- Currency Market Basics

- Reference Rates

- Events and Interest Rates Parity

- USD/INR Pair

- Futures Calendar

- EUR, GBP and JPY

- Commodities Market

- Gold Part-1

- Gold -Part 2

- Silver

- Crude Oil

- Crude Oil -Part 2

- Crude Oil-Part 3

- Copper and Aluminium

- Lead and Nickel

- Cardamom and Mentha Oil

- Natural Gas

- Commodity Options

- Cross Currency Pairs

- Government Securities

- Electricity Derivatives

- Study

- Slides

- Videos

2.1 Currency Trading: A Dual Perspective

Varun: Isha, I get how stocks work, like if I buy Reliance, I am betting it will go up. But I’m a bit confused about currencies. When I trade something like GBP/INR, am I betting on both currencies at once?

Isha: Yes. That’s the twist with forex. Unlike stocks, currency trading always involves two sides. When you buy GBP/INR, you’re saying, “I believe the British Pound will strengthen compared to the Indian Rupee.” So yes, you’re bullish on one and bearish on the other.

When you trade a stock, your view is singular you are either optimistic or pessimistic about that company. But in forex, every trade reflects a dual opinion. Take the pair GBP/INR = 104.50. If you buy this pair, you’re expecting the Pound to rise in value relative to the Rupee. In other words, you believe the Pound will appreciate and the Rupee will depreciate.

Let’s say the rate moves to 106.00. That means 1 Pound now fetches ₹106 instead of ₹104.50. The Pound has strengthened, and the Rupee has weakened. Your trade is profitable because your dual view bullish on GBP and bearish on INR played out correctly. On the flip side, if you sell GBP/INR, you’re anticipating the Pound will weaken and the Rupee will gain strength. If the rate drops to 102.00, you’ve made the right call.

Strengthening vs Weakening: What It Really Means

- If GBP/INR moves from 104.50 to 106.00, the base currency (GBP) has strengthened. It now buys more INR.

- If it moves from 104.50 to 102.00, the quote currency (INR) has strengthened. It now takes fewer rupees to buy one pound.

These movements are often described as appreciation or depreciation, and the terms are used interchangeably with strengthening or weakening.

Two-Way Quotes: Bid and Ask

Just like stocks, currency pairs are quoted with two prices the Bid and the Ask. The Bid is the price at which you can sell the pair, and the Ask is the price at which you can buy it.

Imagine you’re looking at the pair AUD/USD on a trading platform. The quote might read:

AUD/USD – 0.6645/46

Here:

- 6645 is the Bid (sell price)

- 6646 is the Ask (buy price)

If you buy AUD/USD, you’re going long on the Australian Dollar and short on the US Dollar. You’ll enter at the Ask price. If you sell, you’re shorting the Aussie and going long on the Dollar, entering at the Bid price.

What is a Pip?

- In forex, the smallest unit of price movement is called a pip. It’s usually the fourth decimal place in most currency pairs. So if AUD/USD moves from 0.6645 to 0.6646, that’s a 1-pip move.

- Pips help traders measure volatility, calculate profits, and set stop-loss or target levels. Even small pip movements can mean big gains or losses, especially when leverage is involved.

2.2 Understanding Rate Fixing and Conversion Paths

Isha: Varun, did you check the USD/INR rate today? It is hovering around ₹88.79.

Varun: Wow, that’s quite a jump! I remember it being in the mid-60s not too long ago. Who decides this rate anyway?

Isha: That’s the RBI’s Reference Rate. They publish it daily. It’s actually based on polling a few major banks.

Varun: Polling? Like they call up banks and ask for quotes?

Isha: Exactly. Between 11:30 AM and 12:30 PM, RBI contacts a set of contributing banks and collects their bid-ask quotes for USD/INR. Then they average those out to fix the rate for the day.

Varun: That’s surprisingly straightforward. But what about other currencies like EUR/INR or GBP/INR?

Isha: Ah, for those, RBI uses a method called “crossing.” They don’t poll directly—they derive the rate using USD as a pivot.

Varun: So they use EUR/USD and USD/INR to get EUR/INR?

Isha: Exactly. For example, today’s EUR/USD ask rate is 1.1566, and USD/INR ask is 88.797. So to buy 1 Euro, you’d need:

1.1566 × 88.797 = ₹102.74

That’s your EUR/INR ask rate.

Varun: Got it! So the Euro costs ₹102.74 today. And I guess the bid rate would use the lower ends of both quotes?

Isha: Yep. You’d multiply the EUR/USD bid with the USD/INR bid to get the EUR/INR bid. It’s a neat way to triangulate the value.

Varun: Makes sense. So these reference rates aren’t just numbers—they’re shaped by market sentiment and global events.

Isha: Exactly. And that sentiment flows through the contributing banks, which is why the rates shift daily.

In India’s foreign exchange ecosystem, the USD/INR rate published daily by the Reserve Bank of India (RBI plays a pivotal role. This rate known as the RBI Reference Rate is not just a number on a screen; it serves as the benchmark for currency futures settlement and is widely used across financial institutions for valuation and accounting purposes.

The reference rate reflects the spot price of the currency pair, not the future price. Futures rates, which incorporate expectations and premiums, are available separately on platforms like the NSE. The RBI’s rate, however, is grounded in actual market quotes collected through a structured polling process.

How RBI Determines the USD/INR Reference Rate

Each trading day (excluding weekends and holidays), the RBI reaches out to a select group of banks that are active participants in the forex market. These institutions, referred to as “contributing banks,” are chosen based on their market share and liquidity contribution.

Between 11:30 AM and 12:30 PM, RBI randomly selects a subset of these banks and requests their two-way quotes for USD/INR—that is, both bid and ask prices. Once these quotes are collected, RBI computes a simple average and publishes the resulting rate as the official reference for the day. This process ensures transparency and reflects prevailing market sentiment.

Deriving Cross Currency Rates: The Role of USD as a Pivot

While RBI directly polls for USD/INR, it does not do the same for other currency pairs like EUR/INR or GBP/INR. Instead, it uses a method called “crossing,” which involves triangulating rates using USD as the intermediary currency.

Let’s illustrate this with a current example involving GBP/INR. Suppose today’s spot rates are:

- USD/INR Ask: ₹88.80

- GBP/USD Ask: 1.2200

To determine the GBP/INR Ask rate, we multiply the two:

1.2200 × 88.80 = ₹108.34

This means to purchase 1 British Pound, you would need ₹108.34. The USD acts as the common denominator, enabling conversion between currencies that don’t have a direct quote.

To calculate the Bid rate, you would use the lower end of both quotes:

- USD/INR Bid: ₹88.75

- GBP/USD Bid: 1.2190

1.2190 × 88.75 = ₹108.17

So, the bid price for GBP/INR would be ₹108.17. This bid-ask spread reflects the cost of conversion and market liquidity.

What Drives These Rates?

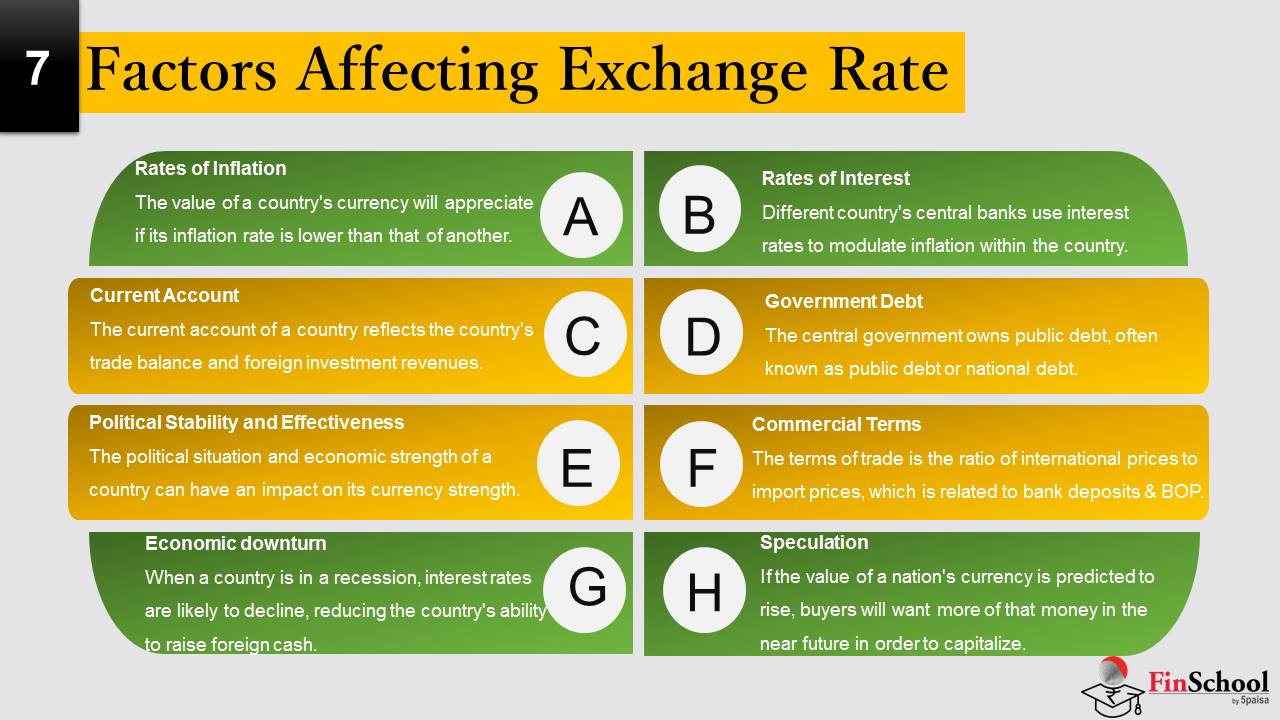

- The reference and cross rates fluctuate daily, influenced by the sentiment of contributing banks. But what shapes that sentiment? The answer lies in macroeconomic factors, both domestic and global. Interest rate decisions, inflation data, geopolitical developments, trade balances, and central bank interventions all play a role in shaping currency expectations.

- For example, if the US Federal Reserve signals a rate hike, banks may anticipate a stronger Dollar, which could push USD/INR higher. Similarly, if India reports a widening trade deficit, it may weigh on the Rupee, influencing the quotes banks provide to RBI.

2.3 Events That Influence Currency Movements

Varun: You know, Isha, I was thinking, predicting stock movements feels pretty straightforward sometimes. Like, if Infosys posts great quarterly results, you expect the stock to rally.

Isha: Yeah, that kind of cause-and-effect is easy to follow. Good news, price goes up. Bad news, price drops.

Varun: Exactly. But when it comes to currency pairs, it’s not that linear. Even with strong economic data, the Rupee might not strengthen the way you’d expect.

Isha: Because currencies are traded in pairs. So any event can push one currency up while another event might pull the other down at the same time. It’s like trying to balance two moving parts. So you need to track both sides of the story.

Varun: Yes. That’s why understanding global and domestic events is crucial in forex trading. Please explain me the kinds of events that really move currency markets.

In equity markets, certain events have a direct and predictable impact on stock prices. Take quarterly earnings, for example. If a company reports strong results, investor sentiment improves and the stock typically rallies. If the results disappoint, the sentiment turns negative and the stock tends to decline. The relationship is linear and relatively easy to interpret.

Currency markets, however, operate on a more complex framework. Since currencies are always traded in pairs like USD/INR or EUR/INR any event can simultaneously strengthen one currency while weakening the other. This dual dynamic makes it far more challenging to assess the net impact of economic developments.

Conflicting Forces in Currency Pairs

Consider this scenario: India receives a steady inflow of Foreign Direct Investment (FDI), which is a long-term positive for the Rupee. At the same time, the US economy shows signs of acceleration, boosting the Dollar. Now, both currencies are strengthening but in opposite directions. Which way will the USD/INR pair move?

The answer depends on which factor dominates market sentiment. Until that becomes clear, the pair may exhibit erratic or volatile behaviour. This is why currency traders must monitor global and domestic developments closely and interpret their relative impact on both sides of the pair.

Key Economic Indicators That Drive Currency Sentiment

Here are some of the most influential data points and events that traders track to anticipate currency movements:

- Trade Data (Exports & Imports)

India’s economy is sensitive to trade balances.

- Exportsbring in foreign currency (usually USD), which is converted to INR strengthening the Rupee.

- Imports, especially commodities like crude oil, require payment in USD. This increases demand for Dollars, weakening the Rupee.

- Trade Deficit (Current Account Deficit)

A widening trade deficit means more imports than exports, which puts pressure on the domestic currency. Conversely, a narrowing deficit is seen as a positive signal for INR.

- Interest Rates & Monetary Policy

Global investors often engage in carry trades borrowing from low-interest countries and investing in high-interest ones.

- Higher interest rates attract foreign capital, strengthening the domestic currency.

- Central banks like the RBI, Fed, and ECB review interest rates periodically. Traders watch these reviews for signals about future rate changes.

Policy Stances:

- Dovish: Indicates a likelihood of rate cuts → weakens the currency.

- Hawkish: Suggests rate hikes → strengthens the currency.

- Inflation Trends

Inflation reflects the rise in prices of essential goods and services.

- High inflation often prompts central banks to raise interest rates to curb spending.

- Rate hikes, in turn, attract foreign investment and boost the currency.

Mechanism: More money in circulation → higher spending → rising prices → central bank intervention via rate hikes → stronger currency.

- Consumer Price Index (CPI)

CPI is a key measure of inflation. A rising CPI signals increasing inflation, which may lead to a hawkish monetary response. Traders use CPI data to anticipate interest rate decisions.

- Gross Domestic Product (GDP)

GDP represents the total value of goods and services produced in a country.

- A higher GDP growth rate boosts investor confidence and strengthens the currency.

- For example, a 7.1% GDP growth rate implies robust economic expansion, which is typically favorable for INR.

2.4 Key Takeaways

- Currency trading always involves two views—you’re bullish on one currency and bearish on the other.

- Forex quotes include a Bid and Ask, where you sell at the Bid and buy at the Ask.

- A pip is the smallest unit of price movement, typically the fourth decimal place in major currency pairs.

- Buying GBP/INR means expecting the Pound to strengthen and the Rupee to weaken.

- The RBI Reference Rate for USD/INR is calculated by averaging bid-ask quotes from contributing banks.

- Cross currency rates like EUR/INR or GBP/INR are derived using USD as a pivot through triangulation.

- Reference rates reflect spot prices and are used for settlement, valuation, and accounting across institutions.

- Macroeconomic events like interest rate decisions and inflation trends directly influence currency movements.

- Trade deficits, CPI data, and GDP growth shape market sentiment and impact forex quotes.

- Currency pairs can behave unpredictably when both sides are influenced by conflicting economic forces.

2.5 Fun Activity

You are now a currency detective.

Your mission: use the clues below to calculate the correct cross currency rate and identify which currency is strengthening.

Scenario:

Today’s market quotes are:

- USD/INR Ask= ₹88.80

- EUR/USD Ask= 1.1566

- USD/INR Bid= ₹88.75

- EUR/USD Bid= 1.1550

Questions:

- What is the EUR/INR Ask rate?

- What is the EUR/INR Bid rate?

- Based on the movement from yesterday’s EUR/INR rate of ₹101.90 to today’s Ask rate, has the Euro strengthened or weakened against the Rupee?

Answer Key:

- EUR/INR Ask= 1.1566 × ₹88.80 = ₹102.74

- EUR/INR Bid= 1.1550 × ₹88.75 = ₹102.52

- Since the rate moved from ₹101.90 to ₹102.74, the Euro has strengthened against the Rupee