- Study

- Slides

- Videos

1.1 What is Scalping??

In trading, “scalping” refers to a strategy where traders aim to make small profits from small price changes in a short period. Scalpers typically execute numerous trades throughout the day, sometimes holding positions for only a few seconds or minutes. They capitalize on rapid price movements, often relying on technical analysis and short-term indicators to identify opportunities. This strategy requires quick decision-making, tight risk management, and often involves high-frequency trading techniques. Scalping can be executed in various markets, including stocks, forex, futures, and cryptocurrencies.

1.2 How Stock Scalping Works??

Stock scalping involves buying and selling stocks quickly to capitalize on small price movements. Here’s how it typically works:

- Choosing Stocks: Scalpers look for highly liquid stocks with tight bid-ask spreads, as they need to enter and exit positions quickly without suffering significant slippage.

- Technical Analysis: Scalpers rely heavily on technical analysis and short-term indicators such as moving averages, Bollinger Bands, and stochastic oscillators to identify short-term price movements and entry/exit points.

- Short Timeframes: Scalpers operate on very short timeframes, often trading on tick charts, one-minute charts, or five-minute charts. They aim to take advantage of small price fluctuations that occur within these short periods.

- Quick Entries and Exits: Scalpers enter and exit trades swiftly, often within seconds or minutes. They set predefined profit targets and stop-loss levels to manage risk and lock in profits.

- High Volume: Scalpers execute a large number of trades throughout the day, aiming to accumulate small gains from each trade. They may trade dozens or even hundreds of times in a single session.

- Low Profit Margins: While individual scalped trades may yield small profits, these profits can accumulate over the course of many trades. However, the profit margins per trade are typically lower compared to longer-term trading strategies.

- Risk Management: Effective risk management is crucial for scalpers, as the fast-paced nature of scalping can amplify losses if trades move against them. Stop-loss orders are often used to limit potential losses.

- Platform and Technology: Scalpers rely on advanced trading platforms and technology to execute trades quickly and efficiently. They may use direct market access (DMA) platforms and algorithmic trading strategies to gain an edge in speed and execution.

1.3 Characteristics of scalping

Scalping is a trading strategy employed in financial markets, including stocks, currencies, futures, and commodities. It involves making numerous small trades over short time frames to exploit small price movements. Here are some characteristics of scalping:

- Short Timeframes: Scalping involves holding trades for very short periods, often just seconds to minutes. Traders aim to capture small price movements within these short timeframes.

- High Frequency Trading: Scalpers execute a large number of trades in a single trading session. They rely on the volume of trades to generate profits, rather than significant gains from individual trades.

- Small Profits per Trade: Scalping targets small price movements, aiming to capture just a few ticks or pips per trade. Cumulatively, these small gains can add up to significant profits over time.

- Tight Stop Losses: Scalpers typically use tight stop-loss orders to limit their potential losses on each trade. Since they are aiming for small gains, they also accept small losses if the trade moves against them.

- Focus on Liquidity: Scalpers prefer highly liquid markets where there is ample trading volume and tight bid-ask spreads. This allows them to enter and exit positions quickly without significant slippage.

- Technical Analysis: Scalping relies heavily on technical analysis, including chart patterns, indicators, and price action. Traders use these tools to identify short-term trends and potential entry and exit points.

- Low Transaction Costs: Since scalpers execute a large number of trades, they are sensitive to transaction costs such as commissions and spreads. They often look for brokers with low trading costs to maximize their profits.

- Requires Discipline and Focus: Scalping requires intense focus and discipline as traders need to make quick decisions and act promptly. Emotions can interfere with the decision-making process, leading to poor trading outcomes.

- Not Suitable for Everyone: Scalping can be demanding and stressful, requiring traders to monitor the market closely and make rapid decisions. It may not be suitable for everyone, especially those who cannot devote sufficient time and attention to trading.

- Risk Management is Crucial: Effective risk management is essential for scalpers to protect their capital. This includes setting appropriate stop-loss levels, sizing positions correctly, and managing overall exposure to the market.

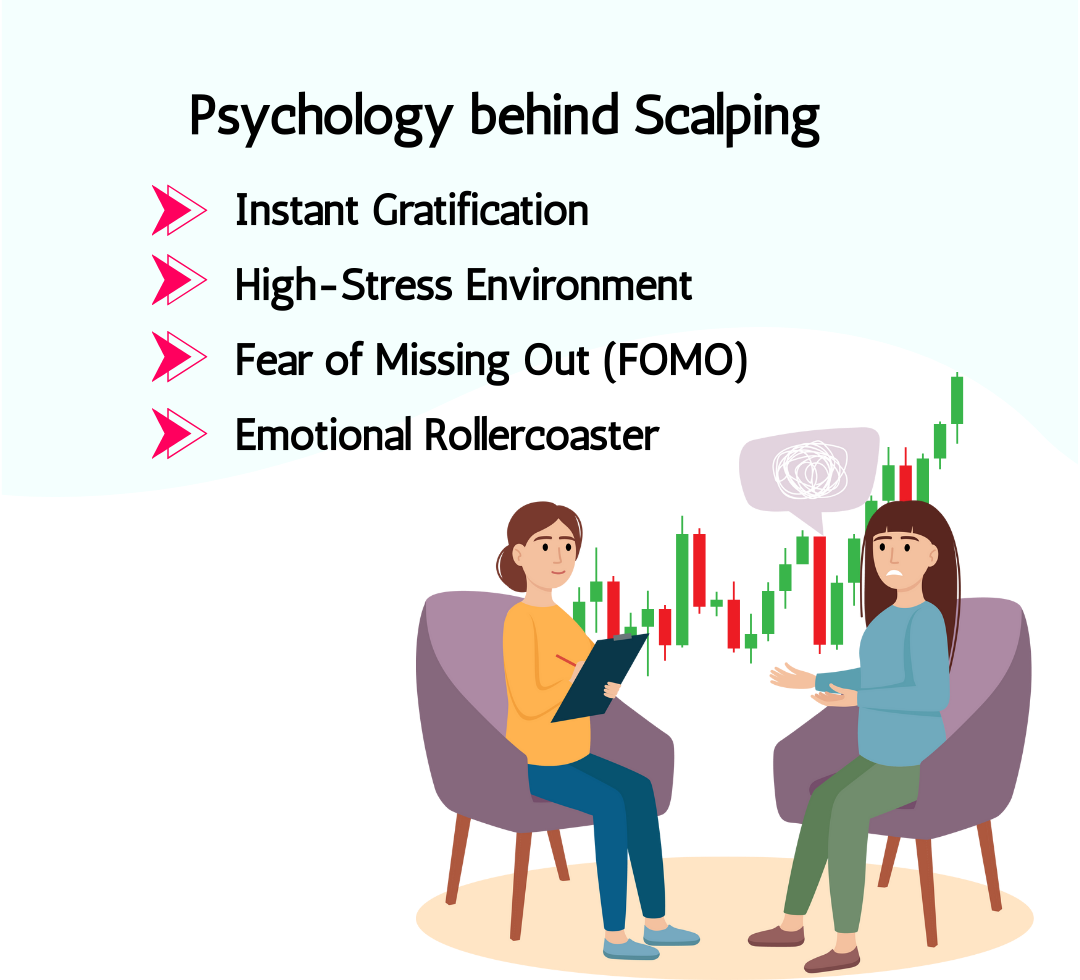

1.4 Psychology behind Scalping

The psychology behind scalping involves understanding the mind set and emotional dynamics of traders who employ this rapid-fire trading strategy. Here are some key psychological aspects:

- Instant Gratification: Scalping provides traders with the opportunity for instant gratification as they aim to capture quick profits within minutes or even seconds. The thrill of making frequent trades and seeing immediate results can be addictive for some traders.

- High-Stress Environment: Scalping operates in a high-stress environment where traders need to make rapid decisions and execute trades swiftly. The pressure to perform under such conditions can lead to heightened levels of stress, anxiety, and emotional strain.

- Fear of Missing Out (FOMO): Scalping is often driven by the fear of missing out on potential profit opportunities. Traders may feel compelled to constantly monitor the market and enter trades in fear of missing a favourable price movement.

- Emotional Rollercoaster: The fast-paced nature of scalping can lead to an emotional rollercoaster for traders. They may experience a wide range of emotions, including euphoria after a successful trade, frustration after a loss, and anxiety during volatile market conditions.

- Overtrading: The desire to capitalize on every price fluctuation can lead to overtrading, where traders execute an excessive number of trades beyond their original trading plan. Overtrading can result in increased transaction costs, fatigue, and emotional exhaustion.

- Impulsivity: Scalping requires traders to act quickly and decisively, which can sometimes lead to impulsive decision-making. Impulsive trades are often driven by emotions rather than logic or analysis, increasing the risk of poor trading outcomes.

- Discipline and Patience: Despite the fast-paced nature of scalping, discipline and patience are essential for success. Traders must adhere to their trading plan, follow strict risk management practices, and remain patient during periods of market volatility or consolidation.

- Ability to Handle Losses: Scalping involves accepting a high frequency of small losses in exchange for the potential of small gains. Traders must be psychologically resilient and able to handle losses without becoming emotionally distressed or deviating from their trading strategy.

- Constant Monitoring: Scalping requires constant monitoring of the market, which can be mentally and physically demanding. Traders may experience fatigue, burnout, or difficulty maintaining focus over extended periods of time.

- Continuous Learning and Adaptation: Successful scalpers are constantly learning and adapting to changing market conditions, refining their strategies, and improving their skills. The ability to adapt to new information and adjust trading tactics is crucial for staying ahead in the competitive world of scalping.

1.5 Example of Scalping

Suppose a scalper is long on a stock of company ABC trading for Rs 50. The scalper buys large quantities of ABC, say 10,000 shares, and sell them when the price increases. For instance, buy and sell the stock of ABC at every increase of Rs 0.5. Here the scalper gets a profit of Rs 5,000 on each trade. And if the scalper does this five times a day, the total profit would be Rs 25,000.

1.6 Scalping V/s Swing Trading

What is Scalping??

Scalping is a trading strategy where traders aim to make small profits by rapidly buying and selling securities or financial instruments within short timeframes. The goal of scalping is to capitalize on small price movements or fluctuations in the market to generate quick profits. Scalpers typically hold positions for only a few seconds, minutes, or at most, a few hours.

What is Swing Trading??

Swing trading is a trading strategy that aims to capture short- to medium-term gains in the financial markets by holding positions for several days to weeks. Unlike day trading, where positions are opened and closed within the same trading day, swing traders aim to profit from “swings” or price movements that occur over a slightly longer timeframe.

The difference between Scalping and Swing Trading is explained through following points:

Scalping and swing trading are two distinct trading strategies with differing approaches, time horizons, and risk profiles. Here’s a comparison between the two:

-

Time Horizon:

Scalping Involves making trades with very short holding periods, typically ranging from seconds to minutes. Scalpers aim to capture small price movements within intraday trading sessions. Swing Trading Involves holding trades for a longer duration, typically from several days to weeks. Swing traders aim to capitalize on medium-term price swings within the broader trend of the market.

-

Trade Frequency:

Scalping Involves executing a large number of trades within a single trading session. Scalpers rely on the volume of trades to generate profits, often entering and exiting positions rapidly. Swing Trading Involves fewer trades compared to scalping. Swing traders typically wait for high-probability setups and are willing to hold positions for an extended period until their profit targets or stop-loss levels are reached.

-

Profit Targets:

Scalping Targets small price movements, aiming to capture just a few ticks or pips per trade. Scalpers focus on generating multiple small profits throughout the trading session. Swing Trading Targets larger price movements, aiming to capture a significant portion of a trend. Swing traders aim for larger profit targets relative to their risk, often seeking to ride trends for several days or weeks.

-

Risk Management:

Scalping requires tight risk management as trades are held for very short periods. Scalpers use tight stop-loss orders to limit losses on each trade and accept small losses if the trade moves against them. Swing Trading Involves more relaxed risk management compared to scalping. Swing traders typically use wider stop-loss orders to accommodate the greater volatility and longer holding periods.

-

Psychological Factors:

Scalping Requires intense focus, discipline, and the ability to make quick decisions under pressure. Scalpers need to manage emotions such as fear, greed, and impatience due to the fast-paced nature of trading. Swing Trading Involves a less stressful trading environment compared to scalping. Swing traders have more time to analyse trades and make decisions, which can reduce emotional strain.

-

Market Conditions:

Scalping Thrives in highly liquid markets with tight bid-ask spreads, such as major currency pairs or highly traded stocks. Scalpers may struggle in choppy or low-volume market conditions. Swing Trading Can adapt to various market conditions, including trending, range-bound, or volatile markets. Swing traders look for setups that offer favourable risk-to-reward ratios regardless of market conditions.

1.7 Benefits of Scalping

Scalping as a trading strategy offers several potential benefits for traders who are able to execute it effectively:

- Quick Profits: Scalping allows traders to capitalize on small price movements within a short timeframe, potentially generating profits on a rapid basis. By making numerous trades throughout the day, scalpers aim to accumulate gains that can add up over time.

- High Probability Trades: Scalping often involves trading in the direction of short-term momentum or volatility, increasing the likelihood of success on individual trades. By focusing on short-term price movements, scalpers aim to exploit predictable patterns or inefficiencies in the market.

Short-term momentum refers to the rate of change in the price of a financial asset over a relatively brief period, typically ranging from minutes to a few days. It is a measure of how quickly and decisively the price of an asset is moving in a particular direction within this short timeframe. Short-term momentum can be observed in various financial markets, including stocks, forex, commodities, and indices. - Reduced Overnight Risk: Since scalping typically involves closing out all positions by the end of the trading day, traders are not exposed to overnight risks such as overnight gaps or adverse news events that can impact prices while markets are closed.

- Flexibility: Scalping can be applied to various financial markets, including stocks, forex, futures, and options, providing traders with opportunities in different asset classes. Scalpers can adapt their strategies to different market conditions and trade multiple instruments based on current opportunities.

- Enhanced Liquidity: Scalpers contribute to market liquidity by frequently entering and exiting trades, helping to narrow bid-ask spreads and improve price efficiency. This can result in better execution prices for both scalpers and other market participants.

- Lower Exposure to Market Trends: Unlike longer-term trading strategies that may require holding positions for days, weeks, or even months, scalping focuses on short-term price movements that are less influenced by broader market trends or macroeconomic factors.

- Skill Development: Successfully scalping requires traders to develop discipline, patience, and quick decision-making abilities. Over time, traders can use their skills and intuition, becoming more proficient at identifying and capitalizing on short-term trading opportunities.

- Adaptability: Scalping strategies can be adapted to different market conditions, including both trending and range-bound markets. Scalpers may adjust their approach based on factors such as volatility levels, news events, or changes in market sentiment.

While scalping offers potential benefits, it’s important to note that it also comes with risks, including transaction costs, slippage, and the need for precise timing and execution. Traders should carefully consider their risk tolerance and skill level before engaging in scalping strategies.

Key takeaways

- Scalping is a short-term trading strategy focused on making numerous trades to profit from small price movements in highly liquid markets.

- Scalpers hold positions for very brief periods, often just seconds to minutes, and rely heavily on technical analysis.

- The strategy aims for small price targets and often uses leverage to amplify returns.

- While scalping can provide consistent profit potential and reduced overnight risk, it involves high transaction costs, requires advanced technology, and can be stressful due to its fast-paced nature.