- Study

- Slides

- Videos

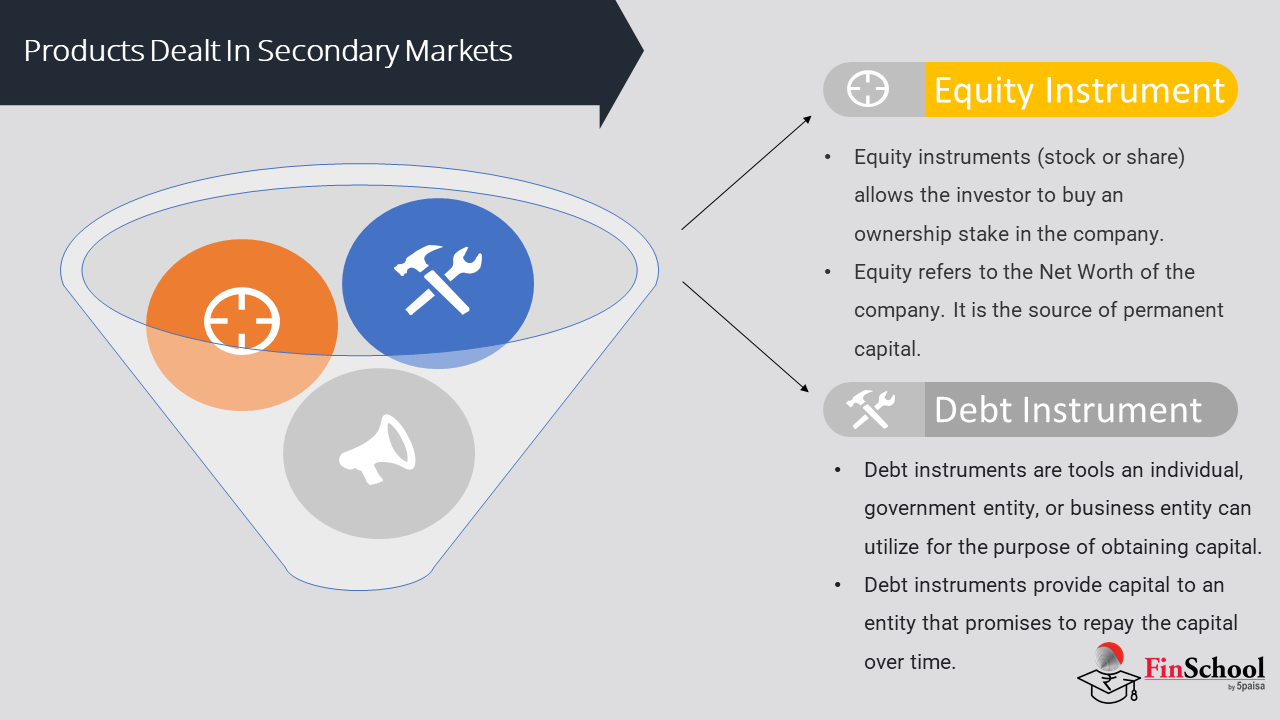

7.1 What Are The Products Dealt In Secondary Markets?

Vedant: Nirav, I used to think the secondary market was just about buying and selling shares, but there’s so much more to it.

Nirav: You’re right. It includes equities, bonds, mutual funds, ETFs, and derivatives—each with unique roles and risks.

Vedant: So it’s not just for investing, but also for hedging and speculation?

Nirav: Exactly. Derivatives help manage risk or make bets, while ETFs offer diversification with stock-like liquidity.

Vedant: And all these are traded on platforms like NSE and BSE?

Nirav: Yes. These exchanges give access to various instruments, catering to both long-term investors and short-term traders.

Vedant: Then let’s break down each product to see how they work and fit into different strategies.

Nirav: Perfect. Let’s start with bonds and fixed-income products, then move on to derivatives and ETFs.

What Are The Products Dealt In Secondary Markets?

At a weekend investment seminar in Pune, four distinct personalities converged over secondary market strategies. Asha, confident and analytical, leaned into volatile equities with a long-term vision. Rahul preferred the stability of preferred stocks, valuing predictable income.

Priya balanced caution and growth through convertible debentures, adapting fluidly to market shifts. Ramesh, ever the bold speculator, saw opportunity in warrants, chasing high-reward plays with conviction. Their approaches reflected not just financial choices, but deeply personal interpretations of risk, reward, and ambition.

They discussed about the products dealt in secondary market: –

- Equity Instrument

- Debt Instrument

Equity Instruments

Equity instruments (stock or share) allows the investor to buy an ownership stake in the company. Equity refers to the Net Worth of the company. It is the source of permanent capital. Equity instruments may or may not pay their investors a monthly income because such income relies on the profit/loss of the business. When they do, it is a dividend.

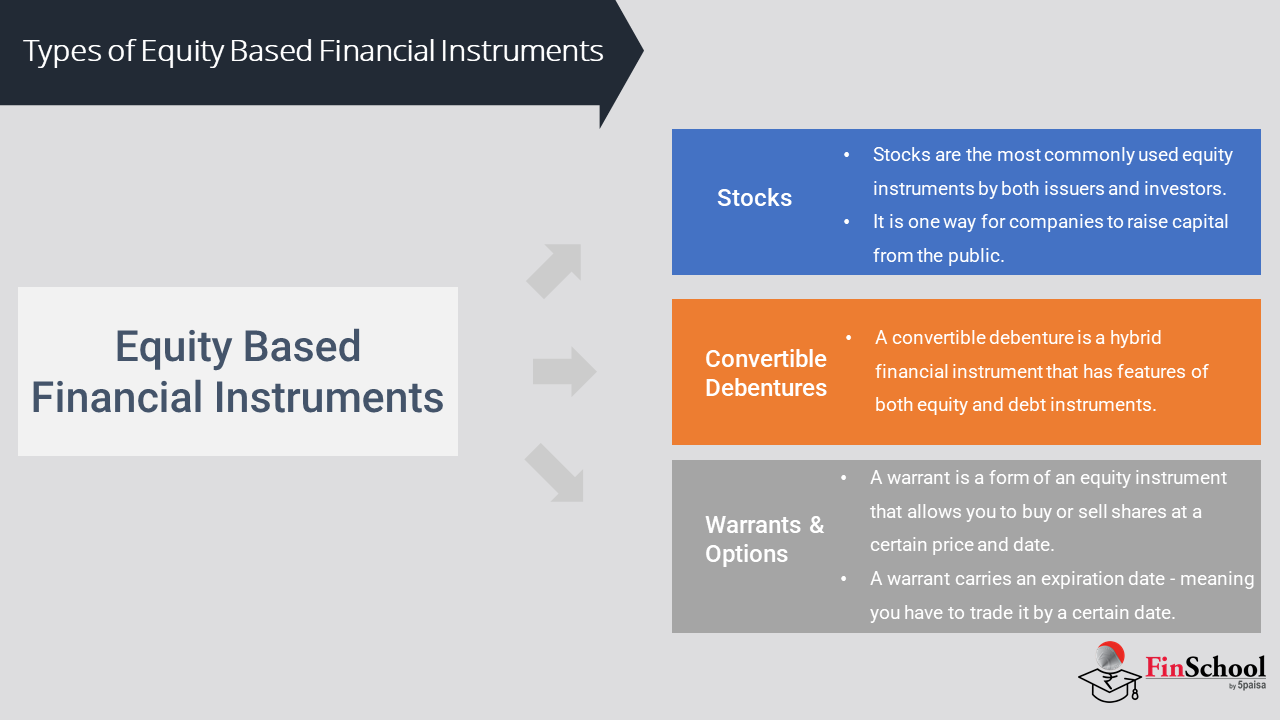

The most common types of equity-based financial instruments are:

- Stocks

Stocks are the most commonly used equity instruments by both issuers and investors. It is one way for companies to raise capital from the public.

There are two types of stocks:

- Common or ordinary stocks

- Preferred stocks

Investing in common/ordinary stocks comes with various benefits, such as:

- Co-ownership of the company

- Right to vote in shareholders’ meetings

- Right to make decisions on capital raising, dividends, and business mergers

- Authority to apply for new shares when the company’s capital increase

- Can declare common stocks as assets when applying for loans

- Common or ordinary stocks

Asha invests in common shares of a retail chain, gaining part ownership and voting rights on key decisions like international expansion. She receives dividends when the company profits, but none during losses, as dividends aren’t guaranteed. Common stockholders face high risk and are last in line for payouts—after creditors and priority shareholders, but they benefit from potentially higher returns when the company does well.

- Preferred stocks

Rahul opts for preferred shares in a utility company, valuing steady income over control. He doesn’t vote on decisions but receives fixed quarterly dividends, even during modest earnings—and has priority over common shareholders in payouts. Preferred stockholders have ownership with limited risk, no voting rights, and are paid after bondholders but before common shareholders, making it a stable, income-focused choice.

- Convertible Debentures

Priya invests in convertible debentures from an EV startup, earning regular interest like a loan. When the company’s stock surges, she converts her debentures into equity, becoming a part-owner and shifting from fixed income to potential capital gains. Convertible debentures blend debt and equity, offering higher interest than bonds and the flexibility to convert into shares, though they’re typically unsecured and carry some risk.

- Warrants And Options

Ramesh receives a warrant from a pharma company, allowing him to buy shares at ₹150 anytime over the next 3 years. Since the current price is ₹120, he waits. But if the stock jumps to ₹250 after a drug approval, he can exercise the warrant and gain instantly. Warrants are company-issued equity instruments that offer a fixed-price deal for future potential, with an expiration date.

Sneha, anticipating a tech stock surge, buys a call option at ₹200 valid for one month. If the stock rises to ₹280, she profits by exercising the option. If it stays at ₹190, she lets it expire, losing only the premium. Options offer a way to speculate with limited downside and no obligation to trade.

While both warrants and options give rights to buy shares at a set price and date, warrants are issued by companies and typically have longer durations. Options, on the other hand, are traded on stock exchanges and offer more flexibility for short-term strategies.

Nirav: Vedant, some shares don’t have a maturity date, they’re designed to last forever.

Vedant: Right, that’s a key trait of equity securities. But not all shares are alike some have expiry terms or unique voting setups.

Nirav: I found it interesting that shareholders don’t run the company, they just elect the board. It’s influence without direct control.

Vedant: Exactly. Plus, features like par value, cash flow rights, and liquidation seniority matter too. Investors need to understand what they truly own.

Nirav: So equity isn’t just about price—it’s about the built-in terms.

Vedant: Agreed. Let’s break down each feature to evaluate companies more smartly.

Features That Characterize and Vary Among Equity Securities:

- Life

Many equity securities are issued with an infinite life. In other words, they are issued without maturity dates. Some equity securities are issued with a maturity date.

- Par Value

Equity securities may or may not be issued with a par value. The par value of a share is the stated value, or face value, of the equity security. In some jurisdictions, issuing companies are required to assign a par value when issuing shares.

- Voting Rights

Some shares give their holders the right to vote on certain matters. Shareholders do not typically participate in the day-to-day business decisions of large companies. Instead, shareholders with voting rights collectively elect a group of people, called the board of directors, whose job it is to monitor the company’s business activities on behalf of its shareholders. The board of directors is responsible for appointing the company’s senior management (e.g., chief executive officer and chief operating officer), who manage the company’s day-to-day business operations. But decisions of high importance, such as the decision to acquire another company, usually require the approval of shareholders with voting rights.

- Cash flow rights Life

Cash flow rights are the rights of shareholders to distributions, such as dividends, made by the company. In the event of the company being liquidated, assets are distributed following a priority of claims, or seniority ranking. This priority of claims can affect the amount that an investor will receive upon liquidation.

Nirav: Vedant, I’ve been exploring FDs, gold, and real estate—but equities keep popping up. Why are they so hyped?

Vedant: Because equities offer ownership. You’re not just investing—you’re sharing in a company’s growth.

Nirav: So it’s more than price gains?

Vedant: Absolutely. Over time, equities build wealth through compounding and dividends. Risky short-term, but powerful long-term.

Nirav: Got it. It’s like backing business potential.

Vedant: Exactly. And with diversification, you can manage risk while tapping into growth.

7.2 Why Should One Invest In Equities In Particular?

Suppose if you spend ₹2,000 every month on takeaway coffees and weekend meals. On the other hand, if you decide to invest that same amount in a systematic investment plan (SIP) linked to a Nifty-based equity fund. After five years, you have nothing beyond memories and receipts, while your investments, assuming a 16% annual return, could grow to over ₹1.85 lakh.

This difference reflects how routine spending decisions, without considering opportunity cost, can delay wealth creation. Equities reward those who consistently invest and stay invested through market cycles, converting everyday trade-offs into long-term gains.

When you buy a share of a company you become a shareholder in that company. Shares are also known as Equities. Equities have the potential to increase in value over time. Research studies have proved that the equity returns have outperformed the returns of most other forms of investments in the long term. Investors buy equity shares or equity based mutual funds because: –

- Equities are considered the most rewarding, when compared to other investment options if held over a long duration.

- Research studies have proved that investments in some shares with a longer tenure of investment have yielded far superior returns than any other investment. The average annual return of the stock market over the period of last fifteen years, if one takes the Nifty index as the benchmark to compute the returns, has been around 16%.

However, this does not mean all equity investments would guarantee similar high returns. Equities are high risk investments. Though higher the risk, higher the potential returns, high risk also indicates that the investor stands to lose some or all his investment amount if prices move unfavourably. One needs to study equity markets and stocks in which investments are being made carefully, before investing

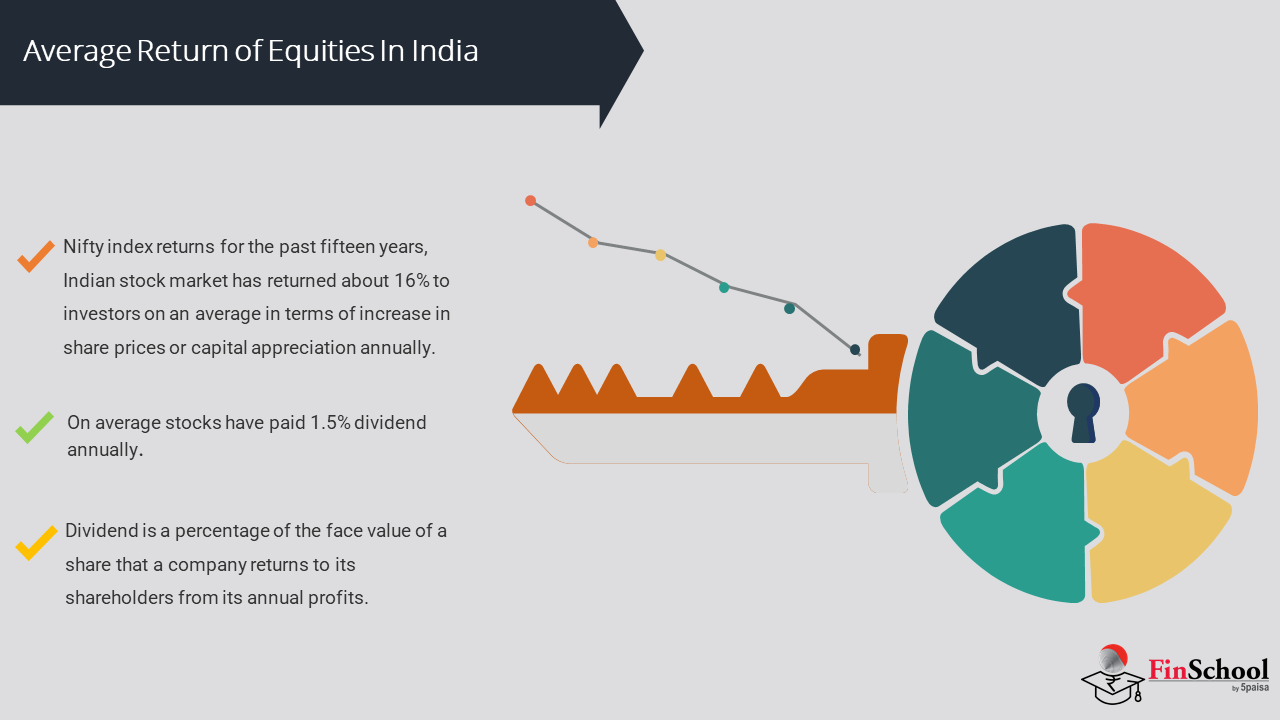

What Has Been The Average Return On Equities In India?

- If we take the Nifty index returns for the past fifteen years, Indian stock market has returned about 16% to investors on an average in terms of increase in share prices or capital appreciation annually. Besides that, on average stocks have paid 1.5% dividend annually.

- Dividend is a percentage of the face value of a share that a company returns to its shareholders from its annual profits. Compared to most other forms of investments, investing in equity shares offers the highest rate of return, if invested over a longer duration

Nirav: Vedant, I’ve been watching a mid-cap stock—it swings wildly without any news. What’s driving that?

Vedant: It’s more than company performance. Prices react to market psychology, macro trends, and speculation.

Nirav: So not just earnings?

Vedant: Right. Fundamentals matter, but so do interest rates, global events, and investor sentiment. Even rumors can move prices.

Nirav: Feels unpredictable.

Vedant: It is, but patterns emerge when you track demand-supply, sector trends, and economic signals. Charts and news together give clarity.

Nirav: Like using a compass and map?

Vedant: Exactly—both help you navigate market volatility.

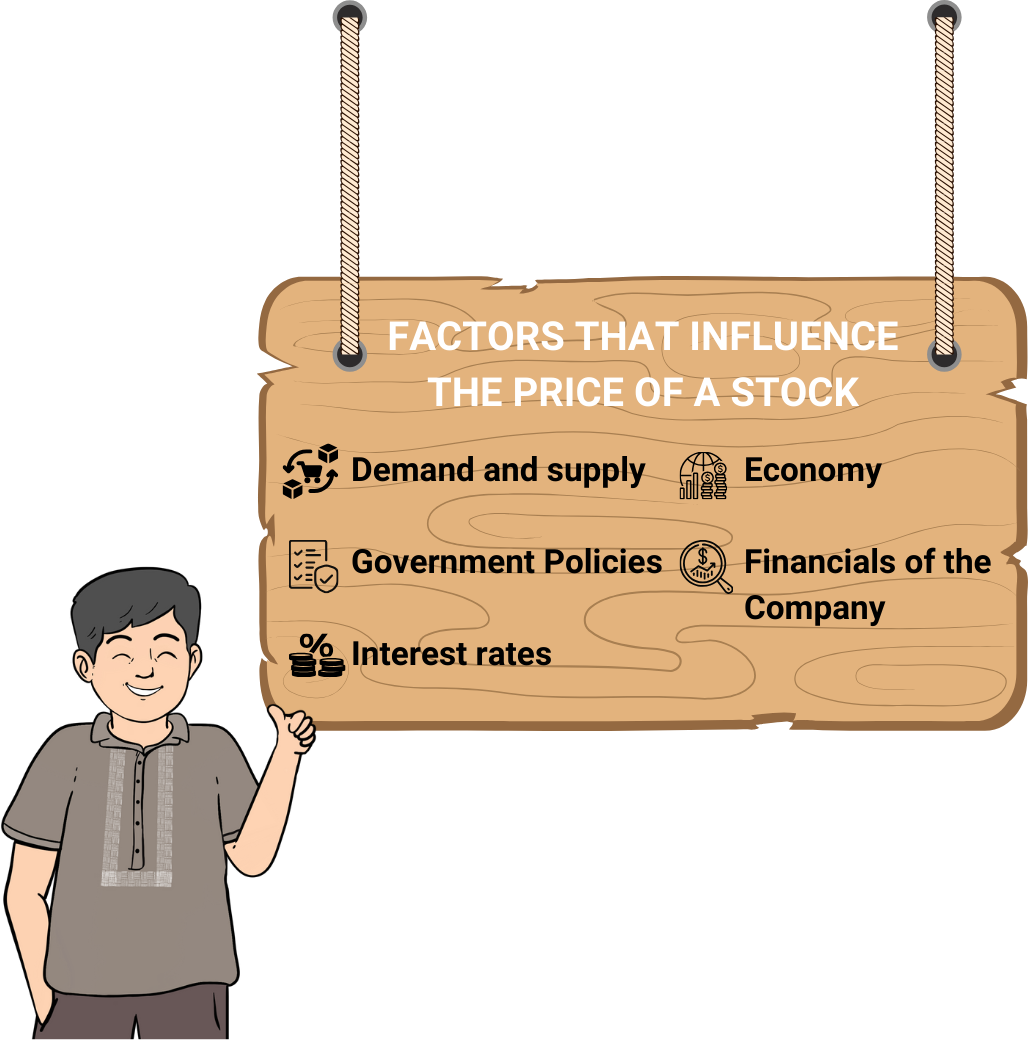

7.3 What Are The Factors That Influence The Price Of A Stock?

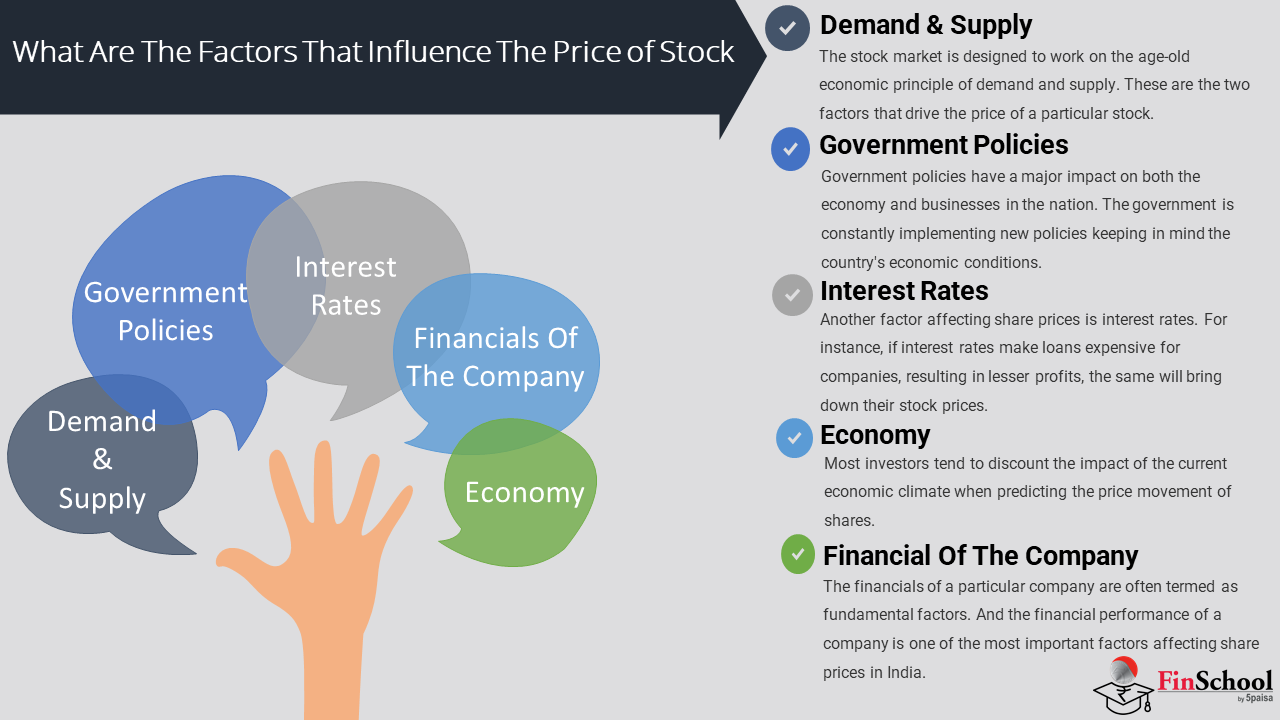

Demand and supply

Imagine trying to book tickets for an India vs. Pakistan match—huge demand, limited seats. Prices soar on resale platforms because fans are willing to pay more. Now picture a local weekday match—plenty of tickets, few takers. Sellers drop prices just to fill seats.

Stocks work the same way.

- High demand, low supply→ Price rises

- Low demand, high supply→ Price falls

The stock market runs on this basic principle: when more people want to buy a stock than sell it, prices go up. When more want to sell than buy, prices drop. Just like any marketplace, it’s all about what people want and how much is available.

Government Policies

Imagine you run a bakery and the government hikes electricity tariffs and GST on food. Your costs rise, profits shrink—you might raise prices or cut staff. Now scale that up. A company like Jubilant FoodWorks faces the same pressures. Higher taxes and input costs mean lower expected profits. Investors react by selling shares, and the stock price drops. Government policies—like tax changes or new regulations, can directly impact business costs and profitability. These ripple through investor sentiment, influencing stock prices across sectors.

Interest rates

Say your friend wants to open a café, but the bank hikes loan interest rates. Borrowing gets costly, so he delays or scales down. Less growth, less profit.

Now apply that to listed companies. When interest rates rise, borrowing becomes expensive. Businesses cut back on expansion, profits dip, and investors sell shares—causing stock prices to fall.

The RBI adjusts rates like the repo rate to manage inflation.

- Higher rates→ Costlier loans → Lower profits → Falling stock prices

- Lower rates→ Cheaper loans → More growth → Rising stock prices

Interest rates shape business decisions—and investor expectations.

Economy

Imagine your uncle’s travel agency struggling as fewer people book vacations during a global slowdown. His revenue drops, and he cuts costs. Similarly, when India’s economy slows or global uncertainty rises, companies face reduced demand, impacting profits and stock prices.Foreign Institutional Investors (FIIs) play a big role in Indian markets. If the economy weakens, FIIs may pull out funds, seeking safer investments elsewhere. This selling pressure can drag down stock prices, reflecting broader economic health and investor confidence.

Financials of the Company

If your friend’s clothing brand triples its sales and boosts profits, you’d feel confident investing in her. Similarly, when companies report strong financials—like rising revenue and healthy profit margins—investor confidence grows, increasing demand for their shares and pushing prices up.A company’s financial performance, or fundamentals, is a key driver of stock prices. Investors tend to avoid firms with weak numbers, causing their stock to fall. On the flip side, strong fundamentals attract more investors and traders, fueling price growth.

Nirav: Vedant, I saw “growth stock” and “value stock” in a blog. What’s the difference?

Vedant: Growth stocks are companies expected to grow faster than average—like tech disruptors. They’re priced for future potential, often with high valuations and no dividends.

Nirav: And value stocks?

Vedant: They’re stable companies trading below their true worth—like buying quality on discount. Investors believe the market’s undervalued them, and prices will eventually rise.

Nirav: So growth is momentum, value is mispricing?

Vedant: Exactly. It depends—do you want future stars or overlooked bargains?

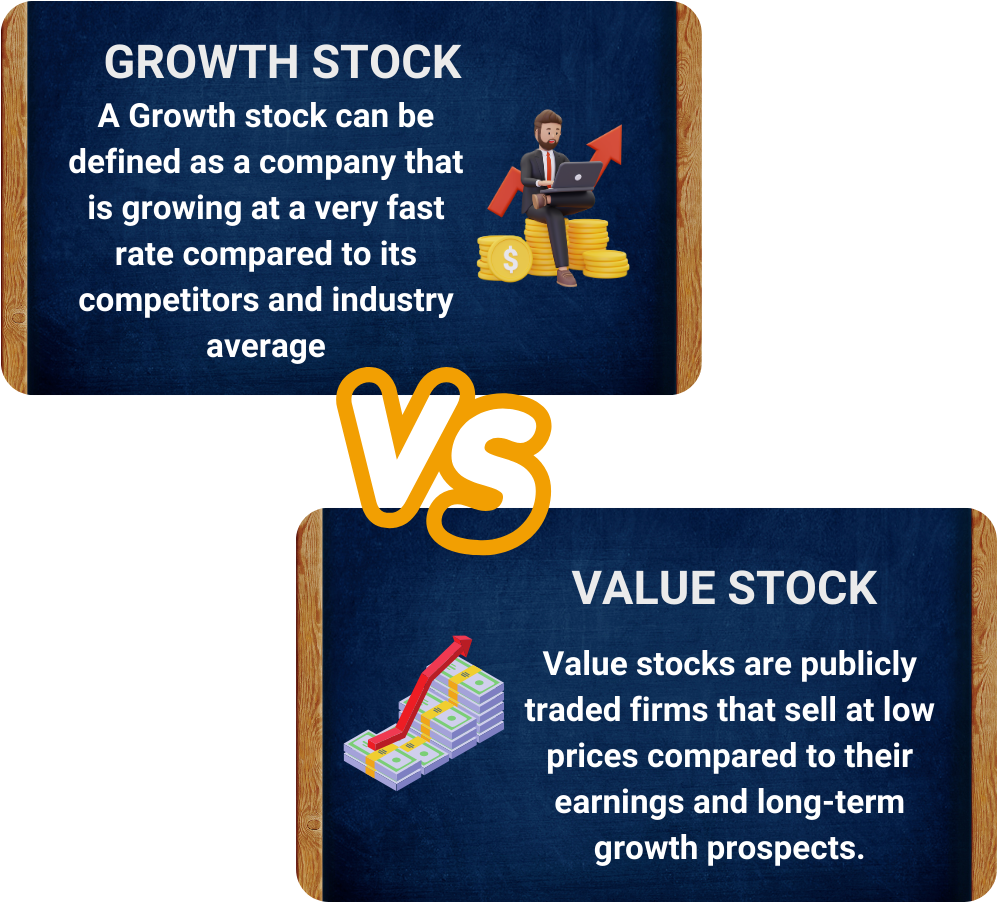

7.4 What Is Meant By The Term Growth Stock/Value Stock?

Companies that are deemed to have the ability to outperform the broader market over time due to their future potential are known as growth stocks.

Value stocks are companies that are currently trading at a discount to their true value and will consequently deliver a higher return. In this article we will be looking into both of their differences and which one is good to invest in.

Growth Stocks

Imagine “TiffinBox,” a startup delivering home-cooked meals in metro cities. It expanded rapidly, kept prices low, and invested heavily in tech—running at a loss to gain market share. Over three years, it scaled from 500 to 15,000 meals a day. Though not initially profitable, its soaring revenues and customer base signaled long-term potential, attracting investors and boosting its share price.

Growth stocks are companies growing faster than their peers, often measured by revenue, profits, or market share. Early on, they prioritize expansion over earnings. As financials improve, investor confidence rises, creating a cycle of rising valuations and demand.

Value Stocks

Think of your neighborhood kirana store, steady sales, loyal customers, and predictable earnings. If it were publicly listed, its slow growth might lead to a low valuation. But small upgrades like digitizing inventory or online tie-ups could quietly boost profits, attracting savvy investors before the market catches on.Value stocks are companies trading below their true worth, often overlooked due to slow growth or temporary setbacks. They offer stable business models and modest earnings, but their low prices can hide strong long-term potential—making them ideal for patient, value-focused investors.

Growth v/s Value which one to choose?

Both growth and value stocks provide investors with profitable investment options. Your specific financial goals and investing preferences will determine which investment strategy is ideal for you.

Nirav: Vedant, how do I choose between growth and value stocks?

Vedant: Growth stocks focus on future potential—rapid expansion, innovation, and high valuations. They reinvest profits and rarely pay dividends.

Nirav: And value stocks?

Vedant: They’re stable, often undervalued companies with steady earnings and regular dividends. Growth is about future upside; value is about present mispricing.

Nirav: So it depends on whether I want momentum or patience?

Vedant: Exactly. Your strategy decides the pick.

Growth Stocks and value Stocks Characteristics

Growth Stocks Characteristics

- You are not concerned about your portfolio’s current income

The majority of fast-growing corporations do not pay big dividends to their owners. This is because they choose to reinvest all available cash back into their firm in order to promote faster growth.

- You’re at ease with large stock price swings

A growth stock’s price is very sensitive to changes in a company’s business prospects in the future. Growth stocks can skyrocket in value when things go better than expected. Higher-priced growth stocks can fall back to Earth just as rapidly as lower-priced growth companies when they disappoint.

- You’re confident in your ability to predict winners in emerging markets

Growth stocks are frequently found in fast-moving sectors of the economy, such as technology. Many various growth companies fight against each other on a regular basis. You’ll need to identify as many future winners as possible in a certain industry while avoiding losers.

- You’ll have plenty of time to get your money back before you need it

Growth stocks can take a long time to reach their full potential, and they frequently experience setbacks. It’s vital to have a long enough time horizon to allow the business to flourish.

Value Stocks Characteristics

- You’re looking for current income from your investment portfolio

Many value stocks pay out large amounts of money in dividends to their stockholders. Because such organisations lack considerable development potential, they must find other ways to keep their stock appealing. One strategy to entice investors to look at a stock is to pay out attractive dividend pay-outs.

- You’d rather have more consistent and stable stock prices

Value stocks aren’t known for having huge price swings in either way. Stock price volatility is usually modest as long as their business circumstances remain within predictable parameters.

- You’re certain you’ll be able to avoid value traps

Stocks that appear to be bargains are frequently value traps or bargains for a cause. It’s possible that a business has lost its competitive advantage or is unable to keep up with the pace of innovation. To see whether a company’s future business prospects are weak, you’ll need to be able to look past its enticing values.

- You’re looking for a faster return on your investment

Value stocks don’t make money overnight. A company’s stock price might fast grow if it is successful in getting its business moving in the correct way. The finest value investors spot stocks that are undervalued and buy shares before others do.

Nirav: What does “portfolio” mean in finance?

Vedant: It’s a collection of investments—like stocks, bonds, or real estate. Think of it like a cricket team, where each asset plays a role: growth, safety, or income.

Nirav: And diversification?

Vedant: That’s spreading investments across types or sectors to manage risk. If one underperforms, others can balance it—just like a team effort.

Nirav: So managing a portfolio is strategic?

Vedant: Exactly. It depends on your goals, risk appetite, and time horizon. Smart investors review and adjust regularly.

7.5 What Is a Portfolio?

Meera uses her bonus wisely—₹50,000 in fixed deposits for safety, ₹40,000 in mutual funds for growth, ₹30,000 in blue-chip stocks, ₹10,000 in savings for emergencies, plus gold ETFs and international funds. This mix of assets forms her portfolio, balancing risk, returns, and liquidity. A portfolio is a collection of investments—stocks, bonds, cash, ETFs, and more. Like a balanced diet, a diversified portfolio helps maintain financial health. Managing it well ensures steady growth and protects against market ups and downs.

Portfolio Management

How well investment risk is managed is a key determinant of the success of investment management. Risk occurs when there is uncertainty- meaning that a variety of outcomes are possible from a particular situation or action.

In investment terms, risk is the possibility that the actual realized return on an investment will be something other than the return originally expected on the investment. There will be times when the return fails to meet an investor’s expectations and times when the return exceeds expectations.

Nirav: Vedant, everyone talks about returns in equities—but what about the risks?

Vedant: Good point. Equities offer strong returns but come with volatility. Prices swing due to news, sentiment, and economic shifts.

Nirav: So it’s more than picking the right stock?

Vedant: Yes—there’s business risk, market risk, and liquidity risk. That’s why diversification, time horizon, and knowing your risk tolerance are key.

Nirav: So risk isn’t to be feared, but managed?

Vedant: Exactly. Equities need strategy, not just optimism.

Risk Involved

These two types of risk are called systematic risk and specific risk, respectively.

Systematic risk :

Imagine Rahul runs a chain of retail clothing stores. During an economic downturn, fewer people shop for clothes, and consumer spending drops across the board, even though Rahul’s stores are well managed. His revenue declines not because of something he did, but because the overall economy is struggling. This is systematic risk, it affects all businesses, regardless of individual performance.

The risk created by general economic conditions is known as systematic or market risk because the risk stems from the wider economic system. For example, if the economy enters a recession, many companies will see a downturn in their revenues and profits.

Specific risk

If Rahul invests heavily in a new clothing line and it flops, that’s specific risk—linked to company-level decisions. He can reduce it by expanding to multiple cities, just like investors diversify across stocks and sectors to manage unsystematic risk. Even if Rahul diversifies, a nationwide recession would still hurt his business. That’s systematic risk—caused by broad economic factors. It affects all investments and can’t be eliminated through diversification. Investors accept this risk in exchange for potentially higher long-term returns.

Nirav: Vedant, what does diversification really mean?

Vedant: It’s about spreading investments across assets, sectors, or geographies—so if one crashes, others can cushion the impact.

Nirav: Like a safety net?

Vedant: Exactly. Holding banking, FMCG, and IT stocks—or mixing equities, debt, and gold—helps balance risk. True diversification means choosing assets that react differently to market shifts.

Nirav: So the aim is steadier returns and fewer shocks?

Vedant: Spot on. Ready to explore how to build one for the Indian market?

7.6 What Is Diversification?

Diversification is an investing strategy used to manage danger. Rather than concentrating capital in a single company, sector or asset class, investors diversify their investments across a range of different companies, sector and asset classes.

When assets and/ or asset classes with different characteristics are combined in a portfolio, the overall level of risk is typically reduced. Mathematically, a portfolio that combines two assets has an expected return that is the weighted average of the returns on the individual assets. Provided that the two assets are less than perfectly correlated, the risk of the portfolio will be less than the weighted average of the risk of the two assets individually.

7.7 What Are The Advantages Of Having A Diversified Portfolio?

Reduces the Impact Of Market Volatility

A diversified portfolio minimizes the overall risk associated with the portfolio. Since investment is made across different asset classes and sectors, the overall impact of market volatility comes down. Owning investments across different funds ensures that industry-specific and enterprise-specific risks are low. Thus, it reduces risks and generates higher returns in the long run.

Benefit Of Different Investment Instrument

Diversification balances your risk and returns that are associated with different funds. For example, if you are investing in mutual funds, you enjoy debt and equity. When you invest in fixed deposits, you would be taking advantage of returns and low risk. This is the case with a diversified portfolio, and you can enjoy the benefits of different instruments.

Capital Preservation

It is quite probable that every investor is not always at their growing stage. Some who are near to their retirement age are looking forward to ways to do capital preservation. At that time, portfolio diversification will help them in achieving that objective.

Generating Better Returns (At Similar Levels Of Risk)

With asset diversification, there is a higher possibility for better returns. There are market rallies when certain asset classes perform extremely well and having a diversified portfolio better ensures you benefitting from this. Having equity during a bull market phase allows for higher-than-average returns. And having debt during a bear market allows decent returns even with drop-in equity portfolio.

Nirav: Vedant, I get the basic idea behind stocks. But I saw this term “debt instrument” in a portfolio breakdown, what exactly does it mean?

Vedant: Simply put, debt instruments are tools companies or governments use to borrow money. When you invest in one, you’re basically lending them money in exchange for interest.

Nirav: So it’s like being the bank?

Vedant: Exactly. Instruments like bonds, debentures, and treasury bills fall under this. They come with fixed returns and maturity dates—unlike equities, where returns depend on market performance.

Nirav: Sounds safer than stocks?

Vedant: Generally, yes. Less volatile and more predictable. But returns are usually lower too. And some carry credit risk—if the borrower defaults, you might lose money.

Nirav: Got it. So debt instruments are about capital preservation and steady income.

Vedant: Spot on. They’re useful for balancing a portfolio, especially when you want reduced exposure to market swings.

7.8 What Is A Debt Instrument?

Ankit lends ₹50,000 to Neha for her baking venture, formalized through a promissory note with 10% interest and a one-year repayment term. This note legally binds Neha to repay the amount, making it a debt instrument—Ankit earns fixed income, and Neha gets capital to grow. Debt instruments like bonds, debentures, and promissory notes are fixed-income assets. They legally obligate the borrower to repay principal plus interest and can be paper or digital. These instruments may also be transferred, offering predictable returns to lenders.

7.9 What Are The Features Of Debt Instruments?

Main Features of Debt Securities

Issue date and issue price

Debt securities will always come with an issue date and an issue price at which investors buy the securities when first issued.

Coupon rate

Issuers are also warranted to pay an interest rate, also related to as the coupon rate. The coupon rate is fixed throughout the life of the security. Coupons are declared either by stating the number (example: 8%) or with a benchmark rate (example: LIBOR+0.5%). It is usually represented as a percentage of the face value or the par value of the bond.

Maturity date

Maturity date refers to when the issuer must repay the headliner at face value and remaining interest. The maturity date determines the term that categorizes debt securities.

Yield-to- Maturity (YTM)

Originally, yield-to- maturity (YTM) measures the periodic rate of return an investor is hoped to earn if the debt is held to maturity. It’s used to compare securities with parallel maturity dates and considers the bond’s pasteboard payments, copping price, and face value.

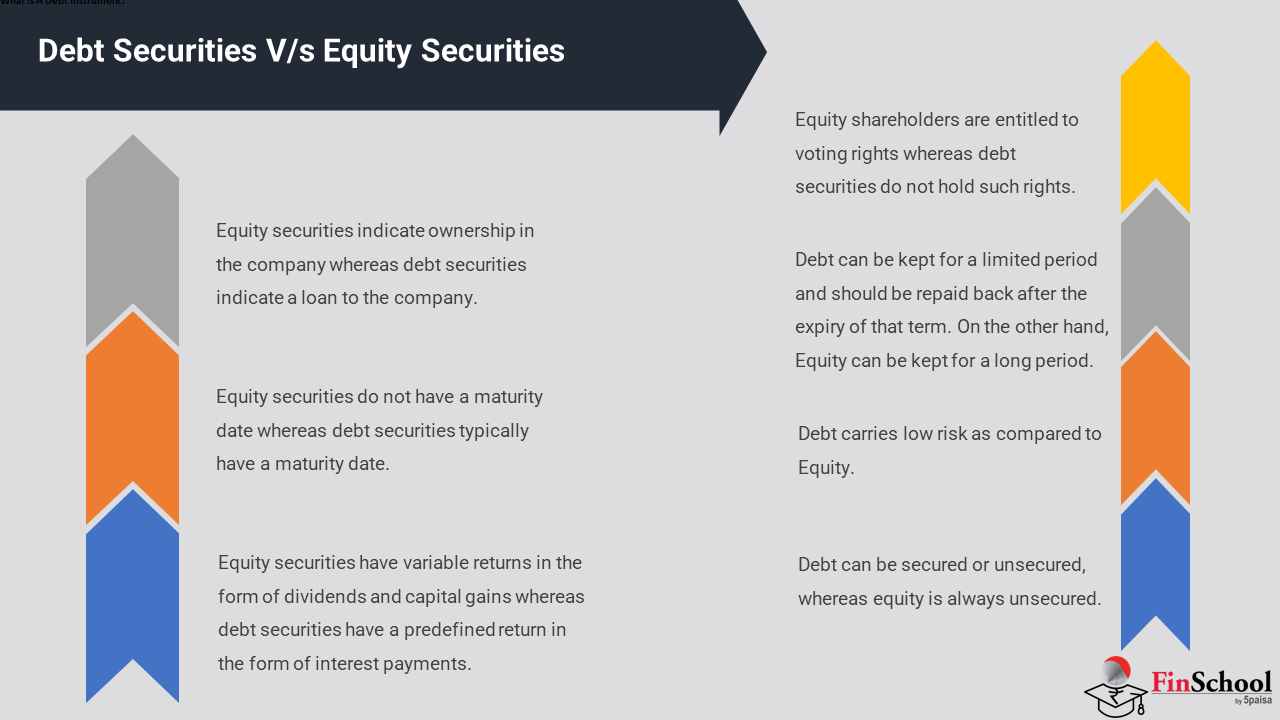

Debt Securities Vs. Equity Securities

- Equity securities indicate ownership in the company whereas debt securities indicate a loan to the company.

- Equity securities do not have a maturity date whereas debt securities typically have a maturity date.

- Equity securities have variable returns in the form of dividends and capital gains whereas debt securities have a predefined return in the form of interest payments.

- Equity shareholders are entitled to voting rights whereas debt securities do not hold such rights.

- Debt can be kept for a limited period and should be repaid back after the expiry of that term. On the other hand, Equity can be kept for a long period.

- Debt carries low risk as compared to Equity.

- Debt can be secured or unsecured, whereas equity is always unsecured.

Types of Debt Instruments

- Bonds

Bonds are fixed-income securities where investors lend money to companies or governments for a set period in exchange for regular interest payments and repayment of the principal at maturity. They’re used by issuers to fund operations, projects, or supplement revenue, and are considered lower-risk than stocks—especially investment-grade bonds. Bonds help diversify portfolios, offer steady income, and preserve capital, making them ideal for retirement planning and balancing more volatile investments.

Debenture: A debenture is an unsecured bond without collateral backing. Debenture holders are general creditors and rely on the issuer’s overall creditworthiness. Firms with strong credit or limited collateral often issue debentures, trusting their reputation to attract investors.

Commercial Paper: Commercial paper is a short-term, unsecured debt instrument issued by corporations to cover immediate expenses like payroll or inventory. It typically matures within a few days to 270 days, pays fixed interest, and is sold at a discount due to its risk.

Fixed Deposit (FD): A fixed deposit is a term investment offered by banks or NBFCs that provides higher interest than savings accounts. Popular in India, FDs lock in funds until maturity and come in various forms like regular FDs, recurring deposits, and Flexi FDs.

Nirav: That was a lot—from equities to debt and diversification. I didn’t realize how deep “stock market products” go.

Vedant: Right. Each instrument serves a purpose—wealth building, capital preservation, or risk management. Now you can evaluate them based on your goals and market trends.

Nirav: I keep seeing terms like Nifty 50, Sensex, and sectoral indices. What’s their role?

Vedant: Those are stock market indices—tools that track groups of stocks and reflect market performance. They’re reference points, not products.

Nirav: So they help interpret market sentiment?

Vedant: Exactly. Let’s dive into how they’re built, why they matter, and how investors use them.