List Of Maharatna Companies In India

Markets are near their All-Time High; What Should You Do?

Last Updated: 12th December 2022 - 12:26 am

Have you been to those roller coaster rides, where you get those butterflies in your belly as soon as the ride goes up? As it gets near the top, your palms get sweaty, your heartbeat increases, and you try to hold the swing as tight as possible. The fear of falling down increases as the ride is near the top.

Well, investing in the equity markets feels kinda same. Whenever the markets reach their highest levels, investors fear that the markets would correct. Currently, there is a similar scenario in the Indian equity markets as, after a steep fall in June, markets have recovered and reached their all-time highs.

For Instance, NIFTY is close to 18000 levels and SENSEX is around 59,719, quite close to their all-time high this year.

Whenever the markets are at an all-time high, investors panic and sell their holdings in the anticipation of a market fall! So, what should you do? Book profits or Invest more?

Let’s do some number crunching to understand how markets have performed after reaching their all-time highs!

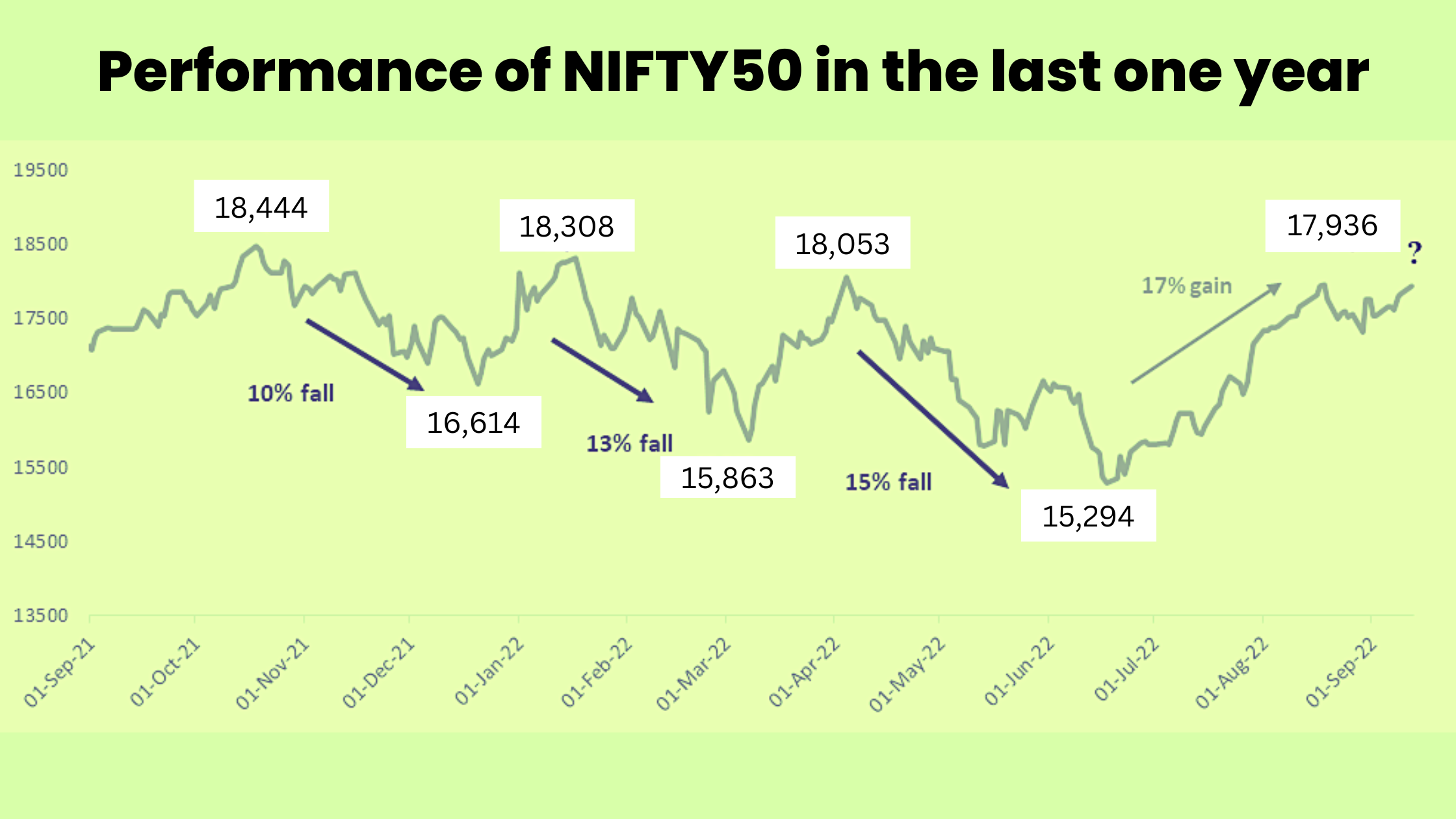

During the last year, NIFTY50 has reached its highest level three times, each time exceeding 18000 points, and every time it reached its peak, the markets fell 10%-15%.

Well, if you are in a panic by now, relax! Because if we zoom out a bit and see how markets have reacted after reaching their all-time highs over the last twenty years, we get a completely different answer.

Between 2007 and 2014, NIFTY50 crossed the level of 6000 three times. The first time it crossed the 6000 levels in 2008, after reaching its all-time high, it fell by 56%, the second time it breached the 6000 level in Nov 2010, at that time it fell almost by 25%. Then in 2013-14, NIFTY50 hovered around 6000 levels for quite a few months and then finally broke out of it, rallied 46%, and made new all-time highs!

Historically, equity markets have followed a certain pattern of hitting a new all-time high followed by a fall, but then suddenly breaking out and rallying to hit higher and newer all-time highs.

So sometimes, yes markets have fallen after reaching all time high, but if you zoom out, markets have only grown in the long run!

Also, it isn’t like investors have not made money by investing at all-time highs.

A study was conducted by Economic times in which they looked at all the instances when the NIFTY 50 had hit an all-time high in the last 20 years and then looked at the 1-year, 3-year, and 5-year returns from these all-time highs

Surprisingly, even if an investor had invested only at all-time high levels during the past 20 years and stayed invested for at least 5 years, he would have still earned positive returns 100% of the time.

If you zoom out, over the last 15-20 years, Indian equity markets have only grown, so if you are a long-term investor, then you need not worry about these falls!

Amidst these market conditions, instead of worrying about the volatility and market fall, investors should focus on their evaluating their investment strategy.

Here are the things you can do,

Expensive valuation: If you believe, the stocks in your portfolio are trading at exorbitant valuations and their fundamentals do not back their valuations, then you might consider booking profit on those stocks!

Buying in small dips: An analyst with ICICI securities shared a strategy for investing when markets are at all-time highs

“With markets recovering almost all their losses and trading back at around all-time highs, it is better to adopt a buy on dips allocation strategy instead of lum psum at current levels”

A good investment strategy can help you ride all the market highs and lows safely.

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial.

Trending on 5paisa

Discover more of what matters to you.

Indian Stock Market Related Articles

Sachin Gupta

Sachin Gupta Ruchit Jain

Ruchit Jain Tanushree Jaiswal

Tanushree Jaiswal