- Study

- Slides

- Videos

7.1 What are the Right Investment Options

Low-Risk Investments

Fixed Deposits (FDs): Fixed deposits are one of the safest investment options where you deposit a lump sum of money with a bank for a fixed tenure at a predetermined interest rate. The interest rate is guaranteed, and you receive the principal amount along with the interest at the end of the tenure. FDs are ideal for risk-averse investors looking for stable returns without market volatility. They offer flexible tenures ranging from a few months to several years, allowing you to choose based on your financial goals.

Public Provident Fund (PPF): The Public Provident Fund is a government-backed long-term saving scheme with attractive interest rates and tax benefits. With a lock-in period of 15 years, PPF encourages disciplined saving while offering compounded interest. Contributions to PPF are eligible for tax deductions under Section 80C of the Income Tax Act, and the interest earned is tax-free. PPF is suitable for individuals seeking a safe and tax-efficient investment option for long-term financial goals such as retirement or education.

National Savings Certificate (NSC): NSC is a fixed-income investment scheme offered by the Government of India. It provides guaranteed returns at a fixed interest rate, with a maturity period of 5 or 10 years. NSCs can be purchased from post offices, and the interest earned is reinvested annually, leading to compound growth. Investments in NSC are eligible for tax deductions under Section 80C, making it an attractive option for risk-averse investors seeking tax-saving benefits and stable returns.

Medium-Risk Investments

Debt Mutual Funds: Debt mutual funds invest in a mix of government and corporate bonds, treasury bills, and other fixed-income securities. These funds aim to provide regular income and capital preservation with moderate risk. Debt funds are suitable for investors looking for better returns than traditional savings accounts or fixed deposits, with relatively lower risk than equity investments. They offer liquidity and can be tailored to various investment horizons, from short-term to long-term.

Corporate Bonds: Corporate bonds are debt securities issued by companies to raise capital. Investors lend money to the company in exchange for regular interest payments and the return of the principal amount at maturity. Corporate bonds typically offer higher interest rates than government bonds, reflecting the higher risk associated with the issuing company. They are ideal for investors seeking fixed income with a moderate risk tolerance, and can be diversified across different companies and industries to manage risk.

Balanced Mutual Funds: Balanced mutual funds, also known as hybrid funds, invest in a mix of equity (stocks) and debt (bonds) to achieve a balanced risk-return profile. These funds aim to provide capital appreciation through equity investments while ensuring stability and income through debt investments. Balanced funds are suitable for investors looking for a diversified portfolio that balances growth and stability, making them a good option for medium-term financial goals.

High-Risk Investments

Equity Mutual Funds: Equity mutual funds pool money from investors to invest in a diversified portfolio of stocks. These funds aim to provide long-term capital appreciation by investing in shares of companies across various sectors. Equity funds are subject to market volatility and can offer high returns over the long term, making them suitable for investors with a higher risk tolerance and a longer investment horizon. Different types of equity funds, such as large-cap, mid-cap, and small-cap funds, cater to varying risk appetites and investment objectives.

Direct Equity: Investing directly in stocks involves buying shares of individual companies through stock exchanges. This investment option requires a good understanding of the stock market and the ability to analyze company performance and market trends. Direct equity investments carry significant risk due to market volatility but can offer substantial returns. They are ideal for experienced investors with a high-risk tolerance and the ability to actively manage their portfolios.

Real Estate: Real estate investment involves purchasing property for rental income or capital appreciation. This investment option requires substantial capital and market knowledge. Real estate can provide steady rental income and potential for significant value appreciation over time. However, it also comes with risks such as property market fluctuations, maintenance costs, and liquidity challenges. Real estate is suitable for investors with a long-term perspective and the ability to manage physical assets.

Diversification

Diversification is a key strategy in investment management, involving spreading investments across different asset classes (such as stocks, bonds, real estate, and commodities) to manage risk and optimize returns. By diversifying your portfolio, you reduce the impact of poor performance in any single investment. A well-diversified portfolio balances risk and return based on your financial goals, risk tolerance, and investment horizon.

Regular Review

Regularly reviewing your investment portfolio is essential to ensure it remains aligned with your financial goals and risk tolerance. Market conditions and personal circumstances can change, necessitating adjustments to your investments. Periodic reviews help identify underperforming assets, rebalance your portfolio, and make informed decisions to achieve your long-term financial objectives.

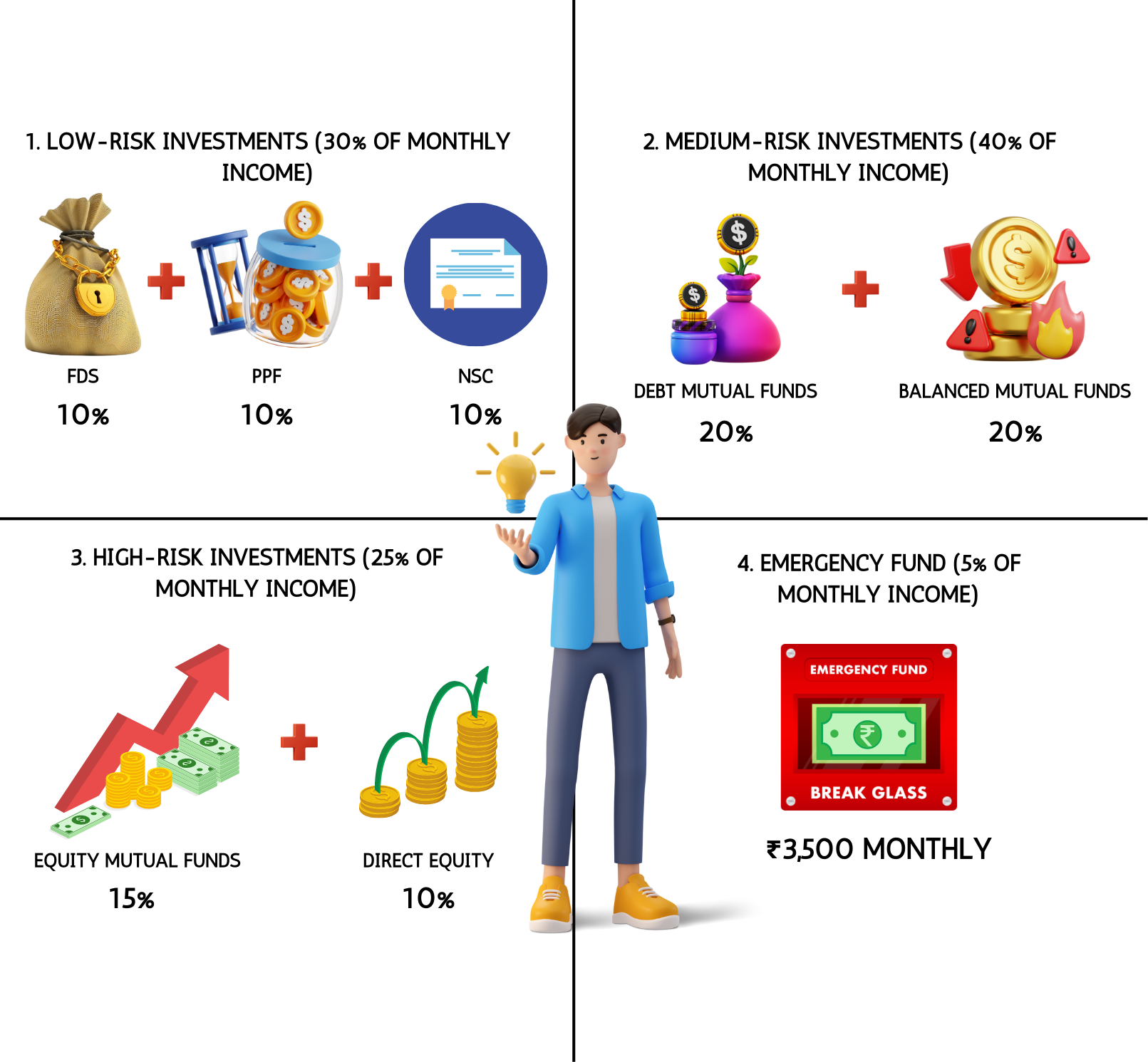

Investment Plan for Ravi

Investment Allocation:

Low-Risk Investments (30%)

Fixed Deposits (FDs): ₹7,000 per month (10% of income)

FDs will provide Ravi with guaranteed returns and safety of capital.

Public Provident Fund (PPF): ₹7,000 per month (10% of income)

PPF will offer Ravi long-term tax-efficient savings with attractive interest rates.

National Savings Certificate (NSC): ₹7,000 per month (10% of income)

NSC will provide Ravi with safe and stable returns, along with tax benefits.

Medium-Risk Investments (40%)

Debt Mutual Funds: ₹14,000 per month (20% of income)

Debt mutual funds will offer better returns than traditional savings instruments with lower risk compared to equities.

Balanced Mutual Funds: ₹14,000 per month (20% of income)

Balanced funds will provide a mix of equity and debt exposure, balancing growth potential with stability.

High-Risk Investments (25%)

Equity Mutual Funds: ₹10,500 per month (15% of income)

Equity mutual funds will offer Ravi potential for high returns by investing in a diversified portfolio of stocks.

Direct Equity: ₹7,000 per month (10% of income)

Direct equity investments will allow Ravi to invest in individual stocks with the potential for substantial returns, though with higher risk.

Emergency Fund (5%)

Savings Account/Liquid Fund: ₹3,500 per month (5% of income)

Building an emergency fund will ensure Ravi has readily available cash for unexpected expenses.

Diversification:

-

- Ravi’s investment plan includes a mix of low, medium, and high-risk investments to balance risk and return.

- Regular contributions to FDs, PPF, and NSC ensure safety and tax benefits.

- Debt and balanced mutual funds offer moderate returns with controlled risk.

- Equity mutual funds and direct equity investments provide growth potential.

Regular Review:

Ravi should review his investment portfolio annually to ensure it aligns with his financial goals and make adjustments based on market conditions and personal circumstances.

7.2 What is a risk-return pyramid?

Risk-Return Pyramid

The risk-return pyramid is a framework that categorizes investments based on their level of risk and potential return. It’s shaped like a pyramid to illustrate the proportion of different investment types within a diversified portfolio.

Base of the Pyramid: Low Risk, Low Return

Description: The base of the pyramid consists of investments that offer low risk and consequently low returns. These investments are typically stable and provide capital preservation, making them ideal for risk-averse investors.

Examples:

- Savings Accounts: These are basic bank accounts that provide interest on the deposited amount. They offer high liquidity and safety but usually have low interest rates.

- Fixed Deposits (FDs): FDs involve depositing a lump sum of money with a bank for a fixed tenure at a predetermined interest rate. The interest is guaranteed, and the principal amount is returned at the end of the tenure. FDs are safe and provide stable returns.

- Government Bonds: These are debt securities issued by the government to raise funds. They offer regular interest payments and return the principal amount at maturity. Government bonds are low-risk as they are backed by the government.

- Public Provident Fund (PPF): PPF is a long-term saving scheme with tax benefits. It has a lock-in period of 15 years and offers attractive interest rates, compounded annually. Contributions to PPF are eligible for tax deductions, and the interest earned is tax-free.

- National Savings Certificate (NSC): NSC is a government-backed savings scheme with a fixed interest rate and a maturity period of 5 or 10 years. The interest earned is reinvested annually, and the principal and interest are returned at maturity. NSC investments are eligible for tax deductions.

Middle of the Pyramid: Medium Risk, Medium Return

Description: The middle layer of the pyramid includes investments that have a moderate level of risk and offer moderate returns. These investments aim to provide a balance between growth and stability.

Examples:

- Debt Mutual Funds: These funds invest in a mix of government and corporate bonds, treasury bills, and other fixed-income securities. They aim to provide regular income and capital preservation with moderate risk. Debt funds offer better returns than traditional savings accounts but carry some risk.

- Corporate Bonds: Corporate bonds are debt securities issued by companies to raise capital. Investors lend money to the company in exchange for regular interest payments and the return of the principal at maturity. Corporate bonds typically offer higher interest rates than government bonds but come with slightly higher risk.

- Balanced Mutual Funds: Also known as hybrid funds, balanced mutual funds invest in a mix of equity (stocks) and debt (bonds) to achieve a balanced risk-return profile. They aim to provide capital appreciation through equity investments while ensuring stability and income through debt investments. These funds are suitable for investors looking for a diversified portfolio that balances growth and stability.

- Real Estate: Investing in real estate involves purchasing property for rental income or capital appreciation. Real estate can provide steady rental income and potential for significant value appreciation over time. However, it requires substantial capital and market knowledge and comes with risks such as property market fluctuations and maintenance costs.

Top of the Pyramid: High Risk, High Return

Description: The top of the pyramid represents investments with high risk and high potential returns. These investments are more volatile and can lead to significant gains or losses.

Examples:

- Equity Mutual Funds: These funds pool money from investors to invest in a diversified portfolio of stocks. They aim to provide long-term capital appreciation by investing in shares of companies across various sectors. Equity funds are subject to market volatility and can offer high returns over the long term, making them suitable for investors with a higher risk tolerance.

- Direct Equity: Investing directly in stocks involves buying shares of individual companies through stock exchanges. This option requires a good understanding of the stock market and the ability to analyze company performance and market trends. Direct equity investments carry significant risk due to market volatility but can offer substantial returns.

- Commodities: Investing in commodities such as gold, silver, or oil can provide high returns but comes with high risk due to price fluctuations. Commodities can be a hedge against inflation but require market knowledge and timing.

- Cryptocurrency: Cryptocurrencies are digital assets that operate on blockchain technology. They can offer high returns but are highly volatile and speculative. Investing in cryptocurrencies requires a high risk tolerance and an understanding of the market dynamics.

Key Takeaways

- Risk and Return Relationship: Generally, the higher the risk, the higher the potential return, and vice versa. Investors need to understand their risk tolerance and investment goals to make informed decisions.

- Diversification: Diversification involves spreading investments across different asset classes to manage overall portfolio risk and optimize returns. A well-diversified portfolio balances risk and return based on individual financial goals and risk appetite.

- Investment Goals: Investors should consider their financial goals, risk tolerance, and time horizon when choosing investments from different layers of the pyramid. For example, someone close to retirement may prefer low-risk investments, while a younger investor with a longer time horizon may opt for higher-risk options.

7.3. How to design your portfolio?

Designing an investment portfolio involves a few key steps to ensure it aligns with your financial goals, risk tolerance, and time horizon. Here’s a comprehensive guide to help you design your portfolio:

- Set Clear Financial Goals

- Short-Term Goals: (0-3 years) Examples include saving for a vacation, emergency fund, or a down payment on a house.

- Medium-Term Goals: (3-7 years) Examples include funding a child’s education or purchasing a car.

- Long-Term Goals: (7+ years) Examples include retirement planning or creating wealth.

- Assess Your Risk Tolerance

Understand how comfortable you are with the ups and downs of the market. Risk tolerance is influenced by factors such as age, financial stability, investment experience, and time horizon.

- Determine Asset Allocation

Decide on the percentage of your portfolio to allocate to different asset classes based on your risk tolerance and financial goals. A typical asset allocation might include:

- Equities (Stocks): Higher potential returns but higher risk.

- Bonds (Fixed Income): Moderate returns with lower risk compared to equities.

- Cash and Cash Equivalents: Highly liquid and low risk, but with lower returns.

- Real Estate: Potential for steady income and capital appreciation.

- Commodities: Diversification and a hedge against inflation.

- Diversify Your Investments

Spread your investments across different asset classes, industries, and geographic regions to manage risk and optimize returns. Diversification reduces the impact of poor performance in any single investment.

- Select Investment Vehicles

Choose specific investment options within each asset class. For example:

- Equities: Direct stocks, equity mutual funds, or exchange-traded funds (ETFs).

- Bonds: Government bonds, corporate bonds, or bond mutual funds.

- Real Estate: Real estate investment trusts (REITs) or direct property investment.

- Commodities: Gold, silver, or commodity ETFs.

- Regularly Rebalance Your Portfolio

Periodically review and adjust your portfolio to ensure it remains aligned with your financial goals and asset allocation strategy. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain your desired allocation.

- Stay Informed and Make Informed Decisions

Stay updated with market trends, economic conditions, and changes in your financial situation. Make informed investment decisions based on research and analysis.

Example- Investment Portfolio for Ravi

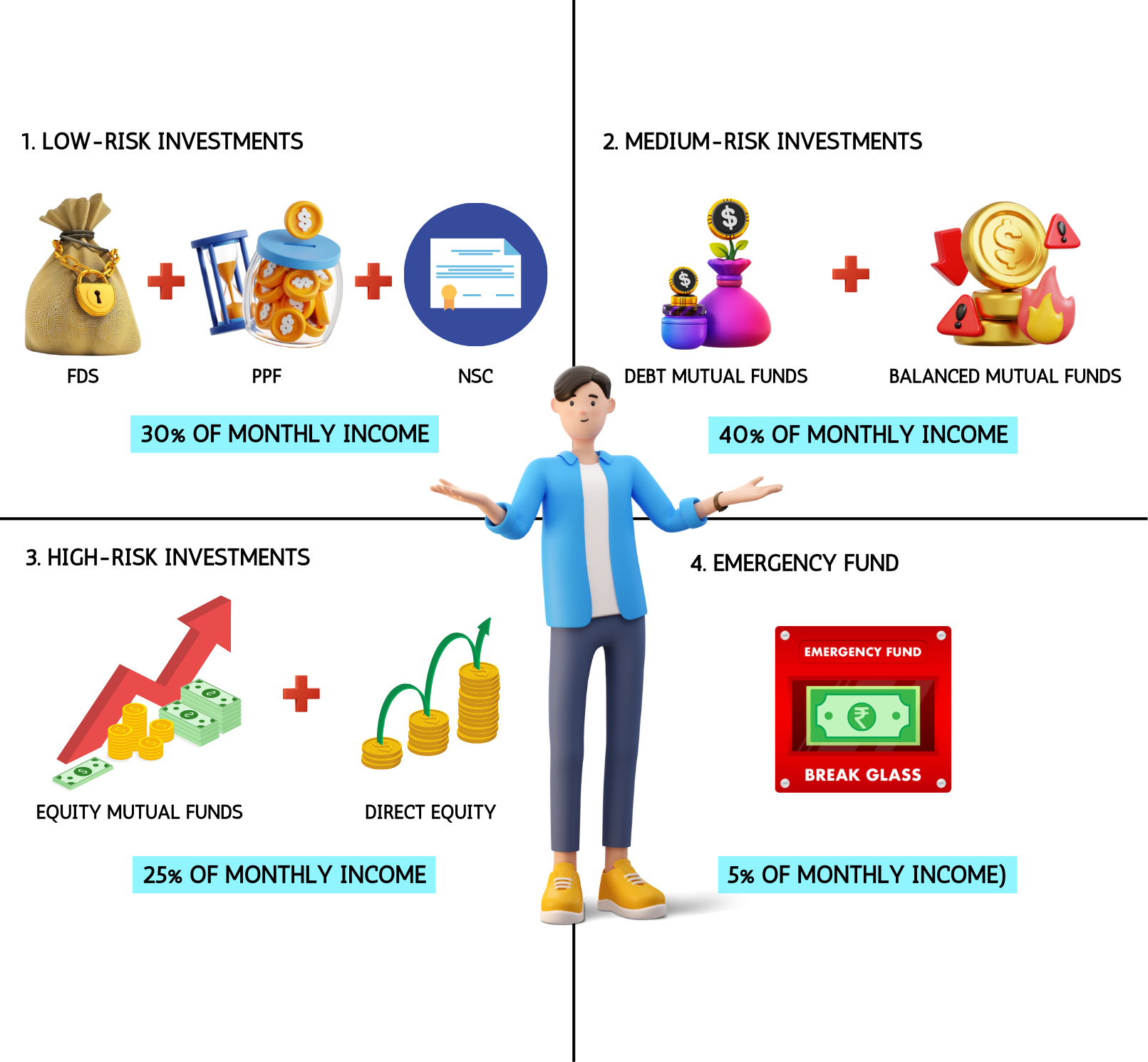

- Low-Risk Investments (30% of Monthly Income)

Fixed Deposits (FDs): ₹7,000 per month (10% of income)

Ravi sets aside ₹7,000 each month in fixed deposits. This provides him with guaranteed returns and ensures the safety of his capital. He chooses FDs with different tenures to have a mix of short-term and long-term savings.

Public Provident Fund (PPF): ₹7,000 per month (10% of income)

Ravi contributes ₹7,000 monthly to his PPF account. This long-term savings scheme offers attractive interest rates and tax benefits. With a 15-year lock-in period, it helps Ravi build a substantial retirement corpus.

National Savings Certificate (NSC): ₹7,000 per month (10% of income)

Ravi invests ₹7,000 monthly in NSCs, a government-backed scheme offering fixed interest rates and tax benefits. NSC investments are safe and provide stable returns, helping Ravi with secure and tax-efficient savings.

- Medium-Risk Investments (40% of Monthly Income)

Debt Mutual Funds: ₹14,000 per month (20% of income)

Ravi allocates ₹14,000 monthly to debt mutual funds. These funds invest in government and corporate bonds, providing moderate returns with lower risk compared to equity investments. They offer better returns than traditional savings accounts.

Balanced Mutual Funds: ₹14,000 per month (20% of income)

Ravi invests ₹14,000 monthly in balanced mutual funds, which combine equity and debt investments. This balanced risk-return profile helps Ravi achieve growth while ensuring stability in his portfolio.

- High-Risk Investments (25% of Monthly Income)

Equity Mutual Funds: ₹10,500 per month (15% of income)

Ravi invests ₹10,500 monthly in equity mutual funds, which pool money from investors to invest in a diversified portfolio of stocks. These funds offer the potential for long-term capital appreciation but come with higher risk due to market volatility.

Direct Equity: ₹7,000 per month (10% of income)

Ravi invests ₹7,000 monthly in direct equity, buying shares of individual companies through stock exchanges. This option requires market knowledge and carries significant risk, but it can offer substantial returns if managed well.

- Emergency Fund (5% of Monthly Income)

Savings Account/Liquid Fund: ₹3,500 per month (5% of income)

Ravi allocates ₹3,500 monthly to a savings account or liquid fund to build an emergency fund. This ensures that he has readily available cash for unexpected expenses, providing financial security and peace of mind.

Diversification:

- Ravi’s portfolio includes a mix of low, medium, and high-risk investments, balancing safety, stability, and growth.

- Regular contributions to FDs, PPF, and NSC ensure secure and tax-efficient savings.

- Investments in debt and balanced mutual funds offer moderate returns with controlled risk.

- Equity mutual funds and direct equity provide growth potential, aligning with Ravi’s long-term goals.

Regular Review:

- Ravi should review his investment portfolio annually to ensure it remains aligned with his financial goals and make adjustments based on market conditions and personal circumstances.

Summary of Ravi’s Portfolio:

|

Investment Type |

Monthly Contribution |

Percentage of Income |

|

Fixed Deposits (FDs) |

₹7,000 |

10% |

|

Public Provident Fund (PPF) |

₹7,000 |

10% |

|

National Savings Certificate (NSC) |

₹7,000 |

10% |

|

Debt Mutual Funds |

₹14,000 |

20% |

|

Balanced Mutual Funds |

₹14,000 |

20% |

|

Equity Mutual Funds |

₹10,500 |

15% |

|

Direct Equity |

₹7,000 |

10% |

|

Savings Account/Liquid Fund |

₹3,500 |

5% |

By following this diversified investment plan, Ravi can work towards his long-term financial goals while managing risk effectively. This approach ensures a balanced portfolio that supports his financial well-being and future aspirations.

7.4 How to match your existing investments with Goals?

Matching your existing investments with your financial goals is a crucial step in ensuring you’re on the right track to achieving them. Here’s a step-by-step example similar to Ravi’s situation from yesterday:

- Identify Your Goals: List out your short-term, medium-term, and long-term financial goals. For example:

- Short-term: Vacation in Goa next year.

- Medium-term: Buying a car in 5 years.

- Long-term: Retirement in 25 years.

- Assess Your Current Investments: Take stock of all your current investments, such as stocks, mutual funds, fixed deposits, real estate, etc. For example, Ravi has:

- Stocks worth ₹5,00,000

- Mutual funds worth ₹3,00,000

- Fixed deposits worth ₹2,00,000

- Match Investments to Goals:

- Short-term Goals: For goals within the next 1-3 years, consider safer investments like fixed deposits or liquid mutual funds. For Ravi’s vacation in Goa, he could allocate ₹1,00,000 from his fixed deposits.

- Medium-term Goals: For goals within 3-7 years, consider balanced mutual funds or bonds. For Ravi’s car purchase, he could allocate ₹2,00,000 from his mutual funds.

- Long-term Goals: For goals beyond 7 years, consider higher-risk investments like stocks or equity mutual funds. For Ravi’s retirement, he could allocate ₹5,00,000 from his stocks and ₹1,00,000 from his mutual funds.

- Review and Adjust Regularly: Regularly review your investments and goals to ensure they are aligned. Market conditions and personal circumstances can change, so be flexible and adjust as needed.

Here’s a simple table to summarize Ravi’s example:

|

Goal |

Time Horizon |

Investment |

Amount |

|

Vacation in Goa |

Short-term |

Fixed Deposit |

₹1,00,000 |

|

Buying a Car |

Medium-term |

Mutual Funds |

₹2,00,000 |

|

Retirement |

Long-term |

Stocks & Mutual Funds |

₹6,00,000 |

By aligning his investments with his goals, Ravi can ensure he has the right amount of money available when he needs it. This approach provides a clear roadmap to achieving his financial objectives.

7.5 Is Gold Investment safe

Investing in gold is often considered a safe haven, especially during times of economic uncertainty. Here are some points to consider:

Pros of Gold Investment:

- Hedge Against Inflation: Gold tends to maintain its value over time and can act as a hedge against inflation.

- Diversification: Including gold in your investment portfolio can reduce overall risk by diversifying your assets.

- Liquidity: Gold is easily convertible to cash, making it a highly liquid asset.

- Historical Value: Gold has been valued for centuries, giving it a sense of stability and trust.

Cons of Gold Investment:

- No Regular Income: Unlike stocks or bonds, gold does not provide regular income in the form of dividends or interest.

- Storage Costs: Physical gold requires secure storage, which can incur additional costs.

- Price Volatility: Gold prices can be volatile in the short term, influenced by global economic conditions and market speculation.

Different Forms of Gold Investment:

- Physical Gold: Includes gold bars, coins, and jewelry.

- Gold ETFs: Exchange-traded funds that invest in gold.

- Gold Mining Stocks: Shares of companies involved in gold mining.

- Sovereign Gold Bonds: Government-issued bonds linked to the price of gold.

Is It Safe?

Gold is generally considered a low-risk investment, especially compared to more volatile assets like stocks. However, like any investment, it comes with its own set of risks and considerations. It’s essential to balance your investment in gold with other assets to achieve a diversified portfolio.

Reasons for Ravi to Invest in Gold:

- Hedge Against Inflation: Gold can help protect Ravi’s wealth from inflation, as its value tends to increase during inflationary periods.

- Diversification: Adding gold to his investment portfolio can reduce overall risk by diversifying his assets.

- Liquidity: Gold is highly liquid and can be easily converted to cash, providing Ravi with a safety net in case of emergencies.

Gold Investment Options for Ravi:

- Physical Gold: Ravi can invest in gold bars, coins, or jewelry. However, he should consider storage and insurance costs.

- Gold ETFs: Exchange-traded funds that invest in gold are convenient and eliminate the need for physical storage.

- Sovereign Gold Bonds: Government-issued bonds linked to the price of gold. These bonds also offer interest income, making them an attractive option.

Example Investment Plan for Ravi:

Let’s assume Ravi wants to allocate 15% of his annual income to gold investment.

- Annual Income: ₹70,000 x 12 = ₹8,40,000

- 15% Allocation: ₹8,40,000 x 0.15 = ₹1,26,000

Investment Breakdown:

- Gold ETFs: ₹70,000 (55%)

- Sovereign Gold Bonds: ₹56,000 (45%)

Here’s a simple table to summarize Ravi’s gold investment plan:

|

Investment Type |

Amount |

Percentage |

|

Gold ETFs |

₹70,000 |

55% |

|

Sovereign Gold Bonds |

₹56,000 |

45% |

Safety Considerations:

- Economic Stability: Gold is generally considered a safe investment, especially during times of economic uncertainty.

- No Regular Income: Unlike stocks or bonds, gold does not provide regular income (except for Sovereign Gold Bonds which offer interest).

- Market Volatility: Gold prices can fluctuate based on global economic conditions and market speculation.

By allocating a portion of his income to gold, Ravi can achieve diversification and wealth preservation. However, it’s essential for Ravi to review his investment strategy regularly and adjust it based on his financial goals and risk tolerance.

7.6 Gold vs Nifty 50 ?

Comparing gold and the Nifty 50 index can help you understand the different characteristics and potential benefits of each investment. Here’s a brief overview:

Gold:

- Hedge Against Inflation: Gold is often seen as a safe haven during economic uncertainty and inflation.

- Liquidity: Gold is highly liquid and can be easily converted to cash.

- No Regular Income: Unlike stocks, gold does not provide dividends or interest.

- Storage Costs: Physical gold requires secure storage, which can incur additional costs.

- Historical Performance: Gold has performed well during economic crises, such as the 2008 financial crisis and the COVID-19 pandemic.

Nifty 50:

- Growth Potential: The Nifty 50 index represents the top 50 companies listed on the National Stock Exchange (NSE) in India, offering growth potential through capital appreciation.

- Regular Income: Stocks in the Nifty 50 can provide dividends.

- Volatility: The stock market can be volatile, with prices influenced by various factors such as economic conditions, company performance, and global events.

- Diversification: Investing in the Nifty 50 provides exposure to a diversified portfolio of companies across different sectors.

Performance Comparison:

- Long-Term Returns: Over the long term, the Nifty 50 has generally outperformed gold. For example, in a 20-year period, the Nifty 50 has managed to outperform gold returns.

- Crisis Periods: During economic crises, gold tends to perform better as a safe haven, while stocks may suffer.

Here’s a simple table to summarize the comparison:

|

Aspect |

Gold |

Nifty 50 |

|

Hedge Against Inflation |

Yes |

No |

|

Liquidity |

High |

High |

|

Regular Income |

No |

Yes (Dividends) |

|

Storage Costs |

Yes (for physical gold) |

No |

|

Growth Potential |

Moderate |

High |

|

Volatility |

Low to Moderate |

High |

|

Performance in Crises |

Strong |

Weak |

|

Long-Term Returns |

Moderate |

High |

Example Investment Plan for Ravi:

Assume Ravi wants to allocate ₹1,50,000 from his annual savings to both gold and the Nifty 50, aiming for diversification and growth.

- Annual Income: ₹70,000 x 12 = ₹8,40,000

- Allocation for Investments: ₹1,50,000

Investment Breakdown:

- Gold ETFs: ₹60,000 (40%)

- Nifty 50 ETFs: ₹90,000 (60%)

Here’s a simple table to summarize Ravi’s investment plan:

|

Investment Type |

Amount |

Percentage |

|

Gold ETFs |

₹60,000 |

40% |

|

Nifty 50 ETFs |

₹90,000 |

60% |

Pros and Cons for Ravi:

- Gold:

- Pros: Hedge against inflation, high liquidity, safe investment during crises.

- Cons: No regular income, storage costs for physical gold.

- Nifty 50:

- Pros: High growth potential, regular income through dividends, diversified portfolio.

- Cons: Higher volatility, influenced by market conditions.

Performance Comparison:

- Long-Term Returns: Over a 20-year period, the Nifty 50 has generally outperformed gold in terms of returns.

- Crisis Periods: During economic crises, gold tends to perform better as a safe haven, while the Nifty 50 may suffer.

By investing in both gold and the Nifty 50, Ravi can achieve a balanced portfolio that leverages the growth potential of equities while benefiting from the stability and diversification offered by gold.

7.1 What are the Right Investment Options

Low-Risk Investments

Fixed Deposits (FDs): Fixed deposits are one of the safest investment options where you deposit a lump sum of money with a bank for a fixed tenure at a predetermined interest rate. The interest rate is guaranteed, and you receive the principal amount along with the interest at the end of the tenure. FDs are ideal for risk-averse investors looking for stable returns without market volatility. They offer flexible tenures ranging from a few months to several years, allowing you to choose based on your financial goals.

Public Provident Fund (PPF): The Public Provident Fund is a government-backed long-term saving scheme with attractive interest rates and tax benefits. With a lock-in period of 15 years, PPF encourages disciplined saving while offering compounded interest. Contributions to PPF are eligible for tax deductions under Section 80C of the Income Tax Act, and the interest earned is tax-free. PPF is suitable for individuals seeking a safe and tax-efficient investment option for long-term financial goals such as retirement or education.

National Savings Certificate (NSC): NSC is a fixed-income investment scheme offered by the Government of India. It provides guaranteed returns at a fixed interest rate, with a maturity period of 5 or 10 years. NSCs can be purchased from post offices, and the interest earned is reinvested annually, leading to compound growth. Investments in NSC are eligible for tax deductions under Section 80C, making it an attractive option for risk-averse investors seeking tax-saving benefits and stable returns.

Medium-Risk Investments

Debt Mutual Funds: Debt mutual funds invest in a mix of government and corporate bonds, treasury bills, and other fixed-income securities. These funds aim to provide regular income and capital preservation with moderate risk. Debt funds are suitable for investors looking for better returns than traditional savings accounts or fixed deposits, with relatively lower risk than equity investments. They offer liquidity and can be tailored to various investment horizons, from short-term to long-term.

Corporate Bonds: Corporate bonds are debt securities issued by companies to raise capital. Investors lend money to the company in exchange for regular interest payments and the return of the principal amount at maturity. Corporate bonds typically offer higher interest rates than government bonds, reflecting the higher risk associated with the issuing company. They are ideal for investors seeking fixed income with a moderate risk tolerance, and can be diversified across different companies and industries to manage risk.

Balanced Mutual Funds: Balanced mutual funds, also known as hybrid funds, invest in a mix of equity (stocks) and debt (bonds) to achieve a balanced risk-return profile. These funds aim to provide capital appreciation through equity investments while ensuring stability and income through debt investments. Balanced funds are suitable for investors looking for a diversified portfolio that balances growth and stability, making them a good option for medium-term financial goals.

High-Risk Investments

Equity Mutual Funds: Equity mutual funds pool money from investors to invest in a diversified portfolio of stocks. These funds aim to provide long-term capital appreciation by investing in shares of companies across various sectors. Equity funds are subject to market volatility and can offer high returns over the long term, making them suitable for investors with a higher risk tolerance and a longer investment horizon. Different types of equity funds, such as large-cap, mid-cap, and small-cap funds, cater to varying risk appetites and investment objectives.

Direct Equity: Investing directly in stocks involves buying shares of individual companies through stock exchanges. This investment option requires a good understanding of the stock market and the ability to analyze company performance and market trends. Direct equity investments carry significant risk due to market volatility but can offer substantial returns. They are ideal for experienced investors with a high-risk tolerance and the ability to actively manage their portfolios.

Real Estate: Real estate investment involves purchasing property for rental income or capital appreciation. This investment option requires substantial capital and market knowledge. Real estate can provide steady rental income and potential for significant value appreciation over time. However, it also comes with risks such as property market fluctuations, maintenance costs, and liquidity challenges. Real estate is suitable for investors with a long-term perspective and the ability to manage physical assets.

Diversification

Diversification is a key strategy in investment management, involving spreading investments across different asset classes (such as stocks, bonds, real estate, and commodities) to manage risk and optimize returns. By diversifying your portfolio, you reduce the impact of poor performance in any single investment. A well-diversified portfolio balances risk and return based on your financial goals, risk tolerance, and investment horizon.

Regular Review

Regularly reviewing your investment portfolio is essential to ensure it remains aligned with your financial goals and risk tolerance. Market conditions and personal circumstances can change, necessitating adjustments to your investments. Periodic reviews help identify underperforming assets, rebalance your portfolio, and make informed decisions to achieve your long-term financial objectives.

Investment Plan for Ravi

Investment Allocation:

Low-Risk Investments (30%)

Fixed Deposits (FDs): ₹7,000 per month (10% of income)

FDs will provide Ravi with guaranteed returns and safety of capital.

Public Provident Fund (PPF): ₹7,000 per month (10% of income)

PPF will offer Ravi long-term tax-efficient savings with attractive interest rates.

National Savings Certificate (NSC): ₹7,000 per month (10% of income)

NSC will provide Ravi with safe and stable returns, along with tax benefits.

Medium-Risk Investments (40%)

Debt Mutual Funds: ₹14,000 per month (20% of income)

Debt mutual funds will offer better returns than traditional savings instruments with lower risk compared to equities.

Balanced Mutual Funds: ₹14,000 per month (20% of income)

Balanced funds will provide a mix of equity and debt exposure, balancing growth potential with stability.

High-Risk Investments (25%)

Equity Mutual Funds: ₹10,500 per month (15% of income)

Equity mutual funds will offer Ravi potential for high returns by investing in a diversified portfolio of stocks.

Direct Equity: ₹7,000 per month (10% of income)

Direct equity investments will allow Ravi to invest in individual stocks with the potential for substantial returns, though with higher risk.

Emergency Fund (5%)

Savings Account/Liquid Fund: ₹3,500 per month (5% of income)

Building an emergency fund will ensure Ravi has readily available cash for unexpected expenses.

Diversification:

-

- Ravi’s investment plan includes a mix of low, medium, and high-risk investments to balance risk and return.

- Regular contributions to FDs, PPF, and NSC ensure safety and tax benefits.

- Debt and balanced mutual funds offer moderate returns with controlled risk.

- Equity mutual funds and direct equity investments provide growth potential.

Regular Review:

Ravi should review his investment portfolio annually to ensure it aligns with his financial goals and make adjustments based on market conditions and personal circumstances.

7.2 What is a risk-return pyramid?

Risk-Return Pyramid

The risk-return pyramid is a framework that categorizes investments based on their level of risk and potential return. It’s shaped like a pyramid to illustrate the proportion of different investment types within a diversified portfolio.

Base of the Pyramid: Low Risk, Low Return

Description: The base of the pyramid consists of investments that offer low risk and consequently low returns. These investments are typically stable and provide capital preservation, making them ideal for risk-averse investors.

Examples:

- Savings Accounts: These are basic bank accounts that provide interest on the deposited amount. They offer high liquidity and safety but usually have low interest rates.

- Fixed Deposits (FDs): FDs involve depositing a lump sum of money with a bank for a fixed tenure at a predetermined interest rate. The interest is guaranteed, and the principal amount is returned at the end of the tenure. FDs are safe and provide stable returns.

- Government Bonds: These are debt securities issued by the government to raise funds. They offer regular interest payments and return the principal amount at maturity. Government bonds are low-risk as they are backed by the government.

- Public Provident Fund (PPF): PPF is a long-term saving scheme with tax benefits. It has a lock-in period of 15 years and offers attractive interest rates, compounded annually. Contributions to PPF are eligible for tax deductions, and the interest earned is tax-free.

- National Savings Certificate (NSC): NSC is a government-backed savings scheme with a fixed interest rate and a maturity period of 5 or 10 years. The interest earned is reinvested annually, and the principal and interest are returned at maturity. NSC investments are eligible for tax deductions.

Middle of the Pyramid: Medium Risk, Medium Return

Description: The middle layer of the pyramid includes investments that have a moderate level of risk and offer moderate returns. These investments aim to provide a balance between growth and stability.

Examples:

- Debt Mutual Funds: These funds invest in a mix of government and corporate bonds, treasury bills, and other fixed-income securities. They aim to provide regular income and capital preservation with moderate risk. Debt funds offer better returns than traditional savings accounts but carry some risk.

- Corporate Bonds: Corporate bonds are debt securities issued by companies to raise capital. Investors lend money to the company in exchange for regular interest payments and the return of the principal at maturity. Corporate bonds typically offer higher interest rates than government bonds but come with slightly higher risk.

- Balanced Mutual Funds: Also known as hybrid funds, balanced mutual funds invest in a mix of equity (stocks) and debt (bonds) to achieve a balanced risk-return profile. They aim to provide capital appreciation through equity investments while ensuring stability and income through debt investments. These funds are suitable for investors looking for a diversified portfolio that balances growth and stability.

- Real Estate: Investing in real estate involves purchasing property for rental income or capital appreciation. Real estate can provide steady rental income and potential for significant value appreciation over time. However, it requires substantial capital and market knowledge and comes with risks such as property market fluctuations and maintenance costs.

Top of the Pyramid: High Risk, High Return

Description: The top of the pyramid represents investments with high risk and high potential returns. These investments are more volatile and can lead to significant gains or losses.

Examples:

- Equity Mutual Funds: These funds pool money from investors to invest in a diversified portfolio of stocks. They aim to provide long-term capital appreciation by investing in shares of companies across various sectors. Equity funds are subject to market volatility and can offer high returns over the long term, making them suitable for investors with a higher risk tolerance.

- Direct Equity: Investing directly in stocks involves buying shares of individual companies through stock exchanges. This option requires a good understanding of the stock market and the ability to analyze company performance and market trends. Direct equity investments carry significant risk due to market volatility but can offer substantial returns.

- Commodities: Investing in commodities such as gold, silver, or oil can provide high returns but comes with high risk due to price fluctuations. Commodities can be a hedge against inflation but require market knowledge and timing.

- Cryptocurrency: Cryptocurrencies are digital assets that operate on blockchain technology. They can offer high returns but are highly volatile and speculative. Investing in cryptocurrencies requires a high risk tolerance and an understanding of the market dynamics.

Key Takeaways

- Risk and Return Relationship: Generally, the higher the risk, the higher the potential return, and vice versa. Investors need to understand their risk tolerance and investment goals to make informed decisions.

- Diversification: Diversification involves spreading investments across different asset classes to manage overall portfolio risk and optimize returns. A well-diversified portfolio balances risk and return based on individual financial goals and risk appetite.

- Investment Goals: Investors should consider their financial goals, risk tolerance, and time horizon when choosing investments from different layers of the pyramid. For example, someone close to retirement may prefer low-risk investments, while a younger investor with a longer time horizon may opt for higher-risk options.

7.3. How to design your portfolio?

Designing an investment portfolio involves a few key steps to ensure it aligns with your financial goals, risk tolerance, and time horizon. Here’s a comprehensive guide to help you design your portfolio:

- Set Clear Financial Goals

- Short-Term Goals: (0-3 years) Examples include saving for a vacation, emergency fund, or a down payment on a house.

- Medium-Term Goals: (3-7 years) Examples include funding a child’s education or purchasing a car.

- Long-Term Goals: (7+ years) Examples include retirement planning or creating wealth.

- Assess Your Risk Tolerance

Understand how comfortable you are with the ups and downs of the market. Risk tolerance is influenced by factors such as age, financial stability, investment experience, and time horizon.

- Determine Asset Allocation

Decide on the percentage of your portfolio to allocate to different asset classes based on your risk tolerance and financial goals. A typical asset allocation might include:

- Equities (Stocks): Higher potential returns but higher risk.

- Bonds (Fixed Income): Moderate returns with lower risk compared to equities.

- Cash and Cash Equivalents: Highly liquid and low risk, but with lower returns.

- Real Estate: Potential for steady income and capital appreciation.

- Commodities: Diversification and a hedge against inflation.

- Diversify Your Investments

Spread your investments across different asset classes, industries, and geographic regions to manage risk and optimize returns. Diversification reduces the impact of poor performance in any single investment.

- Select Investment Vehicles

Choose specific investment options within each asset class. For example:

- Equities: Direct stocks, equity mutual funds, or exchange-traded funds (ETFs).

- Bonds: Government bonds, corporate bonds, or bond mutual funds.

- Real Estate: Real estate investment trusts (REITs) or direct property investment.

- Commodities: Gold, silver, or commodity ETFs.

- Regularly Rebalance Your Portfolio

Periodically review and adjust your portfolio to ensure it remains aligned with your financial goals and asset allocation strategy. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain your desired allocation.

- Stay Informed and Make Informed Decisions

Stay updated with market trends, economic conditions, and changes in your financial situation. Make informed investment decisions based on research and analysis.

Example- Investment Portfolio for Ravi

- Low-Risk Investments (30% of Monthly Income)

Fixed Deposits (FDs): ₹7,000 per month (10% of income)

Ravi sets aside ₹7,000 each month in fixed deposits. This provides him with guaranteed returns and ensures the safety of his capital. He chooses FDs with different tenures to have a mix of short-term and long-term savings.

Public Provident Fund (PPF): ₹7,000 per month (10% of income)

Ravi contributes ₹7,000 monthly to his PPF account. This long-term savings scheme offers attractive interest rates and tax benefits. With a 15-year lock-in period, it helps Ravi build a substantial retirement corpus.

National Savings Certificate (NSC): ₹7,000 per month (10% of income)

Ravi invests ₹7,000 monthly in NSCs, a government-backed scheme offering fixed interest rates and tax benefits. NSC investments are safe and provide stable returns, helping Ravi with secure and tax-efficient savings.

- Medium-Risk Investments (40% of Monthly Income)

Debt Mutual Funds: ₹14,000 per month (20% of income)

Ravi allocates ₹14,000 monthly to debt mutual funds. These funds invest in government and corporate bonds, providing moderate returns with lower risk compared to equity investments. They offer better returns than traditional savings accounts.

Balanced Mutual Funds: ₹14,000 per month (20% of income)

Ravi invests ₹14,000 monthly in balanced mutual funds, which combine equity and debt investments. This balanced risk-return profile helps Ravi achieve growth while ensuring stability in his portfolio.

- High-Risk Investments (25% of Monthly Income)

Equity Mutual Funds: ₹10,500 per month (15% of income)

Ravi invests ₹10,500 monthly in equity mutual funds, which pool money from investors to invest in a diversified portfolio of stocks. These funds offer the potential for long-term capital appreciation but come with higher risk due to market volatility.

Direct Equity: ₹7,000 per month (10% of income)

Ravi invests ₹7,000 monthly in direct equity, buying shares of individual companies through stock exchanges. This option requires market knowledge and carries significant risk, but it can offer substantial returns if managed well.

- Emergency Fund (5% of Monthly Income)

Savings Account/Liquid Fund: ₹3,500 per month (5% of income)

Ravi allocates ₹3,500 monthly to a savings account or liquid fund to build an emergency fund. This ensures that he has readily available cash for unexpected expenses, providing financial security and peace of mind.

Diversification:

- Ravi’s portfolio includes a mix of low, medium, and high-risk investments, balancing safety, stability, and growth.

- Regular contributions to FDs, PPF, and NSC ensure secure and tax-efficient savings.

- Investments in debt and balanced mutual funds offer moderate returns with controlled risk.

- Equity mutual funds and direct equity provide growth potential, aligning with Ravi’s long-term goals.

Regular Review:

- Ravi should review his investment portfolio annually to ensure it remains aligned with his financial goals and make adjustments based on market conditions and personal circumstances.

Summary of Ravi’s Portfolio:

|

Investment Type |

Monthly Contribution |

Percentage of Income |

|

Fixed Deposits (FDs) |

₹7,000 |

10% |

|

Public Provident Fund (PPF) |

₹7,000 |

10% |

|

National Savings Certificate (NSC) |

₹7,000 |

10% |

|

Debt Mutual Funds |

₹14,000 |

20% |

|

Balanced Mutual Funds |

₹14,000 |

20% |

|

Equity Mutual Funds |

₹10,500 |

15% |

|

Direct Equity |

₹7,000 |

10% |

|

Savings Account/Liquid Fund |

₹3,500 |

5% |

By following this diversified investment plan, Ravi can work towards his long-term financial goals while managing risk effectively. This approach ensures a balanced portfolio that supports his financial well-being and future aspirations.

7.4 How to match your existing investments with Goals?

Matching your existing investments with your financial goals is a crucial step in ensuring you’re on the right track to achieving them. Here’s a step-by-step example similar to Ravi’s situation from yesterday:

- Identify Your Goals: List out your short-term, medium-term, and long-term financial goals. For example:

- Short-term: Vacation in Goa next year.

- Medium-term: Buying a car in 5 years.

- Long-term: Retirement in 25 years.

- Assess Your Current Investments: Take stock of all your current investments, such as stocks, mutual funds, fixed deposits, real estate, etc. For example, Ravi has:

- Stocks worth ₹5,00,000

- Mutual funds worth ₹3,00,000

- Fixed deposits worth ₹2,00,000

- Match Investments to Goals:

- Short-term Goals: For goals within the next 1-3 years, consider safer investments like fixed deposits or liquid mutual funds. For Ravi’s vacation in Goa, he could allocate ₹1,00,000 from his fixed deposits.

- Medium-term Goals: For goals within 3-7 years, consider balanced mutual funds or bonds. For Ravi’s car purchase, he could allocate ₹2,00,000 from his mutual funds.

- Long-term Goals: For goals beyond 7 years, consider higher-risk investments like stocks or equity mutual funds. For Ravi’s retirement, he could allocate ₹5,00,000 from his stocks and ₹1,00,000 from his mutual funds.

- Review and Adjust Regularly: Regularly review your investments and goals to ensure they are aligned. Market conditions and personal circumstances can change, so be flexible and adjust as needed.

Here’s a simple table to summarize Ravi’s example:

|

Goal |

Time Horizon |

Investment |

Amount |

|

Vacation in Goa |

Short-term |

Fixed Deposit |

₹1,00,000 |

|

Buying a Car |

Medium-term |

Mutual Funds |

₹2,00,000 |

|

Retirement |

Long-term |

Stocks & Mutual Funds |

₹6,00,000 |

By aligning his investments with his goals, Ravi can ensure he has the right amount of money available when he needs it. This approach provides a clear roadmap to achieving his financial objectives.

7.5 Is Gold Investment safe

Investing in gold is often considered a safe haven, especially during times of economic uncertainty. Here are some points to consider:

Pros of Gold Investment:

- Hedge Against Inflation: Gold tends to maintain its value over time and can act as a hedge against inflation.

- Diversification: Including gold in your investment portfolio can reduce overall risk by diversifying your assets.

- Liquidity: Gold is easily convertible to cash, making it a highly liquid asset.

- Historical Value: Gold has been valued for centuries, giving it a sense of stability and trust.

Cons of Gold Investment:

- No Regular Income: Unlike stocks or bonds, gold does not provide regular income in the form of dividends or interest.

- Storage Costs: Physical gold requires secure storage, which can incur additional costs.

- Price Volatility: Gold prices can be volatile in the short term, influenced by global economic conditions and market speculation.

Different Forms of Gold Investment:

- Physical Gold: Includes gold bars, coins, and jewelry.

- Gold ETFs: Exchange-traded funds that invest in gold.

- Gold Mining Stocks: Shares of companies involved in gold mining.

- Sovereign Gold Bonds: Government-issued bonds linked to the price of gold.

Is It Safe?

Gold is generally considered a low-risk investment, especially compared to more volatile assets like stocks. However, like any investment, it comes with its own set of risks and considerations. It’s essential to balance your investment in gold with other assets to achieve a diversified portfolio.

Reasons for Ravi to Invest in Gold:

- Hedge Against Inflation: Gold can help protect Ravi’s wealth from inflation, as its value tends to increase during inflationary periods.

- Diversification: Adding gold to his investment portfolio can reduce overall risk by diversifying his assets.

- Liquidity: Gold is highly liquid and can be easily converted to cash, providing Ravi with a safety net in case of emergencies.

Gold Investment Options for Ravi:

- Physical Gold: Ravi can invest in gold bars, coins, or jewelry. However, he should consider storage and insurance costs.

- Gold ETFs: Exchange-traded funds that invest in gold are convenient and eliminate the need for physical storage.

- Sovereign Gold Bonds: Government-issued bonds linked to the price of gold. These bonds also offer interest income, making them an attractive option.

Example Investment Plan for Ravi:

Let’s assume Ravi wants to allocate 15% of his annual income to gold investment.

- Annual Income: ₹70,000 x 12 = ₹8,40,000

- 15% Allocation: ₹8,40,000 x 0.15 = ₹1,26,000

Investment Breakdown:

- Gold ETFs: ₹70,000 (55%)

- Sovereign Gold Bonds: ₹56,000 (45%)

Here’s a simple table to summarize Ravi’s gold investment plan:

|

Investment Type |

Amount |

Percentage |

|

Gold ETFs |

₹70,000 |

55% |

|

Sovereign Gold Bonds |

₹56,000 |

45% |

Safety Considerations:

- Economic Stability: Gold is generally considered a safe investment, especially during times of economic uncertainty.

- No Regular Income: Unlike stocks or bonds, gold does not provide regular income (except for Sovereign Gold Bonds which offer interest).

- Market Volatility: Gold prices can fluctuate based on global economic conditions and market speculation.

By allocating a portion of his income to gold, Ravi can achieve diversification and wealth preservation. However, it’s essential for Ravi to review his investment strategy regularly and adjust it based on his financial goals and risk tolerance.

7.6 Gold vs Nifty 50 ?

Comparing gold and the Nifty 50 index can help you understand the different characteristics and potential benefits of each investment. Here’s a brief overview:

Gold:

- Hedge Against Inflation: Gold is often seen as a safe haven during economic uncertainty and inflation.

- Liquidity: Gold is highly liquid and can be easily converted to cash.

- No Regular Income: Unlike stocks, gold does not provide dividends or interest.

- Storage Costs: Physical gold requires secure storage, which can incur additional costs.

- Historical Performance: Gold has performed well during economic crises, such as the 2008 financial crisis and the COVID-19 pandemic.

Nifty 50:

- Growth Potential: The Nifty 50 index represents the top 50 companies listed on the National Stock Exchange (NSE) in India, offering growth potential through capital appreciation.

- Regular Income: Stocks in the Nifty 50 can provide dividends.

- Volatility: The stock market can be volatile, with prices influenced by various factors such as economic conditions, company performance, and global events.

- Diversification: Investing in the Nifty 50 provides exposure to a diversified portfolio of companies across different sectors.

Performance Comparison:

- Long-Term Returns: Over the long term, the Nifty 50 has generally outperformed gold. For example, in a 20-year period, the Nifty 50 has managed to outperform gold returns.

- Crisis Periods: During economic crises, gold tends to perform better as a safe haven, while stocks may suffer.

Here’s a simple table to summarize the comparison:

|

Aspect |

Gold |

Nifty 50 |

|

Hedge Against Inflation |

Yes |

No |

|

Liquidity |

High |

High |

|

Regular Income |

No |

Yes (Dividends) |

|

Storage Costs |

Yes (for physical gold) |

No |

|

Growth Potential |

Moderate |

High |

|

Volatility |

Low to Moderate |

High |

|

Performance in Crises |

Strong |

Weak |

|

Long-Term Returns |

Moderate |

High |

Example Investment Plan for Ravi:

Assume Ravi wants to allocate ₹1,50,000 from his annual savings to both gold and the Nifty 50, aiming for diversification and growth.

- Annual Income: ₹70,000 x 12 = ₹8,40,000

- Allocation for Investments: ₹1,50,000

Investment Breakdown:

- Gold ETFs: ₹60,000 (40%)

- Nifty 50 ETFs: ₹90,000 (60%)

Here’s a simple table to summarize Ravi’s investment plan:

|

Investment Type |

Amount |

Percentage |

|

Gold ETFs |

₹60,000 |

40% |

|

Nifty 50 ETFs |

₹90,000 |

60% |

Pros and Cons for Ravi:

- Gold:

- Pros: Hedge against inflation, high liquidity, safe investment during crises.

- Cons: No regular income, storage costs for physical gold.

- Nifty 50:

- Pros: High growth potential, regular income through dividends, diversified portfolio.

- Cons: Higher volatility, influenced by market conditions.

Performance Comparison:

- Long-Term Returns: Over a 20-year period, the Nifty 50 has generally outperformed gold in terms of returns.

- Crisis Periods: During economic crises, gold tends to perform better as a safe haven, while the Nifty 50 may suffer.

By investing in both gold and the Nifty 50, Ravi can achieve a balanced portfolio that leverages the growth potential of equities while benefiting from the stability and diversification offered by gold.