Which Indicators Actually Help in Options Trading? A Practical Guide

Understanding the Fibonacci Trading Method: Retracements, Extensions & Market Behaviour

Last Updated: 21st November 2025 - 03:33 pm

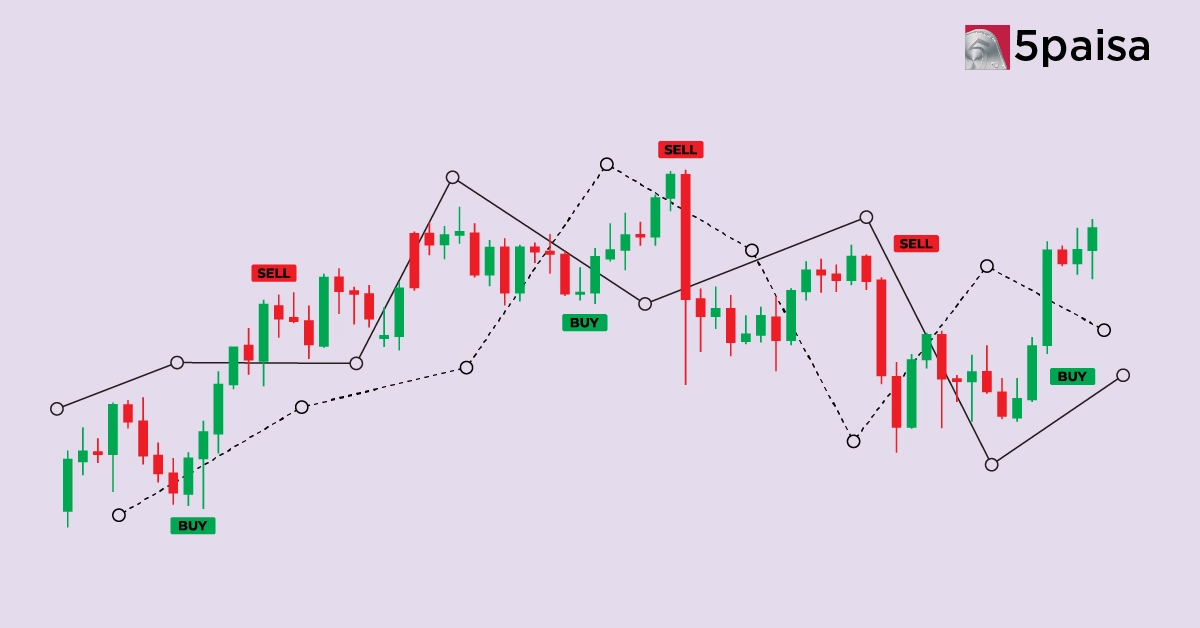

The Fibonacci trading method is a simple way to understand market movements and identify key turning points. It is based on a number sequence introduced by Leonardo Fibonacci, an Italian mathematician. This sequence appears across nature, and many traders believe it reflects human behaviour in financial markets. As a result, the fibonacci trading strategy is widely used to read price action and spot potential opportunities.

What Is the Fibonacci Trading Method?

Fibonacci tools use specific ratios to map price levels on a chart. These levels help traders find areas where the market may pause or reverse. The approach is easy to understand, and it offers a structured way to view chart patterns. Many traders rely on it because it brings clarity to uncertain market conditions.

Fibonacci Retracements

Fibonacci retracements are the most recognised part of the method. Traders mark levels such as 38.2%, 50%, and 61.8% to measure pullbacks. These lines often act as support or resistance. They help traders judge whether the market is correcting briefly or preparing for a deeper shift. This makes retracements useful for finding entry and exit zones while keeping the process simple.

Fibonacci Extensions

Fibonacci extensions project price targets beyond the 100% level. Traders use them after a strong move or breakout. Common levels include 127.2% and 161.8%. These levels help estimate how far a trend may continue. They offer a clear view of potential future swings, and they support more confident planning during trending markets.

Market Behaviour and Fibonacci

Markets do not always follow Fibonacci levels because price is influenced by news, sentiment, and broader conditions. Even so, Fibonacci tools remain helpful because they guide traders through shifting trends. When combined with trendlines, moving averages, or candlestick patterns, the fibonacci trading strategy becomes more reliable and easier to apply.

Conclusion

The Fibonacci method offers a simple framework for reading market rhythm. It helps traders manage risk, plan trades, and interpret price swings with better structure. While not perfect, it remains a valuable tool for those seeking a clear and practical approach to market behaviour.

- Flat Brokerage

- P&L Table

- Option Greeks

- Payoff Charts

Trending on 5paisa

Futures and Options Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd

5paisa Capital Ltd

5paisa Capital Ltd