- Study

- Slides

- Videos

4.1 Importance of Savings

What is Savings?

Savings refer to the portion of income that is not spent on immediate expenses and is set aside for future use. It involves putting money away regularly to build a financial cushion that can be used for emergencies, major purchases, or achieving long-term goals like buying a house or retirement. Savings provide financial security, reduce reliance on credit, and help individuals achieve their financial objectives. Establishing a habit of saving, even a small amount regularly, can lead to significant financial stability and peace of mind over time. Let’s explore the various strategies and benefits of building a robust savings plan.

Why Savings is Important?

Savings play a critical role in achieving financial stability and securing your future. Here are some key reasons why saving money is important:

Emergency Fund

Having savings set aside for emergencies can provide a financial cushion in case of unexpected expenses, such as medical bills, car repairs, or job loss. This helps you avoid relying on high-interest debt and reduces financial stress during tough times.

Achieving Financial Goals

Savings enable you to work towards your financial goals, whether they are short-term, like buying a new gadget or going on a vacation, or long-term, like purchasing a home or funding your child’s education. Consistently saving a portion of your income helps you build the necessary funds to achieve these goals.

Retirement Planning

Saving for retirement ensures that you have a comfortable and financially secure life after you stop working. Contributing regularly to retirement accounts allows your money to grow over time, thanks to the power of compound interest.

Reducing Financial Stress

Knowing that you have a financial safety net can significantly reduce stress and anxiety. It provides peace of mind, knowing you are prepared for unexpected expenses or financial setbacks.

Avoiding Debt

By having savings, you can avoid relying on credit cards or loans for major purchases or emergencies. This helps you maintain a healthy financial situation and keeps your debt levels low.

Building Wealth

Saving and investing your money allows it to grow over time. This can help you build wealth and achieve financial independence, giving you more control over your financial future.

Example

Ravi was hardworking and had a stable job at a local company. He enjoyed his life, spending money on dining out, buying the latest gadgets, and traveling. However, Ravi never thought much about saving money.

One day, Ravi’s car broke down unexpectedly. The repair costs were high, and he had no savings to cover the expense. Ravi had to borrow money from a friend, which made him realize the importance of having an emergency fund. Determined to avoid such situations in the future, Ravi decided to change his financial habits.

Ravi started by setting aside a small portion of his monthly income for savings. He opened a savings account and contributed to it regularly. Over time, his savings grew, and Ravi felt a sense of security knowing he had a financial cushion for emergencies.

A few years later, Ravi decided he wanted to buy a house. He set a goal to save for a down payment and adjusted his budget to allocate more money towards savings. By cutting back on unnecessary expenses and sticking to his savings plan, Ravi was able to accumulate enough money for the down payment.

Eventually, Ravi purchased his dream home. The joy and pride he felt were unparalleled, knowing his disciplined savings habit had made it possible. Ravi continued to save, now focusing on building a retirement fund. He understood the power of compound interest and knew that starting early would ensure a comfortable and financially secure future.

Through his journey, Ravi learned that savings provide financial stability, reduce stress, and help achieve life goals. His story inspired his friends and family to adopt similar savings habits, knowing that a secure future starts with a little discipline and a lot of determination.

4.2 Different Types of Savings

Savings Account

A savings account is a basic bank account where you can deposit money, earn interest, and withdraw funds as needed. It’s a secure place to store money for short-term needs and emergencies. The interest rate is usually low, but the funds are easily accessible, making it ideal for building an emergency fund.

Fixed Deposits (FDs)

A fixed deposit is a financial instrument provided by banks that offers a higher interest rate than a regular savings account. In an FD, you invest a lump sum of money for a fixed term, ranging from a few months to several years. The interest rate is fixed, and the money cannot be withdrawn before the maturity date without incurring a penalty.

Recurring Deposits (RDs)

A recurring deposit is a type of term deposit offered by banks that allows you to deposit a fixed amount of money regularly (usually monthly) over a specified period. It combines the benefits of regular saving and fixed deposits, providing a higher interest rate than a savings account. At the end of the term, you receive the invested amount along with the accumulated interest.

Mutual Funds

Mutual funds are investment vehicles managed by professional fund managers that pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. Mutual funds offer potential for higher returns compared to traditional savings accounts and fixed deposits, but they also come with a level of risk. They are suitable for long-term wealth creation and achieving financial goals.

Public Provident Fund (PPF)

The Public Provident Fund is a government-backed long-term savings scheme that offers attractive interest rates and tax benefits. PPF has a lock-in period of 15 years, and contributions can be made annually. The interest earned and the maturity amount are tax-free. It is designed for long-term savings and retirement planning.

National Savings Certificates (NSC)

National Savings Certificates are government savings bonds that offer a fixed interest rate and tax benefits. They have a lock-in period of 5 years and can be purchased at post offices. NSCs provide secure medium to long-term savings with guaranteed returns, making them a safe investment option.

Employee Provident Fund (EPF)

The Employee Provident Fund is a retirement savings scheme for salaried employees, where both the employer and employee contribute a percentage of the employee’s salary each month. The contributions earn interest, and the accumulated corpus can be withdrawn upon retirement or under specific conditions. EPF ensures a substantial retirement corpus and provides social security.

Gold and Real Estate

Investing in physical assets like gold and real estate offers value appreciation over time. Gold is considered a safe-haven asset and hedge against inflation, while real estate provides potential for rental income and capital appreciation. These investments diversify your portfolio and can offer long-term gains.

Digital Savings Apps

Digital savings apps offer convenient and automated saving features, such as round-up savings and micro-investments. These apps allow you to set saving goals, track progress, and invest in various financial products. They provide an easy and modern way to save and invest money.

For example,

Ravi started by maintaining a savings account for immediate needs and emergencies while investing in fixed deposits for better interest rates. To build a disciplined saving habit, he set up recurring deposits. For long-term growth, Ravi invested in mutual funds through a Systematic Investment Plan. He opened a PPF account for retirement savings and bought National Savings Certificates for tax benefits. Contributing regularly to his EPF, Ravi ensured a substantial retirement corpus. Additionally, he invested in gold and real estate for value appreciation and used digital savings apps for automated savings. Through this diversified approach, Ravi achieved financial stability and worked towards his future goals with confidence.

4.3. How Much Savings is Enough?

Determining how much savings is enough depends on your individual financial goals, lifestyle, and circumstances. Here are some guidelines to help you figure out the right amount:

Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an emergency fund. This provides a financial cushion in case of unexpected events like job loss, medical emergencies, or major repairs.

Retirement Savings

- 10-15% of Income: Financial experts recommend saving 10-15% of your annual income for retirement. The exact amount depends on your age, retirement goals, and expected lifestyle.

- Retirement Savings Benchmarks: By age 30, aim to have saved 1x your annual income; by age 40, 3x your income; by age 50, 6x your income; by age 60, 8x your income; and by retirement, 10x your annual income.

Short-Term Goals: For short-term goals like vacations, buying a car, or home improvements, determine the total amount needed and create a savings plan to reach that target within a specific timeframe.

Long-Term Goals: For long-term goals like children’s education or buying a home, calculate the total cost and save consistently to reach the target amount.

Debt Repayment: If you have high-interest debt, focus on paying it off while also building an emergency fund. Prioritize debt repayment to reduce interest costs and free up more money for savings.

Lifestyle and Expenses: Your savings goals should align with your lifestyle and expenses. Create a budget to track your income and expenses, ensuring you allocate enough for savings while meeting your daily needs.

Professional Advice: Consider consulting a financial planner for personalized advice based on your unique financial situation and goals.

Example:

As Ravi’s earning is ₹70,000 per month, he aims to build a strong financial future. He sets aside ₹10,000 monthly to build an emergency fund of ₹3,00,000 and allocates ₹8,400 per month to his EPF and PPF accounts for retirement. He also saves ₹10,000 monthly for a vacation and ₹16,000 for a house down payment. Balancing his savings, he makes an ₹8,000 monthly car loan repayment while maintaining a discretionary spending budget of ₹7,600. By consulting a financial planner, Ravi ensures his savings plan aligns with his goals, achieving financial stability and security through disciplined savings.

4.4 How to plan for big expenses?

Planning for big expenses is crucial to ensuring you can afford them without straining your finances. Here’s a step-by-step guide to help you prepare for major expenditures:

Step 1: Identify the Expense

- Determine the nature of the big expense. It could be a vacation, a home renovation, buying a car, or paying for education. Understand the total cost and timeframe in which you need the money.

Step 2: Set a Clear Goal

- Define your savings goal clearly. Know exactly how much you need to save and by when. This will give you a target to work towards.

Step 3: Create a Budget

- Review your current budget to identify areas where you can cut back on expenses. Allocate a specific amount of money each month towards your big expense.

Step 4: Open a Separate Savings Account

- Consider opening a dedicated savings account for the big expense. This helps keep your funds organized and ensures you don’t accidentally spend the money on something else.

Step 5: Automate Your Savings

- Set up automatic transfers from your main account to your dedicated savings account. This ensures you consistently save without having to remember to do it manually.

Step 6: Track Your Progress

- Regularly monitor your savings progress. Use a spreadsheet, budgeting app, or even a simple notebook to keep track of how much you’ve saved and how much more you need.

Step 7: Make Adjustments as Needed

- If you find that you’re not saving as quickly as you’d like, consider adjusting your budget. Look for additional ways to cut costs or increase your income temporarily.

Step 8: Avoid Unnecessary Debt

- Try to save as much as possible before making the big purchase. Avoid taking on high-interest debt unless absolutely necessary. If you do need to borrow, explore low-interest loan options.

Step 9: Celebrate Milestones

- Reward yourself for reaching savings milestones along the way. This can help keep you motivated and committed to your goal.

Example Scenario

Ravi plans to buy a new car that costs ₹5,00,000 in two years:

- Identify the Expense: New car costing ₹5,00,000.

- Set a Goal: Save ₹5,00,000 in 24 months.

- Create a Budget: Save ₹20,833 per month (₹5,00,000 / 24 months).

- Open a Separate Account: Ravi opens a savings account specifically for the car fund.

- Automate Savings: Sets up an automatic transfer of ₹20,833 from his salary account to the car savings account each month.

- Track Progress: Monitors the savings account balance monthly to ensure he’s on track.

- Make Adjustments: If Ravi finds it challenging to save ₹20,833 monthly, he cuts back on discretionary spending or looks for additional income sources.

- Avoid Debt: Ravi avoids taking out a high-interest car loan by saving enough money in advance.

- Celebrate Milestones: Ravi celebrates every ₹1,00,000 saved with a small treat, keeping him motivated.

4.5 How to earn ₹1 crore in one Year through Mutual Funds and Stocks ?

Mutual Funds

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. Here’s how it works:

- Pooling Money: Investors buy shares or units of the mutual fund, contributing their money to the fund.

- Investment Strategy: The fund manager uses the pooled money to buy a variety of assets according to the fund’s investment objectives and strategy.

- NAV Calculation: The Net Asset Value (NAV) is the value of one share or unit of the mutual fund. It is calculated by dividing the total value of the fund’s assets minus any liabilities by the number of outstanding shares or units.

- Returns to Investors: Investors can earn returns through capital gains (when the fund sells investments at a profit) and income distributions (such as dividends or interest from the fund’s holdings).

- Buying and Selling: Investors can buy or redeem (sell) their mutual fund shares at the NAV price at the end of each trading day.

Stock Market

The stock market is a platform where investors buy, sell, and trade shares of publicly traded companies. Here’s how it works:

- Buying Shares: When you buy shares of a company, you become a partial owner of that company.

- Stock Exchanges: Shares are traded on stock exchanges like the New York Stock Exchange (NYSE) or the National Stock Exchange of India (NSE).

- Price Fluctuations: The price of a stock changes based on the demand for shares from new investors who want to buy or the supply of shares from existing investors who want to sell.

- Returns to Investors: Investors can earn returns through capital gains (when the stock price increases) and dividends (a portion of the company’s profits distributed to shareholders).

- Regulation: The stock market is regulated by government agencies like the Securities and Exchange Commission (SEC) in the U.S. and the Securities and Exchange Board of India (SEBI) in India.

Ravi’s Investment Journey to Earn ₹1 Crore

Ravi’s Profile:

- Age: 40 years

- Monthly Income: ₹70,000

- Risk Tolerance: Moderate

- Investment Horizon: 15 years

Step-by-Step Plan:

- Set Clear Goals: Ravi wants to accumulate ₹1 crore in 15 years. He decides to invest in a mix of mutual funds and stocks to achieve this goal.

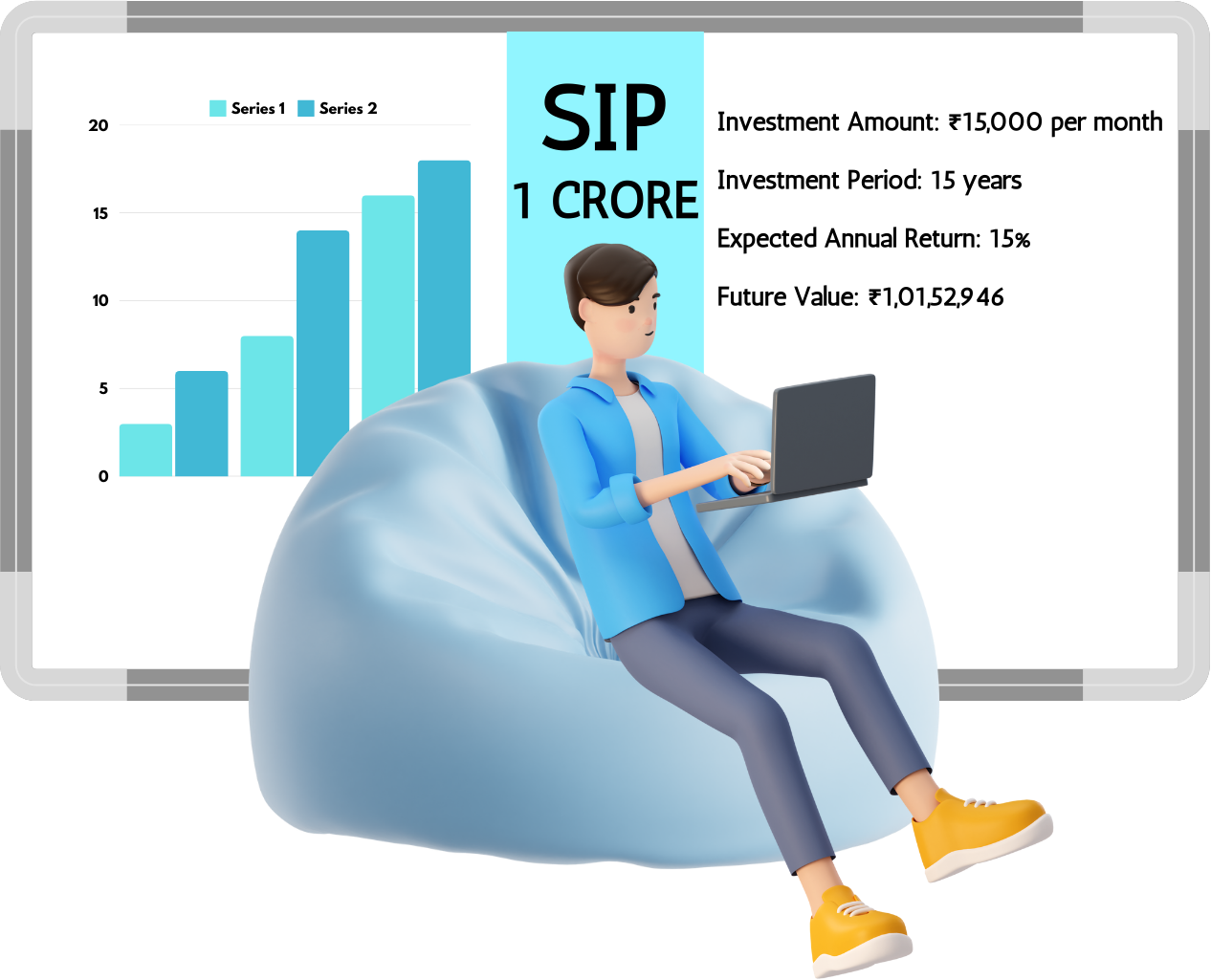

- Systematic Investment Plan (SIP):

Ravi starts a SIP in mutual funds. Given his revised salary, he decides to invest ₹10,500 per month in an equity mutual fund with an expected annual return of 15%. Using the 15x15x15 formula, he can still aim to achieve his goal.

- Investment Amount: ₹10,500 per month

- Investment Period: 15 years

- Expected Annual Return: 15%

- Future Value: Approximately ₹1,00,84,458 (adjusted for the revised investment amount)

- Diversify Portfolio:

Ravi diversifies his investments across different types of mutual funds and stocks:

- Large-Cap Funds: 40%

- Mid-Cap Funds: 30%

- Small-Cap Funds: 20%

- Stocks: 10%

- Regular Monitoring:

Ravi regularly monitors his investments and makes adjustments based on market conditions and his financial goals. He reviews his portfolio every six months and rebalances it if necessary.

- Consult a Financial Advisor:

Ravi consults a financial advisor to optimize his investment strategy and make informed decisions. The advisor helps him choose the right mutual funds and stocks based on his risk tolerance and investment horizon.

By adhering to this disciplined investment approach, Ravi can aim to accumulate ₹1 crore over 15 years, even with a monthly income of ₹70,000. Regular monitoring, diversification, and professional advice ensure that his investment strategy aligns with his financial goals and risk tolerance

4.6 How does compounding benefit us?

Compounding is a powerful concept in investing that can significantly boost your wealth over time. It’s the process where the earnings from an investment (interest, dividends, or capital gains) are reinvested to generate additional earnings. Here’s how it benefits you:

How Compounding Works

- Initial Investment: You start with an initial amount of money invested.

- Earnings: Your investment earns returns over a period.

- Reinvestment: The returns earned are reinvested back into the investment.

- Growth: The reinvested returns start earning additional returns.

Example

Let’s take an example to illustrate the benefits of compounding.

Example: Ravi’s Investment

- Initial Investment: ₹1,00,000

- Annual Return: 10%

- Investment Period: 20 years

Without Compounding:

- Annual Earnings: ₹1,00,000 * 10% = ₹10,000

- Total Earnings in 20 Years: ₹10,000 * 20 = ₹2,00,000

- Total Value After 20 Years: ₹1,00,000 (Initial) + ₹2,00,000 (Earnings) = ₹3,00,000

With Compounding:

- Year 1: ₹1,00,000 * 10% = ₹10,000 (Earnings)

- Year 2: ₹1,10,000 * 10% = ₹11,000 (Earnings)

- Year 3: ₹1,21,000 * 10% = ₹12,100 (Earnings)

And so on…

After 20 years, the total value of the investment with compounding would be approximately ₹6,72,750.

Benefits of Compounding

- Exponential Growth: Compounding leads to exponential growth of your investment over time.

- Higher Returns: The longer you stay invested, the more your returns compound, leading to higher overall returns.

- Reinvestment: Reinvesting your earnings ensures that your money is continuously working for you.

- Wealth Accumulation: Compounding is a key factor in wealth accumulation, allowing you to achieve your financial goals faster.

Tips for Maximizing Compounding Benefits

- Start Early: The earlier you start investing, the longer your money has to compound.

- Stay Invested: Keep your investments for the long term to maximize the benefits of compounding.

- Reinvest Earnings: Ensure that your earnings (interest, dividends, or capital gains) are reinvested to generate additional returns.

Regular Contributions: Regularly add to your investments to take full advantage of compounding

4.1 Importance of Savings

What is Savings?

Savings refer to the portion of income that is not spent on immediate expenses and is set aside for future use. It involves putting money away regularly to build a financial cushion that can be used for emergencies, major purchases, or achieving long-term goals like buying a house or retirement. Savings provide financial security, reduce reliance on credit, and help individuals achieve their financial objectives. Establishing a habit of saving, even a small amount regularly, can lead to significant financial stability and peace of mind over time. Let’s explore the various strategies and benefits of building a robust savings plan.

Why Savings is Important?

Savings play a critical role in achieving financial stability and securing your future. Here are some key reasons why saving money is important:

Emergency Fund

Having savings set aside for emergencies can provide a financial cushion in case of unexpected expenses, such as medical bills, car repairs, or job loss. This helps you avoid relying on high-interest debt and reduces financial stress during tough times.

Achieving Financial Goals

Savings enable you to work towards your financial goals, whether they are short-term, like buying a new gadget or going on a vacation, or long-term, like purchasing a home or funding your child’s education. Consistently saving a portion of your income helps you build the necessary funds to achieve these goals.

Retirement Planning

Saving for retirement ensures that you have a comfortable and financially secure life after you stop working. Contributing regularly to retirement accounts allows your money to grow over time, thanks to the power of compound interest.

Reducing Financial Stress

Knowing that you have a financial safety net can significantly reduce stress and anxiety. It provides peace of mind, knowing you are prepared for unexpected expenses or financial setbacks.

Avoiding Debt

By having savings, you can avoid relying on credit cards or loans for major purchases or emergencies. This helps you maintain a healthy financial situation and keeps your debt levels low.

Building Wealth

Saving and investing your money allows it to grow over time. This can help you build wealth and achieve financial independence, giving you more control over your financial future.

Example

Ravi was hardworking and had a stable job at a local company. He enjoyed his life, spending money on dining out, buying the latest gadgets, and traveling. However, Ravi never thought much about saving money.

One day, Ravi’s car broke down unexpectedly. The repair costs were high, and he had no savings to cover the expense. Ravi had to borrow money from a friend, which made him realize the importance of having an emergency fund. Determined to avoid such situations in the future, Ravi decided to change his financial habits.

Ravi started by setting aside a small portion of his monthly income for savings. He opened a savings account and contributed to it regularly. Over time, his savings grew, and Ravi felt a sense of security knowing he had a financial cushion for emergencies.

A few years later, Ravi decided he wanted to buy a house. He set a goal to save for a down payment and adjusted his budget to allocate more money towards savings. By cutting back on unnecessary expenses and sticking to his savings plan, Ravi was able to accumulate enough money for the down payment.

Eventually, Ravi purchased his dream home. The joy and pride he felt were unparalleled, knowing his disciplined savings habit had made it possible. Ravi continued to save, now focusing on building a retirement fund. He understood the power of compound interest and knew that starting early would ensure a comfortable and financially secure future.

Through his journey, Ravi learned that savings provide financial stability, reduce stress, and help achieve life goals. His story inspired his friends and family to adopt similar savings habits, knowing that a secure future starts with a little discipline and a lot of determination.

4.2 Different Types of Savings

Savings Account

A savings account is a basic bank account where you can deposit money, earn interest, and withdraw funds as needed. It’s a secure place to store money for short-term needs and emergencies. The interest rate is usually low, but the funds are easily accessible, making it ideal for building an emergency fund.

Fixed Deposits (FDs)

A fixed deposit is a financial instrument provided by banks that offers a higher interest rate than a regular savings account. In an FD, you invest a lump sum of money for a fixed term, ranging from a few months to several years. The interest rate is fixed, and the money cannot be withdrawn before the maturity date without incurring a penalty.

Recurring Deposits (RDs)

A recurring deposit is a type of term deposit offered by banks that allows you to deposit a fixed amount of money regularly (usually monthly) over a specified period. It combines the benefits of regular saving and fixed deposits, providing a higher interest rate than a savings account. At the end of the term, you receive the invested amount along with the accumulated interest.

Mutual Funds

Mutual funds are investment vehicles managed by professional fund managers that pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. Mutual funds offer potential for higher returns compared to traditional savings accounts and fixed deposits, but they also come with a level of risk. They are suitable for long-term wealth creation and achieving financial goals.

Public Provident Fund (PPF)

The Public Provident Fund is a government-backed long-term savings scheme that offers attractive interest rates and tax benefits. PPF has a lock-in period of 15 years, and contributions can be made annually. The interest earned and the maturity amount are tax-free. It is designed for long-term savings and retirement planning.

National Savings Certificates (NSC)

National Savings Certificates are government savings bonds that offer a fixed interest rate and tax benefits. They have a lock-in period of 5 years and can be purchased at post offices. NSCs provide secure medium to long-term savings with guaranteed returns, making them a safe investment option.

Employee Provident Fund (EPF)

The Employee Provident Fund is a retirement savings scheme for salaried employees, where both the employer and employee contribute a percentage of the employee’s salary each month. The contributions earn interest, and the accumulated corpus can be withdrawn upon retirement or under specific conditions. EPF ensures a substantial retirement corpus and provides social security.

Gold and Real Estate

Investing in physical assets like gold and real estate offers value appreciation over time. Gold is considered a safe-haven asset and hedge against inflation, while real estate provides potential for rental income and capital appreciation. These investments diversify your portfolio and can offer long-term gains.

Digital Savings Apps

Digital savings apps offer convenient and automated saving features, such as round-up savings and micro-investments. These apps allow you to set saving goals, track progress, and invest in various financial products. They provide an easy and modern way to save and invest money.

For example,

Ravi started by maintaining a savings account for immediate needs and emergencies while investing in fixed deposits for better interest rates. To build a disciplined saving habit, he set up recurring deposits. For long-term growth, Ravi invested in mutual funds through a Systematic Investment Plan. He opened a PPF account for retirement savings and bought National Savings Certificates for tax benefits. Contributing regularly to his EPF, Ravi ensured a substantial retirement corpus. Additionally, he invested in gold and real estate for value appreciation and used digital savings apps for automated savings. Through this diversified approach, Ravi achieved financial stability and worked towards his future goals with confidence.

4.3. How Much Savings is Enough?

Determining how much savings is enough depends on your individual financial goals, lifestyle, and circumstances. Here are some guidelines to help you figure out the right amount:

Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an emergency fund. This provides a financial cushion in case of unexpected events like job loss, medical emergencies, or major repairs.

Retirement Savings

- 10-15% of Income: Financial experts recommend saving 10-15% of your annual income for retirement. The exact amount depends on your age, retirement goals, and expected lifestyle.

- Retirement Savings Benchmarks: By age 30, aim to have saved 1x your annual income; by age 40, 3x your income; by age 50, 6x your income; by age 60, 8x your income; and by retirement, 10x your annual income.

Short-Term Goals: For short-term goals like vacations, buying a car, or home improvements, determine the total amount needed and create a savings plan to reach that target within a specific timeframe.

Long-Term Goals: For long-term goals like children’s education or buying a home, calculate the total cost and save consistently to reach the target amount.

Debt Repayment: If you have high-interest debt, focus on paying it off while also building an emergency fund. Prioritize debt repayment to reduce interest costs and free up more money for savings.

Lifestyle and Expenses: Your savings goals should align with your lifestyle and expenses. Create a budget to track your income and expenses, ensuring you allocate enough for savings while meeting your daily needs.

Professional Advice: Consider consulting a financial planner for personalized advice based on your unique financial situation and goals.

Example:

As Ravi’s earning is ₹70,000 per month, he aims to build a strong financial future. He sets aside ₹10,000 monthly to build an emergency fund of ₹3,00,000 and allocates ₹8,400 per month to his EPF and PPF accounts for retirement. He also saves ₹10,000 monthly for a vacation and ₹16,000 for a house down payment. Balancing his savings, he makes an ₹8,000 monthly car loan repayment while maintaining a discretionary spending budget of ₹7,600. By consulting a financial planner, Ravi ensures his savings plan aligns with his goals, achieving financial stability and security through disciplined savings.

4.4 How to plan for big expenses?

Planning for big expenses is crucial to ensuring you can afford them without straining your finances. Here’s a step-by-step guide to help you prepare for major expenditures:

Step 1: Identify the Expense

- Determine the nature of the big expense. It could be a vacation, a home renovation, buying a car, or paying for education. Understand the total cost and timeframe in which you need the money.

Step 2: Set a Clear Goal

- Define your savings goal clearly. Know exactly how much you need to save and by when. This will give you a target to work towards.

Step 3: Create a Budget

- Review your current budget to identify areas where you can cut back on expenses. Allocate a specific amount of money each month towards your big expense.

Step 4: Open a Separate Savings Account

- Consider opening a dedicated savings account for the big expense. This helps keep your funds organized and ensures you don’t accidentally spend the money on something else.

Step 5: Automate Your Savings

- Set up automatic transfers from your main account to your dedicated savings account. This ensures you consistently save without having to remember to do it manually.

Step 6: Track Your Progress

- Regularly monitor your savings progress. Use a spreadsheet, budgeting app, or even a simple notebook to keep track of how much you’ve saved and how much more you need.

Step 7: Make Adjustments as Needed

- If you find that you’re not saving as quickly as you’d like, consider adjusting your budget. Look for additional ways to cut costs or increase your income temporarily.

Step 8: Avoid Unnecessary Debt

- Try to save as much as possible before making the big purchase. Avoid taking on high-interest debt unless absolutely necessary. If you do need to borrow, explore low-interest loan options.

Step 9: Celebrate Milestones

- Reward yourself for reaching savings milestones along the way. This can help keep you motivated and committed to your goal.

Example Scenario

Ravi plans to buy a new car that costs ₹5,00,000 in two years:

- Identify the Expense: New car costing ₹5,00,000.

- Set a Goal: Save ₹5,00,000 in 24 months.

- Create a Budget: Save ₹20,833 per month (₹5,00,000 / 24 months).

- Open a Separate Account: Ravi opens a savings account specifically for the car fund.

- Automate Savings: Sets up an automatic transfer of ₹20,833 from his salary account to the car savings account each month.

- Track Progress: Monitors the savings account balance monthly to ensure he’s on track.

- Make Adjustments: If Ravi finds it challenging to save ₹20,833 monthly, he cuts back on discretionary spending or looks for additional income sources.

- Avoid Debt: Ravi avoids taking out a high-interest car loan by saving enough money in advance.

- Celebrate Milestones: Ravi celebrates every ₹1,00,000 saved with a small treat, keeping him motivated.

4.5 How to earn ₹1 crore in one Year through Mutual Funds and Stocks ?

Mutual Funds

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. Here’s how it works:

- Pooling Money: Investors buy shares or units of the mutual fund, contributing their money to the fund.

- Investment Strategy: The fund manager uses the pooled money to buy a variety of assets according to the fund’s investment objectives and strategy.

- NAV Calculation: The Net Asset Value (NAV) is the value of one share or unit of the mutual fund. It is calculated by dividing the total value of the fund’s assets minus any liabilities by the number of outstanding shares or units.

- Returns to Investors: Investors can earn returns through capital gains (when the fund sells investments at a profit) and income distributions (such as dividends or interest from the fund’s holdings).

- Buying and Selling: Investors can buy or redeem (sell) their mutual fund shares at the NAV price at the end of each trading day.

Stock Market

The stock market is a platform where investors buy, sell, and trade shares of publicly traded companies. Here’s how it works:

- Buying Shares: When you buy shares of a company, you become a partial owner of that company.

- Stock Exchanges: Shares are traded on stock exchanges like the New York Stock Exchange (NYSE) or the National Stock Exchange of India (NSE).

- Price Fluctuations: The price of a stock changes based on the demand for shares from new investors who want to buy or the supply of shares from existing investors who want to sell.

- Returns to Investors: Investors can earn returns through capital gains (when the stock price increases) and dividends (a portion of the company’s profits distributed to shareholders).

- Regulation: The stock market is regulated by government agencies like the Securities and Exchange Commission (SEC) in the U.S. and the Securities and Exchange Board of India (SEBI) in India.

Ravi’s Investment Journey to Earn ₹1 Crore

Ravi’s Profile:

- Age: 40 years

- Monthly Income: ₹70,000

- Risk Tolerance: Moderate

- Investment Horizon: 15 years

Step-by-Step Plan:

- Set Clear Goals: Ravi wants to accumulate ₹1 crore in 15 years. He decides to invest in a mix of mutual funds and stocks to achieve this goal.

- Systematic Investment Plan (SIP):

Ravi starts a SIP in mutual funds. Given his revised salary, he decides to invest ₹10,500 per month in an equity mutual fund with an expected annual return of 15%. Using the 15x15x15 formula, he can still aim to achieve his goal.

- Investment Amount: ₹10,500 per month

- Investment Period: 15 years

- Expected Annual Return: 15%

- Future Value: Approximately ₹1,00,84,458 (adjusted for the revised investment amount)

- Diversify Portfolio:

Ravi diversifies his investments across different types of mutual funds and stocks:

- Large-Cap Funds: 40%

- Mid-Cap Funds: 30%

- Small-Cap Funds: 20%

- Stocks: 10%

- Regular Monitoring:

Ravi regularly monitors his investments and makes adjustments based on market conditions and his financial goals. He reviews his portfolio every six months and rebalances it if necessary.

- Consult a Financial Advisor:

Ravi consults a financial advisor to optimize his investment strategy and make informed decisions. The advisor helps him choose the right mutual funds and stocks based on his risk tolerance and investment horizon.

By adhering to this disciplined investment approach, Ravi can aim to accumulate ₹1 crore over 15 years, even with a monthly income of ₹70,000. Regular monitoring, diversification, and professional advice ensure that his investment strategy aligns with his financial goals and risk tolerance

4.6 How does compounding benefit us?

Compounding is a powerful concept in investing that can significantly boost your wealth over time. It’s the process where the earnings from an investment (interest, dividends, or capital gains) are reinvested to generate additional earnings. Here’s how it benefits you:

How Compounding Works

- Initial Investment: You start with an initial amount of money invested.

- Earnings: Your investment earns returns over a period.

- Reinvestment: The returns earned are reinvested back into the investment.

- Growth: The reinvested returns start earning additional returns.

Example

Let’s take an example to illustrate the benefits of compounding.

Example: Ravi’s Investment

- Initial Investment: ₹1,00,000

- Annual Return: 10%

- Investment Period: 20 years

Without Compounding:

- Annual Earnings: ₹1,00,000 * 10% = ₹10,000

- Total Earnings in 20 Years: ₹10,000 * 20 = ₹2,00,000

- Total Value After 20 Years: ₹1,00,000 (Initial) + ₹2,00,000 (Earnings) = ₹3,00,000

With Compounding:

- Year 1: ₹1,00,000 * 10% = ₹10,000 (Earnings)

- Year 2: ₹1,10,000 * 10% = ₹11,000 (Earnings)

- Year 3: ₹1,21,000 * 10% = ₹12,100 (Earnings)

And so on…

After 20 years, the total value of the investment with compounding would be approximately ₹6,72,750.

Benefits of Compounding

- Exponential Growth: Compounding leads to exponential growth of your investment over time.

- Higher Returns: The longer you stay invested, the more your returns compound, leading to higher overall returns.

- Reinvestment: Reinvesting your earnings ensures that your money is continuously working for you.

- Wealth Accumulation: Compounding is a key factor in wealth accumulation, allowing you to achieve your financial goals faster.

Tips for Maximizing Compounding Benefits

- Start Early: The earlier you start investing, the longer your money has to compound.

- Stay Invested: Keep your investments for the long term to maximize the benefits of compounding.

- Reinvest Earnings: Ensure that your earnings (interest, dividends, or capital gains) are reinvested to generate additional returns.

Regular Contributions: Regularly add to your investments to take full advantage of compounding