Content

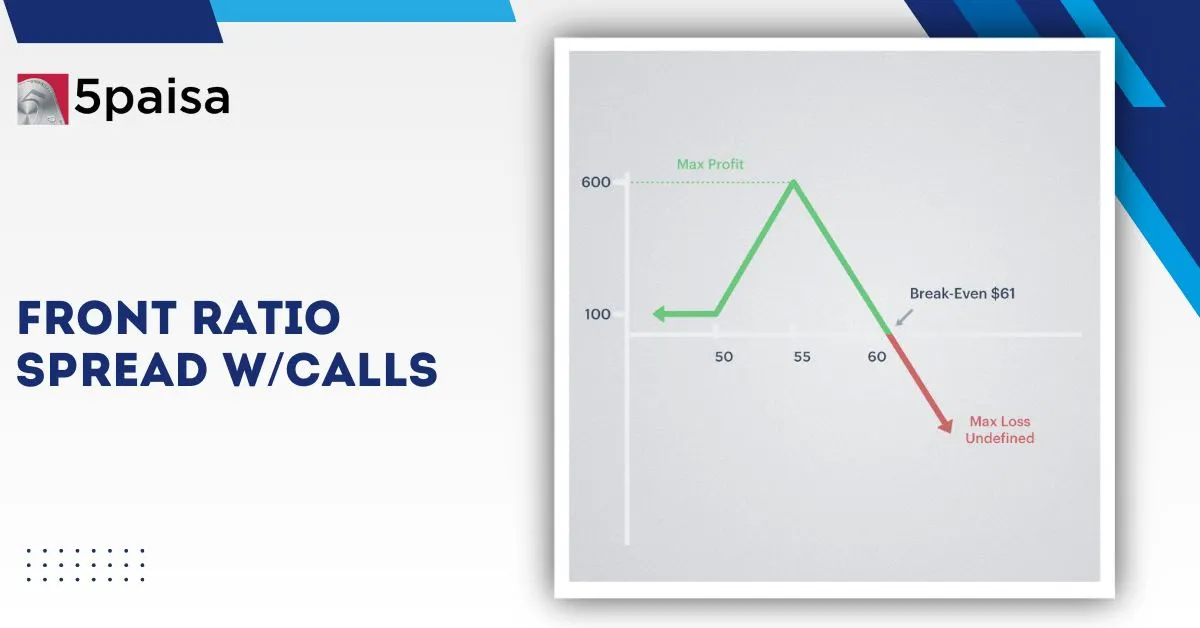

A Front Ratio Put Spread is an options strategy that involves buying one At-the-Money (ATM) put option and selling two Out-of-the-Money (OTM) put options of the same expiry. It is designed to benefit from a neutral to moderately bearish outlook on the underlying asset, and the strategy generates a net credit at the time of initiation.

Since more options are sold than bought, this approach brings in a net premium and allows traders to profit when the underlying price moves slightly lower or stays around the short strike at expiry. However, if the price falls sharply below the breakeven point, the unhedged short put begins to incur losses, making the downside risk unlimited.

This strategy is best suited for experienced traders who can closely monitor positions and adjust if the market turns sharply bearish. Let’s take a look at an example to understand the setup of a front ratio put strategy

More Articles to Explore

- Difference between NSDL and CDSL

- Lowest brokerage charges in India for online trading

- How to find your demat account number using PAN card

- What are bonus shares and how do they work?

- How to transfer shares from one demat account to another?

- What is BO ID?

- Open demat account without a PAN card - a complete guide

- What are DP charges?

- What is DP ID in a demat account

- How to transfer money from demat account to bank account

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.