Power shift at Tata Trusts: Majority Vote Marks End of Mehli Mistry’s Tenure

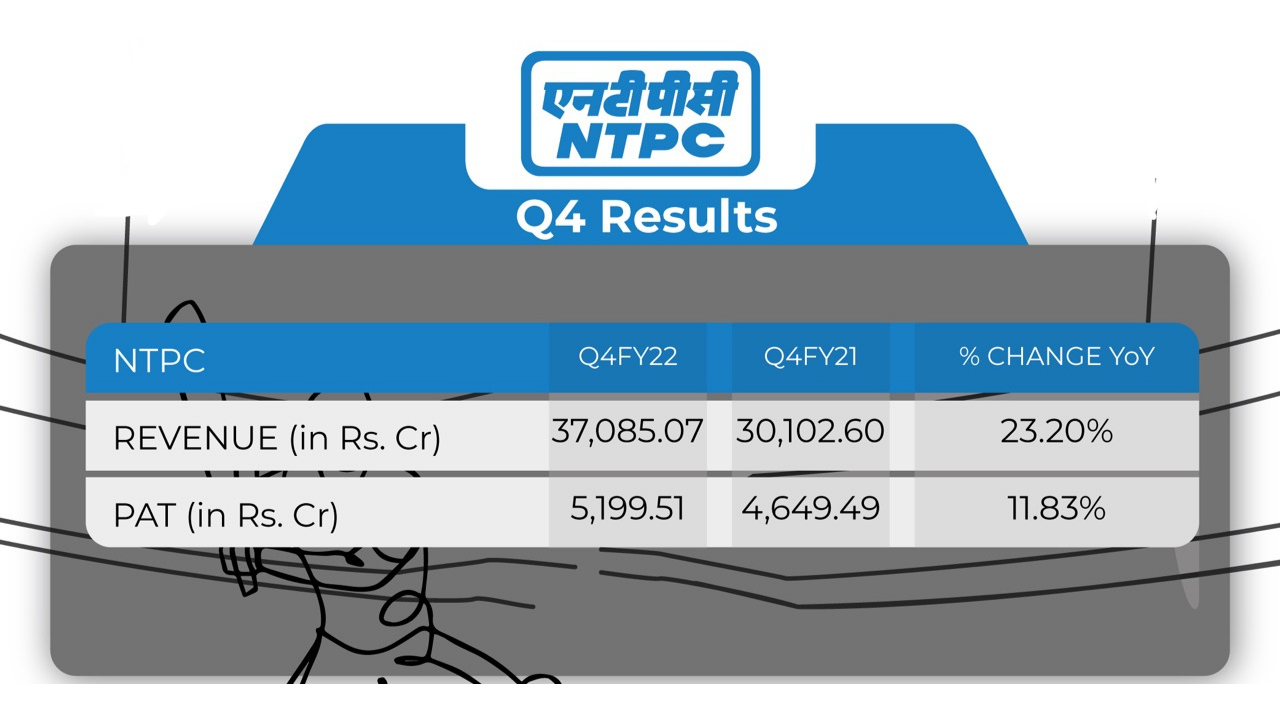

NTPC Q4 Results 2022: Net profit grew by 11.82% for Q4FY22

Last Updated: 11th December 2022 - 06:13 pm

On 20th May 2022, NTPC announced its quarterly results for the last quarter of FY2022.

Key Highlights:

Q4FY22:

- The company's revenue from operations rose 23.19% to Rs.37085.07 Crores in the quarter under review from Rs.30102.6 Crores in the same quarter last fiscal

- Profit before exceptional items, tax, and regulatory deferral account balances was at Rs.5836.44 crores from Rs.3817.5 crores, a growth of 52.88% YoY

- NTPC reported a net profit of Rs.5199.51 Crores for Q4FY22 from Rs.4649.49 crores in Q4FY21, a growth by 11.82%.

FY2022:

- The company's revenue from operations rose by 18.95% to Rs.132669.28 Crores for the year from Rs.111531.15 Crores in FY2021.

- Profit before exceptional items, tax, and regulatory deferral account balances was at Rs.19500.78 crores from Rs.16315.06 crores, a growth of 19.52% YoY

- NTPC reported a Net profit of Rs.16960.29 Crores for FY2022 from Rs.14969.40 crores in the previous year, a growth by 13.30%.

Segments Revenue:

Generation:

The generation segment posted revenue of Rs.36211.51 Crores for Q4FY22 with a growth of 2.02% YoY and Rs.129041.81 Crores for the year with a growth of 17.44% YoY.

Others:

The other segments posted revenue of Rs.2830.27 Crores for Q4FY22 with a growth of 6.92% YoY and Rs.10246.80 Crores for the year with a growth of 13.36% YoY.

Unallocated:

The unallocated segments posted revenue of Rs.17.82 Crores for Q4FY22 with a decline of 61.35% YoY and Rs.260.62 Crores for the year with a growth of 123.51% YoY.

Start Investing in 5 mins*

Get Benefits worth Rs. 5100 | Rs. 20 Flat Per Order | 0% Brokerage

The Board has recommended the final dividend of Rs.3 per equity share for the financial year 2021-22, subject to the Shareholders' approval in the ensuing Annual General Meeting. The final dividend is in addition to the interim dividend of Rs.4 per equity share for FY2022 paid in February 2022.

- Flat ₹20 Brokerage

- Next-gen Trading

- Advanced Charting

- Actionable Ideas

Trending on 5paisa

Corporate Actions Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Capital Ltd

5paisa Capital Ltd