- All About FnO 360

- What are Futures and Options

- All About Futures

- Types of Futures contract

- All About Options

- Types of Options Contract

- Smart Option Strategies

- Smart Scalping Strategies

- Examples of Smart Strategies

- Examples of Smart Scalping Strategies

- How to Access Smart Strategies in FnO 360

- How to Access Scalping Strategies in FnO 360

- Study

- Slides

- Videos

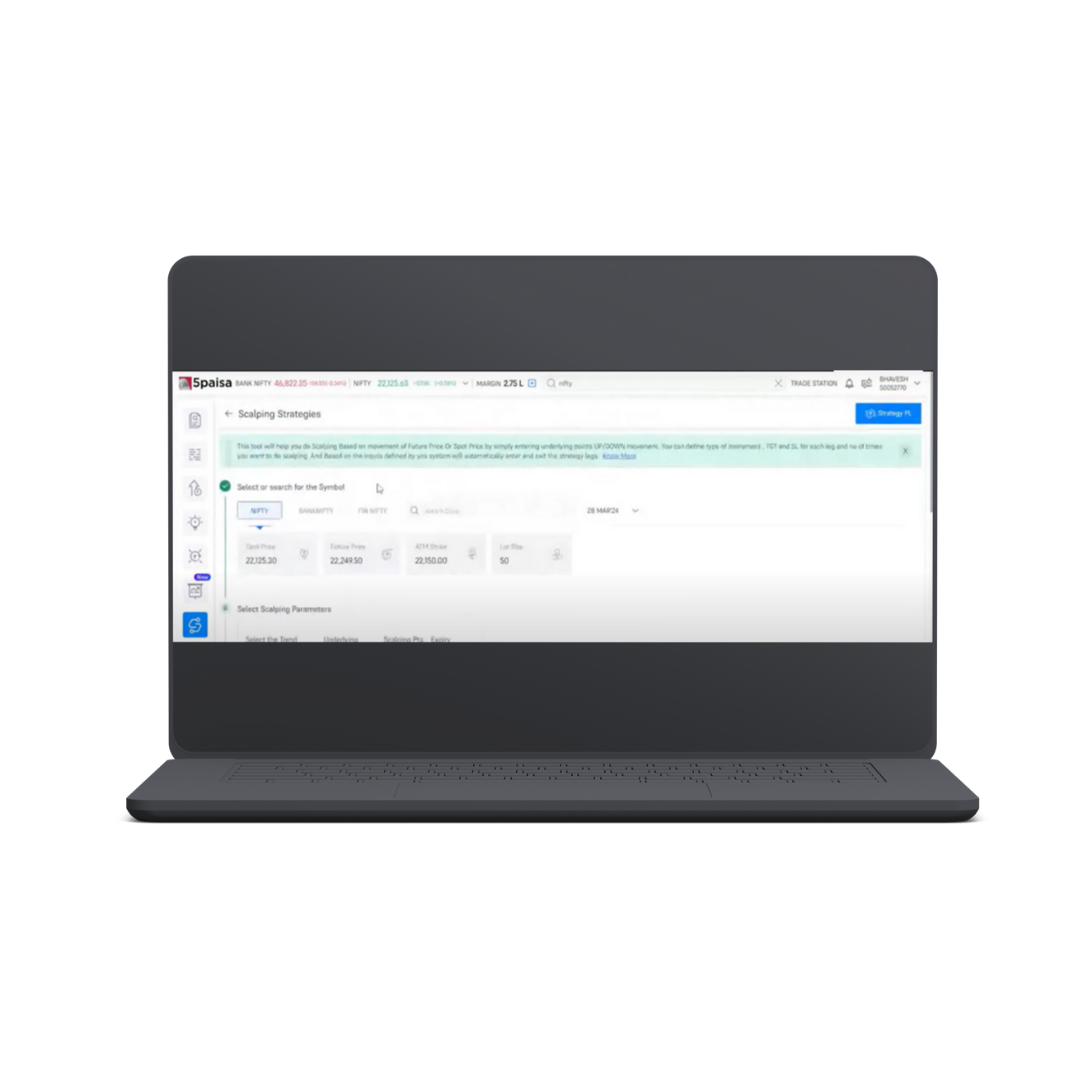

12.1 How to Use Scalping Strategies in FnO 360

Scalping is a fast-paced trading approach where you aim to make quick trades based on small price movements in the market. The FnO 360 Platform by 5paisa helps traders execute scalping by allowing them to predict whether an asset’s price—either spot or future—will rise or fall. You can configure various parameters, such as the type of instrument, target price, stop loss, and the number of times you want to scalp. Once set, the system automatically places trades based on these conditions.

Here’s a quick breakdown of how you can use it:

- Login to the 5paisa web portal and navigate to Smart Strategies.

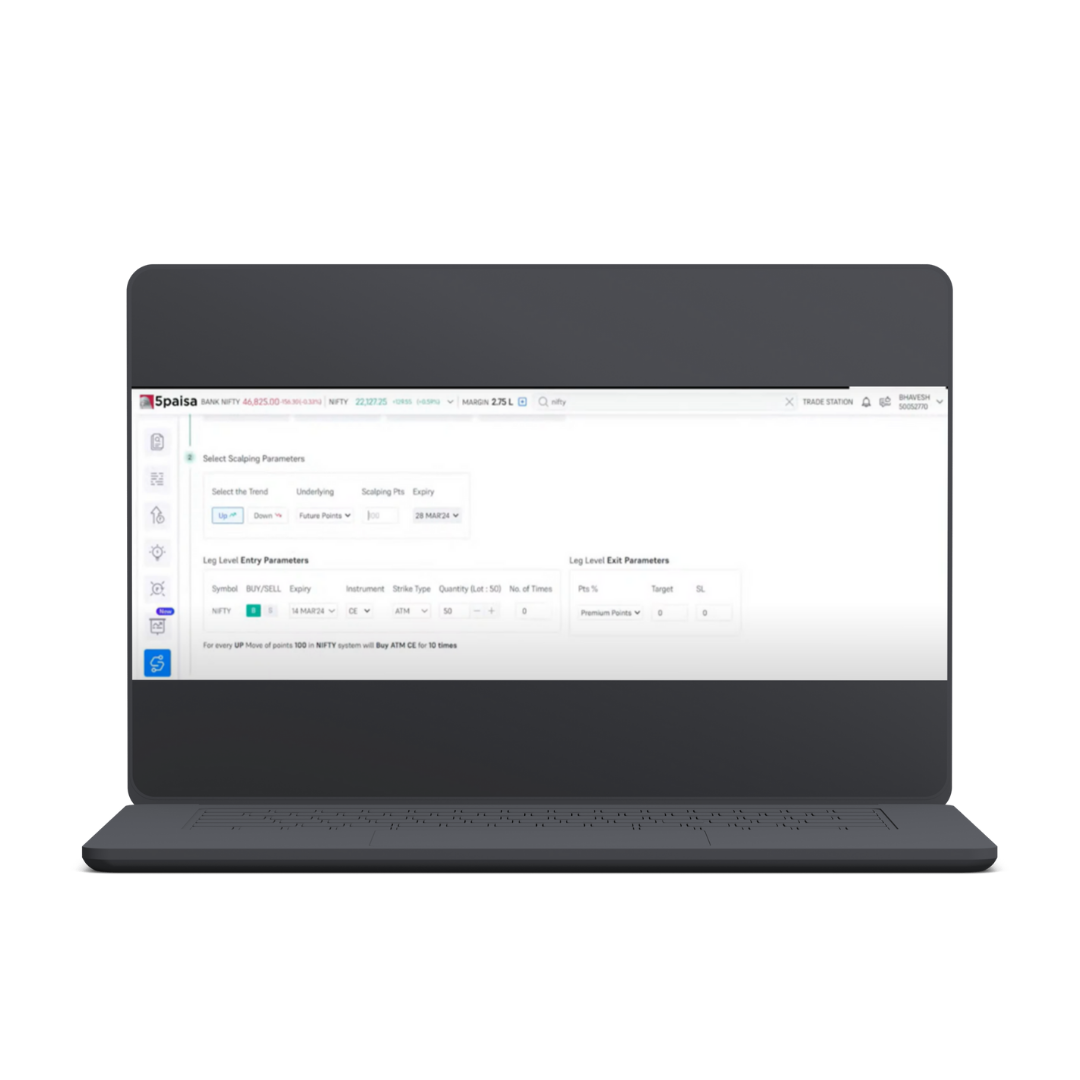

2. Select Scalping and define whether you want to trade in an Uptrend or Downtrend

3. Choose between Future or Spot Points as the basis for scalping.

- Enter Scalping Points (e.g., 50 points from the current market price).

- Select Expiry & Instrument Type (CE, PE, FUT, or EQ).

- Define Quantity per leg and the Number of Times you want to execute scalping.

- Set Leg-wise Target & Stop Loss (either in points or percentage).

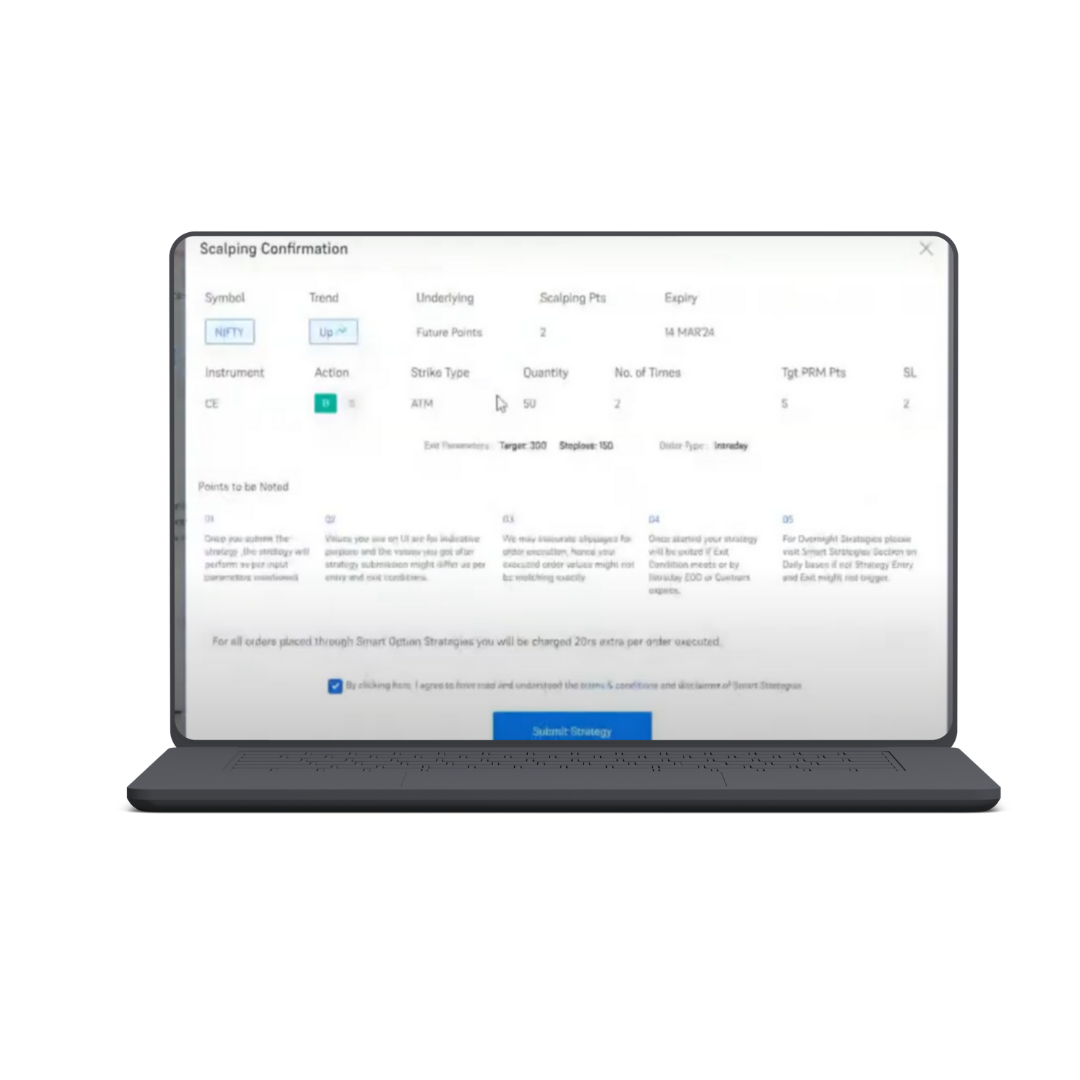

- Once submitted, the system will automatically execute trades based on your predefined conditions.

Understanding Key Scalping Elements:

- Reference Price (Spot or Future Price): This is the price at which your scalping strategy begins. It is set at the moment you submit your trade. For example, if you launch the strategy at 10 AM while NIFTY Futures are trading at 18,500, then 18,500 becomes your reference price, and all subsequent trades will be triggered based on movements from this point.

- Where to Find the Reference Price: You can check this value by accessing the History tab within the Strategy P&L page.

- Scalping Points: These are predefined price gaps that serve as execution triggers within your strategy. Suppose you set scalping points at 50, and your reference price is 18,000—your trades will initiate when the price reaches 18,050 and beyond. Every time the market price moves past this threshold, the system executes trades accordingly.

- Number of Times in Scalping: This refers to the number of times the system will enter a trade based on your settings. If you set 3 times, the strategy will initiate trades three times before stopping further executions. Once the defined number of trades is completed, the system will continue managing open positions based on target and stop-loss settings.

- What Happens if “Number of Times” Condition Isn’t Met by EOD? If your strategy fails to complete the set number of trades within the trading day, the system will carry over any remaining executions to the next day. You must log in each day for the system to continue executing trades. If there is a major overnight price movement—say a 200-point gap-up, and your scalping condition is set for 50 points per trade, then the system will execute four trades on the next trading day to account for missed opportunities.

Managing Risk:

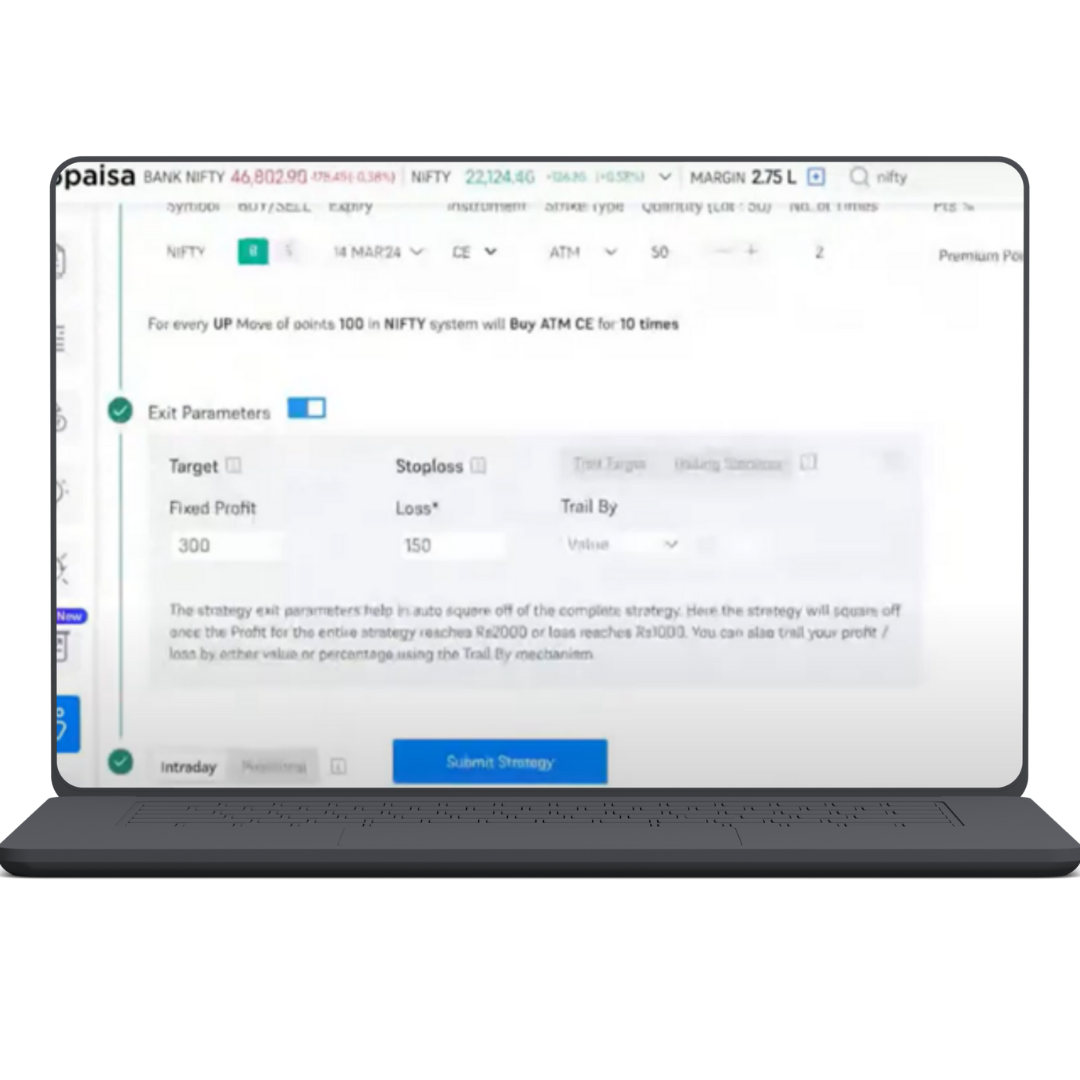

- Leg-wise Target & Stop Loss: You can set individual targets (profit levels) and stop-loss limits for each trade. These can be defined either in points or percentages, giving traders control over how much risk they take per entry.

- Strategy-Level Exit Parameter: This lets you define an overall profit or loss target for your entire scalping strategy. If you reach the profit goal with fewer than the planned entries, the system will stop further trades—allowing you to secure gains effectively.

Can You Modify Scalping Strategy After Placement?

Yes, you can modify exit parameters, such as profit targets and stop-loss levels, even after submitting the strategy. However, entry conditions cannot be adjusted once the strategy is placed. If you need to change these, you will have to delete the existing strategy and create a new one.

12.1 How to Use Scalping Strategies in FnO 360

Scalping is a fast-paced trading approach where you aim to make quick trades based on small price movements in the market. The FnO 360 Platform by 5paisa helps traders execute scalping by allowing them to predict whether an asset’s price—either spot or future—will rise or fall. You can configure various parameters, such as the type of instrument, target price, stop loss, and the number of times you want to scalp. Once set, the system automatically places trades based on these conditions.

Here’s a quick breakdown of how you can use it:

- Login to the 5paisa web portal and navigate to Smart Strategies.

2. Select Scalping and define whether you want to trade in an Uptrend or Downtrend

3. Choose between Future or Spot Points as the basis for scalping.

- Enter Scalping Points (e.g., 50 points from the current market price).

- Select Expiry & Instrument Type (CE, PE, FUT, or EQ).

- Define Quantity per leg and the Number of Times you want to execute scalping.

- Set Leg-wise Target & Stop Loss (either in points or percentage).

- Once submitted, the system will automatically execute trades based on your predefined conditions.

Understanding Key Scalping Elements:

- Reference Price (Spot or Future Price): This is the price at which your scalping strategy begins. It is set at the moment you submit your trade. For example, if you launch the strategy at 10 AM while NIFTY Futures are trading at 18,500, then 18,500 becomes your reference price, and all subsequent trades will be triggered based on movements from this point.

- Where to Find the Reference Price: You can check this value by accessing the History tab within the Strategy P&L page.

- Scalping Points: These are predefined price gaps that serve as execution triggers within your strategy. Suppose you set scalping points at 50, and your reference price is 18,000—your trades will initiate when the price reaches 18,050 and beyond. Every time the market price moves past this threshold, the system executes trades accordingly.

- Number of Times in Scalping: This refers to the number of times the system will enter a trade based on your settings. If you set 3 times, the strategy will initiate trades three times before stopping further executions. Once the defined number of trades is completed, the system will continue managing open positions based on target and stop-loss settings.

- What Happens if “Number of Times” Condition Isn’t Met by EOD? If your strategy fails to complete the set number of trades within the trading day, the system will carry over any remaining executions to the next day. You must log in each day for the system to continue executing trades. If there is a major overnight price movement—say a 200-point gap-up, and your scalping condition is set for 50 points per trade, then the system will execute four trades on the next trading day to account for missed opportunities.

Managing Risk:

- Leg-wise Target & Stop Loss: You can set individual targets (profit levels) and stop-loss limits for each trade. These can be defined either in points or percentages, giving traders control over how much risk they take per entry.

- Strategy-Level Exit Parameter: This lets you define an overall profit or loss target for your entire scalping strategy. If you reach the profit goal with fewer than the planned entries, the system will stop further trades—allowing you to secure gains effectively.

Can You Modify Scalping Strategy After Placement?

Yes, you can modify exit parameters, such as profit targets and stop-loss levels, even after submitting the strategy. However, entry conditions cannot be adjusted once the strategy is placed. If you need to change these, you will have to delete the existing strategy and create a new one.

12.1 How to Use Scalping Strategies in FnO 360

Scalping is a fast-paced trading approach where you aim to make quick trades based on small price movements in the market. The FnO 360 Platform by 5paisa helps traders execute scalping by allowing them to predict whether an asset’s price—either spot or future—will rise or fall. You can configure various parameters, such as the type of instrument, target price, stop loss, and the number of times you want to scalp. Once set, the system automatically places trades based on these conditions.

Here’s a quick breakdown of how you can use it:

- Login to the 5paisa web portal and navigate to Smart Strategies.

2. Select Scalping and define whether you want to trade in an Uptrend or Downtrend

3. Choose between Future or Spot Points as the basis for scalping.

- Enter Scalping Points (e.g., 50 points from the current market price).

- Select Expiry & Instrument Type (CE, PE, FUT, or EQ).

- Define Quantity per leg and the Number of Times you want to execute scalping.

- Set Leg-wise Target & Stop Loss (either in points or percentage).

- Once submitted, the system will automatically execute trades based on your predefined conditions.

Understanding Key Scalping Elements:

- Reference Price (Spot or Future Price): This is the price at which your scalping strategy begins. It is set at the moment you submit your trade. For example, if you launch the strategy at 10 AM while NIFTY Futures are trading at 18,500, then 18,500 becomes your reference price, and all subsequent trades will be triggered based on movements from this point.

- Where to Find the Reference Price: You can check this value by accessing the History tab within the Strategy P&L page.

- Scalping Points: These are predefined price gaps that serve as execution triggers within your strategy. Suppose you set scalping points at 50, and your reference price is 18,000—your trades will initiate when the price reaches 18,050 and beyond. Every time the market price moves past this threshold, the system executes trades accordingly.

- Number of Times in Scalping: This refers to the number of times the system will enter a trade based on your settings. If you set 3 times, the strategy will initiate trades three times before stopping further executions. Once the defined number of trades is completed, the system will continue managing open positions based on target and stop-loss settings.

- What Happens if “Number of Times” Condition Isn’t Met by EOD? If your strategy fails to complete the set number of trades within the trading day, the system will carry over any remaining executions to the next day. You must log in each day for the system to continue executing trades. If there is a major overnight price movement—say a 200-point gap-up, and your scalping condition is set for 50 points per trade, then the system will execute four trades on the next trading day to account for missed opportunities.

Managing Risk:

- Leg-wise Target & Stop Loss: You can set individual targets (profit levels) and stop-loss limits for each trade. These can be defined either in points or percentages, giving traders control over how much risk they take per entry.

- Strategy-Level Exit Parameter: This lets you define an overall profit or loss target for your entire scalping strategy. If you reach the profit goal with fewer than the planned entries, the system will stop further trades—allowing you to secure gains effectively.

Can You Modify Scalping Strategy After Placement?

Yes, you can modify exit parameters, such as profit targets and stop-loss levels, even after submitting the strategy. However, entry conditions cannot be adjusted once the strategy is placed. If you need to change these, you will have to delete the existing strategy and create a new one.