Content

- What is a Long Call Calendar Spread?

- How is a Long Call Calendar Spread Constructed?

- How Does a Long Call Calendar Spread Work?

- Example of a Long Call Calendar Spread

- When Should Investors Consider Using a Long Call Calendar Spread?

- Wrapping Up

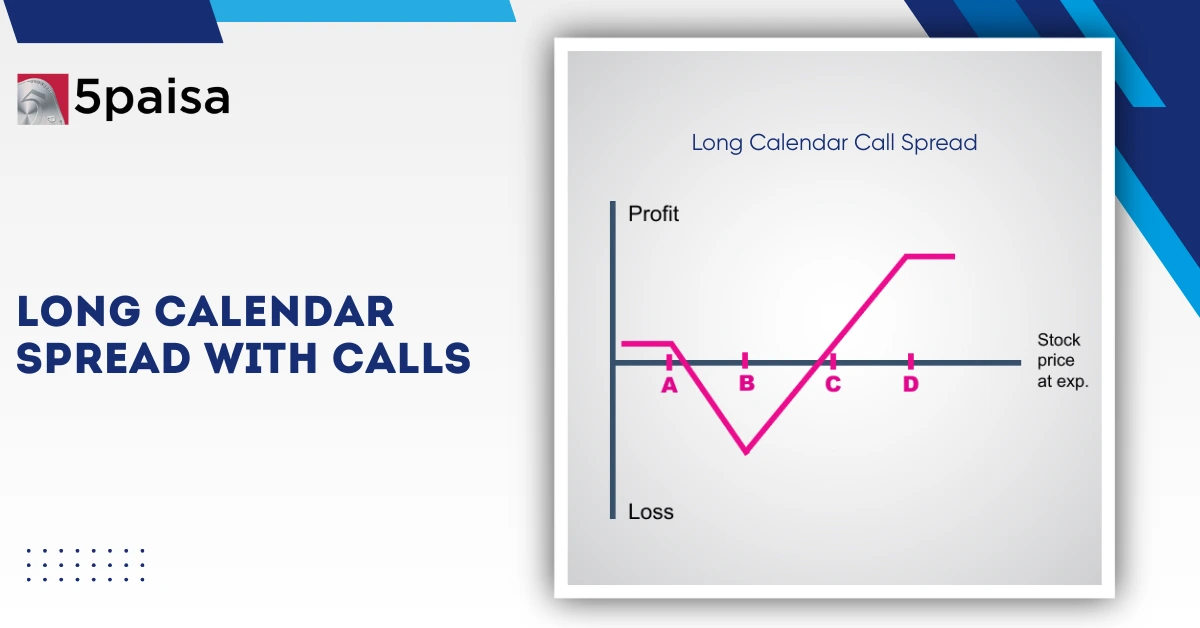

There are countless strategies in the trading world. While some are simple, others are a bit more advanced. Choosing the right strategy depends on what the market is doing and what you expect next. If you are looking for a strategy that can be implemented when the market is not moving much, then you have come to the right place. In this article, we will understand what the Long Call Calendar Spread or Long Calendar Spread with Calls is and how you can benefit from it.

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.