- Study

- Slides

- Videos

6.1 What is Debt Management and Types of Debt

Debt management involves strategies and methods for handling your financial obligations to ensure that you can meet your debt payments on time and reduce or eliminate debt over time. Effective debt management helps you maintain a good credit score, avoid financial stress, and achieve long-term financial goals. Here are key components of debt management:

- Budgeting: Creating and sticking to a budget to track income and expenses, ensuring you have enough funds to cover debt payments.

- Debt Repayment Plans: Developing a structured plan to pay off debts, often prioritizing high-interest debts first.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments.

- Negotiation: Communicating with creditors to negotiate lower interest rates or extended repayment terms.

- Credit Counselling: Seeking advice from credit counselling agencies to develop effective debt management strategies.

- Avoiding New Debt: Reducing the use of credit cards and avoiding taking on additional debt while paying off existing obligations.

Types of Debt

- Secured Debt: Debt backed by collateral. If the borrower defaults, the lender can seize the collateral to recover the debt.

- Unsecured Debt: Debt that is not backed by collateral. Lenders rely on the borrower’s creditworthiness and ability to repay.

- Revolving Debt: Debt that allows the borrower to borrow up to a certain credit limit and repay it over time, with the option to borrow again.

- Installments Debt: Debt that is repaid in fixed monthly installments over a specified period.

- Credit Card Debt: A type of revolving debt incurred by using a credit card to make purchases. Interest is charged on the outstanding balance if not paid in full by the due date.

- Student Loans: Loans taken out to finance education expenses. They can be federal or private loans, with varying interest rates and repayment terms.

- Mortgages: Secured loans used to purchase real estate. The property serves as collateral, and the loan is repaid over a long period, typically 15 to 30 years.

- Auto Loans: Secured loans used to finance the purchase of a vehicle. The vehicle serves as collateral for the loan.

- Payday Loans: Short-term, high-interest loans intended to cover immediate expenses until the borrower’s next payday. They are often considered predatory due to their high fees and interest rates.

- Business Loans: Loans taken out by businesses to finance operations, expansion, or other business activities. They can be secured or unsecured.

Ravi’s Debt Management

Ravi’s Profile:

- Age: 40 years

- Occupation: Corporate Employee

- Debt: Home mortgage, auto loan, credit card debt

Debt Management Strategies:

- Budgeting: Ravi creates a monthly budget to track his income and expenses. With a monthly salary of ₹70,000, he ensures that he allocates a portion of his income to cover his debt payments.

- Debt Repayment Plan: He prioritizes paying off his credit card debt first, as it has the highest interest rate. He makes extra payments towards his credit card debt whenever possible.

- Debt Consolidation: He consolidates his multiple credit card debts into a single personal loan with a lower interest rate. This makes it easier for him to manage his payments and reduces the overall interest burden.

- Negotiation: He contacts his credit card issuer to negotiate a lower interest rate on his outstanding balance. He successfully secures a lower rate, reducing his monthly payments.

- Credit Counselling: He seeks advice from a credit counselling agency to develop an effective debt management strategy. The counsellor helps him create a realistic repayment plan and provides tips on improving his financial habits.

- Avoiding New Debt: He minimizes the use of his credit cards and avoids taking on new debt while focusing on paying off his existing obligations. He saves up for future expenses instead of relying on credit.

By following these debt management strategies, Ravi effectively manages his debts and works towards financial stability. He feels more in control of his finances and confident about his future, demonstrating the importance of proactive debt management.

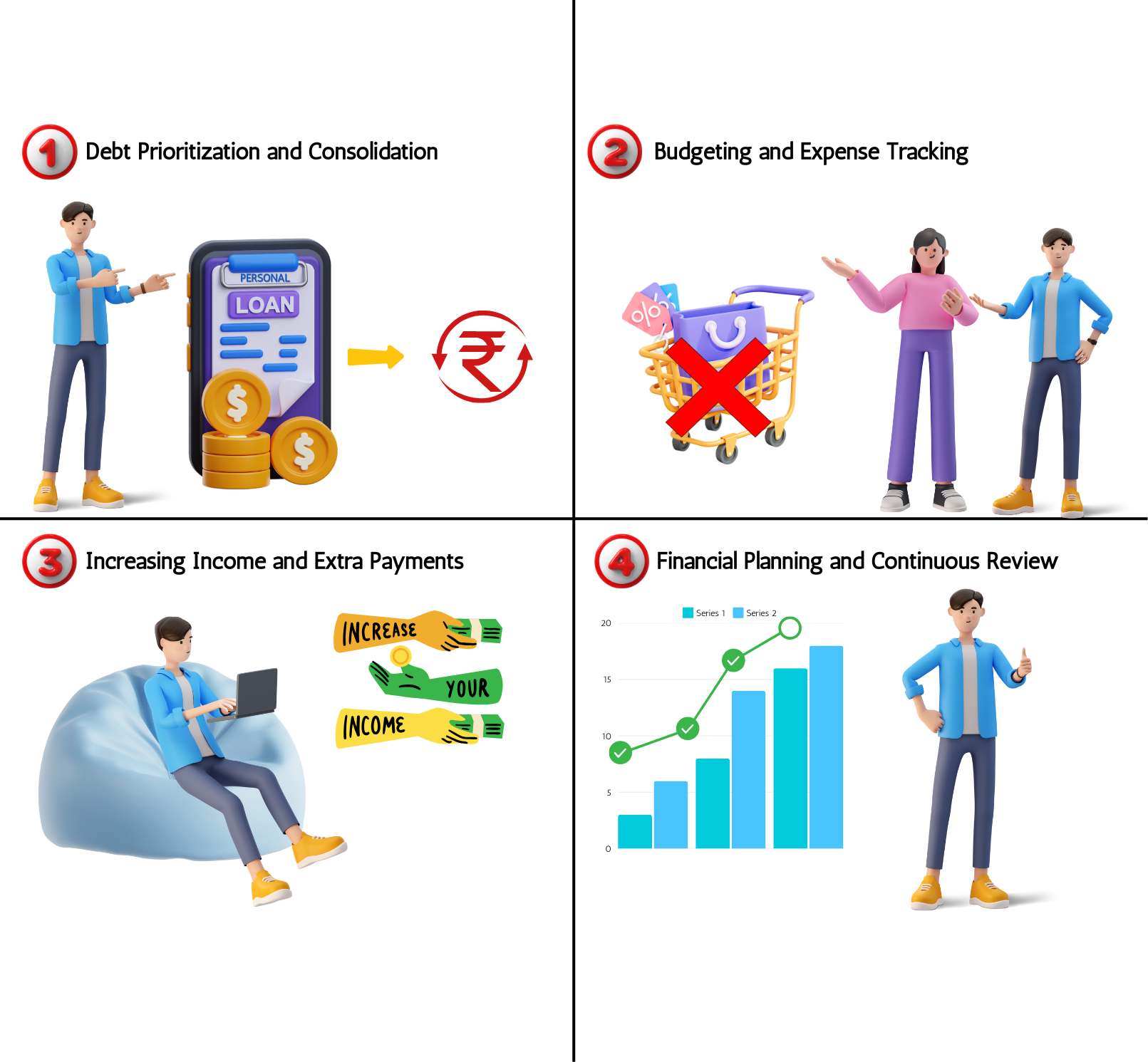

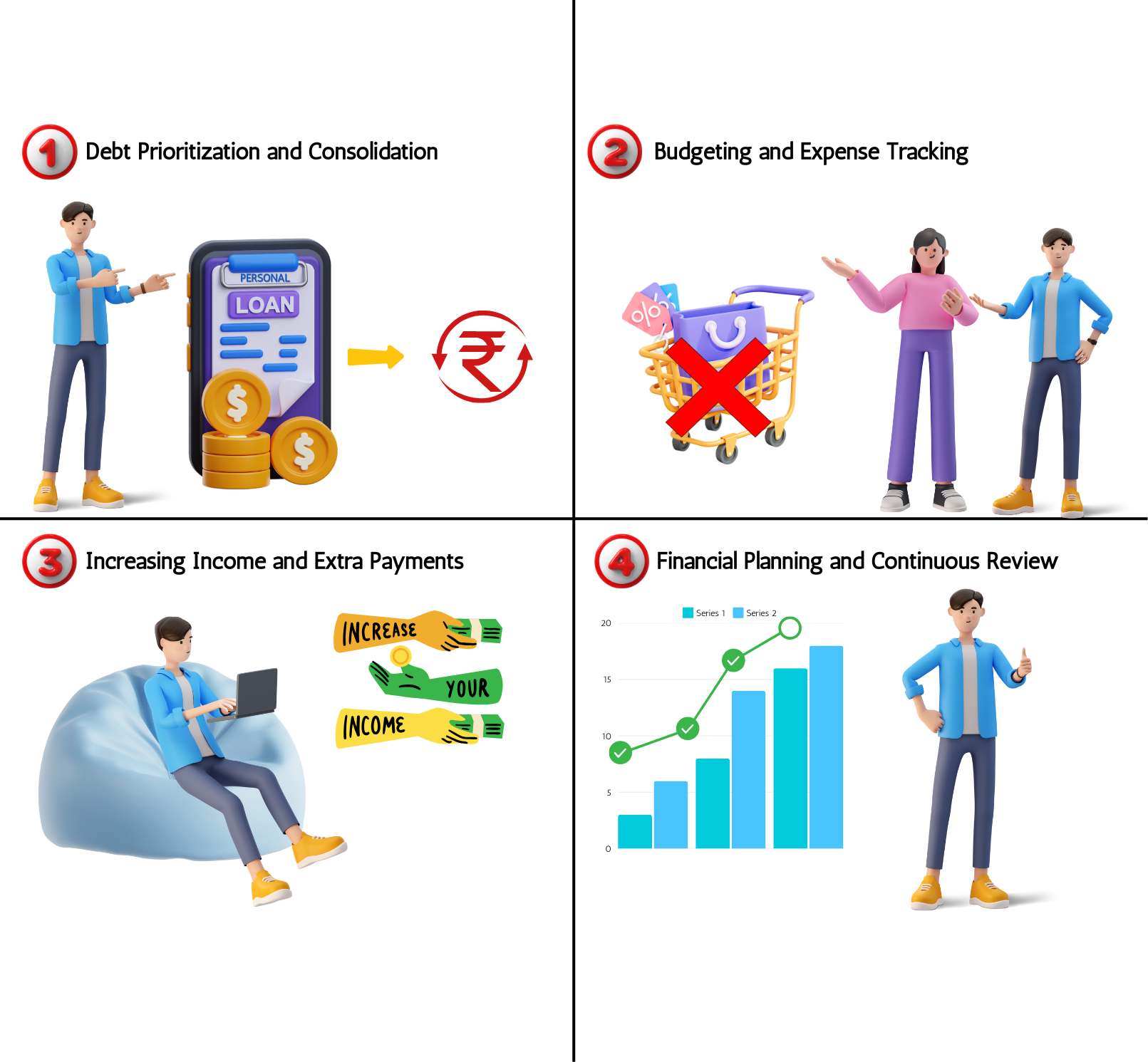

6.2 Strategies to manage Debt

Managing debt effectively is crucial for maintaining financial health and achieving long-term financial goals. Here are some key strategies to help you manage debt:

-

Create a Budget

- Track Income and Expenses: Start by tracking your monthly income and expenses to understand your financial situation.

- Allocate Funds: Allocate a portion of your income specifically for debt repayment.

- Cut Unnecessary Expenses: Identify areas where you can cut back on spending to free up more money for debt repayment.

-

Develop a Debt Repayment Plan

- List All Debts: Make a list of all your debts, including the outstanding balance, interest rate, and minimum monthly payment for each.

- Prioritize High-Interest Debts: Focus on paying off high-interest debts first, as they cost you the most in interest over time.

- Debt Snowball Method: Alternatively, you can use the debt snowball method, where you pay off the smallest debt first and then move on to the next smallest debt.

-

Consolidate Debt

- Debt Consolidation Loan: Consider consolidating multiple debts into a single loan with a lower interest rate. This can simplify your payments and reduce overall interest costs.

- Balance Transfer: Transfer high-interest credit card balances to a card with a lower interest rate, if possible.

-

Negotiate with Creditors

- Lower Interest Rates: Contact your creditors to negotiate lower interest rates or more favourable repayment terms.

- Debt Settlement: In some cases, creditors may be willing to settle for a lump-sum payment that is less than the total amount owed.

- Use the Avalanche Method

- High-Interest First: Pay off debts with the highest interest rates first while making minimum payments on other debts. This method reduces the overall interest paid over time.

-

Seek Professional Help

- Credit Counselling: Work with a credit counselling agency to develop a debt management plan and get advice on managing your finances.

- Debt Management Plan (DMP): Enroll in a DMP, where the credit counselling agency negotiates with your creditors and creates a structured repayment plan.

-

Avoid New Debt

- Limit Credit Card Use: Minimize the use of credit cards while you focus on paying off existing debt.

- Save for Purchases: Save up for purchases instead of relying on credit. This helps prevent accumulating more debt.

-

Increase Income

- Side Hustles: Consider taking on a part-time job or freelance work to increase your income and accelerate debt repayment.

- Sell Unused Items: Sell items you no longer need to generate extra cash for debt repayment.

-

Automate Payments

- Automatic Payments: Set up automatic payments to ensure you never miss a debt payment. This helps avoid late fees and keeps you on track.

-

Monitor Your Credit

- Credit Reports: Regularly check your credit reports to ensure they are accurate and to monitor your progress.

- Credit Score: Keep an eye on your credit score and take steps to improve it, as a good credit score can lead to better interest rates in the future.

Example

Ravi, a diligent 40-year-old corporate employee, lived in a bustling town with his wife Priya and their two children. Although he loved his job and always aimed to provide the best for his family, Ravi had accumulated debt over the years—a home mortgage, an auto loan, and credit card debt. One evening, Ravi and Priya decided to take control of their finances. They created a budget to track their ₹70,000 monthly income and expenses, identifying areas to cut back and allocating funds for debt repayment. Prioritizing high-interest credit card debt, they consolidated it into a lower-interest personal loan and negotiated lower rates with their issuer. They set up automatic payments to avoid late fees and sought advice from a credit counselling agency. Every six months, Ravi reviewed their investments to ensure alignment with financial goals, taking freelance work and selling unused items to increase debt repayment funds. Over time, their efforts paid off: their debt decreased, they avoided new debt, and their financial stability improved. Ravi’s proactive debt management secured a stable future for his family, allowing them to focus on their dreams without financial stress.

6.3. How to avoid unnecessary Debt?

Managing debt effectively involves a combination of strategies to ensure financial stability and avoid unnecessary debt. One of the foundational steps is creating and sticking to a budget. By tracking your monthly income and expenses, you can allocate funds specifically for debt repayment and identify areas where you can cut back on spending. This disciplined approach helps you maintain control over your finances and prevents overspending.

Differentiating between needs and wants is also crucial. Focus on spending money on essential items like housing, utilities, groceries, and healthcare. Avoid impulse purchases and take time to consider whether a purchase is necessary. Using credit cards wisely is another important strategy. Aim to pay off your credit card balances in full each month to avoid interest charges, and limit credit card use to necessary purchases and emergencies.

Saving for major purchases is a proactive way to avoid debt. Build a savings fund for big-ticket items like a car, vacation, or home renovations instead of relying on credit. Setting specific savings goals and working towards them over time ensures that you don’t accumulate unnecessary debt. Additionally, maintaining an emergency fund equivalent to 3-6 months’ worth of living expenses provides a financial cushion for unexpected expenses, allowing you to avoid using credit for emergencies.

Educating yourself on financial literacy is essential for managing debt effectively. Understanding how interest rates work and staying informed about financial management best practices can help you make informed decisions. Regularly monitoring your finances and making adjustments as needed ensures that you stay on track with your budget and savings goals.

Avoiding temptations and peer pressure is also important. Stay focused on your financial goals and set personal boundaries to avoid unnecessary spending in social situations. Lastly, seeking professional advice from financial advisors or credit counselling agencies can provide personalized recommendations and support for managing your finances and avoiding debt.

Example

Ravi, a corporate employee, was determined to avoid unnecessary debt and maintain financial stability for his family. Here’s how he did it:

Budgeting and Planning

Ravi created a monthly budget to track his income and expenses. He set spending limits for different categories and allocated a portion of his income for savings. By differentiating between needs and wants, Ravi focused on spending money on essential items and avoided impulse purchases.

Wise Use of Credit Cards

Ravi used credit cards wisely, paying off his balances in full each month to avoid interest charges. He limited credit card use to necessary purchases and emergencies, ensuring he didn’t accumulate unnecessary debt.

Saving for Major Purchases

Ravi built a savings fund for big-ticket items like vacations and home renovations. He set specific savings goals and worked towards achieving them over time, avoiding the need to rely on credit.

Emergency Fund

Ravi maintained an emergency fund equivalent to six months’ worth of living expenses. This fund provided a financial cushion for unexpected expenses, allowing him to avoid using credit for emergencies.

Financial Literacy

Ravi educated himself on financial management and best practices for avoiding debt. He understood how interest rates worked and stayed informed about financial trends.

Regular Financial Check-Ins

Ravi regularly reviewed his financial situation to ensure he was on track with his budget and savings goals. He made adjustments as needed to stay on track and avoid unnecessary debt.

By following these strategies, Ravi successfully avoided unnecessary debt and maintained financial stability for his family. His proactive approach to managing finances allowed him to focus on his long-term financial goals and achieve peace of mind.

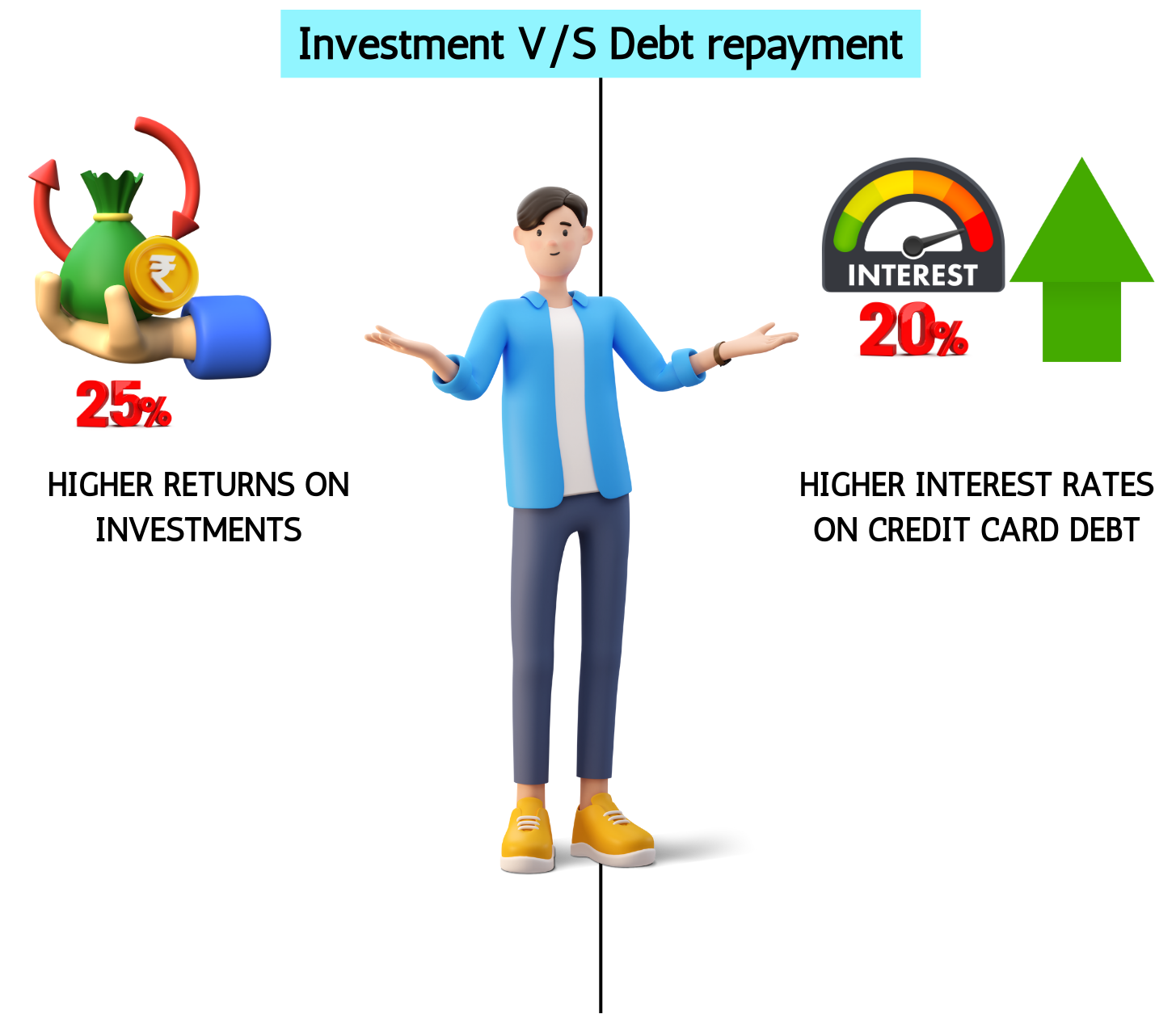

6.4 Investment vs Debt repayment what should you choose?

Choosing between investing and repaying debt depends on your individual financial situation and goals. Both options have their advantages, and the right choice for you will depend on various factors such as interest rates, potential investment returns, and your overall financial goals. Here are some considerations to help you decide:

- Interest Rates

- High-Interest Debt: If you have high-interest debt (e.g., credit card debt with an interest rate of 15% or more), it generally makes sense to focus on paying it off first. The guaranteed return on debt repayment (in the form of interest saved) is often higher than what you can earn from most investments.

- Low-Interest Debt: If your debt has a lower interest rate (e.g., a mortgage with a 3-4% interest rate), you might consider investing, especially if you can earn a higher return on your investments.

- Potential Investment Returns

- Stock Market: Historically, the stock market has provided average annual returns of around 7-10% after adjusting for inflation. If you have low-interest debt, investing in the stock market could potentially offer higher returns over the long term.

- Bonds and Savings Accounts: These typically offer lower returns compared to the stock market. If the interest rate on your debt is higher than the returns from bonds or savings accounts, paying off the debt might be the better choice.

- Financial Goals

- Short-Term Goals: If you have short-term financial goals (e.g., saving for a down payment on a house), prioritizing debt repayment might free up cash flow and reduce financial stress.

- Long-Term Goals: For long-term goals (e.g., retirement savings), balancing both debt repayment and investing can help you build wealth over time.

- Risk Tolerance

- Low Risk Tolerance: If you prefer a low-risk approach, paying off debt provides a guaranteed return in the form of interest saved. It also reduces financial risk and improves your overall financial security.

- Higher Risk Tolerance: If you can tolerate higher risk, investing might be an attractive option, especially if you have a long investment horizon and can ride out market fluctuations.

- Financial Stability

- Emergency Fund: Before focusing on debt repayment or investing, ensure you have an emergency fund equivalent to 3-6 months’ worth of living expenses. This provides a financial cushion for unexpected expenses.

- Cash Flow: Consider your monthly cash flow. Paying off debt can improve your cash flow by reducing monthly payments, while investing can help build long-term wealth.

Example: Ravi’s Decision-Making Process

Ravi has a home mortgage with a 4% interest rate, an auto loan with a 6% interest rate, and credit card debt with an 18% interest rate. Ravi also wants to start investing for his future.

Step-by-Step Decision-Making:

- Evaluate Interest Rates: Ravi starts by evaluating the interest rates on his debts and compares them to potential investment returns. His credit card debt has the highest interest rate (18%), followed by his auto loan (6%), and his mortgage (4%).

- Prioritize High-Interest Debt: Ravi decides to prioritize paying off his credit card debt first, as the interest rate is much higher than the potential returns from most investments.

- Balance Debt Repayment and Investing: After paying off his credit card debt, Ravi considers his auto loan and mortgage. Since the interest rates on these debts are lower, he decides to balance both debt repayment and investing. He continues to make regular payments on his auto loan and mortgage while also investing a portion of his income in a diversified portfolio of stocks and bonds.

- Set Financial Goals: Ravi sets clear financial goals, such as building an emergency fund, saving for his children’s education, and planning for retirement. He allocates funds accordingly, ensuring he maintains a balance between debt repayment and investing.

By carefully evaluating his interest rates, financial goals, and risk tolerance, Ravi makes an informed decision that aligns with his overall financial strategy. This balanced approach allows him to reduce debt, build wealth, and achieve long-term financial stability.

6.5 Is credit card good or Bad?

Credit cards can be a powerful financial tool when used responsibly, offering convenience, rewards, and the ability to build a positive credit history. However, they can also lead to financial pitfalls if not managed wisely, resulting in high-interest debt and financial stress. Understanding the benefits and risks of credit cards is essential for making informed decisions about their use.

Advantages of Credit Cards

- Convenience: Credit cards offer a convenient way to make purchases without carrying cash. They are widely accepted and can be used for online shopping, travel, and everyday expenses.

- Build Credit History: Responsible use of credit cards can help you build a positive credit history and improve your credit score. A good credit score is essential for obtaining loans and favorable interest rates.

- Rewards and Benefits: Many credit cards offer rewards programs, cashback, travel points, and other benefits that can save you money and provide additional value.

- Emergency Funds: Credit cards can serve as a financial safety net in emergencies, providing access to funds when needed.

- Fraud Protection: Credit cards often come with fraud protection features, making it easier to dispute unauthorized charges and protect your financial information.

Disadvantages of Credit Cards

- High-Interest Rates: Credit card debt can carry high-interest rates, leading to substantial interest charges if you don’t pay off the balance in full each month.

- Temptation to Overspend: Credit cards can encourage overspending, leading to debt accumulation and financial stress.

- Fees and Penalties: Late payments, annual fees, and other charges can add up, increasing the overall cost of using a credit card.

- Impact on Credit Score: Missed or late payments, high credit utilization, and carrying large balances can negatively impact your credit score.

- Debt Trap: Relying on credit cards for regular expenses without a repayment plan can lead to a debt trap, making it difficult to pay off the balance and accumulating more interest over time.

Example: Ravi’s Credit Card Journey

Ravi, used his credit card wisely for everyday expenses, paying off the balance in full each month. This helped him build a positive credit history and earn valuable rewards. However, one year, Ravi faced unexpected medical bills and started relying on his credit card for payments. The high-interest charges quickly added up, causing financial stress. Realizing the danger, Ravi created a budget, prioritized debt repayment, and sought financial advice. Through disciplined efforts, he paid off his credit card debt and regained financial stability, understanding the importance of responsible credit card use.

Whether a credit card is good or bad depends on your financial habits and how you use it. If used responsibly, credit cards can provide convenience, rewards, and help build a positive credit history. However, if not managed well, they can lead to high-interest debt, financial stress, and a negative impact on your credit score.

By understanding the benefits and risks, you can make informed decisions about how to use credit cards effectively and avoid potential pitfalls.

6.1 What is Debt Management and Types of Debt

Debt management involves strategies and methods for handling your financial obligations to ensure that you can meet your debt payments on time and reduce or eliminate debt over time. Effective debt management helps you maintain a good credit score, avoid financial stress, and achieve long-term financial goals. Here are key components of debt management:

- Budgeting: Creating and sticking to a budget to track income and expenses, ensuring you have enough funds to cover debt payments.

- Debt Repayment Plans: Developing a structured plan to pay off debts, often prioritizing high-interest debts first.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate, making it easier to manage payments.

- Negotiation: Communicating with creditors to negotiate lower interest rates or extended repayment terms.

- Credit Counselling: Seeking advice from credit counselling agencies to develop effective debt management strategies.

- Avoiding New Debt: Reducing the use of credit cards and avoiding taking on additional debt while paying off existing obligations.

Types of Debt

- Secured Debt: Debt backed by collateral. If the borrower defaults, the lender can seize the collateral to recover the debt.

- Unsecured Debt: Debt that is not backed by collateral. Lenders rely on the borrower’s creditworthiness and ability to repay.

- Revolving Debt: Debt that allows the borrower to borrow up to a certain credit limit and repay it over time, with the option to borrow again.

- Installments Debt: Debt that is repaid in fixed monthly installments over a specified period.

- Credit Card Debt: A type of revolving debt incurred by using a credit card to make purchases. Interest is charged on the outstanding balance if not paid in full by the due date.

- Student Loans: Loans taken out to finance education expenses. They can be federal or private loans, with varying interest rates and repayment terms.

- Mortgages: Secured loans used to purchase real estate. The property serves as collateral, and the loan is repaid over a long period, typically 15 to 30 years.

- Auto Loans: Secured loans used to finance the purchase of a vehicle. The vehicle serves as collateral for the loan.

- Payday Loans: Short-term, high-interest loans intended to cover immediate expenses until the borrower’s next payday. They are often considered predatory due to their high fees and interest rates.

- Business Loans: Loans taken out by businesses to finance operations, expansion, or other business activities. They can be secured or unsecured.

Ravi’s Debt Management

Ravi’s Profile:

- Age: 40 years

- Occupation: Corporate Employee

- Debt: Home mortgage, auto loan, credit card debt

Debt Management Strategies:

- Budgeting: Ravi creates a monthly budget to track his income and expenses. With a monthly salary of ₹70,000, he ensures that he allocates a portion of his income to cover his debt payments.

- Debt Repayment Plan: He prioritizes paying off his credit card debt first, as it has the highest interest rate. He makes extra payments towards his credit card debt whenever possible.

- Debt Consolidation: He consolidates his multiple credit card debts into a single personal loan with a lower interest rate. This makes it easier for him to manage his payments and reduces the overall interest burden.

- Negotiation: He contacts his credit card issuer to negotiate a lower interest rate on his outstanding balance. He successfully secures a lower rate, reducing his monthly payments.

- Credit Counselling: He seeks advice from a credit counselling agency to develop an effective debt management strategy. The counsellor helps him create a realistic repayment plan and provides tips on improving his financial habits.

- Avoiding New Debt: He minimizes the use of his credit cards and avoids taking on new debt while focusing on paying off his existing obligations. He saves up for future expenses instead of relying on credit.

By following these debt management strategies, Ravi effectively manages his debts and works towards financial stability. He feels more in control of his finances and confident about his future, demonstrating the importance of proactive debt management.

6.2 Strategies to manage Debt

Managing debt effectively is crucial for maintaining financial health and achieving long-term financial goals. Here are some key strategies to help you manage debt:

-

Create a Budget

- Track Income and Expenses: Start by tracking your monthly income and expenses to understand your financial situation.

- Allocate Funds: Allocate a portion of your income specifically for debt repayment.

- Cut Unnecessary Expenses: Identify areas where you can cut back on spending to free up more money for debt repayment.

-

Develop a Debt Repayment Plan

- List All Debts: Make a list of all your debts, including the outstanding balance, interest rate, and minimum monthly payment for each.

- Prioritize High-Interest Debts: Focus on paying off high-interest debts first, as they cost you the most in interest over time.

- Debt Snowball Method: Alternatively, you can use the debt snowball method, where you pay off the smallest debt first and then move on to the next smallest debt.

-

Consolidate Debt

- Debt Consolidation Loan: Consider consolidating multiple debts into a single loan with a lower interest rate. This can simplify your payments and reduce overall interest costs.

- Balance Transfer: Transfer high-interest credit card balances to a card with a lower interest rate, if possible.

-

Negotiate with Creditors

- Lower Interest Rates: Contact your creditors to negotiate lower interest rates or more favourable repayment terms.

- Debt Settlement: In some cases, creditors may be willing to settle for a lump-sum payment that is less than the total amount owed.

- Use the Avalanche Method

- High-Interest First: Pay off debts with the highest interest rates first while making minimum payments on other debts. This method reduces the overall interest paid over time.

-

Seek Professional Help

- Credit Counselling: Work with a credit counselling agency to develop a debt management plan and get advice on managing your finances.

- Debt Management Plan (DMP): Enroll in a DMP, where the credit counselling agency negotiates with your creditors and creates a structured repayment plan.

-

Avoid New Debt

- Limit Credit Card Use: Minimize the use of credit cards while you focus on paying off existing debt.

- Save for Purchases: Save up for purchases instead of relying on credit. This helps prevent accumulating more debt.

-

Increase Income

- Side Hustles: Consider taking on a part-time job or freelance work to increase your income and accelerate debt repayment.

- Sell Unused Items: Sell items you no longer need to generate extra cash for debt repayment.

-

Automate Payments

- Automatic Payments: Set up automatic payments to ensure you never miss a debt payment. This helps avoid late fees and keeps you on track.

-

Monitor Your Credit

- Credit Reports: Regularly check your credit reports to ensure they are accurate and to monitor your progress.

- Credit Score: Keep an eye on your credit score and take steps to improve it, as a good credit score can lead to better interest rates in the future.

Example

Ravi, a diligent 40-year-old corporate employee, lived in a bustling town with his wife Priya and their two children. Although he loved his job and always aimed to provide the best for his family, Ravi had accumulated debt over the years—a home mortgage, an auto loan, and credit card debt. One evening, Ravi and Priya decided to take control of their finances. They created a budget to track their ₹70,000 monthly income and expenses, identifying areas to cut back and allocating funds for debt repayment. Prioritizing high-interest credit card debt, they consolidated it into a lower-interest personal loan and negotiated lower rates with their issuer. They set up automatic payments to avoid late fees and sought advice from a credit counselling agency. Every six months, Ravi reviewed their investments to ensure alignment with financial goals, taking freelance work and selling unused items to increase debt repayment funds. Over time, their efforts paid off: their debt decreased, they avoided new debt, and their financial stability improved. Ravi’s proactive debt management secured a stable future for his family, allowing them to focus on their dreams without financial stress.

6.3. How to avoid unnecessary Debt?

Managing debt effectively involves a combination of strategies to ensure financial stability and avoid unnecessary debt. One of the foundational steps is creating and sticking to a budget. By tracking your monthly income and expenses, you can allocate funds specifically for debt repayment and identify areas where you can cut back on spending. This disciplined approach helps you maintain control over your finances and prevents overspending.

Differentiating between needs and wants is also crucial. Focus on spending money on essential items like housing, utilities, groceries, and healthcare. Avoid impulse purchases and take time to consider whether a purchase is necessary. Using credit cards wisely is another important strategy. Aim to pay off your credit card balances in full each month to avoid interest charges, and limit credit card use to necessary purchases and emergencies.

Saving for major purchases is a proactive way to avoid debt. Build a savings fund for big-ticket items like a car, vacation, or home renovations instead of relying on credit. Setting specific savings goals and working towards them over time ensures that you don’t accumulate unnecessary debt. Additionally, maintaining an emergency fund equivalent to 3-6 months’ worth of living expenses provides a financial cushion for unexpected expenses, allowing you to avoid using credit for emergencies.

Educating yourself on financial literacy is essential for managing debt effectively. Understanding how interest rates work and staying informed about financial management best practices can help you make informed decisions. Regularly monitoring your finances and making adjustments as needed ensures that you stay on track with your budget and savings goals.

Avoiding temptations and peer pressure is also important. Stay focused on your financial goals and set personal boundaries to avoid unnecessary spending in social situations. Lastly, seeking professional advice from financial advisors or credit counselling agencies can provide personalized recommendations and support for managing your finances and avoiding debt.

Example

Ravi, a corporate employee, was determined to avoid unnecessary debt and maintain financial stability for his family. Here’s how he did it:

Budgeting and Planning

Ravi created a monthly budget to track his income and expenses. He set spending limits for different categories and allocated a portion of his income for savings. By differentiating between needs and wants, Ravi focused on spending money on essential items and avoided impulse purchases.

Wise Use of Credit Cards

Ravi used credit cards wisely, paying off his balances in full each month to avoid interest charges. He limited credit card use to necessary purchases and emergencies, ensuring he didn’t accumulate unnecessary debt.

Saving for Major Purchases

Ravi built a savings fund for big-ticket items like vacations and home renovations. He set specific savings goals and worked towards achieving them over time, avoiding the need to rely on credit.

Emergency Fund

Ravi maintained an emergency fund equivalent to six months’ worth of living expenses. This fund provided a financial cushion for unexpected expenses, allowing him to avoid using credit for emergencies.

Financial Literacy

Ravi educated himself on financial management and best practices for avoiding debt. He understood how interest rates worked and stayed informed about financial trends.

Regular Financial Check-Ins

Ravi regularly reviewed his financial situation to ensure he was on track with his budget and savings goals. He made adjustments as needed to stay on track and avoid unnecessary debt.

By following these strategies, Ravi successfully avoided unnecessary debt and maintained financial stability for his family. His proactive approach to managing finances allowed him to focus on his long-term financial goals and achieve peace of mind.

6.4 Investment vs Debt repayment what should you choose?

Choosing between investing and repaying debt depends on your individual financial situation and goals. Both options have their advantages, and the right choice for you will depend on various factors such as interest rates, potential investment returns, and your overall financial goals. Here are some considerations to help you decide:

- Interest Rates

- High-Interest Debt: If you have high-interest debt (e.g., credit card debt with an interest rate of 15% or more), it generally makes sense to focus on paying it off first. The guaranteed return on debt repayment (in the form of interest saved) is often higher than what you can earn from most investments.

- Low-Interest Debt: If your debt has a lower interest rate (e.g., a mortgage with a 3-4% interest rate), you might consider investing, especially if you can earn a higher return on your investments.

- Potential Investment Returns

- Stock Market: Historically, the stock market has provided average annual returns of around 7-10% after adjusting for inflation. If you have low-interest debt, investing in the stock market could potentially offer higher returns over the long term.

- Bonds and Savings Accounts: These typically offer lower returns compared to the stock market. If the interest rate on your debt is higher than the returns from bonds or savings accounts, paying off the debt might be the better choice.

- Financial Goals

- Short-Term Goals: If you have short-term financial goals (e.g., saving for a down payment on a house), prioritizing debt repayment might free up cash flow and reduce financial stress.

- Long-Term Goals: For long-term goals (e.g., retirement savings), balancing both debt repayment and investing can help you build wealth over time.

- Risk Tolerance

- Low Risk Tolerance: If you prefer a low-risk approach, paying off debt provides a guaranteed return in the form of interest saved. It also reduces financial risk and improves your overall financial security.

- Higher Risk Tolerance: If you can tolerate higher risk, investing might be an attractive option, especially if you have a long investment horizon and can ride out market fluctuations.

- Financial Stability

- Emergency Fund: Before focusing on debt repayment or investing, ensure you have an emergency fund equivalent to 3-6 months’ worth of living expenses. This provides a financial cushion for unexpected expenses.

- Cash Flow: Consider your monthly cash flow. Paying off debt can improve your cash flow by reducing monthly payments, while investing can help build long-term wealth.

Example: Ravi’s Decision-Making Process

Ravi has a home mortgage with a 4% interest rate, an auto loan with a 6% interest rate, and credit card debt with an 18% interest rate. Ravi also wants to start investing for his future.

Step-by-Step Decision-Making:

- Evaluate Interest Rates: Ravi starts by evaluating the interest rates on his debts and compares them to potential investment returns. His credit card debt has the highest interest rate (18%), followed by his auto loan (6%), and his mortgage (4%).

- Prioritize High-Interest Debt: Ravi decides to prioritize paying off his credit card debt first, as the interest rate is much higher than the potential returns from most investments.

- Balance Debt Repayment and Investing: After paying off his credit card debt, Ravi considers his auto loan and mortgage. Since the interest rates on these debts are lower, he decides to balance both debt repayment and investing. He continues to make regular payments on his auto loan and mortgage while also investing a portion of his income in a diversified portfolio of stocks and bonds.

- Set Financial Goals: Ravi sets clear financial goals, such as building an emergency fund, saving for his children’s education, and planning for retirement. He allocates funds accordingly, ensuring he maintains a balance between debt repayment and investing.

By carefully evaluating his interest rates, financial goals, and risk tolerance, Ravi makes an informed decision that aligns with his overall financial strategy. This balanced approach allows him to reduce debt, build wealth, and achieve long-term financial stability.

6.5 Is credit card good or Bad?

Credit cards can be a powerful financial tool when used responsibly, offering convenience, rewards, and the ability to build a positive credit history. However, they can also lead to financial pitfalls if not managed wisely, resulting in high-interest debt and financial stress. Understanding the benefits and risks of credit cards is essential for making informed decisions about their use.

Advantages of Credit Cards

- Convenience: Credit cards offer a convenient way to make purchases without carrying cash. They are widely accepted and can be used for online shopping, travel, and everyday expenses.

- Build Credit History: Responsible use of credit cards can help you build a positive credit history and improve your credit score. A good credit score is essential for obtaining loans and favorable interest rates.

- Rewards and Benefits: Many credit cards offer rewards programs, cashback, travel points, and other benefits that can save you money and provide additional value.

- Emergency Funds: Credit cards can serve as a financial safety net in emergencies, providing access to funds when needed.

- Fraud Protection: Credit cards often come with fraud protection features, making it easier to dispute unauthorized charges and protect your financial information.

Disadvantages of Credit Cards

- High-Interest Rates: Credit card debt can carry high-interest rates, leading to substantial interest charges if you don’t pay off the balance in full each month.

- Temptation to Overspend: Credit cards can encourage overspending, leading to debt accumulation and financial stress.

- Fees and Penalties: Late payments, annual fees, and other charges can add up, increasing the overall cost of using a credit card.

- Impact on Credit Score: Missed or late payments, high credit utilization, and carrying large balances can negatively impact your credit score.

- Debt Trap: Relying on credit cards for regular expenses without a repayment plan can lead to a debt trap, making it difficult to pay off the balance and accumulating more interest over time.

Example: Ravi’s Credit Card Journey

Ravi, used his credit card wisely for everyday expenses, paying off the balance in full each month. This helped him build a positive credit history and earn valuable rewards. However, one year, Ravi faced unexpected medical bills and started relying on his credit card for payments. The high-interest charges quickly added up, causing financial stress. Realizing the danger, Ravi created a budget, prioritized debt repayment, and sought financial advice. Through disciplined efforts, he paid off his credit card debt and regained financial stability, understanding the importance of responsible credit card use.

Whether a credit card is good or bad depends on your financial habits and how you use it. If used responsibly, credit cards can provide convenience, rewards, and help build a positive credit history. However, if not managed well, they can lead to high-interest debt, financial stress, and a negative impact on your credit score.

By understanding the benefits and risks, you can make informed decisions about how to use credit cards effectively and avoid potential pitfalls.