Megha Engineering: Unravelling Mystery Behind Second Biggest Electoral Bond Buyer

What's happening with Megha Engineering?

Megha Engineering & Infrastructures Ltd (MEIL), In recent times has garnered significant attention after its name surfaced as second-largest buyer of electoral bonds between 2019 & 2023. This revelation has sparked curiosity surrounding company's business operations, its promoters, & its sudden prominence in political landscape. Here, we delve into details to uncover story behind Megha Engineering.

Company Profile

MEIL, closely-held company headquartered in Hyderabad, has emerged as major player in engineering, procurement, & construction (EPC) sector. With over 4,000 employees operating out of its expansive office complex, MEIL has made substantial contributions to various infrastructural projects across India. Notable among these is Zoji-la tunnel project, aimed at connecting Jammu & Kashmir with Ladakh, showcasing company's prowess in executing large-scale infrastructure projects.

Leadership & Growth

Led by P.V. Krishna Reddy, Managing Director, MEIL's journey from modest fabrication unit to diversified business conglomerate is remarkable. Reddy, commerce graduate, entered his uncle's business in early 1990s & learned ropes through hands-on experience. MEIL's breakthrough came with JalaYagnam project initiated by Andhra Pradesh government in 2004, catapulting company into spotlight with projects worth billions of rupees.

Project Portfolio

MEIL's project portfolio spans diverse sectors, including irrigation, hydrocarbons, roads, power, railways, & electric vehicles. MEIL's successful execution of prestigious projects such as Kaleshwaram & Polavaram has earned it recognition as leading EPC player in India. Additionally, MEIL's foray into international markets underscores its ambition to expand its footprint globally.

But what does Megha Engineering do? How do its financials look?

Financial Strength

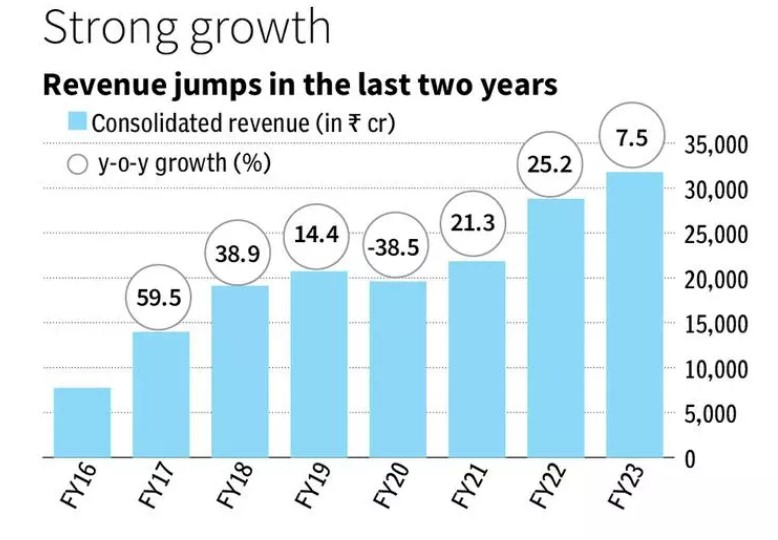

Despite its rapid expansion & substantial investments in infrastructure projects, MEIL maintains robust financial position. company's revenue growth, supported by strong order book, reflects its operational efficiency & market competitiveness. With healthy profit margin & low leverage, MEIL's financials outshine many peers in infrastructure sector, underlining its prudent financial management.

Diversification & Risk Factors

MEIL's diversification into sectors like hydrocarbons, gas distribution, & electric vehicles, along with its subsidiary ventures, demonstrates its strategic vision for growth. However, analysts caution against potential risks associated with unrelated businesses & corporate governance issues, urging vigilance in navigating these challenges.

Conclusion

MEIL's ascent as key player in Indian infrastructure landscape is testament to its entrepreneurial spirit, operational excellence, & strategic foresight. While its involvement in electoral bond transactions has drawn scrutiny, company's core strengths & track record of delivering landmark projects position it as formidable force in EPC sector. As MEIL continues to expand its horizons & contribute to nation's development, its journey remains one to watch closely.

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial.

Sachin Gupta

Sachin Gupta Ruchit Jain

Ruchit Jain Tanushree Jaiswal

Tanushree Jaiswal