- Study

- Slides

- Videos

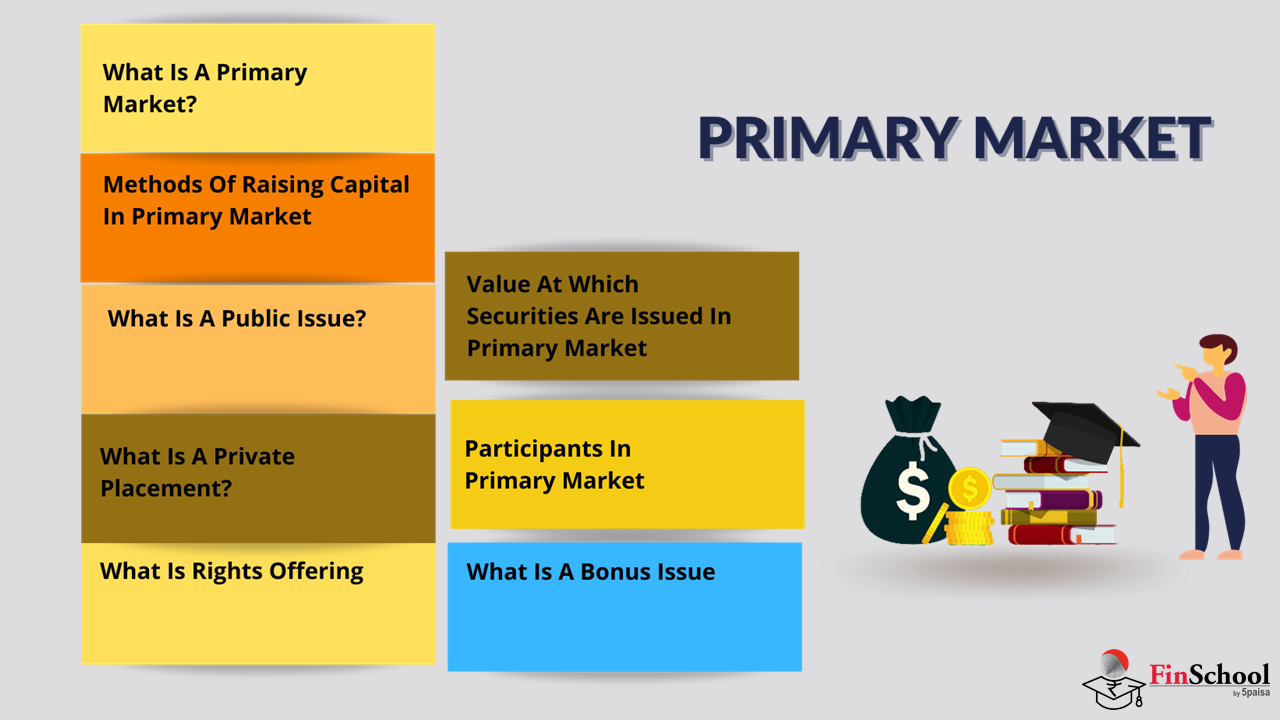

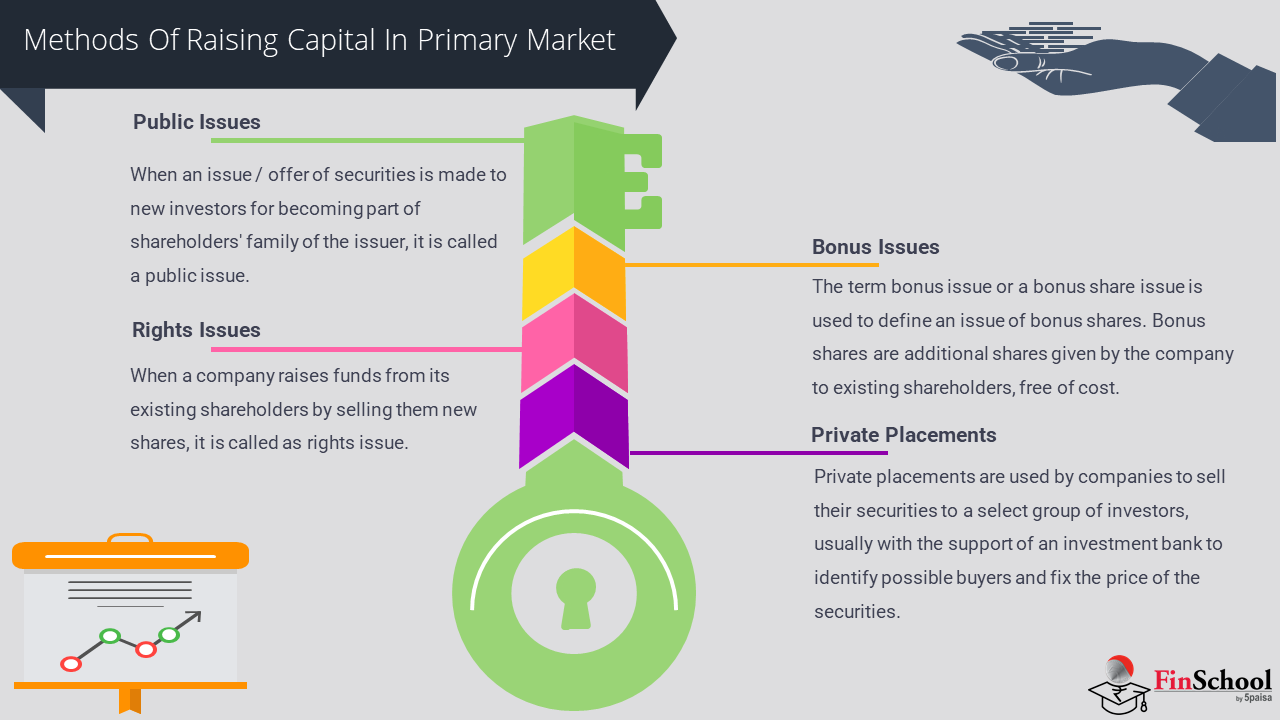

10.1. What is Implied Volatility??

Implied volatility (IV) is a critical concept in options trading, representing the market’s expectation of future volatility of the underlying asset. Here’s an in-depth understanding of implied volatility:

- Definition: Implied volatility is the estimated volatility of a financial instrument’s price derived from the price of its options. It reflects the market’s consensus on the potential magnitude of future price fluctuations.

- Option Pricing Model: Implied volatility is a key input in option pricing models, such as the Black-Scholes model or the more advanced models like the Binomial or Trinomial tree models. In these models, all other variables being equal, higher implied volatility leads to higher option prices.

- Contrast with Historical Volatility: Historical volatility is calculated from past price movements of the underlying asset. In contrast, implied volatility is forward-looking and reflects the market’s expectation of future volatility. It’s important to note that implied volatility can deviate from historical volatility.

Interpretation:

- High Implied Volatility: Indicates expectations of large price swings in the future. This could be due to upcoming news events, earnings announcements, economic data releases, or geopolitical events.

- Low Implied Volatility: Suggests expectations of relatively stable prices in the future. It could indicate periods of market complacency or uncertainty.

10.2.Impact on Option Premiums:

- Call and Put Options: Higher implied volatility leads to higher option premiums for both call and put options, reflecting the increased probability of larger price movements.

- Option Strategies: Implied volatility influences the choice of option strategies. Traders may use strategies such as straddles or strangles when expecting high volatility and strategies like covered calls or cash-secured puts when expecting low volatility.

- Volatility Skew and Smile: Implied volatility can vary across different strike prices and expiration dates, leading to volatility skew or smile. Skew refers to the difference in implied volatility between out-of-the-money, at-the-money, and in-the-money options. Smile refers to the pattern where implied volatility is higher for options that are significantly out-of-the-money or in-the-money compared to at-the-money options.

- Risk Management: Implied volatility plays a crucial role in risk management for option traders. It helps traders assess the potential risk of their positions and adjust their strategies accordingly to mitigate losses.

- Market Sentiment Indicator: Implied volatility can also serve as a sentiment indicator. A rapid increase in implied volatility may suggest fear or uncertainty in the market, while a decrease may indicate confidence or complacency.

10.3. What is the Significance of Implied Volatility??

Implied volatility (IV) holds significant importance in various aspects of financial markets and trading due to its predictive power and impact on option pricing. Here are some key significances of implied volatility:

- Option Pricing: Implied volatility is a crucial component in option pricing models like the Black-Scholes model. It represents the market’s expectation of future price volatility. Higher implied volatility leads to higher option premiums and vice versa. Therefore, it directly affects the cost of buying or selling options.

- Market Expectations: Implied volatility reflects market participants’ collective expectations regarding future price movements. A high implied volatility indicates anticipated significant price fluctuations, while low implied volatility suggests expectations of relatively stable prices.

- Risk Assessment: Implied volatility helps traders and investors assess the risk associated with holding or trading options. Higher implied volatility implies higher potential risk, as it suggests greater uncertainty and larger potential price swings. Traders often adjust their position sizes or employ risk management strategies based on implied volatility levels.

- Volatility Trading: Implied volatility itself can be traded through options or volatility derivatives. Traders may take positions based on their forecasts of implied volatility changes, aiming to profit from fluctuations in IV levels.

- Options Strategy Selection: Implied volatility plays a significant role in selecting options trading strategies. For instance, strategies like straddles or strangles are often used when implied volatility is expected to increase, while covered call writing or cash-secured puts may be favoured in low implied volatility environments.

- Market Sentiment Indicator: Implied volatility can serve as a sentiment indicator. Rapid increases in IV may signal fear or uncertainty in the market, potentially indicating a heightened risk of market downturns. Conversely, decreasing IV may indicate rising confidence or complacency.

- Earnings and Events Trading: Implied volatility tends to increase around events like earnings announcements, product launches, or regulatory decisions. Traders often analyze changes in implied volatility before and after such events to gauge market expectations and identify trading opportunities.

- Hedging and Risk Management: Implied volatility is used extensively in hedging and risk management strategies. For instance, options traders may adjust their positions based on changes in IV to hedge against adverse price movements or to fine-tune their portfolio’s risk exposure.

10.4. Implied Volatility and its Implications

Implied volatility (IV) is a crucial concept in options trading, reflecting market participants’ expectations regarding future price volatility of the underlying asset. Understanding IV and its implications is essential for options traders and investors. Here are some key implications of implied volatility:

- Option Pricing: Implied volatility directly impacts option prices. Higher implied volatility leads to higher option premiums, while lower implied volatility results in lower premiums. Traders use IV to assess whether options are overvalued or undervalued relative to their expectations of future volatility.

- Market Expectations: Implied volatility provides insights into market sentiment and expectations. High IV suggests anticipated significant price fluctuations, indicating uncertainty or fear in the market. Conversely, low IV indicates expectations of relatively stable prices, signaling confidence or complacency.

- Risk Assessment: IV helps traders assess the risk associated with holding or trading options. Higher IV implies higher potential risk, as it indicates greater uncertainty and larger potential price swings. Traders adjust their position sizes or employ risk management strategies based on IV levels.

- Volatility Trading: Implied volatility itself can be traded through options or volatility derivatives. Traders may take positions based on their forecasts of IV changes, aiming to profit from fluctuations in volatility levels. Strategies like volatility spreads or straddles are commonly used in volatility trading.

- Options Strategy Selection: IV plays a significant role in selecting options trading strategies. Traders choose strategies based on their expectations of IV changes. For instance, buying options (long volatility strategies) is favoured when expecting IV to increase, while selling options (short volatility strategies) is preferred in high IV environments.

- Event Trading: Implied volatility tends to increase around events like earnings announcements, product launches, or economic reports. Traders analyze changes in IV before and after such events to gauge market expectations and identify trading opportunities.

- Hedging and Risk Management: IV is used in hedging and risk management strategies. Traders adjust their positions based on changes in IV to hedge against adverse price movements or to fine-tune their portfolio’s risk exposure. For example, delta-neutral hedging involves adjusting options positions based on changes in IV to maintain a neutral delta.

- Historical vs. Implied Volatility: Comparing historical volatility (HV) with IV can provide insights into options pricing discrepancies. A high IV relative to HV may indicate overvalued options, while a low IV relative to HV may suggest undervalued options.

10.5 Implied Volatility and Options Scalping

Implied volatility (IV) plays a significant role in options scalping, a short-term trading strategy focused on profiting from small price movements in options or the underlying asset. Here’s how IV influences options scalping:

- Option Pricing: Implied volatility directly affects option prices. Higher IV leads to higher option premiums, while lower IV results in lower premiums. Options scalpers seek to capitalize on small price changes by buying options at relatively low premiums and selling them at higher premiums.

- Volatility Expansion: Options scalpers often target periods of volatility expansion, where IV increases rapidly. During such periods, option premiums rise quickly, providing opportunities for scalpers to profit from price movements. Scalpers may adjust their strategies based on changes in IV to maximize their profits.

- Option Selection: Options scalpers focus on options with short expiration dates and high liquidity, enabling them to enter and exit positions quickly. They may prefer options with relatively low IV, as they offer lower premiums and may provide better risk/reward opportunities for scalping.

- Scalping Volatility: Some options scalpers specialize in scalping volatility itself. They take advantage of IV fluctuations by buying options when IV is low and selling them when IV increases. This strategy requires precise timing and careful risk management to profit from changes in IV.

- IV Rank and IV Percentile: Options scalpers may use IV rank and IV percentile to gauge the current level of IV relative to its historical range. A high IV rank or percentile indicates that IV is relatively high compared to its historical values, potentially presenting opportunities for scalping options with high premiums.

- Gamma Scalping: Gamma scalping is a specific options scalping strategy that involves adjusting delta-hedged options positions to profit from small price movements. IV influences gamma scalping, as changes in IV can affect option delta and gamma, impacting the profitability of gamma scalping strategies.

- Event Scalping: Options scalpers may target events such as earnings announcements, product releases, or economic reports that can cause rapid changes in IV. By anticipating IV expansion or contraction around these events, scalpers can position themselves to profit from short-term price movements.

- Risk Management: Risk management is crucial in options scalping, especially when trading options with high IV. Scalpers use stop-loss orders and position sizing techniques to limit their potential losses. They may also hedge their positions using other options or the underlying asset to manage their risk exposure.

10.6 Impact of Implied Volatility in Options Chain Analysis

Implied volatility (IV) plays a crucial role in options chain analysis, as it provides insight into the market’s expectations for future price movements and the perceived risk of an underlying asset. Here are several ways in which implied volatility impacts options chain analysis:

1. Option Pricing

Implied volatility is a key input in option pricing models, such as the Black-Scholes model. Higher IV leads to higher option premiums because it indicates greater expected future volatility of the underlying asset. Conversely, lower IV results in lower premiums. This relationship is crucial for traders when evaluating the cost of entering options positions.

2. Market Sentiment

IV reflects the market’s sentiment about future volatility. When IV is high, it typically signifies uncertainty or fear in the market, often due to anticipated events like earnings announcements, economic reports, or geopolitical developments. Conversely, low IV suggests a more stable market environment. Traders use IV to gauge market sentiment and adjust their strategies accordingly.

3. Relative Value Analysis

Traders compare IV across different options to identify relative value. For instance, an option with unusually high IV compared to its historical levels or compared to IVs of similar options might be considered overvalued, suggesting a potential selling opportunity. Conversely, options with low IV might be seen as undervalued, indicating potential buying opportunities.

4. Volatility Skew and Smile

IV is not uniform across all strike prices and expirations. The pattern of IV across different strikes is known as the volatility skew or smile. For example, a common pattern is higher IV for out-of-the-money puts than calls, indicating higher perceived risk of a significant downward move. Analyzing the skew helps traders understand market expectations for different price levels and tailor their strategies (e.g., by selecting strikes with favourable IV characteristics).

5. Risk Management

Implied volatility affects the risk profile of options strategies. Strategies like straddles and strangles, which profit from significant price movements, become more attractive when IV is expected to increase. Conversely, strategies that benefit from stable prices, like iron condors or butterflies, may be more appropriate in low IV environments. By analyzing IV, traders can better manage their risk and optimize their strategies.

6. Predictive Power

While IV is not a perfect predictor, changes in IV can provide clues about upcoming market moves. For instance, a sudden increase in IV might precede a significant market event or announcement. Traders monitor IV trends as part of their overall market analysis to anticipate potential volatility and position themselves accordingly.

Example

Consider a stock currently trading at Rs 100 with two call options, both expiring in one month but with different strike prices: Rs 100 and Rs 110. If the IV for the Rs 100 strike call is 20%, while the IV for the Rs 110 strike call is 25%, the latter option is more expensive relative to its intrinsic value due to higher IV. A trader might infer that the market expects more significant movements beyond Rs 110 than around Rs 100, possibly due to an upcoming earnings report or other significant event.

Key Takeaways

- Implied volatility (IV) is a measure used in options trading to reflect the market’s expectations of future volatility of the underlying asset’s price. Unlike historical volatility, which looks at past price movements, implied volatility projects the market’s view of how volatile the asset will be in the future.

- Implied volatility directly affects option prices. Higher IV leads to higher option premiums, while lower IV results in lower premiums. Options scalpers seek to capitalize on small price changes by buying options at relatively low premiums and selling them at higher premiums.

- Implied volatility (IV) plays a crucial role in options chain analysis, as it provides insight into the market’s expectations for future price movements and the perceived risk of an underlying asset.