Content

- Risk Compression vs Probability Cushion

- Gamma Risk and Strike Proximity

- Implied Volatility (IV) Impact: When Vega Comes into Play

- Payoff Symmetry and Margin Efficiency

- Tactical Deployment: When to Choose Which

- Adjustments and Exit Strategy

- Final Thoughts: Strategy Depends on Volatility, Not Preference

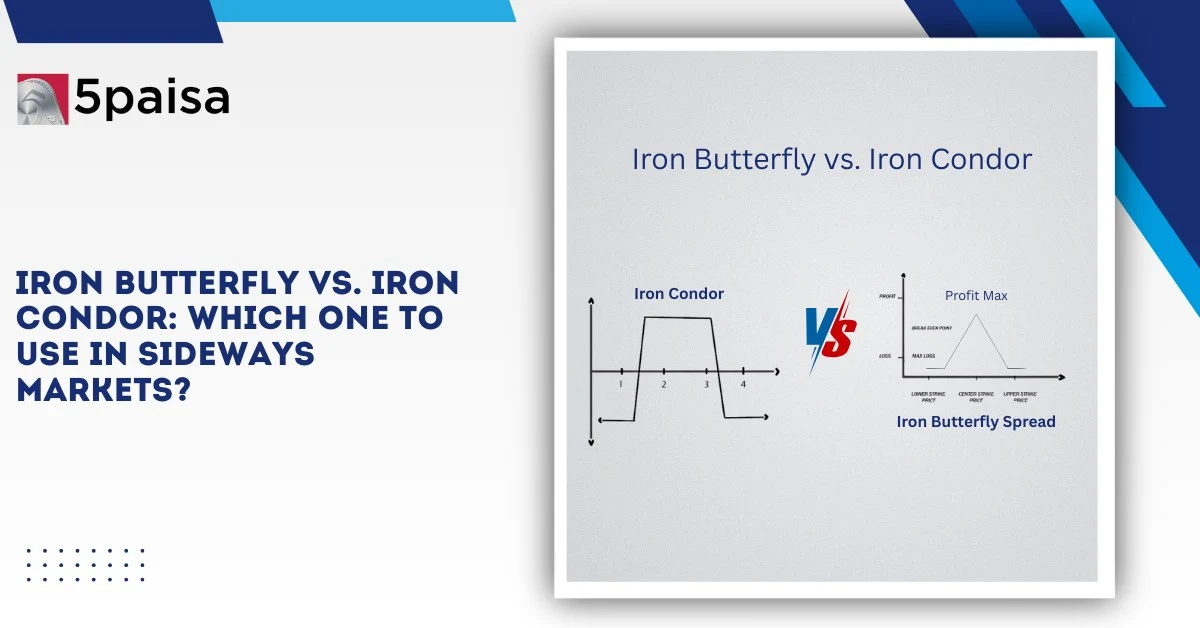

For experienced options traders navigating low-volatility environments, Iron Condor and Iron Butterfly setups are two of the most powerful strategies in the non-directional arsenal. While they may appear structurally similar — both being four-legged spreads with limited risk and capped profit — the real tactical edge lies in the nuanced differences around risk compression, strike placement psychology, and implied volatility (IV) behavior.

This deep dive goes beyond definitions to dissect which setup offers a better edge based on volatility skew, premium decay, gamma exposure, and strike symmetry.

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Frequently Asked Questions

Both risk and profit are lower with the iron condor. Both risk and profit are higher for an iron butterfly.

With call and put credit spreads that share short strikes, an iron fly is an iron condor. A long spread using the same strikes is synthetically comparable to an iron fly.

It is a risk-defined, multi-legged, neutral strategy that offers greater safety at the expense of a smaller profit.

The position could be closed by closing the entire iron butterfly at any point before expiration.

Every tactic is named after a flying animal, such as a condor or butterfly.