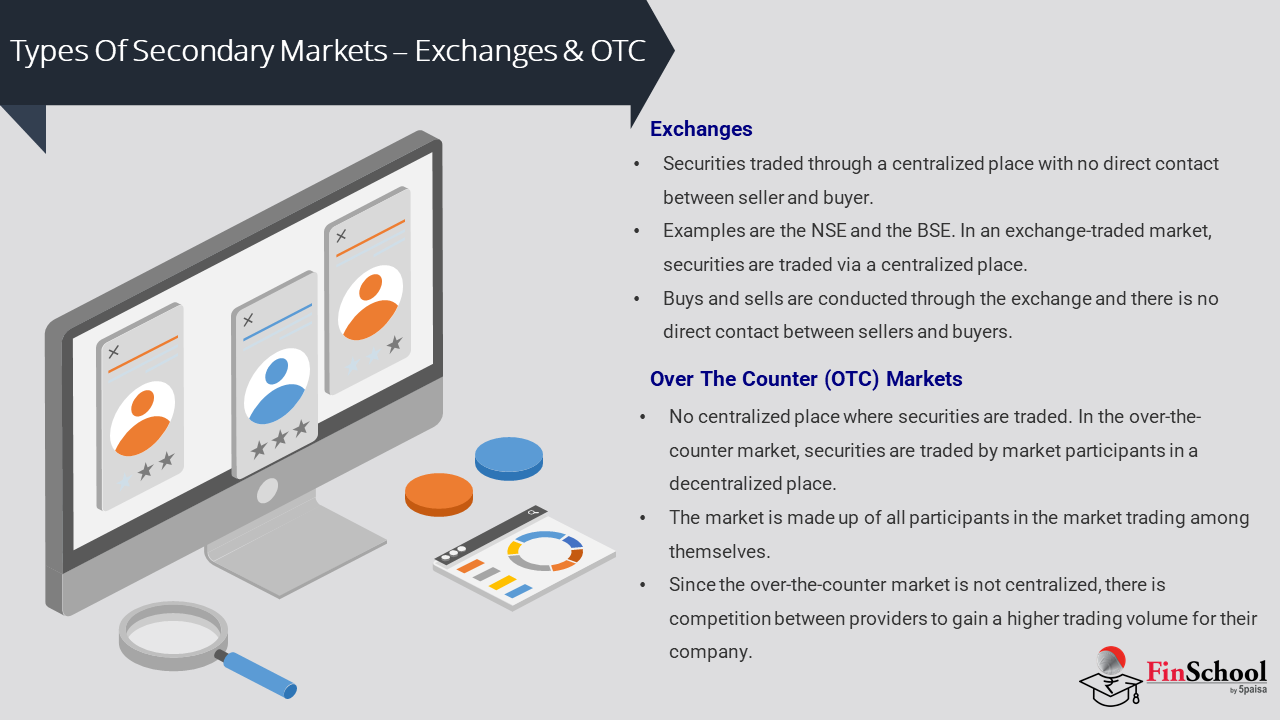

6.2 Types of Secondary Market – Exchanges & OTC

Secondary markets are divided into exchange-traded (like NSE/BSE) and over-the-counter (OTC) segments. Exchange-traded markets are centralized and regulated, ensuring transparency and investor protection. OTC markets are decentralized, allowing direct trades often in bonds or derivatives, with more flexibility but higher counterparty risk. A key feature of secondary markets is liquidity, enabling investors to easily buy or sell securities and adjust portfolios. Continuous trading drives price discovery, reflecting market sentiment and economic trends. Though companies don’t raise funds here, strong performance can boost investor confidence and future fundraising. Overall, vibrant secondary markets support efficient capital allocation and signal financial maturity.

Nirav: Vedant, what are the types of trading in secondary markets?

Vedant: There’s stock exchange trading centralized and regulated via NSE or BSE. Then OTC trades happen privately with more flexibility but higher risk.

Nirav: What about dealer markets?

Vedant: Dealers set their own buy/sell prices common in bonds and forex.

Nirav: And auction markets?

Vedant: Buyers and sellers bid openly; trades occur when bids match offers great for price discovery.

Nirav: So each plays a role?

Vedant:Exactly. They together form a diverse and efficient trading ecosystem.

6.3 Trading In Secondary Markets

-

Stock Exchanges (Organized Exchanges)

Think of a railway ticket counter, work: formal platforms where securities are traded under strict regulation. Trades happen via brokers, with every transaction recorded and monitored. The exchange acts as a counterparty, reducing risk and ensuring smooth settlement. Ideal for retail and institutional investors, it offers liquidity, price transparency, and regulatory protection.

-

Over-the-Counter (OTC) Markets

OTC (Over-the-Counter) markets are decentralized platforms where trades happen directly between parties, often through brokers or dealers. Unlike stock exchanges, there’s no central venue or standardized process. Think of it like negotiating a car sale through a trusted mechanic, flexible terms, but no formal receipt or warranty. This setup allows for customized deals, especially useful for complex instruments like corporate bonds, derivatives, foreign exchange, and unlisted shares.

While OTC markets offer flexibility in pricing and contract terms, they also come with higher counterparty risk and lower transparency. Since trades are private and not publicly listed, they rely heavily on mutual trust and creditworthiness. That’s why these markets are typically favored by institutional investors who can manage the risks. In essence, OTC markets are like private boardrooms, tailored, discreet, and trust-driven

-

Dealer Markets

OTC (Over-the-Counter) markets are decentralized platforms where trades happen directly between parties, often through brokers or dealers. Unlike stock exchanges, there’s no central venue or standardized process. Think of it like negotiating a car sale through a trusted mechanic, flexible terms, but no formal receipt or warranty. This setup allows for customized deals, especially useful for complex instruments like corporate bonds, derivatives, foreign exchange, and unlisted shares.

While OTC markets offer flexibility in pricing and contract terms, they also come with higher counterparty risk and lower transparency. Since trades are private and not publicly listed, they rely heavily on mutual trust and creditworthiness. That’s why these markets are typically favored by institutional investors who can manage the risks. In essence, OTC markets are like private boardrooms—tailored, discreet, and trust-driven.

-

Auction Markets

Auction markets are like antique auctions, buyers and sellers openly bid, and trades happen when the highest bid meets the lowest offer. This competitive process ensures transparent price discovery based on real-time demand and supply. Used in stock exchanges for pre-opening sessions or block deals, auction markets promote fairness and efficiency. Alongside other market types, they help build a dynamic, resilient secondary market ecosystem for all kinds of investors.

Nirav: What does a stock exchange actually do after an IPO?

Vedant: It’s the official marketplace—structured and regulated—where buyers and sellers meet.

Nirav: So it’s more than just a website?

Vedant: Definitely. It provides liquidity, real-time price discovery, and ensures transparency by recording every trade.

Nirav: And investor protection?

Vedant: Yes, exchanges follow regulations like SEBI’s to prevent fraud and require companies to disclose financials.

Nirav: So they’re essential?

Vedant: Absolutely. They’re the backbone of the secondary market, ensuring trust and efficiency.

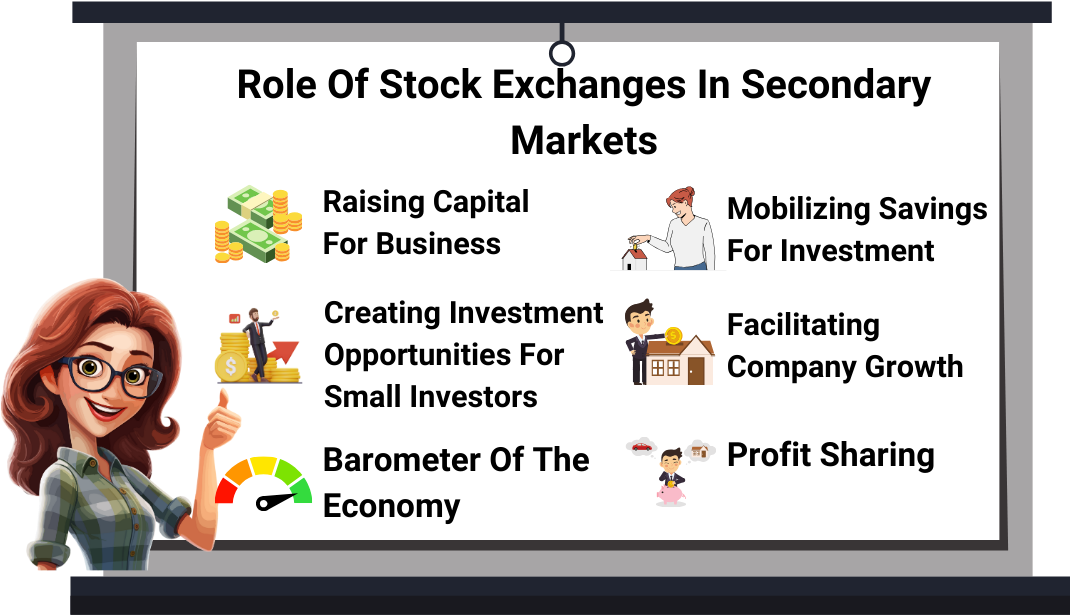

6.4 What Is The Role Of A Stock Exchange In Secondary Market?

-

Centralized Trading Platform

A stock exchange serves as a centralized and organized marketplace where securities such as shares, bonds, and exchange-traded funds (ETFs) are bought and sold. This eliminates the need for investors to search for counterparties on their own. By providing a common platform, the exchange ensures that trades are executed efficiently, securely, and transparently. It standardizes the trading process, making it accessible to both institutional and retail investors.

-

Liquidity Provision

One of the most critical functions of a stock exchange is to provide liquidity. Liquidity refers to the ease with which an asset can be converted into cash without significantly affecting its price. Stock exchanges facilitate this by maintaining a large pool of buyers and sellers. This ensures that investors can enter or exit positions quickly, which is essential for both short-term traders and long-term investors.

-

Price Discovery Mechanism

Stock exchanges play a vital role in the price discovery process. Prices of securities are determined by the forces of supply and demand, which are constantly at play in the secondary market. As investors react to news, earnings reports, economic data, and other market signals, the exchange reflects these sentiments in real-time prices. This dynamic pricing helps establish the fair market value of securities and guides investment decisions.

-

Regulatory Oversight and Investor Protection

Stock exchanges operate under the supervision of regulatory authorities such as the Securities and Exchange Board of India (SEBI). They enforce strict rules and compliance standards to prevent malpractices like insider trading, price manipulation, and fraud. Exchanges also require listed companies to adhere to disclosure norms, ensuring that investors have access to timely and accurate information. This regulatory framework builds trust and safeguards investor interests.

-

Clearing and Settlement Services

After a trade is executed, the stock exchange ensures that the transaction is completed through a process known as clearing and settlement. Clearing involves confirming the trade details, while settlement refers to the actual transfer of securities and funds between the buyer and seller. This process is typically handled by a clearing corporation affiliated with the exchange, which guarantees the trade and reduces counterparty risk.

-

Encouraging Capital Formation and Economic Growth

Although companies raise capital in the primary market, their performance in the secondary market influences their ability to raise funds in the future. A strong secondary market performance enhances a company’s reputation and investor confidence. Moreover, by enabling investors to trade freely, stock exchanges encourage savings and investment, which in turn supports broader economic development.

-

Transparency and Information Dissemination

Stock exchanges provide a transparent environment where all market participants have access to the same information. Real-time data on prices, volumes, and corporate announcements is made publicly available. This level of transparency reduces information asymmetry and promotes fair competition among investors.

Nirav: Vedant, I saw someone offering shares outside the regular platforms. Is it safe to buy or sell shares like that?

Vedant: Not really. That’s why trading on a recognized stock exchange like NSE or BSE is so important. These exchanges are regulated by SEBI and ensure transparency, fairness, and investor protection.

Nirav: So what’s the risk if I trade outside?

Vedant: You lose the safety net. Unrecognized platforms don’t guarantee proper settlement, price accuracy, or protection against fraud. There’s no regulatory oversight, so if something goes wrong, you’re on your own.

Nirav: But aren’t the prices better sometimes?

Vedant: Maybe, but without proper checks, you could be dealing with manipulated prices or fake securities. Recognized exchanges have clearing corporations that ensure trades are settled securely and brokers who are registered and accountable.

Nirav: Makes sense. So it’s not just about convenience, it’s about trust and legality.

Vedant: Exactly. Trading on recognized exchanges means your transactions are recorded, monitored, and backed by law. It’s the only way to ensure your investments are safe and legitimate.As you read furthrer you will understand why one should trade on A Recognized Stock Exchange Only

6.5 Why Should One Trade On A Recognized Stock Exchange Only For Buying/ Selling Shares?

Trading on a recognized stock exchange is essential for ensuring safety, transparency, and fairness in the buying and selling of shares. Here’s a detailed explanation of why this matters so much:

-

Legal and Regulatory Protection

Recognized stock exchanges operate under the supervision of regulatory authorities such as the Securities and Exchange Board of India (SEBI). These exchanges are bound by the Securities Contracts (Regulation) Act, 1956, which ensures that all trading activities are legal, monitored, and compliant with established norms. This legal framework protects investors from fraud, insider trading, and market manipulation risks that are far more prevalent in unregulated or informal markets.

-

Transparency and Fair Price Discovery

Stock exchanges provide a transparent trading environment where prices are determined by real-time supply and demand. All buy and sell orders are matched through an electronic order book, ensuring that no single party can manipulate prices. This transparency helps investors make informed decisions based on publicly available data, such as trading volumes, price trends, and corporate disclosures.

-

Guaranteed Settlement and Reduced Counterparty Risk

When you trade on a recognized exchange, the clearing and settlement of trades is handled by a clearing corporation affiliated with the exchange. This institution guarantees that the buyer receives the shares and the seller receives the payment, even if one party defaults. This eliminates counterparty risk, which is a major concern in off-market or informal transactions.

-

Investor Grievance Redressal Mechanism

Recognized exchanges offer a formal mechanism for resolving disputes between investors and brokers. If an investor faces issues such as unauthorized trades, delayed settlements, or non-receipt of funds or securities, they can file complaints through the exchange’s grievance redressal system. This level of accountability is absent in unregulated markets.

-

Access to Verified and Listed Securities

Only companies that meet stringent listing requirements such as minimum capital, profitability, and corporate governance standards are allowed to trade on recognized exchanges. This ensures that investors are dealing with credible and vetted companies, reducing the risk of investing in fraudulent or shell entities.

-

Audit Trails and Record-Keeping

Every transaction on a recognized exchange is recorded and time-stamped, creating a verifiable audit trail. This is crucial for tax reporting, compliance, and dispute resolution. In contrast, off-market trades often lack proper documentation, making them difficult to track or verify.

-

Market Integrity and Economic Confidence

Recognized exchanges contribute to the overall integrity and stability of the financial system. They foster investor confidence, attract foreign investment, and support capital formation. By trading through these platforms, investors play a role in strengthening the broader economy.

Nirav: Vedant, I have been exploring trading lately. Everyone talks about platforms like 5paisa. What exactly is a trading platform?

Vedant: Great question. A trading platform is a software system that brokers offer to help you buy, sell, and manage financial instruments such as stocks, bonds, mutual funds, and derivatives. It’s your access point to financial markets.

Nirav: So, with 5paisa, I could trade just using my phone or computer?

Vedant: Exactly. 5paisa offers both web and mobile platforms. It’s designed to help users place orders, track portfolios, and analyze the market, all in real time.

Nirav: What features should I be looking for when choosing one?

Vedant: Let’s take 5paisa as an example. A good trading platform should be easy to use, support multiple order types, offer strong charting and research tools, work well on mobile, and ensure data security.

Nirav: Sounds like it does a lot more than just buying or selling stocks.

Vedant: That’s right. Platforms like 5paisa are built to be comprehensive, helping investors make informed decisions while ensuring their data and transactions are secure.

Nirav: Appreciate the clarity. I’ll dive deeper into what 5paisa has to offer.

Vedant: Absolutely. A good platform doesn’t just execute trades it empowers your entire investment strategy.

6.6 Understanding Trading Platforms

A trading platform is a software system provided by brokers or financial institutions that allows users to buy, sell, and manage financial instruments such as stocks, bonds, derivatives, mutual funds, and ETFs. It acts as the bridge between the investor and the financial markets.

A trading platform is like a digital control room for investors similar to how a travel booking app lets you compare flights, book tickets, and track your itinerary. Just as that app connects you to airlines and travel options, a trading platform connects you to financial markets, allowing you to place orders, monitor your portfolio, analyze trends, and make informed decisions all from one interface. It simplifies complex financial activities into a streamlined experience, whether you’re at home or on the move.

Core Functions

At its core, a trading platform enables:

- Order Execution: Placing buy/sell orders in real

- Portfolio Monitoring: Tracking holdings, P&L, and asset

- Market Access: Connecting to exchanges like NSE, BSE, NYSE,

- Research & Analysis: Providing tools for technical and fundamental

- Key Features to Evaluate

|

Feature |

Description |

|

User Interface (UI/UX) |

Clean, intuitive layout for efficient navigation and quick decision-making |

|

Order Types |

Market, Limit, Stop Loss, Bracket, GTT, etc. |

|

Charting Tools |

Real-time charts, indicators, drawing tools for technical analysis |

|

News & Research |

Live feeds, analyst reports, and economic calendars |

|

Mobile Compatibility |

Seamless trading via mobile apps |

|

Security |

Two-factor authentication, encryption, and secure servers |

Nirav : So What are the Different Types of Trading Platforms? Vedant : Lets discuss that in detail

6.7 Types of Trading Platforms

- Commercial Platforms: Designed for retail investors, Like

- Proprietary Platforms: Built by large institutions for internal or high-frequency trading. These are often inaccessible to the public and tailored for speed and

- Direct Market Access (DMA): Used by institutional traders for ultra-fast execution and access to market depth.

Costs and Considerations

While many platforms are free, some charge for premium features like advanced charting, real-time data, or research tools. Key considerations include:

- Brokerage fees

- Platform subscription charges

- Latency and execution speed

- Customer support quality

Why It Matters

The right platform can enhance decision-making, reduce execution errors, and support your trading strategy. For someone like you, who blends analytical depth with storytelling, platforms that offer customizable dashboards, exportable data, and integrated research tools can be especially powerful.

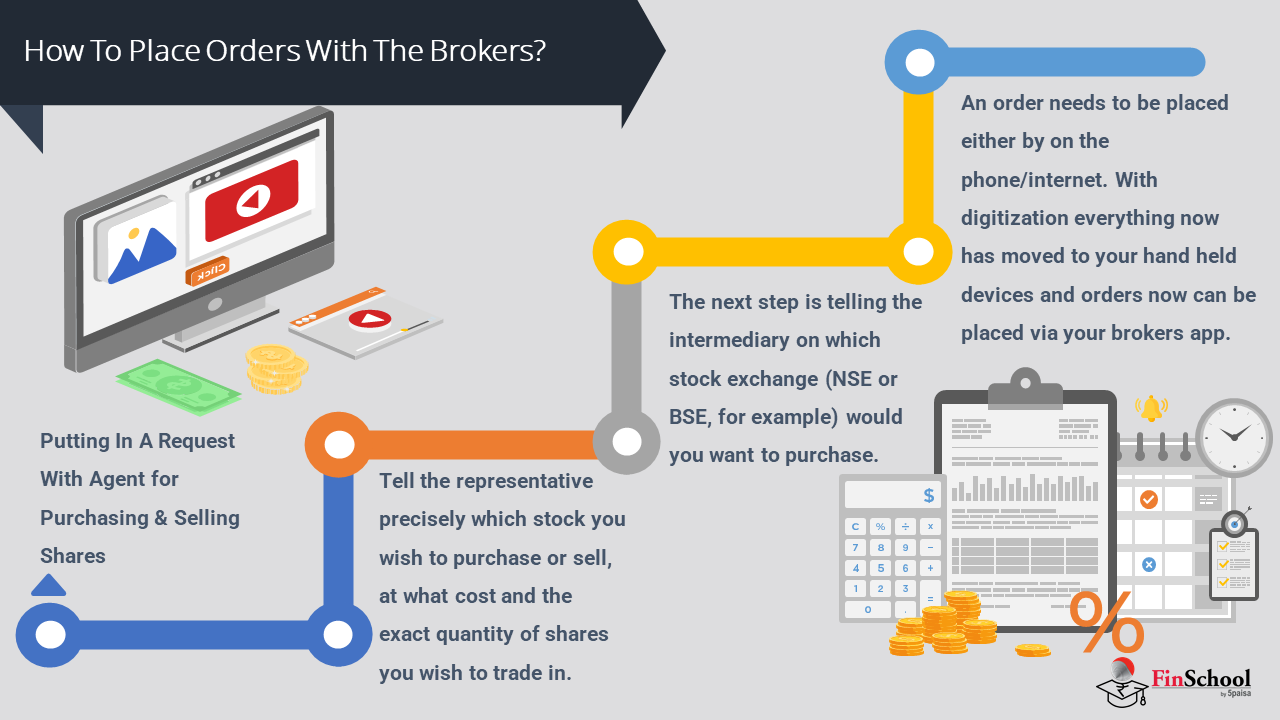

Nirav : How should I start Trading with Platforms Vedant : There are few steps you need to follow.

6.8 Using Trading Platforms

User Id And Password

A login ID and password protect your online trading account. The broker will offer you a login ID, but you will need to create a password. For the sake of your account’s security, you should change your password on a regular basis. Also, if additional security measures are available for your account, please be sure to select them to safeguard your account’s safety.

Indices Display

The market indices will be shown in an appropriate area on your screen by the online trading platform. This allows you to keep track of the movements of all the indices, particularly the Sensex and Nifty. Most systems allow you to customize the interface to show all of the indices you want to track. This aids investors in gaining a broad understanding of market sentiments and executing their trades accordingly.

Market Watch

It’s an important screen to have in your trading account. It provides you with a tabular representation of the current market position of the selected equities. Each row contains information on a single share, such as the script name, the most recent traded price, the most recent traded quantity, the best bid and offer rate, total transacted volume, and so on. You can customize the market monitor window by selecting which columns you want to see and which ones you don’t. You can also alter the appearance of the table by changing the colours, size, and whether or not to employ a divider between the rows and columns.

Charts

Nowadays, all trading systems have a charting feature. The investor can use these charts to:

- Createintraday charts using only data from the current trading

- Makehistorical charts using data from previous

- Openmany charts at the same

- Allows you to construct several types of charts, such as line, bar, and candlestick.

- Youmay use technical analysis tools and other indicators to analyse

- Someplatforms also allow you to store charts to your computer for offline

Reports

You will have access to various reports linked to your market activities at any moment. The order book, trade book, margin, net positions, exercise book, and portfolio are all included in these reports. These reports are also dynamically updated as soon as a transaction is completed, eliminating the need to refresh them. In the reports themselves, you can do a variety of trading actions. These reports can also be saved in text or CSV file for offline use.

Market Analyzer

This feature shows you the top traded stocks, top gainers, and top losers, as well as the % change in total volume and value. It gives you the names of the stocks that have hit their highest and lowest prices in the previous 52 weeks. It aids in the identification of significant trades and provides insight about scrip activity in the market.

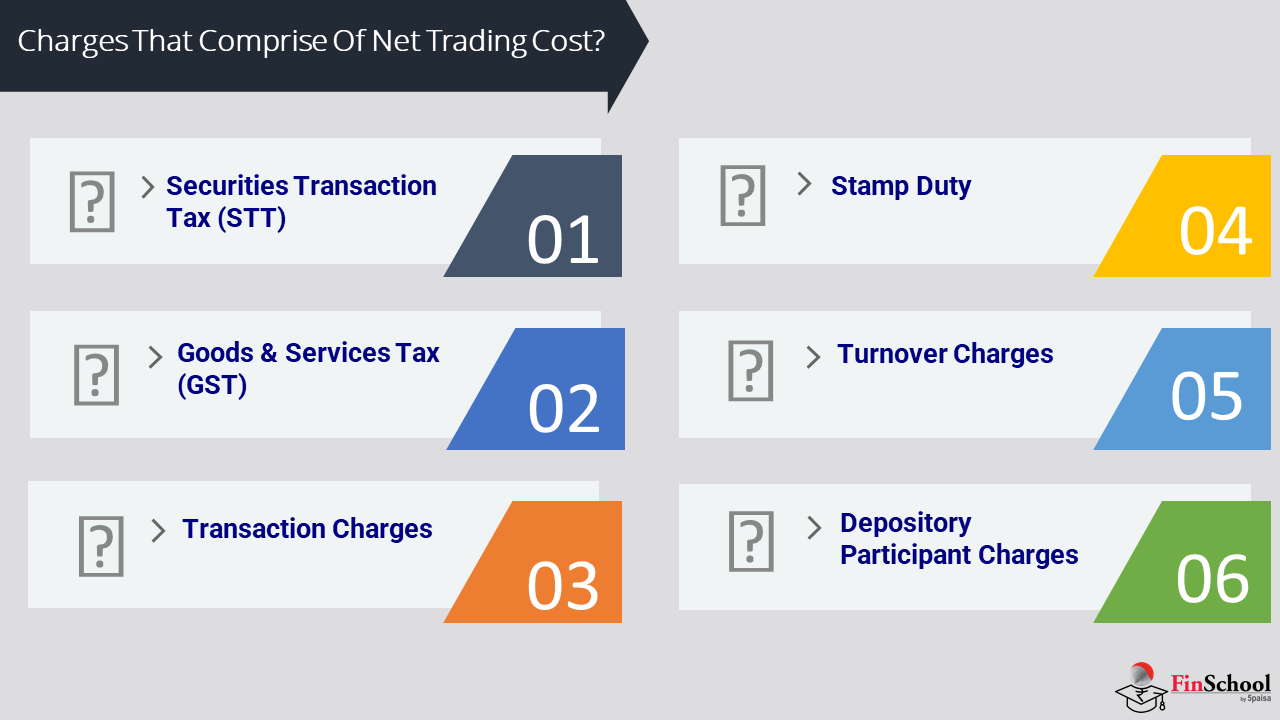

- TransactionCost

Trading is expensive. The costs associated with trading are called transaction costs and include two components: explicit costs and implicit costs.

- Explicit Trading Costs

This cost represents the direct costs associated with trading. Brokerage commissions are the largest explicit trading cost.

The brokerage fee is the fee related to buying and selling of stocks. The concept of brokerage can be a little tricky to grasp initially. Aside from that, there are a number of other fees that brokers charge but do not disclose. As a result, the effective cost of brokerage differs from the one which is actually mentioned to the client.

Brokerage

- It is evaluated as a percentage of the total cost of all the shares purchased and sold. It is a fee that brokers charge for providing their services. This is not uniform and often varies from one broker to another. It also depends on the type of transactions you make.

- Often, the brokerage slabs provided by stockbrokers are dynamic, and regular clients get benefits of lower brokerage rates. The brokerage plans depend on the type of broker.

How Are Brokerage Charges Calculated For Trading?

The brokerage is calculated on the agreed percentage of on the total cost of shares either purchased or sold. Here, you are charged for intraday trading, and for delivery. Let’s understand both concepts: –

Intraday Trading:

- Intraday trading involves buying and selling of stocks on the same day and earning a profit or loss based on the price difference. You don’t carry forward any shares because you purchase and sell on the same day, and no shares enter orleave your Demat As a result, the cost of intraday trading brokerage is usually relatively minimal.

- Dependingupon the stockbroker, intraday trading charges can range from 01% to 0.05% of the volume/amount transacted. The formula for calculating this charge is to multiply the market price of shares into a number of shares, again multiplied by the agreed percentage of intraday charges.

Delivery:

- In delivery trading, on the other hand, the position is not closed on the same day, and the shares are purchased and held in a Demat account. You can hold the shares for a few days, months, or even years until you achieve your goal

- Theseare the charges when you decide to hold your

- You can hold your stocks in sync with the market movements for as long as you want.Delivery charges can vary between 2% and 0.75% of the trading volume.

- The formula for this charge again, is to multiply the delivery charges into the number of shares and their market price

Nirav: Vedant, I’ve been thinking, most of my trades go wrong not because of flawed analysis but due to how I react emotionally. Have you experienced that?

Vedant: Absolutely. I’ve realized it’s not just about reading charts but reading ourselves. Trading psychology can be the thin line between consistency and chaos.

Nirav: True. I often get caught in the fear-of-missing-out trap. Like, when I see a stock rallying, I dive in late and end up with losses.

Vedant: That’s classic herd sentiment. Market euphoria pushes people into irrational decision-making. Sentiment indicators like the volatility index or put- call ratio can help gauge that mood swing.

Nirav: Interesting. But I’ve always wondered, how do you stay disciplined when sentiment is against your position? Like, when everyone’s bearish but your analysis is bullish?

Vedant: I try to anchor my conviction in the setup and ensure I’m not trading based on validation. One tool I use is journaling. After each trade, I reflect, was this impulsive or methodical?

Nirav: That’s powerful. Do you factor in news-driven sentiment? Like economic data releases or RBI announcements?

Vedant: Yes, but I treat them as context, not confirmation. They can spike emotions. That’s where risk management guards against overreaction. Setups are fragile if emotion hijacks strategy.

Nirav: Makes sense. I’m working on mindfulness techniques like deep breathing before entering a trade. Helps me stay grounded.

Vedant: That’s a great practice. After all, trading is less about predicting and more about responding. Mastering psychology means accepting uncertainty, not resisting it. Lets understand about trading psychology in detail

6.9 Psychology & Market Sentiment

What Is Trading Psychology?

Trading psychology refers to the mental and emotional factors that influence a trader’s decisions. It’s the internal dialogue that determines whether you follow your strategy or abandon it under pressure. While technical and fundamental analysis guide what to trade, psychology governs how you trade.

Key Psychological Biases and Emotions in Trading

|

Emotion / Bias |

Description |

|

Fear |

Leads to premature exits or hesitation to enter trades |

|

Greed |

Encourages over-trading or holding positions too long |

|

FOMO (Fear of Missing Out) |

Causes impulsive entries during rallies without proper analysis |

|

Overconfidence |

Results in ignoring risk or over leveraging |

|

Loss Aversion |

Makes traders hold losing positions too long to avoid realizing a loss |

|

Revenge Trading |

Taking irrational trades to recover from previous losses |

Why It Matters

Even with a sound strategy, poor emotional control can sabotage performance. For example, exiting a trade too early due to fear might limit profits, while holding on too long due to greed can turn gains into losses.

Example: The FOMO Trap

Let’s say a trader named Arjun has a rule: only buy a stock after a breakout confirmed by volume. One day, he sees a stock rallying 8% on news. It hasn’t met his criteria, but he fears missing out. He buys impulsively.

The stock reverses sharply the next day, and Arjun exits with a 5% loss.

Lesson: The loss wasn’t due to a bad strategy it was due to emotional override.

How to Strengthen Trading Psychology

- Havea Written Trading Plan: Define entry, exit, position size, and risk management rules.

- Use Stop-Loss Orders: Automate discipline and reduce emotional decision-

- Maintain aTrading Journal: Track not just trades, but your emotional state during each.

- PracticeMindfulness: Techniques like meditation or deep breathing can help manage stress.

- Review and Reflect: Weekly reviews help identify patterns in Behavior and improve discipline.

Market Sentiment

Market sentiment refers to the overall attitude or mood of investors toward a particular security, sector, or the market as a whole. It’s a reflection of crowd psychology how investors feel, not necessarily what the fundamentals say.

Types of Market Sentiment

- BullishSentiment Investors are They expect prices to rise, so buying activity increases.

- Bearish Sentiment Investors are pessimistic.They expect prices to fall, leading to more selling.

- NeutralSentiment Uncertainty or balance between bulls and Markets may consolidate or move sideways.

Why It Matters

Market sentiment often drives short-term price movements, even when fundamentals remain unchanged. Traders especially technical analysts and contrarians use sentiment to anticipate reversals or momentum.

Example: Budget Day Rally

Let’s say the finance minister announces a Union Budget with tax cuts and infrastructure spending. Even before analysts finish reading the fine print, the market surges 3% intraday.

- Why?The sentiment turned Investors felt optimistic about economic growth, even if the actual impact would take months to materialize.

- Result: Stocks rally across sectors like cement, steel, and banking notpurely on fundamentals, but on positive sentiment.

How to Gauge Market Sentiment

|

Indicator |

What It Reveals |

|

VIX (Volatility Index) |

High = fear; Low = complacency |

|

Put-Call Ratio |

High = bearish bias; Low = bullish bias |

|

Advance-Decline Ratio |

Market breadth how many stocks are rising |

|

Social Media Trends |

Real-time investor mood |

COVID-19 Market Crash & V-Shaped Recovery Backdrop

In early 2020, global markets were rattled by the rapid spread of COVID-19. India announced a nationwide lockdown on March 24, 2020, halting economic activity almost overnight.

Market Reaction

|

Date |

Event |

Nifty 50 Level |

|

Jan 2020 |

Pre-COVID high |

~12,300 |

|

Mar 23, 2020 |

Lockdown announced |

~7,610 (down ~38%) |

|

Nov 2020 |

Vaccine optimism, global liquidity |

~12,900 |

|

Feb 2021 |

Budget 2021 (Capex-led, no tax hikes) |

~14,600 |

- Sectorshit hardest: Banks, travel, hospitality, real estate

- Sectorsthat recovered fastest: Pharma, IT, FMCG, digital platforms

Key Drivers of the Crash

- Globaluncertainty and fear

- Lockdown-inducedhalt in consumption and production

- FIIoutflows and liquidity crunch

Policy Response

- RBIslashed repo rates and infused liquidity

- Governmentannounced the ₹20 lakh crore Atmanirbhar Bharat stimulus

- SEBIrelaxed margin norms and volatility controls

Investor Behavior

- Panicselling in March 2020

- Massiveretail participation from April 2020 onward (rise of DIY investors)

- SIPflows remained resilient, showing maturing investor psychology

This chart from the Research Gate study shows the performance of the Nifty 50 index alongside COVID-19 case counts in India between January 2020 and March 2021. Here’s a breakdown of what it conveys and why it’s significant:

Steep Decline in March 2020

- As India recorded its first wave of COVID-19 cases and imposed a nationwide lockdown (March 24, 2020), the Nifty plummeted by nearly 38% from its January high.

- This sharp dip reflects investor panic, liquidity fears, and uncertainty about earnings and economic survival.

- ShapedRecovery

- Despite rising COVID-19 cases in April–June 2020, the index beganrecovering, driven by:

- RBI’smonetary support

- Government’s₹20 lakh crore stimulus

- Globalcentral bank liquidity

- Strongretail investor participation

- By November 2020, Nifty had crossed its pre-COVID high (~12,300), even as cases were still mounting. This divergence shows how markets are forward- looking, often pricing in future expectations rather than current conditions.

- Post-BudgetRally (Feb 2021)

- The Union Budget of 2021, with increased capital expenditure and no new taxes, ignited optimism. The index surged further, reaching 14,600+.

- Notably,this occurred while the country was still dealing with pandemic challenges an example of how sentiment and policy clarity can drive rallies.

- KeyInsight

The chart visually demonstrates how market sentiment decoupled from pandemic realities. While COVID cases were still rising, the Nifty rallied due to policy responses, liquidity, and investor confidence in long-term recovery.

Lessons Learned

- Liquiditydrives markets: Central bank action can override weak fundamentals in the short term.

- Sentimentis cyclical: Extreme fear often precedes strong

- Retail investors matter: Their resilience and digital adoption reshaped market

Vedant: So to sum it up, the secondary market is where existing shares are traded among investors. Unlike the primary market, there’s no new issuance, just exchanges between buyers and sellers.

Nirav: Exactly. And platforms like the NSE and BSE make that possible by offering a centralized system to match orders. Liquidity, price discovery, and transparency all emerge from this dynamic.

Vedant: It’s fascinating how the value of a stock in the secondary market reflects not just company performance, but also investor perception and broader market sentiment.

Nirav: Right. And speaking of that, the range of products traded in the secondary market goes well beyond equity shares.

Vedant: Perfect timing. Next we’ll break down the different instruments available like bonds, derivatives, ETF and explore how they function in real market scenarios.

Nirav: It’s where trading meets strategy. Whether you’re hedging risk, speculating on price movements, or seeking passive income, understanding these products is key.

Vedant: Then let’s dive in next up: Secondary Market Products.