- Study

- Slides

- Videos

2.1 How to build Emergency Fund

An emergency fund is a financial safety net designed to cover unexpected expenses or emergencies, such as medical bills, car repairs, or job loss. It should ideally contain enough money to cover three to six months’ worth of living expenses and be kept in an easily accessible savings account. This fund provides peace of mind and financial stability by ensuring you’re prepared for life’s unpredictable events, reducing the need to rely on credit cards or loans in times of crisis.

To build an emergency fund, start by determining your monthly expenses and aim to save three to six months’ worth. For example, if your expenses are ₹30,000 per month, you should target ₹90,000 to ₹180,000. Open a separate savings account to avoid spending it on non-emergencies. Set a monthly savings goal, say ₹5,000, and automate the transfer from your main account to your emergency fund. Regularly review your progress and adjust as needed. Maintaining this fund will provide financial security and peace of mind in case of unexpected expenses or emergencies.

What is emergency fund

An emergency fund is a stash of money set aside to cover unexpected expenses or financial emergencies. Think of it as a safety net to help you navigate life’s unpredictable twists and turns. Here are a few key points about emergency funds:

- Purpose: It’s meant for unforeseen expenses, like medical emergencies, car repairs, or sudden job loss.

- Amount: Financial experts often recommend having enough to cover three to six months’ worth of living expenses.

- Accessibility: It should be kept in a liquid form, such as a savings account, so you can access it quickly when needed.

- Peace of Mind: Having an emergency fund can reduce financial stress and give you peace of mind, knowing you’re prepared for the unexpected.

An emergency fund is a financial safety net designed to cover unexpected expenses or emergencies, such as medical bills, car repairs, or job loss. It should ideally contain enough money to cover three to six months’ worth of living expenses and be kept in an easily accessible savings account. This fund provides peace of mind and financial stability by ensuring you’re prepared for life’s unpredictable events, reducing the need to rely on credit cards or loans in times of crisis.

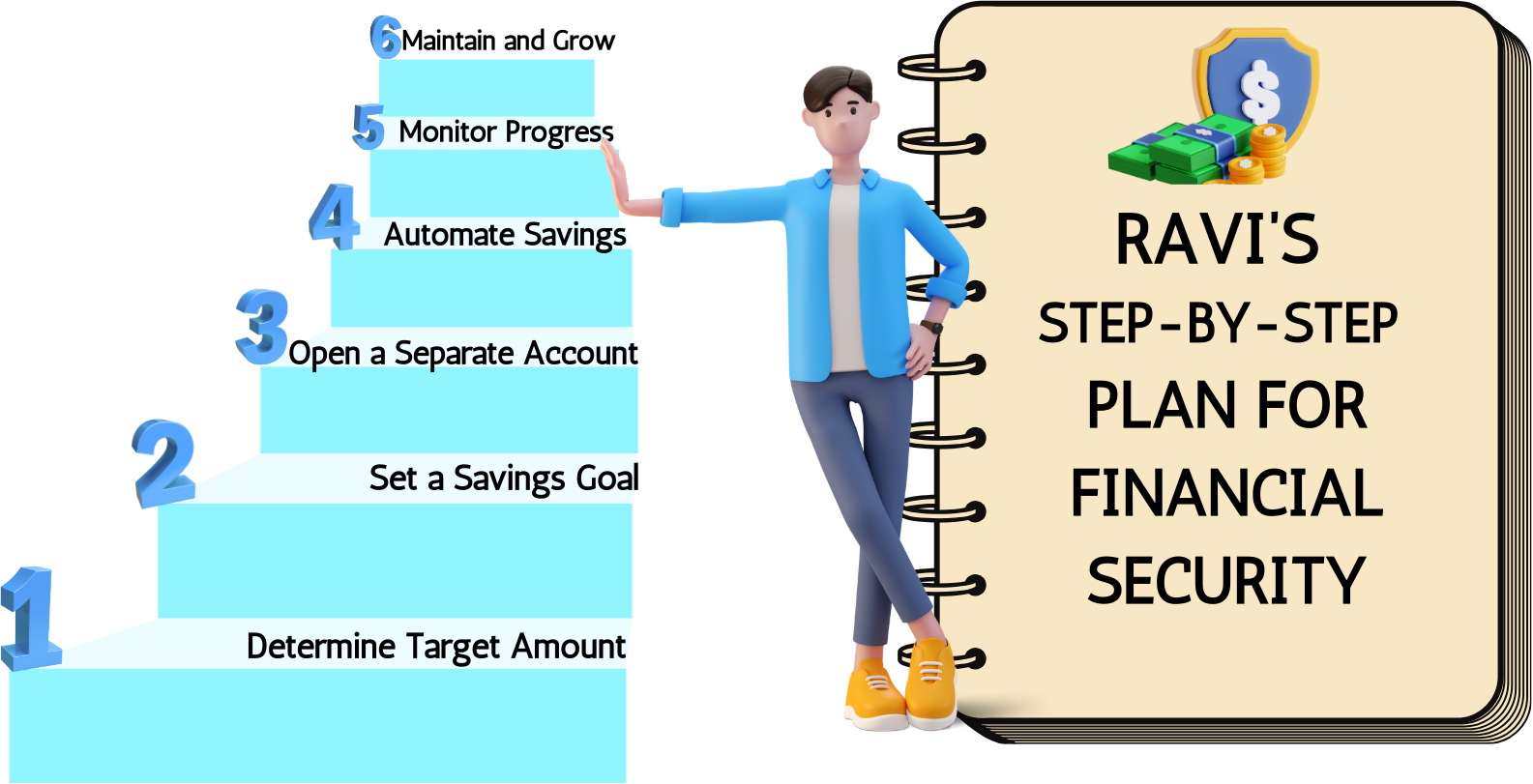

How to build emergency fund explain with example of Ravi

Let’s take an example to illustrate how to build an emergency fund:

Ravi is a 30-year-old working professional who earns ₹50,000 per month. He wants to create an emergency fund to cover at least three months of his living expenses. Here’s how Ravi can go about building his emergency fund:

- Determine the target amount: Ravi calculates his monthly living expenses, including rent, groceries, utilities, and other necessities, which amount to ₹30,000. To cover three months of expenses, he needs an emergency fund of ₹90,000 (₹30,000 x 3).

- Set a savings goal: Ravi decides to save ₹5,000 each month from his salary. He sets this amount aside as a non-negotiable part of his budget.

- Open a separate savings account: Ravi opens a dedicated savings account for his emergency fund to keep it separate from his regular expenses. This helps him avoid the temptation of dipping into the fund for non-emergency purposes.

- Automate savings: To make the process easier, Ravi sets up an automatic transfer of ₹5,000 from his main account to his emergency fund account every month. This way, he doesn’t have to remember to do it manually.

- Monitor progress and adjust: Every month, Ravi checks his progress and makes adjustments if needed. For example, if he gets a bonus or a salary increase, he may choose to allocate a portion of it to his emergency fund to reach his goal faster.

- Maintain and grow: Once Ravi reaches his target of ₹90,000, he continues to monitor and maintain his emergency fund. If his expenses increase or he faces an unexpected financial need, he replenishes the fund as necessary.

2.2 Important Points to check before buying insurance

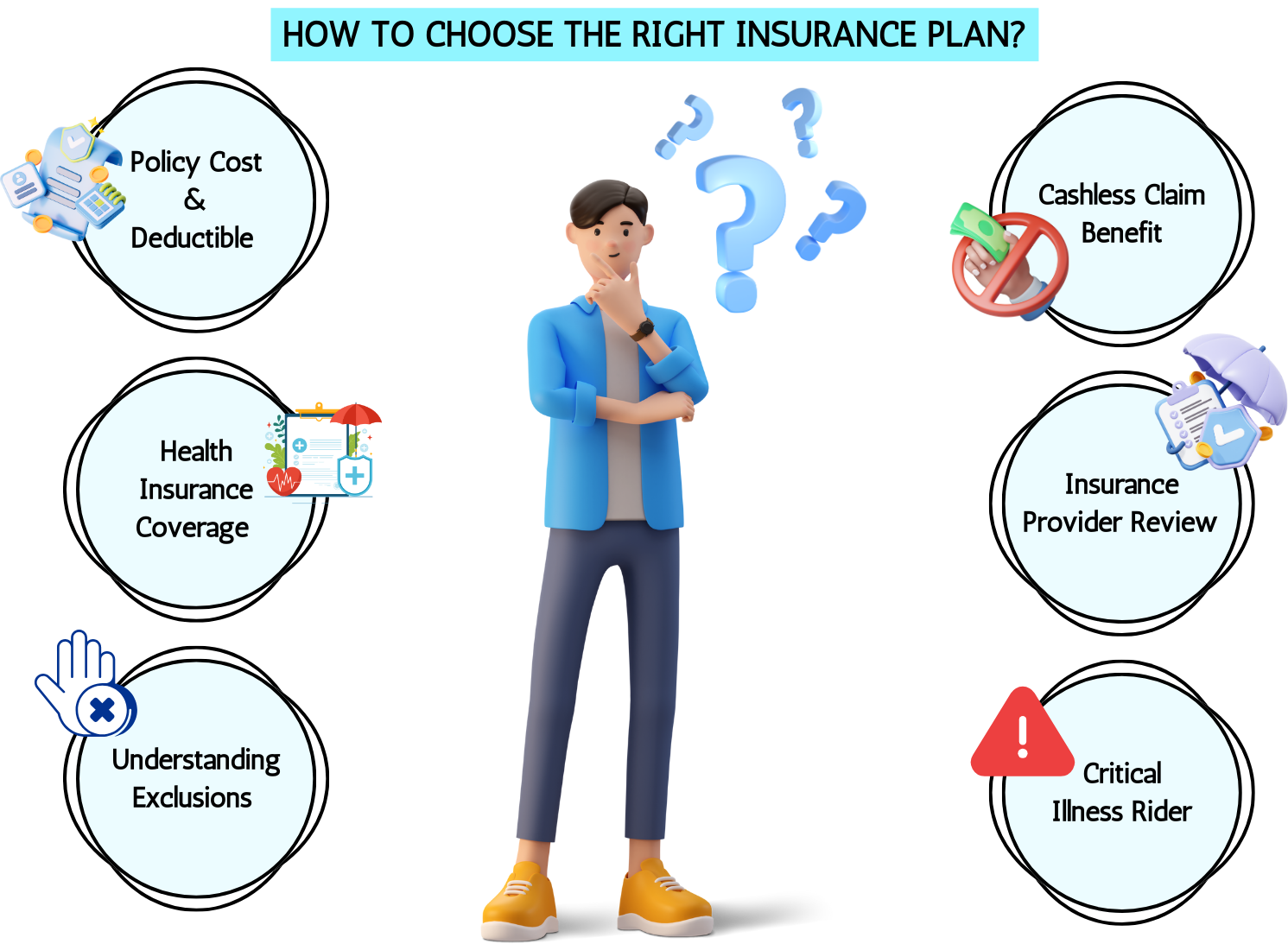

When buying insurance, there are several important factors to consider. Here are some key points to check:

Coverage and Policy Limits: Understand what the insurance policy covers and its limitations. Ensure it covers all your needs, whether it’s health, life, auto, or home insurance.

Example: Ravi wants to ensure that his policy covers hospitalization, surgery, and outpatient treatments. He chooses a policy with a sum insured of ₹10 lakh to provide adequate coverage for his family.

Premiums and Deductibles: Compare the premium amounts and deductible options. Choose a policy that fits your budget and offers a reasonable deductible.

Example: Ravi compares different policies and finds that the annual premium for the chosen policy is ₹15,000. The deductible (the amount he must pay before the insurance kicks in) is ₹5,000. This is a reasonable amount for Ravi’s budget.

Exclusions and Limitations: Be aware of any exclusions or limitations in the policy. This includes understanding what is not covered and any specific conditions or situations where coverage may be denied.

Example: Ravi carefully reads the policy document to understand the exclusions. For instance, the policy does not cover pre-existing conditions for the first two years. Ravi makes a note of this to avoid any surprises.

Claim Process: Review the claim process and how easy it is to file a claim. Check the insurer’s reputation for handling claims efficiently and fairly.

Example: Ravi reviews the claim process and finds that the insurer offers a cashless facility at network hospitals. This means Ravi doesn’t have to pay upfront and can get treated at network hospitals without much hassle.

Provider Reputation: Research the insurance provider’s reputation, customer reviews, and financial stability. A reliable insurer with good customer service is crucial.

Example: Ravi researches the insurance provider’s reputation and finds positive customer reviews. He also checks the insurer’s financial stability and ratings to ensure that it is a reliable company.

Rider Options: Consider any additional rider options that can enhance your coverage, such as add-ons for critical illness, accidental death, or personal belongings.

Example: Ravi decides to add a critical illness rider to his policy. For an additional premium of ₹2,000 per year, this rider will cover him for critical illnesses such as cancer and heart disease.

Policy Renewal Terms: Check the policy renewal terms and any potential increases in premiums upon renewal. Understanding the renewal conditions will help you avoid unexpected costs.

Example: Ravi checks the policy renewal terms and finds that the premiums may increase by about 10% each year. He factors this into his long-term budgeting.

Network of Providers (for Health Insurance): If buying health insurance, check the network of hospitals and doctors covered by the policy. Ensure that your preferred healthcare providers are included in the network.

Example: Ravi ensures that nearby hospitals are part of the insurer’s network. This gives him peace of mind knowing that he can access quality healthcare locally.

Government Regulations and Compliance: Ensure the insurance policy complies with local regulations and standards. This can provide an extra layer of security and trust.

Example: Ravi verifies that the insurance policy complies with regulatory guidelines. This adds a layer of trust and security.

Discounts and Incentives: Look for any available discounts or incentives that can reduce your premium costs. This might include no-claims bonuses, multi-policy discounts, or loyalty rewards.

Example: Ravi looks for available discounts and finds that he is eligible for a no-claims bonus. If doesn’t make any claims in a year, his sum insured will increase by 10% without any additional premium.

2.3.What are Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

PMJJBY is a life insurance scheme that provides coverage for death due to any reason. Here are the key details:

- Coverage: The scheme offers a life cover of ₹2 lakh.

- Eligibility: Individuals aged 18 to 50 years with a bank or post office account are eligible to join.

- Premium: The annual premium is ₹436, which is auto-debited from the subscriber’s bank or post office account.

- Policy Term: It is a one-year cover, renewable from year to year.

- Enrolment Period: The cover period is from June 1 to May 31. Enrolment can be done at any time during the year, with pro-rata premium payments for those enrolling mid-year.

- Administration: The scheme is administered through Life Insurance Corporation (LIC) and other life insurance companies in collaboration with participating banks and post offices.

Scenario

- Ravi is a 40-year-old individual with a savings bank account. He wants to secure his family’s financial future by enrolling in the PMJJBY scheme

- Ravi is eligible for the scheme as he is between 18 and 50 years old and has a savings bank account.

- The scheme provides a life cover of ₹2 lakh in case of Ravi’s death due to any reason.

- The annual premium for the scheme is ₹436, which will be auto debited from Ravi’s bank account.

- Ravi enrolls in the scheme by submitting the consent-cum-declaration form to his bank. The premium is auto-debited from his account, and the coverage starts from the date of auto-debit.

- The policy is a one-year cover, renewable from year to year. The cover period is from June 1 to May 31.

- For the first 30 days from the date of enrolment, the insurance cover is not available for death due to any reason other than an accident. This is known as the lien period.

- In the unfortunate event of Ravi’s death, his nominee can file a claim by submitting the necessary documents to the bank. The claim amount of ₹2 lakh will be paid to the nominee.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

PMSBY is an accident insurance scheme that provides coverage for accidental death and disability. Here are the key details:

- Coverage: The scheme offers coverage of ₹2 lakh for accidental death or total and irrecoverable loss of both eyes or both hands or feet. It provides ₹1 lakh for total and irrecoverable loss of sight of one eye or loss of use of one hand or foot.

- Eligibility: Individuals aged 18 to 70 years with a bank or post office account are eligible to join.

- Premium: The annual premium is ₹20, which is auto debited from the subscriber’s bank or post office account.

- Policy Term: It is a one-year cover, renewable from year to year.

- Enrolment Period: The cover period is from June 1 to May 31. Enrolment can be done at any time during the year.

- Administration: The scheme is administered through Public Sector General Insurance Companies (PSGICs) and other general insurance companies in collaboration with participating banks and post offices

Example

- Ravi is a 40-year-old individual with a savings bank account. He wants to ensure financial protection for himself and his family in case of an accident by enrolling in the PMSBY scheme.

- Ravi is eligible for the scheme as he is between 18 and 70 years old and has a savings bank account.

- The scheme provides coverage of ₹2 lakh for accidental death or total and irrecoverable loss of both eyes or both hands or feet. It also provides ₹1 lakh for total and irrecoverable loss of sight of one eye or loss of use of one hand or foot.

- The annual premium for the scheme is ₹20, which will be auto debited from Ravi’s bank account.

- Ravi enrolls in the scheme by submitting the consent-cum-declaration form to his bank. The premium is auto-debited from his account, and the coverage starts from the date of auto-debit.

- The policy is a one-year cover, renewable from year to year. The cover period is from June 1 to May 31.

- In the unfortunate event of Ravi’s accidental death or disability, his nominee or he himself can file a claim by submitting the necessary documents to the bank. The claim amount will be paid to the nominee or credited to Ravi’s bank account, depending on the situation.

2.1 How to build Emergency Fund

An emergency fund is a financial safety net designed to cover unexpected expenses or emergencies, such as medical bills, car repairs, or job loss. It should ideally contain enough money to cover three to six months’ worth of living expenses and be kept in an easily accessible savings account. This fund provides peace of mind and financial stability by ensuring you’re prepared for life’s unpredictable events, reducing the need to rely on credit cards or loans in times of crisis.

To build an emergency fund, start by determining your monthly expenses and aim to save three to six months’ worth. For example, if your expenses are ₹30,000 per month, you should target ₹90,000 to ₹180,000. Open a separate savings account to avoid spending it on non-emergencies. Set a monthly savings goal, say ₹5,000, and automate the transfer from your main account to your emergency fund. Regularly review your progress and adjust as needed. Maintaining this fund will provide financial security and peace of mind in case of unexpected expenses or emergencies.

What is emergency fund

An emergency fund is a stash of money set aside to cover unexpected expenses or financial emergencies. Think of it as a safety net to help you navigate life’s unpredictable twists and turns. Here are a few key points about emergency funds:

- Purpose: It’s meant for unforeseen expenses, like medical emergencies, car repairs, or sudden job loss.

- Amount: Financial experts often recommend having enough to cover three to six months’ worth of living expenses.

- Accessibility: It should be kept in a liquid form, such as a savings account, so you can access it quickly when needed.

- Peace of Mind: Having an emergency fund can reduce financial stress and give you peace of mind, knowing you’re prepared for the unexpected.

An emergency fund is a financial safety net designed to cover unexpected expenses or emergencies, such as medical bills, car repairs, or job loss. It should ideally contain enough money to cover three to six months’ worth of living expenses and be kept in an easily accessible savings account. This fund provides peace of mind and financial stability by ensuring you’re prepared for life’s unpredictable events, reducing the need to rely on credit cards or loans in times of crisis.

How to build emergency fund explain with example of Ravi

Let’s take an example to illustrate how to build an emergency fund:

Ravi is a 30-year-old working professional who earns ₹50,000 per month. He wants to create an emergency fund to cover at least three months of his living expenses. Here’s how Ravi can go about building his emergency fund:

- Determine the target amount: Ravi calculates his monthly living expenses, including rent, groceries, utilities, and other necessities, which amount to ₹30,000. To cover three months of expenses, he needs an emergency fund of ₹90,000 (₹30,000 x 3).

- Set a savings goal: Ravi decides to save ₹5,000 each month from his salary. He sets this amount aside as a non-negotiable part of his budget.

- Open a separate savings account: Ravi opens a dedicated savings account for his emergency fund to keep it separate from his regular expenses. This helps him avoid the temptation of dipping into the fund for non-emergency purposes.

- Automate savings: To make the process easier, Ravi sets up an automatic transfer of ₹5,000 from his main account to his emergency fund account every month. This way, he doesn’t have to remember to do it manually.

- Monitor progress and adjust: Every month, Ravi checks his progress and makes adjustments if needed. For example, if he gets a bonus or a salary increase, he may choose to allocate a portion of it to his emergency fund to reach his goal faster.

- Maintain and grow: Once Ravi reaches his target of ₹90,000, he continues to monitor and maintain his emergency fund. If his expenses increase or he faces an unexpected financial need, he replenishes the fund as necessary.

2.2 Important Points to check before buying insurance

When buying insurance, there are several important factors to consider. Here are some key points to check:

Coverage and Policy Limits: Understand what the insurance policy covers and its limitations. Ensure it covers all your needs, whether it’s health, life, auto, or home insurance.

Example: Ravi wants to ensure that his policy covers hospitalization, surgery, and outpatient treatments. He chooses a policy with a sum insured of ₹10 lakh to provide adequate coverage for his family.

Premiums and Deductibles: Compare the premium amounts and deductible options. Choose a policy that fits your budget and offers a reasonable deductible.

Example: Ravi compares different policies and finds that the annual premium for the chosen policy is ₹15,000. The deductible (the amount he must pay before the insurance kicks in) is ₹5,000. This is a reasonable amount for Ravi’s budget.

Exclusions and Limitations: Be aware of any exclusions or limitations in the policy. This includes understanding what is not covered and any specific conditions or situations where coverage may be denied.

Example: Ravi carefully reads the policy document to understand the exclusions. For instance, the policy does not cover pre-existing conditions for the first two years. Ravi makes a note of this to avoid any surprises.

Claim Process: Review the claim process and how easy it is to file a claim. Check the insurer’s reputation for handling claims efficiently and fairly.

Example: Ravi reviews the claim process and finds that the insurer offers a cashless facility at network hospitals. This means Ravi doesn’t have to pay upfront and can get treated at network hospitals without much hassle.

Provider Reputation: Research the insurance provider’s reputation, customer reviews, and financial stability. A reliable insurer with good customer service is crucial.

Example: Ravi researches the insurance provider’s reputation and finds positive customer reviews. He also checks the insurer’s financial stability and ratings to ensure that it is a reliable company.

Rider Options: Consider any additional rider options that can enhance your coverage, such as add-ons for critical illness, accidental death, or personal belongings.

Example: Ravi decides to add a critical illness rider to his policy. For an additional premium of ₹2,000 per year, this rider will cover him for critical illnesses such as cancer and heart disease.

Policy Renewal Terms: Check the policy renewal terms and any potential increases in premiums upon renewal. Understanding the renewal conditions will help you avoid unexpected costs.

Example: Ravi checks the policy renewal terms and finds that the premiums may increase by about 10% each year. He factors this into his long-term budgeting.

Network of Providers (for Health Insurance): If buying health insurance, check the network of hospitals and doctors covered by the policy. Ensure that your preferred healthcare providers are included in the network.

Example: Ravi ensures that nearby hospitals are part of the insurer’s network. This gives him peace of mind knowing that he can access quality healthcare locally.

Government Regulations and Compliance: Ensure the insurance policy complies with local regulations and standards. This can provide an extra layer of security and trust.

Example: Ravi verifies that the insurance policy complies with regulatory guidelines. This adds a layer of trust and security.

Discounts and Incentives: Look for any available discounts or incentives that can reduce your premium costs. This might include no-claims bonuses, multi-policy discounts, or loyalty rewards.

Example: Ravi looks for available discounts and finds that he is eligible for a no-claims bonus. If doesn’t make any claims in a year, his sum insured will increase by 10% without any additional premium.

2.3.What are Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY)?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

PMJJBY is a life insurance scheme that provides coverage for death due to any reason. Here are the key details:

- Coverage: The scheme offers a life cover of ₹2 lakh.

- Eligibility: Individuals aged 18 to 50 years with a bank or post office account are eligible to join.

- Premium: The annual premium is ₹436, which is auto-debited from the subscriber’s bank or post office account.

- Policy Term: It is a one-year cover, renewable from year to year.

- Enrolment Period: The cover period is from June 1 to May 31. Enrolment can be done at any time during the year, with pro-rata premium payments for those enrolling mid-year.

- Administration: The scheme is administered through Life Insurance Corporation (LIC) and other life insurance companies in collaboration with participating banks and post offices.

Scenario

- Ravi is a 40-year-old individual with a savings bank account. He wants to secure his family’s financial future by enrolling in the PMJJBY scheme

- Ravi is eligible for the scheme as he is between 18 and 50 years old and has a savings bank account.

- The scheme provides a life cover of ₹2 lakh in case of Ravi’s death due to any reason.

- The annual premium for the scheme is ₹436, which will be auto debited from Ravi’s bank account.

- Ravi enrolls in the scheme by submitting the consent-cum-declaration form to his bank. The premium is auto-debited from his account, and the coverage starts from the date of auto-debit.

- The policy is a one-year cover, renewable from year to year. The cover period is from June 1 to May 31.

- For the first 30 days from the date of enrolment, the insurance cover is not available for death due to any reason other than an accident. This is known as the lien period.

- In the unfortunate event of Ravi’s death, his nominee can file a claim by submitting the necessary documents to the bank. The claim amount of ₹2 lakh will be paid to the nominee.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

PMSBY is an accident insurance scheme that provides coverage for accidental death and disability. Here are the key details:

- Coverage: The scheme offers coverage of ₹2 lakh for accidental death or total and irrecoverable loss of both eyes or both hands or feet. It provides ₹1 lakh for total and irrecoverable loss of sight of one eye or loss of use of one hand or foot.

- Eligibility: Individuals aged 18 to 70 years with a bank or post office account are eligible to join.

- Premium: The annual premium is ₹20, which is auto debited from the subscriber’s bank or post office account.

- Policy Term: It is a one-year cover, renewable from year to year.

- Enrolment Period: The cover period is from June 1 to May 31. Enrolment can be done at any time during the year.

- Administration: The scheme is administered through Public Sector General Insurance Companies (PSGICs) and other general insurance companies in collaboration with participating banks and post offices

Example

- Ravi is a 40-year-old individual with a savings bank account. He wants to ensure financial protection for himself and his family in case of an accident by enrolling in the PMSBY scheme.

- Ravi is eligible for the scheme as he is between 18 and 70 years old and has a savings bank account.

- The scheme provides coverage of ₹2 lakh for accidental death or total and irrecoverable loss of both eyes or both hands or feet. It also provides ₹1 lakh for total and irrecoverable loss of sight of one eye or loss of use of one hand or foot.

- The annual premium for the scheme is ₹20, which will be auto debited from Ravi’s bank account.

- Ravi enrolls in the scheme by submitting the consent-cum-declaration form to his bank. The premium is auto-debited from his account, and the coverage starts from the date of auto-debit.

- The policy is a one-year cover, renewable from year to year. The cover period is from June 1 to May 31.

- In the unfortunate event of Ravi’s accidental death or disability, his nominee or he himself can file a claim by submitting the necessary documents to the bank. The claim amount will be paid to the nominee or credited to Ravi’s bank account, depending on the situation.