- Study

- Slides

- Videos

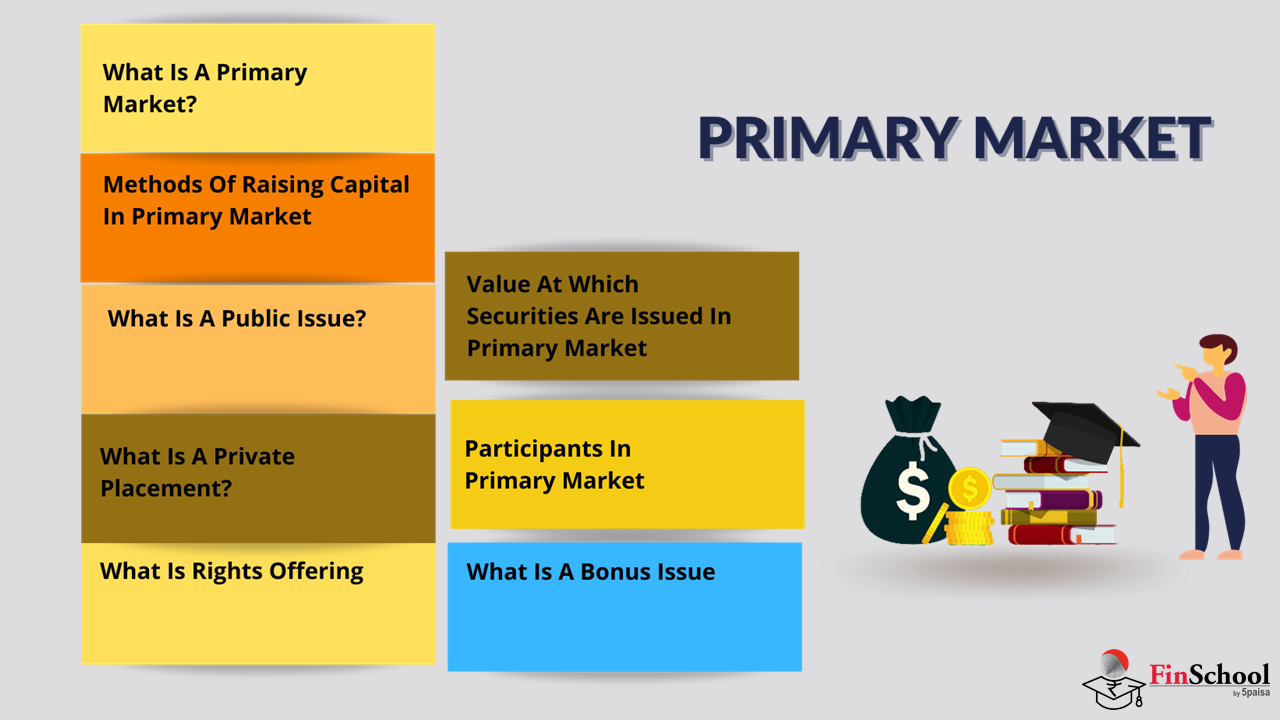

4.1 What Is A Primary Market & Functions Of Primary Market

So by now you must be having a fair idea about Market Intermediaries, Types their Roles and who Regulates them. And as Vedant had Promised Nirav to discuss about Primary Market , they meet again and the learning continues

Nirav : Vedant whatever you explained till now was incredibly helpful. You Broke things in such a clear way. I really appreciate you taking time to explain these complex topics in detail

Vedant : Glad to hear that, Nirav! I’m really happy the explanation helped. The securities market can seem complex at first, but once you break it down, it starts making sense. So today as promised lets discuss about Primary Market

Vedant asks Nirav : Have you heard about the term “ Go Public”

Nirav : No. Does it mean Company is open for public debate?

Vedant : No No. It means securities are created and sold for the first time .

Nirav : Oh ! Sounds interesting . Please explain

Vedant . Securities are created and sold for the first time in primary market .

So ,

The primary market is a segment of the capital market where companies, governments, or institutions raise fresh capital by issuing new securities directly to investors. In simple terms The primary market is where new securities are issued for the very first time. It’s the starting point in the life cycle of a financial asset—whether it’s a stock, bond, or other instrument.

What are the Functions of Primary Market?

- Capital Formation: It enables companies, governments, and institutions to raise funds for expansion, operations, or infrastructure projects.

- Direct Transactions: Investors buy securities straight from the issuer, helping companies bypass intermediaries initially.

- Price Discovery: The market helps establish the base price of a security, shaped by investor appetite, valuation, and economic conditions.

- Regulatory Oversight: In India, entities like SEBI ensure that the process is transparent, protecting retail investors through mandated disclosures.

- Diversification for Investors: It offers fresh investment opportunities, especially in growing sectors—think tech, renewable, or healthcare startups.

Nirav : What exactly Happens in Primary Market? How Funds are Raised?

Vedant : Ok. Lets understand different methods of raising capital with examples for clearing your doubts.

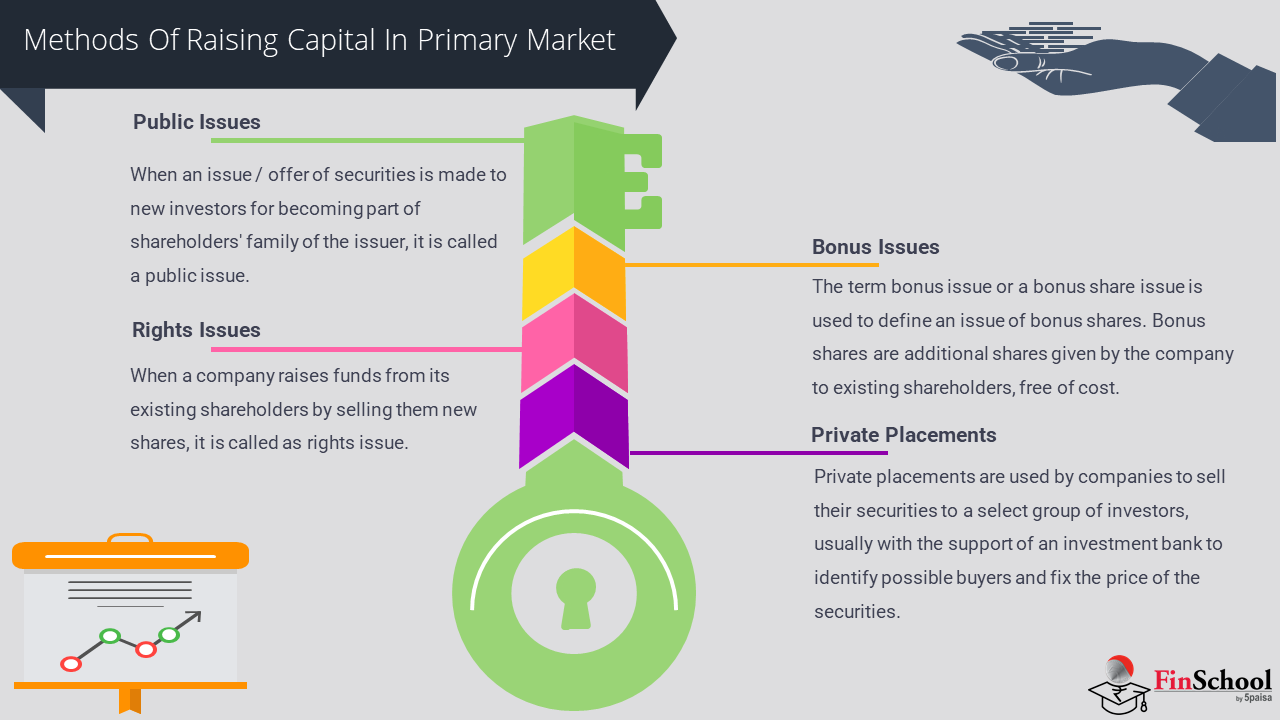

4.2 Different Methods Of Raising Capital In Primary Market

In the primary market, capital is raised through several structured methods, each tailored to the issuer’s needs and regulatory considerations. Here’s a detailed breakdown of the key methods:

-

Initial Public offer (IPO) :

An Initial Public Offering (IPO) is the most recognized method, where an unlisted company offers its shares to the public for the first time. This process enables the company to become publicly traded and raise substantial equity capital. The IPO involves preparing a detailed prospectus, securing regulatory approvals, and determining the offer price through mechanisms like book-building. It marks a significant milestone in a company’s growth, often used to fund expansion, repay debt, or enhance visibility.

-

Follow-on-Public Offering (FPO)

A Follow-on Public Offering (FPO), also known as a Further Public Offer, is used by companies that are already listed on a stock exchange. Through an FPO, these companies issue additional shares to the public to raise more capital. This method is typically employed when a company needs further funding for strategic initiatives or operational scaling. FPOs can involve fresh issues of shares or an offer for sale by existing shareholders, such as promoters reducing their stake.

-

Rights Issue

The Rights Issue is a method where a company offers new shares to its existing shareholders at a discounted price, in proportion to their current holdings. This approach allows companies to raise capital while maintaining shareholder control and avoiding dilution from external investors. Rights issues are often used during restructuring phases or when companies need quick access to funds without engaging in a full public offering.

-

Bonus Issue

A Bonus Issue involves the distribution of additional shares to existing shareholders without any cost, drawn from the company’s reserves. While it does not raise fresh capital, it serves to reward shareholders and increase the liquidity of the stock. Bonus issues are typically used when companies have accumulated profits but prefer to reinvest rather than distribute cash dividends.

Private Placement

Private Placement is a targeted method where securities are sold directly to a select group of investors, such as institutional buyers or high-net-worth individuals. This route is favored for its speed and reduced regulatory burden compared to public offerings. It allows companies to raise capital efficiently, especially when market conditions are volatile or when confidentiality is a priority.

Preferential Allotment

A Preferential Allotment is a form of private placement where shares are issued to specific investors at a predetermined price. This method is often used to bring in strategic investors or to raise funds from promoters. It provides flexibility in structuring the deal and can be tailored to meet specific financial or governance objectives.

Qualified Institutional Placement

The Qualified Institutional Placement (QIP) is a specialized form of preferential allotment available only to Qualified Institutional Buyers (QIBs), such as mutual funds, banks, and insurance companies. QIP is regulated to ensure that only financially sophisticated entities participate, and it offers a streamlined process for listed companies to raise capital without undergoing extensive regulatory filings.

Nirav : Vedant can you please explain each type with examples. It becomes easy to understand

Vedant : Ok so let us understand each category in detail with examples.

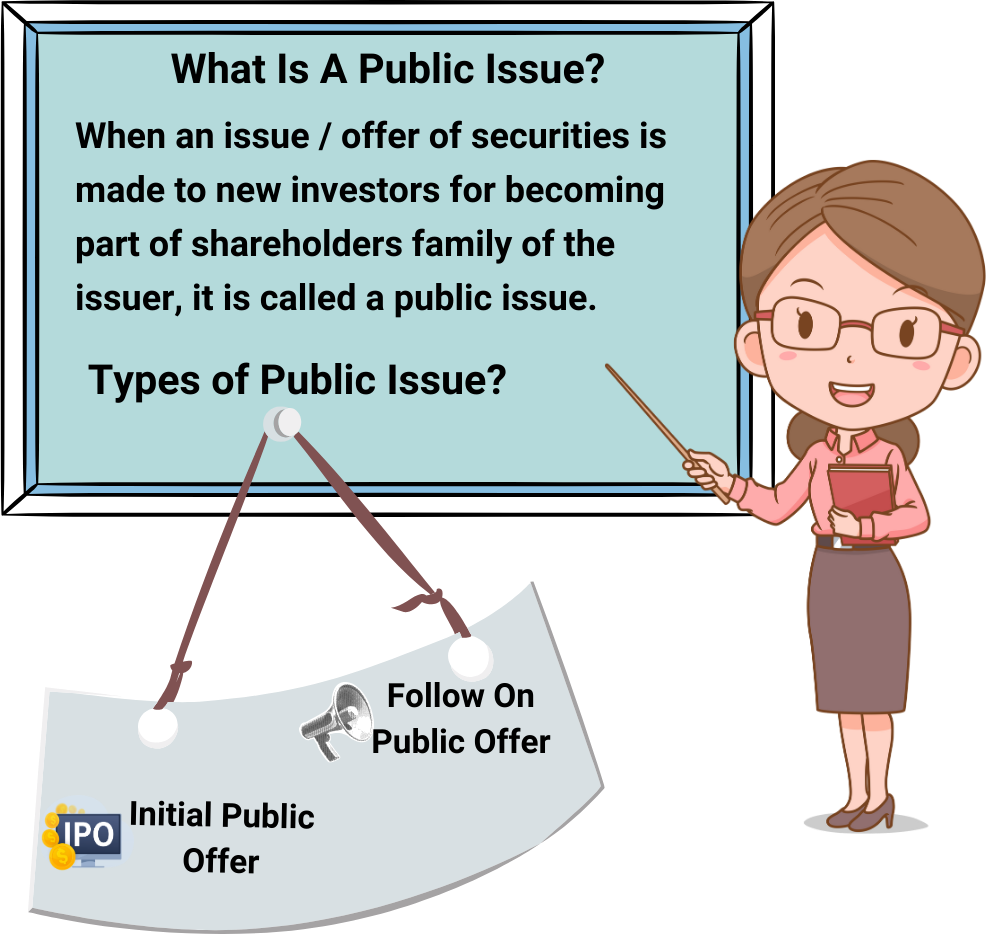

4.3 Public Issue

What Is A Public Issue

When an issue / offer of securities is made to new investors for becoming part of shareholders family of the issuer, it is called a public issue. Public issue can be further classified into Initial Public Offer (IPO) and Follow-on Public Offer (FPO).

Types of Public Issue

- Initial Public Offerings

- Follow On Public Offer

Initial Public offer

An Initial Public Offering (IPO) is the process by which a privately held company offers its shares to the public for the first time, thereby becoming a publicly traded entity. This transition allows the company to raise capital from a wide pool of investors and provides liquidity to early stakeholders.

For example Nirav

There is a company named GreenGrid . It was just like a private club. Only few people could invest in it. But now, they’re opening the doors to the public. By launching an IPO, they’re selling a portion of their ownership shares to everyday investors like you and me.

Nirav: “So if I buy those shares, I become part-owner?”

Vedant: “Exactly. You’d own a small piece of GreenGrid. And if the company grows, your shares could increase in value. Plus, they might pay dividends in the future.”

Nirav: “Interesting. So it’s like getting in on the ground floor of something big?”

Vedant: “Yes, but with risks too. You need to read the prospectus and understand the business before investing.”

Nirav : Prospectus? What does that mean?

Vedant : A prospectus is a formal document issued by a company when it wants to offer securities—like shares or bonds—to the public. It provides detailed information about the company’s business, financial health, risks, and how it plans to use the money raised from investors.

In simpler terms, it’s like a fact sheet for investors. Before you decide to invest in a company’s IPO or mutual fund, the prospectus helps you understand what the company does, how it’s performing, what risks are involved, and what your money will be used for.

What are the objectives of IPO?

- Capital Raising: To fund expansion, repay debt, or invest in new projects.

- Liquidity for Existing Shareholders: Founders and early investors can monetize part of their holdings.

- Brand Visibility & Credibility: Public listing enhances reputation and transparency.

- Market Valuation: Establishes a market-driven valuation for the company.

IPO Process Overview

- Appointment of IntermediariesInvestment bankers, legal advisors, auditors, and registrars are engaged.

- Due Diligence & Draft Red Herring Prospectus (DRHP)The DRHP is filed with SEBI, outlining financials, risks, and objectives.

- SEBI Review & ApprovalSEBI ensures compliance and transparency before approving the offer.

- Roadshows & MarketingCompany promotes the IPO to institutional and retail investors.

- Price Band & Book BuildingInvestors bid within a price range; final price is determined based on demand.

- Subscription PeriodTypically 3–5 working days; investors apply via ASBA (Application Supported by Blocked Amount).

- Allotment & ListingShares are allotted based on demand and category; listing occurs on the exchange.

Follow-on public offer (FPO)

Nirav: “Vedant, I thought IPOs were the big deal—why are companies issuing more shares later?”

Vedant: “That’s an FPO. Think of it as a company topping up its funds. They’ve already gone public, but now they need more capital—maybe for expansion or reducing debt—so they offer additional shares to the public.”

Nirav: “Won’t that affect the price or ownership?”

Vedant: “It might. New shares dilute ownership a bit, but it’s often a sign they’re pursuing growth.”

So,

An FPO is a method by which a publicly listed company issues additional shares to investors after its Initial Public Offering (IPO). It serves as a secondary offering to raise capital.

Types of FPOs:

1 . Dilutive FPOs

A dilutive Follow-on Public Offer (FPO) occurs when a publicly listed company issues new shares to raise additional capital, thereby increasing the total number of outstanding shares in the market. This expansion of share capital leads to a dilution of ownership for existing shareholders, meaning their percentage stake in the company becomes smaller. It also typically reduces earnings per share (EPS), since profits are now distributed across a larger base of shares. Companies opt for dilutive FPOs to fund growth initiatives, repay debt, or strengthen their balance sheets. While it may temporarily pressure the stock price due to increased supply, it can signal long-term strategic intent if the capital is deployed effective.

- Non Dilutive Shares

A non-dilutive Follow-on Public Offer (FPO) is a type of secondary offering where a company’s existing shareholders typically promoters, early investors, or directors sell their personal holdings to the public without issuing new shares. Since no fresh equity is created, the total number of outstanding shares remains unchanged, and existing shareholders’ ownership percentages are not diluted. This approach doesn’t raise new capital for the company itself but can serve strategic purposes like increasing public shareholding to meet regulatory norms, improving stock liquidity, or allowing early investors to partially exit. It’s often referred to as an Offer for Sale (OFS) and is commonly used when the company wants to broaden its investor base without altering its capital structure.

Purpose:

- Fund expansion projects

- Reduce debt

- Improve working capital

- Meet regulatory requirements (e.g., minimum public shareholding)

Key Features:

- Requires SEBI approval and filing of a prospectus

- Shares are priced below market to attract investors

- May impact share price due to dilution

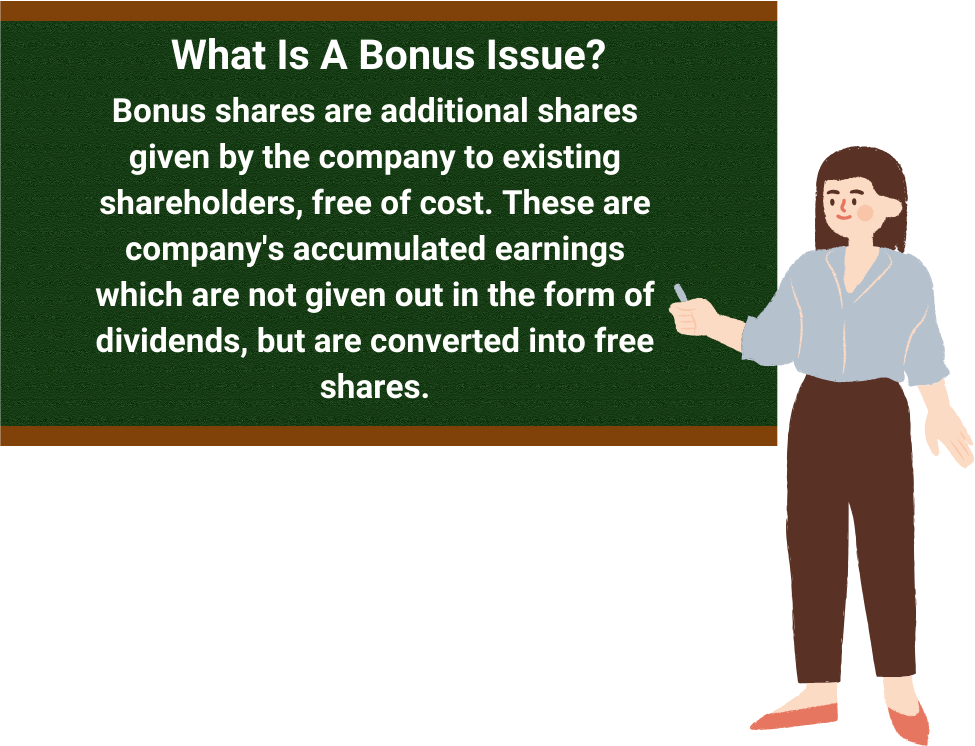

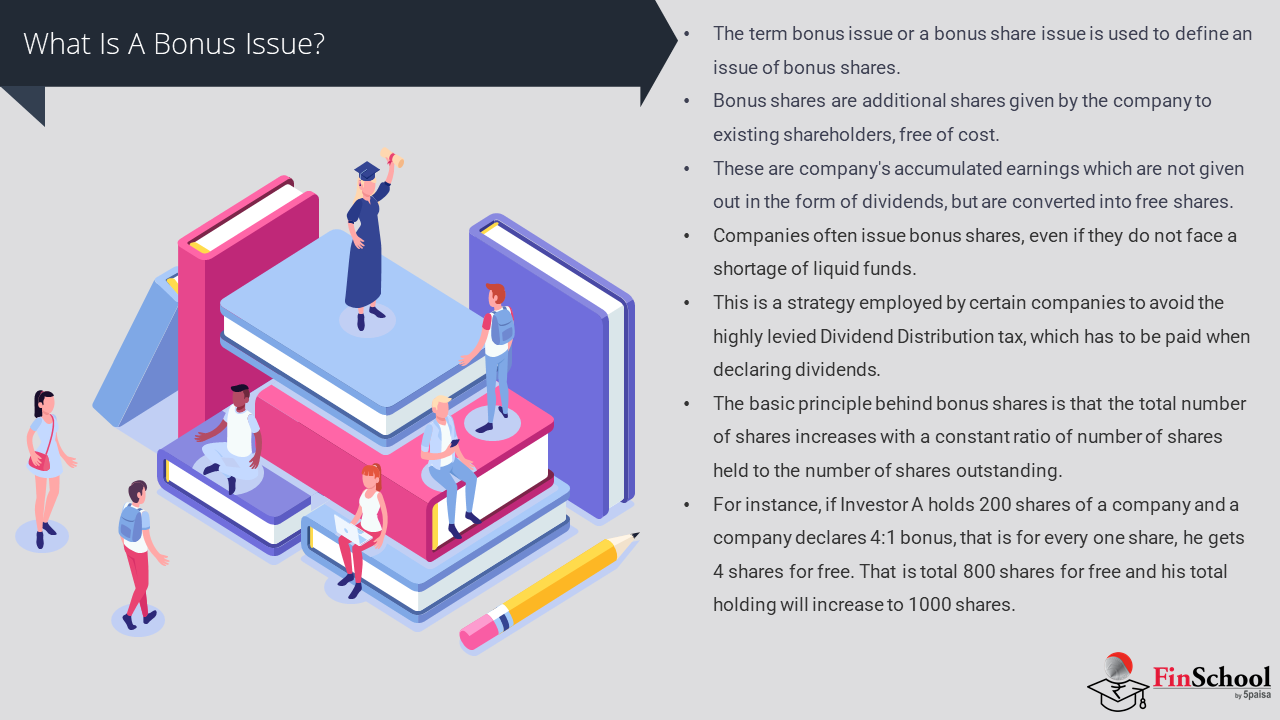

4.4 Bonus Issue

Vedant: “Nirav, I just received extra shares from a company without paying anything!”. “That’s a bonus issue. The company’s rewarding you for staying invested. Instead of giving out cash dividends, they’re giving you more shares from their accumulated profits.”

Nirav: “So You didn’t pay for them, but your total number of shares increased?”

Vedant: “Exactly. It increases liquidity and signals confidence in future earnings.”

So,

A Bonus Issue involves issuing additional shares to existing shareholders at no cost, based on their current holdings.

Mechanism:

Bonus shares are distributed to existing shareholders by a company using its accumulated free reserves or retained earnings, rather than through fresh capital infusion. These reserves are essentially past profits that the company chooses to reinvest into its equity structure rather than paying out as cash dividends. The issuance follows a specific ratio—for instance, a 1:1 bonus means each shareholder receives one additional share for every share already held, while a 2:1 ratio would result in two extra shares per existing share. This process doesn’t impact the company’s cash position but increases its share capital, often enhancing liquidity and reflecting management’s confidence in long-term performance.

Purpose:

- Signal strong financial health

- Increase liquidity by reducing share price proportionally

- Reward long-term shareholders

Impact:

- No change in total equity value

- EPS and share price adjust downward post-issue

- Shareholder ownership percentage remains unchanged

4.5 Rights Offering

Nirav: ” I heard one my friend who invests in shares , his company offered him new shares at a lower price. What’s going on?”

Vedant: “That’s a rights issue. Since you’re an existing shareholder, they’re giving you a chance to buy more shares usually at a discount before offering them to outsiders.”

Nirav: “Why would they do that?”

Vedant: “It helps them raise capital while keeping ownership within their current base. You have the right to buy more but it’s your choice.”

So,

A Rights Issue allows existing shareholders to purchase additional shares at a discounted price, in proportion to their holdings.

Purpose:

- Raise capital without diluting promoter control

- Fund acquisitions, repay debt, or support growth

Key Considerations:

- Requires board and shareholder approval

- Must comply with SEBI guidelines

- Subscription ratio and pricing are critical to investor response

4.6 Private Placement

Private Placement is the sale of securities to a select group of investors (not exceeding 200 in a financial year), bypassing public markets.

Nirav: “I heard a startup raised money but didn’t go public. How’s that possible?”

Vedant: “That’s private placement. They directly approached select investors—like banks or HNIs—instead of doing a public issue.”

Nirav: “So it’s faster and less regulated?”

Vedant: “Precisely. It’s ideal when companies want confidentiality or need urgent funds without the complexity of an IPO.”

Eligible Instruments: In a private placement under Section 42 of the Companies Act, eligible instruments typically include equity shares, preference shares, and debentures, allowing companies to structure funding according to their capital strategy and investor profiles.

Process: The process begins with the issuance of PAS-4, a Private Placement Offer Letter that formally communicates the terms of the offer to identified investors. This offer cannot be open to the public and requires both a valuation report and formal approvals from the company’s board and shareholders to proceed. One critical compliance aspect is that application money must be paid exclusively from the investor’s bank account to ensure transparency and traceability

Advantages: This method offers several advantages, such as faster execution, minimal regulatory burden compared to public issues, and the ability to tailor the offering to strategic investors like high-net-worth individuals and institutions.

Limitations: However, it also carries specific limitations—companies are prohibited from advertising or openly soliciting participation, and they must maintain comprehensive records of the offer recipients through PAS-5 to demonstrate regulatory compliance and safeguard against it being classified as a public offer.

What is PAS-4 and PAS-5?

PAS-4 and PAS-5 are forms prescribed under Section 42 of the Companies Act, 2013 and Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014, specifically designed to regulate private placements by Indian companies.

4.7 Qualified Institutional Placement

QIBs Include:

- Mutual funds

- Insurance companies

- Pension funds

- Banks

Nirav: “I saw a company raised money only from big institutions, no public offer. What’s that?”

Vedant: “That’s a QIP. It’s a quicker route for listed companies to raise capital from institutional players—like mutual funds or insurance firms.”

Nirav: “Why not include retail investors?”

Vedant: “Because QIPs involve financially savvy buyers and don’t require lengthy disclosures. It’s efficient and often helps stabilize investor confidence.”

So,

A QIP is a capital-raising tool for listed companies to issue securities to Qualified Institutional Buyers (QIBs) without undergoing elaborate regulatory procedures.

Features:

- Faster than FPO or Rights Issue

- No need for SEBI approval (subject to compliance with ICDR regulations)

- Pricing based on average market price over preceding weeks

Benefits:

- Efficient access to institutional capital

- Minimal dilution due to targeted issuance

- Enhances credibility and visibility among large investors

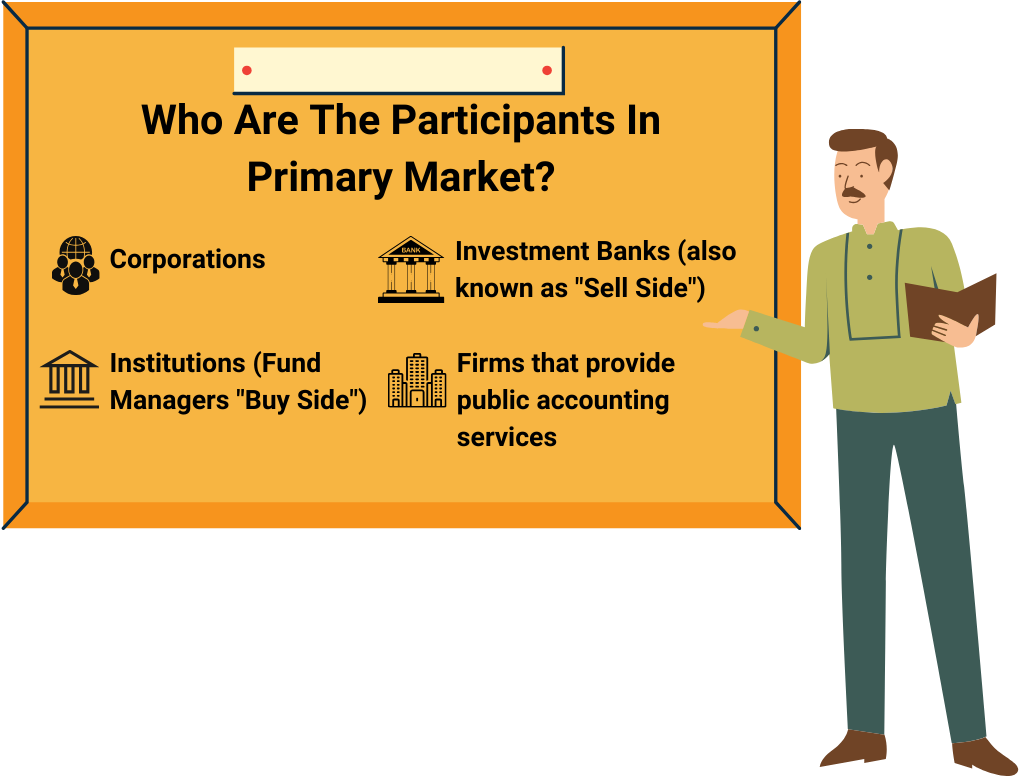

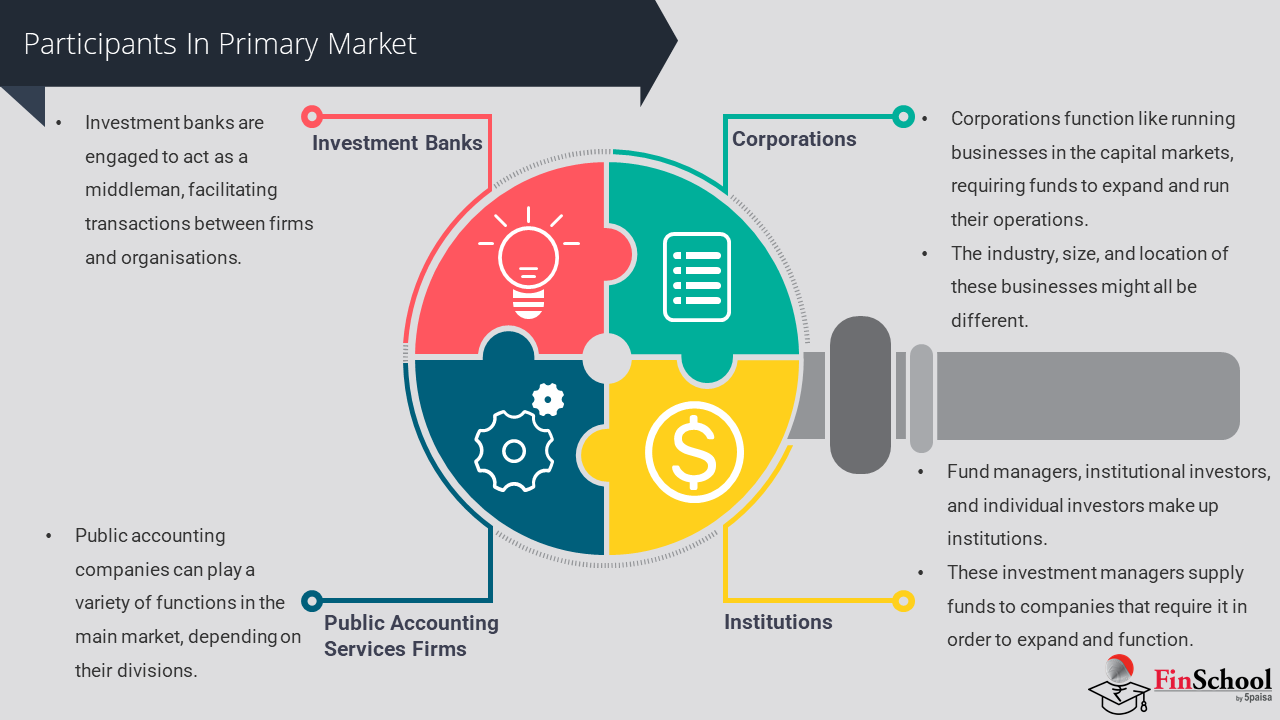

Nirav : So, who are the participants of Primary Market?

Vedant : There are several participants to Primary Market . Lets understand each of them in detail

4.8 Participants In Primary Market

Think of the primary market like organizing a big wedding. You have the couple i.e. the company ready to begin a new financial journey, and they need support to bring their big plans to life. The event planner (merchant banker) helps design and execute the perfect setup, the guests (investors) bring their gifts (capital), and the venue regulators (SEBI, stock exchanges) ensure everything follows proper customs and laws. Just like each participant makes the wedding successful, in the primary market, various players—from issuers to underwriters to regulators—collaborate to launch new securities and channel funds efficiently.

In the primary market, several participants work together to facilitate the issuance and subscription of new securities. Each plays a distinct role in ensuring that capital formation is efficient, transparent, and compliant with regulatory norms. Here’s a comprehensive breakdown:

Issuers

Suppose you’re opening a new restaurant and need funding. You prepare a business plan, decide whether you’ll take a loan or sell a share of your ownership, and invite people to invest. That’s you acting as an issuer—seeking capital to grow or stabilize your operations.

Issuers are entities typically companies, governments, or public sector undertakings that seek to raise capital by offering securities such as shares, debentures, or bonds. They initiate the process by preparing offer documents, determining the type of instrument to be issued, and setting the terms of the offer. Their objective may include funding expansion, repaying debt, or meeting regulatory requirements.

Merchant Bankers (Lead Managers)

Think of them as your consultant when launching that restaurant. They help you decide how much funding you need, draft legal paperwork, talk to government agencies for permits, and even figure out when to launch for maximum attention. They manage everything behind the scenes.

Merchant bankers are financial institutions authorized by SEBI to manage the issue. They conduct due diligence, draft the prospectus, coordinate with regulators, and oversee the entire issuance process. They also advise on pricing, timing, and investor targeting. In many cases, they act as underwriters, committing to subscribe to unsold portions of the issue.

Underwriters

Suppose you’re selling 100 pre-order vouchers for your restaurant. A friend promises to buy any leftover vouchers if others don’t, just because your opening day doesn’t flop. That friend is the underwriter, ensuring you get the cash regardless of demand.

Underwriters assume the risk of the issue by guaranteeing that a certain portion will be subscribed. If the public does not fully subscribe, underwriters purchase the remaining shares. This ensures that the issuer receives the intended capital. Underwriting may be done by banks, financial institutions, or merchant bankers.

Registrars and Transfer Agents (RTAs)

Think of them like the organizers handling RSVP forms (These forms help organizers know who’s coming, how many guests they’re bringing, and any special needs they might have—like dietary restrictions or accessibility requirements.) and meal preferences at your wedding. They collect details from guests, ensure everything’s correct, and distribute the right meals. For securities, they manage who applied, who got allotment, and update records.

RTAs manage the logistics of the issue, including collecting applications, verifying investor details, and overseeing allotment and refunds. They maintain records of ownership and facilitate the transfer of securities post-issuance. Their role is critical in ensuring accuracy and transparency in investor servicing.

Bankers to the Issue

These are the cash counters at your event or donation desk. People walk in to pay or register and these folks manage the money—making sure it goes to the right account, handling refunds, and maintaining transaction clarity.

These are designated banks that collect application money from investors during the subscription period. They manage escrow accounts, process refunds, and ensure that funds are securely transferred to the issuer. Their infrastructure supports both online and offline transactions.

Depositories (NSDL and CDSL)

Like digital lockers where you store family jewelry—safe, secure, and easily transferable. These institutions hold your investment electronically, ensuring you don’t lose physical papers and can access your securities whenever needed.

Depositories hold securities in electronic form and facilitate dematerialization. They ensure secure custody and enable seamless transfer of ownership. Investors must have a demat account with a depository participant to receive securities issued in the primary market.

Stock Exchanges

They’re like online marketplaces—say, Amazon or Flipkart—where you list your restaurant’s gift vouchers once they’re launched. People can buy and sell them afterward. The exchanges ensure rules are followed and buyers trust the platform.

Exchanges like NSE and BSE provide the platform for listing securities post-issuance. They review listing applications, ensure compliance with disclosure norms, and enable secondary market trading. Their involvement begins during the IPO process and continues through the lifecycle of the security.

Regulatory Authorities (SEBI)

Picture the food safety inspector who checks your restaurant before opening. They ensure you follow hygiene and safety norms. SEBI ensures all participants in the financial setup behave fairly and transparently.

SEBI governs the primary market in India. It reviews offer documents, enforces disclosure standards, and monitors compliance to protect investor interests. SEBI’s role ensures that issuers and intermediaries operate within a transparent and fair framework.

Investors

These are the people who book tables at your new restaurant or buy your pre-order vouchers. Some are your close friends (retail investors), some are big restaurant chains scouting for opportunities (QIBs), each with their own expectation and impact on your success.

Investors include retail individuals, high-net-worth individuals (HNIs), Qualified Institutional Buyers (QIBs), mutual funds, insurance companies, pension funds, and foreign portfolio investors. They provide the capital by subscribing to the securities. Their participation is segmented by category, each with specific allotment quotas and bidding norms.

Credit Rating Agencies

Imagine a food critic reviewing your restaurant even before it opens. They taste your sample dishes and assign ratings. People use those reviews to decide whether it’s worth dining in. Similarly, investors rely on ratings to judge the risk of your bonds or debentures.

For debt instruments, credit rating agencies assess the issuer’s financial health and assign ratings that reflect the risk level. These ratings influence investor decisions and pricing of the securities.

Legal Advisors and Auditors

Like your lawyer checking the lease and your accountant verifying the costs before opening day. They ensure everything is legit and that your paperwork isn’t hiding unpleasant surprises. Their stamp builds trust with investors.

Legal advisors ensure that the offer complies with applicable laws, while auditors verify the accuracy of financial disclosures. Their due diligence supports investor confidence and regulatory approval.

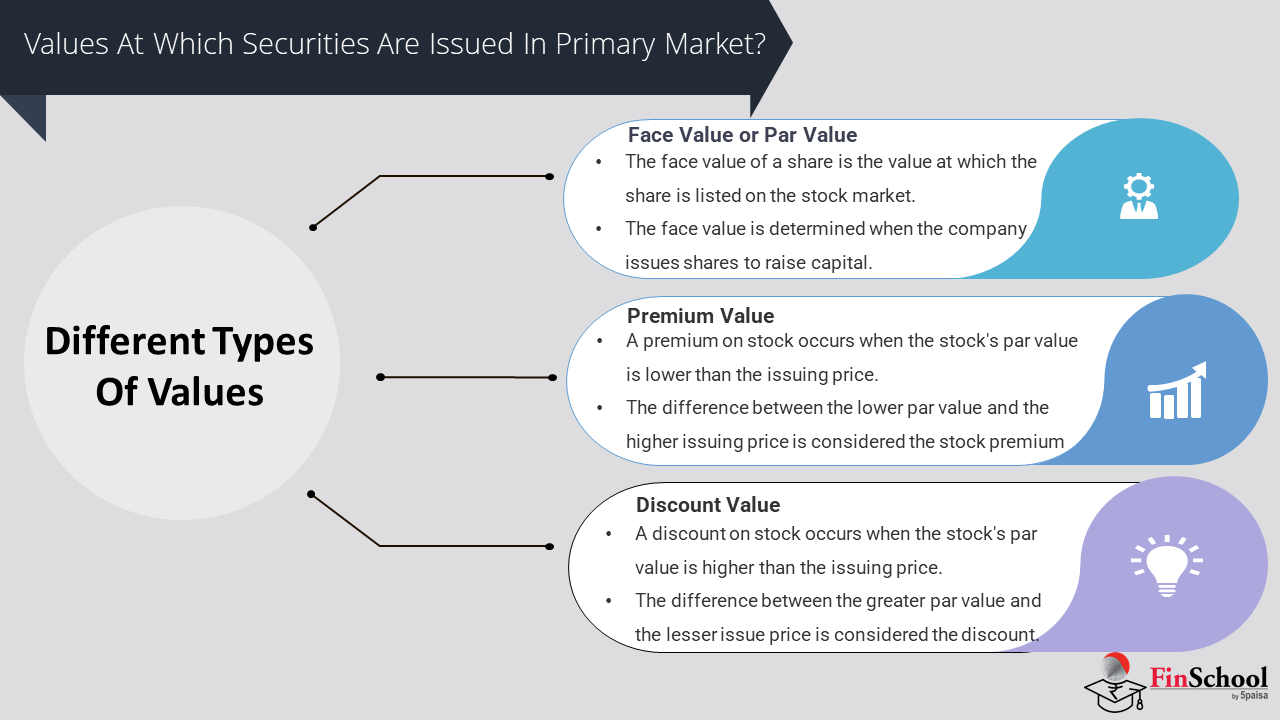

Nirav: Vedant,I came across the section on the value at which securities are issued. Can you explain how that value is determined?

Vedant: Sure. In the primary market, companies issue securities directly to investors to raise capital. The value—or issue price—is typically decided based on either face value, premium, or through book-building. The choice depends on factors like company valuation, investor demand, and market conditions.

Nirav: So, if a company issues shares at ₹100, and the face value is ₹10, does that mean ₹90 is premium?

Vedant: Exactly. That ₹90 becomes part of the securities premium reserve in the company’s balance sheet. It reflects investor perception of the company’s growth potential.

Nirav: And what’s this book-building method you mentioned?

Vedant: Book-building is a price discovery mechanism used mostly for IPOs. Instead of setting a fixed price, the company sets a price band—say ₹95 to ₹105—and investors place bids within that range. The final issue price is then based on the highest demand concentration.

Nirav: Interesting. Does SEBI regulate how these prices are set?

Vedant: Absolutely. SEBI mandates full disclosures in the offer document to ensure transparency. Pricing methods must be clearly stated to protect investors and maintain market integrity.

Nirav: That makes sense. So, whether it’s fixed pricing or book-building, it all comes down to balancing investor interest and company valuation.

Vedant: Exactly. And for traders or analysts, understanding these pricing strategies helps in evaluating IPO prospects or interpreting market responses to new listings.

4.9 Value At Which Securities Are Issued In Primary Market

1. Types of Issue Pricing Mechanisms

a. Fixed Price Method

For example : For Movie Tickets at a Theatre You pay ₹250 for a ticket, whether the hall is full or nearly empty. The price is fixed and disclosed before you decide to buy.

- The issuer sets a predetermined price for the securities.

- This price is disclosed in the offer document before the issue opens.

- Investors know the exact price they will pay when applying.

- Common in smaller or less complex offerings.

b. Book Building Method

For example A flight from Mumbai to Delhi may have a price band of ₹3,000–₹6,000. Early buyers or those booking during low demand get lower prices, while peak-time buyers pay more. The final price reflects demand.

- A price range (called the price band) is announced.

- Investors bid within this band, specifying the quantity and price they’re willing to pay.

- The final issue price is discovered based on demand and investor bids.

- Widely used in IPOs for efficient price discovery.

2. Factors Influencing Issue Price

Imagine you’re selling homemade Diwali sweets in your neighborhood. If your sweets are consistently delicious and well-received, that reflects strong fundamentals—people trust your quality, and you’re known for good results. Neighbors start comparing your prices to others offering similar treats, and this helps you gauge your pricing, much like valuation metrics such as P/E or P/B ratios in finance. Now, if it’s the festive season and everyone’s eager to buy, the mood is upbeat and demand spikes; this is similar to bullish market conditions that support premium pricing.

On the other hand, if it’s an off-season or there’s sudden inflation in ingredient costs, demand could dip or your costs might rise—comparable to bearish conditions in the stock market. In such cases, you may need to lower your price or even postpone selling. Finally, if your housing society sets rules that require clear labeling of prices and ingredients, that’s like SEBI’s regulatory oversight, ensuring transparency and protecting buyers’ interests.

a. Company Fundamentals

- Financial performance, growth prospects, asset base, and profitability.

- Strong fundamentals often justify a higher issue price.

b. Valuation Metrics

- Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Discounted Cash Flow (DCF) analysis.

- These help benchmark the company against peers and industry standards.

c. Market Conditions

- Prevailing investor sentiment, interest rates, and macroeconomic indicators.

- Bullish markets may support premium pricing; bearish conditions may require discounts.

d. Demand-Supply Dynamics

- Over subscriptionin book building may push the final price toward the upper band.

- Weak demand may lead to pricing at the lower end or even withdrawal of the issue.

e. Regulatory Oversight

- SEBI mandates full disclosure of pricing rationale in the offer document.

- Ensures transparency and protects investor interests.

3. Premium, Discount, and Face Value

Suppose you’re selling handmade notebooks at a local fair. You decide the base price is ₹100 per notebook—that’s your face value. Now:

- If your notebooks are beautifully crafted and in high demand, you might sell them for ₹150. That extra ₹50 is a premium, reflecting how much people value your product.

- If you’re trying to clear stock or attract early buyers, you might offer them at ₹80. That’s a discount, used strategically to boost interest.

- And if you sell them exactly at ₹100, that’s at par no premium or discount, just the nominal value.

So,

- Face Value: Nominal value of the security (e.g., ₹10 per share).

- Issue Price: Can be at par (equal to face value), at a premium(above face value), or at a discount (below face value, though rare and regulated).

- Premiumreflects investor confidence and company valuation.

- Discountsmay be offered in rights issues or to strategic investors under specific conditions.

4. Role of Intermediaries

Think of organizing a big wedding. You’re the host, but you need help managing the details:

A wedding planner acts like a merchant banker. They advise you on budget, venue selection, and how to allocate resources—just like merchant bankers guide companies on pricing and valuation. A caterer who guarantees food for 500 guests even if only 300 show up is like an underwriter. They take on the risk and ensure service delivery, regardless of turnout. A food critic who reviews the caterer’s past work and gives a rating is like a credit rating agency. Their opinion influences whether guests trust the food quality—just as ratings affect investor confidence in debt instruments.

So,

- Merchant Bankers: Advise on pricing strategy and conduct valuation.

- Underwriters: May influence pricing based on risk appetite and market reach.

- Credit Rating Agencies: For debt instruments, ratings impact coupon rates and investor perception.

Nirav : Vedant , Now I Just need to Understand what are Risks and Challenges involved in Primary Market?

Vedant : Sure! You definitely need to know What are the Risks involved in Primary Market

4.10 Risks and Challenges in Primary Market

Imagine a local entrepreneur launching a new food delivery app in your city. She sets a high subscription price based on optimistic projections i.e. overvaluation, but after launch, users find the service unreliable and uninstall it just like poor post-listing performance in an IPO. Since she’s new to the business, there’s no track record to assess her credibility, and her promotional brochure leaves out key details about delivery zones and refund policies similar to disclosure gaps.

Early adopters who signed up based on hype feel misled, while others hesitate due to lack of information. Meanwhile, tech-savvy users who researched alternatives had better insights, reflecting information asymmetry. If she launched during monsoon season when demand is low and logistics are tough, that’s timing risk. And if her app crashes during peak hours due to poor infrastructure, it mirrors operational challenges. Just like in the primary market, success depends not just on the product, but on timing, transparency, and trust.

1. Issuer-Specific Risks

- Overvaluation or Mispricing: Inaccurate valuation models or aggressive pricing strategies can lead to poor post-listing performance, eroding investor confidence.

- Limited Track Record: Especially in IPOs, new or unlisted companies may lack historical financial data, making risk assessment difficult.

- Disclosure Gaps: Incomplete or misleading information in offer documents can distort investor decision-making and attract regulatory scrutiny.

2. Investor-Related Challenges

- Information Asymmetry: Retail investors often lack access to the same level of analysis or due diligence as institutional participants.

- Speculative Participation: Herd behavior or short-term speculation can inflate demand artificially, leading to volatility post-listing.

- Allocation Inequity: In oversubscribed issues, retail investors may receive minimal allotment, reducing participation incentives.

3. Market and Economic Risks

- Volatile Market Conditions: Macroeconomic instability, interest rate fluctuations, or geopolitical events can dampen investor sentiment during the issuance period.

- Liquidity Constraints: In thinly subscribed issues, lack of secondary market interest can trap investors innon- liquid positions.

- Timing Risk: Poorly timed offeringssuch as during bearish phases can result in under-subscription or pricing at the lower end of the band.

4. Regulatory and Compliance Challenges

- Complex Approval Processes: Navigating SEBI norms, listing requirements, and disclosure mandates can delay issuance and increase costs.

- Legal Liabilities: Misstatements or omissions in offer documents can expose issuers and intermediaries to litigation or penalties.

- Changing Norms: Frequent updates to regulatory frameworks may require issuers to adapt quickly, increasing compliance burden.

5. Operational and Cost-Related Risks

- High Issuance Costs: Expenses related to merchant bankers, legal advisors, marketing, and underwriting can be prohibitive for smaller firms.

- Underwriting Risk: If underwriters fail to sell the committed portion, they may incur losses or reputational damage.

- Technology and Infrastructure Gaps: Inadequate digital platforms or investor outreach mechanisms can hinder subscription efficiency.

Nirav: That was a deep dive into the primary market—pricing mechanisms, risks, the role of intermediaries… quite a lot to absorb.

Vedant: Absolutely. And what’s fascinating is that all these elements come together when a company decides to raise capital from the public. It’s where the primary market really shines.

Nirav: Makes sense. So, just to wrap up—primary market is basically where securities are issued for the first time, and the pricing, demand-supply, regulations, and market conditions shape how that process unfolds.

Vedant: Exactly. And all of this leads us naturally into the next topic for discussion—IPOs.

Nirav: IPOs are when companies go public, right? But why do they even do that?

Vedant: Good question. Companies go public mainly to raise large-scale capital. It helps them expand operations, reduce debt, or even fund innovation. Plus, going public enhances credibility and gives early investors a chance to exit.

Nirav: So, in a way, an IPO is the bridge between private ambitions and public capital.

Vedant: Well said. Next time we can disscuss IPO actually is, the entire journey from planning to listing, and the strategic reasons behind going public.