Commodity Trading

- 50 Lakh+ Customers

- 4.3 App Rating

- 22.7 M+ App Downloads

What is Commodity Trading?

Commodity trading is a commodity market where buying and selling of various commodities and their derivative products take place. These commodities are primarily categorized into metal, energy, livestock and meat, and agriculture.

For investors, the mcx commodity market from MCX (Multi Commodity Exchange of India Ltd), one of India's leading national commodity exchanges, is a way to diversify their portfolios beyond traditional securities.

There are various ways to invest in commodities, such as commodity futures contracts, options & exchange traded funds (ETFs).

Commodity Trading Pairs for India

| Commodity | INR Price | Change | Change(%) |

|---|---|---|---|

| Crude oil | 7106 | 136 | 1.95% |

| Gold | 163391 | 2283 | 1.42% |

| Natural Gas | 282.4 | -6.1 | -2.11% |

| Silver | 267042 | 8567 | 3.31% |

| Zinc | 327.85 | 0.9 | 0.28% |

5 Reasons to Invest in Commodities with 5paisa

Diversify & reduce your portfolio risk by investing with commodities

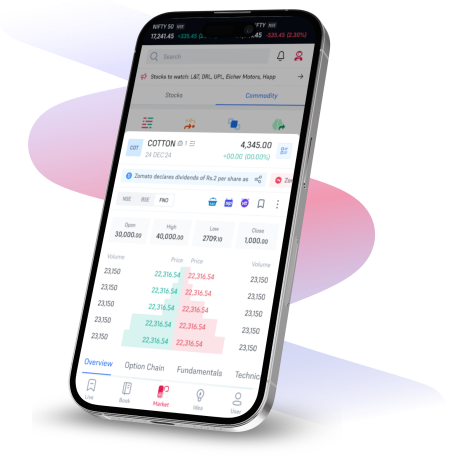

Use web or mobile platform to invest in commodities from your couch

Analyze charts and trade commodities in real time.

Learn about commodities at 5paisa school

Execute all orders at Flat fees of ₹20/order

Fill in your personal details required for account opening & select Derivatives segment while proceeding with your account opening journey.

In addition to the below mentioned list of documents, submit your income proof that is required for trading in derivatives segment.

Post verification, your trading account will be activated and you can start investing in currencies.

Commodity Basics

Brief about the chapter on equity market, covering

topics on equity, averaging, understanding trading psychology.

Level: Beginner

- 4.8

- 2.1K

FAQs

Just like any other market trading commodity market takes place where traders can buy or sell or trade in various commodities at current or future date. Similar to stock trading, investors can invest in commodities through various commodity exchanges.

MCX (Multi Commodity Exchange) offers trading in commodity derivative contracts across varied segments including bullion, industrial metals, energy and agricultural commodities, as also on indices constituted from these contracts. The clearing corporation provides collateral management and risk management services, along with clearing and settlement of trades executed on the Exchange.

Multi Commodity Exchange of India Ltd is an independent commodity exchange established in November 2003 and is based in Mumbai. It is India's largest commodity derivatives exchange.

Apart from three sectoral indices that are the Base Metal index, the Bullion index and the Energy index, there are nine single-commodity indices, which includes agricultural commodities like corn, wheat, cotton, soybean, cereals and pulses, spices and much more.

To trade in commodities through 5paisa, you would first need to activate Derivatives segment while opening your account. There are no additional charges applicable for activation if you already have a trading and Demat Account with 5paisa.

Trading holidays at MCX are different than other stock market holidays. At 5paisa we provide a list of MCX holidays at our Trading Holidays section.