Crypto Trading Strategy Basics: How Traders Interpret Digital Asset Movements

Gann Trading Strategy: A Look at Gann’s Geometric and Time-Based Concepts

Last Updated: 1st January 2026 - 04:33 pm

The Gann trading strategy is a popular approach that uses geometric angles and time cycles to study market behaviour. It helps traders understand how price moves and how trends shift. Many traders use it to spot support, resistance, and reversal points with more structure and clarity.

Before jumping in, explore how options trading works and what drives price movement in derivatives market.

Understanding Gann’s Core Ideas

W.D. Gann believed that markets follow natural cycles. He also argued that price and time move in harmony. His work focused on how angles reveal the strength of a trend. The 1x1 angle, set at 45 degrees, remains one of his most important tools because it shows a balanced market.

Gann suggested that price tends to react when it touches key angles. This idea forms the base of the Gann trading strategy. Traders draw these angles from major tops or bottoms to identify the shift from bullish to bearish conditions.

Price and Time in Market Analysis

Price study helps traders find support and resistance levels, which are spots where the price might stop or change direction. Time study gives hints about when a trend might shift. When used together, they make the market easier to understand. If the price falls below the 1x1 angle, the trend usually becomes weaker. If it moves above the 1x1 angle, the trend often becomes stronger and gains momentum.

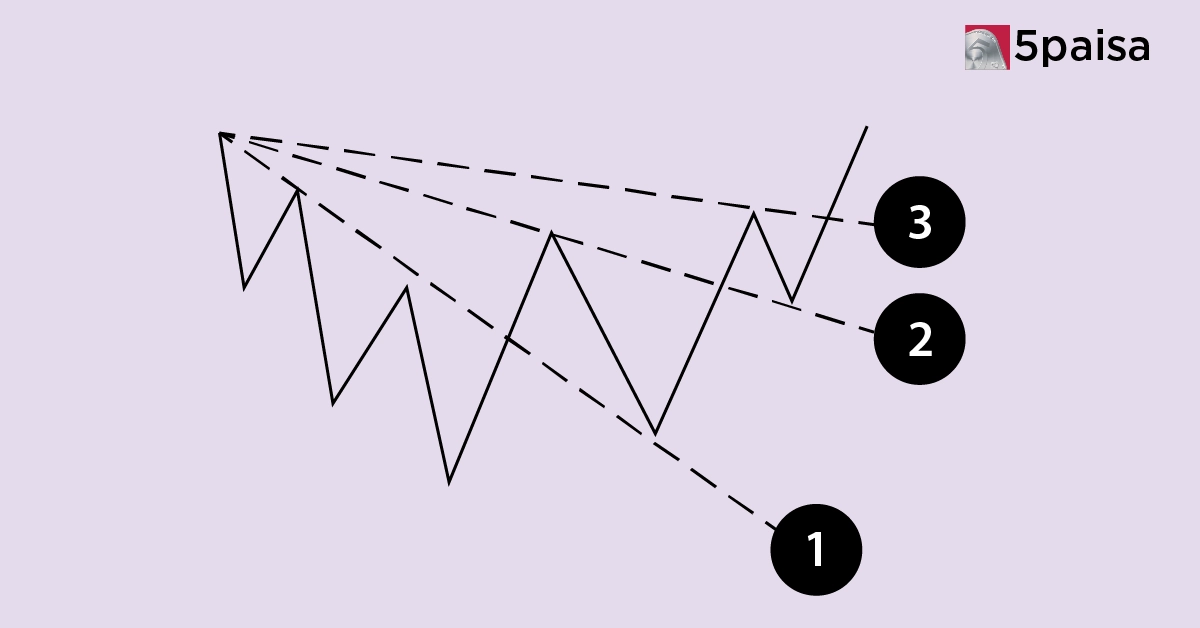

Using Gann Angles in Trading

Traders draw angles like 1x1, 2x1, or 1x2 on price charts to see how the market is moving. These angles work like simple guideposts. They help traders understand how strong a trend is and where the price might change direction. The market often moves from one angle to another, which gives traders a clearer idea of what might happen next.

Some traders also use the 50 per cent retracement level as a key point. It often acts as support in an uptrend or resistance in a downtrend. These levels create price clusters that highlight important trading zones.

Conclusion

The Gann trading strategy gives people a clear and organised way to study the stock market. It uses simple ideas like angles, patterns, and time cycles to understand how prices move. Traders who follow this method carefully often find it easier to see trends and decide when to buy or sell with more confidence.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advanced Charting

- Actionable Ideas

Trending on 5paisa

02

5paisa Capital Ltd

5paisa Capital Ltd

Fundamental & Technical Analysis Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.