How lipsticks and men's underwear can predict a recession?

You see things in our economy have not been well recently. Inflation is rising, currently, it is at 6.16%. There are fears of recession and economic slowdown.

The World bank has cut the GDP forecast for FY22-23 from 8.7% to 7.5%. Globally, major economies in the world are expected to enter a recession.

According to Nomura,“Increasing signs that the world economy is entering a synchronized growth slowdown, meaning countries can no longer rely on a rebound in exports for growth, have also prompted us to forecast multiple recessions,”

Well, recession is not really bad for all industries, some sectors flourish during a recession, while some are untouched by it.

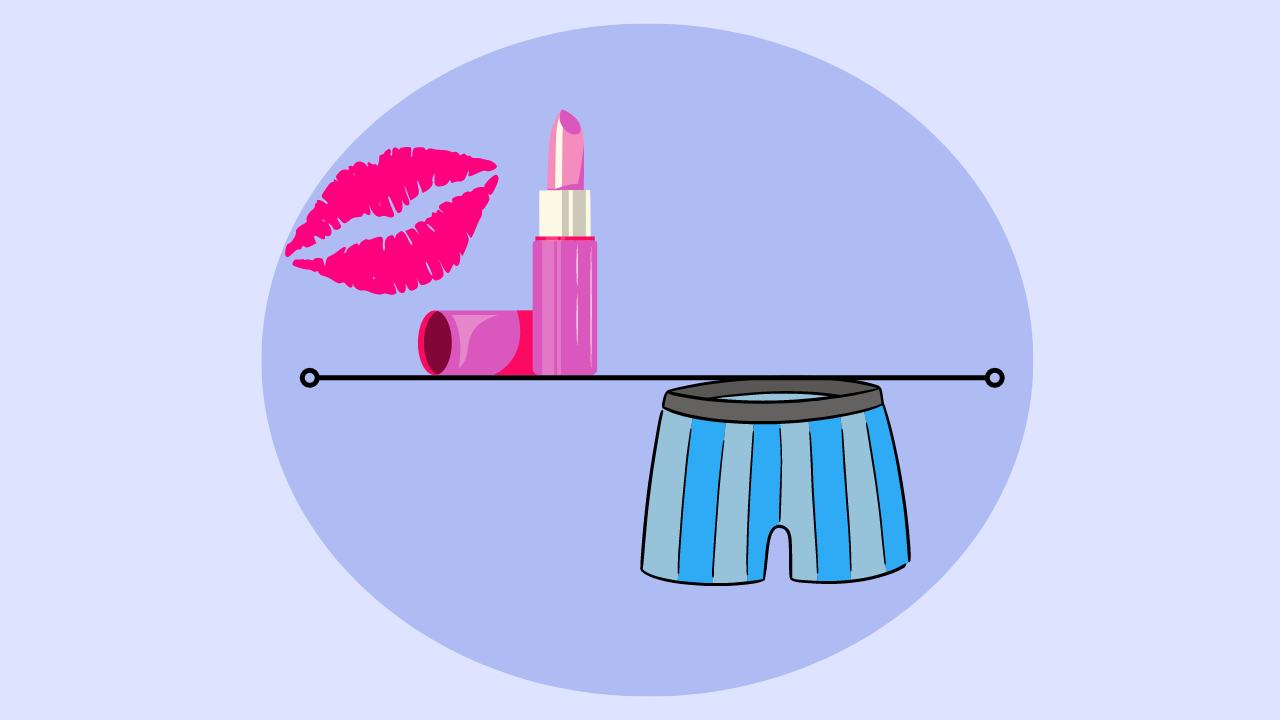

One product that sells well in a recession is Lipsticks and they sell so well that they are an economic indicator of a recession. It is known as the lipstick effect, which says that during a recession the sales of lipstick surge because it is a feel-good product for women. In bad, times women indulge in buying lipsticks because they make them feel good and they are not heavy on the pocket either.

Well, as they say, “Give a woman the right lipstick and she can conquer the world.”

Lipsticks are instant mood lifters, they are easy to apply, they lift up the face with just a swatch, and women feel attractive wearing lipstick.

During a recession or bad times, when they have less money, they don’t invest in skin care or cleansers that are used in private, rather they indulge in luxury lipsticks that make them feel good amidst the bad times.

The theory was coined by Professor Juliet Schor in her 1998 book The Overspent American.

She mentioned, “They are looking for affordable luxury, the thrill of buying in an expensive department store, indulging in a fantasy of beauty and sexiness, buying ‘hope in a bottle.’ Cosmetics are an escape from an otherwise drab everyday existence,”

Even Leonard Lauder, chairman of Estee Lauder, one of the biggest cosmetic company, agreed to this theory and provided evidence to support it. He mentioned that the company reported a spike in lipstick sales after the 9/11 terrorist attacks and 2008 recession as well!

A research group that studies the effect noted that lip makeup (which includes lip gloss and other pucker enhancers) was the fastest growing area in the makeup category for 2022 in the US, where the economy is showing clear signs of recession. Sales revenues in the first quarter were up 48% compared with the same period in 2021.

In India as well, the lipstick effect witnessed in 2020, amidst the pandemic cosmetic companies like Nykaa, HUL, and My glam witnessed a splurge in their sales.

Most economists believe that during a recession, people cut down on expensive and nonessential items, and they increase their spending on feel-good products, like ice-creams, OTT subscriptions, things that divert their minds off the harsh reality.

Well, if you feel the sale of lipsticks predicting a recession is absurd, then the men’s underwear index that predicts a recession would sound more absurd but it does exist.

Former Federal Reserve head Alan Greenspan believes Men’s underwear are an important economic indicator.

He believes that male underpants are the most private clothing for them, no one really sees them. So whenever they are tight on money, they don’t replace their underpants.

Well, if you think, I have gone crazy, then there is evidence that supports Greenspan’s theory. Men's underwear sales in the United States fell significantly from 2007 to 2009 during the Great Recession but rebounded in 2010 as the economy recovered.

In India as well, in the quarter ended Mar 22, the sales of Page Industries, which owns the brand Jockey and Lux industries fell from the previous quarter. So, what do you think is the decline in quarterly sales a mere coincidence or it is indicating a recession?

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial. Also, The

Tanushree Jaiswal

Tanushree Jaiswal