- Study

- Slides

- Videos

10.1 Meaning & Importance of Open Interest

Open Interest defines the total number of open or outstanding contracts presently held by the market participants at a given time. It helps in identification of stock market trends. In simple language, open interest analysis helps a trader to understand the market scenario by only showing a number of futures contracts that have changed hands during the market hours. This concept is applicable for Future and options contract traders. Open Interest or OI data changes day by day depending on the outstanding contracts.

There are four participants in the market A, B, C, D, and E

On 1st July, A buys 10 contracts from B => OI 10

2nd July C buys 20 contracts from D => OI 30

3rd July A sells his 10 contracts to D => OI 20

4th July E buys 20 contracts from C => OI 20

So, we can understand how OI changes depending on the change in hand of contracts. When a new entrant trades with a new entrant in the F & O market, then the Open Interest goes up. When an existing position holder squares off with entry of a new entrant, open interest remains unchanged. When two existing position holders square off their positions, we see open interest go down.

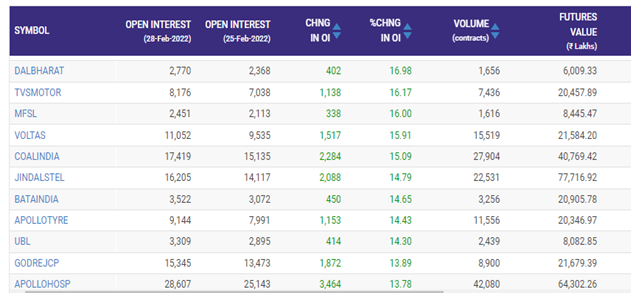

10.2 Finding Open Interest Data

Go to nseindia.com and click live analysis

Analysing Open Interest Data

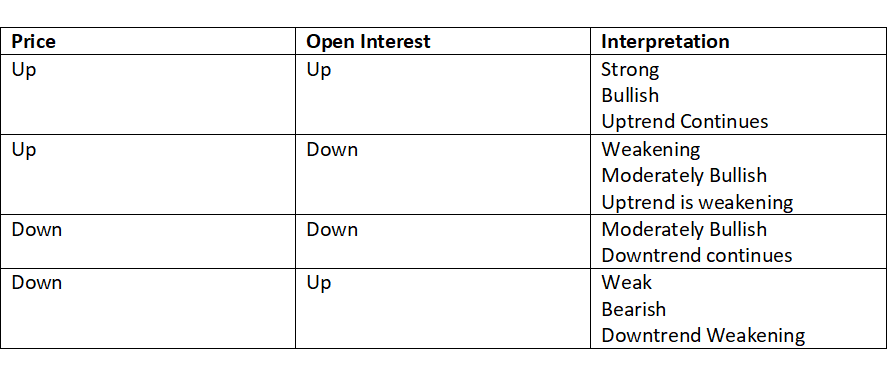

A trend can be defined by price upward and downward direction but the sustainability of that trend is questionable. There are some important factors which backs up the price to take a certain direction. OI is one of the factors and a reason for a sustainable trend as well as trend reversal.

When the price is going up or down and the future open interest increases alongside the price at a certain level then we can expect that the price movement is going to sustain. In other hand when a trend is present in the market and a sudden fall in futures open interest is visible then we should be doubtful about the trend. There might be a chance of trend reversal.

Open interest increasing means fresh money is flowing into the market and decrease in open interest suggest money outflow from the market. Buyers move the market up by investing fresh cash into the market, while sellers do the opposite.

A trend depends on how many fresh contracts are exchanging hands with the new price move. If the fresh cash does not flow into the market and the fresh contract does not exchange hands, then we should be doubtful about the trend.

10.3 Open Interest & Volume Data

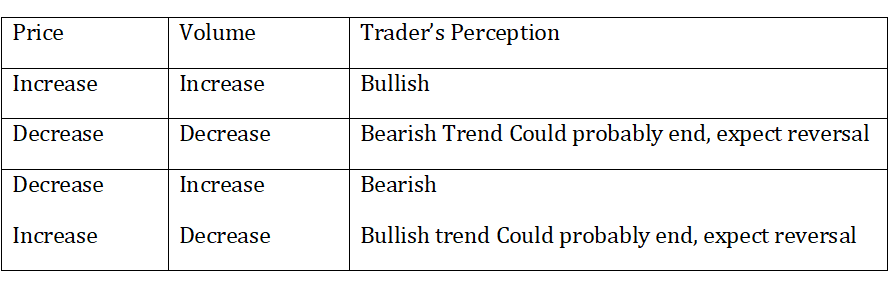

Volume represents the total amount of trading activity or contracts that have changed hands in a given market for a single trading day. The greater the amount of trading during a market session the higher will be the trading volume. As mentioned earlier, a higher volume bar on the chart means that the trading activity was heavier for that day. Another way to look at this, is that the volume represents a measure of intensity or pressure behind a price trend. The greater the volume the more one can expect the existing trend to continue rather than reverse.

Thus, volume and Open Interest can be a barometer of future activity and direction. Volume measures the number of contracts that exchanged hands during the trading session. It measures market activity. Open Interest is the total number of outstanding contracts. It gauges market participation.

The following tables summarizes the trader’s perspective with respect to changes in volume and prices –

Do note, if there is an abnormally high OI backed by a rapid increase or decrease in prices then be cautious. This situation simply means that there is a lot of euphoria and leverage being built up in the market. In situations like this, even a small trigger could lead to a lot of panic in the market.

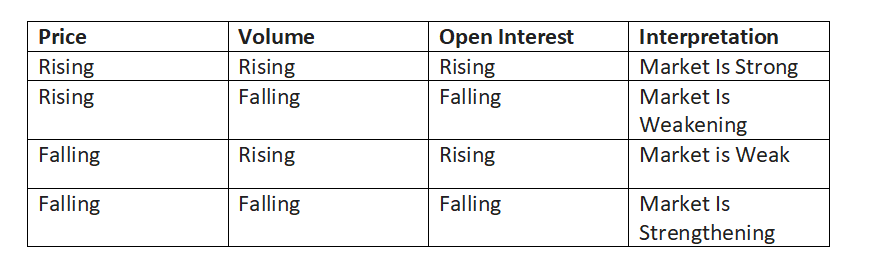

10.4 Relationship Between Price, Volume & Open Interest