Intraday in Stocks vs 24x7 Crypto Trading: Which Actually Works for Retail Investors?

NSE’s Co location Scam is Bigger than you think!

Let me tell you a story, there was a woman who was in the senior-most position in one of the leading stock exchanges in India, now during her tenure she introduced the facility of Co-location, it is basically when exchanges offer dedicated spaces in the exchange building which are close to exchanging servers to high frequency and algo traders.

Their servers are in close proximity to exchange servers therefore their orders are executed faster than others. These co-locations are generally used by institutional investors and brokers.

Now, the problem is when they started providing the facilities, they created their infrastructure in such a way that they could provide undue advantage to certain brokers. The infrastructure was created in a way that some brokers could connect to the exchange servers faster and get the price information ahead of others, this early access would help them make illegal money through trades.

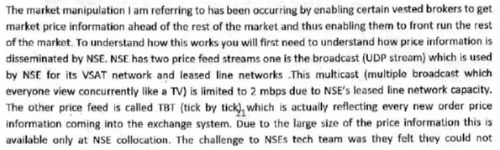

I am no tech geek here, but I happen to come across a letter that was sent by a whistleblower to NSE and SEBI, which explained the Modus operandi of this system.

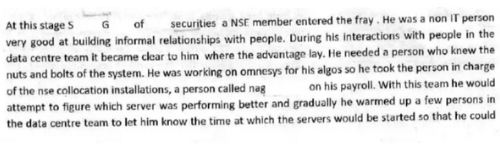

In the letter, these brokers had used their connections in the data center staff of NSE, to get the advantage. One name that was taken by the whistle blower , quite a few time was Sanjay Gupta, MD of OPG securities, he mentioned that he contacts in NSE data center staff and through his contacts and a software he got access to the stock prices early. Due to which he was able to make copious amounts of money.

The scam and the woman recently came into the limelight after she was arrested and questioned about the wrongdoings. The scam nearly cost Rs. 75000 crores to the investors.

We are talking about Chitra Ramakrishnan here, she was arrested for her involvement in the scam, and after her probe CBI recently arrested Sanjay Gupta, MD of OPG securities.

Start Investing in 5 mins*

Get Benefits worth 2100* | Rs. 20 Flat Per Order | 0% Brokerage

Now, this isn’t it, they believe there is a cartel of people that were helping Sanjay in approaching SEBI, also they believe he had bribed the officials for destroying the evidence.

Can you believe this could happen in one of the oldest and largest stock exchanges in the world? Well, it did.

But while going through all the drama, I was wondering whenever NSDL or NSE comes with an IPO, CBI is suddenly active in a scam that happened almost a decade ago, do you also think so?

- Flat ₹20 Brokerage

- Next-gen Trading

- Advance Charting

- Actionable Ideas

Trending on 5paisa

02

5paisa Research Team

5paisa Research Team

Indian Stock Market Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

Sachin Gupta

Sachin Gupta

5paisa Research Team

5paisa Research Team