Market Outlook for 29 July 2024

Nifty Outlook - 7 Oct-2022

Last Updated: 13th December 2022 - 07:14 pm

Post the mid-week holiday, our markets opened on a positive note as the global witnessed continued their upmove. Amidst stock specific momentum, Nifty consolidated in a range for most part of the day and gave up some of the gains towards the close to end the day around 17330 with gains of about one-third of a percent.

Nifty Today:

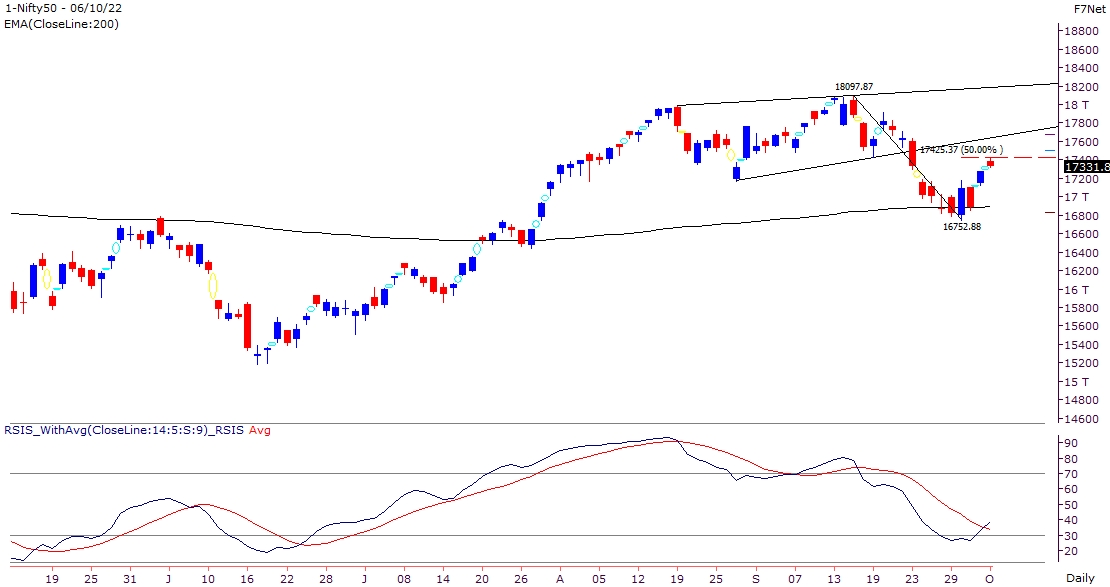

In last four trading sessions, Nifty has recovered half of the recent losses and has retraced the corrective move from 18100 to 16750 by 50 percent. The upmove has been from the support of ‘200 DEMA’ and has been mainly due to the global factors where the Bond Yields and the Dollar Index has cooled off from their highs which is positive for equities. However, the indices are now trading around the crucial resistances as both Nifty and Bank Nifty are at the 50 percent retracement of the previous correction. The momentum readings which were in the oversold zone in during last week have cooled-off and has infact now reached the overbought zone on the hourly time frame chart. Hence, traders should look to lighten up some longs around current level and will for more confirmation where the markets sustain above these retracement resistances or not.

Indices nearing short-term hurdles post the recent upmove

Until there’s resumption of a ‘Higher Top Higher Bottom’ structure, this upmove should just be read as a pullback move and hence, one should stay cautious.

The intraday supports for Nifty for the coming session are placed around 17245 and 17135 while resistance will be seen around 17400 and 17470.

Nifty & Bank Nifty Levels:

|

|

Nifty Levels |

Bank Nifty Levels |

|

Support 1 |

17245 |

39000 |

|

Support 2 |

17135 |

38810 |

|

Resistance 1 |

17400 |

39610 |

|

Resistance 2 |

17470 |

39750 |

Disclaimer: Investment/Trading in securities Market is subject to market risk, past performance is not a guarantee of future performance. The risk of loss in trading and investment in Securities markets including Equites and Derivatives can be substantial.

Trending on 5paisa

Discover more of what matters to you.

Market Outlook Related Articles

Sachin Gupta

Sachin Gupta Ruchit Jain

Ruchit Jain Tanushree Jaiswal

Tanushree Jaiswal