- Study

- Slides

- Videos

4.1 What is Gamma Options Scalping??

Gamma scalping is a sophisticated trading strategy used primarily by options traders to manage and profit from the changes in the delta of their options positions. To understand gamma scalping, it’s essential to grasp a few fundamental concepts in options trading: delta, gamma, and how they interrelate.

Gamma options scalping is an advanced options trading strategy aimed at profiting from the dynamic hedging of an options portfolio. It revolves around the concept of gamma, which measures the rate of change in delta (the sensitivity of the option’s price to changes in the price of the underlying asset).

Key Concepts

- Delta: Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset. For instance, if a call option has a delta of 0.5, its price is expected to increase by Rs 0.50 for every Rs 1 increase in the underlying asset’s price.

- Gamma: Gamma measures the rate of change of delta with respect to changes in the underlying asset’s price. It indicates how much the delta will change as the underlying asset’s price changes. High gamma means that delta is more sensitive to changes in the underlying asset’s price.

- Theta: Theta measures the rate of decline in the value of an option due to the passage of time, also known as time decay.

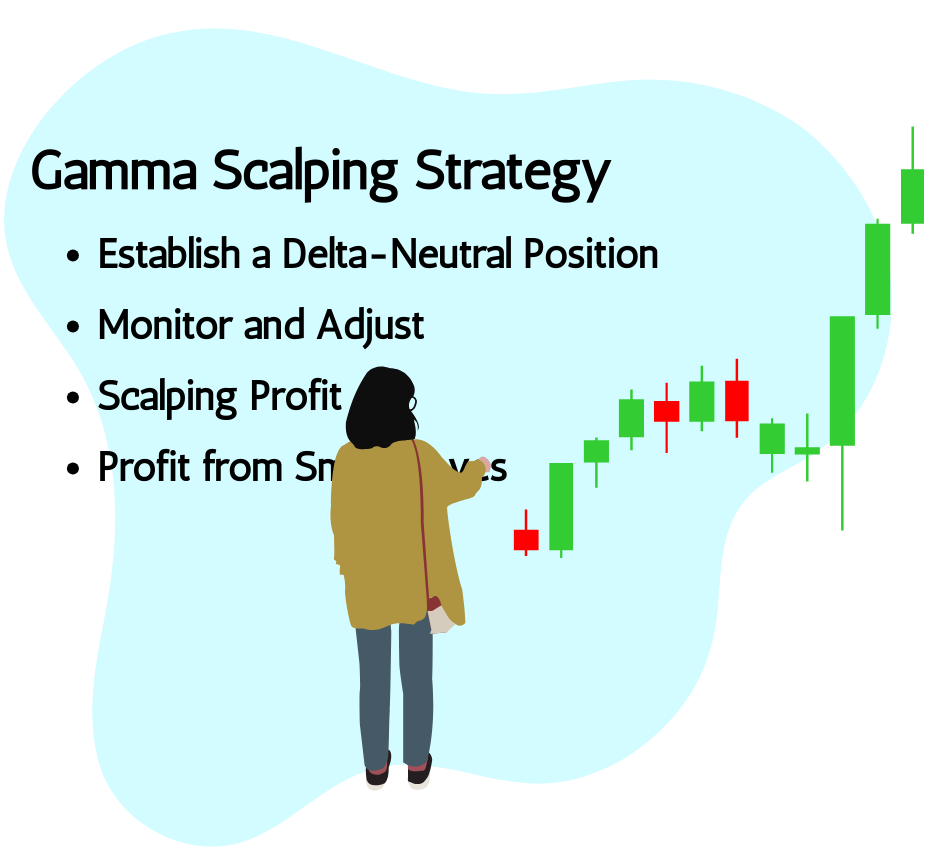

4.2 Gamma Scalping Strategy

The core idea behind gamma scalping is to capitalize on the small movements in the price of the underlying asset while maintaining a delta-neutral position. Here’s how it works:

- Establish a Delta-Neutral Position: Start by setting up a position that has a net delta close to zero. This could involve buying and selling a combination of options and the underlying asset to ensure that the total delta of the portfolio is neutral.

- Monitor and Adjust: As the price of the underlying asset moves, the delta of the options will change due to gamma. For instance, if you have a positive gamma position and the underlying price increases, the delta will become positive. If the underlying price decreases, the delta will become negative.

- Scalping Profits: To maintain delta neutrality, the trader buys or sells the underlying asset. For example, if the delta becomes positive due to an increase in the underlying asset’s price, the trader would sell the underlying asset to bring the delta back to neutral. Conversely, if the delta becomes negative, the trader would buy the underlying asset.

- Profit from Small Moves: Each adjustment to bring the delta back to neutral can result in a small profit, especially if the underlying asset’s price fluctuates frequently. These small profits add up over time.

4.3 Example

- Position Establishment:

- Suppose the stock is trading at Rs 100.

- You buy 10 at-the-money call options with a strike price of Rs 100. Each option has a delta of 0.5 and a gamma of 0.1.

- The total delta of your position is 10×0.5 = 5

- Initial Delta-Neutral Position:

- To make the position delta-neutral, you sell 5 shares of the stock (since your total delta from the options is 5).

Monitoring and Adjusting the Position

Scenario 1: Stock Price Increases

Stock Price Moves Up:

- The stock price rises from Rs 100 to Rs 101.

- The delta of each call option increases due to gamma: new delta = 5+0.1=0.6

- The new total delta of your options position is 10×0.6=6

Rebalancing

- To neutralize the new delta, you need to adjust your stock position.

- Initially, you sold 5 shares. Now, with a total delta of 6, you sell 1 more share to get back to delta-neutral.

- You now have sold a total of 6 shares.

Scenario 2: Stock Price Decreases

Stock Price Moves Down:

- The stock price falls back from Rs 101 to Rs 100.

- The delta of each call option decreases back due to gamma: new delta = 6−0.1=0.5

- The new total delta of your options position is 10×0.5=5

Rebalancing:

- To neutralize the delta, you need to adjust your stock position again.

- Now, you buy back 1 share to reduce the sold position back to 5 shares.

Calculating the Profits

Profit from Rebalancing:

- When the stock price rose from Rs 100 to Rs 101, you sold 1 share at Rs 101.

- When the stock price fell back from Rs 101 to Rs 100, you bought back 1 share at Rs 100.

- The profit from this round-trip transaction is Rs 101−Rs 100=Rs 1

Summary

- By frequently adjusting your stock position to maintain delta neutrality, you have captured a small profit from the stock’s price fluctuations.

- The key to gamma scalping is these repeated adjustments as the stock price oscillates around a certain range, locking in small gains each time.

Important Considerations

1. Transaction Costs:

Frequent buying and selling of the stock can incur transaction costs. Ensure that the costs do not outweigh the profits from gamma scalping.

- Market Conditions:

This strategy works best in a volatile market with frequent price fluctuations. In a trending market, adjustments might not be as frequent, and the strategy might not be as profitable.

- Theta Decay:

While gamma scalping, remember that options lose value over time (theta decay). The trader must manage this aspect carefully to ensure it does not erode profits.

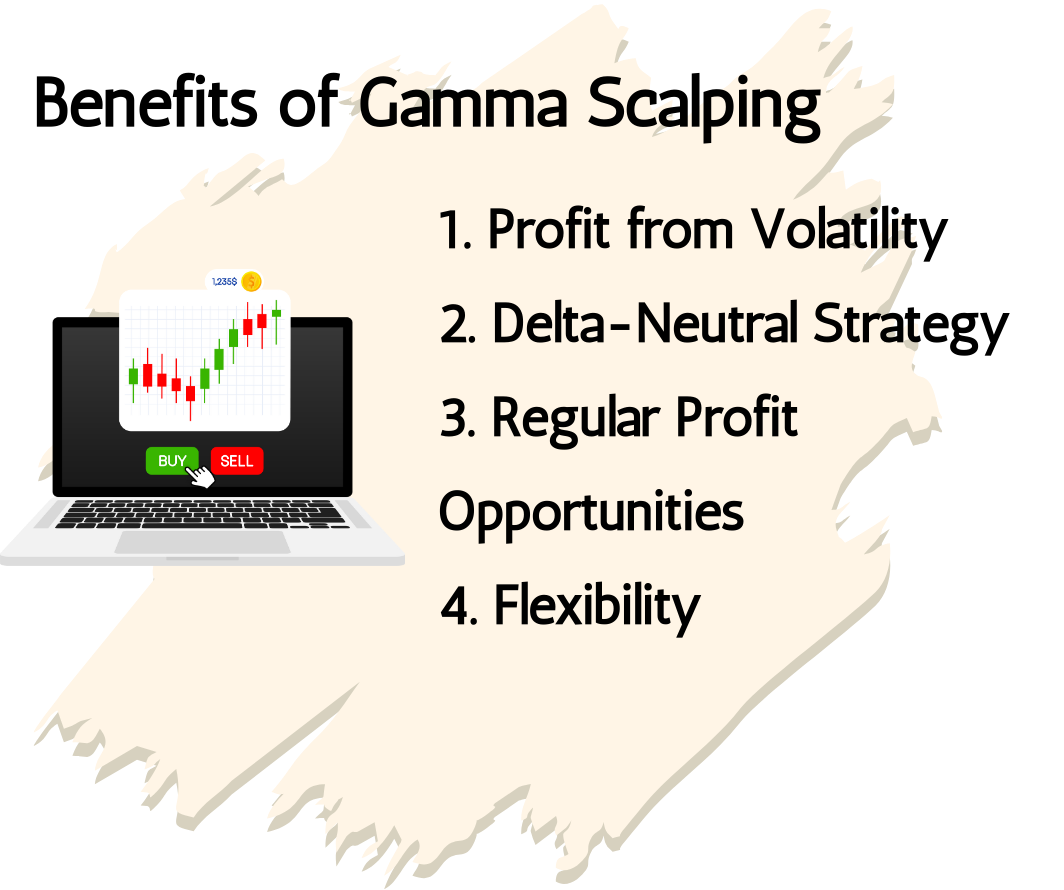

4.4 Benefits of Gamma Scalping

Gamma scalping offers several benefits, especially for traders who are adept at managing options and understanding the intricacies of the options market. Here are some of the key benefits:

1. Profit from Volatility

- Capitalizing on Price Movements: Gamma scalping is particularly effective in volatile markets where the underlying asset’s price frequently fluctuates. The strategy allows traders to profit from these frequent price movements through dynamic hedging.

2. Delta-Neutral Strategy

- Risk Management: By maintaining a delta-neutral position, gamma scalping reduces exposure to the directional risk of the underlying asset. This means that the portfolio’s value is not significantly affected by whether the underlying asset’s price goes up or down, allowing traders to focus on volatility rather than direction.

3. Regular Profit Opportunities

- Frequent Adjustments: The strategy involves constant buying and selling of the underlying asset to maintain a delta-neutral position. Each adjustment can yield small profits, which can accumulate over time.

4. Flexibility

- Adaptable to Market Conditions: Gamma scalping can be adjusted based on market conditions. Traders can increase or decrease their trading activity depending on the level of volatility in the market.

5. Enhanced Understanding of Market Dynamics

- Improved Market Insight: Engaging in gamma scalping requires a deep understanding of options Greeks and market movements. This can enhance a trader’s overall understanding of market dynamics and improve their trading skills in general.

6. Hedge against Other Positions

- Portfolio Hedging: Gamma scalping can be used as a hedging tool for other positions in a trader’s portfolio. By maintaining a delta-neutral stance, it can offset the risks of other trades that might be directional.

7. Scalability

- Small and Large Portfolios: The strategy can be applied to both small and large portfolios. It’s scalable because the principles of maintaining delta-neutrality and capturing small profits from price movements apply regardless of the portfolio size.

8. Potential for Non-Directional Profits

- Non-Directional Gains: Unlike directional trading strategies that require the underlying asset to move in a specific direction to make a profit, gamma scalping allows traders to profit from the mere existence of price movements, irrespective of the direction.

9. Exploiting Market Inefficiencies

- Inefficiency Capture: Gamma scalping can take advantage of short-term inefficiencies in the options and underlying markets. The frequent trading can help capture these inefficiencies before they are corrected.

10. Improved Risk/Reward Ratio

- Risk Control: By constantly adjusting the hedge, traders can control the risk more effectively compared to purely directional strategies. This improved risk management can lead to a better risk/reward ratio over time.

Practical Considerations

While gamma scalping offers several benefits, it is important to consider the following practical aspects to maximize its effectiveness:

- Transaction Costs: Frequent trading can lead to high transaction costs, which need to be managed carefully to ensure profitability.

- Execution Speed: The ability to execute trades quickly and efficiently is crucial. Delays in execution can result in missed opportunities or increased risks.

- Bid-Ask Spread: The cost of the bid-ask spread should be considered, especially in less liquid markets where spreads can be wider.

- Market Conditions: The strategy is most effective in volatile markets. In low volatility environments, the cost of maintaining the hedge might outweigh the benefits.

- Technological Support: Advanced trading platforms and tools can help manage the complex calculations and adjustments required for gamma scalping.

Key Takeaways

- Gamma scalping is a sophisticated strategy that offers numerous benefits, particularly for experienced traders who can effectively manage the dynamic adjustments required.

- It allows traders to profit from volatility, maintain a delta-neutral stance, and potentially achieve consistent returns through frequent trading.

- However, it requires careful consideration of transaction costs, market conditions, and execution efficiency to be successful.