- Study

- Slides

- Videos

3.1 Key Components of Budgeting

Budgeting is the process of creating a plan for how to allocate your income to cover your expenses, savings, and financial goals. It helps you manage your money effectively, ensuring you live within your means and achieve your financial objectives. Here are the key components and benefits of budgeting:

- Income: The total amount of money you receive, such as your salary, business income, or any other sources of revenue.

- Expenses: The money you spend, categorized into fixed expenses (e.g., rent, mortgage, utilities) and variable expenses (e.g., groceries, entertainment).

- Savings: The portion of your income that you set aside for future use, such as emergency funds, retirement savings, or specific goals like buying a house or going on vacation.

- Financial Goals: Short-term and long-term objectives that you aim to achieve with your money. These can include paying off debt, building an emergency fund, or saving for a major purchase.

Benefits of Budgeting

- Financial Control: Helps you take control of your finances and understand where your money is going.

- Savings Growth: Encourages regular saving, which can lead to financial security and the ability to achieve your goals.

- Debt Management: Assists in managing and paying off debt by allocating funds appropriately.

- Expense Tracking: Enables you to track your spending patterns and identify areas where you can cut costs.

- Stress Reduction: Reduces financial stress by providing a clear plan and reducing uncertainties about money.

Let’s go through the steps of creating a budget using Ravi as an example.

Step 1: Determine Income: Ravi’s monthly income from his job is ₹60,000 as he gets an increment.

Step 2: Track Expenses

Ravi lists all his monthly expenses and categorizes them:

- Housing (Rent): ₹15,000

- Utilities (Electricity, Water, Internet): ₹5,000

- Transportation (Fuel, Maintenance): ₹5,000

- Groceries: ₹10,000

- Savings: ₹10,000

- Discretionary Spending (Entertainment, Dining Out): ₹5,000

- Insurance: ₹3,000

- Miscellaneous: ₹2,000

Step 3: Set Goals

Ravi identifies his financial goals:

- Short-term goal: Save ₹50,000 for a vacation in 5 months.

- Long-term goal: Save ₹2,00,000 for an emergency fund.

Step 4: Create Budget

Ravi allocates funds to each category based on his income and expenses:

|

Category |

Amount (₹) |

|

Housing (Rent) |

15,000 |

|

Utilities |

5,000 |

|

Transportation |

5,000 |

|

Groceries |

10,000 |

|

Savings |

10,000 |

|

Discretionary Spending |

5,000 |

|

Insurance |

3,000 |

|

Miscellaneous |

2,000 |

|

Total Expenses |

55,000 |

Monthly Savings:

- Vacation savings: ₹50,000 / 5 months = ₹10,000 per month.

- Emergency fund savings: ₹5,000 per month.

Step 5: Monitor and Adjust

- Ravi regularly reviews his budget to ensure he is sticking to it.

- If he finds certain categories are consistently over or under budget, he makes adjustments to keep the budget realistic.

Example Budget Breakdown

Ravi’s monthly budget looks like this: By following these steps, Ravi can effectively manage his finances, save for his goals, and ensure he stays on track

|

Category |

Amount (₹) |

|

Income |

60,000 |

|

Housing (Rent) |

15,000 |

|

Utilities |

5,000 |

|

Transportation |

5,000 |

|

Groceries |

10,000 |

|

Discretionary Spending |

5,000 |

|

Insurance |

3,000 |

|

Miscellaneous |

2,000 |

|

Savings |

10,000 |

|

Emergency Fund |

5,000 |

|

Total Expenses |

60,000 |

3.2 How to Adjust Your Budget?

Adjusting your budget is crucial for maintaining financial stability and achieving your financial goals. As life circumstances change—such as receiving a salary increase, facing unexpected expenses, or modifying your financial goals—your budget needs to be flexible and adaptable. Regularly reviewing and fine-tuning your budget ensures that it remains aligned with your income and expenditure patterns. By tracking your spending and making necessary adjustments, you can avoid overspending, increase savings, and manage debt effectively. Let’s delve into the steps for adjusting your budget using practical examples to illustrate the process.

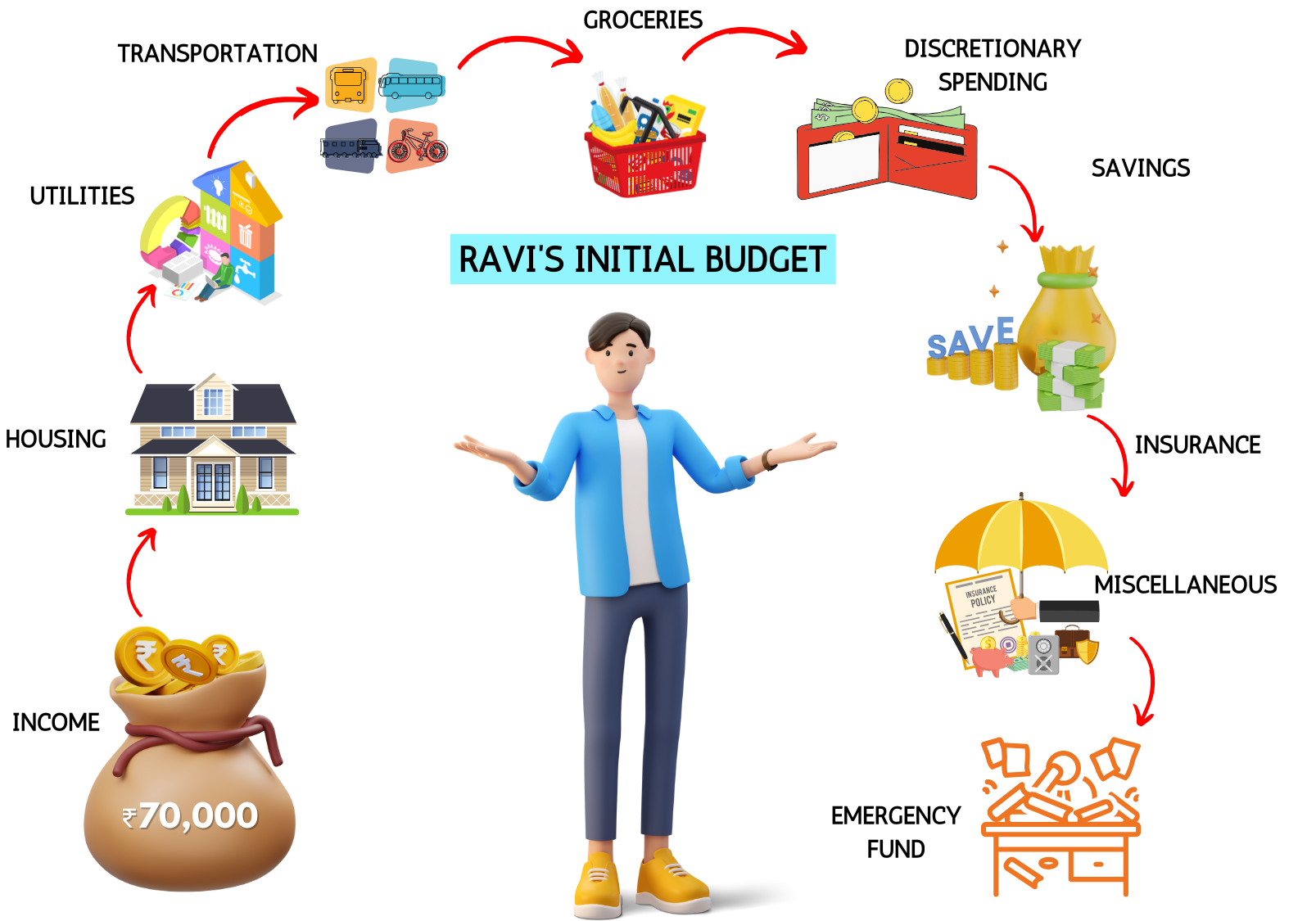

Scenario

Ravi has an initial budget, but he recently got a salary raise, and he also noticed that his transportation expenses have increased. Here’s how Ravi can adjust his budget:

Initial Budget

|

Category |

Amount (₹) |

|

Income |

60,000 |

|

Housing (Rent) |

15,000 |

|

Utilities |

5,000 |

|

Transportation |

5,000 |

|

Groceries |

10,000 |

|

Discretionary Spending |

5,000 |

|

Insurance |

3,000 |

|

Miscellaneous |

2,000 |

|

Savings |

10,000 |

|

Emergency Fund |

5,000 |

|

Total Expenses |

60,000 |

Adjustments

- Income Increase: Ravi’s new monthly income is ₹70,000 (a ₹10,000 raise).

- Transportation Expense Increase: Ravi’s transportation expenses have increased to ₹7,000 (an additional ₹2,000).

Adjusted Budget

Ravi needs to allocate the additional income and cover the increased expenses. Here’s his adjusted budget:

|

Category |

Initial Amount (₹) |

Adjustment (₹) |

Adjusted Amount (₹) |

|

Income |

60,000 |

+10,000 |

70,000 |

|

Housing (Rent) |

15,000 |

0 |

15,000 |

|

Utilities |

5,000 |

0 |

5,000 |

|

Transportation |

5,000 |

+2,000 |

7,000 |

|

Groceries |

10,000 |

0 |

10,000 |

|

Discretionary Spending |

5,000 |

+1,000 |

6,000 |

|

Insurance |

3,000 |

0 |

3,000 |

|

Miscellaneous |

2,000 |

0 |

2,000 |

|

Savings |

10,000 |

+5,000 |

15,000 |

|

Emergency Fund |

5,000 |

+2,000 |

7,000 |

|

Total Expenses |

60,000 |

+10,000 |

70,000 |

Adjusted Budget Explanation

- Transportation: Ravi increases his transportation budget by ₹2,000 to cover the additional expenses.

- Discretionary Spending: Ravi adds ₹1,000 to his discretionary spending to allow for a bit more flexibility in entertainment and dining out.

- Savings: Ravi decides to allocate an additional ₹5,000 to his savings, aiming to build a stronger financial cushion.

- Emergency Fund: Ravi adds ₹2,000 to his emergency fund savings, increasing his overall financial security.

By making these adjustments, Ravi ensures that his budget remains balanced and aligns with his updated financial situation. Regularly reviewing and adjusting the budget helps him stay on track with his financial goals.

3.3. How to Track Your Budget?

Tracking your budget is a vital practice for effective financial management. It involves regularly recording your income and expenses to ensure you stay within your financial limits and work towards your financial goals. By consistently monitoring your spending, you can identify patterns, spot areas where you might be overspending, and make necessary adjustments. This not only helps in maintaining control over your finances but also aids in making informed decisions, setting realistic savings targets, and reducing financial stress. Let’s explore how to track your budget effectively, using practical steps and examples to guide you through the process.

Steps to Track Your Budget

- Choose a Tracking Method: Ravi decides to use a budgeting app, a spreadsheet, or even a notebook to track his expenses. Popular budgeting apps include Mint, YNAB (You Need a Budget), and PocketGuard.

- Record Income and Expenses: Ravi records all sources of income, including his salary and any other earnings. He categorizes and records every expense, such as rent, utilities, groceries, transportation, savings, and discretionary spending.

- Set Up a Budget Template: Ravi creates a budget template with different categories and allocates funds to each based on his initial budget plan.

- Track Daily Spending: Ravi diligently logs every expense as soon as it occurs. This includes keeping receipts, noting down expenses, and updating his budget regularly.

- Review and Compare: At the end of each week or month, Ravi reviews his actual spending and compares it to his budgeted amounts. He notes any discrepancies and areas where he overspent or underspent.

- Adjust as Needed: Based on his review, Ravi makes adjustments to his budget. If he notices he’s consistently overspending in one category, he reallocates funds or looks for ways to cut back.

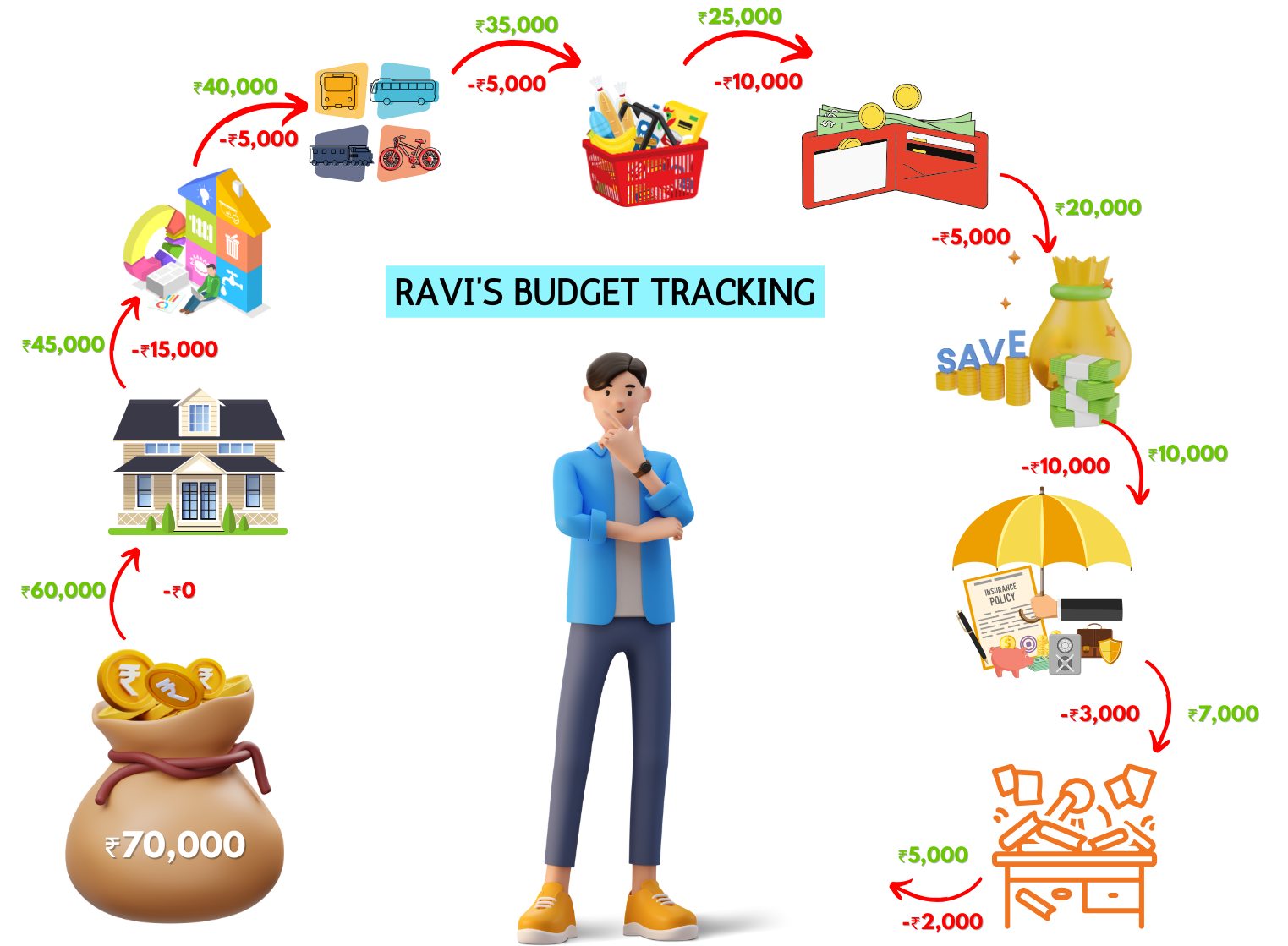

Ravi’s Budget Tracking

|

Category |

Budgeted Amount (₹) |

Actual Spent (₹) |

Difference (₹) |

|

Income |

70,000 |

70,000 |

0 |

|

Housing (Rent) |

15,000 |

15,000 |

0 |

|

Utilities |

5,000 |

4,800 |

+200 |

|

Transportation |

5,000 |

6,000 |

-1,000 |

|

Groceries |

10,000 |

10,500 |

-500 |

|

Discretionary Spending |

10,000 |

8,000 |

+2,000 |

|

Savings |

15,000 |

15,000 |

0 |

|

Insurance |

5,000 |

5,000 |

0 |

|

Miscellaneous |

2,000 |

1,700 |

+300 |

|

Total Expenses |

67,000 |

66,000 |

+1,000 |

Adjustments and Insights:

- Transportation: Ravi overspent by ₹1,000. He decides to reduce discretionary spending or find ways to cut transportation costs.

- Groceries: Ravi spent ₹500 more than budgeted. He plans to look for deals or buy in bulk to save money next month.

- Utilities and Miscellaneous: Ravi underspent by ₹200 and ₹300 respectively. He considers reallocating these savings to other categories or increasing his savings.

- Discretionary Spending: Ravi underspent by ₹2,000. He can choose to save this amount or allocate it to another category if needed.

By tracking his budget regularly, Ravi stays aware of his spending habits and makes informed decisions to stay on track with his financial goals.

3.1 Key Components of Budgeting

Budgeting is the process of creating a plan for how to allocate your income to cover your expenses, savings, and financial goals. It helps you manage your money effectively, ensuring you live within your means and achieve your financial objectives. Here are the key components and benefits of budgeting:

- Income: The total amount of money you receive, such as your salary, business income, or any other sources of revenue.

- Expenses: The money you spend, categorized into fixed expenses (e.g., rent, mortgage, utilities) and variable expenses (e.g., groceries, entertainment).

- Savings: The portion of your income that you set aside for future use, such as emergency funds, retirement savings, or specific goals like buying a house or going on vacation.

- Financial Goals: Short-term and long-term objectives that you aim to achieve with your money. These can include paying off debt, building an emergency fund, or saving for a major purchase.

Benefits of Budgeting

- Financial Control: Helps you take control of your finances and understand where your money is going.

- Savings Growth: Encourages regular saving, which can lead to financial security and the ability to achieve your goals.

- Debt Management: Assists in managing and paying off debt by allocating funds appropriately.

- Expense Tracking: Enables you to track your spending patterns and identify areas where you can cut costs.

- Stress Reduction: Reduces financial stress by providing a clear plan and reducing uncertainties about money.

Let’s go through the steps of creating a budget using Ravi as an example.

Step 1: Determine Income: Ravi’s monthly income from his job is ₹60,000 as he gets an increment.

Step 2: Track Expenses

Ravi lists all his monthly expenses and categorizes them:

- Housing (Rent): ₹15,000

- Utilities (Electricity, Water, Internet): ₹5,000

- Transportation (Fuel, Maintenance): ₹5,000

- Groceries: ₹10,000

- Savings: ₹10,000

- Discretionary Spending (Entertainment, Dining Out): ₹5,000

- Insurance: ₹3,000

- Miscellaneous: ₹2,000

Step 3: Set Goals

Ravi identifies his financial goals:

- Short-term goal: Save ₹50,000 for a vacation in 5 months.

- Long-term goal: Save ₹2,00,000 for an emergency fund.

Step 4: Create Budget

Ravi allocates funds to each category based on his income and expenses:

|

Category |

Amount (₹) |

|

Housing (Rent) |

15,000 |

|

Utilities |

5,000 |

|

Transportation |

5,000 |

|

Groceries |

10,000 |

|

Savings |

10,000 |

|

Discretionary Spending |

5,000 |

|

Insurance |

3,000 |

|

Miscellaneous |

2,000 |

|

Total Expenses |

55,000 |

Monthly Savings:

- Vacation savings: ₹50,000 / 5 months = ₹10,000 per month.

- Emergency fund savings: ₹5,000 per month.

Step 5: Monitor and Adjust

- Ravi regularly reviews his budget to ensure he is sticking to it.

- If he finds certain categories are consistently over or under budget, he makes adjustments to keep the budget realistic.

Example Budget Breakdown

Ravi’s monthly budget looks like this: By following these steps, Ravi can effectively manage his finances, save for his goals, and ensure he stays on track

|

Category |

Amount (₹) |

|

Income |

60,000 |

|

Housing (Rent) |

15,000 |

|

Utilities |

5,000 |

|

Transportation |

5,000 |

|

Groceries |

10,000 |

|

Discretionary Spending |

5,000 |

|

Insurance |

3,000 |

|

Miscellaneous |

2,000 |

|

Savings |

10,000 |

|

Emergency Fund |

5,000 |

|

Total Expenses |

60,000 |

3.2 How to Adjust Your Budget?

Adjusting your budget is crucial for maintaining financial stability and achieving your financial goals. As life circumstances change—such as receiving a salary increase, facing unexpected expenses, or modifying your financial goals—your budget needs to be flexible and adaptable. Regularly reviewing and fine-tuning your budget ensures that it remains aligned with your income and expenditure patterns. By tracking your spending and making necessary adjustments, you can avoid overspending, increase savings, and manage debt effectively. Let’s delve into the steps for adjusting your budget using practical examples to illustrate the process.

Scenario

Ravi has an initial budget, but he recently got a salary raise, and he also noticed that his transportation expenses have increased. Here’s how Ravi can adjust his budget:

Initial Budget

|

Category |

Amount (₹) |

|

Income |

60,000 |

|

Housing (Rent) |

15,000 |

|

Utilities |

5,000 |

|

Transportation |

5,000 |

|

Groceries |

10,000 |

|

Discretionary Spending |

5,000 |

|

Insurance |

3,000 |

|

Miscellaneous |

2,000 |

|

Savings |

10,000 |

|

Emergency Fund |

5,000 |

|

Total Expenses |

60,000 |

Adjustments

- Income Increase: Ravi’s new monthly income is ₹70,000 (a ₹10,000 raise).

- Transportation Expense Increase: Ravi’s transportation expenses have increased to ₹7,000 (an additional ₹2,000).

Adjusted Budget

Ravi needs to allocate the additional income and cover the increased expenses. Here’s his adjusted budget:

|

Category |

Initial Amount (₹) |

Adjustment (₹) |

Adjusted Amount (₹) |

|

Income |

60,000 |

+10,000 |

70,000 |

|

Housing (Rent) |

15,000 |

0 |

15,000 |

|

Utilities |

5,000 |

0 |

5,000 |

|

Transportation |

5,000 |

+2,000 |

7,000 |

|

Groceries |

10,000 |

0 |

10,000 |

|

Discretionary Spending |

5,000 |

+1,000 |

6,000 |

|

Insurance |

3,000 |

0 |

3,000 |

|

Miscellaneous |

2,000 |

0 |

2,000 |

|

Savings |

10,000 |

+5,000 |

15,000 |

|

Emergency Fund |

5,000 |

+2,000 |

7,000 |

|

Total Expenses |

60,000 |

+10,000 |

70,000 |

Adjusted Budget Explanation

- Transportation: Ravi increases his transportation budget by ₹2,000 to cover the additional expenses.

- Discretionary Spending: Ravi adds ₹1,000 to his discretionary spending to allow for a bit more flexibility in entertainment and dining out.

- Savings: Ravi decides to allocate an additional ₹5,000 to his savings, aiming to build a stronger financial cushion.

- Emergency Fund: Ravi adds ₹2,000 to his emergency fund savings, increasing his overall financial security.

By making these adjustments, Ravi ensures that his budget remains balanced and aligns with his updated financial situation. Regularly reviewing and adjusting the budget helps him stay on track with his financial goals.

3.3. How to Track Your Budget?

Tracking your budget is a vital practice for effective financial management. It involves regularly recording your income and expenses to ensure you stay within your financial limits and work towards your financial goals. By consistently monitoring your spending, you can identify patterns, spot areas where you might be overspending, and make necessary adjustments. This not only helps in maintaining control over your finances but also aids in making informed decisions, setting realistic savings targets, and reducing financial stress. Let’s explore how to track your budget effectively, using practical steps and examples to guide you through the process.

Steps to Track Your Budget

- Choose a Tracking Method: Ravi decides to use a budgeting app, a spreadsheet, or even a notebook to track his expenses. Popular budgeting apps include Mint, YNAB (You Need a Budget), and PocketGuard.

- Record Income and Expenses: Ravi records all sources of income, including his salary and any other earnings. He categorizes and records every expense, such as rent, utilities, groceries, transportation, savings, and discretionary spending.

- Set Up a Budget Template: Ravi creates a budget template with different categories and allocates funds to each based on his initial budget plan.

- Track Daily Spending: Ravi diligently logs every expense as soon as it occurs. This includes keeping receipts, noting down expenses, and updating his budget regularly.

- Review and Compare: At the end of each week or month, Ravi reviews his actual spending and compares it to his budgeted amounts. He notes any discrepancies and areas where he overspent or underspent.

- Adjust as Needed: Based on his review, Ravi makes adjustments to his budget. If he notices he’s consistently overspending in one category, he reallocates funds or looks for ways to cut back.

Ravi’s Budget Tracking

|

Category |

Budgeted Amount (₹) |

Actual Spent (₹) |

Difference (₹) |

|

Income |

70,000 |

70,000 |

0 |

|

Housing (Rent) |

15,000 |

15,000 |

0 |

|

Utilities |

5,000 |

4,800 |

+200 |

|

Transportation |

5,000 |

6,000 |

-1,000 |

|

Groceries |

10,000 |

10,500 |

-500 |

|

Discretionary Spending |

10,000 |

8,000 |

+2,000 |

|

Savings |

15,000 |

15,000 |

0 |

|

Insurance |

5,000 |

5,000 |

0 |

|

Miscellaneous |

2,000 |

1,700 |

+300 |

|

Total Expenses |

67,000 |

66,000 |

+1,000 |

Adjustments and Insights:

- Transportation: Ravi overspent by ₹1,000. He decides to reduce discretionary spending or find ways to cut transportation costs.

- Groceries: Ravi spent ₹500 more than budgeted. He plans to look for deals or buy in bulk to save money next month.

- Utilities and Miscellaneous: Ravi underspent by ₹200 and ₹300 respectively. He considers reallocating these savings to other categories or increasing his savings.

- Discretionary Spending: Ravi underspent by ₹2,000. He can choose to save this amount or allocate it to another category if needed.

By tracking his budget regularly, Ravi stays aware of his spending habits and makes informed decisions to stay on track with his financial goals.