Virat Kohli & Anushka Sharma Set to Gain Big from Go Digit IPO

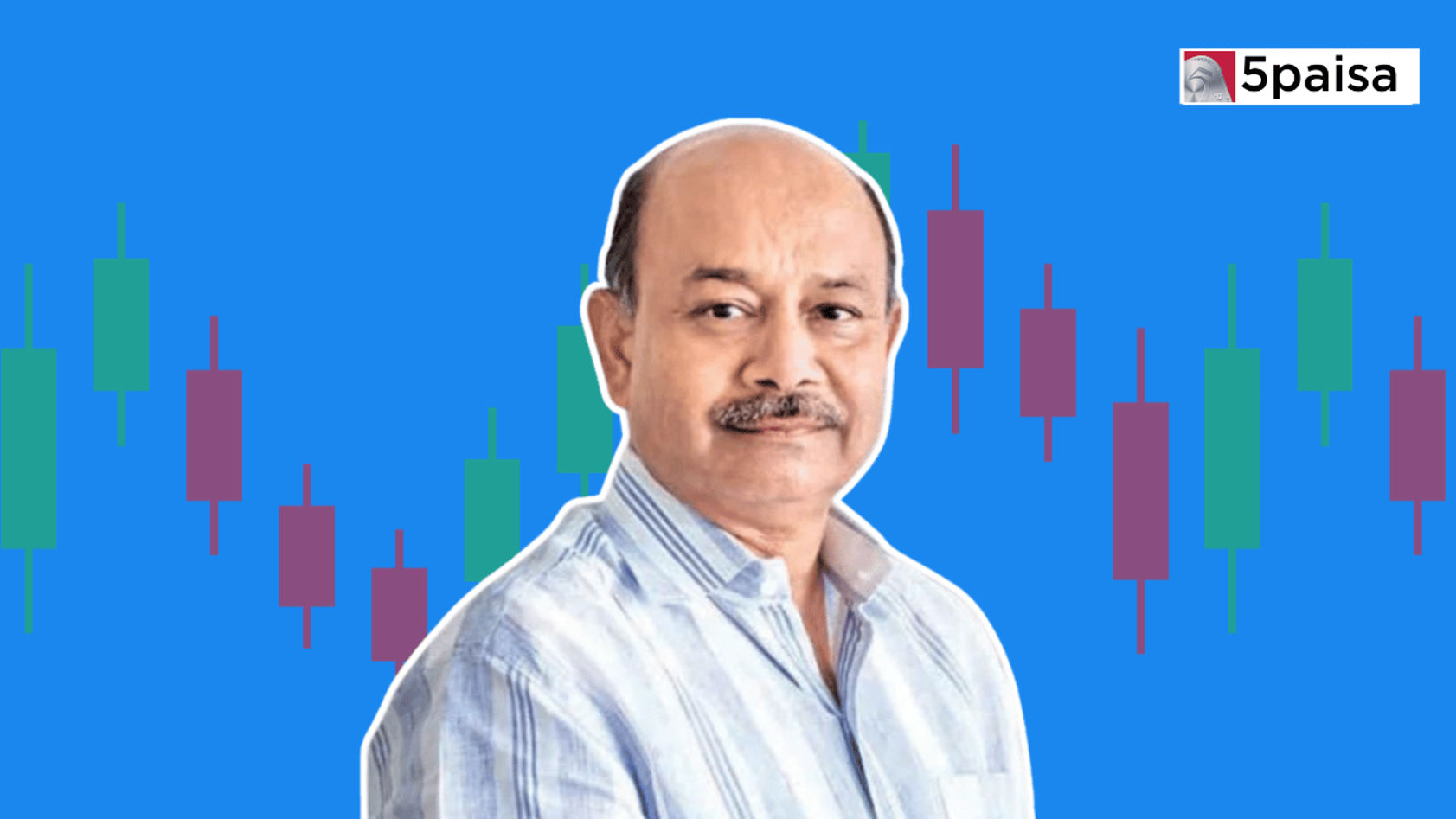

How Dolly Khanna almost overhauled her portfolio last quarter

Last Updated: 11th December 2022 - 12:05 am

Chennai-based investor Dolly Khanna, who has been an active investor in the stock markets since 1996, has been rebuilding her portfolio along with her husband Rajiv, who co-manages her stock investments that is now worth upwards of $70 million.

Rajiv Khanna had sold the Kwality ice cream business to Unilever over two decades ago and has been slowly building a portfolio along with his wife since then.

The duo’s portfolio under Dolly’s name typically focuses on small and micro caps with small stakes.

A peek at her portfolio for the three months ended June 30 shows that it went through a major churn. While the overall number of stocks remains in the 26-27 range like the previous quarter, she added as many as six new stocks, while likely exiting six others.

At the same time, she trimmed holding in nearly a dozen existing companies in the portfolio while buying additional shares of a handful others.

Buys

Khanna added oil refining company, Chennai Petroleum Corporation, a subsidiary of Indian Oil Corporation (IOC) besides a micro-cap company National Oxygen, an industrial gas producer.

CPCL saw its share price nearly triple since March and even as it has moderated over the last one month, it is still trading almost twice the level before the last quarter.

In contrast, National Oxygen had a different journey. Its share price had tripled to hit a peak in January only to slide since then and has been almost flat over the last quarter.

She also added Manali Petrochemicals, Zuari Industries, Monte Carlo Fashions and Suryoday Small Finance Bank.

In addition, Khanna bulked up by purchasing additional stake in at least four companies: Prakash Pipes, Pondy Oxides, Tina Rubber & Infrastructure and Ajanta Soya. These four stocks were added to her portfolio less than a year ago.

But to be fair, she is known to make short-duration trades in either direction with the same stock.

Flip side

In a bunch of companies notably Butterfly Gandhimathi, Rain Industries, Indo tech Transformers, Nahar Spinning Mills, Sandur Manganese and Khaitan Chemicals, she either completely exited or brought down her holding to under 1%. Companies are obliged to publicly disclose shareholder names to the stock exchanges who own 1% or more in a listed firm.

She also cut stake in a string of other stocks, though she continued to own over 1%. These include Rama Phosphates, Goa Carbons, NDTV, KCP, Mangalore Chemicals & Fertilizers and Sharda Cropchem among others.

Trending on 5paisa

Discover more of what matters to you.

Superstar Portfolio Related Articles

Sachin Gupta

Sachin Gupta Ruchit Jain

Ruchit Jain Tanushree Jaiswal

Tanushree Jaiswal