- Study

- Slides

- Videos

2.1 What Are Securities?

As we have already laid a solid foundation by emphasizing the necessity of investing over mere saving, highlighting how timely, informed investments drive long-term financial security, wealth creation, and independence. It explores the psychological, economic, and strategic dimensions of investing, introducing asset classes and instruments with practical frameworks for decision-making. Now this naturally builds a transition to the structural backbone of the investment ecosystem-The Securities Market. It connects the ‘why’ of investing to the ‘where’ and ‘how’ by delving into the roles of exchanges, regulatory authorities, and various market participants who facilitate investment activity. So let us first understand what are securities?

Remember our Example about Nirav and Vedant? If No , Then this will help you recollect

Nirav – The Saver

Nirav was cautious. Every month, he carefully set aside a portion of his salary in his savings account. He felt secure knowing he had money for emergencies. His account grew slowly, and he was content seeing his balance rise little by little.

Vedant – The Investor

Vedant, on the other hand, believed that money should grow. While he also kept some money in savings for emergencies, he invested a portion in stocks, mutual funds, and real estate. He understood that investing came with risks, but he believed in the power of compounding and market growth.

After comparing both Vedant had earned more as inflation had eaten up all savings of Nirav. Now after realizing that an investor earns much more than the saver, Nirav decides to explore the investing opportunities and approached Vedant to know Where Should he invest?

Nirav : Hello Vedant. You have made me realise that Saving alone will not help me get a better life. I need to Invest and put my money to work . But I am not aware about any investments and where should I Invest. Can you help me ?

Vedant : Hey Nirav. I will help you for sure. But before I make you understand where to invest you should be aware about the basic concepts. So let us begin with Securities

Vedant explains to Nirav before investing you should Know What is securities market, What are its functions and who regulates the Securities Market. So lets understand each in detail.

What are Securities?

Securities are the financial instruments through which individuals and institutions invest, lend, and trade to generate returns or hedge risks ranging from shares and bonds to derivatives and commodities. But these instruments don’t function in isolation; Yo need to know how the securities market provides the necessary infrastructure for these instruments to circulate efficiently. It transforms the theoretical definition of securities into practical application by explaining how capital is mobilized, prices are discovered, and risk is managed.So as we have understood what securities are lets figure out where and how they operate , making the transition from understanding financial assets to engaging with the broader financial ecosystem.

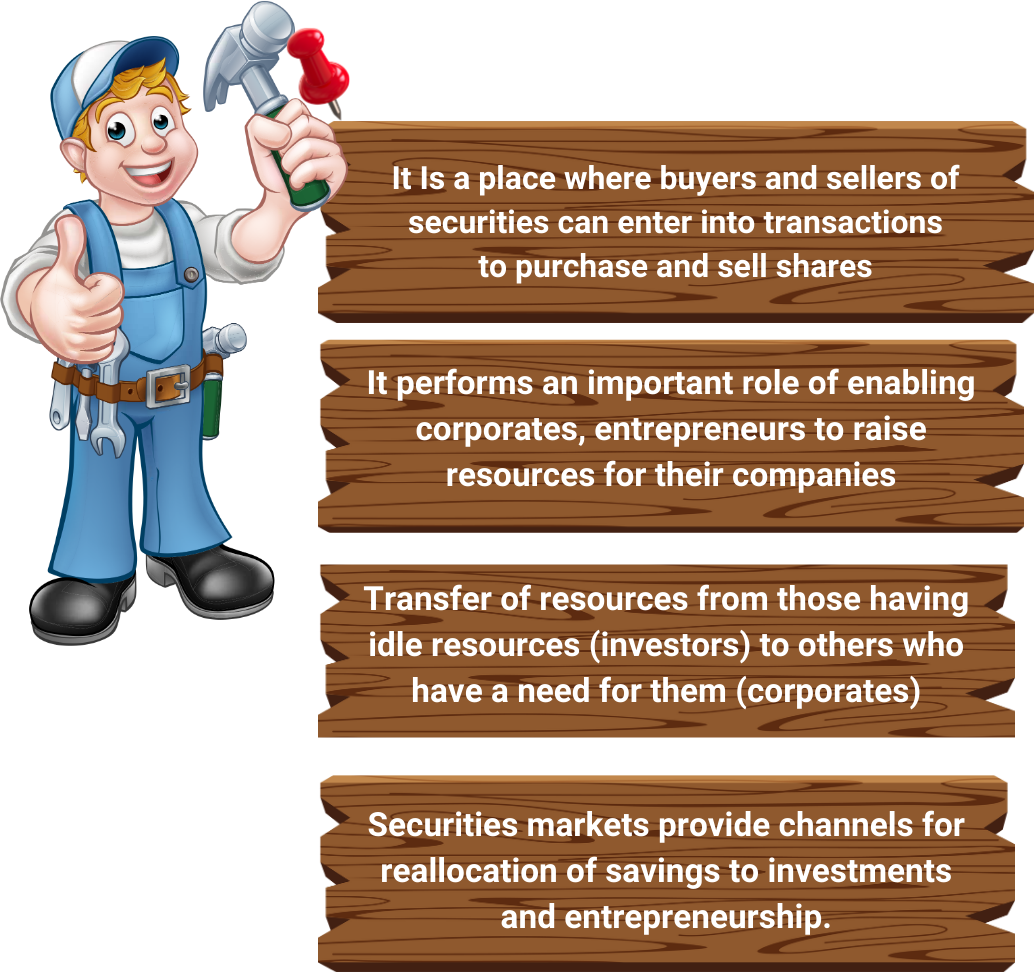

2.2 Securities Market Functions

Suppose you live in a neighborhood where families lend and borrow money to fund various needs. One day, Mr. Mehta who is one of your neighbour wants to expand his grocery shop but doesn’t want to rely solely on bank loans. So, he offers part-ownership to neighbors in exchange for money kind of like an IPO. Now, others can buy or sell their ownership based on how they feel the shop is doing. If business booms, more neighbors want in, and the value of that ownership rises now that’s price discovery at work.

Now if someone suddenly needs money and wants to sell their share. Because many neighbors are interested, they find a buyer quickly. That’s liquidity. And since every neighbor has put their money into different ventures—a tea stall, a tailoring unit, they’re practicing diversification to reduce risk.

To keep things fair, the neighborhood has a committee ensuring transparent deals and settling disputes—just like SEBI does in financial markets. Over time, as more ventures thrive and jobs are created, the whole locality prospers, mirroring how a strong securities market fuels economic growth. Securities Market Functions are

-

Capital Formation and Fundraising

The securities market provides companies and governments with a platform to raise capital for expansion, infrastructure development, and operational needs. Initial Public Offerings (IPOs) and bond issuance enable entities to secure funds from investors instead of relying solely on bank loans.

-

Liquidity and Marketability of Securities

Liquidity refers to the ease of buying and selling securities without significant price changes. Stock exchanges like NSE and BSE ensure a continuous market for securities, enabling investors to enter and exit positions efficiently.

-

Price Discovery Mechanism

The securities market establishes fair market prices through supply and demand dynamics. Market participants, including retail investors, institutional traders, and fund managers, influence security prices based on economic indicators, earnings reports, and geopolitical events.

-

Risk Management through Diversification

Investors utilize the securities market to diversify portfolios and hedge risks using different asset classes, including stocks, bonds, commodities, and derivatives. The availability of hedging instruments such as futures and options allows traders to mitigate losses from price fluctuations.

-

Regulatory Oversight and Investor Protection

The securities market operates under the supervision of regulatory bodies like SEBI (Securities and Exchange Board of India) to ensure transparency, prevent fraud, and protect investor interests. Regulations govern insider trading, corporate disclosures, and ethical trading practices to maintain trust in financial markets.

-

Economic Growth and Financial Stability

A well-functioning securities market supports economic development by channeling investments into productive sectors, driving corporate growth, creating jobs, and influencing national GDP trends. Strong markets attract foreign investments, contributing to economic expansion.

Vedant – Now Nirav lets understand Securities Market Regulators!

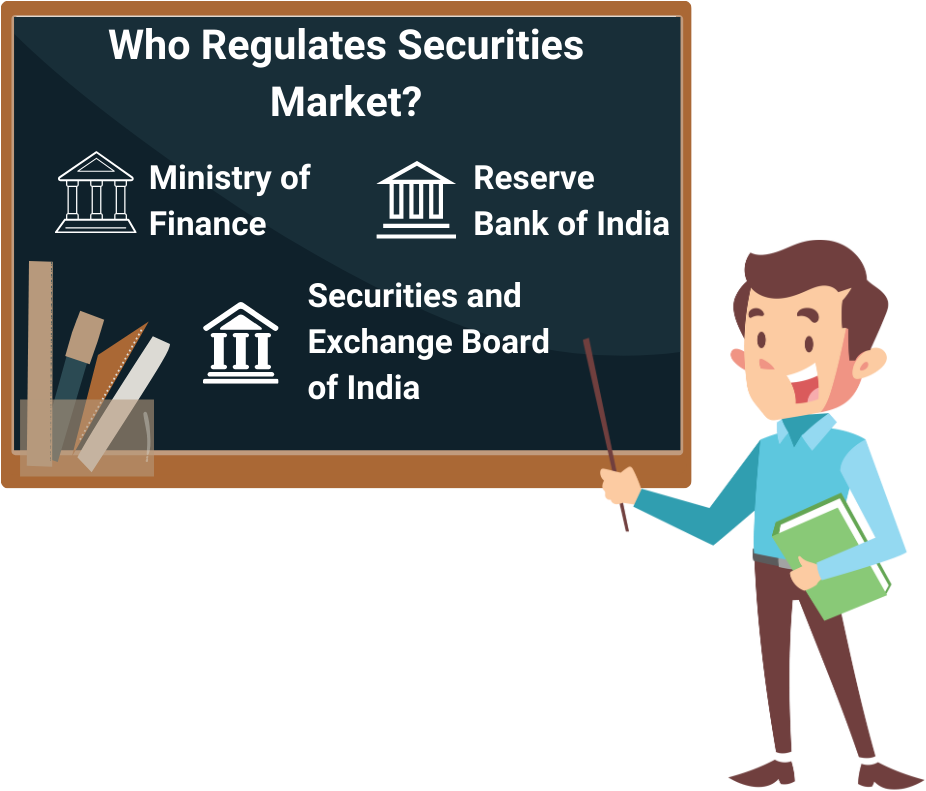

2.3 The Securities Market Regulators

Think of a busy office with departments like HR, Finance, Sales, and Legal, all working together under the guidance of a CEO who enforces policies, ensures ethical conduct, and resolves disputes. That’s exactly what securities market regulators like SEBI do for India’s financial markets. Acting as the compliance head, SEBI ensures that brokers, investors, listed companies, and exchanges follow fair and transparent practices. If rules are broken, it investigates, penalizes, and restores order to protect the integrity of the system. India’s securities market is governed by such regulatory bodies to uphold investor protection, market transparency, and financial stability through well-defined guidelines and oversight.

-

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) is the principal regulatory authority overseeing India’s securities market. Established in 1992, SEBI was created to safeguard investors, regulate financial participants, and maintain the integrity of stock exchanges. It ensures fair trading practices by monitoring financial instruments like stocks, bonds, derivatives, mutual funds, and corporate securities.

a. Regulating Stock Market Participants

SEBI governs various market entities such as brokers, stock exchanges, portfolio managers, mutual funds, and listed companies to prevent misconduct. It sets licensing norms and operational guidelines to ensure ethical business practices.

Key Regulatory Measures:

- SEBI mandates registration and compliance for individuals and firms offering investment advice or stock trading services.

- Ensures that investment advisory firms maintain transparency and adhere to fiduciary responsibilities.

- Regulates trading mechanisms, settlement procedures, and market conduct to prevent manipulation.

b. Monitoring IPOs & Corporate Listings

When a company launches an Initial Public Offering (IPO), SEBI ensures compliance with listing requirements and investor disclosures. It reviews financial statements, risk factors, and prospectus filings before approving IPO applications.

SEBI’s Role in IPOs & Listings:

- Scrutinizes company financials, governance structure, and business stability before public listing.

- Ensures that IPO pricing and subscription process are conducted fairly.

- Once listed, companies must follow SEBI’s disclosure norms on quarterly earnings and corporate developments.

c. Preventing Insider Trading & Market Manipulation

SEBI enforces stringent insider trading laws to curb illicit activities where company executives or major stakeholders trade stocks based on non-public information. It monitors suspicious price movements and investigates fraudulent activities.

Measures Against Insider Trading:

- Encourages reporting of unethical trading activities.

- SEBI tracks abnormal trading volumes and sudden price fluctuations linked to insider information.

- Heavy fines and legal action are imposed against individuals or entities violating insider trading laws.

d. Promoting Market Transparency & Financial Reporting Standards

Transparency is crucial for investor confidence. SEBI mandates publicly listed companies to disclose financial statements, management decisions, and stockholder interests.

Key Compliance Norms:

- Companies must publish financial results, including revenue, expenses, profit margins, and liabilities.

- Boards must maintain ethical leadership practices with independent directors.

- SEBI ensures fair rights for retail investors in mergers, acquisitions, and stock buybacks.

2. Reserve Bank of India (RBI)

RBI regulates monetary policy and financial institutions, influencing interest rates, liquidity, and banking operations. Though primarily a central bank, RBI impacts the securities market by:

- Controlling foreign exchange transactions and currency markets.

- Setting banking regulations that influence investment availability.

- Managing government bond issuance and public debt securities.

RBI’s policies on repo rates, inflation control, and banking stability indirectly shape stock market movements.

-

Ministry of Finance (Department of Economic Affairs)

The Ministry of Finance supervises overall financial policies, taxation rules, and fiscal measures that affect investment markets. It works closely with SEBI and RBI to:

- Frame foreign investment policies for FDI and FPI participation.

- Regulate tax implications for securities transactions.

- Ensure compliance with global financial regulations affecting Indian markets.

Government policies introduced through the Union Budget significantly influence stock market trends and investor confidence.

-

Insurance Regulatory and Development Authority of India (IRDAI)

IRDAI oversees insurance-related investments, ensuring fair practices in pension funds and life insurance-linked securities. It regulates:

- Unit-linked insurance plans (ULIPs) that invest in equities.

- Investment-linked health insurance schemes.

- Corporate governance standards for insurance firms investing in stock markets.

IRDAI ensures that insurance funds are safeguarded against market volatility while allowing growth opportunities for policyholders.

-

Pension Fund Regulatory and Development Authority (PFRDA)

PFRDA regulates India’s National Pension System (NPS), ensuring long-term financial security for retirees. It governs:

- Retirement savings investments in equities and bonds.

- Fund management practices for pension accounts.

- Investor protection for long-term retirement-linked securities.

PFRDA plays a crucial role in shaping retirement-focused securities investments for individual and institutional investors.

Vedant : Nirav Have you Understand What is Securities Market is all about?

Nirav : Yes . But I really need to know much more about SEBI as it is the primary regulatory body who overseas securities market . Can you please explain in detail about it?

Vedant : Ok Sure! Lets understand what is SEBI and What are its Roles.

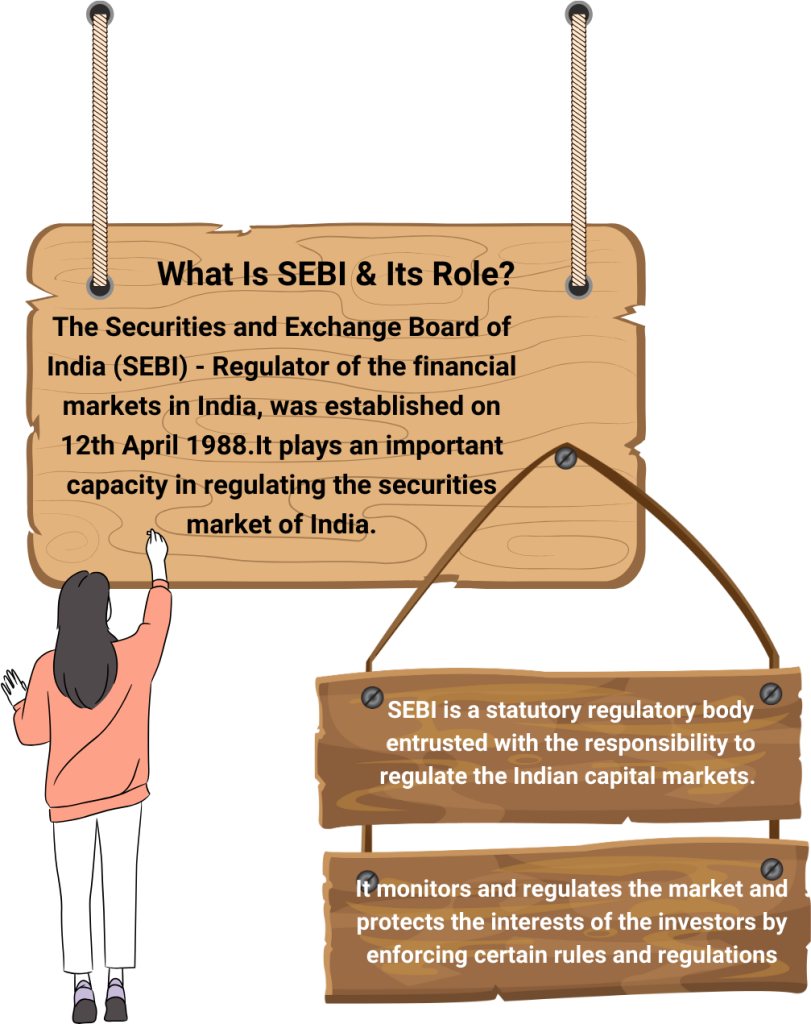

2.4 What Is SEBI And Its Role?

Now suppose if someday you try to choose tiffin service for your office lunches. . There are dozens of options—some call themselves “healthy,” others “budget-friendly,” and a few promise “gourmet flavors.” But without clear categories or nutritional details, the choices feel confusing and misleading.Now a trusted food committee steps in and says, “Every tiffin must clearly say if it’s vegetarian, high-protein, spicy, or budget. No more vague claims or duplicate menus.” That’s exactly what SEBI does in the mutual fund world. It steps in as the regulatory authority, making sure every fund house labels their offerings accurately, discloses risks, and protects your financial ‘diet’ from hidden ingredients.

So Lets understand What is SEBI, Structure of SEBI, Objectives of SEBI, Functions of SEBI and Mutual Funds Regulation by SEBI.

What is SEBI and how it is established

The Securities and Exchange Board of India (SEBI) is the primary regulatory body overseeing India’s capital markets. It was established in 1988 to ensure fair trading, investor protection, and market transparency. In 1992, SEBI was granted statutory powers under the SEBI Act, making it the official governing authority responsible for stock exchanges, mutual funds, investment advisors, and corporate disclosures. SEBI plays a pivotal role in maintaining market stability, preventing fraud, and fostering economic growth.

Structure of SEBI

SEBI operates under a well-defined structure, ensuring effective regulation and governance. The organization consists of key personnel and departments responsible for policy implementation and market supervision.

Chairperson: The head of SEBI, appointed by the Government of India, responsible for strategic decisions and overall market oversight.

Board Members: SEBI is governed by a board consisting of representatives from the Ministry of Finance, Reserve Bank of India (RBI), and independent financial experts.

Departments: SEBI has specialized divisions, including:

- Market Regulation:Oversees stock exchanges, brokers, and trading practices.

- Corporate Finance: Manages IPO approvals and company filings.

- Investor Protection & Education: Ensures awareness and transparency in investments.

- Enforcement & Surveillance:Tracks insider trading and fraudulent activities.

Objectives of SEBI

SEBI was created to regulate the securities market and protect the interests of investors, ensuring fair trading practices. Its primary objectives include:

|

Objective |

Description |

|

Investor Protection |

Safeguards investors from fraud, insider trading, and market manipulation. |

|

Market Regulation |

Ensures fair trading practices among stock exchanges, brokers, and investment firms. |

|

Transparency & Disclosure |

Mandates financial reporting, IPO approvals, and corporate governance standards. |

|

Market Development |

Promotes innovation in financial instruments, mutual funds, and investment products. |

|

Fair Trading Practices |

Prevents price manipulation, illegal stock transactions, and unethical market behavior. |

|

Surveillance & Fraud Prevention |

Uses monitoring tools to detect suspicious activities and enforce penalties. |

|

Regulation of Intermediaries |

Oversees brokers, depository participants, portfolio managers, and credit rating agencies. |

|

Financial Literacy & Awareness |

Educates investors on market risks, investment strategies, and financial planning. |

Functions of SEBI

SEBI performs several critical functions to regulate financial markets and foster investor trust. These functions include:

|

Function |

Description |

|

Regulation of Stock Exchanges |

SEBI monitors stock exchanges (NSE, BSE) to ensure fair trading and prevent market manipulation. |

|

Investor Protection |

Implements rules to safeguard retail investors from fraud, misrepresentation, and insider trading. |

|

Market Development |

Promotes innovation in financial products, including mutual funds, derivatives, and ETFs. |

|

Approval of IPOs & Listings |

Reviews corporate filings before companies go public to ensure transparency and compliance. |

|

Monitoring Brokers & Intermediaries |

Oversees stockbrokers, investment firms, and portfolio managers to maintain ethical practices. |

|

Preventing Insider Trading |

Tracks suspicious stock movements and penalizes violations to maintain market integrity. |

|

Mutual Fund Regulation |

Sets guidelines for mutual funds, ensuring fair expense ratios, investor disclosures, and risk transparency. |

|

Corporate Governance Enforcement |

Mandates financial disclosures and ethical standards for publicly listed companies. |

|

Fraud Detection & Surveillance |

Uses market surveillance tools to detect fraudulent schemes and prevent stock manipulation. |

|

Financial Education & Awareness |

Conducts investor awareness campaigns to promote informed decision-making. |

Role of SEBI

The Securities and Exchange Board of India (SEBI) serves as the regulatory authority for India’s capital markets, ensuring transparency, investor protection, and financial stability. SEBI oversees stock exchanges, mutual funds, portfolio managers, brokers, and investment advisors. Its primary role is to prevent fraudulent practices, regulate financial instruments, monitor corporate governance, and promote fair competition in the securities market. Through its regulatory framework, SEBI enhances market efficiency, safeguards investors, and encourages sustainable economic growth.

Mutual Funds Regulation by SEBI

SEBI plays a crucial role in regulating mutual funds, ensuring that fund houses adhere to transparent practices, risk disclosures, and investor protection guidelines. SEBI oversees:

- Fund Management Practices:Mutual funds must follow strict asset allocation rules and disclose performance metrics.

- Investment Portfolio Transparency:Fund managers must reveal sector-wise holdings and risk factors.

- Investor Grievance Redressal:SEBI enables complaint resolution mechanisms for mutual fund investors.

- Taxation and Compliance:Mutual funds must comply with financial reporting and taxation policies set by SEBI.

SEBI Guidelines on Mutual Funds Reclassification

SEBI introduced mutual fund reclassification rules to bring uniformity and reduce investor confusion regarding fund categories. The key guidelines include:

- Defining Clear Categories: Mutual funds are now classified into broad segments like large-cap, mid-cap, small-cap, debt, hybrid, and thematic funds.

- Standardized Risk Profiles: Funds must provide clear risk classifications, such as low, moderate, or high risk.

- Preventing Misleading Fund Names: Fund houses cannot arbitrarily label schemes without defined strategies.

- Limiting Scheme Duplication:Asset Management Companies (AMCs) must maintain unique portfolios for each fund category.

Vedant : Nirav , I hope you are now clear about Security Market Regulators. But it seems you have more questions to ask.

Nirav : Yes! I need to Know Who are the Participants of Securities Market?

Vedant: Sure. Lets further discuss about Participants of Securities Market

2.5 Participants Involved in Securities Market

Imagine organizing a local cricket tournament. You’ve got players, spectators who buy tickets , and sponsors who fund equipment and promotions similar to institutional investors backing large market moves. There’s a commentator sharing real-time updates, much like brokers and analysts offering market insights. And then there’s the umpire ensuring fair play think of that as SEBI, the market regulator. Just like this tournament runs smoothly with everyone doing their part, the securities market depends on multiple participants companies, investors, brokers, regulators—to maintain order, fairness, and liquidity.

The securities market involves multiple participants, each playing a distinct role in trading, investing, regulating, and managing financial instruments like stocks, bonds, derivatives, and mutual funds. These participants facilitate liquidity, price discovery, and stability in the financial ecosystem.

-

Investors

Investors are individuals or institutions that buy and sell securities for financial returns. They include:

- Retail Investors: Individual traders investing in stocks, mutual funds, and bonds.

- Institutional Investors:Large organizations such as banks, hedge funds, pension funds, and insurance firms managing large capital.

- Foreign Portfolio Investors (FPIs):Overseas investors participating in Indian markets through approved channels.

-

Stock Exchanges

Stock exchanges are platforms where securities are traded, facilitating transparent transactions and price determination.

- NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) are India’s largest exchanges.

- Commodity Exchanges:MCX (Multi Commodity Exchange) and NCDEX (National Commodity & Derivatives Exchange) deal with commodity trading.

- International Exchanges:NYSE, NASDAQ, and LSE attract global investors.

-

Regulators

Regulators maintain market integrity, prevent fraud, and enforce legal compliance.

- SEBI (Securities and Exchange Board of India):India’s primary securities regulator.

- RBI (Reserve Bank of India): Regulates monetary policy and bond markets.

- PFRDA (Pension Fund Regulatory and Development Authority): Oversees retirement savings schemes.

-

Brokers and Intermediaries

Brokers facilitate buying and selling of securities for investors and institutions.

- Stock Brokers: Provide market access and execute trades for clients.

- Investment Advisors:Offer financial guidance and portfolio management.

- Depositories (NSDL & CDSL):Maintain electronic records of securities ownership.

-

Issuers (Companies & Governments)

Issuers are entities that raise capital by selling securities to investors.

- Corporations: Issue stocks and bonds to fund expansion.

- Government Bodies: Issue treasury bills and sovereign bonds for national financing.

Nirav : Vedant I have understood about who are investors , what is securities market , who regulates securities market , Who are the participants involved in securities market, But there is something which you have not explained yet.

Vedant : Ohh! What is it?

Nirav : Who are Financial Intermediaries? And What Role do they have in Securities Market?

Vedant : Yes! That’s a very important point you have noted . Lets understand Who are Financial Intermediaries.

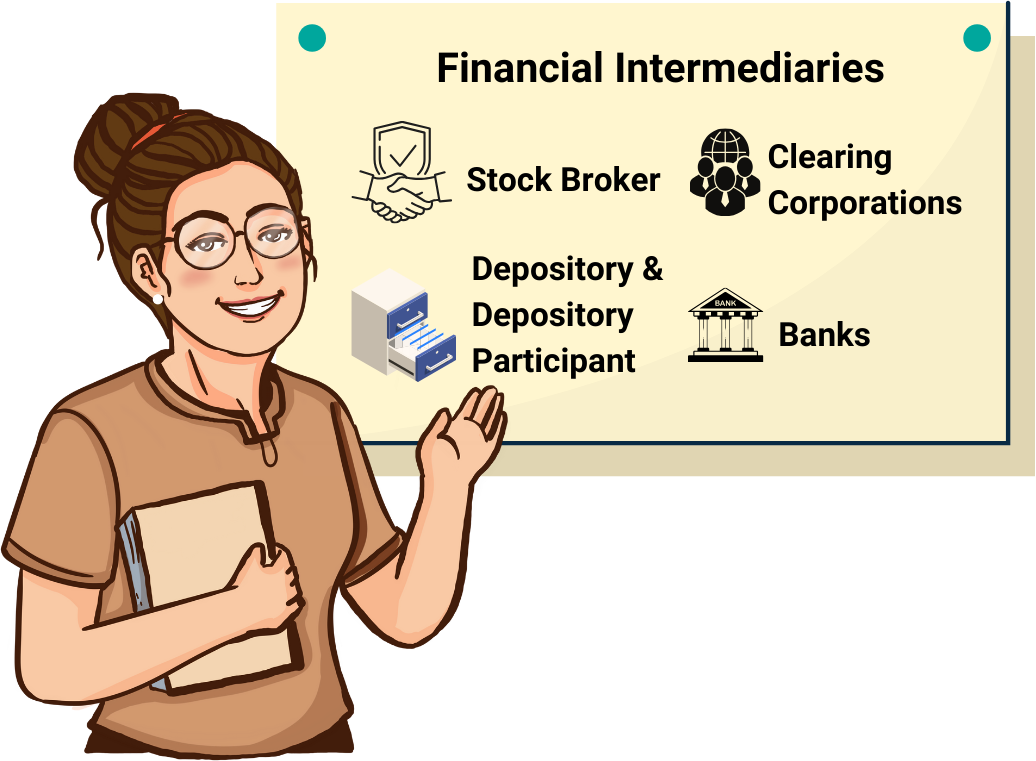

2.6 Financial Intermediaries

Imagine you’re planning a wedding and need ₹10 lakh. You could try asking friends or family, but that’s not always practical. Instead, you apply for a personal loan from a bank. On the other side, someone else, let’s say your neighbour just went to the same bank and deposited ₹10 lakh into a fixed deposit. Neither of you knows the other exists, but the bank connects your need for funds with your neighbor’s desire to earn interest.

That bank acts as the financial intermediary:

- It gives you the loan and charges interest,

- It pays your neighbor interest on their deposit,

- And it earns a margin while managing the risk and paperwork.

Types of Financial Intermediaries

|

Category |

Role & Function |

|

Banks |

Accept deposits and provide loans, enabling liquidity and credit creation. |

|

Investment Banks |

Assist companies with IPOs, mergers, acquisitions, and corporate financing. |

|

Insurance Companies |

Offer risk protection through life, health, and asset insurance policies. |

|

Mutual Funds & Asset Management Companies |

Pool investor funds into diversified portfolios of stocks, bonds, and commodities. |

|

Pension Funds |

Manage retirement savings to ensure long-term financial security for individuals. |

|

Stock Exchanges |

Facilitate the buying and selling of securities, ensuring liquidity and price discovery. |

|

Venture Capital & Private Equity Firms |

Provide funding for startups and high-growth enterprises in exchange for equity. |

|

Microfinance Institutions |

Offer small-scale credit to underserved segments, promoting financial inclusion. |

-

Banks

Banks are the backbone of the financial system, bridging depositors and borrowers to facilitate capital flow. Commercial banks like SBI, HDFC, and ICICI support financial inclusion by offering services such as savings accounts, loans, and payment solutions. Central banks like the RBI regulate monetary policy, manage currency, and ensure financial stability.

-

Investment Banks

Investment banks specialize in corporate finance, mergers & acquisitions, IPO underwriting, and asset management. Unlike commercial banks, they do not offer regular deposit accounts but instead focus on institutional investments, advisory services, and high-value financial transactions. Global giants such as Goldman Sachs, JP Morgan, and Morgan Stanley help companies raise capital, structure complex deals, and navigate financial risks.

-

Insurance Companies

Insurance companies offer financial protection against risks related to life, health, property, and business by pooling premiums and investing them to ensure fund reserves. Firms like LIC, HDFC Ergo, and ICICI Prudential provide customized policies that act as safety nets during unforeseen events. Reinsurance companies help spread liabilities, further strengthening risk management.

-

Mutual Funds & Asset Management Companies (AMCs)

Mutual funds allow retail investors to pool their money into professionally managed portfolios that invest in stocks, bonds, commodities, and other securities. Asset management companies (AMCs) like SBI Mutual Fund, HDFC Mutual Fund, and Nippon India Asset Management oversee these investments, ensuring diversification and market efficiency. Mutual funds are classified into categories such as equity funds, debt funds, hybrid funds, and index funds, helping investors achieve financial goals based on their risk appetite. The SEBI Mutual Fund Reclassification further ensures transparency by standardizing fund categories, reducing ambiguity in investment choices.

-

Pension Funds

Pension funds offer long-term savings for retirement, helping individuals stay financially secure after employment. Schemes like NPS, EPF, and PPF invest contributions in diversified portfolios to build wealth over time. Regulated by PFRDA, these funds balance equities and debt to manage inflation and provide stable returns.

-

Stock Exchanges

Stock exchanges like BSE and NSE are platforms for trading securities, enabling liquidity, price discovery, and capital formation. They allow investors to buy and sell shares of listed companies, supporting investment diversification. Regulated by SEBI, these exchanges ensure transparent transactions and fair pricing, contributing to economic stability.

-

Venture Capital & Private Equity Firms

Venture capital (VC) firms and private equity (PE) companies provide funding to startups and high-growth businesses, in exchange for equity stakes. These firms fuel entrepreneurship and corporate growth by providing capital, strategic expertise, and market access

8. Microfinance Institutions

Microfinance institutions like SKS Microfinance, Bharat Financial Inclusion, and Grameen Bank provide small loans to underserved individuals and entrepreneurs, promoting financial inclusion and rural development. These loans help build assets, support small businesses, and enhance livelihoods, driving grassroots economic growth.

Functions of Financial Intermediaries

- Capital Allocation: Channel funds from savers to borrowers for productive investments.

- Liquidity Management: Ensure that financial assets remain tradable without significant price fluctuations.

- Risk Mitigation: Spread investment risks through diversification and structured financial products.

- Market Stability:Regulate financial transactions, reducing volatility in the economy.

- Wealth Creation:Offer investment avenues for individuals and institutions to grow their capital over time.

Nirav : Thank you so much Vedant. You explained all the concepts so well. But there is one more question which I need you to answer me please?

Vedant : Ah! Never Mind . I would love to answer your question so that you get a clear idea about securities market.

Nirav : You said Securities in trading refer to financial assets that can be bought, sold, or exchanged in markets to generate profits or hedge risks. These assets include stocks, bonds, derivatives, commodities, and forex. But do you know how these financial assets are traded ?

Vedant: That’s a very important question you have asked. These financial assets are traded in various Market segments where each have distinct functions.

2.7 Securities Market Segment

The securities market is divided into various segments, each serving distinct functions within the financial system. These segments facilitate capital formation, liquidity management, price discovery, and risk allocation for investors and institutions. Below is a breakdown of key securities market segments in India.

-

Primary Market (New Issue Market – IPO & Bond Issuance)

The primary market is where securities are issued for the first time. Companies and governments raise capital by selling stocks, bonds, and other securities directly to investors.

- Initial Public Offerings (IPOs): Companies issue shares to the public for the first time to raise funds.

- Bond Issuance:Governments and corporations sell fixed-income securities to investors, providing periodic interest payments.

- Rights Issues & Private Placements:Existing companies offer new shares to existing investors or select institutions.

-

Secondary Market (Stock Exchanges & Trading Platforms)

The secondary market is where previously issued securities are bought and sold among investors on stock exchanges like NSE and BSE.

- Stock Trading:Investors trade company shares based on market demand and price fluctuations.

- Bonds & Debenture Market: Fixed-income securities are resold, ensuring liquidity for bond

- Derivatives Market:Trading of futures, options, swaps linked to stocks, commodities, or indices.

-

Derivatives Market (Futures & Options Trading)

The derivatives market deals with financial instruments whose value is derived from underlying assets like stocks, commodities, indices, or currencies.

- Futures Contracts: Agreements to buy/sell assets at a future date at a fixed price.

- Options Contracts:Give the right but not obligation to trade an asset at a predetermined price.

- Commodity Derivatives:Gold, crude oil, and agricultural goods are traded via futures.

-

Debt Market (Fixed-Income Securities)

The debt market facilitates trading in bonds, treasury bills, and debentures, providing stable income to investors.

- Government Securities (G-Secs):Sovereign bonds with low risk and fixed returns.

- Corporate Bonds: Issued by companies offering periodic interest payments.

- Municipal Bonds:Local government entities raise funds for infrastructure projects.

-

Commodity Market (Physical & Futures Trading)

The commodity market deals with the trade of gold, silver, crude oil, agricultural products, and other raw materials.

- Spot Market: Immediate purchase and delivery of commodities at current prices.

- Commodity Futures:Contracts based on future price predictions of commodities.

- Multi Commodity Exchange (MCX) & National Commodity Exchange (NCDEX): Leading platforms for commodity trading in India.

-

Forex Market (Foreign Exchange Trading)

The forex market facilitates currency trading involving USD, INR, EUR, GBP, JPY, and more.

- Spot Forex Trading:Real-time buying/selling of currencies.

- Forex Futures & Options:Contracts based on exchange rate movements.

- Central Bank Regulations:RBI oversees currency stability in India.

Vedant: Nirav, I hope you now understood about Securities Market and How financial assets are traded . Here is a Summary for you to understand better.

Nirav : Thank you so much Vedant. I am sure we will meet up next time to discuss and gain more knowledge about Securities Market .

Vedant : Sure . Next time we meet we will surely discuss about Role of each Securities Market Intermediaries.

Key Takeaways

- Securities are financial instrumentslike stocks, bonds, derivatives, and commodities that can be traded to generate returns or hedge risks. They form the backbone of investment markets.

- The securities market enables capital formation, price discovery, liquidity, and risk management. It plays a crucial role in funding businesses, channeling savings into investments, and contributing to economic growth.

- SEBI (Securities and Exchange Board of India)is the primary regulator ensuring transparency, preventing fraud, and protecting investors. It governs IPOs, trading norms, mutual fund practices, and insider trading laws.

- Other key regulators include the Reserve Bank of India (RBI), which influences liquidity through monetary policy, and the Ministry of Finance, which shapes fiscal policy and taxation. IRDAIand PFRDA oversee insurance- and pension-linked investments.

- The securities market has various participants: retail and institutional investors, brokers, exchanges (NSE, BSE), depositories (NSDL, CDSL), and foreign portfolio investors. Each contributes to market functioning, liquidity, and governance.

- Financial intermediariessuch as banks, mutual funds, insurance companies, and pension funds facilitate capital flow by connecting savers and borrowers, investing funds, and managing risks.

- The market is segmented into the primary market(where new securities like IPOs and bonds are issued), the secondary market (where existing securities are traded), and specialized markets like derivatives, commodities, debt, and forex.

- The debt marketis vital for income-focused investors and includes government bonds, corporate bonds, and municipal securities that offer fixed returns and lower risk compared to equities.

- Mutual funds in India are regulated by SEBI, ensuring risk-based categorization, transparency in holdings, and investor protection through fair expense ratios and disclosure norms.

- SEBI promotes financial literacy, corporate governance, and ethical tradingby enforcing disclosure standards, regulating market intermediaries, and conducting investor awareness campaigns to build trust in the securities ecosystem.