- Study

- Slides

- Videos

8.1 Importance of early planning for Retirement

Early retirement planning is crucial to ensure a financially secure and comfortable retirement. Here are detailed reasons why starting early is beneficial:

-

Compound Interest:

- Magic of Compounding: The earlier you start investing, the more time your money has to grow. Compounding allows you to earn returns on your initial investment as well as on the accumulated interest over time.

-

Financial Security:

- Peace of Mind: Early planning helps you build a substantial retirement corpus, ensuring you have enough funds to cover your living expenses, healthcare, and leisure activities during retirement.

- Risk Mitigation: Having a well-thought-out plan allows you to weather financial uncertainties, such as market fluctuations, inflation, or unexpected expenses.

-

Achieving Financial Goals:

- Setting Clear Goals: Early planning helps you define and achieve your financial goals, such as traveling, purchasing a second home, or supporting family members.

- Tailored Investments: You can choose investment options that align with your risk tolerance and time horizon, maximizing your returns.

-

Tax Benefits:

- Tax Efficiency: Investing in retirement-specific accounts, such as Public Provident Fund (PPF) or National Pension System (NPS), offers tax benefits. Starting early ensures you take full advantage of these benefits over the long term.

- Tax-Free Returns: Certain retirement investments provide tax-free returns, boosting your retirement savings.

-

Inflation Protection:

- Combat Inflation: Over time, inflation erodes the purchasing power of money. Early planning allows you to invest in assets that outpace inflation, ensuring your retirement corpus maintains its value.

- Diversified Portfolio: A diversified investment portfolio, including equities, bonds, and real estate, helps protect against inflation.

-

Lifestyle Choices:

- Retirement Lifestyle: Early planning gives you the freedom to choose the lifestyle you want in retirement. Whether it’s traveling the world, pursuing hobbies, or volunteering, you’ll have the financial means to support your desired activities.

- Reduced Financial Stress: Knowing you have a well-funded retirement plan reduces financial stress and allows you to enjoy your golden years.

-

Flexibility and Options:

- Flexible Plans: Starting early provides the flexibility to adjust your plan as needed. Life events, such as changes in income, health, or family dynamics, can impact your retirement strategy. Early planning allows you to adapt without compromising your goals.

- Early Retirement: If you start early, you have the option to retire earlier than planned, providing you with more freedom and control over your life.

-

Health and Longevity:

- Health Expenses: Healthcare costs tend to rise with age. Early planning ensures you have adequate funds to cover medical expenses and health insurance premiums.

- Longer Lifespan: With increasing life expectancy, early planning ensures you don’t outlive your savings, providing financial security throughout your retirement years.

Practical Steps for Early Retirement Planning:

- Assess Your Financial Situation: Evaluate your current income, expenses, debts, and savings.

- Set Retirement Goals: Determine your desired retirement age, lifestyle, and financial needs.

- Create a Retirement Plan: Develop a comprehensive plan that includes investment strategies, savings goals, and risk management.

- Invest Wisely: Choose suitable investment options based on your risk tolerance and time horizon.

- Review and Adjust: Regularly review your retirement plan and make adjustments based on changes in your financial situation or goals.

Early retirement planning empowers you to take control of your financial future, providing security, flexibility, and peace of mind. It’s never too early to start planning for a comfortable and fulfilling retirement.

Example

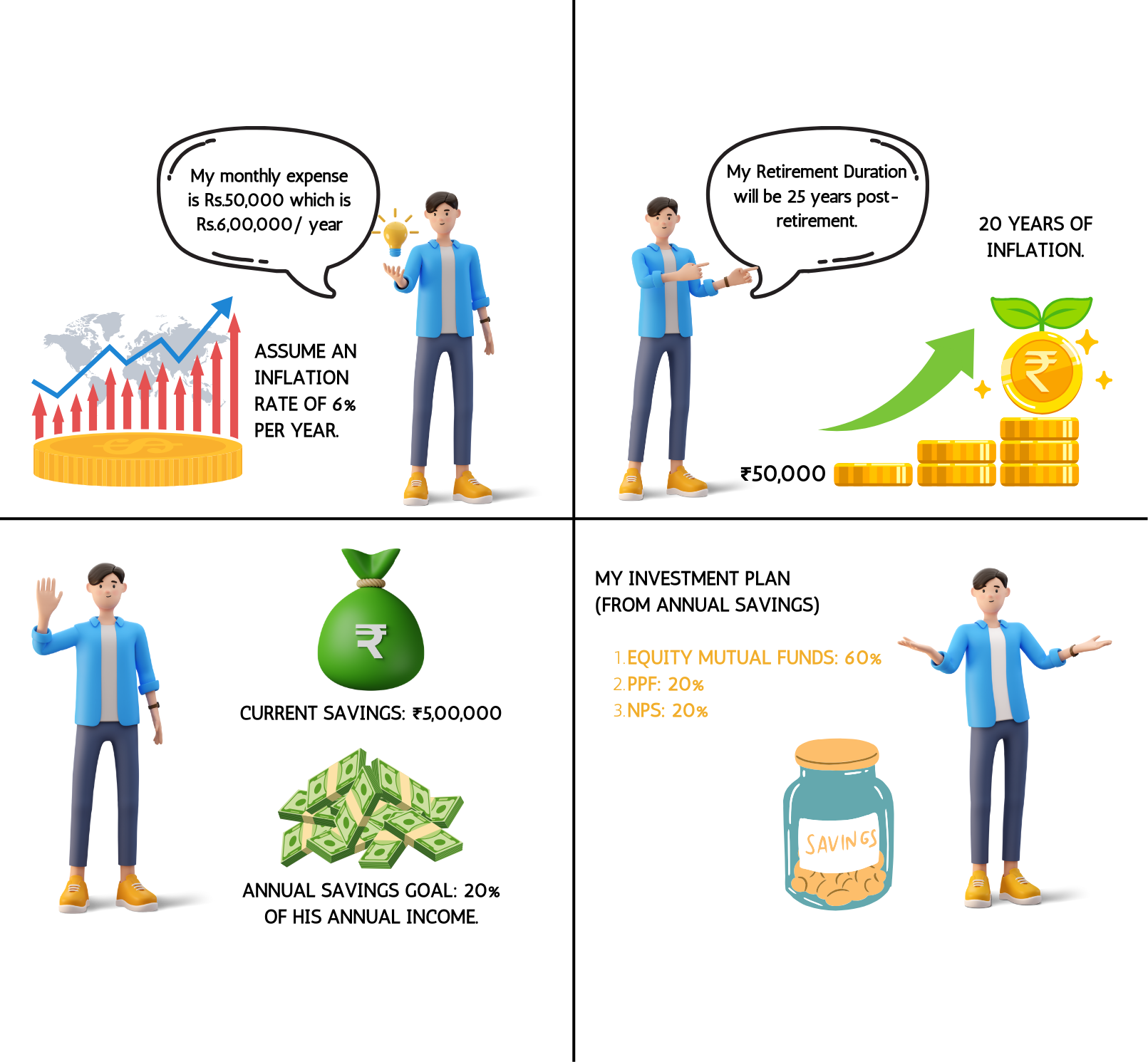

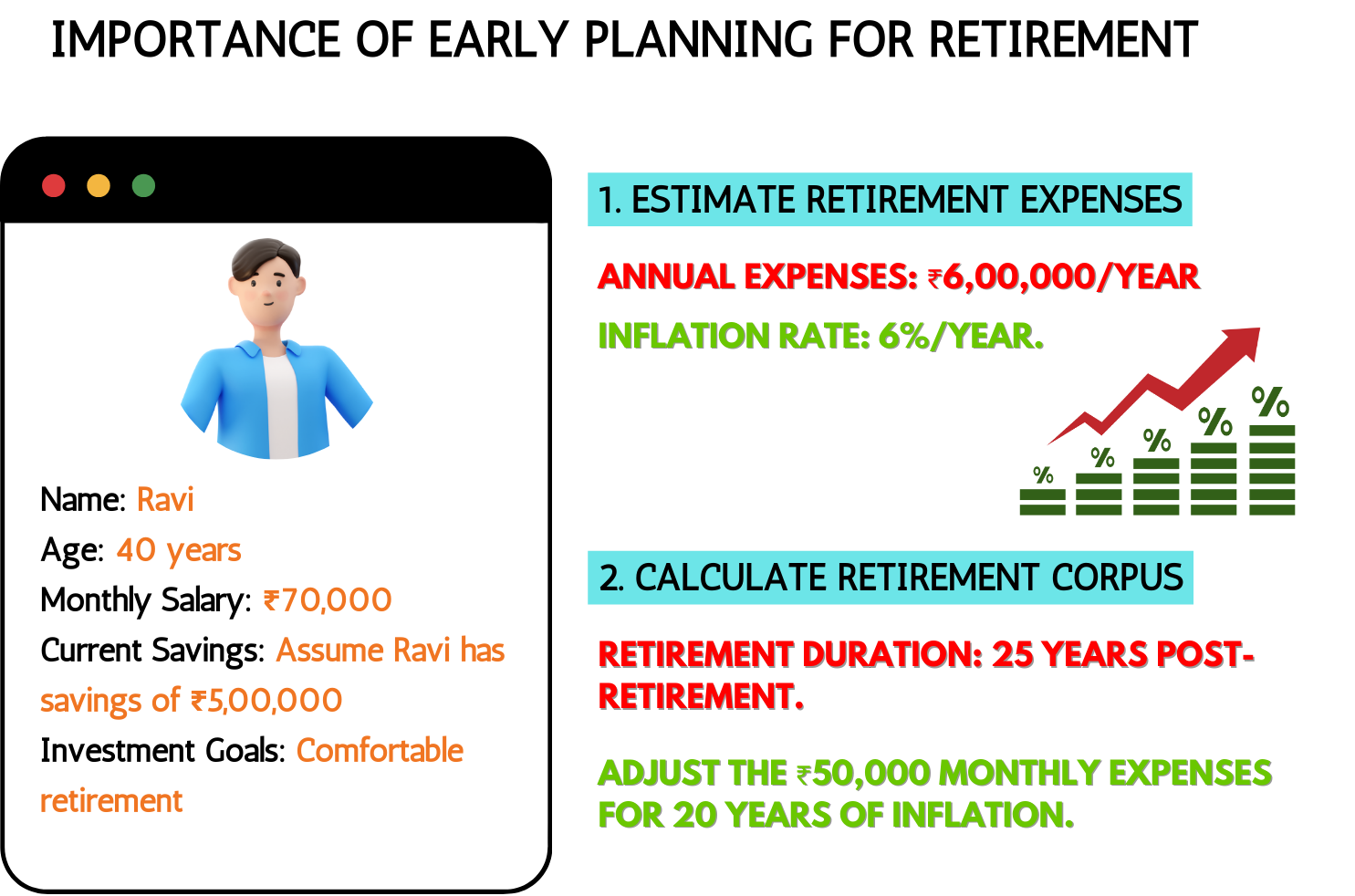

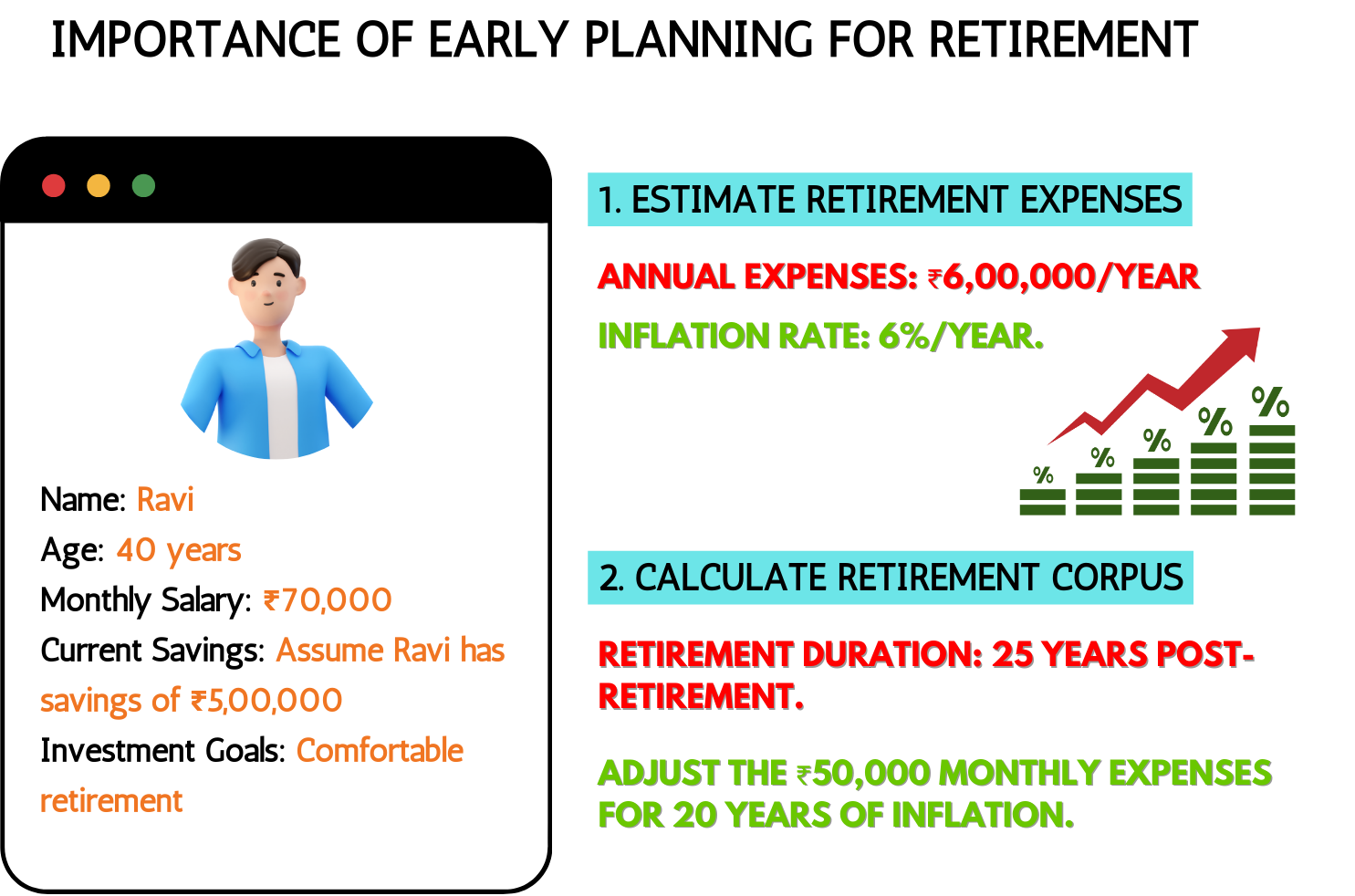

Ravi’s Financial Profile:

- Age: 40 years

- Monthly Salary: ₹70,000

- Current Savings: Assume Ravi has savings of ₹5,00,000

- Investment Goals: Comfortable retirement with sufficient funds for living expenses, healthcare, and leisure activities

Steps for Ravi’s Retirement Planning:

- Estimate Retirement Expenses:

- Monthly Expenses: Assume Ravi will need ₹50,000 per month (adjusted for inflation) during retirement.

- Annual Expenses: ₹50,000 x 12 = ₹6,00,000 per year

- Inflation Rate: Assume an inflation rate of 6% per year.

- Calculate Retirement Corpus:

- Retirement Duration: Assume Ravi lives until age 85, so he will need funds for 25 years post-retirement.

- Future Value of Monthly Expenses: Adjust the ₹50,000 monthly expenses for 20 years of inflation.

Future Value of Monthly Expenses (FV):

FV=PV×(1+r)n

Where:

- PV = ₹50,000 (current monthly expenses)

- r = 6% (inflation rate)

- n = 20 years (time until retirement)

FV=50,000×(1+0.06)20 ≈ ₹1,60,357

Annual Retirement Expenses (Adjusted for Inflation):

Annual Retirement Expenses= ₹1,60,357×12 = ₹19,24,284

Total Retirement Corpus Needed:

Corpus=Annual Expenses×((1+r)t−1/ r×(1+r)t)

Where:

- Annual Expenses = ₹19,24,284

- r = 8% (assumed annual return on investment)

- t = 25 years (retirement duration)

Corpus=19,24,284×((1+0.08)25−1/ 0.08×(1+0.08)25)≈ ₹3,59,67,066

This revised calculation ensures that we’re using rupees instead of dollars. The final corpus required for Ravi’s retirement remains ₹3,59,67,066.

8.2 CAGR ultimate Step-up Calculator

A CAGR (Compound Annual Growth Rate) calculator is an essential tool for retirement planning, and here’s why:

Understanding CAGR

CAGR measures the mean annual growth rate of an investment over a specified period of time. Unlike simple growth rates, CAGR accounts for the compounding effect, which means earning returns on both the initial principal and the accumulated interest or returns from previous periods.

Importance of a CAGR Calculator for Retirement Planning

- Evaluating Investment Performance:

- Long-Term Perspective: CAGR gives a long-term perspective on investment growth, showing how an investment has performed over multiple years.

- Consistency: By providing a smooth annualized rate of growth, CAGR helps in comparing the performance of different investments consistently over time.

- Setting Realistic Retirement Goals:

- Goal Setting: CAGR helps you set realistic retirement goals by estimating the annual growth rate needed to reach your target corpus.

- Projection: It allows you to project the future value of your current investments, helping you understand how much you need to save and invest to achieve your retirement goals.

- Comparing Different Investment Options:

- Benchmarking: CAGR can be used to compare the performance of different investment options, such as mutual funds, stocks, and bonds, helping you choose the best ones for your retirement plan.

- Informed Decisions: It aids in making informed investment decisions by providing a clear picture of the average growth rate of various assets.

- Assessing Risk and Return:

- Risk Assessment: By analyzing the historical CAGR of an investment, you can assess its performance and volatility, helping you choose investments that align with your risk tolerance.

- Return Expectations: It helps set realistic return expectations, ensuring you don’t overestimate the growth potential of your investments.

- Financial Planning:

- Retirement Corpus Estimation: CAGR helps estimate the total corpus needed for retirement by projecting the growth of your current investments.

- Tax Efficiency: By understanding the CAGR of different investment options, you can choose tax-efficient investments that maximize your returns.

Example Using a CAGR Calculator for Retirement Planning

Let’s consider Ravi, who is 40 years old and plans to retire at 60. He wants to know how much his current investment of ₹10,00,000 will grow over 20 years with an estimated CAGR of 8%.

Calculation:

- Initial Investment (PV): ₹10,00,000

- CAGR (r): 8% or 0.08

- Time Period (n): 20 years

CAGR Formula:

FV=PV×(1+r)n

Calculation:

FV=10,00,000×(1+0.08)20

FV=10,00,000×(4.66)

FV≈ ₹46,60,000

In this example, Ravi’s initial investment of ₹10,00,000 would grow to approximately ₹46,60,000 over 20 years with an 8% CAGR.

A CAGR calculator is a valuable tool for retirement planning. It helps evaluate investment performance, set realistic goals, compare different investment options, assess risk and return, and estimate the total retirement corpus needed. Using a CAGR calculator ensures you make informed decisions and stay on track to achieve a financially secure and comfortable retirement.

8.3. How much should you save for retirement life

The amount you should save for retirement depends on various factors, including your desired retirement lifestyle, current age, income, and expected expenses. Here are some general guidelines to help you determine how much to save:

- Estimate Your Retirement Expenses:

- Monthly Expenses: Calculate your expected monthly expenses during retirement, including housing, healthcare, food, travel, and leisure activities.

- Annual Expenses: Multiply your monthly expenses by 12 to get your annual expenses.

- Consider Inflation:

- Inflation Rate: Account for inflation, which erodes the purchasing power of money over time. A common assumption is an inflation rate of 3-4% per year.

- Determine Your Retirement Duration:

- Retirement Age: Decide at what age you plan to retire.

- Life Expectancy: Estimate your life expectancy to determine the number of years you need to fund your retirement.

- Calculate Your Retirement Corpus:

- Retirement Corpus: Use the formula to calculate the total amount needed for retirement:

Retirement Corpus=Annual Expenses×((1+r)t−1/r×(1+r)t)

Where:

- Annual Expenses = Estimated annual expenses during retirement

- r = Expected annual return on investment (e.g., 6-8%)

- t = Number of years in retirement

- Save Regularly:

- Savings Rate: Aim to save at least 15-20% of your annual income for retirement.

- Investment Options: Consider investing in a mix of equity mutual funds, fixed deposits, Public Provident Fund (PPF), and National Pension System (NPS) to build a diversified retirement portfolio.

Example

Steps for Ravi’s Retirement Planning:

- Estimate Retirement Expenses:

- Monthly Expenses: Assume Ravi will need ₹50,000 per month (adjusted for inflation) during retirement.

- Annual Expenses: ₹50,000 x 12 = ₹6,00,000 per year

- Inflation Rate: Assume an inflation rate of 6% per year.

- Calculate Retirement Corpus:

- Retirement Duration: Assume Ravi lives until age 85, so he will need funds for 25 years post-retirement.

- Future Value of Monthly Expenses: Adjust the ₹50,000 monthly expenses for 20 years of inflation.

- Formula for Future Value of Monthly Expenses (FV):

FV= PV×(1+r) n

Where PV = ₹50,000, r = 6% (inflation rate), n = 20 years.

FV=50,000×(1+0.06)20≈ ₹1,60,357

- Annual Retirement Expenses (Adjusted for Inflation): ₹1,60,357 x 12 = ₹19,24,284 per year.

- Total Retirement Corpus Needed:

Corpus= Annual Expenses ×((1+r)t−1r×(1+r)t)

Where Annual Expenses = ₹19,24,284, r = 8% (expected annual return on investment), t = 25 years.

Corpus=19,24,284× ((1+0.08)25−10.08×(1+0.08)25)≈ ₹3,59,67,066

- Assess Current Savings and Investments:

- Current Savings: ₹5,00,000

- Annual Savings Goal: Assume Ravi can save 20% of his annual income.

Annual Income: ₹70,000×12 = ₹8,40,000

Annual Savings: ₹8,40,000×0.20 = ₹1,68,000

- Investment Strategy:

- Equity Mutual Funds: High growth potential, suitable for long-term investments.

- Public Provident Fund (PPF): Safe investment with tax benefits.

- National Pension System (NPS): Long-term retirement savings with tax benefits.

- Investment Plan:

- Equity Mutual Funds: 60% of annual savings = ₹1,00,800

- PPF: 20% of annual savings = ₹33,600

- NPS: 20% of annual savings = ₹33,600

Here’s a simple table to summarize Ravi’s annual investment plan:

|

Investment Type |

Annual Amount |

Percentage |

|

Equity Mutual Funds |

₹1,00,800 |

60% |

|

PPF |

₹33,600 |

20% |

|

NPS |

₹33,600 |

20% |

By following this investment plan, Ravi can build a substantial retirement corpus over the next 20 years, ensuring financial security and a comfortable retirement. It’s essential for Ravi to review his investment strategy regularly and adjust it based on changes in his financial situation or goals.

8.4 Is Rs 1 crore enough for your retirement?

Whether ₹1 crore is enough for your retirement depends on various factors, such as your lifestyle, location, expected retirement duration, and inflation.

Factors to Consider:

- Monthly Expenses: Calculate your expected monthly expenses during retirement, including housing, healthcare, food, travel, and leisure activities.

- Inflation: Account for inflation, which erodes the purchasing power of money over time. A common assumption is an inflation rate of 6% per year in India.

- Retirement Duration: Estimate the number of years you will be in retirement. For example, if you plan to retire at 60 and expect to live until 85, you’ll need funds for 25 years.

Example Calculation:

Let’s assume Ravi plans to retire at age 60 and expects to live until age 85. His estimated monthly expenses are ₹50,000, and we consider an inflation rate of 6%.

- Annual Expenses:

Annual Expenses= ₹50,000×12=₹6,00,000

Future Value of Monthly Expenses (Adjusted for 20 Years of Inflation):

FV=₹50,000×(1+0.06)20≈₹1,60,357

- Adjusted Annual Expenses:

Adjusted Annual Expenses=₹1,60,357×12=₹19,24,284

- Total Retirement Corpus Needed:

Corpus=Adjusted Annual Expenses×((1+r)t−1/r×(1+r)t)

Where:

- Adjusted Annual Expenses = ₹19,24,284

- r = 8% (expected annual return on investment)

- t = 25 years (retirement duration)

Corpus= ₹19,24,284×((1+0.08)25−1/ 0.08×(1+0.08)25) ≈ ₹3,59,67,066

In this example, Ravi would need approximately ₹3.59 crore to fund his retirement. Therefore, ₹1 crore may not be sufficient for a comfortable retirement if his expenses and assumptions are similar to this example.

It’s essential to tailor your retirement savings plan to your specific needs and circumstances. Regularly reviewing and adjusting your plan based on changes in expenses, lifestyle, and economic conditions is crucial.

8.5 What is Atal Pension Yojana

The Atal Pension Yojana (APY) is a government-backed pension scheme in India aimed at providing a steady pension to workers in the unorganized sector. Here are the key details:

Key Features:

- Eligibility:

- Indian citizens aged 18 to 40 years.

- Must have a savings bank account linked to Aadhaar.

- Pension Amount:

- Offers a guaranteed minimum pension of ₹1,000 to ₹5,000 per month after the age of 60, depending on the contributions made.

- Contributions:

- The contribution amount varies based on the chosen pension amount and the age at which the subscriber joins the scheme.

- Government Co-Contribution:

- The government co-contributes 50% of the total contribution or ₹1,000 per annum, whichever is lower, for eligible subscribers who joined between June 2015 and December 2015 for a period of 5 years.

- Nominee Benefits:

- In case of the subscriber’s death before 60, the spouse can continue the scheme or exit and claim the corpus. After the death of both the subscriber and spouse, the nominee will receive the accumulated corpus.

Enrollment Process:

- Eligibility Check: Ensure you meet the eligibility criteria.

- Visit Bank: Go to the nearest branch of the bank where you have an account and ask for the APY registration form.

- Fill Form: Provide details like name, date of birth, address, mobile number, Aadhaar number, and nominee details.

- Submit Documents: Attach photocopies of your Aadhaar card and PAN card with the application form.

- Auto-Debit Facility: Arrange for an auto-debit facility with your bank to ensure timely contributions.

Benefits:

- Social Security: Provides a sense of security and financial stability in old age.

- Government Guarantee: The government guarantees the minimum pension amount.

- Tax Benefits: Contributions to APY are eligible for tax benefits under Section 80CCD of the Income Tax Act.

Example

Steps for Ravi’s Retirement Planning with APY:

- Estimate Retirement Expenses:

- Monthly Expenses: Assume Ravi will need ₹50,000 per month (adjusted for inflation) during retirement.

- Annual Expenses: ₹50,000 x 12 = ₹6,00,000 per year

- Inflation Rate: Assume an inflation rate of 6% per year.

- Calculate Retirement Corpus with APY:

- Ravi decides to enroll in the Atal Pension Yojana for a guaranteed pension of ₹5,000 per month after age 60.

- The contribution amount will depend on his age at the time of joining and the pension amount chosen.

- APY Contribution for ₹5,000 Monthly Pension:

- At age 40, Ravi needs to contribute approximately ₹1,454 per month to receive a pension of ₹5,000 per month after age 60.

- Additional Savings and Investments:

- Ravi can supplement his APY contributions with other investments to ensure he meets his overall retirement goals.

- Current Savings: ₹5,00,000

- Annual Savings Goal: Assume Ravi can save 20% of his annual income.

Annual Income:₹70,000×12=₹8,40,000text{Annual Income:} ₹70,000 times 12 = ₹8,40,000

Annual Savings:₹8,40,000×0.20=₹1,68,000text{Annual Savings:} ₹8,40,000 times 0.20 = ₹1,68,000

- Investment Strategy:

- Equity Mutual Funds: 60% of annual savings = ₹1,00,800

- Public Provident Fund (PPF): 20% of annual savings = ₹33,600

- National Pension System (NPS): 20% of annual savings = ₹33,600

Here’s a simple table to summarize Ravi’s annual investment plan alongside his APY contributions:

|

Investment Type |

Annual Amount |

Percentage |

|

Equity Mutual Funds |

₹1,00,800 |

60% |

|

PPF |

₹33,600 |

20% |

|

NPS |

₹33,600 |

20% |

|

APY (₹1,454 x 12) |

₹17,448 |

– |

Benefits of APY for Ravi:

- Guaranteed Pension: Ravi will receive a guaranteed pension of ₹5,000 per month after age 60, providing a steady income.

- Government Support: The government’s co-contribution (if eligible) enhances the benefits of the scheme.

- Social Security: APY offers social security and financial stability during retirement.

8.6 Should You Make A Will

Creating a will is a critical aspect of estate planning. It ensures that your assets are distributed according to your wishes and provides clarity and peace of mind for your loved ones. Here’s a detailed explanation of why making a will is important and how to go about it:

Why You Should Make a Will:

- Control Over Asset Distribution:

- Specify Beneficiaries: A will allows you to clearly define who will receive your assets and belongings. This ensures that your property is distributed according to your wishes.

- Avoid Disputes: By specifying your wishes, you can help prevent potential disputes among family members and heirs.

- Appointing Guardians for Minor Children:

- Legal Guardianship: If you have minor children, a will enables you to appoint legal guardians who will take care of them in the event of your passing. This ensures your children are cared for by someone you trust.

- Estate Management:

- Executor Appointment: You can appoint an executor in your will, who will be responsible for managing and distributing your estate according to your wishes. This person will handle financial matters, settle debts, and ensure your instructions are followed.

- Reducing Legal Complications:

- Clear Instructions: A well-drafted will provides clear instructions for the distribution of your estate, minimizing legal complications and potential challenges.

- Legal Validity: A will ensures your estate is distributed in accordance with the law, providing legal validity to your wishes.

- Tax Benefits:

- Estate Planning: Proper estate planning through a will can help minimize taxes and expenses associated with the transfer of assets to your beneficiaries.

- Charitable Bequests:

- Philanthropy: If you wish to leave a portion of your estate to charitable organizations, a will allows you to specify these bequests.

Steps to Create a Will:

List Your Assets and Debts:

- Make a comprehensive list of all your assets, including property, bank accounts, investments, valuable possessions, and digital assets.

- List any debts or liabilities you have.

Choose Beneficiaries:

- Decide who will inherit your assets. You can choose family members, friends, or charitable organizations.

Appoint an Executor:

- Select a trusted individual to act as the executor of your will. This person will be responsible for carrying out your wishes and managing your estate.

Appoint Guardians for Minor Children:

- If you have minor children, appoint guardians who will take care of them in the event of your passing.

Specify Funeral and Burial Wishes:

- Include any specific instructions for your funeral or burial arrangements.

Draft the Will:

- You can write the will yourself, use online will-writing services, or consult an attorney to draft the will. Ensure it is clear and unambiguous.

Sign the Will:

- Sign the will in the presence of witnesses. The number of witnesses required and their qualifications may vary depending on your jurisdiction.

- Store the Will Safely:

- Keep the original will in a safe place and inform your executor and close family members of its location

Example

Ravi’s Financial Profile:

Age: 40 years

Marital Status: Married

Children: Two minor children (ages 10 and 7)

Assets:

- House worth ₹70,00,000

- Savings of ₹20,00,000

- Investments in mutual funds worth ₹15,00,000

- Car worth ₹5,00,000

Liabilities: Home loan balance of ₹10,00,000

Ravi’s Objectives for His Will:

- Distribution of Assets:

- Ensure that his wife and children are well taken care of.

- Allocate specific assets to his family members.

- Make a charitable bequest.

- Appointing Guardians:

- Designate legal guardians for his minor children to ensure their upbringing in his absence.

- Executor Appointment:

- Choose a trusted person to manage and distribute his estate according to his wishes.

Steps Ravi Takes to Create His Will:

- List of Assets and Debts:

- Ravi makes a comprehensive list of all his assets and liabilities.

- Choose Beneficiaries:

- Ravi decides to leave his house and investments to his wife.

- He allocates his savings and car to be divided equally between his children.

- He includes a charitable bequest of ₹2,00,000 to a local NGO.

- Appoint an Executor:

- Ravi appoints his close friend, Raj, as the executor of his will to manage and distribute his estate.

- Appoint Guardians for Minor Children:

- Ravi designates his brother and sister-in-law as legal guardians for his children.

- Specify Funeral and Burial Wishes:

- Ravi includes specific instructions for his funeral arrangements, requesting a simple ceremony.

- Draft the Will:

- Ravi consults an attorney to draft a clear and legally valid will, ensuring all his wishes are documented accurately.

- Sign the Will:

- Ravi signs the will in the presence of two witnesses to make it legally binding.

- Store the Will Safely:

- Ravi keeps the original will in a safe place and informs his wife and the executor of its location.

Example of Ravi’s Will Summary:

Ravi Sharma’s Will

I, Ravi Sharma, residing at [Address], hereby declare this to be my last will and testament.

Distribution of Assets:

- I leave my house located at [Address] to my wife, Meera Sharma.

- I leave my mutual fund investments worth ₹15,00,000 to my wife, Meera Sharma.

- I leave my savings of ₹20,00,000 to be divided equally between my children, Aarav Sharma and Ananya Sharma.

- I leave my car worth ₹5,00,000 to be divided equally between my children, Aarav Sharma and Ananya Sharma.

- I make a charitable bequest of ₹2,00,000 to [NGO Name].

Appointing Guardians:

- I appoint my brother, Rakesh Sharma, and his wife, Priya Sharma, as legal guardians for my minor children, Aarav Sharma and Ananya Sharma.

Executor Appointment:

- I appoint Raj Kapoor as the executor of my will to manage and distribute my estate according to my wishes.

Funeral and Burial Wishes:

- I request a simple funeral ceremony.

Signed this [Date] Day of [Month], [Year].

[Signature of Ravi Sharma]

Witnesses:

- [Witness 1 Name and Signature]

- [Witness 2 Name and Signature]

By creating this will, Ravi ensures that his assets are distributed according to his wishes, his children are cared for, and legal complications are minimized.

8.1 Importance of early planning for Retirement

Early retirement planning is crucial to ensure a financially secure and comfortable retirement. Here are detailed reasons why starting early is beneficial:

-

Compound Interest:

- Magic of Compounding: The earlier you start investing, the more time your money has to grow. Compounding allows you to earn returns on your initial investment as well as on the accumulated interest over time.

-

Financial Security:

- Peace of Mind: Early planning helps you build a substantial retirement corpus, ensuring you have enough funds to cover your living expenses, healthcare, and leisure activities during retirement.

- Risk Mitigation: Having a well-thought-out plan allows you to weather financial uncertainties, such as market fluctuations, inflation, or unexpected expenses.

-

Achieving Financial Goals:

- Setting Clear Goals: Early planning helps you define and achieve your financial goals, such as traveling, purchasing a second home, or supporting family members.

- Tailored Investments: You can choose investment options that align with your risk tolerance and time horizon, maximizing your returns.

-

Tax Benefits:

- Tax Efficiency: Investing in retirement-specific accounts, such as Public Provident Fund (PPF) or National Pension System (NPS), offers tax benefits. Starting early ensures you take full advantage of these benefits over the long term.

- Tax-Free Returns: Certain retirement investments provide tax-free returns, boosting your retirement savings.

-

Inflation Protection:

- Combat Inflation: Over time, inflation erodes the purchasing power of money. Early planning allows you to invest in assets that outpace inflation, ensuring your retirement corpus maintains its value.

- Diversified Portfolio: A diversified investment portfolio, including equities, bonds, and real estate, helps protect against inflation.

-

Lifestyle Choices:

- Retirement Lifestyle: Early planning gives you the freedom to choose the lifestyle you want in retirement. Whether it’s traveling the world, pursuing hobbies, or volunteering, you’ll have the financial means to support your desired activities.

- Reduced Financial Stress: Knowing you have a well-funded retirement plan reduces financial stress and allows you to enjoy your golden years.

-

Flexibility and Options:

- Flexible Plans: Starting early provides the flexibility to adjust your plan as needed. Life events, such as changes in income, health, or family dynamics, can impact your retirement strategy. Early planning allows you to adapt without compromising your goals.

- Early Retirement: If you start early, you have the option to retire earlier than planned, providing you with more freedom and control over your life.

-

Health and Longevity:

- Health Expenses: Healthcare costs tend to rise with age. Early planning ensures you have adequate funds to cover medical expenses and health insurance premiums.

- Longer Lifespan: With increasing life expectancy, early planning ensures you don’t outlive your savings, providing financial security throughout your retirement years.

Practical Steps for Early Retirement Planning:

- Assess Your Financial Situation: Evaluate your current income, expenses, debts, and savings.

- Set Retirement Goals: Determine your desired retirement age, lifestyle, and financial needs.

- Create a Retirement Plan: Develop a comprehensive plan that includes investment strategies, savings goals, and risk management.

- Invest Wisely: Choose suitable investment options based on your risk tolerance and time horizon.

- Review and Adjust: Regularly review your retirement plan and make adjustments based on changes in your financial situation or goals.

Early retirement planning empowers you to take control of your financial future, providing security, flexibility, and peace of mind. It’s never too early to start planning for a comfortable and fulfilling retirement.

Example

Ravi’s Financial Profile:

- Age: 40 years

- Monthly Salary: ₹70,000

- Current Savings: Assume Ravi has savings of ₹5,00,000

- Investment Goals: Comfortable retirement with sufficient funds for living expenses, healthcare, and leisure activities

Steps for Ravi’s Retirement Planning:

- Estimate Retirement Expenses:

- Monthly Expenses: Assume Ravi will need ₹50,000 per month (adjusted for inflation) during retirement.

- Annual Expenses: ₹50,000 x 12 = ₹6,00,000 per year

- Inflation Rate: Assume an inflation rate of 6% per year.

- Calculate Retirement Corpus:

- Retirement Duration: Assume Ravi lives until age 85, so he will need funds for 25 years post-retirement.

- Future Value of Monthly Expenses: Adjust the ₹50,000 monthly expenses for 20 years of inflation.

Future Value of Monthly Expenses (FV):

FV=PV×(1+r)n

Where:

- PV = ₹50,000 (current monthly expenses)

- r = 6% (inflation rate)

- n = 20 years (time until retirement)

FV=50,000×(1+0.06)20 ≈ ₹1,60,357

Annual Retirement Expenses (Adjusted for Inflation):

Annual Retirement Expenses= ₹1,60,357×12 = ₹19,24,284

Total Retirement Corpus Needed:

Corpus=Annual Expenses×((1+r)t−1/ r×(1+r)t)

Where:

- Annual Expenses = ₹19,24,284

- r = 8% (assumed annual return on investment)

- t = 25 years (retirement duration)

Corpus=19,24,284×((1+0.08)25−1/ 0.08×(1+0.08)25)≈ ₹3,59,67,066

This revised calculation ensures that we’re using rupees instead of dollars. The final corpus required for Ravi’s retirement remains ₹3,59,67,066.

8.2 CAGR ultimate Step-up Calculator

A CAGR (Compound Annual Growth Rate) calculator is an essential tool for retirement planning, and here’s why:

Understanding CAGR

CAGR measures the mean annual growth rate of an investment over a specified period of time. Unlike simple growth rates, CAGR accounts for the compounding effect, which means earning returns on both the initial principal and the accumulated interest or returns from previous periods.

Importance of a CAGR Calculator for Retirement Planning

- Evaluating Investment Performance:

- Long-Term Perspective: CAGR gives a long-term perspective on investment growth, showing how an investment has performed over multiple years.

- Consistency: By providing a smooth annualized rate of growth, CAGR helps in comparing the performance of different investments consistently over time.

- Setting Realistic Retirement Goals:

- Goal Setting: CAGR helps you set realistic retirement goals by estimating the annual growth rate needed to reach your target corpus.

- Projection: It allows you to project the future value of your current investments, helping you understand how much you need to save and invest to achieve your retirement goals.

- Comparing Different Investment Options:

- Benchmarking: CAGR can be used to compare the performance of different investment options, such as mutual funds, stocks, and bonds, helping you choose the best ones for your retirement plan.

- Informed Decisions: It aids in making informed investment decisions by providing a clear picture of the average growth rate of various assets.

- Assessing Risk and Return:

- Risk Assessment: By analyzing the historical CAGR of an investment, you can assess its performance and volatility, helping you choose investments that align with your risk tolerance.

- Return Expectations: It helps set realistic return expectations, ensuring you don’t overestimate the growth potential of your investments.

- Financial Planning:

- Retirement Corpus Estimation: CAGR helps estimate the total corpus needed for retirement by projecting the growth of your current investments.

- Tax Efficiency: By understanding the CAGR of different investment options, you can choose tax-efficient investments that maximize your returns.

Example Using a CAGR Calculator for Retirement Planning

Let’s consider Ravi, who is 40 years old and plans to retire at 60. He wants to know how much his current investment of ₹10,00,000 will grow over 20 years with an estimated CAGR of 8%.

Calculation:

- Initial Investment (PV): ₹10,00,000

- CAGR (r): 8% or 0.08

- Time Period (n): 20 years

CAGR Formula:

FV=PV×(1+r)n

Calculation:

FV=10,00,000×(1+0.08)20

FV=10,00,000×(4.66)

FV≈ ₹46,60,000

In this example, Ravi’s initial investment of ₹10,00,000 would grow to approximately ₹46,60,000 over 20 years with an 8% CAGR.

A CAGR calculator is a valuable tool for retirement planning. It helps evaluate investment performance, set realistic goals, compare different investment options, assess risk and return, and estimate the total retirement corpus needed. Using a CAGR calculator ensures you make informed decisions and stay on track to achieve a financially secure and comfortable retirement.

8.3. How much should you save for retirement life

The amount you should save for retirement depends on various factors, including your desired retirement lifestyle, current age, income, and expected expenses. Here are some general guidelines to help you determine how much to save:

- Estimate Your Retirement Expenses:

- Monthly Expenses: Calculate your expected monthly expenses during retirement, including housing, healthcare, food, travel, and leisure activities.

- Annual Expenses: Multiply your monthly expenses by 12 to get your annual expenses.

- Consider Inflation:

- Inflation Rate: Account for inflation, which erodes the purchasing power of money over time. A common assumption is an inflation rate of 3-4% per year.

- Determine Your Retirement Duration:

- Retirement Age: Decide at what age you plan to retire.

- Life Expectancy: Estimate your life expectancy to determine the number of years you need to fund your retirement.

- Calculate Your Retirement Corpus:

- Retirement Corpus: Use the formula to calculate the total amount needed for retirement:

Retirement Corpus=Annual Expenses×((1+r)t−1/r×(1+r)t)

Where:

- Annual Expenses = Estimated annual expenses during retirement

- r = Expected annual return on investment (e.g., 6-8%)

- t = Number of years in retirement

- Save Regularly:

- Savings Rate: Aim to save at least 15-20% of your annual income for retirement.

- Investment Options: Consider investing in a mix of equity mutual funds, fixed deposits, Public Provident Fund (PPF), and National Pension System (NPS) to build a diversified retirement portfolio.

Example

Steps for Ravi’s Retirement Planning:

- Estimate Retirement Expenses:

- Monthly Expenses: Assume Ravi will need ₹50,000 per month (adjusted for inflation) during retirement.

- Annual Expenses: ₹50,000 x 12 = ₹6,00,000 per year

- Inflation Rate: Assume an inflation rate of 6% per year.

- Calculate Retirement Corpus:

- Retirement Duration: Assume Ravi lives until age 85, so he will need funds for 25 years post-retirement.

- Future Value of Monthly Expenses: Adjust the ₹50,000 monthly expenses for 20 years of inflation.

- Formula for Future Value of Monthly Expenses (FV):

FV= PV×(1+r) n

Where PV = ₹50,000, r = 6% (inflation rate), n = 20 years.

FV=50,000×(1+0.06)20≈ ₹1,60,357

- Annual Retirement Expenses (Adjusted for Inflation): ₹1,60,357 x 12 = ₹19,24,284 per year.

- Total Retirement Corpus Needed:

Corpus= Annual Expenses ×((1+r)t−1r×(1+r)t)

Where Annual Expenses = ₹19,24,284, r = 8% (expected annual return on investment), t = 25 years.

Corpus=19,24,284× ((1+0.08)25−10.08×(1+0.08)25)≈ ₹3,59,67,066

- Assess Current Savings and Investments:

- Current Savings: ₹5,00,000

- Annual Savings Goal: Assume Ravi can save 20% of his annual income.

Annual Income: ₹70,000×12 = ₹8,40,000

Annual Savings: ₹8,40,000×0.20 = ₹1,68,000

- Investment Strategy:

- Equity Mutual Funds: High growth potential, suitable for long-term investments.

- Public Provident Fund (PPF): Safe investment with tax benefits.

- National Pension System (NPS): Long-term retirement savings with tax benefits.

- Investment Plan:

- Equity Mutual Funds: 60% of annual savings = ₹1,00,800

- PPF: 20% of annual savings = ₹33,600

- NPS: 20% of annual savings = ₹33,600

Here’s a simple table to summarize Ravi’s annual investment plan:

|

Investment Type |

Annual Amount |

Percentage |

|

Equity Mutual Funds |

₹1,00,800 |

60% |

|

PPF |

₹33,600 |

20% |

|

NPS |

₹33,600 |

20% |

By following this investment plan, Ravi can build a substantial retirement corpus over the next 20 years, ensuring financial security and a comfortable retirement. It’s essential for Ravi to review his investment strategy regularly and adjust it based on changes in his financial situation or goals.

8.4 Is Rs 1 crore enough for your retirement?

Whether ₹1 crore is enough for your retirement depends on various factors, such as your lifestyle, location, expected retirement duration, and inflation.

Factors to Consider:

- Monthly Expenses: Calculate your expected monthly expenses during retirement, including housing, healthcare, food, travel, and leisure activities.

- Inflation: Account for inflation, which erodes the purchasing power of money over time. A common assumption is an inflation rate of 6% per year in India.

- Retirement Duration: Estimate the number of years you will be in retirement. For example, if you plan to retire at 60 and expect to live until 85, you’ll need funds for 25 years.

Example Calculation:

Let’s assume Ravi plans to retire at age 60 and expects to live until age 85. His estimated monthly expenses are ₹50,000, and we consider an inflation rate of 6%.

- Annual Expenses:

Annual Expenses= ₹50,000×12=₹6,00,000

Future Value of Monthly Expenses (Adjusted for 20 Years of Inflation):

FV=₹50,000×(1+0.06)20≈₹1,60,357

- Adjusted Annual Expenses:

Adjusted Annual Expenses=₹1,60,357×12=₹19,24,284

- Total Retirement Corpus Needed:

Corpus=Adjusted Annual Expenses×((1+r)t−1/r×(1+r)t)

Where:

- Adjusted Annual Expenses = ₹19,24,284

- r = 8% (expected annual return on investment)

- t = 25 years (retirement duration)

Corpus= ₹19,24,284×((1+0.08)25−1/ 0.08×(1+0.08)25) ≈ ₹3,59,67,066

In this example, Ravi would need approximately ₹3.59 crore to fund his retirement. Therefore, ₹1 crore may not be sufficient for a comfortable retirement if his expenses and assumptions are similar to this example.

It’s essential to tailor your retirement savings plan to your specific needs and circumstances. Regularly reviewing and adjusting your plan based on changes in expenses, lifestyle, and economic conditions is crucial.

8.5 What is Atal Pension Yojana

The Atal Pension Yojana (APY) is a government-backed pension scheme in India aimed at providing a steady pension to workers in the unorganized sector. Here are the key details:

Key Features:

- Eligibility:

- Indian citizens aged 18 to 40 years.

- Must have a savings bank account linked to Aadhaar.

- Pension Amount:

- Offers a guaranteed minimum pension of ₹1,000 to ₹5,000 per month after the age of 60, depending on the contributions made.

- Contributions:

- The contribution amount varies based on the chosen pension amount and the age at which the subscriber joins the scheme.

- Government Co-Contribution:

- The government co-contributes 50% of the total contribution or ₹1,000 per annum, whichever is lower, for eligible subscribers who joined between June 2015 and December 2015 for a period of 5 years.

- Nominee Benefits:

- In case of the subscriber’s death before 60, the spouse can continue the scheme or exit and claim the corpus. After the death of both the subscriber and spouse, the nominee will receive the accumulated corpus.

Enrollment Process:

- Eligibility Check: Ensure you meet the eligibility criteria.

- Visit Bank: Go to the nearest branch of the bank where you have an account and ask for the APY registration form.

- Fill Form: Provide details like name, date of birth, address, mobile number, Aadhaar number, and nominee details.

- Submit Documents: Attach photocopies of your Aadhaar card and PAN card with the application form.

- Auto-Debit Facility: Arrange for an auto-debit facility with your bank to ensure timely contributions.

Benefits:

- Social Security: Provides a sense of security and financial stability in old age.

- Government Guarantee: The government guarantees the minimum pension amount.

- Tax Benefits: Contributions to APY are eligible for tax benefits under Section 80CCD of the Income Tax Act.

Example

Steps for Ravi’s Retirement Planning with APY:

- Estimate Retirement Expenses:

- Monthly Expenses: Assume Ravi will need ₹50,000 per month (adjusted for inflation) during retirement.

- Annual Expenses: ₹50,000 x 12 = ₹6,00,000 per year

- Inflation Rate: Assume an inflation rate of 6% per year.

- Calculate Retirement Corpus with APY:

- Ravi decides to enroll in the Atal Pension Yojana for a guaranteed pension of ₹5,000 per month after age 60.

- The contribution amount will depend on his age at the time of joining and the pension amount chosen.

- APY Contribution for ₹5,000 Monthly Pension:

- At age 40, Ravi needs to contribute approximately ₹1,454 per month to receive a pension of ₹5,000 per month after age 60.

- Additional Savings and Investments:

- Ravi can supplement his APY contributions with other investments to ensure he meets his overall retirement goals.

- Current Savings: ₹5,00,000

- Annual Savings Goal: Assume Ravi can save 20% of his annual income.

Annual Income:₹70,000×12=₹8,40,000text{Annual Income:} ₹70,000 times 12 = ₹8,40,000

Annual Savings:₹8,40,000×0.20=₹1,68,000text{Annual Savings:} ₹8,40,000 times 0.20 = ₹1,68,000

- Investment Strategy:

- Equity Mutual Funds: 60% of annual savings = ₹1,00,800

- Public Provident Fund (PPF): 20% of annual savings = ₹33,600

- National Pension System (NPS): 20% of annual savings = ₹33,600

Here’s a simple table to summarize Ravi’s annual investment plan alongside his APY contributions:

|

Investment Type |

Annual Amount |

Percentage |

|

Equity Mutual Funds |

₹1,00,800 |

60% |

|

PPF |

₹33,600 |

20% |

|

NPS |

₹33,600 |

20% |

|

APY (₹1,454 x 12) |

₹17,448 |

– |

Benefits of APY for Ravi:

- Guaranteed Pension: Ravi will receive a guaranteed pension of ₹5,000 per month after age 60, providing a steady income.

- Government Support: The government’s co-contribution (if eligible) enhances the benefits of the scheme.

- Social Security: APY offers social security and financial stability during retirement.

8.6 Should You Make A Will

Creating a will is a critical aspect of estate planning. It ensures that your assets are distributed according to your wishes and provides clarity and peace of mind for your loved ones. Here’s a detailed explanation of why making a will is important and how to go about it:

Why You Should Make a Will:

- Control Over Asset Distribution:

- Specify Beneficiaries: A will allows you to clearly define who will receive your assets and belongings. This ensures that your property is distributed according to your wishes.

- Avoid Disputes: By specifying your wishes, you can help prevent potential disputes among family members and heirs.

- Appointing Guardians for Minor Children:

- Legal Guardianship: If you have minor children, a will enables you to appoint legal guardians who will take care of them in the event of your passing. This ensures your children are cared for by someone you trust.

- Estate Management:

- Executor Appointment: You can appoint an executor in your will, who will be responsible for managing and distributing your estate according to your wishes. This person will handle financial matters, settle debts, and ensure your instructions are followed.

- Reducing Legal Complications:

- Clear Instructions: A well-drafted will provides clear instructions for the distribution of your estate, minimizing legal complications and potential challenges.

- Legal Validity: A will ensures your estate is distributed in accordance with the law, providing legal validity to your wishes.

- Tax Benefits:

- Estate Planning: Proper estate planning through a will can help minimize taxes and expenses associated with the transfer of assets to your beneficiaries.

- Charitable Bequests:

- Philanthropy: If you wish to leave a portion of your estate to charitable organizations, a will allows you to specify these bequests.

Steps to Create a Will:

List Your Assets and Debts:

- Make a comprehensive list of all your assets, including property, bank accounts, investments, valuable possessions, and digital assets.

- List any debts or liabilities you have.

Choose Beneficiaries:

- Decide who will inherit your assets. You can choose family members, friends, or charitable organizations.

Appoint an Executor:

- Select a trusted individual to act as the executor of your will. This person will be responsible for carrying out your wishes and managing your estate.

Appoint Guardians for Minor Children:

- If you have minor children, appoint guardians who will take care of them in the event of your passing.

Specify Funeral and Burial Wishes:

- Include any specific instructions for your funeral or burial arrangements.

Draft the Will:

- You can write the will yourself, use online will-writing services, or consult an attorney to draft the will. Ensure it is clear and unambiguous.

Sign the Will:

- Sign the will in the presence of witnesses. The number of witnesses required and their qualifications may vary depending on your jurisdiction.

- Store the Will Safely:

- Keep the original will in a safe place and inform your executor and close family members of its location

Example

Ravi’s Financial Profile:

Age: 40 years

Marital Status: Married

Children: Two minor children (ages 10 and 7)

Assets:

- House worth ₹70,00,000

- Savings of ₹20,00,000

- Investments in mutual funds worth ₹15,00,000

- Car worth ₹5,00,000

Liabilities: Home loan balance of ₹10,00,000

Ravi’s Objectives for His Will:

- Distribution of Assets:

- Ensure that his wife and children are well taken care of.

- Allocate specific assets to his family members.

- Make a charitable bequest.

- Appointing Guardians:

- Designate legal guardians for his minor children to ensure their upbringing in his absence.

- Executor Appointment:

- Choose a trusted person to manage and distribute his estate according to his wishes.

Steps Ravi Takes to Create His Will:

- List of Assets and Debts:

- Ravi makes a comprehensive list of all his assets and liabilities.

- Choose Beneficiaries:

- Ravi decides to leave his house and investments to his wife.

- He allocates his savings and car to be divided equally between his children.

- He includes a charitable bequest of ₹2,00,000 to a local NGO.

- Appoint an Executor:

- Ravi appoints his close friend, Raj, as the executor of his will to manage and distribute his estate.

- Appoint Guardians for Minor Children:

- Ravi designates his brother and sister-in-law as legal guardians for his children.

- Specify Funeral and Burial Wishes:

- Ravi includes specific instructions for his funeral arrangements, requesting a simple ceremony.

- Draft the Will:

- Ravi consults an attorney to draft a clear and legally valid will, ensuring all his wishes are documented accurately.

- Sign the Will:

- Ravi signs the will in the presence of two witnesses to make it legally binding.

- Store the Will Safely:

- Ravi keeps the original will in a safe place and informs his wife and the executor of its location.

Example of Ravi’s Will Summary:

Ravi Sharma’s Will

I, Ravi Sharma, residing at [Address], hereby declare this to be my last will and testament.

Distribution of Assets:

- I leave my house located at [Address] to my wife, Meera Sharma.

- I leave my mutual fund investments worth ₹15,00,000 to my wife, Meera Sharma.

- I leave my savings of ₹20,00,000 to be divided equally between my children, Aarav Sharma and Ananya Sharma.

- I leave my car worth ₹5,00,000 to be divided equally between my children, Aarav Sharma and Ananya Sharma.

- I make a charitable bequest of ₹2,00,000 to [NGO Name].

Appointing Guardians:

- I appoint my brother, Rakesh Sharma, and his wife, Priya Sharma, as legal guardians for my minor children, Aarav Sharma and Ananya Sharma.

Executor Appointment:

- I appoint Raj Kapoor as the executor of my will to manage and distribute my estate according to my wishes.

Funeral and Burial Wishes:

- I request a simple funeral ceremony.

Signed this [Date] Day of [Month], [Year].

[Signature of Ravi Sharma]

Witnesses:

- [Witness 1 Name and Signature]

- [Witness 2 Name and Signature]

By creating this will, Ravi ensures that his assets are distributed according to his wishes, his children are cared for, and legal complications are minimized.