- Study

- Slides

- Videos

10.1 How to prepare your own personalized Financial Planning Sheet?

Creating your own personalized financial planning sheet is a great way to manage your finances, set goals, and track your progress. Here’s a step-by-step guide to help you get started:

Step 1: Gather Financial Information

Before you start, gather all relevant financial documents and information, including:

- Income statements (salary, bonuses, rental income, etc.)

- Bank statements

- Investment account statements

- Loan and mortgage statements

- Credit card statements

- Bills and receipts for monthly expenses

Step 2: Set Up the Financial Planning Sheet

You can use a spreadsheet software like Microsoft Excel, Google Sheets, or any other tool you prefer. Set up the following sections:

- Personal Information

- Name

- Contact Information

- Financial Goals: List short-term, medium-term, and long-term financial goals (e.g., buying a house, saving for retirement, children’s education).

- Income

Create a section to record your sources of income. Include:

- Monthly Salary

- Bonuses

- Rental Income

- Other Sources

|

Income Source |

Monthly Amount |

Annual Amount |

|

Salary |

₹70,000 |

₹8,40,000 |

|

Bonuses |

₹10,000 |

₹1,20,000 |

|

Rental Income |

₹5,000 |

₹60,000 |

|

Other Sources |

₹3,000 |

₹36,000 |

|

Total Income |

₹88,000 |

₹10,56,000 |

- Expenses

Create a section to track your monthly and annual expenses. Categorize your expenses for better clarity.

Fixed Expenses:

- Rent/Mortgage

- Utilities (electricity, water, gas)

- Insurance (health, life, home)

|

Expense Category |

Monthly Amount |

Annual Amount |

|

Rent/Mortgage |

₹20,000 |

₹2,40,000 |

|

Utilities |

₹5,000 |

₹60,000 |

|

Insurance |

₹3,000 |

₹36,000 |

|

Other Fixed Expenses |

₹2,000 |

₹24,000 |

|

Total Fixed Expenses |

₹30,000 |

₹3,60,000 |

Variable Expenses:

- Groceries

- Transportation

- Entertainment

|

Expense Category |

Monthly Amount |

Annual Amount |

|

Groceries |

₹10,000 |

₹1,20,000 |

|

Transportation |

₹5,000 |

₹60,000 |

|

Entertainment |

₹3,000 |

₹36,000 |

|

Other Variable Expenses |

₹2,000 |

₹24,000 |

|

Total Variable Expenses |

₹20,000 |

₹2,40,000 |

- Savings and Investments

Create a section to track your savings and investments.

|

Investment Type |

Monthly Amount |

Annual Amount |

|

PPF |

₹5,000 |

₹60,000 |

|

ELSS |

₹3,000 |

₹36,000 |

|

EPF |

₹2,500 |

₹30,000 |

|

Other Investments |

₹1,500 |

₹18,000 |

|

Total Investments |

₹12,000 |

₹1,44,000 |

- Debt and Liabilities

Create a section to record your debts and liabilities, including loan balances and monthly payments.

|

Debt Type |

Outstanding Balance |

Monthly Payment |

|

Home Loan |

₹10,00,000 |

₹10,000 |

|

Car Loan |

₹2,00,000 |

₹5,000 |

|

Credit Card Debt |

₹50,000 |

₹2,000 |

|

Total Debt |

₹12,50,000 |

₹17,000 |

- Net Worth Calculation

Calculate your net worth by subtracting your total liabilities from your total assets.

|

Assets |

Amount |

|

Cash and Bank Accounts |

₹1,00,000 |

|

Investments |

₹5,00,000 |

|

Property |

₹20,00,000 |

|

Other Assets |

₹2,00,000 |

|

Total Assets |

₹28,00,000 |

|

Liabilities |

Amount |

|

Home Loan |

₹10,00,000 |

|

Car Loan |

₹2,00,000 |

|

Credit Card Debt |

₹50,000 |

|

Other Liabilities |

₹1,00,000 |

|

Total Liabilities |

₹13,50,000 |

Net Worth: ₹28,00,000 – ₹13,50,000 = ₹14,50,000

Step 3: Review and Update Regularly

Regularly review and update your financial planning sheet to track your progress and make adjustments as needed. This will help you stay on top of your financial goals and make informed decisions.

Step 4: Seek Professional Advice

Consider consulting a financial advisor for personalized advice and guidance based on your unique financial situation and goals.

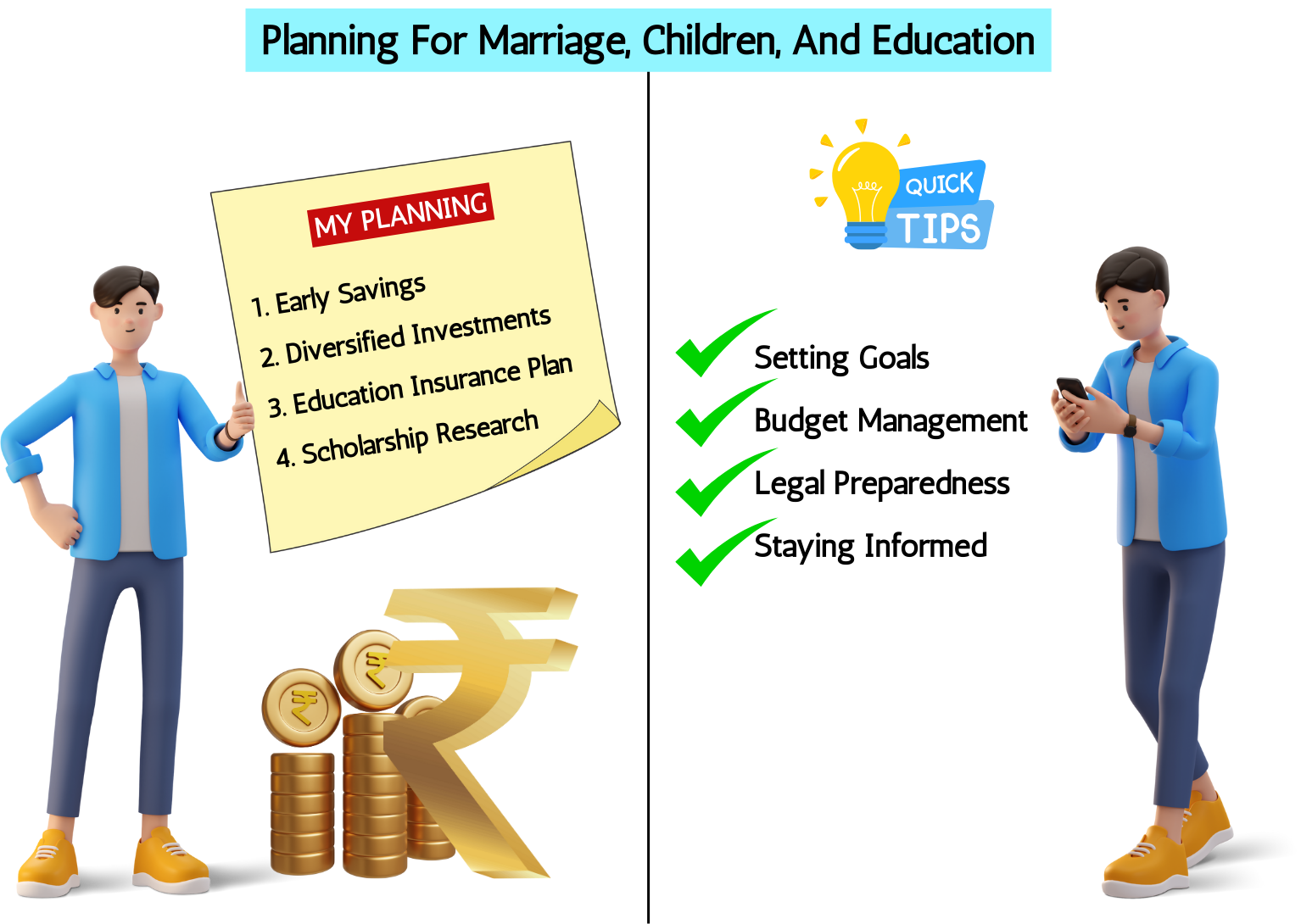

10.2 Planning for marriage, children, and education

Planning for major life events like marriage, having children, and their education requires thoughtful financial preparation and goal-setting. Here’s a comprehensive guide to help you plan effectively:

- Planning for Marriage

Marriage is a significant milestone that involves various expenses. Here’s how to plan for it:

1.1 Budgeting for the Wedding:

- Estimate Costs: Determine the cost of key wedding elements such as the venue, catering, attire, decorations, and photography.

- Set a Budget: Create a realistic budget based on your estimates and prioritize expenses.

- Save in Advance: Start saving early to ensure you have enough funds for the wedding. Consider opening a dedicated savings account.

1.2 Managing Expenses:

- Compare Vendors: Get quotes from multiple vendors to find the best deals.

- DIY Options: Consider do-it-yourself (DIY) options for certain aspects like decorations or invitations to reduce costs.

- Track Spending: Keep track of your expenses to avoid overspending.

- Planning for Children

Having children involves ongoing expenses, from medical costs to education. Here’s how to prepare:

2.1 Healthcare and Medical Expenses:

- Health Insurance: Ensure you have adequate health insurance coverage for maternity and child healthcare.

- Emergency Fund: Build an emergency fund to cover unexpected medical expenses.

2.2 Childcare and Early Education:

- Daycare or Nanny Costs: Research the costs of daycare, nannies, or other childcare options in your area.

- Early Education: Start planning for early education expenses, including preschool and extracurricular activities.

- Planning for Children’s Education

Education costs can be significant, but with proper planning, you can secure your child’s future:

3.1 Setting Education Goals:

- Identify Education Milestones: Consider the costs of primary, secondary, and higher education.

- Set Financial Goals: Determine how much you need to save for each milestone.

3.2 Saving for Education:

- Education Savings Plans: Consider education savings plans such as Sukanya Samriddhi Yojana (SSY) for girl children or dedicated education savings accounts.

- Systematic Investment Plan (SIP): Invest in mutual funds through SIPs to accumulate funds over time.

- Fixed Deposits: Use fixed deposits for safe and guaranteed returns.

3.3 Scholarships and Grants:

- Research Opportunities: Look for scholarships, grants, and financial aid options available for various educational levels.

- Encourage Merit: Encourage your child to excel academically and participate in extracurricular activities that may qualify them for scholarships.

Creating a Financial Plan

To tie everything together, create a comprehensive financial plan that covers all aspects:

4.1 Assess Your Current Financial Situation:

- Income and Expenses: Evaluate your current income, expenses, and savings.

- Net Worth: Calculate your net worth by subtracting liabilities from assets.

4.2 Set Clear Financial Goals:

- Short-Term Goals: Wedding expenses, maternity costs, and early childcare.

- Medium-Term Goals: Primary and secondary education expenses.

- Long-Term Goals: Higher education costs and other future needs.

4.3 Create a Budget and Stick to It:

- Monthly Budget: Allocate funds for each category (e.g., savings, investments, expenses) and stick to your budget.

- Review Regularly: Regularly review and adjust your budget based on changing circumstances.

4.4 Invest Wisely:

- Diversified Portfolio: Create a diversified investment portfolio to balance risk and returns.

- Consult a Financial Advisor: Seek professional advice for personalized investment strategies.

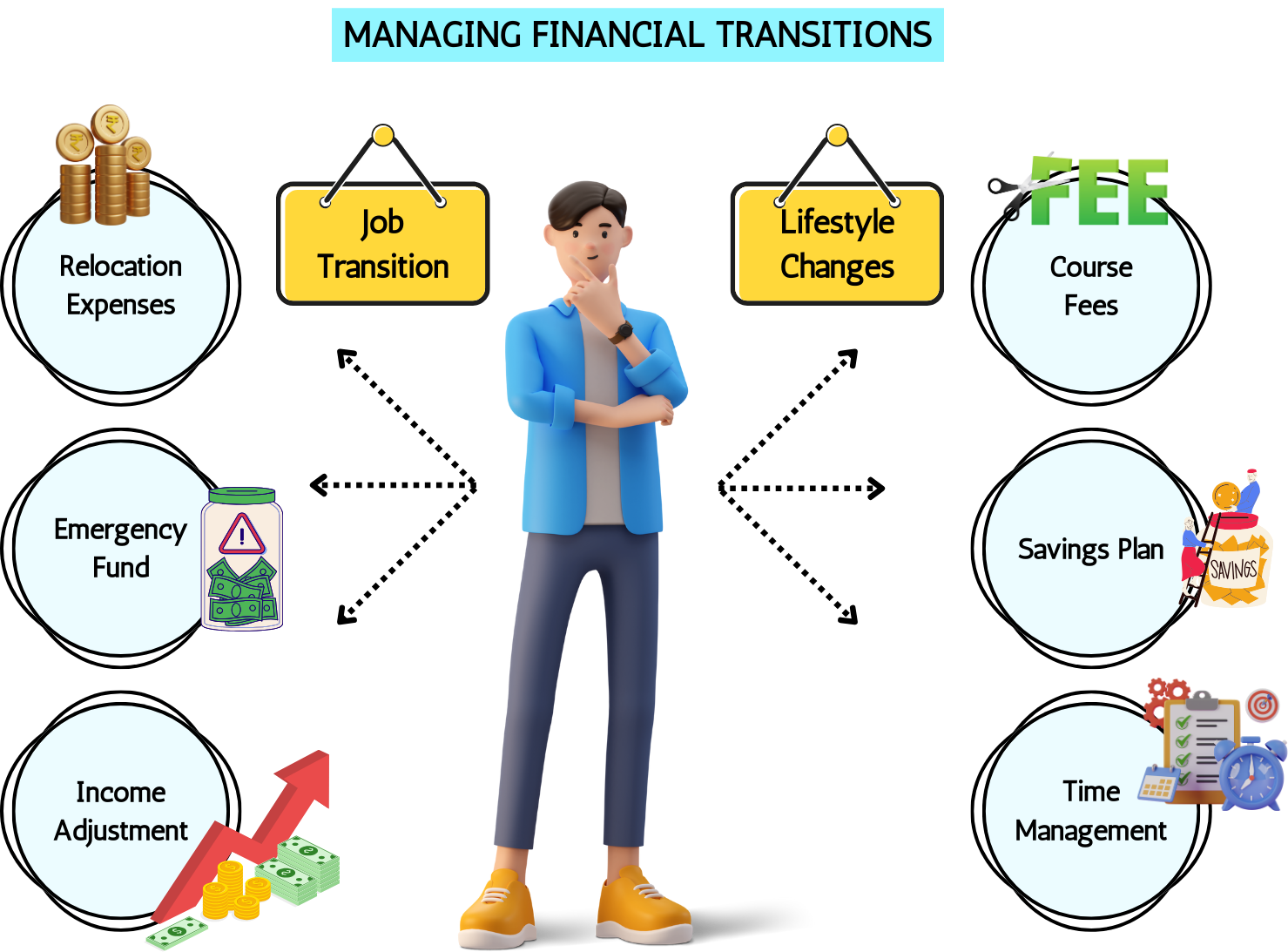

10.3. Managing financial transitions

Managing financial transitions, such as changing jobs, getting married, buying a home, or retiring, can be complex and sometimes challenging. Here are some key steps to help you navigate these transitions smoothly and effectively:

- Assess Your Current Financial Situation

- Review Your Finances: Take stock of your current financial situation, including your income, expenses, savings, investments, and debts.

- Update Your Budget: Adjust your budget to reflect any changes in income or expenses due to the transition.

- Set Clear Financial Goals

- Identify Short-Term Goals: These could include covering immediate expenses, building an emergency fund, or saving for a specific purchase.

- Set Long-Term Goals: These might include retirement planning, saving for your children’s education, or buying a home.

- Create an Action Plan

- Outline Steps: List the steps you need to take to achieve your financial goals. This might include saving a certain amount each month, paying off debt, or investing in specific assets.

- Set Deadlines: Assign deadlines to each step to keep yourself on track.

- Build an Emergency Fund

- Save for Emergencies: Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This can provide a financial cushion during transitions.

- Manage Debt Wisely

- Pay Down Debt: Focus on paying down high-interest debt, such as credit card balances, to reduce financial stress.

- Avoid New Debt: Be cautious about taking on new debt during financial transitions, unless it’s necessary and manageable.

- Review and Adjust Your Investments

- Diversify Investments: Ensure your investment portfolio is diversified to balance risk and return.

- Reassess Risk Tolerance: Consider whether your risk tolerance has changed due to the transition and adjust your investments accordingly.

- Plan for Taxes

- Understand Tax Implications: Be aware of the tax implications of your financial transition, such as changes in income, deductions, or credits.

- Seek Professional Advice: Consult a tax advisor to ensure you’re making tax-efficient decisions.

- Protect Your Assets

- Insurance Coverage: Review and update your insurance coverage to ensure it aligns with your new financial situation. This includes health, life, home, and auto insurance.

- Estate Planning: Ensure your will, power of attorney, and other estate planning documents are up to date.

- Communicate with Family Members

- Discuss Financial Goals: Have open and honest conversations with family members about financial goals and expectations.

- Involve Loved Ones: Involve your spouse or other family members in financial planning decisions to ensure everyone is on the same page.

- Seek Professional Advice

- Financial Advisor: Consider working with a financial advisor to get personalized guidance and create a comprehensive financial plan.

- Legal Advice: Consult a lawyer for any legal matters related to the financial transition, such as property transfers or prenuptial agreements.

Example: Transitioning to a New Job

Scenario:

- Ravi is transitioning to a new job with a higher salary.

- Assess Financial Situation: Review current income, expenses, savings, and debts.

- Set Goals: Short-term goals might include adjusting the budget for the new salary and long-term goals could be increasing retirement contributions.

- Action Plan: Outline steps such as setting up direct deposit for the new salary, adjusting monthly savings contributions, and updating the budget.

- Emergency Fund: Ensure an adequate emergency fund is in place to cover any unexpected expenses during the transition.

- Manage Debt: Focus on paying down existing debts and avoid taking on new ones.

- Investments: Reassess investment strategy to align with new financial goals and risk tolerance.

- Taxes: Understand the tax implications of the higher salary and adjust tax withholding if necessary.

- Insurance: Update health, life, and disability insurance coverage with the new employer.

- Communicate: Discuss the financial changes and goals with family members.

- Professional Advice: Seek advice from a financial advisor to optimize the new financial situation.

By following these steps, Ravi can smoothly transition to his new job while effectively managing his finances and achieving his financial goals.

10.4 Planning for unexpected medical expenses

Planning for unexpected medical expenses is crucial to avoid financial stress and ensure you have the resources needed for medical emergencies. Here are some steps to help you prepare:

- Build an Emergency Fund

- Set a Goal: Aim to save at least three to six months’ worth of living expenses in an emergency fund.

- Automate Savings: Set up automatic transfers to a dedicated emergency fund account to ensure consistent contributions.

- Accessibility: Ensure the emergency fund is easily accessible in case of urgent medical needs.

- Obtain Adequate Health Insurance

- Review Coverage: Assess your current health insurance policy to ensure it provides adequate coverage for potential medical emergencies.

- Supplemental Policies: Consider purchasing supplemental insurance policies for specific needs, such as critical illness or accident insurance.

- Network Hospitals: Ensure your insurance plan includes a wide network of hospitals and healthcare providers.

- Understand Your Health Insurance Benefits

- Know Your Plan: Familiarize yourself with the details of your health insurance plan, including coverage limits, co-pays, deductibles, and out-of-pocket maximums.

- Pre-Authorization: Understand the pre-authorization process for medical treatments and procedures covered by your insurance.

- Claim Process: Learn how to file claims and what documentation is required to expedite reimbursements.

- Budget for Medical Expenses

- Allocate Funds: Include a category for medical expenses in your monthly budget to cover routine healthcare costs and minor emergencies.

- Track Spending: Keep track of your medical expenses to identify patterns and adjust your budget accordingly.

- Use Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA)

- HSA: If you have a high-deductible health plan (HDHP), contribute to a Health Savings Account (HSA). HSAs offer tax advantages and can be used to pay for qualified medical expenses.

- FSA: If available, contribute to a Flexible Spending Account (FSA) to set aside pre-tax money for medical expenses.

- Compare and Negotiate Medical Costs

- Shop Around: Research and compare costs for medical procedures and treatments from different providers.

- Negotiate Bills: Don’t hesitate to negotiate with healthcare providers for discounts or payment plans, especially for large medical bills.

- Plan for Long-Term Care

- Consider Long-Term Care Insurance: Evaluate the need for long-term care insurance to cover expenses related to chronic illnesses or disabilities that require extended care.

- Financial Planning: Include potential long-term care expenses in your overall financial plan.

- Stay Healthy

- Preventive Care: Prioritize preventive care and regular check-ups to catch health issues early and reduce the risk of costly medical emergencies.

- Healthy Lifestyle: Adopt a healthy lifestyle with a balanced diet, regular exercise, and stress management to maintain overall well-being.

Example Plan for Ravi

Let’s create an example plan for Ravi, who has a monthly salary of ₹70,000, to prepare for unexpected medical expenses:

- Build an Emergency Fund:

- Target Amount: ₹2,10,000 (three months’ salary)

- Monthly Contribution: ₹5,000

- Health Insurance:

- Review and update health insurance coverage.

- Consider adding a critical illness policy.

- Budget for Medical Expenses:

- Allocate ₹5,000 per month for routine medical expenses.

- Health Savings Account (HSA):

- If applicable, contribute ₹2,000 per month to an HSA.

- Track and Negotiate Costs:

- Keep records of all medical expenses and negotiate with providers if needed.

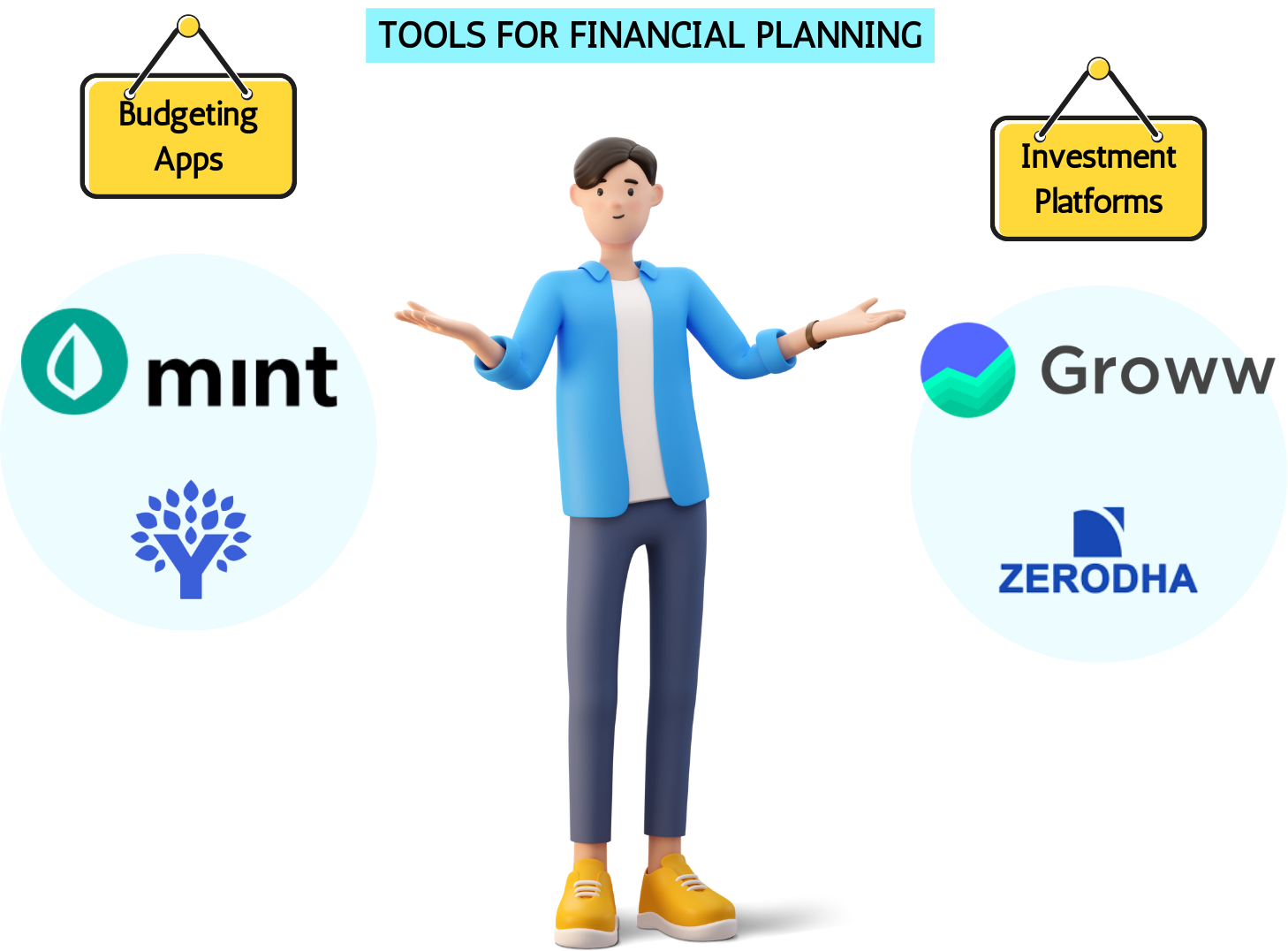

10.5 Tools for Financial planning

There are various tools and resources available to help you with financial planning. Here are some of the most useful tools:

- Budgeting Tools

- Mint: A free budgeting app that helps you track your income, expenses, and savings. It also provides alerts and insights to help you manage your finances.

- You Need a Budget (YNAB): A paid budgeting app that focuses on zero-based budgeting and helps you allocate every dollar to a specific category.

- Goodbudget: A budgeting app that uses the envelope budgeting method to help you manage your finances.

- Investment Planning Tools

- Robo-Advisors: Platforms like Betterment, Wealthfront, and Acorns provide automated investment management based on your goals and risk tolerance.

- Stock Market Simulators: Tools like Investopedia Simulator and MarketWatch Virtual Stock Exchange allow you to practice investing without real financial risk.

- Investment Calculators: Use online calculators to estimate returns, such as Vanguard’s Investment Calculator or the SIP Calculator on mutual fund websites.

- Retirement Planning Tools

- Retirement Calculators: Tools like the AARP Retirement Calculator or Fidelity Retirement Score can help you estimate how much you need to save for retirement.

- Pension Planners: Tools like the EPFO Pension Calculator can help you understand your pension benefits and plan accordingly.

- Social Security Estimators: Use the Social Security Administration’s Retirement Estimator to estimate your future Social Security benefits.

- Debt Management Tools

- Debt Payoff Calculators: Tools like the Debt Snowball Calculator or the Debt Avalanche Calculator can help you create a plan to pay off your debts.

- Debt Management Apps: Apps like Tally and Undebt.it help you manage and pay off your debts efficiently.

- Tax Planning Tools

- Tax Preparation Software: Tools like TurboTax, H&R Block, and TaxAct help you file your taxes accurately and find deductions and credits.

- Tax Calculators: Use online tax calculators like the IRS Tax Withholding Estimator or TaxSlayer’s Tax Calculator to estimate your tax liability.

- Savings and Emergency Fund Tools

- Savings Calculators: Tools like the Bankrate Savings Calculator or the Simple Savings Calculator can help you plan your savings goals.

- Emergency Fund Planners: Apps like Simple and Digit help you automate savings for an emergency fund.

- Financial Planning Software

- Personal Capital: A comprehensive financial planning tool that tracks your investments, net worth, and retirement planning.

- Quicken: A financial management software that helps you manage your income, expenses, investments, and budget.

- YNAB (You Need a Budget): Besides budgeting, YNAB also offers tools for tracking your financial goals and progress.

- Estate Planning Tools

- LegalZoom: An online platform that helps you create legal documents for estate planning, such as wills and trusts.

- WillMaker: A software that guides you through creating a will, living trust, and other estate planning documents.

10.6 Assessing affordability and financial readiness

Assessing affordability and financial readiness is crucial for making informed decisions about major financial commitments like buying a home, investing in education, or starting a business.

- Budgeting: Assessing affordability starts with budgeting. By evaluating your monthly income and expenses, you gain a clear picture of your financial situation. Identifying areas where you can cut costs or save more is essential to free up funds for other priorities. Tracking your spending helps you understand your financial habits and make informed decisions about where to allocate your resources more effectively.

- Savings: Building an emergency fund is a critical aspect of financial readiness. This fund should cover at least 3-6 months of living expenses, providing a safety net for unexpected situations like medical emergencies or job loss. Additionally, setting aside money for specific goals, such as a down payment on a house or an education fund, ensures that you are prepared for future financial commitments without derailing your overall financial plan.

- Debt Management: Managing your debt effectively is crucial for financial stability. Begin by assessing your current debt situation, including credit cards, loans, and mortgages. Prioritize paying off high-interest debt to reduce the overall financial burden. Debt consolidation can also be a viable option if it helps lower your overall interest rate, making it easier to manage monthly payments and pay off debt faster.

- Credit Score: A good credit score is essential for accessing favorable loan terms and interest rates. Regularly checking your credit score and credit report helps you stay informed about your credit health. Aim to maintain or improve your credit score by paying bills on time, keeping credit card balances low, and managing credit responsibly. A strong credit score can significantly impact your financial readiness for major commitments.

- Insurance: Adequate insurance coverage is vital to protect yourself and your assets from unforeseen events. Ensure you have the necessary coverage for health, life, home, and auto insurance. Regularly review and update your insurance policies to ensure they align with your current needs and provide adequate protection. Proper insurance coverage can prevent financial setbacks and provide peace of mind.

- Investments: Diversifying your investment portfolio is key to spreading risk and achieving long-term financial goals. Consult a financial advisor to develop an investment strategy that aligns with your goals, risk tolerance, and time horizon. A well-diversified portfolio can help you navigate market fluctuations and achieve a balanced approach to wealth building.

- Financial Goals: Setting clear short-term and long-term financial goals is essential for financial readiness. Create a realistic timeline for achieving these goals and break them down into manageable steps. Regularly monitor your progress and adjust your plan as needed to stay on track. Having well-defined goals provides direction and motivation for making informed financial decisions.

- Income Potential: Increasing your income can enhance your financial stability and readiness for major commitments. Consider pursuing additional education, certifications, or side gigs to boost your earning potential. Enhancing your skills and exploring new opportunities can lead to higher income and greater financial flexibility.

10.1 How to prepare your own personalized Financial Planning Sheet?

Creating your own personalized financial planning sheet is a great way to manage your finances, set goals, and track your progress. Here’s a step-by-step guide to help you get started:

Step 1: Gather Financial Information

Before you start, gather all relevant financial documents and information, including:

- Income statements (salary, bonuses, rental income, etc.)

- Bank statements

- Investment account statements

- Loan and mortgage statements

- Credit card statements

- Bills and receipts for monthly expenses

Step 2: Set Up the Financial Planning Sheet

You can use a spreadsheet software like Microsoft Excel, Google Sheets, or any other tool you prefer. Set up the following sections:

- Personal Information

- Name

- Contact Information

- Financial Goals: List short-term, medium-term, and long-term financial goals (e.g., buying a house, saving for retirement, children’s education).

- Income

Create a section to record your sources of income. Include:

- Monthly Salary

- Bonuses

- Rental Income

- Other Sources

|

Income Source |

Monthly Amount |

Annual Amount |

|

Salary |

₹70,000 |

₹8,40,000 |

|

Bonuses |

₹10,000 |

₹1,20,000 |

|

Rental Income |

₹5,000 |

₹60,000 |

|

Other Sources |

₹3,000 |

₹36,000 |

|

Total Income |

₹88,000 |

₹10,56,000 |

- Expenses

Create a section to track your monthly and annual expenses. Categorize your expenses for better clarity.

Fixed Expenses:

- Rent/Mortgage

- Utilities (electricity, water, gas)

- Insurance (health, life, home)

|

Expense Category |

Monthly Amount |

Annual Amount |

|

Rent/Mortgage |

₹20,000 |

₹2,40,000 |

|

Utilities |

₹5,000 |

₹60,000 |

|

Insurance |

₹3,000 |

₹36,000 |

|

Other Fixed Expenses |

₹2,000 |

₹24,000 |

|

Total Fixed Expenses |

₹30,000 |

₹3,60,000 |

Variable Expenses:

- Groceries

- Transportation

- Entertainment

|

Expense Category |

Monthly Amount |

Annual Amount |

|

Groceries |

₹10,000 |

₹1,20,000 |

|

Transportation |

₹5,000 |

₹60,000 |

|

Entertainment |

₹3,000 |

₹36,000 |

|

Other Variable Expenses |

₹2,000 |

₹24,000 |

|

Total Variable Expenses |

₹20,000 |

₹2,40,000 |

- Savings and Investments

Create a section to track your savings and investments.

|

Investment Type |

Monthly Amount |

Annual Amount |

|

PPF |

₹5,000 |

₹60,000 |

|

ELSS |

₹3,000 |

₹36,000 |

|

EPF |

₹2,500 |

₹30,000 |

|

Other Investments |

₹1,500 |

₹18,000 |

|

Total Investments |

₹12,000 |

₹1,44,000 |

- Debt and Liabilities

Create a section to record your debts and liabilities, including loan balances and monthly payments.

|

Debt Type |

Outstanding Balance |

Monthly Payment |

|

Home Loan |

₹10,00,000 |

₹10,000 |

|

Car Loan |

₹2,00,000 |

₹5,000 |

|

Credit Card Debt |

₹50,000 |

₹2,000 |

|

Total Debt |

₹12,50,000 |

₹17,000 |

- Net Worth Calculation

Calculate your net worth by subtracting your total liabilities from your total assets.

|

Assets |

Amount |

|

Cash and Bank Accounts |

₹1,00,000 |

|

Investments |

₹5,00,000 |

|

Property |

₹20,00,000 |

|

Other Assets |

₹2,00,000 |

|

Total Assets |

₹28,00,000 |

|

Liabilities |

Amount |

|

Home Loan |

₹10,00,000 |

|

Car Loan |

₹2,00,000 |

|

Credit Card Debt |

₹50,000 |

|

Other Liabilities |

₹1,00,000 |

|

Total Liabilities |

₹13,50,000 |

Net Worth: ₹28,00,000 – ₹13,50,000 = ₹14,50,000

Step 3: Review and Update Regularly

Regularly review and update your financial planning sheet to track your progress and make adjustments as needed. This will help you stay on top of your financial goals and make informed decisions.

Step 4: Seek Professional Advice

Consider consulting a financial advisor for personalized advice and guidance based on your unique financial situation and goals.

10.2 Planning for marriage, children, and education

Planning for major life events like marriage, having children, and their education requires thoughtful financial preparation and goal-setting. Here’s a comprehensive guide to help you plan effectively:

- Planning for Marriage

Marriage is a significant milestone that involves various expenses. Here’s how to plan for it:

1.1 Budgeting for the Wedding:

- Estimate Costs: Determine the cost of key wedding elements such as the venue, catering, attire, decorations, and photography.

- Set a Budget: Create a realistic budget based on your estimates and prioritize expenses.

- Save in Advance: Start saving early to ensure you have enough funds for the wedding. Consider opening a dedicated savings account.

1.2 Managing Expenses:

- Compare Vendors: Get quotes from multiple vendors to find the best deals.

- DIY Options: Consider do-it-yourself (DIY) options for certain aspects like decorations or invitations to reduce costs.

- Track Spending: Keep track of your expenses to avoid overspending.

- Planning for Children

Having children involves ongoing expenses, from medical costs to education. Here’s how to prepare:

2.1 Healthcare and Medical Expenses:

- Health Insurance: Ensure you have adequate health insurance coverage for maternity and child healthcare.

- Emergency Fund: Build an emergency fund to cover unexpected medical expenses.

2.2 Childcare and Early Education:

- Daycare or Nanny Costs: Research the costs of daycare, nannies, or other childcare options in your area.

- Early Education: Start planning for early education expenses, including preschool and extracurricular activities.

- Planning for Children’s Education

Education costs can be significant, but with proper planning, you can secure your child’s future:

3.1 Setting Education Goals:

- Identify Education Milestones: Consider the costs of primary, secondary, and higher education.

- Set Financial Goals: Determine how much you need to save for each milestone.

3.2 Saving for Education:

- Education Savings Plans: Consider education savings plans such as Sukanya Samriddhi Yojana (SSY) for girl children or dedicated education savings accounts.

- Systematic Investment Plan (SIP): Invest in mutual funds through SIPs to accumulate funds over time.

- Fixed Deposits: Use fixed deposits for safe and guaranteed returns.

3.3 Scholarships and Grants:

- Research Opportunities: Look for scholarships, grants, and financial aid options available for various educational levels.

- Encourage Merit: Encourage your child to excel academically and participate in extracurricular activities that may qualify them for scholarships.

Creating a Financial Plan

To tie everything together, create a comprehensive financial plan that covers all aspects:

4.1 Assess Your Current Financial Situation:

- Income and Expenses: Evaluate your current income, expenses, and savings.

- Net Worth: Calculate your net worth by subtracting liabilities from assets.

4.2 Set Clear Financial Goals:

- Short-Term Goals: Wedding expenses, maternity costs, and early childcare.

- Medium-Term Goals: Primary and secondary education expenses.

- Long-Term Goals: Higher education costs and other future needs.

4.3 Create a Budget and Stick to It:

- Monthly Budget: Allocate funds for each category (e.g., savings, investments, expenses) and stick to your budget.

- Review Regularly: Regularly review and adjust your budget based on changing circumstances.

4.4 Invest Wisely:

- Diversified Portfolio: Create a diversified investment portfolio to balance risk and returns.

- Consult a Financial Advisor: Seek professional advice for personalized investment strategies.

10.3. Managing financial transitions

Managing financial transitions, such as changing jobs, getting married, buying a home, or retiring, can be complex and sometimes challenging. Here are some key steps to help you navigate these transitions smoothly and effectively:

- Assess Your Current Financial Situation

- Review Your Finances: Take stock of your current financial situation, including your income, expenses, savings, investments, and debts.

- Update Your Budget: Adjust your budget to reflect any changes in income or expenses due to the transition.

- Set Clear Financial Goals

- Identify Short-Term Goals: These could include covering immediate expenses, building an emergency fund, or saving for a specific purchase.

- Set Long-Term Goals: These might include retirement planning, saving for your children’s education, or buying a home.

- Create an Action Plan

- Outline Steps: List the steps you need to take to achieve your financial goals. This might include saving a certain amount each month, paying off debt, or investing in specific assets.

- Set Deadlines: Assign deadlines to each step to keep yourself on track.

- Build an Emergency Fund

- Save for Emergencies: Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This can provide a financial cushion during transitions.

- Manage Debt Wisely

- Pay Down Debt: Focus on paying down high-interest debt, such as credit card balances, to reduce financial stress.

- Avoid New Debt: Be cautious about taking on new debt during financial transitions, unless it’s necessary and manageable.

- Review and Adjust Your Investments

- Diversify Investments: Ensure your investment portfolio is diversified to balance risk and return.

- Reassess Risk Tolerance: Consider whether your risk tolerance has changed due to the transition and adjust your investments accordingly.

- Plan for Taxes

- Understand Tax Implications: Be aware of the tax implications of your financial transition, such as changes in income, deductions, or credits.

- Seek Professional Advice: Consult a tax advisor to ensure you’re making tax-efficient decisions.

- Protect Your Assets

- Insurance Coverage: Review and update your insurance coverage to ensure it aligns with your new financial situation. This includes health, life, home, and auto insurance.

- Estate Planning: Ensure your will, power of attorney, and other estate planning documents are up to date.

- Communicate with Family Members

- Discuss Financial Goals: Have open and honest conversations with family members about financial goals and expectations.

- Involve Loved Ones: Involve your spouse or other family members in financial planning decisions to ensure everyone is on the same page.

- Seek Professional Advice

- Financial Advisor: Consider working with a financial advisor to get personalized guidance and create a comprehensive financial plan.

- Legal Advice: Consult a lawyer for any legal matters related to the financial transition, such as property transfers or prenuptial agreements.

Example: Transitioning to a New Job

Scenario:

- Ravi is transitioning to a new job with a higher salary.

- Assess Financial Situation: Review current income, expenses, savings, and debts.

- Set Goals: Short-term goals might include adjusting the budget for the new salary and long-term goals could be increasing retirement contributions.

- Action Plan: Outline steps such as setting up direct deposit for the new salary, adjusting monthly savings contributions, and updating the budget.

- Emergency Fund: Ensure an adequate emergency fund is in place to cover any unexpected expenses during the transition.

- Manage Debt: Focus on paying down existing debts and avoid taking on new ones.

- Investments: Reassess investment strategy to align with new financial goals and risk tolerance.

- Taxes: Understand the tax implications of the higher salary and adjust tax withholding if necessary.

- Insurance: Update health, life, and disability insurance coverage with the new employer.

- Communicate: Discuss the financial changes and goals with family members.

- Professional Advice: Seek advice from a financial advisor to optimize the new financial situation.

By following these steps, Ravi can smoothly transition to his new job while effectively managing his finances and achieving his financial goals.

10.4 Planning for unexpected medical expenses

Planning for unexpected medical expenses is crucial to avoid financial stress and ensure you have the resources needed for medical emergencies. Here are some steps to help you prepare:

- Build an Emergency Fund

- Set a Goal: Aim to save at least three to six months’ worth of living expenses in an emergency fund.

- Automate Savings: Set up automatic transfers to a dedicated emergency fund account to ensure consistent contributions.

- Accessibility: Ensure the emergency fund is easily accessible in case of urgent medical needs.

- Obtain Adequate Health Insurance

- Review Coverage: Assess your current health insurance policy to ensure it provides adequate coverage for potential medical emergencies.

- Supplemental Policies: Consider purchasing supplemental insurance policies for specific needs, such as critical illness or accident insurance.

- Network Hospitals: Ensure your insurance plan includes a wide network of hospitals and healthcare providers.

- Understand Your Health Insurance Benefits

- Know Your Plan: Familiarize yourself with the details of your health insurance plan, including coverage limits, co-pays, deductibles, and out-of-pocket maximums.

- Pre-Authorization: Understand the pre-authorization process for medical treatments and procedures covered by your insurance.

- Claim Process: Learn how to file claims and what documentation is required to expedite reimbursements.

- Budget for Medical Expenses

- Allocate Funds: Include a category for medical expenses in your monthly budget to cover routine healthcare costs and minor emergencies.

- Track Spending: Keep track of your medical expenses to identify patterns and adjust your budget accordingly.

- Use Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA)

- HSA: If you have a high-deductible health plan (HDHP), contribute to a Health Savings Account (HSA). HSAs offer tax advantages and can be used to pay for qualified medical expenses.

- FSA: If available, contribute to a Flexible Spending Account (FSA) to set aside pre-tax money for medical expenses.

- Compare and Negotiate Medical Costs

- Shop Around: Research and compare costs for medical procedures and treatments from different providers.

- Negotiate Bills: Don’t hesitate to negotiate with healthcare providers for discounts or payment plans, especially for large medical bills.

- Plan for Long-Term Care

- Consider Long-Term Care Insurance: Evaluate the need for long-term care insurance to cover expenses related to chronic illnesses or disabilities that require extended care.

- Financial Planning: Include potential long-term care expenses in your overall financial plan.

- Stay Healthy

- Preventive Care: Prioritize preventive care and regular check-ups to catch health issues early and reduce the risk of costly medical emergencies.

- Healthy Lifestyle: Adopt a healthy lifestyle with a balanced diet, regular exercise, and stress management to maintain overall well-being.

Example Plan for Ravi

Let’s create an example plan for Ravi, who has a monthly salary of ₹70,000, to prepare for unexpected medical expenses:

- Build an Emergency Fund:

- Target Amount: ₹2,10,000 (three months’ salary)

- Monthly Contribution: ₹5,000

- Health Insurance:

- Review and update health insurance coverage.

- Consider adding a critical illness policy.

- Budget for Medical Expenses:

- Allocate ₹5,000 per month for routine medical expenses.

- Health Savings Account (HSA):

- If applicable, contribute ₹2,000 per month to an HSA.

- Track and Negotiate Costs:

- Keep records of all medical expenses and negotiate with providers if needed.

10.5 Tools for Financial planning

There are various tools and resources available to help you with financial planning. Here are some of the most useful tools:

- Budgeting Tools

- Mint: A free budgeting app that helps you track your income, expenses, and savings. It also provides alerts and insights to help you manage your finances.

- You Need a Budget (YNAB): A paid budgeting app that focuses on zero-based budgeting and helps you allocate every dollar to a specific category.

- Goodbudget: A budgeting app that uses the envelope budgeting method to help you manage your finances.

- Investment Planning Tools

- Robo-Advisors: Platforms like Betterment, Wealthfront, and Acorns provide automated investment management based on your goals and risk tolerance.

- Stock Market Simulators: Tools like Investopedia Simulator and MarketWatch Virtual Stock Exchange allow you to practice investing without real financial risk.

- Investment Calculators: Use online calculators to estimate returns, such as Vanguard’s Investment Calculator or the SIP Calculator on mutual fund websites.

- Retirement Planning Tools

- Retirement Calculators: Tools like the AARP Retirement Calculator or Fidelity Retirement Score can help you estimate how much you need to save for retirement.

- Pension Planners: Tools like the EPFO Pension Calculator can help you understand your pension benefits and plan accordingly.

- Social Security Estimators: Use the Social Security Administration’s Retirement Estimator to estimate your future Social Security benefits.

- Debt Management Tools

- Debt Payoff Calculators: Tools like the Debt Snowball Calculator or the Debt Avalanche Calculator can help you create a plan to pay off your debts.

- Debt Management Apps: Apps like Tally and Undebt.it help you manage and pay off your debts efficiently.

- Tax Planning Tools

- Tax Preparation Software: Tools like TurboTax, H&R Block, and TaxAct help you file your taxes accurately and find deductions and credits.

- Tax Calculators: Use online tax calculators like the IRS Tax Withholding Estimator or TaxSlayer’s Tax Calculator to estimate your tax liability.

- Savings and Emergency Fund Tools

- Savings Calculators: Tools like the Bankrate Savings Calculator or the Simple Savings Calculator can help you plan your savings goals.

- Emergency Fund Planners: Apps like Simple and Digit help you automate savings for an emergency fund.

- Financial Planning Software

- Personal Capital: A comprehensive financial planning tool that tracks your investments, net worth, and retirement planning.

- Quicken: A financial management software that helps you manage your income, expenses, investments, and budget.

- YNAB (You Need a Budget): Besides budgeting, YNAB also offers tools for tracking your financial goals and progress.

- Estate Planning Tools

- LegalZoom: An online platform that helps you create legal documents for estate planning, such as wills and trusts.

- WillMaker: A software that guides you through creating a will, living trust, and other estate planning documents.

10.6 Assessing affordability and financial readiness

Assessing affordability and financial readiness is crucial for making informed decisions about major financial commitments like buying a home, investing in education, or starting a business.

- Budgeting: Assessing affordability starts with budgeting. By evaluating your monthly income and expenses, you gain a clear picture of your financial situation. Identifying areas where you can cut costs or save more is essential to free up funds for other priorities. Tracking your spending helps you understand your financial habits and make informed decisions about where to allocate your resources more effectively.

- Savings: Building an emergency fund is a critical aspect of financial readiness. This fund should cover at least 3-6 months of living expenses, providing a safety net for unexpected situations like medical emergencies or job loss. Additionally, setting aside money for specific goals, such as a down payment on a house or an education fund, ensures that you are prepared for future financial commitments without derailing your overall financial plan.

- Debt Management: Managing your debt effectively is crucial for financial stability. Begin by assessing your current debt situation, including credit cards, loans, and mortgages. Prioritize paying off high-interest debt to reduce the overall financial burden. Debt consolidation can also be a viable option if it helps lower your overall interest rate, making it easier to manage monthly payments and pay off debt faster.

- Credit Score: A good credit score is essential for accessing favorable loan terms and interest rates. Regularly checking your credit score and credit report helps you stay informed about your credit health. Aim to maintain or improve your credit score by paying bills on time, keeping credit card balances low, and managing credit responsibly. A strong credit score can significantly impact your financial readiness for major commitments.

- Insurance: Adequate insurance coverage is vital to protect yourself and your assets from unforeseen events. Ensure you have the necessary coverage for health, life, home, and auto insurance. Regularly review and update your insurance policies to ensure they align with your current needs and provide adequate protection. Proper insurance coverage can prevent financial setbacks and provide peace of mind.

- Investments: Diversifying your investment portfolio is key to spreading risk and achieving long-term financial goals. Consult a financial advisor to develop an investment strategy that aligns with your goals, risk tolerance, and time horizon. A well-diversified portfolio can help you navigate market fluctuations and achieve a balanced approach to wealth building.

- Financial Goals: Setting clear short-term and long-term financial goals is essential for financial readiness. Create a realistic timeline for achieving these goals and break them down into manageable steps. Regularly monitor your progress and adjust your plan as needed to stay on track. Having well-defined goals provides direction and motivation for making informed financial decisions.

- Income Potential: Increasing your income can enhance your financial stability and readiness for major commitments. Consider pursuing additional education, certifications, or side gigs to boost your earning potential. Enhancing your skills and exploring new opportunities can lead to higher income and greater financial flexibility.