- Home

- IPO

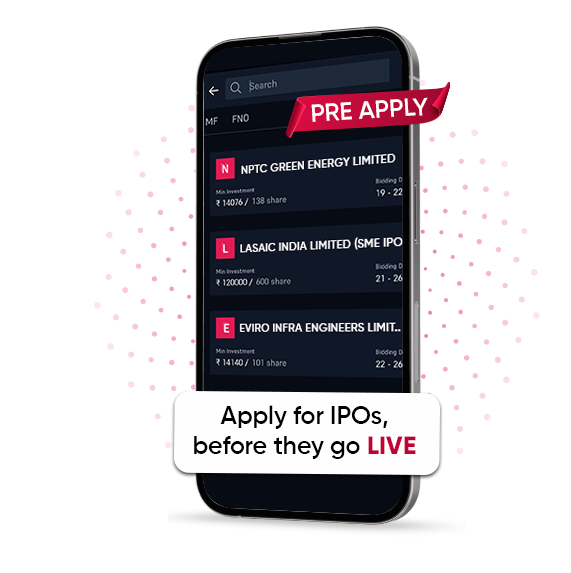

IPO - Initial Public Offering

With just a few clicks, invest in upcoming IPOs!

Complete guide to all IPO-related information!

- IPO Name

- Issue Date

- Price

- IPO Size

-

PAN HR Solution Ltd

SME

PAN HR Solution Ltd

SME

- Issue Date 6 Feb - 10 Feb

- Price ₹ 74

- IPO Size ₹ 16.16 - 17.04 Cr.

-

Biopol Chemicals Ltd

SME

Biopol Chemicals Ltd

SME

- Issue Date 6 Feb - 10 Feb

- Price ₹ 102

- IPO Size ₹ 29.52 - 31.26 Cr.

How to Apply for an IPO on 5paisa?

Trending News about IPOs

- 06-02-2026

- 05-02-2026

- 05-02-2026

- 04-02-2026

About Mainboard & SME IPOs

What is an initial public offering (IPO)?

An Initial Public Offering (IPO) is the process by which a private company makes its shares available to the public for the first time, allowing investors to acquire ownership of the firm. Companies frequently use the move from private to public to obtain funds for expansion, debt repayment, and other economic operations. Investing in an IPO can give prospects for early involvement in a company's growth, but it is not without risk.

How does an IPO work?

- Private companies that have achieved the ‘unicorn status’ in their growth trajectory, generally decide on ‘going public’.

- In India, the process of IPO is regulated by the Securities and Exchange Board (SEBI), so the first step is to register with SEBI.

- After submitting all the required documents and on receiving approval from SEBI, the company is required to determine the share price and the number of shares it plans to issue.

- Following this, the company must choose between the two types of IPO issues- Fixed price IPO and Book Building IPO.

- After IPO valuation, the company’s shares are made public.

Procedure for investing in IPO

- Acquire the application form, either physically from a broker, a distributor, or from an online portal like 5paisa

- Fill the form with all the required details including personal, bank, and Demat account details.

- Provide details about the total investment amount.

- The shares will be allotted to an individual within 10 days of closing of the offer.

Who is eligible for applying for an IPO?

An adult who is capable of entering into a legal contract is considered eligible for investing in a mainboard IPO or an SME IPO. The individual can be a qualified institutional investor, anchor investor, retail investor or a high net-worth individual. Apart from this, some basic criteria for eligibility are:

- The individual should have a pan card issued by the income tax department.

- A valid Demat account

- It is not mandatory to have a trading account for investing in an IPO but it is advisable to have one. A trading account will help an investor sell the stocks present on the IPO listings, in near future.

Steps to apply for an IPO from 5paisa

There are five steps to apply for an IPO from 5paisa

- Login to the 5paisa account and select the issue from the current IPO section, under mainboard & SME IPOs.

- Based on the individual’s preference, one can select the number of lots and price for the desired mainboard IPO or SME IPO.

- Enter the UPI ID, check all the details, and select submit. With this, the process is completed and the bid will be placed with the exchange.

- Finally, the individual needs to approve a mandate notification received in their UPI app.

Open a demat account with 5paisa now!

FAQs

When it comes to an IPO, there are 4 types of investors who can bid, as per SEBI guidelines. They are –

1. Qualified institutional investors (QIIs)

2. Anchor investors

3. Retail investors and

4. High net-worth individuals (HNIs)/Non-institutional investors (NII).

IPO subscription period is the period of time during which investors can promise to purchase shares of a security to be issued as initial public offering (IPO).

To invest in IPOs, you can check our List of Upcoming IPO here at 5paisa.

Before applying for an IPO, it’s important to read the Red Herring Prospectus (RHP) carefully. It provides key details about the company’s business model, financials, risks, and how the IPO proceeds will be used. Also, assess the company's fundamentals, industry outlook, and valuation to make an informed decision.

Investors can use an IPO registrar to check the status of their subscription. The investor will need his PAN card number, IPO application number, and Demat account number in order to verify the status of his IPO subscription. The investor will get the information under the search button on the registrar's or BSE's website if the shares are allocated.

Investors receive information from BSE, NSE, CDSL, and NSDL via shared Email and SMS.

To read an IPO prospectus, start by focusing on key sections: the "Business Overview" to understand the company's operations and market potential, the "Financial Statements" to assess profitability and financial health, the "Risk Factors" to identify potential challenges and risks, and the "Use of Proceeds" to see how the raised funds will be utilized. Finally, check the "Management Discussion and Analysis" for insights on future strategies and growth opportunities.

Verify Your Details

Krishca Strapping Solutions Limited

sme- Date Range 23 Oct- 27 Oct’23

- Price 200

- IPO Size 23

Apply IPO “Hassle Free” even without opening a Demat Account with 5Paisa.

Verify Your Details

We have sent an OTP on your mobile number .

Krishca Strapping Solutions Limited

sme- Date Range 23 Oct- 27 Oct’23

- Price 23

- IPO Size 200

Be a part of 5paisa community - The first listed discount broker of India.

- Flat brokerage

- Dedicated platform for F&O

- 0 account opening charges

- Trade on charts

- MTF facility up to 4X leverage

- 0%* Commission on Mutual funds

By proceeding, you agree to all T&C*