- Study

- Slides

- Videos

1.1 Introduction to mastering money management

Mastering money management is an essential life skill that can significantly impact your financial well-being and overall quality of life. Effective money management involves budgeting, saving, investing, and controlling spending habits to achieve financial goals. By developing a sound financial plan, you can avoid debt, build wealth, and ensure financial stability. Understanding the principles of money management also empowers you to make informed decisions, reduce financial stress, and secure a prosperous future. Whether you’re just starting your financial journey or looking to improve your existing strategies, mastering money management is the key to achieving financial success. In this course we would be focussing on following

Key Concepts

- Budgeting: Creating a plan for your income and expenses.

- Saving: Setting aside money for future needs or emergencies.

- Investing: Using money to generate returns over time.

- Debt Management: Handling any borrowed money wisely.

- Financial Goals: Setting short-term and long-term objectives

We wanted to explain this course with examples. So we have taken one Hero named Ravi who would help us understand our concepts in much simpler way.

-

Budgeting

Budgeting is the cornerstone of effective money management. A budget is a financial plan that outlines your income and expenses over a specific period. It helps you track your spending, identify areas where you can cut costs, and ensure that you are living within your means. Here are some key steps to creating and maintaining a budget:

- Know Your Income: Start by calculating your what is your total monthly income. This includes your salary, bonus, your freelance earnings, and any other sources of income.

- List Your Expenses: Categorize your expenses into fixed (rent, mortgage, utilities) and variable (groceries, entertainment, dining out). Don’t forget to include irregular expenses such as car maintenance or medical bills.

- Set Financial Goals: Establish short-term and long-term financial goals. While long-term objectives can include purchasing a home or having a comfortable retirement, short-term objectives might include saving for a trip.

- Allocate Funds: Assign a portion of your income to each expense category and your financial goals. Make sure to prioritize essentials like housing, food, and transportation.

- Track and Adjust: Regularly monitor your spending to ensure you’re sticking to your budget. Long-term objectives can include purchasing a home or having a contented retirement, while short-term objectives might be saving for a trip.

-

Saving: Building a Financial Cushion

Saving money is crucial for financial security. It provides a safety net for unexpected expenses and helps you achieve your financial goals. Here are some strategies to boost your savings:

- Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an emergency fund. This fund will cover unexpected costs like medical emergencies or job loss.

- Automate Savings: Set up automatic transfers from your checking account to your savings account. This way, you ensure that a portion of your income is saved before you have a chance to spend it.

- Cut Unnecessary Expenses: Identify non-essential expenses that you can reduce or eliminate. For example, consider cooking at home more often instead of dining out or cancelling subscriptions you rarely use.

- Take Advantage of Savings Accounts: Choose savings accounts with high-interest rates to maximize your earnings. Consider opening a high-yield savings account or a certificate of deposit (CD) for better returns.

-

Investing: Growing Your Wealth

Investing is a powerful way to grow your wealth over time. While it involves some risk, it can yield higher returns compared to traditional savings accounts. Here are some key principles of investing:

- Understand the Basics: Learn about different types of investments, such as stocks, bonds, mutual funds, and real estate. Each investment type has its own risk and return profile.

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk. Diversification helps protect your portfolio from significant losses in any one investment.

- Invest for the Long Term: Investing with a long-term perspective allows you to ride out market fluctuations and benefit from compound interest. Avoid making impulsive decisions based on short-term market movements.

- Seek Professional Advice: Consider consulting a financial advisor to create an investment strategy tailored to your goals and risk tolerance. A professional can help you navigate complex investment options and make informed decisions.

-

Controlling Spending Habits: Avoiding Debt and Overspending

Controlling your spending habits is essential to maintaining financial health. It’s easy to fall into the trap of overspending, especially with the convenience of credit cards and online shopping. Here are some tips to keep your spending in check:

- Track Your Spending: Use a spending tracker or budgeting app to monitor your daily expenses. This helps you identify patterns and areas where you can cut back.

- Avoid Impulse Purchases: Before making a purchase, ask yourself if it’s a necessity or a want. Consider waiting 24 hours before buying non-essential items to avoid impulse buying.

- Use Credit Wisely: If you use credit cards, pay off the balance in full each month to avoid interest charges. Limit the number of credit cards you have to reduce the temptation to overspend.

- Set Spending Limits: Establish spending limits for discretionary categories like entertainment and dining out. Stick to these limits to prevent overspending.

-

Achieving Financial Goals: Planning for the Future

Setting and achieving financial goals is a critical component of money management. Whether you’re saving for a major purchase, planning for retirement, or funding your child’s education, having a clear plan can help you stay focused and motivated. Here are some steps to achieve your financial goals:

- Set SMART Goals: Ensure your financial goals are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, instead of saying, “I want to save money,” set a goal like, “I want to save ₹10,000 for a down payment on a house in three years.”

- Create a Financial Plan: Develop a detailed plan outlining how you will achieve your goals. This plan should include specific actions, timelines, and milestones to track your progress.

- Review and Adjust: Regularly review your financial goals and progress. Adjust your plan as needed to account for changes in your financial situation or priorities.

- Celebrate Milestones: Celebrate your achievements along the way. Recognizing your progress can keep you motivated and committed to your financial goals.

Example of how Mastering Money Management works

Ravi’s Financial Adventure

Once upon a time in the vibrant town Surat lived a young man named Ravi. Ravi had just landed his dream job and was excited about his monthly salary of ₹50,000. However, managing his finances seemed like a daunting task. One evening, Ravi sat down with his wise grandfather, who shared a tale about mastering money management.

The Tale of the Golden Coins

In a small village, there lived a farmer named Arjun. Each month, Arjun received a bag of 50 golden coins for his crops. To ensure he managed his money well, Arjun followed these steps:

- Budgeting: Arjun created a plan for his income and expenses. He allocated:

- Rent for his cottage: 15 coins

- Utilities and bills for water and firewood: 5 coins

- Groceries for his family: 8 coins

- Saving: Arjun set aside 13 coins for future needs:

- Emergency fund: 5 coins

- Retirement fund: 5 coins

- Stock investments: 3 coins

- Debt Management: Arjun had borrowed money to buy a new Plow, so he repaid 4 coins each month.

- Variable Expenses: Arjun allowed himself some leisure:

- Entertainment: 3 coins (like attending village fairs)

- Dining out: 2 coins (enjoying treats with his family)

- Financial Goals: Arjun dreamt of expanding his farm and set goals to save for it.

A Month in Arjun’s Life

Each month, Arjun followed his budget. He recorded every expense to understand where his money went. By tracking his spending, he realized he spent a bit too much on treats and adjusted his budget. With his savings, Arjun soon built a strong emergency fund and started investing in stocks, securing a better future.

Ravi’s Epiphany

Inspired by the story, Ravi decided to apply the same principles:

- Track Spending: He noted every rupee spent.

- Create a Budget: Allocated ₹50,000 into specific categories.

- Review and Adjust: Regularly checked his budget and made changes.

- Set Goals: Defined clear financial goals, like buying a car and saving for travel.

Ravi found that managing his money wasn’t so daunting after all. With careful planning and discipline, he achieved his financial aspirations and lived happily ever after.

1.2 What is the need of Mastering Money Management?

Mastering money management is crucial for a variety of reasons, each contributing to a stable, prosperous, and stress-free financial life.

Financial Stability

Financial stability is the cornerstone of a secure and comfortable life. By managing your money effectively, you can ensure that you have enough funds to cover your essential needs, such as housing, food, and healthcare. This stability allows you to live without the constant worry of running out of money or facing financial crises.

Example: Ravi meticulously tracks his monthly income and expenses. He ensures he always has enough funds to cover his essential needs, such as rent, utilities, and groceries, providing him with a stable financial foundation.

Debt Avoidance

Unmanaged finances can lead to accumulating debt, which can quickly spiral out of control. By mastering money management, you can create a budget that helps you live within your means, avoid unnecessary debt, and pay off existing debts more efficiently. This reduces the burden of high-interest payments and the stress associated with debt.

Example Ravi uses a budget to control his spending and pay off his credit card debt. By avoiding unnecessary purchases and focusing on debt repayment, he significantly reduces his financial burden and avoids high-interest charges.

Wealth Building

Effective money management is essential for building wealth over time. By saving and investing wisely, you can grow your financial resources and secure a comfortable future. Investments, such as stocks, bonds, mutual funds, and real estate, can provide higher returns compared to traditional savings accounts, helping you achieve long-term financial goals like buying a home or retiring comfortably.

Example: Ravi regularly contributes to his investment portfolio, which includes stocks, bonds, and mutual funds. Over the years, his investments grow, allowing him to accumulate wealth and plan for a comfortable retirement.

Financial Goal Achievement

Setting and achieving financial goals is a vital part of financial planning. Whether you want to save for a major purchase, plan for retirement, or fund your child’s education, mastering money management helps you create a detailed plan to reach these goals. By allocating funds strategically and staying disciplined, you can make steady progress toward your objectives.

Example: Ravi sets a goal to save Rs 20,000 for a down payment on a house within five years. He creates a savings plan, cutting down on non-essential expenses and increasing his monthly savings to achieve his goal on time

Stress Reduction

Financial stress is a common issue that can affect your mental and physical well-being. Managing your money effectively reduces financial uncertainty and the anxiety associated with it. Knowing that you have a plan in place and are making progress toward your financial goals can provide peace of mind and improve your overall quality of life.

Example: Ravi has an emergency fund that covers six months of living expenses. Knowing he has a financial safety net, he feels less stressed and anxious about potential unexpected expenses or job loss.

Informed Decision-Making

Understanding the principles of money management empowers you to make informed financial decisions. This knowledge allows you to evaluate investment opportunities, choose the right financial products, and avoid common financial pitfalls. Informed decision-making maximizes your financial resources and helps you take advantage of opportunities to grow your wealth.

Example: Ravi takes the time to learn about different investment options and consults with a financial advisor. This knowledge empowers him to make informed decisions about his retirement savings and investment strategy.

Emergency Preparedness

Life is full of unexpected events, such as medical emergencies, job loss, or major repairs. Mastering money management ensures that you have an emergency fund in place to cover these unforeseen expenses. An emergency fund provides a financial cushion, allowing you to handle unexpected situations without resorting to high-interest debt or compromising your long-term financial goals.

Example: Ravi saves a portion of his income in an easily accessible emergency fund. When his car unexpectedly breaks down, he uses the emergency fund to cover the repair costs without disrupting his monthly budget.

Improved Spending Habits

Effective money management helps you develop healthy spending habits. By tracking your expenses and creating a budget, you become more conscious of your spending patterns and can identify areas where you can cut costs. This awareness helps you avoid impulsive purchases and allocate your funds to more meaningful and essential expenses.

Example: Ravi tracks his daily expenses using a budgeting app. He realizes he spends a significant amount on dining out and decides to cook more meals at home, resulting in substantial savings over time.

Financial Independence

Mastering money management is key to achieving financial independence. By managing your money wisely, you can build a financial foundation that allows you to live comfortably without relying on others for financial support. Financial independence provides freedom and flexibility to make choices that align with your values and goals.

Example: Ravi consistently saves and invests a portion of his income. Over the years, his disciplined approach allows him to achieve financial independence, giving him the freedom to retire early and travel the world.

Legacy Planning

Effective money management also involves planning for the future and ensuring that your wealth is preserved for future generations. By creating a comprehensive financial plan, you can provide for your loved ones, support charitable causes, and leave a lasting legacy. Estate planning, trusts, and wills are important components of legacy planning that ensure your assets are distributed according to your wishes.

Example: Ravi creates a comprehensive estate plan, including a will and trusts, to ensure his assets are distributed according to his wishes. His planning provides financial security for his children and supports charitable causes he cares about.

1.3. Importance of Mastering Money Management

Mastering money management is essential for achieving financial stability and ensuring a comfortable future. By effectively managing your finances, you can create a budget that helps you live within your means, save for emergencies, and plan for long-term goals. For instance, Ravi, who earns ₹50,000 a month, diligently tracks his income and expenses, ensuring he allocates funds for essentials like rent, groceries, and utilities. This disciplined approach helps Ravi maintain financial stability and avoid the pitfalls of overspending.

One of the key benefits of mastering money management is the ability to build wealth over time. Ravi sets aside ₹10,000 each month for investments in stocks, mutual funds, and other financial instruments. By consistently investing a portion of his income, Ravi can take advantage of compound interest and grow his wealth. This approach not only helps him achieve his long-term financial goals but also provides a sense of security and confidence in his financial future.

In addition to building wealth, effective money management helps reduce financial stress. Knowing that he has an emergency fund covering six months’ worth of living expenses, Ravi feels more at ease, knowing he is prepared for unexpected expenses like medical emergencies or car repairs. This financial cushion allows Ravi to handle unforeseen situations without resorting to high-interest debt or compromising his long-term financial goals.

Mastering money management also empowers individuals to make informed decisions about their finances. Ravi takes the time to learn about different investment options and consults with a financial advisor to develop a well-rounded investment strategy. This knowledge enables Ravi to make sound financial decisions, maximizing his returns and minimizing risks. By staying informed and proactive, Ravi can navigate the complexities of the financial world with confidence.

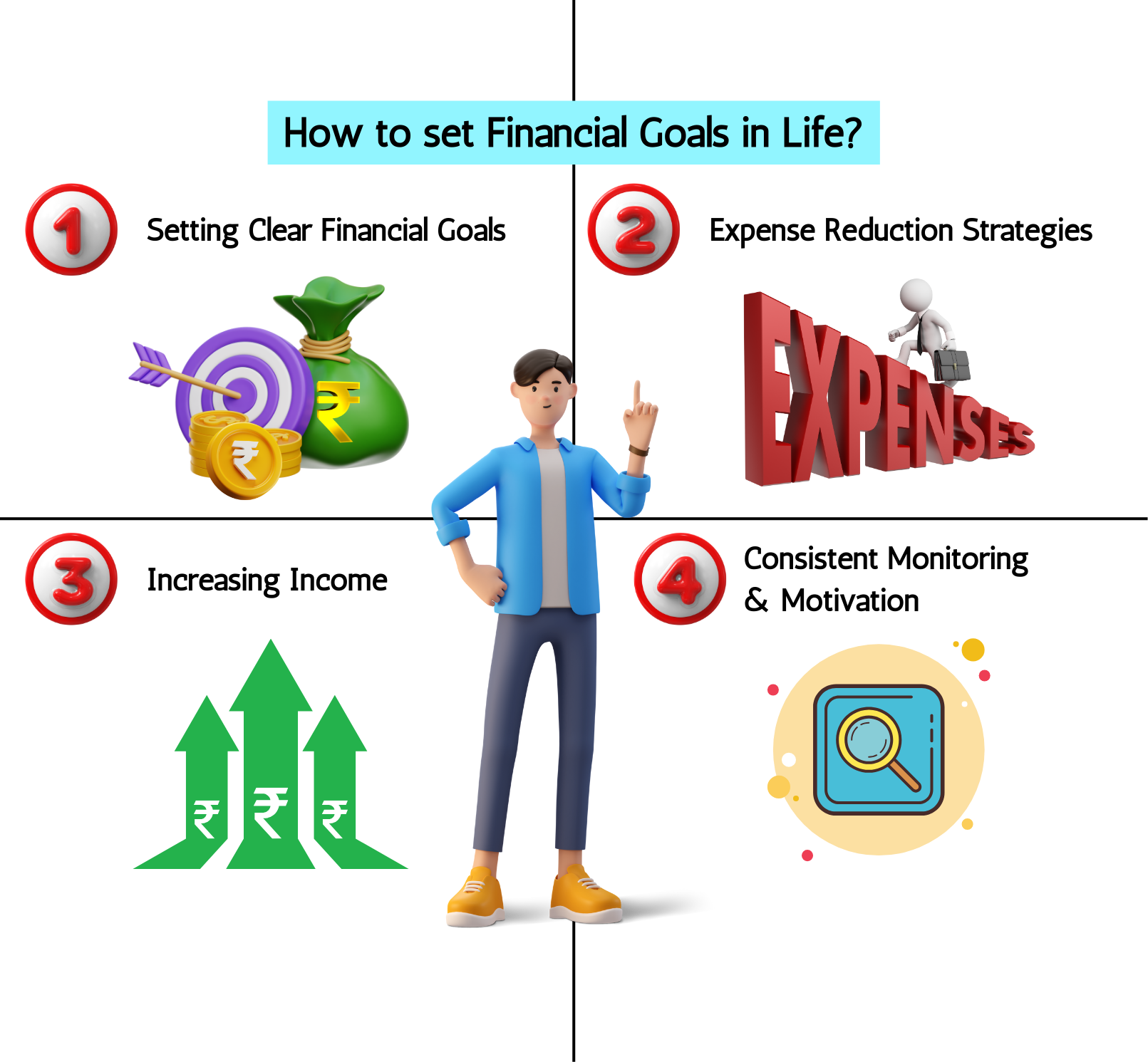

1.4. How to set Financial Goals in Life

Steps to Set Financial Goals

Goal: Save ₹5,00,000 for a down payment on a house in three years.

-

Assess Your Current Financial Situation:

Begin by evaluating your current financial status. Take stock of your income, expenses, debts, assets, and savings. This will give you a clear picture of where you stand financially and help you identify areas for improvement.

-

Define Your Goals:

Be specific about what you want to achieve. Financial goals can be short-term (e.g., saving for a vacation), medium-term (e.g., paying off a car loan), or long-term (e.g., saving for retirement). Ensure that your goals are clear and well-defined.

-

Make Your Goals SMART:

Use the SMART criteria to set your financial goals:

- Specific: Clearly define what you want to achieve.

- Measurable: Ensure that your goal can be quantified or measured.

- Achievable: Set realistic goals that you can attain with effort.

- Relevant: Make sure your goal aligns with your overall financial objectives.

- Time-bound: Set a specific timeframe for achieving your goal.

- Break Down Your Goals: Divide larger goals into smaller, manageable steps. This makes them less overwhelming and easier to track. For example, if you want to save ₹1,00,000 in a year, break it down into monthly or weekly savings targets.

- Create a Plan of Action: Develop a detailed plan outlining how you will achieve your financial goals. This should include specific actions, timelines, and milestones. For instance, if your goal is to save for a down payment on a house, outline the steps you will take to cut expenses and increase your savings.

- Track Your Progress: Regularly monitor your progress toward your financial goals. Use tools such as budgeting apps, spreadsheets, or financial software to keep track of your income, expenses, and savings. Adjust your plan as needed to stay on track.

- Stay Motivated: Keep yourself motivated by celebrating milestones and small achievements. This can help you stay focused and committed to your long-term financial goals. Share your goals with a trusted friend or family member who can provide support and encouragement.

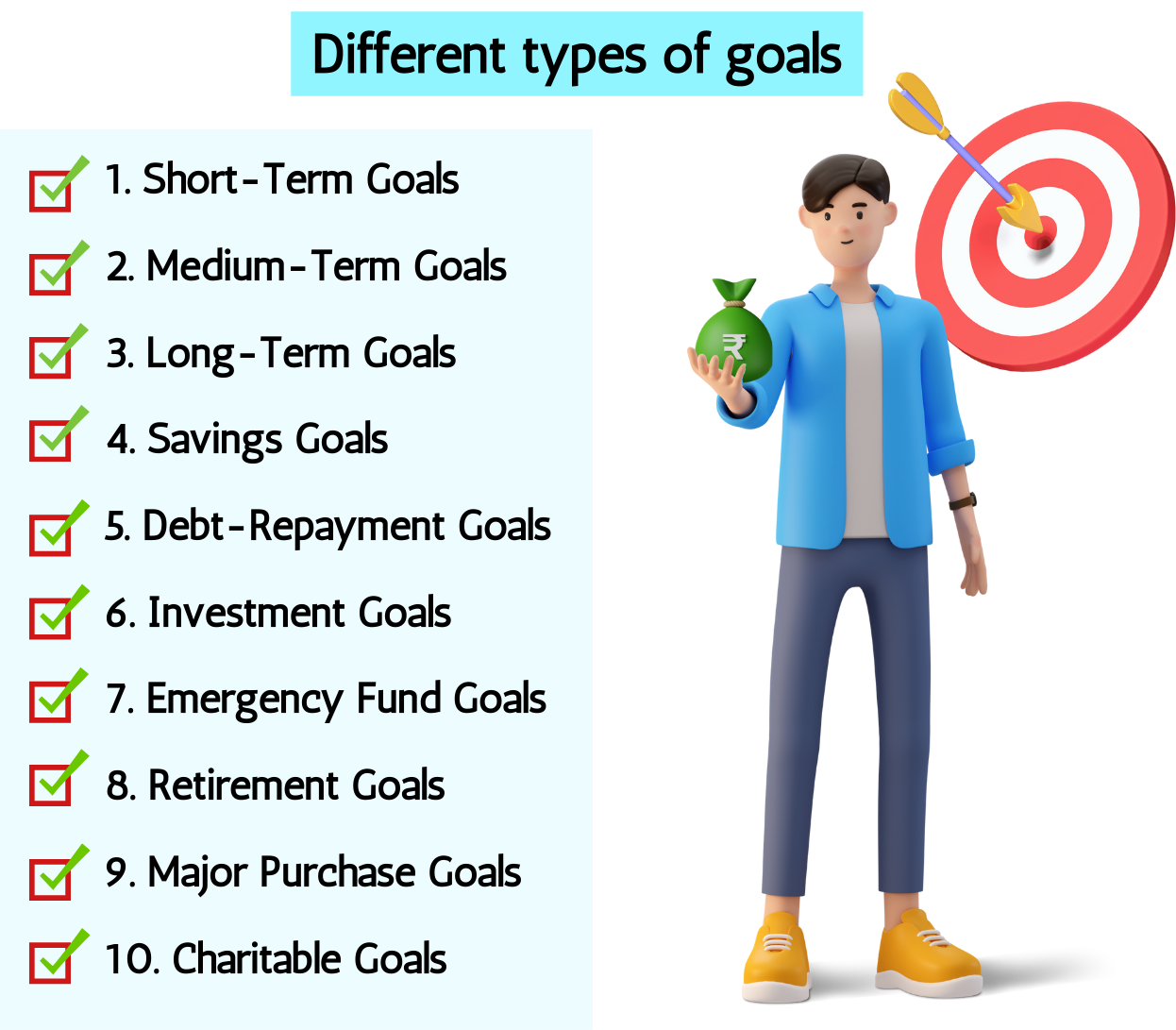

1.5. Different types of goals

Example: Ravi celebrates small milestones, such as reaching ₹1,00,000 in savings, by treating himself to a modest reward. He also shares his progress with a close friend who provides support and encouragement.

-

Short-Term Goals :

Goals that you aim to achieve within a year or less. Ravi wants to save ₹50,000 for a vacation to Gujarat within the next six months. To achieve this, he plans to save ₹8,334 each month by cutting down on discretionary expenses like dining out and entertainment. -

Medium-Term Goals

Goal’s that you plan to achieve within one to five years. Ravi is planning to buy a new car worth ₹6,00,000 in the next three years. He decides to save ₹16,667 monthly and invest in a recurring deposit to reach his target amount. -

Long-Term Goals :

Goals that take more than five years to achieve. Ravi wants to build a retirement corpus of ₹1 crore (₹10 million) over the next 25 years. He decides to invest ₹15,000 monthly in a diversified portfolio of mutual funds to achieve this long-term goal. -

Savings Goals :

Goals focused on accumulating a specific amount of savings for future needs. Ravi aims to save ₹2,00,000 for his daughter’s education in the next five years. He sets up an education savings account and contributes ₹3,333 monthly to reach this goal. -

Debt-Repayment Goals :

Goals centred on paying off existing debts. Ravi has a personal loan of ₹1,20,000 with an interest rate of 12% per annum. He decides to pay an extra ₹5,000 each month, in addition to his regular EMI, to repay the loan faster and save on interest costs. -

Investment Goals :

Goals focused on growing wealth through various investment avenues. Ravi plans to invest ₹1,00,000 in the stock market over the next year. He researches and selects a mix of blue-chip stocks and equity mutual funds to achieve this investment goal. -

Emergency Fund Goals :

Goals aimed at building a financial cushion to cover unexpected expenses. Ravi sets a goal to save ₹1,50,000 in an emergency fund over the next year. He allocates ₹12,500 monthly to a high-interest savings account to build this financial cushion. -

Retirement Goals :

Goals focused on saving and planning for a comfortable retirement. Ravi wants to retire at the age of 60 with a retirement corpus that provides a monthly income of ₹50,000. He calculates that he needs ₹1 crore (₹10 million) and starts investing ₹20,000 monthly in retirement-focused mutual funds and pension schemes. -

Major Purchase Goals :

Goals aimed at saving for significant purchases. Ravi plans to buy a new home worth ₹50 lakhs (₹5 million) in the next ten years. He starts saving ₹25,000 monthly and invests in real estate-focused mutual funds to accumulate the down payment and other related expenses. -

Charitable Goals :

Goals focused on donating to charitable causes or supporting community initiatives. Ravi wants to donate ₹1,00,000 to a local charity over the next two years. He sets aside ₹4,167 monthly from his income to support this charitable cause.

By setting specific, measurable, and time-bound financial goals, Ravi can effectively manage his finances and work towards achieving his dreams and aspirations. Each type of goal requires careful planning, discipline, and regular monitoring to ensure success.

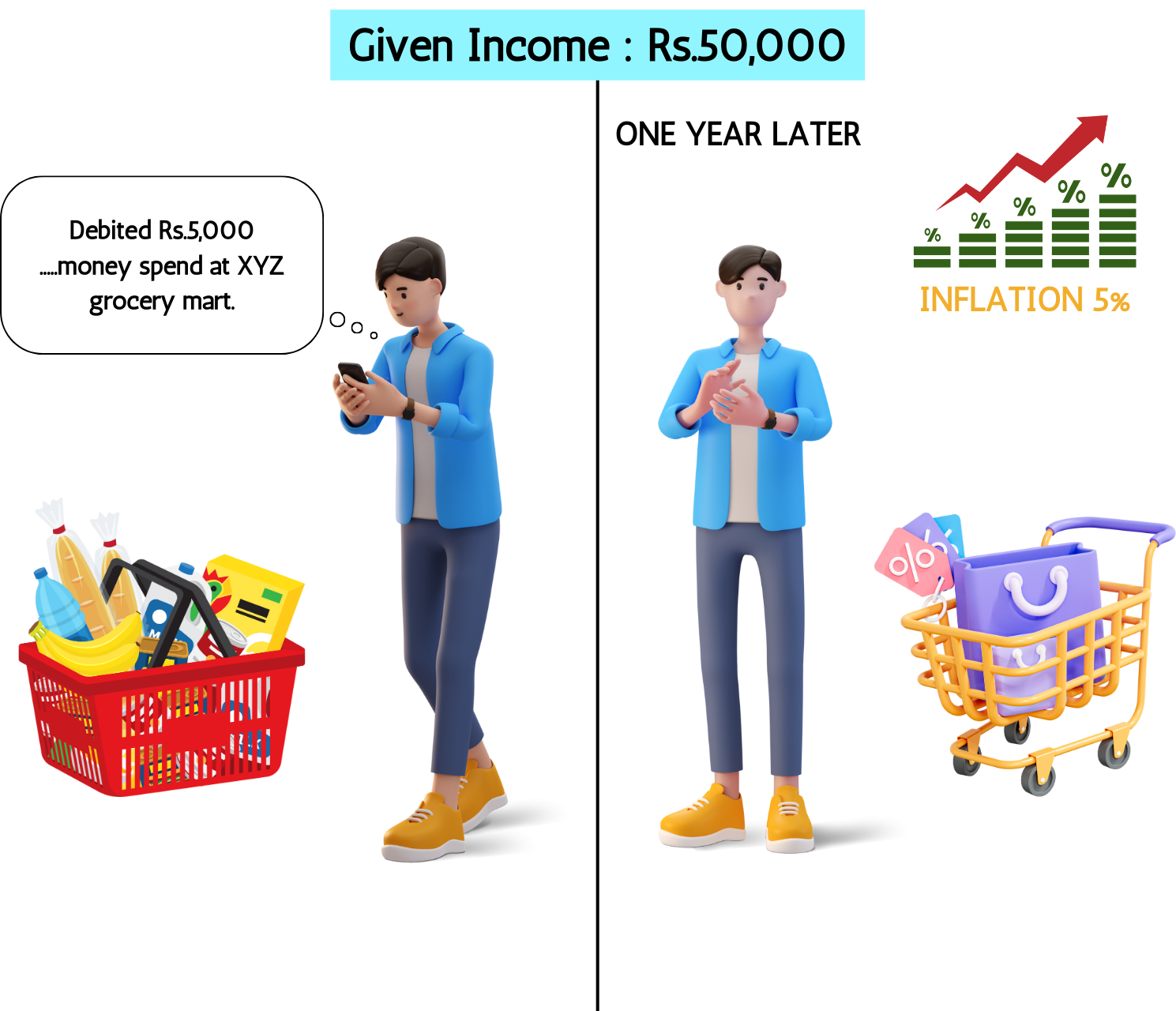

1.6.What is inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. In simpler terms, inflation means that over time, you will need more money to buy the same amount of goods and services that you could purchase with less money in the past.

Key Aspects of Inflation:

- Measurement: Inflation is typically measured using price indices such as the Consumer Price Index (CPI) or the Wholesale Price Index (WPI). These indices track the prices of a basket of goods and services over time.

- Causes: Inflation can be caused by several factors, including:

- Demand-Pull Inflation: When demand for goods and services exceeds supply, leading to higher prices.

- Cost-Push Inflation: When the cost of production increases (e.g., due to higher wages or raw material costs), producers pass on the higher costs to consumers.

- Monetary Policy: An increase in the money supply by a central bank can lead to inflation if it outpaces economic growth.

- Effects: Inflation affects various aspects of the economy and personal finance:

- Purchasing Power: As prices rise, the value of money decreases, reducing the purchasing power of consumers.

- Interest Rates: Central banks may adjust interest rates to control inflation, which can impact borrowing and savings rates.

- Income and Wages: Inflation can erode the real value of income and wages if they do not keep pace with rising prices.

- Savings and Investments: Inflation can reduce the real value of savings and fixed-income investments if returns do not outpace inflation.

Example:

Let’s consider Ravi, who earns ₹50,000 per month. A year ago, he could buy a basket of groceries for ₹5,000. Due to an annual inflation rate of 5%, the same basket of groceries now costs ₹5,250. This means Ravi’s ₹50,000 income now has slightly less purchasing power than it did a year ago, as he needs to spend more to buy the same goods and services.

1.7. How does inflation affect your investments?

Inflation can have a significant impact on your investments, influencing both their value and the returns they generate. Here are some keyways inflation affects investments, along with examples for better understanding:

- Erosion of Purchasing Power

Inflation reduces the real purchasing power of your investment returns. For example, if you have a fixed-income investment like a bond that pays an annual interest rate of 5%, but the inflation rate is 6%, your real return is actually negative (-1%). This means that even though you are earning interest, the value of your money is decreasing in terms of what it can buy.

- Impact on Fixed-Income Investments

Fixed-income investments, such as bonds, are particularly vulnerable to inflation. When inflation rises, the fixed interest payments from these investments may not keep pace with the increasing cost of living. For instance, if Ravi holds a 10-year government bond with a 4% annual interest rate and inflation rises to 5%, the bond’s real return becomes negative, reducing its attractiveness.

- Stock Market Performance

Inflation can have mixed effects on the stock market. On one hand, companies may pass on higher costs to consumers, potentially leading to higher revenues and profits. On the other hand, rising inflation can lead to higher interest rates, increasing borrowing costs for companies and reducing consumer spending. For example, if Ravi invests in stocks of a company that successfully raises prices to counter inflation, his investment may perform well. However, if higher interest rates lead to reduced consumer demand, the stock’s value may decline.

- Real Estate Investments

Real estate can be a good hedge against inflation, as property values and rental income tend to rise with inflation. For example, if Ravi owns a rental property, he may be able to increase rent in line with inflation, preserving his purchasing power and maintaining the value of his investment.

- Commodities and Inflation-Protected Securities

Certain investments, such as commodities (gold, oil) and inflation-protected securities (like Treasury Inflation-Protected Securities or TIPS), are designed to perform well during periods of inflation. For example, if Ravi invests in gold, the value of his investment may rise as inflation increases, since gold is often seen as a safe haven during inflationary periods.

Example:

Let’s say Ravi has ₹10,00,000 invested in a mix of stocks, bonds, and a rental property. Over the next year, inflation rises to 6%. The value of his fixed-income investments decreases in real terms, while his stocks may perform variably depending on the companies’ ability to pass on costs to consumers. However, the value of his rental property and the rental income may increase, helping to offset the negative impact of inflation on his overall portfolio.

1.1 Introduction to mastering money management

Mastering money management is an essential life skill that can significantly impact your financial well-being and overall quality of life. Effective money management involves budgeting, saving, investing, and controlling spending habits to achieve financial goals. By developing a sound financial plan, you can avoid debt, build wealth, and ensure financial stability. Understanding the principles of money management also empowers you to make informed decisions, reduce financial stress, and secure a prosperous future. Whether you’re just starting your financial journey or looking to improve your existing strategies, mastering money management is the key to achieving financial success. In this course we would be focussing on following

Key Concepts

- Budgeting: Creating a plan for your income and expenses.

- Saving: Setting aside money for future needs or emergencies.

- Investing: Using money to generate returns over time.

- Debt Management: Handling any borrowed money wisely.

- Financial Goals: Setting short-term and long-term objectives

We wanted to explain this course with examples. So we have taken one Hero named Ravi who would help us understand our concepts in much simpler way.

-

Budgeting

Budgeting is the cornerstone of effective money management. A budget is a financial plan that outlines your income and expenses over a specific period. It helps you track your spending, identify areas where you can cut costs, and ensure that you are living within your means. Here are some key steps to creating and maintaining a budget:

- Know Your Income: Start by calculating your what is your total monthly income. This includes your salary, bonus, your freelance earnings, and any other sources of income.

- List Your Expenses: Categorize your expenses into fixed (rent, mortgage, utilities) and variable (groceries, entertainment, dining out). Don’t forget to include irregular expenses such as car maintenance or medical bills.

- Set Financial Goals: Establish short-term and long-term financial goals. While long-term objectives can include purchasing a home or having a comfortable retirement, short-term objectives might include saving for a trip.

- Allocate Funds: Assign a portion of your income to each expense category and your financial goals. Make sure to prioritize essentials like housing, food, and transportation.

- Track and Adjust: Regularly monitor your spending to ensure you’re sticking to your budget. Long-term objectives can include purchasing a home or having a contented retirement, while short-term objectives might be saving for a trip.

-

Saving: Building a Financial Cushion

Saving money is crucial for financial security. It provides a safety net for unexpected expenses and helps you achieve your financial goals. Here are some strategies to boost your savings:

- Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an emergency fund. This fund will cover unexpected costs like medical emergencies or job loss.

- Automate Savings: Set up automatic transfers from your checking account to your savings account. This way, you ensure that a portion of your income is saved before you have a chance to spend it.

- Cut Unnecessary Expenses: Identify non-essential expenses that you can reduce or eliminate. For example, consider cooking at home more often instead of dining out or cancelling subscriptions you rarely use.

- Take Advantage of Savings Accounts: Choose savings accounts with high-interest rates to maximize your earnings. Consider opening a high-yield savings account or a certificate of deposit (CD) for better returns.

-

Investing: Growing Your Wealth

Investing is a powerful way to grow your wealth over time. While it involves some risk, it can yield higher returns compared to traditional savings accounts. Here are some key principles of investing:

- Understand the Basics: Learn about different types of investments, such as stocks, bonds, mutual funds, and real estate. Each investment type has its own risk and return profile.

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk. Diversification helps protect your portfolio from significant losses in any one investment.

- Invest for the Long Term: Investing with a long-term perspective allows you to ride out market fluctuations and benefit from compound interest. Avoid making impulsive decisions based on short-term market movements.

- Seek Professional Advice: Consider consulting a financial advisor to create an investment strategy tailored to your goals and risk tolerance. A professional can help you navigate complex investment options and make informed decisions.

-

Controlling Spending Habits: Avoiding Debt and Overspending

Controlling your spending habits is essential to maintaining financial health. It’s easy to fall into the trap of overspending, especially with the convenience of credit cards and online shopping. Here are some tips to keep your spending in check:

- Track Your Spending: Use a spending tracker or budgeting app to monitor your daily expenses. This helps you identify patterns and areas where you can cut back.

- Avoid Impulse Purchases: Before making a purchase, ask yourself if it’s a necessity or a want. Consider waiting 24 hours before buying non-essential items to avoid impulse buying.

- Use Credit Wisely: If you use credit cards, pay off the balance in full each month to avoid interest charges. Limit the number of credit cards you have to reduce the temptation to overspend.

- Set Spending Limits: Establish spending limits for discretionary categories like entertainment and dining out. Stick to these limits to prevent overspending.

-

Achieving Financial Goals: Planning for the Future

Setting and achieving financial goals is a critical component of money management. Whether you’re saving for a major purchase, planning for retirement, or funding your child’s education, having a clear plan can help you stay focused and motivated. Here are some steps to achieve your financial goals:

- Set SMART Goals: Ensure your financial goals are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, instead of saying, “I want to save money,” set a goal like, “I want to save ₹10,000 for a down payment on a house in three years.”

- Create a Financial Plan: Develop a detailed plan outlining how you will achieve your goals. This plan should include specific actions, timelines, and milestones to track your progress.

- Review and Adjust: Regularly review your financial goals and progress. Adjust your plan as needed to account for changes in your financial situation or priorities.

- Celebrate Milestones: Celebrate your achievements along the way. Recognizing your progress can keep you motivated and committed to your financial goals.

Example of how Mastering Money Management works

Ravi’s Financial Adventure

Once upon a time in the vibrant town Surat lived a young man named Ravi. Ravi had just landed his dream job and was excited about his monthly salary of ₹50,000. However, managing his finances seemed like a daunting task. One evening, Ravi sat down with his wise grandfather, who shared a tale about mastering money management.

The Tale of the Golden Coins

In a small village, there lived a farmer named Arjun. Each month, Arjun received a bag of 50 golden coins for his crops. To ensure he managed his money well, Arjun followed these steps:

- Budgeting: Arjun created a plan for his income and expenses. He allocated:

- Rent for his cottage: 15 coins

- Utilities and bills for water and firewood: 5 coins

- Groceries for his family: 8 coins

- Saving: Arjun set aside 13 coins for future needs:

- Emergency fund: 5 coins

- Retirement fund: 5 coins

- Stock investments: 3 coins

- Debt Management: Arjun had borrowed money to buy a new Plow, so he repaid 4 coins each month.

- Variable Expenses: Arjun allowed himself some leisure:

- Entertainment: 3 coins (like attending village fairs)

- Dining out: 2 coins (enjoying treats with his family)

- Financial Goals: Arjun dreamt of expanding his farm and set goals to save for it.

A Month in Arjun’s Life

Each month, Arjun followed his budget. He recorded every expense to understand where his money went. By tracking his spending, he realized he spent a bit too much on treats and adjusted his budget. With his savings, Arjun soon built a strong emergency fund and started investing in stocks, securing a better future.

Ravi’s Epiphany

Inspired by the story, Ravi decided to apply the same principles:

- Track Spending: He noted every rupee spent.

- Create a Budget: Allocated ₹50,000 into specific categories.

- Review and Adjust: Regularly checked his budget and made changes.

- Set Goals: Defined clear financial goals, like buying a car and saving for travel.

Ravi found that managing his money wasn’t so daunting after all. With careful planning and discipline, he achieved his financial aspirations and lived happily ever after.

1.2 What is the need of Mastering Money Management?

Mastering money management is crucial for a variety of reasons, each contributing to a stable, prosperous, and stress-free financial life.

Financial Stability

Financial stability is the cornerstone of a secure and comfortable life. By managing your money effectively, you can ensure that you have enough funds to cover your essential needs, such as housing, food, and healthcare. This stability allows you to live without the constant worry of running out of money or facing financial crises.

Example: Ravi meticulously tracks his monthly income and expenses. He ensures he always has enough funds to cover his essential needs, such as rent, utilities, and groceries, providing him with a stable financial foundation.

Debt Avoidance

Unmanaged finances can lead to accumulating debt, which can quickly spiral out of control. By mastering money management, you can create a budget that helps you live within your means, avoid unnecessary debt, and pay off existing debts more efficiently. This reduces the burden of high-interest payments and the stress associated with debt.

Example Ravi uses a budget to control his spending and pay off his credit card debt. By avoiding unnecessary purchases and focusing on debt repayment, he significantly reduces his financial burden and avoids high-interest charges.

Wealth Building

Effective money management is essential for building wealth over time. By saving and investing wisely, you can grow your financial resources and secure a comfortable future. Investments, such as stocks, bonds, mutual funds, and real estate, can provide higher returns compared to traditional savings accounts, helping you achieve long-term financial goals like buying a home or retiring comfortably.

Example: Ravi regularly contributes to his investment portfolio, which includes stocks, bonds, and mutual funds. Over the years, his investments grow, allowing him to accumulate wealth and plan for a comfortable retirement.

Financial Goal Achievement

Setting and achieving financial goals is a vital part of financial planning. Whether you want to save for a major purchase, plan for retirement, or fund your child’s education, mastering money management helps you create a detailed plan to reach these goals. By allocating funds strategically and staying disciplined, you can make steady progress toward your objectives.

Example: Ravi sets a goal to save Rs 20,000 for a down payment on a house within five years. He creates a savings plan, cutting down on non-essential expenses and increasing his monthly savings to achieve his goal on time

Stress Reduction

Financial stress is a common issue that can affect your mental and physical well-being. Managing your money effectively reduces financial uncertainty and the anxiety associated with it. Knowing that you have a plan in place and are making progress toward your financial goals can provide peace of mind and improve your overall quality of life.

Example: Ravi has an emergency fund that covers six months of living expenses. Knowing he has a financial safety net, he feels less stressed and anxious about potential unexpected expenses or job loss.

Informed Decision-Making

Understanding the principles of money management empowers you to make informed financial decisions. This knowledge allows you to evaluate investment opportunities, choose the right financial products, and avoid common financial pitfalls. Informed decision-making maximizes your financial resources and helps you take advantage of opportunities to grow your wealth.

Example: Ravi takes the time to learn about different investment options and consults with a financial advisor. This knowledge empowers him to make informed decisions about his retirement savings and investment strategy.

Emergency Preparedness

Life is full of unexpected events, such as medical emergencies, job loss, or major repairs. Mastering money management ensures that you have an emergency fund in place to cover these unforeseen expenses. An emergency fund provides a financial cushion, allowing you to handle unexpected situations without resorting to high-interest debt or compromising your long-term financial goals.

Example: Ravi saves a portion of his income in an easily accessible emergency fund. When his car unexpectedly breaks down, he uses the emergency fund to cover the repair costs without disrupting his monthly budget.

Improved Spending Habits

Effective money management helps you develop healthy spending habits. By tracking your expenses and creating a budget, you become more conscious of your spending patterns and can identify areas where you can cut costs. This awareness helps you avoid impulsive purchases and allocate your funds to more meaningful and essential expenses.

Example: Ravi tracks his daily expenses using a budgeting app. He realizes he spends a significant amount on dining out and decides to cook more meals at home, resulting in substantial savings over time.

Financial Independence

Mastering money management is key to achieving financial independence. By managing your money wisely, you can build a financial foundation that allows you to live comfortably without relying on others for financial support. Financial independence provides freedom and flexibility to make choices that align with your values and goals.

Example: Ravi consistently saves and invests a portion of his income. Over the years, his disciplined approach allows him to achieve financial independence, giving him the freedom to retire early and travel the world.

Legacy Planning

Effective money management also involves planning for the future and ensuring that your wealth is preserved for future generations. By creating a comprehensive financial plan, you can provide for your loved ones, support charitable causes, and leave a lasting legacy. Estate planning, trusts, and wills are important components of legacy planning that ensure your assets are distributed according to your wishes.

Example: Ravi creates a comprehensive estate plan, including a will and trusts, to ensure his assets are distributed according to his wishes. His planning provides financial security for his children and supports charitable causes he cares about.

1.3. Importance of Mastering Money Management

Mastering money management is essential for achieving financial stability and ensuring a comfortable future. By effectively managing your finances, you can create a budget that helps you live within your means, save for emergencies, and plan for long-term goals. For instance, Ravi, who earns ₹50,000 a month, diligently tracks his income and expenses, ensuring he allocates funds for essentials like rent, groceries, and utilities. This disciplined approach helps Ravi maintain financial stability and avoid the pitfalls of overspending.

One of the key benefits of mastering money management is the ability to build wealth over time. Ravi sets aside ₹10,000 each month for investments in stocks, mutual funds, and other financial instruments. By consistently investing a portion of his income, Ravi can take advantage of compound interest and grow his wealth. This approach not only helps him achieve his long-term financial goals but also provides a sense of security and confidence in his financial future.

In addition to building wealth, effective money management helps reduce financial stress. Knowing that he has an emergency fund covering six months’ worth of living expenses, Ravi feels more at ease, knowing he is prepared for unexpected expenses like medical emergencies or car repairs. This financial cushion allows Ravi to handle unforeseen situations without resorting to high-interest debt or compromising his long-term financial goals.

Mastering money management also empowers individuals to make informed decisions about their finances. Ravi takes the time to learn about different investment options and consults with a financial advisor to develop a well-rounded investment strategy. This knowledge enables Ravi to make sound financial decisions, maximizing his returns and minimizing risks. By staying informed and proactive, Ravi can navigate the complexities of the financial world with confidence.

1.4. How to set Financial Goals in Life

Steps to Set Financial Goals

Goal: Save ₹5,00,000 for a down payment on a house in three years.

-

Assess Your Current Financial Situation:

Begin by evaluating your current financial status. Take stock of your income, expenses, debts, assets, and savings. This will give you a clear picture of where you stand financially and help you identify areas for improvement.

-

Define Your Goals:

Be specific about what you want to achieve. Financial goals can be short-term (e.g., saving for a vacation), medium-term (e.g., paying off a car loan), or long-term (e.g., saving for retirement). Ensure that your goals are clear and well-defined.

-

Make Your Goals SMART:

Use the SMART criteria to set your financial goals:

- Specific: Clearly define what you want to achieve.

- Measurable: Ensure that your goal can be quantified or measured.

- Achievable: Set realistic goals that you can attain with effort.

- Relevant: Make sure your goal aligns with your overall financial objectives.

- Time-bound: Set a specific timeframe for achieving your goal.

- Break Down Your Goals: Divide larger goals into smaller, manageable steps. This makes them less overwhelming and easier to track. For example, if you want to save ₹1,00,000 in a year, break it down into monthly or weekly savings targets.

- Create a Plan of Action: Develop a detailed plan outlining how you will achieve your financial goals. This should include specific actions, timelines, and milestones. For instance, if your goal is to save for a down payment on a house, outline the steps you will take to cut expenses and increase your savings.

- Track Your Progress: Regularly monitor your progress toward your financial goals. Use tools such as budgeting apps, spreadsheets, or financial software to keep track of your income, expenses, and savings. Adjust your plan as needed to stay on track.

- Stay Motivated: Keep yourself motivated by celebrating milestones and small achievements. This can help you stay focused and committed to your long-term financial goals. Share your goals with a trusted friend or family member who can provide support and encouragement.

1.5. Different types of goals

Example: Ravi celebrates small milestones, such as reaching ₹1,00,000 in savings, by treating himself to a modest reward. He also shares his progress with a close friend who provides support and encouragement.

-

Short-Term Goals :

Goals that you aim to achieve within a year or less. Ravi wants to save ₹50,000 for a vacation to Gujarat within the next six months. To achieve this, he plans to save ₹8,334 each month by cutting down on discretionary expenses like dining out and entertainment. -

Medium-Term Goals

Goal’s that you plan to achieve within one to five years. Ravi is planning to buy a new car worth ₹6,00,000 in the next three years. He decides to save ₹16,667 monthly and invest in a recurring deposit to reach his target amount. -

Long-Term Goals :

Goals that take more than five years to achieve. Ravi wants to build a retirement corpus of ₹1 crore (₹10 million) over the next 25 years. He decides to invest ₹15,000 monthly in a diversified portfolio of mutual funds to achieve this long-term goal. -

Savings Goals :

Goals focused on accumulating a specific amount of savings for future needs. Ravi aims to save ₹2,00,000 for his daughter’s education in the next five years. He sets up an education savings account and contributes ₹3,333 monthly to reach this goal. -

Debt-Repayment Goals :

Goals centred on paying off existing debts. Ravi has a personal loan of ₹1,20,000 with an interest rate of 12% per annum. He decides to pay an extra ₹5,000 each month, in addition to his regular EMI, to repay the loan faster and save on interest costs. -

Investment Goals :

Goals focused on growing wealth through various investment avenues. Ravi plans to invest ₹1,00,000 in the stock market over the next year. He researches and selects a mix of blue-chip stocks and equity mutual funds to achieve this investment goal. -

Emergency Fund Goals :

Goals aimed at building a financial cushion to cover unexpected expenses. Ravi sets a goal to save ₹1,50,000 in an emergency fund over the next year. He allocates ₹12,500 monthly to a high-interest savings account to build this financial cushion. -

Retirement Goals :

Goals focused on saving and planning for a comfortable retirement. Ravi wants to retire at the age of 60 with a retirement corpus that provides a monthly income of ₹50,000. He calculates that he needs ₹1 crore (₹10 million) and starts investing ₹20,000 monthly in retirement-focused mutual funds and pension schemes. -

Major Purchase Goals :

Goals aimed at saving for significant purchases. Ravi plans to buy a new home worth ₹50 lakhs (₹5 million) in the next ten years. He starts saving ₹25,000 monthly and invests in real estate-focused mutual funds to accumulate the down payment and other related expenses. -

Charitable Goals :

Goals focused on donating to charitable causes or supporting community initiatives. Ravi wants to donate ₹1,00,000 to a local charity over the next two years. He sets aside ₹4,167 monthly from his income to support this charitable cause.

By setting specific, measurable, and time-bound financial goals, Ravi can effectively manage his finances and work towards achieving his dreams and aspirations. Each type of goal requires careful planning, discipline, and regular monitoring to ensure success.

1.6.What is inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. In simpler terms, inflation means that over time, you will need more money to buy the same amount of goods and services that you could purchase with less money in the past.

Key Aspects of Inflation:

- Measurement: Inflation is typically measured using price indices such as the Consumer Price Index (CPI) or the Wholesale Price Index (WPI). These indices track the prices of a basket of goods and services over time.

- Causes: Inflation can be caused by several factors, including:

- Demand-Pull Inflation: When demand for goods and services exceeds supply, leading to higher prices.

- Cost-Push Inflation: When the cost of production increases (e.g., due to higher wages or raw material costs), producers pass on the higher costs to consumers.

- Monetary Policy: An increase in the money supply by a central bank can lead to inflation if it outpaces economic growth.

- Effects: Inflation affects various aspects of the economy and personal finance:

- Purchasing Power: As prices rise, the value of money decreases, reducing the purchasing power of consumers.

- Interest Rates: Central banks may adjust interest rates to control inflation, which can impact borrowing and savings rates.

- Income and Wages: Inflation can erode the real value of income and wages if they do not keep pace with rising prices.

- Savings and Investments: Inflation can reduce the real value of savings and fixed-income investments if returns do not outpace inflation.

Example:

Let’s consider Ravi, who earns ₹50,000 per month. A year ago, he could buy a basket of groceries for ₹5,000. Due to an annual inflation rate of 5%, the same basket of groceries now costs ₹5,250. This means Ravi’s ₹50,000 income now has slightly less purchasing power than it did a year ago, as he needs to spend more to buy the same goods and services.

1.7. How does inflation affect your investments?

Inflation can have a significant impact on your investments, influencing both their value and the returns they generate. Here are some keyways inflation affects investments, along with examples for better understanding:

- Erosion of Purchasing Power

Inflation reduces the real purchasing power of your investment returns. For example, if you have a fixed-income investment like a bond that pays an annual interest rate of 5%, but the inflation rate is 6%, your real return is actually negative (-1%). This means that even though you are earning interest, the value of your money is decreasing in terms of what it can buy.

- Impact on Fixed-Income Investments

Fixed-income investments, such as bonds, are particularly vulnerable to inflation. When inflation rises, the fixed interest payments from these investments may not keep pace with the increasing cost of living. For instance, if Ravi holds a 10-year government bond with a 4% annual interest rate and inflation rises to 5%, the bond’s real return becomes negative, reducing its attractiveness.

- Stock Market Performance

Inflation can have mixed effects on the stock market. On one hand, companies may pass on higher costs to consumers, potentially leading to higher revenues and profits. On the other hand, rising inflation can lead to higher interest rates, increasing borrowing costs for companies and reducing consumer spending. For example, if Ravi invests in stocks of a company that successfully raises prices to counter inflation, his investment may perform well. However, if higher interest rates lead to reduced consumer demand, the stock’s value may decline.

- Real Estate Investments

Real estate can be a good hedge against inflation, as property values and rental income tend to rise with inflation. For example, if Ravi owns a rental property, he may be able to increase rent in line with inflation, preserving his purchasing power and maintaining the value of his investment.

- Commodities and Inflation-Protected Securities

Certain investments, such as commodities (gold, oil) and inflation-protected securities (like Treasury Inflation-Protected Securities or TIPS), are designed to perform well during periods of inflation. For example, if Ravi invests in gold, the value of his investment may rise as inflation increases, since gold is often seen as a safe haven during inflationary periods.

Example:

Let’s say Ravi has ₹10,00,000 invested in a mix of stocks, bonds, and a rental property. Over the next year, inflation rises to 6%. The value of his fixed-income investments decreases in real terms, while his stocks may perform variably depending on the companies’ ability to pass on costs to consumers. However, the value of his rental property and the rental income may increase, helping to offset the negative impact of inflation on his overall portfolio.