Market Outlook for 31 October 2024

Nifty Outlook - 10 Nov-2022

Last Updated: 10th December 2022 - 08:25 am

Post the mid-week holiday, our markets were expected to open on a positive note as the global markets witnessed sharp upmove and the SGX Nifty was hinting at a move above 17400. However, Nifty started the day below 18300 mark and witnessed some selling pressure post opening. The index ended the day around 18150 with a marginal loss compared to previous session’s close.

Nifty Today:

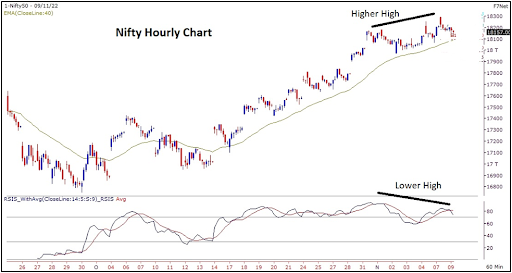

The market participants were quite optimistic looking at the SGX Nifty. However, the index did not open as expected and infact drifted lower gradually throughout the day. The Bank Nifty index continued its outperformance and registered a new all-time high, but Nifty diverged and ended on a negative note. If we look at the lower time frame charts, the hourly chart of Nifty indicates a negative divergence as a higher high in the index has not been confirmed by a higher high in the momentum oscillator and it has infact given a negative crossover post showing this divergence. This does not bode well for the near term as such divergences usually lead to either a price-wise corrective phase or some time-wise correction. The crucial moving average support on the lower time frame chart is placed around 18100 while if we look at the derivative data, then put writers position is concentrated at 18000 strike. Thus 18000-18100 would be seen as an important support range and in case this support range is breached on the downside, then this divergence could lead to a price wise corrective phase in the near term. On the other hand, in case this support is not breached then at least a time-wise correction or a consolidation phase is expected before the next directional move.

Banking stocks propel indices higher post quarterly results

Hence, although the trend remains positive until the supports are breached, we would advise caution for traders and advise to avoid aggressive long positions until there’s a breakout above 18300. The immediate trading range is seen at 18000-18300 and next directional move would be seen in the direction of the breakout on either side.

Nifty & Bank Nifty Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

|

Support 1 |

18084 |

41650 |

|

Support 2 |

18000 |

41500 |

|

Resistance 1 |

18260 |

41930 |

|

Resistance 2 |

18310 |

42100 |

Trending on 5paisa

Discover more of what matters to you.

Market Outlook Related Articles

Disclaimer: Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer please Click here.

5paisa Research Team

5paisa Research Team Ruchit Jain

Ruchit Jain